Blank Loan Agreement Form for Maryland

Navigating the landscape of loan agreements in Maryland can be a complex process, especially for those embarking on this journey for the first time. Whether you're an individual loaning money to a friend or a business providing a loan to another company, understanding the intricacies of the Maryland Loan Agreement form is crucial. This document not only outlines the expectations and responsibilities of both the lender and borrower but also serves as a legal safeguard should disputes arise. It covers essential elements, such as the loan amount, interest rates, repayment schedule, and what happens in case of a default. Moreover, it adheres to the state's legal requirements, ensuring that all transactions conducted under its guidance are valid and enforceable. By thoroughly understanding this form, both parties can enter into a loan agreement with confidence, knowing their interests are protected.

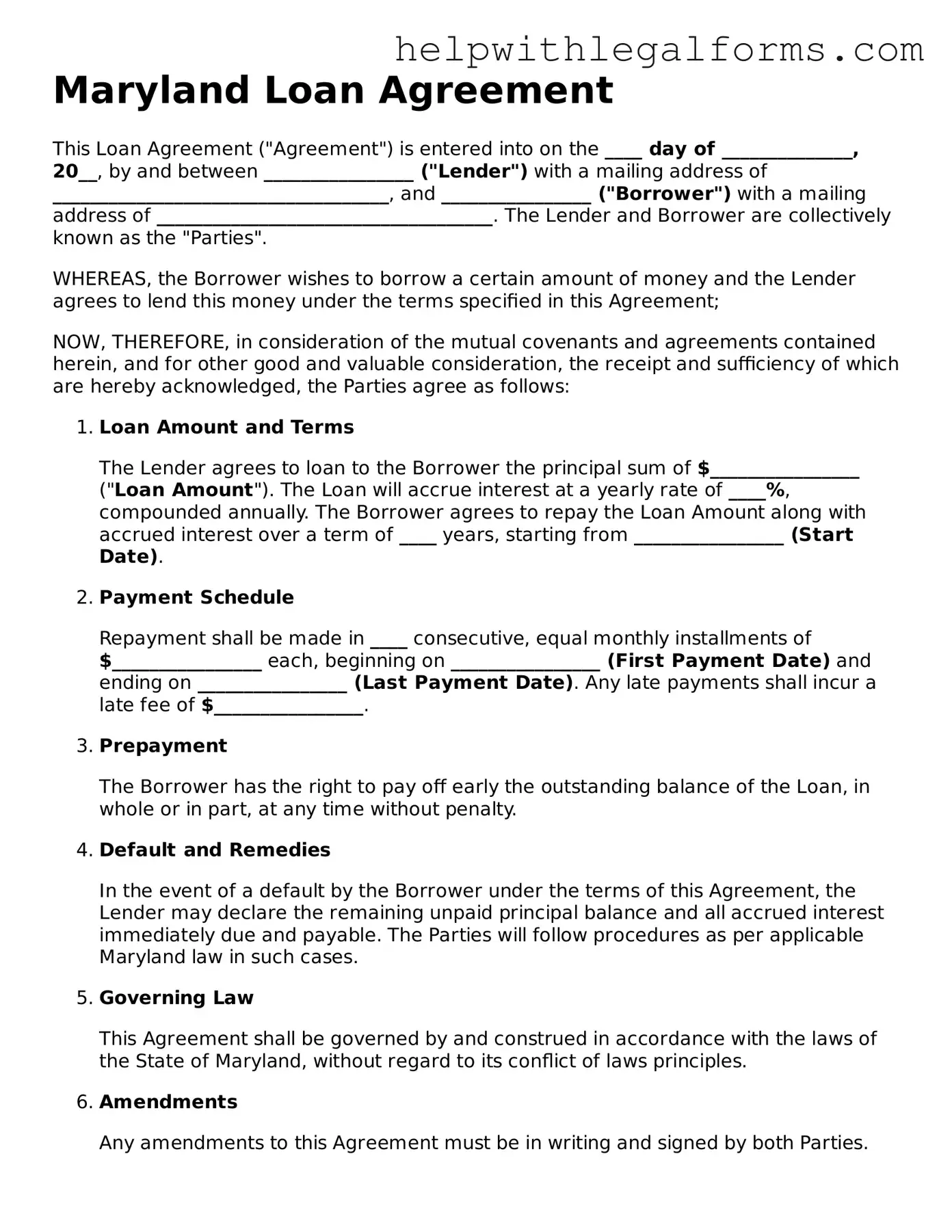

Example - Maryland Loan Agreement Form

Maryland Loan Agreement

This Loan Agreement ("Agreement") is entered into on the ____ day of ______________, 20__, by and between ________________ ("Lender") with a mailing address of ____________________________________, and ________________ ("Borrower") with a mailing address of ____________________________________. The Lender and Borrower are collectively known as the "Parties".

WHEREAS, the Borrower wishes to borrow a certain amount of money and the Lender agrees to lend this money under the terms specified in this Agreement;

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

- Loan Amount and Terms

The Lender agrees to loan to the Borrower the principal sum of $________________ ("Loan Amount"). The Loan will accrue interest at a yearly rate of ____%, compounded annually. The Borrower agrees to repay the Loan Amount along with accrued interest over a term of ____ years, starting from ________________ (Start Date).

- Payment Schedule

Repayment shall be made in ____ consecutive, equal monthly installments of $________________ each, beginning on ________________ (First Payment Date) and ending on ________________ (Last Payment Date). Any late payments shall incur a late fee of $________________.

- Prepayment

The Borrower has the right to pay off early the outstanding balance of the Loan, in whole or in part, at any time without penalty.

- Default and Remedies

In the event of a default by the Borrower under the terms of this Agreement, the Lender may declare the remaining unpaid principal balance and all accrued interest immediately due and payable. The Parties will follow procedures as per applicable Maryland law in such cases.

- Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Maryland, without regard to its conflict of laws principles.

- Amendments

Any amendments to this Agreement must be in writing and signed by both Parties.

- Signatures

Both Parties agree to the terms and conditions set forth in this Agreement and hereby affix their signatures:

_____________________________

Lender: ________________

Date: _____________________________________________

Borrower: ________________

Date: ________________

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | The Maryland Loan Agreement form is governed by Maryland's state laws, ensuring all agreements are compliant with local regulations. |

| 2 | It must include specific details about the borrower and lender, including their names and addresses, to ensure clarity of the parties involved. |

| 3 | The form outlines the loan amount and terms, including the interest rate, repayment schedule, and loan duration, to prevent any misunderstandings. |

| 4 | Security or collateral that the borrower must provide to secure the loan is clearly defined, protecting the lender's interests. |

| 5 | Penalties for late payments and defaults are specified to ensure the borrower understands the consequences of failing to meet the terms. |

| 6 | The agreement includes provisions for amendment and termination, laying out how the terms can be changed or the agreement ended. |

| 7 | Dispute resolution processes are outlined, specifying how any disagreements between the borrower and lender will be handled. |

| 8 | Signatures from both parties are required at the end of the form, providing a legally binding commitment to the terms of the loan. |

Instructions on How to Fill Out Maryland Loan Agreement

When parties in Maryland decide to enter into a loan agreement, completing a Maryland Loan Agreement form is a necessary step. This document formalizes the terms and conditions under which the loan will be provided and repaid. It serves as a legally binding contract between the lender and the borrower, outlining the responsibilities and expectations of each party. For those unfamiliar with legal documentation, the process might seem daunting. However, with a straightforward, step-by-step guide, filling out the Maryland Loan Agreement form can be a manageable task. By carefully following the instructions, the parties can ensure that the agreement accurately reflects their understanding and complies with Maryland state law.

Here are the steps needed to fill out the form:

- Gather necessary information, including the full legal names and contact information of both the lender and the borrower, the loan amount, the interest rate, and the repayment schedule.

- Begin by entering the date on which the agreement is being made at the top of the form.

- Fill in the lender and borrower information sections with their respective names, addresses, and any other contact information required by the form.

- Specify the principal loan amount in the section provided.

- Detail the loan's interest rate. Make sure this rate complies with Maryland's usury laws to avoid legal complications.

- Outline the repayment schedule, including the start date, frequency of payments (monthly, quarterly, etc.), and the amount of each payment. If there are any conditions for early repayment, these should also be included in this section.

- If the loan is secured—that is, backed by collateral—describe the collateral in the section designated for this purpose. Make sure to include specific details that identify the collateral clearly and distinctly.

- Review the sections that describe the rights and obligations of each party, including, but not limited to, provisions for default, late payments, and dispute resolution mechanisms.

- Both parties should carefully read the entire agreement to ensure that it accurately reflects their understanding and intentions.

- Sign and date the form in the presence of a witness or notary, if required by Maryland law or if either party prefers. Typically, having a third-party witness or notarizing the document lends additional legal credibility to the agreement.

- Make copies of the signed agreement. Provide one to each party involved for their records.

After completing these steps, the Maryland Loan Agreement form will be fully executed, making it a legally binding document. The parties should adhere to the terms and conditions laid out in the agreement to avoid potential disputes or legal issues. It's important for both the lender and the borrower to keep their copies of the agreement in a safe place, as it may need to be referenced in the future for any number of reasons, including tax purposes, financial planning, or resolving misunderstandings about the loan's terms.

Crucial Points on This Form

What is a Maryland Loan Agreement?

A Maryland Loan Agreement is a legally binding document between a borrower and a lender. It outlines the loan amount, interest rate, repayment schedule, and other terms specific to the loan. This agreement serves to protect both the borrower's and the lender's interests under Maryland state laws.

Who needs to sign the Maryland Loan Agreement?

The parties involved in the loan—namely, the borrower and the lender—must sign the Maryland Loan Agreement. Depending on the loan's complexity and amount, witnesses or a notary public might also be required to sign, ensuring the agreement’s validity and enforceability.

Is a Maryland Loan Agreement only for business loans?

Not at all. A Maryland Loan Agreement can be used for various loans, including personal loans, business loans, mortgage loans, and auto loans. The agreement's terms can be customized to fit the specific purpose and needs of the loan.

How can I customize the loan terms in the Maryland Loan Agreement?

The loan terms, including the loan amount, interest rate, repayment schedule, and collateral (if any), can be tailored to match the agreement between the borrower and lender. It is advisable to clearly define all terms in the agreement to prevent any future disputes.

Are oral agreements recognized in Maryland for loan agreements?

While oral agreements can be legally binding, proving the terms and existence of an oral agreement can be extremely challenging. For this reason, it is highly recommended to have a written Maryland Loan Agreement for any loan to ensure clarity and enforceability under Maryland law.

What happens if a borrower defaults on a loan under a Maryland Loan Agreement?

If a borrower defaults on a loan, the specific remedies available to the lender will be outlined in the loan agreement. These could include demanding immediate payment of the entire outstanding balance, taking possession of collateral, or pursuing legal action to enforce the agreement.

Can the terms of a Maryland Loan Agreement be changed after signing?

Yes, the terms of a Maryland Loan Agreement can be amended, but any changes must be agreed upon by both the borrower and the lender. The amendment should be in writing and duly signed by both parties to maintain its validity and enforceability.

Is it necessary to have a lawyer review a Maryland Loan Agreement?

While not always required, having a lawyer review your Maryland Loan Agreement can provide added security. A lawyer can help ensure that the agreement complies with all state laws and fully protects your rights and interests.

What documents should accompany a Maryland Loan Agreement?

Supporting documents may include loan application forms, credit reports, collateral documentation, and any other agreements related to the loan (e.g., mortgage documents for real estate loans). The exact documents required will depend on the loan’s nature and terms.

How does a Maryland Loan Agreement impact my credit score?

While the agreement itself does not directly affect your credit score, your compliance with its terms will. Prompt payments can positively impact your credit score, while late payments or defaulting on the loan can negatively affect it. Both borrowers and lenders should consider how the agreement and its fulfillment interact with credit reporting practices.

Common mistakes

When filling out the Maryland Loan Agreement form, a tool essential in documenting the terms and conditions of a loan between two parties, mistakes can compromise the legal integrity of the agreement, potentially leading to disputes or financial losses. Here is a list of common mistakes people often make:

Not Specifying the Loan Amount Clearly - Failing to clearly state the amount being lent can create confusion and disputes down the line.

Ignoring the Interest Rate - Neglecting to mention the interest rate or incorrectly stating it can affect the repayment amount, leading to misunderstandings between the involved parties.

Not Defining the Repayment Schedule - A vague or absent repayment schedule can lead to uncertainties regarding payment deadlines and amounts.

Forgetting to Include Late Payment Penalties - Without clear penalties for late payments, there is less incentive for timely repayment, which could put the lender at a disadvantage.

Omitting Default Terms - Not specifying the actions to be taken if the borrower defaults on the loan leaves the lender without a clear recourse.

Skipping the Governing Law - Not stating which state's law will govern the agreement can complicate legal disputes if they arise.

Misidentifying Parties - Incorrectly identifying the parties involved, or not using their legal names, can lead to the agreement being challenged or considered invalid.

Failing to Sign the Document - An unsigned agreement is often unenforceable, making it crucial for all parties to officially sign the document.

Not Witnessing or Notarizing When Necessary - While not always required, failing to have the document witnessed or notarized if needed can affect its legal standing and enforceability.

Avoiding these common mistakes requires attention to detail and an understanding of the legal obligations each party undertakes. It is often beneficial to consult with a legal professional before finalizing a loan agreement to ensure its validity and enforceability.

Documents used along the form

When entering into a loan agreement in Maryland, parties may often find it necessary to use additional forms and documents to ensure the transaction is comprehensive and legally sound. These supporting documents not only fortify the agreement but also provide clarity and legal protection for both the borrower and the lender. Below is a list of other forms and documents commonly used alongside the Maryland Loan Agreement form.

- Promissory Note: This document serves as a written promise by the borrower to pay back the loan to the lender. It outlines the amount borrowed, interest rate, repayment schedule, and any other terms related to the repayment of the loan.

- Personal Guarantee: Often required for business loans, this document is an agreement by an individual (usually a business owner) to be personally responsible for the loan if the business fails to repay it. This adds an extra layer of security for the lender.

- Security Agreement: This legal document provides the lender a security interest in a specific asset or property that serves as collateral. In the event of default, the lender has the right to seize the collateral to recover the outstanding loan amount.

- Mortgage or Deed of Trust: For real estate transactions, this document secures the loan with the property being purchased. It outlines the rights and responsibilities of both parties regarding the property and provides the legal framework for foreclosure if necessary.

- Amendment Agreement: Changes to the original loan terms are documented with an amendment agreement. This ensures that any adjustments to the loan details, such as changes in repayment schedule or interest rates, are formally recorded and agreed upon by both parties.

Ensuring that these documents are properly completed and executed can significantly mitigate risks involved with lending or borrowing money. Both parties are encouraged to fully understand and carefully consider the implications of each document before proceeding with the loan transaction. Proper legal counsel should be sought when necessary to navigate through the complexities of these agreements and secure the interests of both the borrower and the lender.

Similar forms

Promissory Note: A promissory note is similar to a loan agreement as both are legally binding documents in which a party promises to pay a certain amount of money to another. A promissory note is often simpler, outlining the essentials of the loan, like amount and repayment terms, resembling a loan agreement which covers these basics in addition to more detailed terms and conditions.

Mortgage Agreement: This document is similar to a loan agreement due to its function of outlining the terms under which money is borrowed to purchase real estate. A mortgage agreement secures the loan against the property being bought, mirroring the security aspect in some loan agreements which require collateral.

Line of Credit Agreement: A line of credit agreement shares common ground with a loan agreement in setting forth terms under which a borrower can access funds up to a specified credit limit. Both documents detail interest rates, repayment schedules, and conditions of the financial arrangement.

Lease Agreement: While primarily used for renting purposes, a lease agreement is similar to a loan agreement in its provision of terms and conditions under an agreement between two parties. Both establish a timeframe for the arrangement, payments to be made, and obligations of each party.

Debt Settlement Agreement: This document is similar because it also involves the payment of money owed. A debt settlement agreement outlines the terms under which a debtor agrees to pay a lump sum that is typically less than the total amount owed, comparable to the way a loan agreement might establish repayment terms for borrowed money.

Equity Investment Agreement: Similar to loan agreements, equity investment agreements detail the financial arrangements between parties, but in this case, it involves exchanging money for ownership stakes or shares instead of a repayment of the loan. They both include financial assessments, terms, and conditions of the investment or loan.

Partnership Agreement: This type of agreement outlines the terms of a partnership between two or more parties in business together, specifying the responsibilities, profit and loss distribution, and rules for changes in partnership. It's similar to a loan agreement in detailing the operational aspects and financial responsibilities within a formal arrangement.

Personal Guarantee: A personal guarantee assures repayment of a loan by an individual’s personal assets in case of default. It is related to a loan agreement in its assurance of the loan being repaid, often incorporated as a part of a broader loan contract when collateral is required.

Credit Agreement: A credit agreement provides detailed terms of credit being extended from a lender to a borrower, similar to a loan agreement with its comprehensive detailing of loan terms, repayment schedules, interest rates, and conditions upon which the agreement is made.

Shareholders Agreement: A shareholders agreement among shareholders of a company dictates how the company should be operated and outlines the rights and obligations of the shareholders. It is similar to a loan agreement in structuring financial and operational relationships, although it focuses on equity rather than debt.

Dos and Don'ts

When preparing to fill out a Maryland Loan Agreement form, it's vital to take steps that ensure the document is legally binding, accurate, and clear to all parties involved. To help navigate this process, below is a list of recommended dos and don'ts:

- Do read the entire form before starting to fill it out. Understanding every section in advance can clarify what information you need and prevent mistakes.

- Do use black or blue ink if the form will be filled out by hand. These colors are standard for legal documents because they ensure legibility and photocopy well.

- Do provide accurate and complete details about the loan, including the amount, interest rate, repayment schedule, and any collateral securing the loan. Accuracy is essential for enforceability.

- Do ensure that all parties to the loan agreement sign and date the form. For added legal protection, consider having the signatures notarized.

- Don't leave any sections blank. If a section does not apply, write “N/A” (not applicable) to indicate that the question was considered but did not apply to your situation.

- Don't forget to include any appendices or attachments if they are referenced in the agreement. These might include detailed repayment schedules or legal descriptions of collateral.

- Don't hesitate to seek legal advice. If there is any part of the agreement that is not clear, consulting with a legal advisor can prevent potential issues down the line.

- Don't use vague language. The terms of the agreement should be specific and clear to all parties to avoid misunderstandings and enforceability issues.

Filling out the Maryland Loan Agreement form with due diligence can safeguard the interests of all parties involved and help ensure that the agreement is legally binding. Paying close attention to the details and following these guidelines will aid in the creation of a sound and effective loan agreement.

Misconceptions

Many people in Maryland have misconceptions about the loan agreement form, which can lead to unnecessary confusion or legal challenges. It's important to understand what these misconceptions are so that you can navigate the loan process more effectively. Below are five common misconceptions clarified for better understanding.

It's only about the money being loaned. One common misconception is that the loan agreement form solely concerns the amount of money being loaned. In reality, this form covers a range of terms and conditions, including repayment schedule, interest rates, and what happens in the event of a default. It's a comprehensive document that outlines the entire agreement between the borrower and the lender.

A verbal agreement is just as binding. Some people believe that a verbal agreement between the borrower and the lender in Maryland is as legally binding as a written loan agreement form. However, without a written document, it can be very difficult to enforce the terms of the loan. Maryland law requires certain contracts to be in writing, and for a good reason: to provide clear evidence of what both parties have agreed to.

Only banks and financial institutions use loan agreement forms. This misconception leads people to think that loan agreements are only formalities used by banks and large financial institutions. In reality, any two parties entering into a loan, regardless of the amount, can benefit from having a loan agreement form. This document protects both the borrower and the lender, regardless of their sizes or the nature of their relationship.

Loan agreement forms are identical. Many assume all loan agreement forms in Maryland are the same, but this couldn't be further from the truth. While certain basic elements might be similar, loan agreements can vary greatly depending on the specifics of the loan, the parties involved, and their particular needs and circumstances. Customizing the document helps to ensure that it accurately reflects the agreement.

No need for legal advice if using a standard form. Even when using a standard loan agreement form, it's wise to seek legal advice. Every loan situation is unique, and what works in one scenario might not be appropriate in another. Legal professionals can provide crucial insights into how to tailor the agreement to protect your interests effectively.

Understanding these misconceptions can help Maryland residents navigate the complexities of loan agreements with more confidence and security. When in doubt, consulting with a legal professional can provide clarity and ensure that your financial transactions are solidly documented and legally sound.

Key takeaways

When filling out and using the Maryland Loan Agreement form, it’s important to pay attention to several key aspects to ensure the process goes smoothly and all legal bases are covered. Here’s what you need to know:

Complete all required fields with accurate information to prevent any issues or delays. It’s essential to double-check details like names, addresses, and financial amounts.

Understand the terms of the loan, including the interest rate, repayment schedule, and any fees associated with the loan. These should be clearly stated in the form.

Ensure both the borrower and the lender sign the agreement. Their signatures legally bind them to the terms set out in the document.

Consider the need for a witness or notary public to validate the signatures. This step can add an extra layer of legal protection for both parties.

Keep the language of the agreement clear and straightforward. Avoid using complicated legal terms that might confuse any party.

If collateral is being used to secure the loan, make sure it is described clearly and accurately within the agreement.

Be aware of Maryland's specific laws and provisions regarding loans and interest rates. These laws must be followed to ensure the agreement is enforceable.

Discuss and agree on what happens if a payment is late or missed. The agreement should outline any late fees or penalties.

Do not forget to include a provision about what happens if the borrower defaults on the loan. This can include legal actions or seizing collateral.

Keep a copy of the agreement in a safe place. Both the borrower and the lender should have their own copies for their records.

By paying close attention to these key points, you can ensure that the Maryland Loan Agreement form is filled out correctly and serves its intended purpose without any unforeseen complications.

Create Other Loan Agreement Forms for US States

Promissory Note Template Florida Pdf - Environmental indemnity clauses can also be included to address responsibilities for property-based loans, safeguarding against unforeseen liabilities.

Promissory Note Texas - The agreement includes provisions for what happens if the borrower fails to repay the loan.

Free Promissory Note Template New York - It specifies penalties for late payments and conditions for loan modification or prepayment.

Promissory Note Template California Word - This document is crucial for both personal loans between family members and more formal loans from financial institutions.