Blank Loan Agreement Form for New York

In the bustling metropolis of New York, the dynamics of financial transactions are sophisticated and diverse, reflecting the city's status as a global economic powerhouse. At the heart of many personal and business financial interactions lies the New York Loan Agreement form, a critical document that outlines the terms and conditions under which money is lent and repaid. This form serves as a legal contract between the borrower and lender, specifying details such as the loan amount, interest rates, repayment schedule, and any collateral involved. It also includes provisions for what happens in case of default, making it an indispensable tool for protecting the interests of both parties. The precision and completeness of this agreement are vital, as it minimally mitigates misunderstandings and disputes, ensuring a clear path forward for financial engagements. By comprehensively covering borrower and lender rights, the New York Loan Agreement form embodies the legal rigour and practical necessities required in today's fast-paced financial environment.

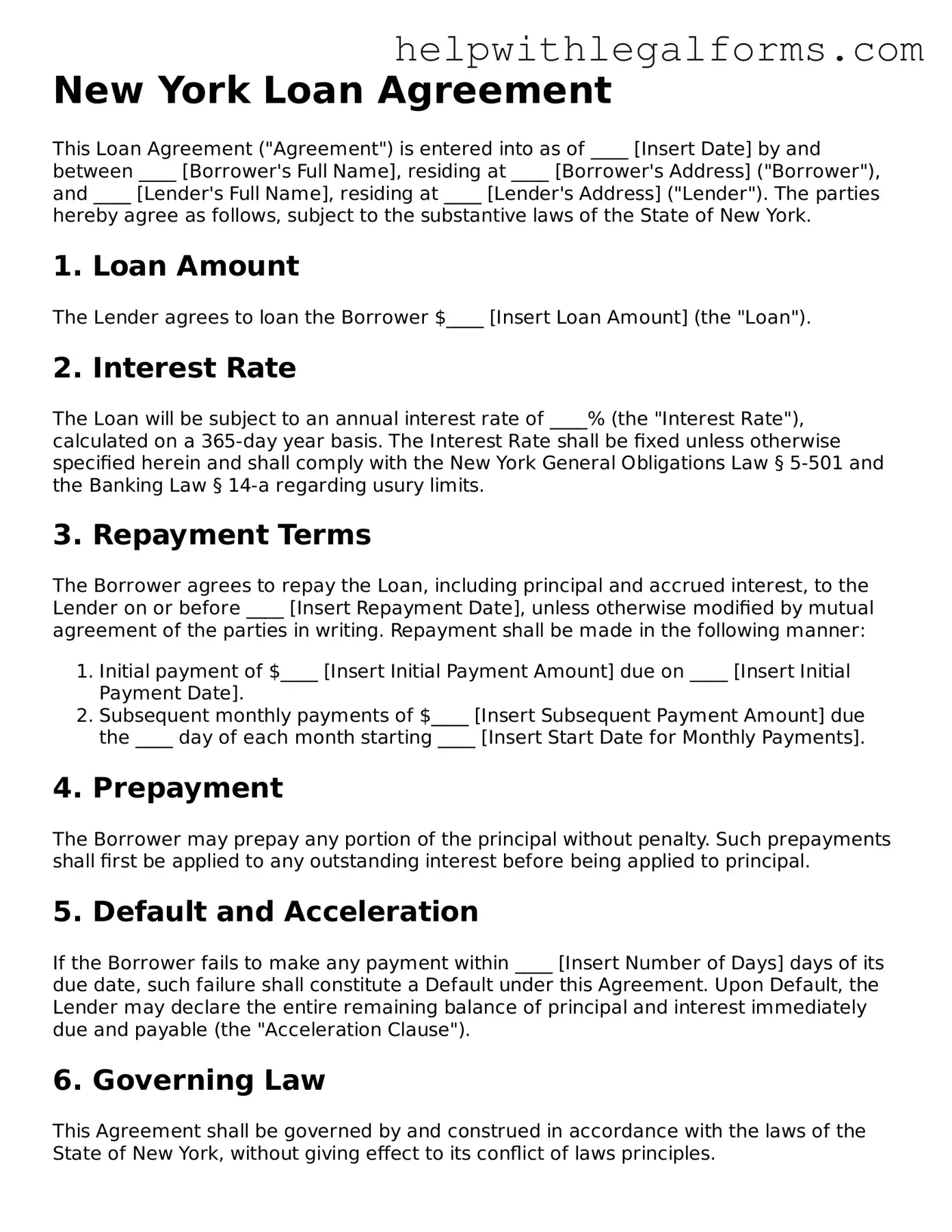

Example - New York Loan Agreement Form

New York Loan Agreement

This Loan Agreement ("Agreement") is entered into as of ____ [Insert Date] by and between ____ [Borrower's Full Name], residing at ____ [Borrower's Address] ("Borrower"), and ____ [Lender's Full Name], residing at ____ [Lender's Address] ("Lender"). The parties hereby agree as follows, subject to the substantive laws of the State of New York.

1. Loan Amount

The Lender agrees to loan the Borrower $____ [Insert Loan Amount] (the "Loan").

2. Interest Rate

The Loan will be subject to an annual interest rate of ____% (the "Interest Rate"), calculated on a 365-day year basis. The Interest Rate shall be fixed unless otherwise specified herein and shall comply with the New York General Obligations Law § 5-501 and the Banking Law § 14-a regarding usury limits.

3. Repayment Terms

The Borrower agrees to repay the Loan, including principal and accrued interest, to the Lender on or before ____ [Insert Repayment Date], unless otherwise modified by mutual agreement of the parties in writing. Repayment shall be made in the following manner:

- Initial payment of $____ [Insert Initial Payment Amount] due on ____ [Insert Initial Payment Date].

- Subsequent monthly payments of $____ [Insert Subsequent Payment Amount] due the ____ day of each month starting ____ [Insert Start Date for Monthly Payments].

4. Prepayment

The Borrower may prepay any portion of the principal without penalty. Such prepayments shall first be applied to any outstanding interest before being applied to principal.

5. Default and Acceleration

If the Borrower fails to make any payment within ____ [Insert Number of Days] days of its due date, such failure shall constitute a Default under this Agreement. Upon Default, the Lender may declare the entire remaining balance of principal and interest immediately due and payable (the "Acceleration Clause").

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New York, without giving effect to its conflict of laws principles.

7. Amendment

Any amendment to this Agreement must be in writing and signed by both parties.

8. Notices

All notices, requests, demands, and other communications under this Agreement shall be in writing and shall be deemed to have been duly given on the day of delivery if delivered by hand, or on the second business day after mailing if mailed by certified or registered mail, postage prepaid, to the addresses first above written or such other address as may be given from time to time in accordance with this section.

9. Waiver

No waiver by either party of any default shall be deemed as a waiver of any prior or subsequent default of the same or other provisions of this Agreement.

10. Signatures

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

__________________________________

Borrower's Signature

__________________________________

Lender's Signature

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The New York Loan Agreement form is governed by the laws of the State of New York. |

| Interest Rate Limits | In New York, the maximum interest rate on personal loans is capped by the state's usury laws. |

| Written Agreement Requirement | A written agreement is required for loans above a certain amount, detailing the terms and conditions of the loan. |

| Late Fees Regulations | Any late fees charged must be reasonable and are subject to limitations set forth by New York State Law. |

| Prepayment Penalties | New York laws may restrict or limit prepayment penalties on loans. |

| Default and Remedies | The form should outline the lender's remedies in the event of default, which are also regulated by state law. |

| Dispute Resolution | The agreement may include provisions for mediation or arbitration in the case of disputes, reflecting New York's legal stance on alternative dispute resolutions. |

Instructions on How to Fill Out New York Loan Agreement

Completing a New York Loan Agreement form is a critical step in formalizing a loan between two parties, ensuring clarity and legal protection for both the borrower and the lender. This agreement outlines the loan's amount, interest rate, repayment schedule, and other essential terms, making the loan execution transparent and legally binding. To accurately fill out this form, each party must provide thorough and precise information, which helps prevent misunderstandings and potential disputes down the line. Following the right steps can simplify this process, making it more straightforward and less daunting for anyone involved.

- Identify the parties involved by writing the full legal names of both the borrower and the lender at the beginning of the agreement. Include their addresses and contact information.

- Specify the loan amount in U.S. dollars. Ensure this number is written clearly and matches the agreed-upon amount between the parties.

- Detail the loan's interest rate. Mention whether the rate is fixed or variable and how it will be calculated and applied to the principal amount.

- Outline the repayment schedule. Include the start date of the repayments, the frequency of payments (e.g., monthly), and the duration of the repayment period. Specify the due date for the final payment.

- Describe any collateral securing the loan, if applicable. Clearly define the collateral and include any necessary details like serial numbers, descriptions, or other identifiers.

- List any covenants or promises between the parties. This could involve the borrower agreeing to maintain certain insurance or the lender promising to provide notice before taking possession of collateral.

- Include provisions for a default and steps for remedy. Detail what constitutes a default and what actions the lender can take if the borrower fails to meet the agreement's terms.

- State the governing law. Specify that the loan agreement will be governed by the laws of the State of New York.

- Provide space for signatures. At the end of the document, include lines for both the borrower and the lender to sign and date the agreement, officially acknowledging their understanding and consent to its terms.

- If necessary, attach any additional documents or schedules referenced in the loan agreement to ensure completeness and legal compliance.

By meticulously following these steps, both parties can execute a comprehensive and legally sound loan agreement that upholds their interests and minimizes future conflicts. Attention to detail and clarity in each section of the form not only facilitate a smoother lending process but also reinforce the mutual responsibilities and expectations of the borrower and lender. Completing the New York Loan Agreement with care and precision is a foundational step in creating a successful financial relationship.

Crucial Points on This Form

What is a New York Loan Agreement?

A New York Loan Agreement is a legal document that outlines the terms and conditions under which one party (the lender) provides a loan to another party (the borrower). This agreement specifies the amount of the loan, interest rate, repayment schedule, and the obligations of both parties involved. Tailored to comply with New York State laws, it ensures that all transactions are conducted legally and transparently.

Who needs a New York Loan Agreement?

Anyone lending or borrowing money in the state of New York could need a loan agreement. This includes individuals, businesses, and entities engaging in financial transactions that involve lending money. Having this agreement in place helps protect both the lender's and the borrower's interests and ensures a clear understanding of the repayment terms.

What are the key components of a New York Loan Agreement?

The key components of a New York Loan Agreement typically include the loan amount, interest rate, repayment schedule, collateral (if any), parties' information, and any warranties or covenants. Additionally, it should outline the actions to be taken in the event of default, including recovery processes and grace periods.

How does one create a New York Loan Agreement?

To create a New York Loan Agreement, the lender and borrower must agree on the terms of the loan. These terms should then be documented in writing, outlining all the agreed-upon components of the loan. It is highly recommended to consult with a legal professional to ensure that the agreement complies with all state laws and adequately protects both parties' interests.

Is a witness or notarization required for a New York Loan Agreement to be valid?

While not always required, having a witness or notarizing a New York Loan Agreement can add an extra layer of validity and may help enforce the agreement should there be a dispute. It's advisable to consider the value of the loan and the relationship between the parties when deciding whether to involve a witness or a notary.

Can a New York Loan Agreement be modified after it's signed?

Yes, a New York Loan Agreement can be modified after it's signed, but any modifications must be agreed upon by all parties involved. It's crucial to document these changes in writing, and both the lender and the borrower should sign the revised document to ensure that the modifications are enforceable.

What happens if the borrower defaults on the loan?

In the event of a default, the actions that can be taken are outlined in the loan agreement itself. These actions may include initiating a collection process, seizing the collateral (if any), or taking legal action. The specific consequences depend on the terms agreed upon in the loan agreement and New York State law.

Are prepayment penalties allowed in New York Loan Agreements?

Prepayment penalties can be included in a New York Loan Agreement if both parties agree to them. However, the terms regarding prepayment penalties must be clearly stated in the agreement to ensure they are enforceable.

How does a New York Loan Agreement interact with other state laws?

While a New York Loan Agreement is designed to comply with New York State laws, when transactions involve parties from different states, federal laws and the laws of other states may also come into play. It's important to consider how these laws interact and consult a legal professional to ensure compliance across jurisdictions.

Where can one get a New York Loan Agreement template?

New York Loan Agreement templates can often be found online through legal services websites. However, it's important to ensure that any template used is up-to-date with current New York State laws. Consulting a legal professional to review or draft a loan agreement is always recommended to ensure its validity and enforceability.

Common mistakes

-

Not specifying the loan amount in clear terms can lead to ambiguity. It's vital that the form clearly states the exact amount being lent to avoid any future disputes over the loan's value. This figure should include not just the principal amount but any interests or fees agreed upon.

-

Omitting the repayment schedule is another common oversight. The agreement should outline specific dates or conditions under which the loan is to be repaid. A lack of a well-defined schedule can result in misunderstandings regarding the expectations for repaying the loan.

-

Failing to detail the interest rate, if applicable, is a mistake that can significantly impact the borrower. The document should clearly state the interest rate to protect both parties and ensure there is no confusion about the cost of borrowing the money.

-

Ignoring the need to specify collateral or security for the loan. If the loan agreement is to be secured with collateral, this must be explicitly stated, including a detailed description of the collateral and the conditions under which it could be seized.

-

Forgetting to include the consequences of a default on the loan. The agreement should always outline the actions that can be taken if the borrower fails to meet the terms of the loan, protecting the lender's interests.

-

Neglecting to have the document reviewed by all parties and, if necessary, by a legal professional. It’s common for individuals to fill out such forms without seeking adequate advice or ensuring all parties fully understand the terms, which can lead to significant issues down the line.

In summary, when completing the New York Loan Agreement form, it is crucial to approach the task with diligence and thoroughness. By avoiding these common mistakes—clearly stating the loan amount, defining the repayment schedule, detailing the interest rate, specifying any collateral, outlining the consequences of default, and ensuring the agreement is reviewed for full understanding—parties can help ensure that the agreement serves its intended purpose and minimizes potential conflicts.

Documents used along the form

When entering into a loan agreement in New York, various other forms and documents may be required or beneficial to ensure that all aspects of the transaction are legally covered and clearly documented. These supplementary documents are tailored to address and secure both the borrower's and lender's interests beyond the primary terms outlined in the loan agreement itself. They range from declarations of personal financial standing to legally binding commitments to repay the loan under specific conditions. Here's an overview of up to 10 forms and documents that are often used in conjunction with the New York Loan Agreement form:

- Promissory Note: This is a vital document that details the borrower’s promise to pay back the loan. It outlines the loan amount, interest rate, repayment schedule, and consequences of defaulting on the loan.

- Personal Guarantee: Often required for business loans, this document is a promise from an individual (usually a business owner) to repay the loan personally if the business is unable to do so.

- Mortgage Agreement: If the loan is secured against real property, a mortgage agreement is used to detail the terms under which the property is used as collateral for the loan.

- Security Agreement: This document is used for loans secured against personal property (as opposed to real estate). It lays out the borrower's agreement to pledge certain assets as collateral.

- Amortization Schedule: A detailed breakdown of each loan payment divided into the amount that goes toward the interest versus the principal amount. This schedule helps both parties track the gradual reduction of the loan balance.

- Credit Report Authorization Form: This authorizes the lender to obtain the borrower's credit report from a credit bureau to assess their creditworthiness.

- Debt Subordination Agreement: Used when there are multiple creditors, this agreement establishes one creditor’s priority over others in the event of a default.

- Prepayment Penalty Disclosure: A document that outlines any penalties the borrower would incur if they pay off the loan early. This is important for lenders expecting to receive a certain amount of interest over the life of the loan.

- Financial Statements: Detailed reports of the borrower’s financial status, including income, expenses, assets, and liabilities, providing the lender with a comprehensive view of the borrower's ability to repay the loan.

- UCC-1 Financing Statement: This is filed with the state to publicize a secured interest in the collateral, giving the lender a priority claim over the assets in the event of default or bankruptcy.

These documents, while varying in purpose and detail, collectively provide a comprehensive framework for securing a loan, protecting the interests of both borrower and lender, and ensuring legal compliance. Each document has its place in creating a clear, enforceable agreement, reinforcing the terms of the New York Loan Agreement with specific, legally binding provisions. Whether the loan is for personal, commercial, real estate, or other purposes, these additional forms and declarations help pave the way for a successful financial transaction.

Similar forms

Promissory Note: This document, like a loan agreement, outlines the borrower's promise to pay back a sum of money to the lender within a specified period. Both documents specify the loan amount, interest rate, repayment schedule, and consequences of default. However, a loan agreement typically includes more detailed provisions regarding the obligations of each party and is often used in more complex transactions.

Mortgage Agreement: Similar to a loan agreement, a mortgage agreement provides a lender security interest in the borrower's property to ensure repayment of the loan. Both agreements include terms about the loan amount, interest rate, and repayment obligations. The key difference lies in the incorporation of the property as collateral in a mortgage agreement, which allows the lender to foreclose on the property if the borrower fails to comply with the repayment terms.

Lease Agreement: Though primarily used for renting property, a lease agreement shares common features with a loan agreement, such as defining term length, payment schedules, and penalties for non-compliance. The principal distinction is that a lease agreement transfers the right to use an asset rather than providing a monetary loan. Nonetheless, both documents are contractual commitments that bind the parties to their agreed-upon terms.

Line of Credit Agreement: Similar to a loan agreement, a line of credit agreement offers the borrower access to funds up to a specified limit for a given period. Both agreements define the terms of access to funds, interest rates, repayment conditions, and the consequences of failing to meet these conditions. However, a line of credit allows for the borrowed amount to be repaid and redrawn repeatedly up to the maximum limit, distinguishing it from a fixed loan amount under a loan agreement.

Partnership Agreement: While a partnership agreement governs the relationship between partners in a business venture rather than a borrower-lender relationship, it bears similarities to a loan agreement in terms of specifying the contributions (which can include loans), roles, and responsibilities of the parties involved. In addition, both types of agreements detail how profits and losses are shared, and set out the procedures for resolving disputes and handling breaches.

Dos and Don'ts

When you're navigating the complexities of filling out a New York Loan Agreement form, it's essential to keep a few key do's and don'ts in mind. This not only helps in making sure your agreement is legally binding and enforceable but also prevents any potential legal pitfalls down the line. Let's dive into the essential practices to follow and the pitfalls to avoid.

Do:- Read the entire form carefully before filling it out. This ensures you understand all the requirements and provisions included in the agreement.

- Include accurate and complete information. Whether it's your personal details, loan amount, interest rates, or repayment terms, accuracy is key to a valid agreement.

- Use clear and precise language. Avoid using technical jargon or ambiguous terms that could be misinterpreted.

- Ensure the interest rates and repayment terms comply with New York's usury laws. Staying within legal limits is crucial to avoid penalties or the agreement being deemed unenforceable.

- Sign and date the form in the presence of a notary public. This step adds a layer of legal validation to the agreement.

- Leave any sections incomplete. An incomplete form may lead to misunderstandings or legal disputes in the future.

- Sign without reading. Make sure you thoroughly understand every provision in the agreement before you add your signature.

- Rely solely on verbal agreements. While oral agreements can be legally binding, they are much harder to prove in court than written ones.

- Forget to keep a copy for your records. Each party should have a complete signed copy of the agreement for future reference.

- Ignore the need for witnesses or additional documentation. Depending on the amount of the loan or the specific terms, additional documentation or witnesses might be necessary to enforce the agreement.

By adhering to these guidelines, parties can ensure that their New York Loan Agreement is legally sound, clear, and enforceable, easing the loan process and protecting the interests of both the borrower and the lender.

Misconceptions

When navigating the process of drafting a New York Loan Agreement, various misconceptions can cloud the understanding of what the form entails and how it functions. Here's a closer look at these misconceptions to provide clarity and aid those preparing to engage in a loan agreement in New York.

One size fits all: A common misconception is that a single template or form suffices for all types of loan agreements in New York. In reality, the specifics of each loan—such as the amount, interest rate, repayment terms, and the presence of collateral—necessitate a tailored document to accurately reflect the agreement's terms.

Only financial institutions can draft them: While banks and other lending institutions often use standardized forms, any lender, including individuals, can draft a loan agreement. The key is ensuring that the document complies with New York laws and adequately protects the interests of both parties involved.

Legal terminology is a must: Though legal terms can provide clarity and precision, the primary goal is to ensure that the agreement is clearly understood by all parties. Therefore, straightforward language that captures the agreement's intentions without unnecessary complexity is often favored and encouraged.

No need for witnesses or notarization: While not always legally required, having the agreement witnessed or notarized can add a level of authenticity and enforceability. This step can be particularly beneficial in the event of a dispute or if the agreement's validity is questioned.

Oral agreements suffice: Although oral agreements can be legally binding, proving the terms without written documentation can be challenging. A written loan agreement is crucial to ensure clarity and provide a tangible reference for the conditions acquiesced by both borrower and lender.

Interest rates are unrestricted: New York law imposes certain limits on interest rates (usury laws) to protect borrowers from exorbitant charges. The agreement must stipulate an interest rate within these legal boundaries to maintain its enforceability.

Collateral must be physical: Collateral, serving as security for the loan, does not necessarily have to be physical assets. Financial instruments, equity interests, or other forms of security can also be designated as collateral under the terms of a loan agreement.

Amendments require a new agreement: It's possible to modify a loan agreement without drafting an entirely new document. Such amendments, however, should be in writing and signed by both parties to ensure they are legally binding.

Default automatically leads to litigation: Many believe that failure to meet the terms of a loan agreement immediately results in court action. In practice, the agreement can specify alternative resolutions such as mediation or restructuring, offering solutions outside of litigation to resolve conflicts.

Key takeaways

When entering into a Loan Agreement in New York, it’s crucial to understand not just the contents of the form but also the implications of signing such a document. Here are key takeaways that one must remember:

- The New York Loan Agreement form must explicitly outline the loan amount, interest rates, repayment schedule, and any collateral involved. These terms should be clearly defined to avoid any ambiguity.

- Both parties—the lender and the borrower—need to provide accurate and truthful information. This includes their legal names, addresses, and any other identifiers.

- Interest rates agreed upon in the loan agreement must comply with New York's usury laws to ensure that the agreement is legally binding and enforceable.

- It’s important to specify the purpose of the loan within the document. This helps in avoiding any misunderstanding regarding how the loaned funds can be used.

- Penalties for late payments and the conditions under which the loan would be considered in default should be thoroughly documented in the agreement to protect both parties.

- Any collateral securing the loan must be explicitly described, including its value and conditions upon which the lender could seize the asset if the loan defaults.

- The agreement should outline the process for amending terms, if necessary, which typically requires written consent from both lender and borrower.

- To ensure the document's legality, both parties should sign the agreement in the presence of a witness or notary public. In New York, notarization could add an extra layer of authentication to the document.

- Keep a record of all payments made under the agreement. Both the borrower and the lender should maintain copies of checks, bank statements, or any transaction records.

- Before signing, both parties should take the time to review every element of the agreement to avoid any surprises. Seeking legal advice to fully understand the implications of the loan agreement is always recommended.

Understanding these key aspects can significantly mitigate potential legal issues and ensure that the loan process is smooth for both the lender and the borrower. Proper documentation and adherence to legal regulations are paramount in protecting the interests of both parties involved in a New York Loan Agreement.

Create Other Loan Agreement Forms for US States

Promissory Note Template California Word - It can be used for a variety of loans, including personal, auto, student, and mortgage loans.

Promissory Note Texas - This document may be required by financial institutions for loan approval processes.