Blank Loan Agreement Form for Florida

In the state of Florida, navigating the complexities of loan agreements requires a comprehensive understanding of the underlying documentation, a cornerstone of which is the Florida Loan Agreement form. This pivotal document serves not only as a binding record between lender and borrower but also delineates the fine details that govern the terms of the loan—ranging from interest rates, repayment schedules, to the consequences of default. Essential for both individuals and institutions, it ensures clarity and legal enforceability, adhering to Florida's specific regulatory standards. The form is crafted to mitigate misunderstandings by succinctly laying out the obligations and rights of all involved parties. Whether securing a personal loan, or arranging financing for business ventures, utilizing the proper form is paramount in safeguarding the interests of both borrower and lender, while simultaneously complying with state laws. Tailored to address the unique requirements of loan transactions within Florida, this document plays a crucial role in facilitating smooth financial exchanges, underpinning the confidence that is vital for any loan agreement.

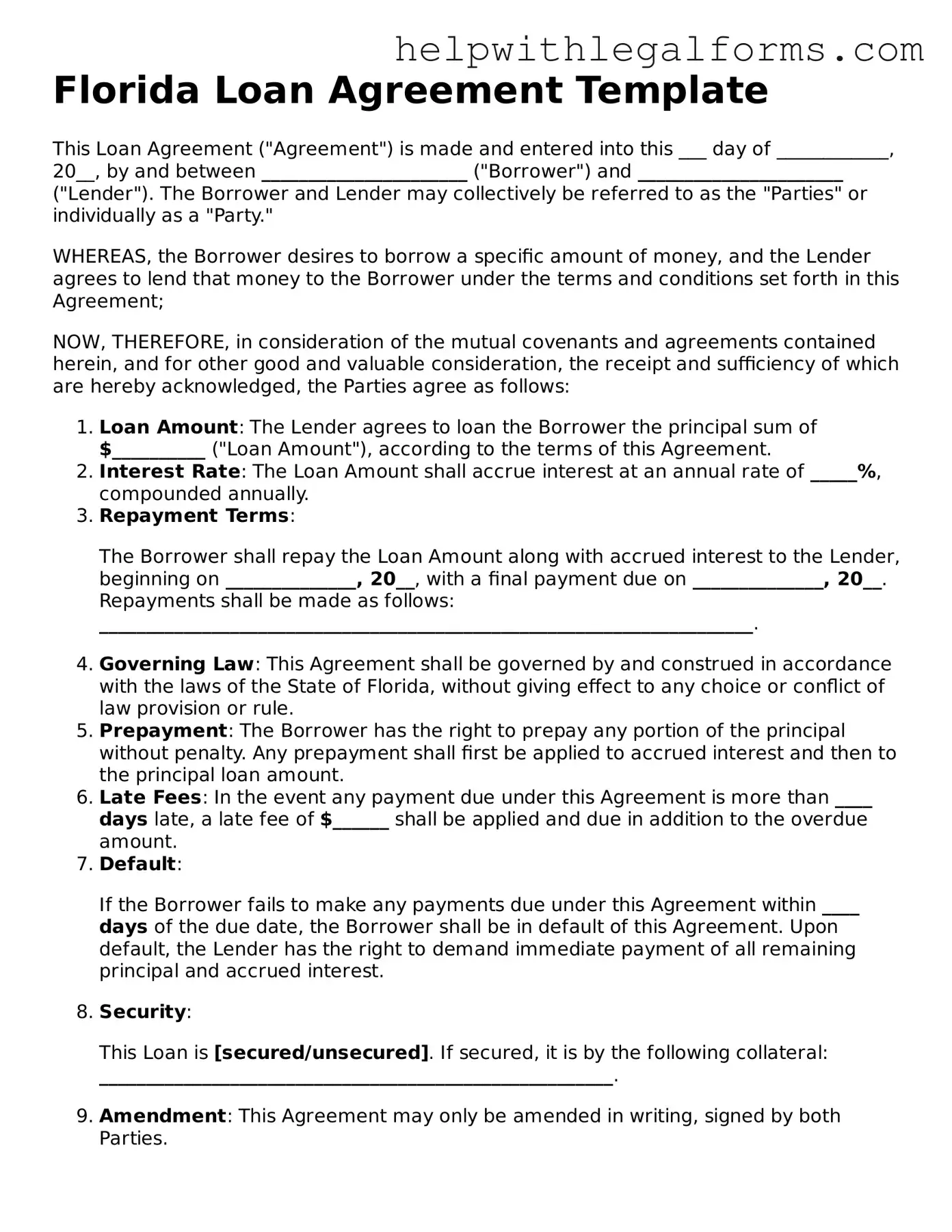

Example - Florida Loan Agreement Form

Florida Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into this ___ day of ____________, 20__, by and between ______________________ ("Borrower") and ______________________ ("Lender"). The Borrower and Lender may collectively be referred to as the "Parties" or individually as a "Party."

WHEREAS, the Borrower desires to borrow a specific amount of money, and the Lender agrees to lend that money to the Borrower under the terms and conditions set forth in this Agreement;

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

- Loan Amount: The Lender agrees to loan the Borrower the principal sum of $__________ ("Loan Amount"), according to the terms of this Agreement.

- Interest Rate: The Loan Amount shall accrue interest at an annual rate of _____%, compounded annually.

- Repayment Terms:

The Borrower shall repay the Loan Amount along with accrued interest to the Lender, beginning on ______________, 20__, with a final payment due on ______________, 20__. Repayments shall be made as follows: ______________________________________________________________________.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Florida, without giving effect to any choice or conflict of law provision or rule.

- Prepayment: The Borrower has the right to prepay any portion of the principal without penalty. Any prepayment shall first be applied to accrued interest and then to the principal loan amount.

- Late Fees: In the event any payment due under this Agreement is more than ____ days late, a late fee of $______ shall be applied and due in addition to the overdue amount.

- Default:

If the Borrower fails to make any payments due under this Agreement within ____ days of the due date, the Borrower shall be in default of this Agreement. Upon default, the Lender has the right to demand immediate payment of all remaining principal and accrued interest.

- Security:

This Loan is [secured/unsecured]. If secured, it is by the following collateral: _______________________________________________________.

- Amendment: This Agreement may only be amended in writing, signed by both Parties.

- Notices: Any notices or communications required or permitted to be given by this Agreement shall be in writing and given by personal delivery or certified mail, return receipt requested, at the addresses specified by the Parties.

- Entire Agreement: This Agreement constitutes the entire agreement between the Parties concerning the subject matter hereof and supersedes all prior agreements and understandings, whether written or oral.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

Lender Signature: ____________________________________

Lender Printed Name: ___________________________________

Date: _________________________________________________

Borrower Signature: ___________________________________

Borrower Printed Name: __________________________________

Date: _________________________________________________

PDF Form Attributes

| Fact Number | Detail |

|---|---|

| 1 | The Florida Loan Agreement form outlines the terms and conditions under which a loan is provided. |

| 2 | This form includes identification of both the borrower and the lender, along with respective addresses. |

| 3 | The agreement specifies the loan amount, interest rate, repayment schedule, and late fees, if any. |

| 4 | Security or collateral that the borrower must provide can also be detailed in the agreement. |

| 5 | Governing laws for this form are based on the state of Florida's statutes related to loans and lending practices. |

| 6 | Signatures of both parties involved are required to validate and enforce the agreement. |

| 7 | Additional clauses, like prepayment penalties or conditions for loan modification, can be incorporated as per the agreement of the parties. |

Instructions on How to Fill Out Florida Loan Agreement

Filling out the Florida Loan Agreement form is a significant step in formalizing the terms between a lender and a borrower. This document will set forth the loan amount, interest rate, repayment schedule, and any other terms that are specific to this financial arrangement. To ensure clarity and avoid potential disputes, it's essential to fill out this form carefully and thoroughly. Follow these steps to complete the Florida Loan Agreement form accurately.

- Gather all necessary information, including the full names and addresses of both the lender and the borrower, the loan amount, the interest rate, and the loan duration.

- Enter the effective date of the agreement at the top of the form.

- Fill in the borrower's and lender's information in the designated sections. Include full legal names and addresses.

- Specify the principal amount of the loan in the section provided.

- Determine and input the annual interest rate that will be applied to the principal loan amount.

- Describe the repayment schedule. Specify the start date of repayment, the frequency of payments (monthly, quarterly, etc.), and the duration of the loan. Also, include any information on the final payment due date.

- If there are any collateral items being used to secure the loan, list those items clearly in the section provided.

- Detail any additional terms or conditions that are relevant to the agreement. This may include provisions for late payments, prepayment, or default.

- Both the lender and the borrower must sign and date the agreement at the bottom of the form.

- For added legal protection, consider having the signatures notarized, although this is not a mandatory step in Florida.

Once the Florida Loan Agreement form is fully completed and signed by both parties, make sure each party receives a copy for their records. This document will serve as a legal record of the loan and the agreed-upon terms, providing protection and clarity for both the lender and the borrower. Remember, if any amendments are made to the agreement in the future, they should be documented in writing and signed by both parties.

Crucial Points on This Form

What is a Florida Loan Agreement form?

A Florida Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower within the state of Florida. It specifies the amount of money being lent, the interest rate, repayment schedule, collateral, if any, and other essential terms. This document is crucial as it legally binds both parties to the agreed-upon conditions, providing a clear framework for the loan and safeguarding the interests of both the lender and the borrower.

Who needs to use a Florida Loan Agreement form?

Anyone who is either lending or borrowing money in the state of Florida should use a Florida Loan Agreement form. This includes individual lenders and borrowers, businesses, friends, family members, and financial institutions. Using this form helps ensure that the loan is legally enforceable and that both parties have a clear understanding of the obligations and terms of the loan.

Can I write my own Florida Loan Agreement, or do I need a lawyer?

It is possible to write your own Florida Loan Agreement if you have a good understanding of the terms and conditions that should be included in such an agreement. However, consulting with a lawyer is highly recommended to ensure that the agreement complies with all state laws and adequately protects your rights and interests. A lawyer can also help identify potential issues that might not be apparent without legal expertise.

What happens if a borrower defaults on a loan outlined in a Florida Loan Agreement?

If a borrower defaults on a loan as outlined in a Florida Loan Agreement, the lender has the right to pursue legal action to recover the outstanding debt. This might include initiating foreclosure proceedings if the loan is secured by collateral, or suing the borrower for the amount owed if the loan is unsecured. The specific course of action will depend on the terms set forth in the loan agreement and the Florida state laws governing such agreements.

Common mistakes

Filling out a Florida Loan Agreement form is a crucial step in securing a loan, whether for personal or business reasons. However, common mistakes can occur during this process, potentially causing delays or complications. Here are seven mistakes people frequently make when filling out this form:

-

Not reading the instructions carefully: Many individuals skip over the instructions, leading to errors in filling out the form correctly. It's essential to read every detail to ensure accuracy and completeness.

-

Incorrect information: Providing incorrect details, such as a wrong date, name, or financial information, can significantly delay the loan process. Accuracy is paramount.

-

Leaving sections blank: Some people leave certain fields empty because they're unsure what to enter or think that the section doesn't apply to them. If a section is not applicable, it's better to write “N/A” than to leave it blank.

-

Forgetting to sign and date: The form is not valid without a signature and date. Overlooking this step can invalidate the entire agreement.

-

Not specifying the loan terms clearly: It's essential to define the loan's terms, including the interest rate, repayment schedule, and any collateral. Vague terms can create confusion and disputes later on.

-

Ignoring the need for witness signatures: Depending on the nature of the loan and local laws, witness signatures may be required. Failing to have the form witnessed can question its enforceability.

-

Not keeping a copy: Once the form is filled out and signed, it's crucial to keep a copy for personal records. This mistake often leads to problems if disputes arise or if there is a need to refer back to the agreement.

By avoiding these common errors, individuals can ensure their Florida Loan Agreement forms are filled out correctly, helping to smooth the loan process and avoid unnecessary complications.

Documents used along the form

In Florida, when entering into a loan agreement, several other documents often accompany the process to ensure legal compliance and protection for both the lender and the borrower. These documents serve various purposes, from securing the loan to detailing the terms of repayment. Understanding each document's role can streamline the borrowing process, making it more efficient and transparent.

- Promissory Note: This is a promise by the borrower to pay back the borrowed amount under specified conditions. It details the loan's interest rate, repayment schedule, and consequences of non-payment.

- Mortgage Agreement: If the loan is secured against property, this document grants the lender a security interest in the property as collateral for the loan.

- Deed of Trust: Similar to a Mortgage Agreement, this document is used in place of a mortgage in some states. It involves a third party, who holds the property's title until the debt is paid.

- Guaranty: This is an agreement whereby a third party (the guarantor) agrees to repay the loan if the borrower fails to do so.

- Security Agreement: If the loan is secured by personal property (not real estate), this document outlines the borrower's assets that serve as collateral.

- Amendment Agreement: This document is used if the terms of the original loan agreement need to be modified or amended.

- Release of Loan Agreement: After the loan is fully repaid, this document releases the borrower from any further obligations under the loan agreement.

- Compliance Certificate: A document the borrower provides, usually annually, confirming they are in compliance with the loan terms.

- Financial Statements: The borrower must often provide updated financial information, such as balance sheets or income statements, to the lender during the loan term.

- Subordination Agreement: If there are multiple creditors, this agreement dictates their priority in case of the borrower's default, determining who gets paid first.

The use of these documents in conjunction with a Florida Loan Agreement form adds layers of security and clarity for all parties involved. By comprehensively outlining the rights and responsibilities of the borrower and lender, these forms help prevent disputes and misunderstandings during the loan's term. Properly executed, they can provide peace of mind to both lenders and borrowers by clearly setting forth the expectations and obligations of each party.

Similar forms

Promissory Note: Much like a Loan Agreement, a Promissory Note is a document where a borrower promises to pay back a lender by a specific date. While both outline repayment terms, the Loan Agreement typically provides more comprehensive details, including collateral and legal recourse.

Mortgage Agreement: This is similar to a Loan Agreement when it comes to obtaining funds to purchase real estate. The Mortgage Agreement secures the loan against the property being purchased, detailing the loan's repayment and what happens in case of default, akin to the collateral stipulation in a Loan Agreement.

Line of Credit Agreement: Similar to a Loan Agreement, a Line of Credit Agreement outlines the terms under which a lender provides a certain amount of money to the borrower. However, rather than receiving a lump sum, the borrower can draw from the line as needed, up to a set limit, and interest typically only accrues on the amount drawn.

Lease Agreement: Although often associated with renting property, a Lease Agreement shares similarities with Loan Agreements, as both involve terms for periodic payments. In both cases, the agreements delineate responsibilities of all parties, late payment penalties, and the consequences of violating terms.

Sales Contract: Like a Loan Agreement, a Sales Contract specifies the terms of a transaction. However, whereas a Loan Agreement focuses on the terms for lending money, a Sales Contract details the exchange of goods or services for payment. Both documents serve to legally bind and protect the parties involved.

Partnership Agreement: This document outlines the terms of a business partnership, similar to how a Loan Agreement sets the terms between lender and borrower. Both agreements include provisions for managing disputes, sharing profits (or interest), and the responsibilities of each party involved.

Dos and Don'ts

Filling out a Loan Agreement form in Florida requires careful attention. To help you navigate this process effectively and avoid common pitfalls, here's a list of dos and don'ts. Whether you're lending money or borrowing, these tips are designed to protect your interests and ensure a clear understanding between both parties.

- Do read the entire form carefully before you start filling it out. Understanding every detail can prevent misunderstandings and make sure all parties are on the same page.

- Don't rush through the process. Taking your time to fill out each section accurately ensures that all the information is correct and reflects the agreed terms.

- Do use clear and concise language to describe the loan terms. Avoid using legal jargon or complex language that might confuse any of the parties involved.

- Don't leave any sections blank. If a section doesn't apply, indicate this with "N/A" (not applicable), to show that you didn't overlook the question.

- Do verify all the parties' information, including full legal names, addresses, and contact details. Accurate information is critical for a valid agreement.

- Don't forget to specify the loan amount in words and numbers to avoid any confusion about the sum being lent.

- Do clarify the repayment terms, including the interest rate, repayment schedule, and any collateral involved. These are crucial details that must be understood and agreed upon by all parties.

- Don't ignore the importance of witnesses or a notary. Having a third party witness the signing can add an extra layer of legal protection and authenticity to the document.

- Do keep copies of the signed agreement for all parties involved. This ensures that everyone has a record of the terms and conditions agreed upon.

Following these guidelines can alleviate many of the common issues that arise with loan agreements in Florida. By being thorough and precise, you can foster a smooth lending or borrowing experience and mitigate potential disputes or misunderstandings.

Misconceptions

When navigating the complexities of loan agreements in Florida, individuals often encounter widespread misconceptions. Understanding these can help in making informed decisions about entering into such agreements. Here are four common misunderstandings:

Filling out the form is enough for the agreement to be legally binding. Many people believe that simply completing the Florida Loan Agreement form ensures a legally binding agreement. However, legal validity also requires proper execution, which includes signatures from all parties involved and, in some cases, notarization. Additionally, certain elements, such as the loan amount, repayment terms, and interest rates, must be clearly stated and agreed upon for the agreement to be enforceable.

There is a universal format for all loan agreements in Florida. Another common misunderstanding is that there is a one-size-fits-all format for loan agreements across the state. In reality, loan agreements can vary significantly depending on the type of loan, the involved parties, and specific terms and conditions. Tailoring the agreement to the particular needs and circumstances of the parties ensures that all legal requirements are met and that the agreement is fair and clear to all involved.

No legal consultation is required. People often assume they don't need to consult a lawyer when creating a loan agreement. While it's possible to draft a loan agreement without legal help, consulting with a legal professional can provide crucial insights into the specific requirements and legal implications of the agreement. Legal consultation can help prevent misunderstandings, conflicts, and potential legal disputes down the line.

Oral agreements are just as valid as written ones. While oral agreements can be legally binding, proving the terms and existence of an oral contract is significantly more challenging than with a written agreement. Florida's laws, such as the Statute of Frauds, require certain agreements, including loan agreements involving substantial amounts of money, to be in writing to be enforceable. Therefore, having a written loan agreement is not only advisable but often necessary to protect the interests of all parties involved.

Dispelling these misconceptions about the Florida Loan Agreement form is essential for anyone looking to establish a clear, fair, and legally sound financial arrangement. Engaging in thorough preparation, seeking legal advice, and ensuring all parties have a mutual understanding of the agreement's terms and conditions can help prevent future disputes and complications.

Key takeaways

Filling out and using the Florida Loan Agreement form involves several important steps and considerations. It's essential to approach this process with care and understanding, ensuring that all parties involved are protected and clear about their obligations. Below are some key takeaways to keep in mind:

Understanding the Terms: Before filling out the form, it’s crucial to fully understand the terms and conditions of the loan. This includes the loan amount, interest rate, repayment schedule, and any collateral involved.

Accurate Information: Provide accurate and complete information about the borrower and the lender. This ensures there are no misunderstandings or disputes in the future.

Signatures are Essential: Both the borrower and the lender must sign the agreement for it to be legally binding. Ensure that these signatures are obtained in the presence of a witness or notary public, if required by state law.

Legal Requirements: Familiarize yourself with Florida’s legal requirements regarding loan agreements. This includes any state-specific provisions that must be included in the contract to make it enforceable.

Notarization: While not always mandatory, getting the agreement notarized can add an extra layer of legality and help in the enforcement of the agreement, should disputes arise.

Amendments: If there are any changes or amendments to the loan agreement after signing, make sure these are documented and signed by both parties. Alterations made without proper documentation and agreement can lead to legal complications.

Keep a Copy: Both parties should keep a signed copy of the loan agreement. This ensures that there is a formal record of the terms agreed upon, which can be referred to if questions or issues arise down the line.

Following these guidelines when dealing with a Florida Loan Agreement form will help ensure that the process is conducted smoothly and professionally, safeguarding the interests of all parties involved.

Create Other Loan Agreement Forms for US States

Free Promissory Note Template New York - It acts as a financial safeguard, particularly for lenders who risk losing their money.

Promissory Note Template California Word - Including a detailed description of the loan purpose within the agreement is common, especially for business or large personal loans.