Legal Mobile Home Purchase Agreement Form

When individuals venture into the world of homeownership via the acquisition of a mobile home, they embark on a legal and financial journey that necessitates a clear and comprehensive understanding of the Mobile Home Purchase Agreement form. This document is pivotal as it codifies the terms and conditions of the sale, laying a foundation for a legally binding contract between the buyer and seller. It meticulously details the responsibilities and expectations of each party, from the agreed-upon purchase price and payment terms to warranties and the allocation of taxes, fees, and other costs associated with the transaction. Additionally, this form serves as a safeguard for both parties, offering protection and clarity, ensuring that each step of the purchase process is conducted fairly and transparently. As such, it is crucial for buyers and sellers alike to grasp the significance and implications of this agreement, navigating through its provisions with due diligence to secure a smooth transition of ownership and avoid potential legal pitfalls that might arise from misunderstandings or misinterpretations of the contractual obligations outlined within.

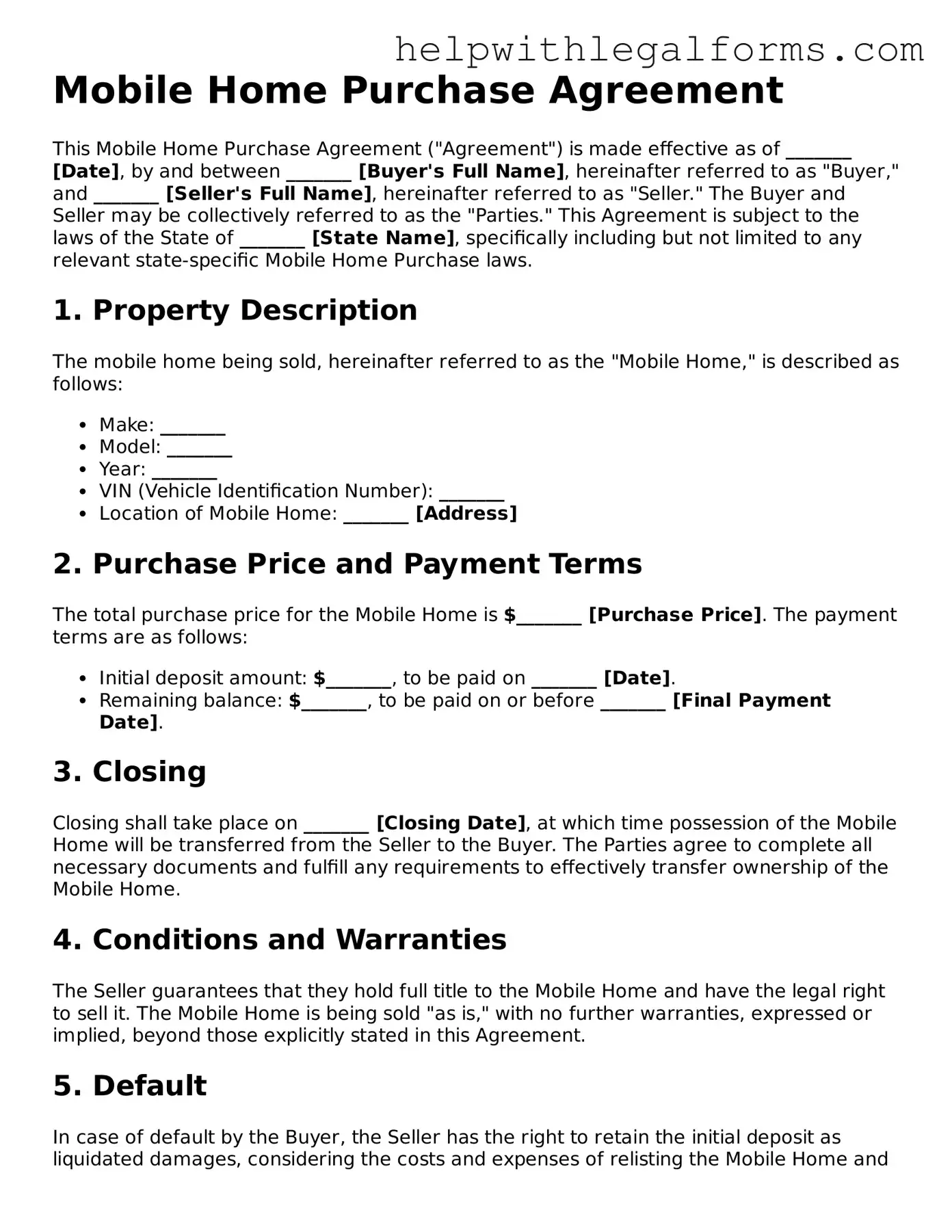

Example - Mobile Home Purchase Agreement Form

Mobile Home Purchase Agreement

This Mobile Home Purchase Agreement ("Agreement") is made effective as of _______ [Date], by and between _______ [Buyer's Full Name], hereinafter referred to as "Buyer," and _______ [Seller's Full Name], hereinafter referred to as "Seller." The Buyer and Seller may be collectively referred to as the "Parties." This Agreement is subject to the laws of the State of _______ [State Name], specifically including but not limited to any relevant state-specific Mobile Home Purchase laws.

1. Property Description

The mobile home being sold, hereinafter referred to as the "Mobile Home," is described as follows:

- Make: _______

- Model: _______

- Year: _______

- VIN (Vehicle Identification Number): _______

- Location of Mobile Home: _______ [Address]

2. Purchase Price and Payment Terms

The total purchase price for the Mobile Home is $_______ [Purchase Price]. The payment terms are as follows:

- Initial deposit amount: $_______, to be paid on _______ [Date].

- Remaining balance: $_______, to be paid on or before _______ [Final Payment Date].

3. Closing

Closing shall take place on _______ [Closing Date], at which time possession of the Mobile Home will be transferred from the Seller to the Buyer. The Parties agree to complete all necessary documents and fulfill any requirements to effectively transfer ownership of the Mobile Home.

4. Conditions and Warranties

The Seller guarantees that they hold full title to the Mobile Home and have the legal right to sell it. The Mobile Home is being sold "as is," with no further warranties, expressed or implied, beyond those explicitly stated in this Agreement.

5. Default

In case of default by the Buyer, the Seller has the right to retain the initial deposit as liquidated damages, considering the costs and expenses of relisting the Mobile Home and other potential losses.

6. Governing Law

This Agreement shall be governed by the laws of the State of _______ [State Name], without regard to its conflict of laws principles.

7. Entire Agreement

This document and any attached documents represent the entire agreement between the Parties regarding the sale of the Mobile Home and supersede all prior discussions, agreements, or understandings of any kind.

8. Signatures

By signing below, the Buyer and Seller acknowledge and agree to all terms and conditions outlined in this Agreement.

Buyer's Signature: ___________________________ Date: ______

Seller's Signature: ___________________________ Date: ______

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | A Mobile Home Purchase Agreement is a legal document that outlines the terms and conditions of the sale of a mobile home between a seller and a buyer. |

| Components | This agreement typically includes details such as the purchase price, description of the mobile home, payment terms, and any warranties or representations. |

| Governing Laws | The governing laws for Mobile Home Purchase Agreements can vary by state, impacting specifics like disclosure requirements and taxation. |

| Binding Agreement | Once signed by both parties, it becomes a legally binding contract that obligates the seller to sell and the buyer to buy under the agreed terms. |

| Transfer of Ownership | The agreement facilitates the formal transfer of the mobile home's title from the seller to the buyer upon fulfillment of the contract terms. |

| Disclosures | State-specific laws may require the seller to provide certain disclosures about the mobile home's condition, any encumbrances, or other material facts. |

| Inspection Clause | Many agreements include an inspection clause, allowing the buyer to inspect the mobile home for defects or issues before finalizing the purchase. |

| Financing | The agreement may specify the arrangement for financing the purchase, whether through a lender or through seller financing. |

| Customization | Though standardized forms exist, parties can customize the agreement to address specific concerns or conditions related to the mobile home's sale. |

Instructions on How to Fill Out Mobile Home Purchase Agreement

When individuals decide to buy or sell a mobile home, a vital step involves the accurate completion of the Mobile Home Purchase Agreement form. This document not only secures the transaction legally but also outlines the rights and responsibilities of each party involved, ensuring that all details are straightforward and agreed upon. Properly filling out this form is crucial for a smooth transfer of ownership and helps in avoiding any potential disputes in the future. Here is a step-by-step guide to assist in this process.

- Identify the Parties: Clearly write the full names of both the buyer(s) and the seller(s), ensuring that all information is accurate. Include current addresses and contact information for both parties.

- Describe the Mobile Home: Include a detailed description of the mobile home, such as the make, model, year, width, length, and any identification number or serial number associated with the unit. Specify the current location of the mobile home.

- Detail the Purchase Price: Input the total purchase price agreed upon by both parties. In addition, outline the payment method (e.g., cash, check, installment) and any deposit made or required.

- Outline Financing Terms: If the purchase will be financed, detail the terms agreed upon, including but not limited to, the loan amount, interest rate, monthly payment, and loan duration.

- Include Additional Terms: Document any additional agreements or terms that have been made. This might cover items such as warranty transfers, responsibility for taxes, or specific conditions that must be met before the sale can be finalized.

- Address Possession Date: State the agreed-upon date when the buyer will take possession of the mobile home. This should include any provisions for early access or conditions that must be satisfied beforehand.

- Warranties and Representations: Note any warranties or representations made by the seller regarding the condition of the mobile home or the land (if applicable). Include any disclosures required by law.

- Signatures: Ensure both the buyer(s) and seller(s) sign and date the agreement. It's often advisable for signatures to be notarized to affirm the identity of the signatories, although this may not be required in all jurisdictions.

Once the Mobile Home Purchase Agreement form is fully completed and signed by all parties, it becomes a legally binding contract. The next steps usually involve fulfilling any remaining conditions outlined in the agreement, conducting a final walkthrough of the property, and then proceeding to the closing where the sale is finalized, and ownership is officially transferred. It’s important for both the buyer and seller to retain copies of the agreement for their records and as proof of the sale.

Crucial Points on This Form

What is a Mobile Home Purchase Agreement form?

A Mobile Home Purchase Agreement form is a legally binding document between a buyer and seller for the purchase and sale of a mobile home. This form outlines the terms and conditions of the sale, including the purchase price, financing arrangements, and any contingencies or disclosures that must be acknowledged before the transaction can be completed.

Who needs to use a Mobile Home Purchase Agreement form?

Anyone involved in the buying or selling of a mobile home should use a Mobile Home Purchase Agreement form. This includes individual buyers and sellers, as well as dealerships and real estate agents representing parties in the transaction.

What information is typically included in this form?

The form usually contains details about the buyer and seller, a description of the mobile home (including make, model, year, and serial number), the purchase price, terms of payment, any included warranties or guarantees, and specific contingencies such as financing approval or the outcome of an inspection.

Why is this form important?

This form is crucial because it provides a clear, written record of the agreement between the buyer and seller, helping to prevent misunderstandings or disputes. It also serves as evidence of the terms agreed upon, which can be useful for legal or financial purposes.

Can this agreement be modified?

Yes, the agreement can be modified, but any changes must be made in writing and signed by both the buyer and the seller. Verbal agreements or understandings not included in the written agreement are generally not enforceable.

What happens if either party breaches the agreement?

If either party breaches the agreement, the other party may have legal grounds to pursue remedies such as enforcing the agreement, seeking damages, or canceling the transaction. The specifics depend on the terms of the agreement and state laws.

Is a Mobile Home Purchase Agreement form legally binding in all states?

While the form is considered legally binding in most states, specific requirements and legal enforceability can vary by state. It's important for both parties to review their state's laws regarding mobile home sales and ensure the agreement complies with those laws.

Do I need a lawyer to create or review a Mobile Home Purchase Agreement?

While not strictly necessary, consulting with a lawyer who has experience in real estate or mobile home sales can provide valuable insights and help ensure that the agreement is legally sound and protective of your rights and interests.

Are there any specific deadlines or timing considerations when using this form?

Yes, timing considerations such as the deadline for obtaining financing, dates for inspections, and the closing date are typically specified in the agreement. Both parties should understand and agree to these timing considerations to prevent delays or issues with completing the transaction.

Common mistakes

Completing a Mobile Home Purchase Agreement requires attention to detail and an understanding of what each section entails. Unfortunately, errors can occur that may lead to misunderstandings or even legal complications down the road. Here are five common mistakes people make when filling out this form:

- Skipping Sections: Often, individuals might overlook certain sections because they think they don’t apply to their situation. Every part of the form is designed to cover various aspects of the sale, ensuring that all terms are clear and agreed upon. Skipping sections can result in incomplete information and misunderstandings.

- Incorrect Information: Entering incorrect information, whether it's the buyer's or seller's personal details, the mobile home description, or the sale price, can lead to significant issues. Accuracy is paramount to ensure that the agreement is legally binding and reflects the true intentions of the parties involved.

- Failing to Specify Terms of Sale: The terms of the sale, including payment plans, any included warranties, and details about the transfer of ownership, need to be explicitly stated. Ambiguities in this area can result in disputes and complications in the finalization of the sale.

- Omitting Signatures and Dates: For a Mobile Home Purchase Agreement to be legally binding, it must be signed and dated by both parties involved. Forgetting to include these can invalidate the agreement or delay the sale process as the documentation will need to be resubmitted.

- Not Reviewing for Errors: Once the agreement is filled out, reviewing it for any errors or omissions is crucial. This final check can catch mistakes that were previously overlooked, ensuring that the agreement accurately represents the terms of the sale.

By avoiding these mistakes, parties can help ensure that their mobile home purchase agreement is completed accurately and reflects all terms of the sale. It is always recommended to review the document carefully and consult with a professional if there are any uncertainties.

Documents used along the form

When purchasing a mobile home, the agreement form is a crucial step in documenting the terms and conditions of the sale. However, this form is often just one part of the document package necessary to complete the purchase. Understanding each of these documents can help both the buyer and the seller ensure a smooth transaction process. The following list identifies and describes additional forms and documents that are commonly used alongside the Mobile Home Purchase Agreement form.

- Bill of Sale: This document acts as a receipt for the mobile home purchase, detailing the transaction between the buyer and the seller. It typically lists the make, model, year, and serial number of the mobile home, along with the sale price and date.

- Manufacturer’s Statement of Origin (MSO) or Certificate of Title: The MSO is issued by the manufacturer to the original purchaser of the mobile home, indicating the home's origin. Upon selling, this document is usually surrendered to the Department of Motor Vehicles (DMV) or similar agency to issue a Certificate of Title to the new owner, proving ownership.

- Warranty Deed or Bill of Sale with Warranty: This document guarantees that the seller holds clear title to the mobile home and has the right to sell it. It protects the buyer from future claims against the home's title.

- Property Disclosure Statement: Sellers provide this form to disclose the condition of the mobile home. It covers a wide range of information, including any known defects or malfunctions within the property.

- Loan Documents: If the purchase is being financed, the buyer and seller will need to complete several loan-related documents. These include the loan application, promissory note, and security agreement, which detail the terms of the loan and the lender's interest in the mobile home as collateral.

Alongside the Mobile Home Purchase Agreement, these documents each play a vital role in establishing the terms, conditions, and responsibilities of both parties involved in the transaction. By ensuring these forms are properly completed and filed, buyers and sellers can protect their interests and facilitate a successful and legally sound transfer of ownership.

Similar forms

Real Estate Purchase Agreement: This document is used for the purchase of real property, such as a house or commercial building. It shares similarities with the Mobile Home Purchase Agreement in that it outlines the terms of the sale, including the purchase price, closing date, and disclosures about the property. Both agreements serve as legally binding contracts between the buyer and seller.

Bill of Sale: Typically used for the sale of personal property, such as cars or boats, a Bill of Sale is similar to a Mobile Home Purchase Agreement because it documents the transfer of ownership from the seller to the buyer. It includes the sale price and a description of the property being sold.

Land Purchase Agreement: This contract is used when buying or selling land. Like the Mobile Home Purchase Agreement, it details the transaction's specifics, including the purchase price, financing terms, and any conditions that must be met before closing. It ensures that both parties are clear on the terms of the sale.

Lease-Purchase Agreement: This combination of a lease agreement and a purchase agreement allows the renter the option to buy the leased property. It shares characteristics with a Mobile Home Purchase Agreement in providing a path to ownership, specifying the sale terms, and including rent payments that may contribute towards the purchase price.

Commercial Lease Agreement: While primarily used for renting commercial properties, this document parallels the Mobile Home Purchase Agreement through its detailed stipulations concerning the property's use, maintenance responsibilities, and payment terms. Although one leads to ownership and the other to tenancy, both set the conditions under which the properties are used and maintained.

Rent-to-Own Agreement: This contract allows renters to eventually purchase the property they are leasing. It is similar to a Mobile Home Purchase Agreement when the mobile home is on leased land. Both agreements typically outline the purchase price, rent payments, and the time frame for the potential sale.

Property Management Agreement: This agreement is between a property owner and a management company or individual who will manage the property on their behalf. Similarities to a Mobile Home Purchase Agreement can be seen in the detailed responsibilities and roles defined for the handling, maintenance, and oversight of the property, though the focus here is on management rather than sale.

Option to Purchase Agreement: This legal document gives someone the right, but not the obligation, to buy a property. Like the Mobile Home Purchase Agreement, it includes specific terms under which the buyer can execute the purchase, such as the price and timeframe. It's specifically designed to hold an opportunity open for a buyer, mirroring the commitment between buyer and seller in a purchase agreement.

Mortgage Agreement: Used when purchasing property with a loan, this agreement secures the loan by using the property as collateral. Similarities with the Mobile Home Purchase Agreement include detailing the financial specifics of purchasing a property. Both are crucial for setting the terms under which the property is bought and paid for, although the Mortgage Agreement specifically relates to financing.

Dos and Don'ts

Entering into a Mobile Home Purchase Agreement requires attention to detail and a clear understanding of the agreement you're about to sign. Whether you're a seasoned investor or a first-time buyer, the process can be intricate. Here are nine essential do's and don'ts to guide you through filling out your Mobile Home Purchase Agreement form efficiently and effectively.

- Do thoroughly read every section of the form before filling it out. Understanding each clause and its implications ensures that you are fully aware of the agreement's terms and conditions.

- Do verify the accuracy of all personal information, including names, addresses, and contact information for both the buyer and the seller. Mistakes in this area can lead to significant complications later on.

- Do specify the payment terms clearly, including the total purchase price, down payment, financing details, and any arrangements regarding escrow. Clear financial terms prevent misunderstandings and disputes.

- Do include a detailed description of the mobile home, such as its make, model, year, serial number, and any included furnishings or fixtures. This prevents discrepancies about what is included in the sale.

- Do review and comply with local laws and regulations regarding mobile home sales. Each state or jurisdiction may have specific requirements that must be met.

- Don't skip the inspection clauses. Ensure there is an agreement on who is responsible for the mobile home's inspection and how any necessary repairs will be handled.

- Don't forget to specify the closing date and location. This information is crucial for planning the transfer of ownership and ensuring all parties are available.

- Don't leave blanks in the form. If a section does not apply, fill it with "N/A" (not applicable) instead of leaving it empty. This shows that you did not overlook any part of the form.

- Don't hesitate to seek legal advice if there are any clauses or terms you don't understand. An attorney can provide clarity and ensure that your rights and interests are protected.

Whether you're selling or purchasing a mobile home, these do's and don'ts will help navigate the complexities of the Mobile Home Purchase Agreement. Approaching the agreement with care and diligence ensures a smoother transaction for both parties involved.

Misconceptions

When it comes to buying a mobile home, the Purchase Agreement form is a crucial document that outlines the terms and conditions of the sale. However, there are several misconceptions about this form that can lead to confusion. Let's clear up some of these misunderstandings.

All Mobile Home Purchase Agreements are the same: This is a common misconception. While many forms follow a general template, specific terms and conditions can vary greatly depending on the state, the seller, and the park where the mobile home is located. It's important to read and understand the specific agreement you are entering into.

You don't need a lawyer to review the agreement: While it's not a legal requirement to have a lawyer review your Mobile Home Purchase Agreement, it's often a good idea. Lawyers can help identify any potential issues with the agreement and ensure your rights are protected, especially if you're unfamiliar with legal documents.

A verbal agreement is just as good as a written one: In the world of real estate, verbal agreements carry little weight. A written and signed Mobile Home Purchase Agreement is essential to have a legally binding contract that clearly outlines the terms of the sale, including responsibilities of both buyer and seller.

The purchase price is the only cost involved: Many buyers don't realize that additional costs may be associated with purchasing a mobile home. These can include taxes, fees, and charges for setting up utilities, among others. These costs should be clearly identified in the Purchase Agreement.

Once you sign the agreement, you cannot back out: While signing a Mobile Home Purchase Agreement is a significant commitment, there are circumstances under which a buyer can legally back out. These conditions, such as financing falling through or the discovery of major defects during an inspection, should be specified in the agreement.

The seller is always responsible for repairs up until the sale is completed: This is not necessarily true. The agreement should specify who is responsible for repairs and maintenance prior to the sale's completion. In some cases, the buyer may agree to buy the mobile home "as-is," meaning they assume responsibility for any necessary repairs.

Mobile Home Purchase Agreements don't allow for negotiation: Actually, much like buying a traditional home, the terms of a Mobile Home Purchase Agreement can often be negotiated. This can include the purchase price, the terms of payment, and other conditions of the sale. Potential buyers should feel free to negotiate terms that work best for them.

Key takeaways

When embarking on the journey of buying or selling a mobile home, one crucial step involves filling out a Mobile Home Purchase Agreement form. This document not only lays out the terms and conditions of the sale but also protects the rights of both the buyer and the seller. Here are four key takeaways about using this form effectively:

- Accuracy is Key: Ensure all information on the form is accurate and complete. This includes the names of the buyer and seller, the description of the mobile home (including make, model, year, and serial number), the sale price, and any other relevant details. Accurate information helps prevent misunderstandings and disputes down the line.

- Understand the Terms: Both parties should thoroughly understand the terms outlined in the agreement. This includes payment terms, any warranties being offered, and the responsibilities of each party. If there's something you don't understand, it's important to seek clarification before signing.

- State-Specific Requirements: Mobile home sales can be subject to different laws and regulations depending on the state. It's essential to be aware of any state-specific requirements that may need to be included in the agreement, such as special disclosures or inspection mandates.

- Keep Records: After the agreement is filled out and signed by both parties, ensure each person receives a copy for their records. This document will serve as the official record of the sale and may be needed for future reference, such as transferring the mobile home to the new owner's name or resolving any disputes that may arise.

By keeping these key points in mind, both buyers and sellers can navigate the mobile home purchase process with confidence and security, ensuring a smooth and transparent transaction.

Other Forms

Consent Letter for Research - This form is designed to promote transparency between parties, clarifying expectations and responsibilities.

Affidavit of Support Sample - Articulating a strong case for the authenticity of a marriage, this letter provides insights and anecdotes from a third-party perspective.

Minutes of the Meeting - It assists in building an organizational memory, capturing the evolution of projects, decisions, and strategies over time.