Blank Loan Agreement Form for Texas

When entering the realm of financial agreements in Texas, especially those involving loans, comprehending the ins and outs of the Texas Loan Agreement form is paramount. This document serves as a critical foundation for both lenders and borrowers, detailing the specific terms under which money is lent and must be repaid. It operates not just as a formal acknowledgment of the loan amount, interest rates, repayment schedule, and any collateral involved, but also plays a vital role in protecting the interests of both parties involved in the transaction. Important aspects such as the legal obligations, rights of each party, and the consequences of default are meticulously outlined, ensuring clarity and understanding. The inclusion of this form in any loan transaction within Texas underscores the seriousness of the commitment and provides a robust framework within which both lenders and borrowers can operate confidently, knowing that they are supported by a well-defined legal structure.

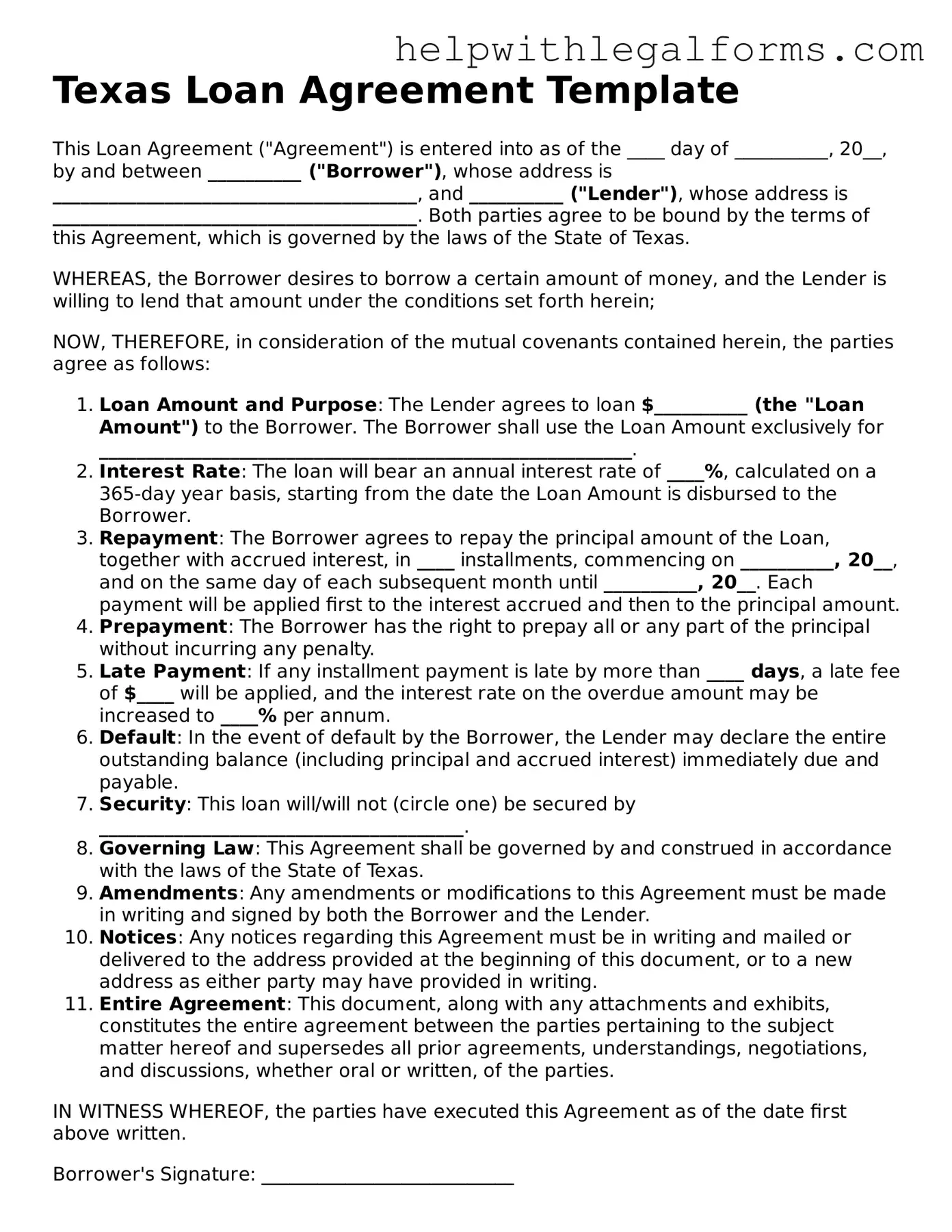

Example - Texas Loan Agreement Form

Texas Loan Agreement Template

This Loan Agreement ("Agreement") is entered into as of the ____ day of __________, 20__, by and between __________ ("Borrower"), whose address is _______________________________________, and __________ ("Lender"), whose address is _______________________________________. Both parties agree to be bound by the terms of this Agreement, which is governed by the laws of the State of Texas.

WHEREAS, the Borrower desires to borrow a certain amount of money, and the Lender is willing to lend that amount under the conditions set forth herein;

NOW, THEREFORE, in consideration of the mutual covenants contained herein, the parties agree as follows:

- Loan Amount and Purpose: The Lender agrees to loan $__________ (the "Loan Amount") to the Borrower. The Borrower shall use the Loan Amount exclusively for _________________________________________________________.

- Interest Rate: The loan will bear an annual interest rate of ____%, calculated on a 365-day year basis, starting from the date the Loan Amount is disbursed to the Borrower.

- Repayment: The Borrower agrees to repay the principal amount of the Loan, together with accrued interest, in ____ installments, commencing on __________, 20__, and on the same day of each subsequent month until __________, 20__. Each payment will be applied first to the interest accrued and then to the principal amount.

- Prepayment: The Borrower has the right to prepay all or any part of the principal without incurring any penalty.

- Late Payment: If any installment payment is late by more than ____ days, a late fee of $____ will be applied, and the interest rate on the overdue amount may be increased to ____% per annum.

- Default: In the event of default by the Borrower, the Lender may declare the entire outstanding balance (including principal and accrued interest) immediately due and payable.

- Security: This loan will/will not (circle one) be secured by _______________________________________.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

- Amendments: Any amendments or modifications to this Agreement must be made in writing and signed by both the Borrower and the Lender.

- Notices: Any notices regarding this Agreement must be in writing and mailed or delivered to the address provided at the beginning of this document, or to a new address as either party may have provided in writing.

- Entire Agreement: This document, along with any attachments and exhibits, constitutes the entire agreement between the parties pertaining to the subject matter hereof and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written, of the parties.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Borrower's Signature: ___________________________

Borrower's Printed Name: ___________________________

Lender's Signature: ___________________________

Lender's Printed Name: ___________________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Loan Agreement is governed by the laws of the State of Texas. |

| Documentation Required | Parties must complete and sign the Texas Loan Agreement form for it to be valid. |

| Interest Rate Limits | Under Texas law, the interest rate on personal loans must not exceed the statutory maximum. |

| Prepayment Rules | Borrowers in Texas have the right to pay off their loans early without facing prepayment penalties, unless specifically agreed upon in the loan agreement. |

Instructions on How to Fill Out Texas Loan Agreement

Filling out a Texas Loan Agreement form is a crucial step in documenting a loan between two parties, ensuring clarity and legal compliance for the transaction. This process can seem daunting, but breaking it down into simple steps can make it more manageable. Once the form is completed and signed by both the lender and the borrower, it becomes a binding agreement, outlining the terms of the loan, repayment schedule, interest rate, and any collateral involved. This ensures both parties have a clear understanding of their obligations and provides a legal framework to address any disputes that may arise.

- Identify the parties involved: Write down the full legal names and addresses of the lender and the borrower at the beginning of the form.

- Define the loan amount: Clearly state the total amount of money being loaned in the section designated for this purpose.

- Specify the interest rate: Enter the agreed-upon interest rate, ensuring it complies with Texas state laws regarding maximum allowable rates.

- Detail the repayment schedule: Outline how and when the loan will be repaid. This could include the number of payments, the amount of each payment, and the dates on which payments are due.

- Address the collateral: If the loan is secured by collateral, describe the collateral in detail, including any identifying information or documents.

- Include any additional terms or conditions: List any other terms both parties have agreed upon that are important to the loan agreement.

- Sign and date the agreement: Both the lender and the borrower must sign and date the form. It’s recommended to have the signatures witnessed or notarized to further validate the agreement.

- Keep copies of the agreement: Ensure both parties receive a copy of the signed agreement for their records.

By carefully following these steps, individuals can successfully complete a Texas Loan Agreement form. This documented agreement serves as a foundational record of the loan, protecting both the lender and borrower's interests and providing legal recourse in case of disagreement.

Crucial Points on This Form

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legal document used when one party, known as the lender, agrees to lend money to another party, known as the borrower. This form outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any collateral securing the loan. It serves to protect both the borrower's and lender's interests and ensure that both parties are clear on their obligations.

Who needs to sign the Texas Loan Agreement form?

The Texas Loan Agreement form must be signed by both the lender and the borrower to be considered legally binding. Additionally, if the loan is secured by collateral, any guarantors or co-signers must also sign the agreement. It's also a good practice to have the signatures notarized to further validate the document.

Is a witness necessary for a Texas Loan Agreement?

While Texas law does not specifically require a witness for the signing of a Loan Agreement, having a witness or a notary public can add an additional layer of validity and protection for the parties involved. This can be especially helpful in the case of disputes or if the agreement is contested in court.

Can I modify a Texas Loan Agreement after it has been signed?

Yes, a Texas Loan Agreement can be modified after it has been signed, but any modifications must be agreed upon by both the lender and the borrower. These modifications must be documented in writing and added as amendments to the original agreement. Both parties should sign any amendments, ideally in the presence of a notary public.

What happens if the borrower fails to repay the loan as agreed?

If the borrower fails to repay the loan according to the terms outlined in the Texas Loan Agreement, the lender has the right to take legal action to recover the owed money. This could include initiating a lawsuit or repossessing any collateral that was used to secure the loan. The specific course of action may depend on the details of the agreement and the nature of the collateral, if any.

Is it necessary to register a Texas Loan Agreement with any state or local government?

Generally, it is not necessary to register a Texas Loan Agreement with state or local government agencies for the agreement to be effective. However, if the loan is secured by real estate as collateral, filing a notice with the appropriate local government office may be required to ensure the lien's enforceability.

How can I ensure that my Texas Loan Agreement is legally binding?

To ensure your Texas Loan Agreement is legally binding, make sure it includes all the essential terms such as loan amount, interest rate, repayment schedule, and information about any collateral. Both parties should review the agreement thoroughly before signing. Obtaining the services of a notary public to witness the signing can also provide additional legal protection and assurance for all parties involved.

Common mistakes

Not Reading the Form Thoroughly: Many individuals start filling out the form without reading the instructions or understanding the terms fully. This can lead to incorrect information or misunderstanding the obligations and rights under the agreement.

Failing to Specify Loan Terms Clearly: It’s crucial to detail the loan amount, interest rate, repayment schedule, and any other vital terms. Unclear terms can lead to disputes or confusion later.

Omitting Signatures or Initials: Every section that requires a signature or initial must be completed. Missing signatures can invalidate the agreement or delay the loan process.

Incorrect Information: Entering incorrect information, such as the wrong legal names of the parties, addresses, or loan amounts, can create significant issues. It's important to double-check all entries for accuracy.

Not Specifying the Collateral (If Applicable): If the loan is secured, failing to describe the collateral clearly can lead to problems if enforcement of the agreement becomes necessary.

Skipping Dates: Dates are crucial in any legal document. Not specifying the effective date of the loan or other pertinent dates can affect the enforceability of the agreement.

Ignoring Governing Law Section: The Governing Law section outlines which state’s laws apply to the agreement. People often overlook this, not realizing it can significantly impact how disputes are resolved.

Leaving Blank Spaces: Instead of leaving blank spaces, it’s advisable to fill in n/a (not applicable) where specific information is not relevant. Blank spaces can lead to unauthorized additions later.

When filling out any legal form, taking the time to review and ensure all information is complete and accurate is crucial. For the Texas Loan Agreement form, avoiding these common mistakes can make the process smoother and protect the interests of all parties involved.

Documents used along the form

In the realm of finance, particularly involving loan agreements in Texas, certain documents play pivotal roles in ensuring both parties are well-protected and the terms are clearly defined. The Texas Loan Agreement form itself is a cornerstone for such financial transactions, laying the groundwork for the terms, responsibilities, and expectations of both the lender and borrower. Alongside this primary document, there are several other forms and documents often utilized to complement and enhance the clarity and enforceability of the loan agreement. Here's a glance at some of these critical documents.

- Promissory Note: This is a written promise by the borrower to pay a definite sum of money to the lender at a specified future date or on demand. It includes the interest rate, repayment schedule, and consequences of default.

- Mortgage or Deed of Trust: In the case of a secured loan, this document places a lien on the property being used as collateral, detailing the rights and responsibilities of both the borrower and the lender if the loan is not repaid.

- Guaranty: A guaranty enlists a third party, guaranteeing they will assume the debt obligation if the original borrower fails to fulfill the payment terms.

- Security Agreement: Similar to a Mortgage or Deed of Trust but for personal property, a security agreement grants the lender a security interest in the personal assets listed as collateral.

- Amendment Agreement: Should both parties agree to modify any terms of the original loan agreement, an amendment agreement is necessary to document these changes.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligation or liability under the loan agreement.

- Compliance Agreement: This outlines the borrower's agreement to adhere to certain regulations or standards as part of the loan agreement, which might include insurance requirements, financial reporting, and maintenance of the collateral.

- Letter of Intent: Often used before the final loan agreement is signed, this document outlines the preliminary terms of the loan and signifies the commitment of both parties to move forward under those terms.

Together, these documents form a comprehensive legal framework that supports and defines the loan agreement, providing clear instructions and protections for all involved parties. By understanding and properly utilizing these additional forms and documents, both borrowers and lenders can facilitate smoother financial transactions and mitigate potential risks associated with lending and borrowing in Texas.

Similar forms

Promissory Note: Like a loan agreement, a promissory note is a written promise to pay a specified sum of money to a specified person at a specified time or on demand. While a loan agreement often includes detailed terms and conditions of the loan, including repayment schedule, interest rates, and security/collateral, a promissory note may be simpler and focuses on the promise to pay.

Mortgage Agreement: A mortgage agreement secures a loan on real property and is similar to a loan agreement because it obligates the borrower to repay a debt. However, it specifically ties the obligation to a piece of real estate, providing the lender the right to foreclose on the property if the borrower fails to meet the terms of the loan repayment.

Line of Credit Agreement: This document outlines the terms under which a financial institution agrees to lend money to the borrower up to a certain limit over a set period. It's related to a loan agreement in its function of detailing the terms of borrowing money, but differs by offering flexibility in borrowing and repayment.

Lease Agreement: While primarily used for renting property, a lease agreement shares similarities with loan agreements in that it has specified terms for the usage of property, payment schedules, and obligations of both parties. Unlike loan agreements, lease agreements deal with the use of an asset rather than borrowing money.

Personal Guarantee: This legal commitment by an individual (the guarantor) to repay a loan issued to a business or another individual if the original borrower fails to do so is akin to a clause that may be found in a loan agreement. It ensures another layer of security for the lender.

Debenture: Often used by corporations, a debenture is an unsecured loan certificate issued by a company, backed by the general credit rather than by specified assets. It is similar to a loan agreement in that it represents a loan to be repaid, but it usually involves public borrowing and the instrument can be tradeable.

Credit Agreement: This is a broad term that can cover various types of loans and lines of credit, including revolving and term loans. A credit agreement is closely related to a loan agreement as it details the amount of credit extended, repayment terms, interest charges, and the duties and obligations of both parties involved.

Dos and Don'ts

When filling out the Texas Loan Agreement form, there are several important practices you should follow to ensure that your document is both legally binding and accurately reflects the agreement between the lender and the borrower. Below are lists of things you should and shouldn't do:

Things You Should Do:

- Read the entire form carefully before filling it out to ensure you understand all the terms and conditions.

- Use clear and precise language when describing the terms of the loan, such as the loan amount, interest rate, repayment schedule, and any collateral involved.

- Include all relevant parties' full legal names and contact information to avoid any confusion about who is obligated or entitled under the agreement.

- Have all parties sign and date the agreement to make it legally binding.

- Keep a copy of the agreement for your records and provide a copy to the other party.

- Consult with a legal professional if you have any questions or concerns about the terms of the agreement or your rights and obligations under Texas law.

- Consider having the document notarized to further authenticate the signatures and identities of the parties involved.

Things You Shouldn't Do:

- Do not leave any sections blank. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it empty.

- Avoid using vague or ambiguous terms that could be open to interpretation.

- Do not forget to specify the governing law (in this case, Texas law) that will apply to the agreement.

- Do not enter into a loan agreement under pressure or without fully understanding the terms and consequences.

- Avoid signing the agreement without ensuring that every party involved has a clear understanding and agreement on its terms.

- Do not rely solely on verbal promises or agreements; ensure that all agreements are documented in writing.

- Do not forget to review and update the agreement if any terms change or if additional agreements are made.

Misconceptions

When discussing the Texas Loan Agreement form, there are several common misconceptions that deserve attention. Clearing up these misunderstandings can help both lenders and borrowers navigate the complexities of financial agreements with more confidence.

One agreement fits all: A widespread misconception is that a single Texas Loan Agreement form can suit every borrowing and lending situation. However, loan agreements need to be tailored to match the specific circumstances of the deal, including the amount loaned, the repayment schedule, and any collateral involved. What works for a personal loan between friends may not be appropriate for a business loan.

No need for witnesses or notarization: Many individuals mistakenly believe that loan agreements don't require witnesses or notarization. While the Texas law does not always mandate these for a loan agreement to be valid, having the agreement witnessed and notarized can add a layer of protection and authenticity, making it easier to enforce the agreement in court if necessary.

Oral agreements are just as good: Some people think an oral agreement is as enforceable as a written one. Although Texas does recognize oral contracts under certain conditions, proving the terms of an oral agreement can be exceptionally challenging. A written loan agreement clearly documents the terms and conditions of the loan, offering far better security and clarity for all parties involved.

Templates from the internet are always reliable: Another common error is the belief that any loan agreement template found online will be sufficient. While many templates provide a good starting point, they often need to be customized to comply with specific Texas laws and the particular terms of your agreement. Always consider consulting with a legal professional to ensure your document is valid and comprehensive.

It's only about the money: While the primary purpose of a loan agreement is to outline the terms of a financial loan, thinking it's only about the money is a mistake. A comprehensive loan agreement also includes provisions for late payments, default, prepayment, and the legal recourse for both parties. These clauses are crucial for protecting the interests of both the lender and the borrower.

Filling out the form is enough: Finally, there's a misconception that simply filling out a Texas Loan Agreement form is all it takes. In reality, both parties should thoroughly review the agreement to ensure it accurately reflects their understanding and intentions. It's also advisable for each party to seek independent legal advice to ensure their rights are protected, and they fully comprehend the agreement's implications.

Key takeaways

When entering into a financial arrangement in Texas, the importance of utilizing a Texas Loan Agreement form cannot be understated. This document serves as a legal record that outlines the terms of the loan, providing clarity and protection for both the lender and the borrower. Here are five key takeaways to consider when filling out and using this crucial form:

- Accurately Complete All Sections: Ensuring that every part of the Texas Loan Agreement form is completed accurately is vital. This includes personal details, the loan amount, interest rates, repayment schedule, and any collateral involved. Mistakes or omissions can lead to misunderstandings or legal issues down the line.

- Understand the Terms: Before signing, both parties must fully understand the terms laid out in the agreement. This includes the loan duration, interest rate, monthly payment amounts, and any penalties for late payments. Clear comprehension can prevent disputes and ensure a smooth repayment process.

- Use Legal Language: While the form should be free of unnecessary jargon, using precise legal language is important to safeguard the interests of both parties. This can also ensure the agreement is enforceable in a court of law, should any disagreements arise.

- Witnesses and Notarization: Having the agreement signed in the presence of a notary or witnesses can add an extra layer of authenticity and can be crucial for the document's enforceability. It’s a simple step that can provide significant protection for all involved parties.

- Keep Copies of the Agreement: Once signed, both the lender and the borrower should keep copies of the loan agreement. In the event of any discrepancies or legal issues, having a copy readily available can be incredibly helpful for resolving any challenges.

Adhering to these guidelines can make the loan process in Texas more secure and transparent, ensuring that the financial interests of both lenders and borrowers are protected. Remember, a well-crafted loan agreement is not just a formality; it's a safeguard for your financial future.

Create Other Loan Agreement Forms for US States

Promissory Note Template California Word - The agreement should be preserved as a permanent record until the loan is fully repaid and the obligation is discharged.

Promissory Note Template Florida Pdf - By signing a Loan Agreement, the borrower commits to adhere to the terms laid out, underlining the seriousness of the financial obligation.

Free Promissory Note Template New York - The form serves as a legal record of the loan, ensuring both parties understand their obligations.

Maryland Promissory Note Download - Includes representations and warranties by the borrower, assuring the legality and their ability to enter the agreement.