Blank Loan Agreement Form for Georgia

In the vibrant mosaic that is the legal landscape, the Georgia Loan Agreement form emerges as a pivotal document, ensuring clarity and security in personal and commercial lending transactions. This form, tailored specifically to comply with the state's legal requirements, serves as a binding contract between lender and borrower, encapsulating all pertinent details of the loan arrangement. From the loan amount, interest rates, repayment schedule, to the consequences of default, this comprehensive document meticulously outlines the terms agreed upon by the parties involved. Its significance cannot be overstated; it not only provides a legal framework for the loan but also acts as a bulwark against misunderstandings and disputes. Given Georgia's unique laws and regulations, having a bespoke loan agreement form is indispensable. It shields both parties' interests and ensures that the transaction adheres to state-specific legal standards. For individuals and entities involved in lending in Georgia, understanding and utilizing this form is not merely advisable—it is an essential step toward securing their financial dealings.

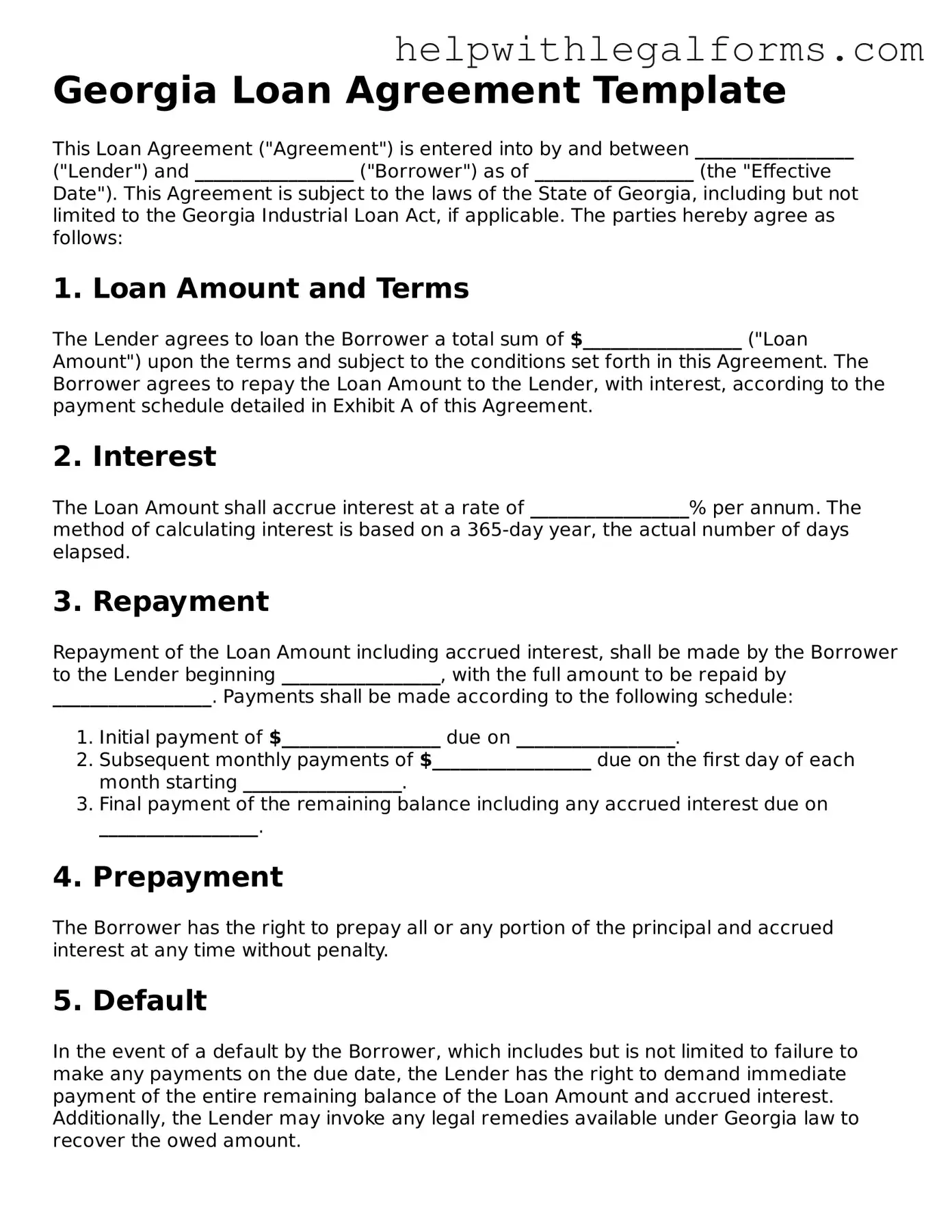

Example - Georgia Loan Agreement Form

Georgia Loan Agreement Template

This Loan Agreement ("Agreement") is entered into by and between _________________ ("Lender") and _________________ ("Borrower") as of _________________ (the "Effective Date"). This Agreement is subject to the laws of the State of Georgia, including but not limited to the Georgia Industrial Loan Act, if applicable. The parties hereby agree as follows:

1. Loan Amount and Terms

The Lender agrees to loan the Borrower a total sum of $_________________ ("Loan Amount") upon the terms and subject to the conditions set forth in this Agreement. The Borrower agrees to repay the Loan Amount to the Lender, with interest, according to the payment schedule detailed in Exhibit A of this Agreement.

2. Interest

The Loan Amount shall accrue interest at a rate of _________________% per annum. The method of calculating interest is based on a 365-day year, the actual number of days elapsed.

3. Repayment

Repayment of the Loan Amount including accrued interest, shall be made by the Borrower to the Lender beginning _________________, with the full amount to be repaid by _________________. Payments shall be made according to the following schedule:

- Initial payment of $_________________ due on _________________.

- Subsequent monthly payments of $_________________ due on the first day of each month starting _________________.

- Final payment of the remaining balance including any accrued interest due on _________________.

4. Prepayment

The Borrower has the right to prepay all or any portion of the principal and accrued interest at any time without penalty.

5. Default

In the event of a default by the Borrower, which includes but is not limited to failure to make any payments on the due date, the Lender has the right to demand immediate payment of the entire remaining balance of the Loan Amount and accrued interest. Additionally, the Lender may invoke any legal remedies available under Georgia law to recover the owed amount.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia, without regard to its conflict of laws principles.

7. Entire Agreement

This document and any attached exhibits constitute the entire agreement between the Lender and the Borrower regarding this loan. Any modifications to this agreement must be made in writing and signed by both parties.

Signatures

By signing below, the Lender and the Borrower agree to the terms and conditions outlined in this Agreement.

Lender's Signature: _____________________ Date: _____________________

Borrower's Signature: _____________________ Date: _____________________

PDF Form Attributes

| Fact Number | Detail |

|---|---|

| 1 | Definition: The Georgia Loan Agreement form is a legal document outlining the terms and conditions under which money is lent and must be repaid. |

| 2 | Governing Law: This form is governed by Georgia state laws, including but not limited to the Georgia Code. |

| 3 | Parties Involved: Typically involves at least two parties, the lender and the borrower. |

| 4 | Contents: Must include loan amount, interest rate, repayment schedule, and any collateral securing the loan. |

| 5 | Interest Rate: Must comply with the usury laws of Georgia to prevent charging of excessive interest. |

| 6 | Signature Requirement: Both lender and borrower must sign the document for it to be legally binding. |

| 7 | Default Terms: Should include specific provisions for handling defaults, which may involve late fees, acceleration of the debt, and collateral seizure. |

Instructions on How to Fill Out Georgia Loan Agreement

After deciding to formalize the terms of a loan with a Loan Agreement, it’s important to ensure all details are correctly filled out on the form. This legal document will serve as a binding agreement between the borrower and lender, delineating repayment terms, interest rates, and the consequences of non-repayment. The clarity and accuracy of this information can prevent misunderstandings and legal disputes down the line. Following are the systematic steps required to fill out the Georgia Loan Agreement form, ensuring both parties are on the same page and legally protected.

- Gather all necessary information, including the legal names and addresses of both the borrower and lender.

- Specify the principal amount of the loan. This is the original amount of money being loaned, before any interest.

- Detail the loan’s interest rate. It’s vital to state whether the interest rate is fixed or adjustable.

- Outline the repayment schedule. Include the start date of payments, the frequency of payments (monthly, quarterly, etc.), and the duration of the repayment period.

- Define the terms of the late payment fees and penalties, if any. This section should clearly state the grace period for late payments and the fees applied thereafter.

- Determine if there will be a collateral securing the loan and describe it thoroughly. If the loan is secured, provide detailed information about the collateral.

- Include any co-signer information if another party will be guaranteeing the loan. This should include the co-signer's legal name, address, and the relationship to either the borrower or lender.

- Clarify the conditions under which the loan will be considered in default and the subsequent actions the lender is authorized to take.

- List any additional terms or conditions both parties have agreed upon that are not covered in the standard sections of the agreement.

- Ensure both the borrower and lender sign and date the Loan Agreement. It may also be necessary to have the document notarized, depending on local laws and regulations.

This completed form will then outline the loan's terms and conditions, signed and acknowledged by both parties. It's advisable to keep multiple copies in a safe place, as it will serve as a record and reference throughout the life of the loan. Consultation with a legal professional can also provide peace of mind, ensuring that the agreement abides by Georgia state laws and fully protects the interests of both the borrower and the lender.

Crucial Points on This Form

What is a Georgia Loan Agreement form?

A Georgia Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a borrower and a lender within the state of Georgia. The form typically includes details such as the loan amount, interest rate, repayment schedule, collateral involved (if any), and other relevant terms ensuring both parties are clear on their obligations and rights.

Who needs to use a Georgia Loan Agreement form?

This form is essential for any individual or entity within Georgia that intends to either lend or borrow money. It is particularly crucial for private loans where the borrower and the lender might know each other personally (e.g., family members, friends, or business partners) as it helps prevent misunderstandings and ensures a clear agreement is in place.

Is a Georgia Loan Agreement form legally binding?

Yes, once both parties sign the form, it becomes a legally binding document. This means that both the lender and the borrower are legally obligated to adhere to the terms set forth in the agreement. In case of any disputes or non-compliance, the aggrieved party has the right to seek legal redress based on the contract's stipulations.

What happens if a borrower defaults on the loan as per the Georgia Loan Agreement form?

If a borrower defaults on the loan, the lender has the legal right to pursue remedies outlined in the agreement. These could include demanding immediate full repayment, taking possession of the collateral (if any), or pursuing legal action to enforce the repayment. The specific consequences depend on the terms agreed upon by both parties in the loan agreement.

Can the terms of a Georgia Loan Agreement form be modified after it is signed?

Yes, the terms of the agreement can be modified, but any modifications must be agreed upon by both the lender and the borrower in writing. The amendment should be documented clearly, signed by both parties, and attached to the original agreement to ensure that there is no ambiguity regarding the new terms.

Do I need a lawyer to draft a Georgia Loan Agreement form?

While it is not legally required to have a lawyer draft the form, consulting with a legal professional can ensure that the agreement is comprehensive, adheres to Georgia state laws, and protects the rights and interests of both parties. Especially for substantial loan amounts or complex terms, professional legal advice can be very valuable.

Where can I find a template for a Georgia Loan Agreement form?

Templates for a Georgia Loan Agreement form can be found online through legal services websites, state government resources, or by consulting a legal professional who specializes in financial agreements. Ensure any template used is up-to-date and specific to Georgia to comply with current state laws and regulations.

Common mistakes

When filling out the Georgia Loan Agreement form, it's important to take your time and pay attention to detail. Here are six common mistakes people often make:

- Not checking for accuracy. People sometimes enter incorrect information about themselves or the loan terms. Double-checking all entries for accuracy can prevent misunderstands down the line.

- Skipping details about the loan. It's crucial to include all terms of the loan, such as the interest rate, repayment schedule, and any other special conditions. Leaving these details unspecified can lead to confusion and disputes.

- Forgetting to specify collateral. If the loan is secured, failing to clearly describe the collateral puts both parties at risk. The lender may not have the proper security, and the borrower might not understand the risks involved.

- Omitting signatures and dates. All parties involved must sign and date the agreement. An unsigned or undated document may not be legally enforceable.

- Ignoring the need for witnesses or notarization. Depending on the type of loan and amount, having witnesses or notarizing the document could be necessary. Not adhering to these requirements can invalidate the agreement.

- Using vague language. Avoid ambiguous terms that can lead to different interpretations. Clear and specific language helps ensure that all parties have the same understanding of the agreement's terms.

Avoiding these mistakes can save people from potential legal issues and financial losses in the future. Always take the time to review the form thoroughly before submission.

Documents used along the form

In the process of securing a loan within the state of Georgia, the Loan Agreement form is a crucial document that outlines the terms and conditions between the borrower and lender. However, to ensure a comprehensive understanding and legal security of the loan process, various other forms and documents are often utilized in conjunction with this agreement. These accompanying documents are essential for detailing the specifics of the loan, verifying the parties involved, and fulfilling the legal requirements that safeguard both lender and borrower interests.

- Amortization Schedule: Provides a detailed breakdown of how the loan will be repaid over time, including the division of payments into principal and interest.

- Promissory Note: A promise by the borrower to pay back the borrowed amount under agreed terms. It serves as a legal record of the loan's existence and conditions.

- Personal Guarantee: If the loan is not fully secured, a personal guarantee might be required, holding an individual (usually the business owner) personally liable if the business fails to repay the loan.

- Security Agreement: Details the collateral offered by the borrower to secure the loan, defining the rights of the lender to seize the collateral if the loan is not repaid.

- UCC-1 Financing Statement: A legal form filed with the state to publicly declare the lender's right to the collateral. It’s essential for perfecting a security interest in the collateral.

- Loan Modification Agreement: If both parties agree to modify the terms of the original loan agreement post-signing, this document outlines the amendments.

- Prepayment Penalty Clause: Some loans include a penalty for early repayment. This clause details the terms, if applicable, including how the penalty is calculated.

- Loan Release Form: Issued upon the full repayment of the loan, this document releases the borrower from any further obligations and lifts any liens placed on collateral.

- Credit Report Authorization: Gives the lender permission to request the borrower's credit report for assessing creditworthiness prior to loan approval.

Understanding and preparing these documents in conjunction with the Georgia Loan Agreement form can provide a solid foundation for the lending process, ensuring all parties are well-informed and legally protected. Each document plays a specific role in clarifying the terms, securing the loan, and detailing the responsibilities of each party, facilitating a smoother transaction and relationship between the borrower and the lender.

Similar forms

A Mortgage Agreement is similar to a loan agreement because it provides a structured plan for borrowing money to purchase property, detailing the borrower’s obligation to repay the borrowed funds over time, typically with interest. Both agreements include the identification of parties, the loan amount, interest rates, and the repayment schedule, as well as conditions for default.

A Personal Guarantee mirrors aspects of a loan agreement in its function of ensuring the repayment of a loan. It involves a third party promising to repay the debt if the original borrower fails to do so. The guarantee details the scope of the guarantor's liability and conditionally operates much like a loan agreement, specifying obligations and conditions for enforcement.

The Promissory Note shares common ground with a loan agreement as it is a commitment to pay back a specified sum of money to a lender. Like a loan agreement, it outlines the amount borrowed, interest rate, repayment schedule, and the consequences of default. However, it is usually simpler and involves fewer details about the conditions of the borrowing.

Line of Credit Agreement parallels a loan agreement in several ways. It authorizes a borrower to access funds up to a specified credit limit instead of a lump sum amount. The agreement contains details on borrowing terms, interest rates, fees, and repayment conditions. Like a loan agreement, it governs the terms under which credit is extended and repaid.

Dos and Don'ts

Filling out a Loan Agreement form in Georgia involves careful attention to detail and an understanding of what is legally required. It's crucial to approach this task with a clear mindset and a thorough review of the document to ensure all parties involved are adequately protected and that the agreement is enforceable. Here are four key things you should and shouldn't do when completing this form:

Do:Review the entire form before starting: Make sure you understand each section and what information is required. This will help prevent mistakes and ensure that you don't miss any important details.

Include all relevant information: Be meticulous in filling out the form. Include full names, addresses, loan amount, interest rate, repayment schedule, and any other pertinent details. Accurate and complete information makes the agreement valid and enforceable.

Check the legal requirements: Georgia law may have specific stipulations for loan agreements. These could include the need for witness signatures or the requirement to have the document notarized. Ensuring that your agreement meets these legal standards is essential for it to be binding.

Keep copies of the agreement: Once the form is completed and signed, make sure both the borrower and the lender retain a copy. This step is crucial for record-keeping and helps protect both parties' interests throughout the term of the loan.

Rush through the process: Taking the time to thoroughly review and complete the loan agreement is vital. Missing details or incorrectly filled sections can lead to disputes or legal challenges down the road.

Leave blank spaces: Do not leave any sections of the form blank. If a particular section does not apply, note it as “N/A” (not applicable). Blank spaces can lead to misunderstandings or alterations after the agreement has been signed.

Forget to specify the loan’s purpose: Clearly stating the purpose of the loan within the agreement helps to ensure that the funds are used as intended. This can also be important for tax and legal reasons.

Ignore the importance of a witness or notary: Depending on the amount of the loan and local regulations, having a witness or a notarized agreement can be crucial for enforceability. Failing to comply with these requirements could render the agreement void.

Misconceptions

When it comes to handling financial agreements, especially in the state of Georgia, clarity and understanding are paramount. Among these documents, the Loan Agreement form is particularly significant and yet often misunderstood. Several misconceptions surround its structure, purpose, and legal implications, leading to confusion and potential complications for those involved. Here's a detailed look at seven common misconceptions about the Georgia Loan Agreement form.

-

One form fits all: Many people believe that there is a standard Loan Agreement form that applies universally within Georgia. This is not the case. Though there may be common elements, loan agreements can vary significantly based on the lender's requirements, the type of loan, and the specific terms agreed upon by the parties involved. Tailoring the document to the transaction at hand is crucial to its effectiveness and legality.

-

It's only about the money: While it's true that the principal amount and repayment terms are central to any loan agreement, these forms cover much more than just financial transactions. They include clauses on late payments, interest rates, consequences of default, and provisions for dispute resolution, among other critical details. Understanding the full scope of the agreement is essential for both lender and borrower.

-

Verbal agreements are just as binding: In Georgia, as in most jurisdictions, certain contracts, including those that deal with the lending of money, need to be in writing to be enforceable. Relying on a verbal agreement, without any written documentation, exposes both parties to unnecessary risks and misunderstandings.

-

Signing without witness or notarization is fine: While not always a legal requirement, having the Loan Agreement witnessed or notarized can add a layer of security and authentication to the document. For certain types of loans or amounts, having a legal witness or notarization can be a critical step in ensuring the agreement's enforceability.

-

Any kind of loan can be subject to a Loan Agreement: It is a misconception that Loan Agreements are appropriate for every type of loan. In Georgia, certain loans, especially those linked to real estate, may require specific forms or must comply with particular legal regulations beyond a simple Loan Agreement. It's important to understand the type of loan and select the right documentation accordingly.

-

The borrower always bears the cost for creating the agreement: This is not necessarily the case. The responsibility for drafting the loan agreement, and the associated costs, can be negotiated between the borrower and the lender. It's a matter of agreement, not a predefined rule.

-

Once signed, the terms are unchangeable: While the terms of a Loan Agreement are legally binding once the document is signed, modifications can be made if both parties agree. Any changes should be documented in writing and added to the original agreement to avoid future disputes.

Dispelling these misconceptions is crucial to formulating a clear, accurate, and enforceable Loan Agreement in Georgia. By ensuring all parties are on the same page and fully understand the implications of the document they are signing, both lenders and borrowers can protect their interests and maintain a healthier financial engagement.

Key takeaways

When entering into a lending arrangement in Georgia, utilizing a Loan Agreement form is a critical step that protects both the lender and the borrower throughout the loan process. This legal document outlines the terms and conditions of the loan, ensuring clarity and legal enforceability. Here are some key takeaways to consider when filling out and using a Georgia Loan Agreement form:

- Complete Accuracy is Critical: Ensure all information provided in the Loan Agreement is accurate and complete. Erroneous or incomplete information can lead to disputes or legal complications.

- Clearly Define the Loan Terms: The agreement should specify the loan amount, interest rate, repayment schedule, and any collateral involved. Precise terms help prevent misunderstandings.

- State Interest Rates Explicitly: Georgia law requires that the interest rate be clearly stated in the loan agreement to avoid usury violations. Ensure the rate is legal and clearly articulated.

- Include All Parties Correctly: Identify all parties involved in the loan agreement accurately, including co-signers or guarantors, to ensure everyone’s responsibilities are clear.

- Delineate Repayment Conditions: Outlining how and when repayments must be made helps in managing expectations and reducing conflicts over payment terms.

- Consider the Use of Collateral: If collateral is to secure the loan, describe it explicitly in the agreement. This includes conditions under which the lender can seize the collateral.

- Understand Default Consequences: Both parties should be aware of the consequences of default, which should be clearly defined in the agreement, including any rights to cure the default.

- Legal and Binding Nature: Remember, once signed by all parties, the loan agreement becomes a legally binding document. Consulting with legal counsel before signing is advisable to understand the implications fully.

Adherence to these guidelines when drafting and executing a Loan Agreement in Georgia can help to avoid common pitfalls and ensure that the process goes as smoothly as possible. The form not only serves as a clear record of the loan but also provides a legal framework within which both lenders and borrowers operate, thereby safeguarding the interests of both parties involved.

Create Other Loan Agreement Forms for US States

Maryland Promissory Note Download - Might specify the use of the loan, restricting how borrowed funds can be spent by the borrower.

Free Promissory Note Template New York - The agreement protects the lender by legally binding the borrower to repay the loan under the agreed terms.

Promissory Note Template Florida Pdf - The agreement can include arbitration or mediation clauses as methods for dispute resolution, avoiding costly legal battles.

Promissory Note Texas - A Loan Agreement is a formal contract between a borrower and lender outlining the terms of a loan.