Legal Operating Agreement Form

In the realm of business, particularly when it comes to managing and setting the foundation for Limited Liability Companies (LLCs), the Operating Agreement plays a pivotal role. This crucial document serves as a comprehensive guide, outlining the structure of operations, the distribution of profits and losses, and the procedural nuances pertaining to the company's governance. Not only does it establish clear rules and expectations for its members, but it also provides a level of protection against misunderstandings and potential disputes. By customizing the agreement to fit the unique needs of the LLC, the members can ensure a smooth operation and management of the business, making adjustments as necessary to accommodate growth or changes in membership. More importantly, the Operating Agreement is recognized by state laws, which often require or strongly recommend that LLCs adopt one to furnish a clear legal framework, thereby reinforcing the company’s limited liability status. In essence, the Operating Agreement is not just a formality but a critical instrument that shapes the foundation and future of an LLC.

State-specific Operating Agreement Forms

Operating Agreement Document Subtypes

Example - Operating Agreement Form

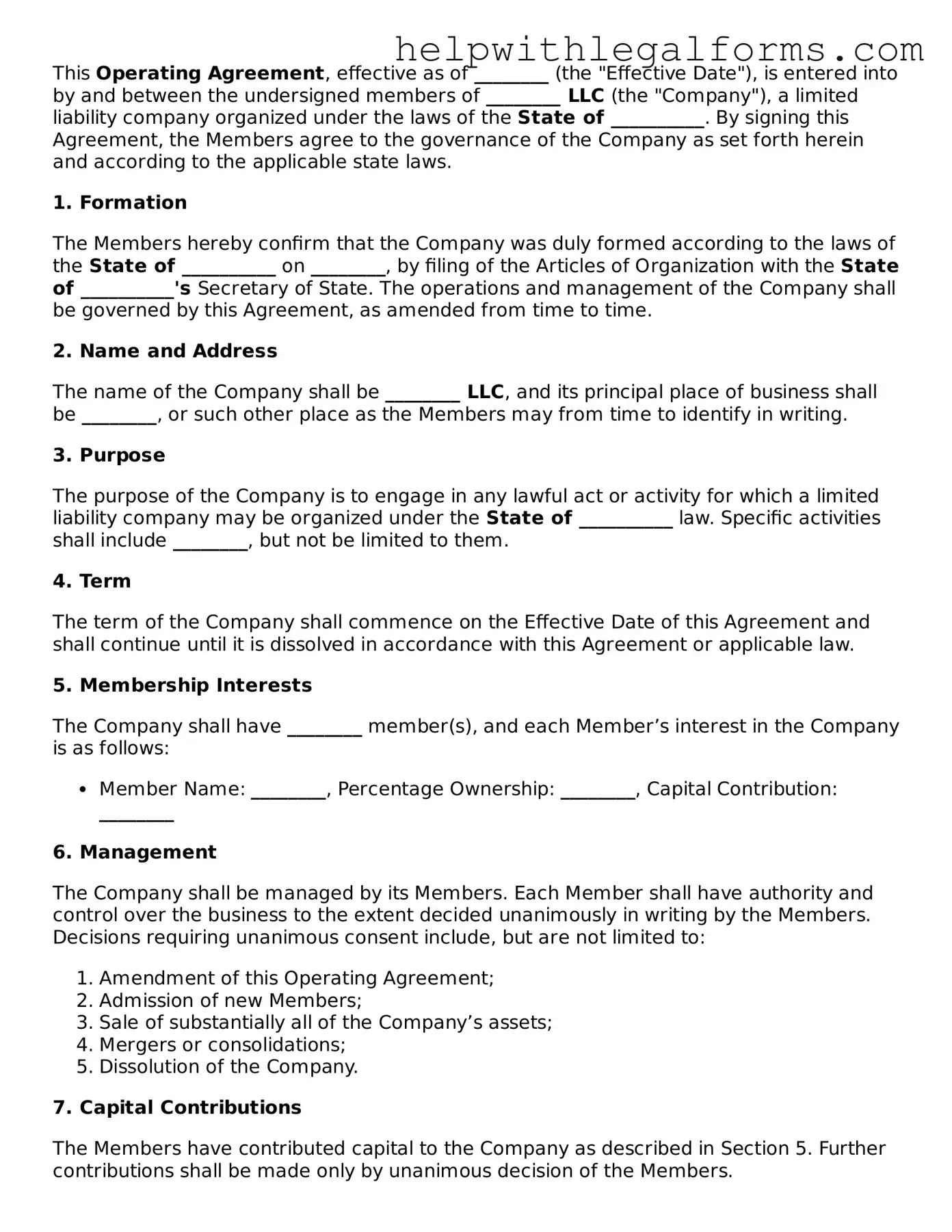

This Operating Agreement, effective as of ________ (the "Effective Date"), is entered into by and between the undersigned members of ________ LLC (the "Company"), a limited liability company organized under the laws of the State of __________. By signing this Agreement, the Members agree to the governance of the Company as set forth herein and according to the applicable state laws.

1. Formation

The Members hereby confirm that the Company was duly formed according to the laws of the State of __________ on ________, by filing of the Articles of Organization with the State of __________'s Secretary of State. The operations and management of the Company shall be governed by this Agreement, as amended from time to time.

2. Name and Address

The name of the Company shall be ________ LLC, and its principal place of business shall be ________, or such other place as the Members may from time to identify in writing.

3. Purpose

The purpose of the Company is to engage in any lawful act or activity for which a limited liability company may be organized under the State of __________ law. Specific activities shall include ________, but not be limited to them.

4. Term

The term of the Company shall commence on the Effective Date of this Agreement and shall continue until it is dissolved in accordance with this Agreement or applicable law.

5. Membership Interests

The Company shall have ________ member(s), and each Member’s interest in the Company is as follows:

- Member Name: ________, Percentage Ownership: ________, Capital Contribution: ________

6. Management

The Company shall be managed by its Members. Each Member shall have authority and control over the business to the extent decided unanimously in writing by the Members. Decisions requiring unanimous consent include, but are not limited to:

- Amendment of this Operating Agreement;

- Admission of new Members;

- Sale of substantially all of the Company’s assets;

- Mergers or consolidations;

- Dissolution of the Company.

7. Capital Contributions

The Members have contributed capital to the Company as described in Section 5. Further contributions shall be made only by unanimous decision of the Members.

8. Allocations and Distributions

Profits and losses shall be allocated to Members in proportion to their respective ownership interests. Distributions shall be made at the discretion of the Members, subject to the Company’s need to retain capital for its business operations.

9. Dissolution

The Company may be dissolved if agreed upon by all Members in writing. Upon dissolution, the assets of the Company shall be liquidated, and the proceeds shall be distributed to the Members in accordance with their respective interests after settling all the Company’s debts.

10. Miscellaneous

This Agreement constitutes the entire agreement among the Members concerning the subject matter hereof and supersedes all previous agreements and understandings, whether oral or written. This Agreement may only be amended by a written document duly executed by all Members.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the Effective Date first above written.

Member(s):

Name: ________ Signature: ________ Date: ________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Operating Agreement form is designed to outline the internal operating procedures, financial decisions, and the structure of a Limited Liability Company (LLC). |

| Flexibility | This document offers significant flexibility, allowing LLC members to structure their business according to their specific needs and preferences. |

| Governing Law | Each state has its own laws that will govern the Operating Agreement, making state-specific customization crucial for compliance and effectiveness. |

| Not Mandatory Everywhere | While highly recommended, not all states require LLCs to have an Operating Agreement. However, having one in place is considered best practice. |

| Dispute Resolution | It typically includes provisions for dispute resolution among members, helping prevent and manage potential conflicts within the LLC. |

| Customizable Sections | Key sections include allocation of profits and losses, management structure, voting rights, and processes for adding or removing members. |

| Significance in Protection | Having a detailed Operating Agreement reinforces the limited liability status of the LLC, providing an extra layer of protection for the members' personal assets. |

Instructions on How to Fill Out Operating Agreement

Once you've decided to organize your business as a Limited Liability Company (LLC), drafting an Operating Agreement is a crucial next step. This document governs the LLC's operations and outlines the rights, duties, and obligations of its members. Though it may seem daunting, filling out an Operating Agreement form can be straightforward if you approach it step by step. The following instructions will guide you through this process, ensuring you cover all essential elements to create a comprehensive agreement.

- Gather Information: Before starting, collect all necessary details about your LLC, including its official name, state of formation, principal place of business, and the names and addresses of its members.

- Choose Management Structure: Decide whether your LLC will be member-managed or manager-managed and provide the names of the managers, if applicable.

- Detail the Ownership Percentages: List each member's ownership percentage, typically based on their contribution to the LLC.

- Outline Member Contributions: Clearly describe the contributions (cash, property, services, etc.) of each member to the LLC.

- Determine Profit and Loss Distribution: Specify how the LLC's profits and losses will be divided among members. This is usually in proportion to ownership percentages but can be adjusted as agreed upon.

- Specify the Voting Rights: Define how voting rights are allocated among members. This can also be based on ownership interest or set as one vote per member, depending on your agreement.

- Describe the Process for Adding or Removing Members: Include procedures for how new members can join the LLC and how existing members can exit.

- Set Rules for Meetings: Outline when and how the LLC will hold meetings, including how many members constitute a quorum.

- Determine the Dissolution Process: Explain the conditions under which the LLC can be dissolved and how its assets will be distributed upon dissolution.

- Sign and Date the Agreement: Ensure that all members sign the Operating Agreement to affirm their acceptance of its terms. Include the date of signing.

Filling out the Operating Agreement with attention to detail and clarity can prevent misunderstandings and disputes among LLC members down the line. Keep in mind that requirements can vary by state, so it's wise to consult with a legal expert familiar with your state's specific LLC regulations. This proactive step can save significant time and effort by establishing clear guidelines for the operation and management of your business.

Crucial Points on This Form

What is an Operating Agreement?

An Operating Agreement is a legal document that outlines the ownership and member duties of a Limited Liability Company (LLC). It defines how the business will be run, how decisions are made, and how profits and losses will be distributed among the members. This agreement is crucial for ensuring that all members of the LLC understand their rights and responsibilities.

Is an Operating Agreement required for an LLC?

While not all states require an Operating Agreement, it is highly recommended that every LLC has one. It not only helps protect the members' personal assets by reinforcing the LLC's limited liability status but also sets forth the operating procedures and expectations, preventing misunderstandings among members.

What should be included in an Operating Agreement?

An Operating Agreement should include details such as the LLC's operating procedures, the allocation of profits and losses, members' rights and responsibilities, management structure, voting rules, how new members can be added, the process for members leaving the LLC, and the dissolution procedures. It should be tailored to fit the specific needs of the LLC.

Can an Operating Agreement be changed?

Yes, an Operating Agreement can be changed. However, most agreements will specify a particular process that must be followed to make amendments. This often requires a certain percentage of member approval. Keeping the agreement up-to-date ensures it accurately reflects how the LLC operates and is essential for maintaining clarity among members.

Who needs to sign the Operating Agreement?

All members of the LLC should sign the Operating Agreement. By signing, members agree to abide by the terms set out in the document. This can help prevent future disputes by having a clear, agreed-upon guideline for the operation of the LLC.

What happens if there is no Operating Agreement?

Without an Operating Agreement, an LLC is subject to the default rules of the state where it was formed. These default rules might not be suitable for all LLCs since they are very general and may not align with how the members wish to run their business. This lack of a personalized agreement could lead to disputes among members and confusion in management and financial matters.

Does the Operating Agreement need to be filed with the state?

In most states, the Operating Agreement does not need to be filed with the state. However, it is crucial to keep a signed copy with your business records. Ensure that all members have a copy of the agreement and any amendments to it.

How does an Operating Agreement protect members' personal assets?

The Operating Agreement strengthens the LLC's limited liability status by clearly separating the members' personal assets from the business's debts and obligations. By establishing that the business will operate as a separate legal entity, it provides an additional layer of protection for members against personal liability for the business's debts.

Can a single-member LLC have an Operating Agreement?

Yes, a single-member LLC can and should have an Operating Agreement. Even for a single-member LLC, having an agreement helps to maintain the distinction between personal and business assets, which is crucial for limited liability protection. It also serves as an official record of the business's operating procedures and goals.

Where can I get help drafting an Operating Agreement?

To draft an Operating Agreement, you can seek the help of a legal professional who understands the specific requirements of your state and can tailor the agreement to fit the needs of your LLC. Alternatively, there are online resources and templates available, but these should be used with caution and ideally reviewed by a legal expert to ensure that they adequately protect your business and are compliant with state laws.

Common mistakes

When people fill out the Operating Agreement form for their LLC, several common mistakes are often made. These mistakes can lead to unnecessary legal issues, misunderstandings among members, and could impact the operation and success of the business. Here’s a closer look at these errors to help individuals avoid them in the future.

Not Customizing the Agreement: Using a generic template without tailoring it to the specific needs of the business is a critical mistake. Every business is unique, and the Operating Agreement should reflect that.

Leaving Out Dispute Resolution Methods: Failing to specify how disputes among members will be resolved can lead to costly and time-consuming litigation.

Omitting the Details of Financial Distributions: Not clearly defining how profits and losses will be distributed among members can result in conflicts and confusion.

Ignoring the Process for Adding or Removing Members: Without clear rules for the addition or removal of members, transitions can become complicated and disruptive.

Forgetting to Define the Roles and Responsibilities of Members: Lack of clarity in members' roles can lead to inefficiencies and misunderstandings within the management of the LLC.

Overlooking the Succession Planning: Not planning for the future in the event a member decides to leave the business or passes away can threaten the continuity of the LLC.

Not Regularly Reviewing and Updating the Agreement: As businesses evolve, so should their Operating Agreements. Failing to update the document can leave it outdated and irrelevant.

Failing to Have the Agreement Reviewed by a Legal Professional: By not seeking legal advice, members might miss incorporating crucial legal protections or complying with state-specific requirements.

Assuming All Members Understand the Agreement the Same Way: Not thoroughly discussing and ensuring a mutual understanding of the agreement among members can lead to disputes down the line.

Avoiding these mistakes requires careful consideration, thorough discussion among members, and often the guidance of a legal professional. Doing so ensures that the Operating Agreement serves its purpose as a foundational document that safeguards the business and its members.

Documents used along the form

Alongside the Operating Agreement, numerous forms and documents play a vital role in the successful operation of a business. Each document serves a specific purpose, ensuring legal compliance, financial clarity, and operational efficiency. The Operating Agreement establishes the framework for the internal operations of a company, but it is just one piece of the broader legal and administrative puzzle. The documents listed below are commonly used in conjunction with an Operating Agreement to provide comprehensive support for the business's governance, financial management, and legal obligations.

- Articles of Organization: This document is essential for officially forming an LLC. It is filed with the state and includes crucial information such as the business name, address, and the names of its members.

- Employer Identification Number (EIN) Application: Businesses must obtain an EIN from the IRS for tax purposes. This unique number is required for opening bank accounts, hiring employees, and filing tax returns.

- Bylaws: Although more common in corporations, bylaws may also be relevant for LLCs, detailing the rules and procedures for the operation of the business. Bylaws complement the Operating Agreement in governing the business's internal affairs.

- Bank Resolution: A document used to authorize opening a business bank account, specifying who can sign checks, access bank statements, and manage the account.

- Membership Certificates: These serve as physical proof of ownership in an LLC and outline each member's ownership percentage.

- Buy-Sell Agreement: A critical document that outlines what happens if a member wants to sell their interest, becomes disabled, or dies. It helps ensure the smooth continuation or termination of the business under unforeseen circumstances.

- Meeting Minutes: Records of meetings held by the LLC's members or managers, documenting decisions made and actions agreed upon. Keeping accurate minutes is important for legal compliance and decision-making history.

- Annual Reports: Most states require LLCs to file an annual or biennial report with the secretary of state, updating the company's information and activities over the past year.

- Operating Licenses and Permits: Depending on the type of business and its location, various licenses and permits may be required to operate legally. These could include professional licenses, sales tax permits, or health department permits.

- Non-Disclosure Agreement (NDA): To protect trade secrets and confidential information, businesses often require employees, contractors, and business partners to sign NDAs.

In summary, while the Operating Agreement is a cornerstone document for any LLC, the effective and lawful operation of a business necessitates the use of additional forms and documents. From establishing the business's legal identity to managing its day-to-day operations and planning for future contingencies, these documents form an integral part of a comprehensive legal framework. Ensuring that these documents are correctly prepared, up to date, and in compliance with relevant laws and regulations is essential for the smooth, efficient, and lawful operation of a business.

Similar forms

Partnership Agreement: Similar to an Operating Agreement, a Partnership Agreement outlines the structure of a partnership, including details about management, profit sharing, and resolutions for disputes. Both documents serve to establish the rights, duties, and obligations of the participants in a business venture.

Shareholders' Agreement: This document is for corporations and is akin to an Operating Agreement in LLCs. It details the relationships among the shareholders and the management decisions of the corporation. Like an Operating Agreement, it aims to protect the business structure and ensure clear communication among its key stakeholders.

Bylaws: Corporate Bylaws serve a purpose similar to an Operating Agreement, but for corporations. They outline the internal rules and procedures for the corporation, including the process for holding meetings, electing officers, and other corporate governance matters. Both Bylaws and Operating Agreements provide a framework for the operation of the entity.

Buy-Sell Agreement: A Buy-Sell Agreement can be part of an Operating Agreement or a Standalone document that dictates what happens if an owner wishes to sell their interest, becomes disabled, or dies. In both cases, the agreement controls the transition of business ownership under various circumstances, protecting the business and its owners.

Member Control Agreement: Specific to LLCs and similar to an Operating Agreement, a Member Control Agreement structures the operations, management decisions, and provides for the disposition of membership interests. It can supplement or replace standard Operating Agreements to tailor to specific needs.

Investment Agreement: This document outlines the terms and conditions of an investment in a company. It is similar to an Operating Agreement when it comes to provisions regarding the management of the investment, distribution of profits, and dispute resolution among investors and owners.

Employment Agreement: While primarily focused on the relationship between an employer and an employee, Employment Agreements often include clauses related to confidentiality, dispute resolution, and duties that can resemble sections of an Operating Agreement, especially in closely held companies where owners are also employees.

Loan Agreement: A Loan Agreement outlines the terms between a borrower and lender, which can mirror aspects of an Operating Agreement that deal with financial obligations, contributions, and distributions within a company. Both agreements are important for defining economic responsibilities and conditions.

Dos and Don'ts

When filling out the Operating Agreement form for your business, it's crucial to pay attention to detail and follow best practices. This document plays a foundational role in defining your business structure, outlining the duties of its members, and safeguarding your business's future. Here are the dos and don'ts to keep in mind:

Do:

Review examples of Operating Agreements relevant to your business type to ensure a comprehensive understanding of what's required.

Clearly outline each member's contributions, whether monetary, property, or services, to prevent any future disputes.

Specify the percentage of ownership for each member based on their contributions to ensure transparency.

Define the process for distributing profits and losses. This clarity will help in managing expectations and financial planning.

Detail the procedure for adding or removing members to the LLC to prepare for future changes in the business structure.

Include a dispute resolution process to handle disagreements among members effectively.

Have all members review the Operating Agreement before signing, to ensure it accurately represents each member's understanding and agreement.

Don't:

Use vague language. Be as clear and specific as possible to avoid misinterpretations.

Ignore state-specific requirements, which can vary significantly. Ensure compliance with local laws and regulations.

Forget to address what happens in the event of a member's death or exit from the LLC. Planning for the unexpected is crucial.

Overlook the importance of outlining the roles and responsibilities of each member. Clear delineation can prevent operational confusion.

Assume one size fits all. Customize the Operating Agreement to suit the unique needs of your business.

Delay the creation of an Operating Agreement. It should be done early in the formation of your LLC to prevent future conflicts.

Forget to update the Operating Agreement as your business grows and changes. Periodic reviews and updates are essential.

Misconceptions

When it comes to understanding the Operating Agreement for LLCs (Limited Liability Companies), many misconceptions can lead to confusion and legal missteps. Clarifying these common misunderstandings is crucial for business owners to ensure they're on the right track. Here’s a look at some key misconceptions:

- An Operating Agreement is not necessary for single-member LLCs. Many believe that if they are the sole owner of an LLC, an Operating Agreement is unnecessary. However, this document is vital as it provides legal documentation of the business's structure and operations, offering protection for the sole member against legal actions and misunderstandings.

- Operating Agreements are the same in every state. While it's true that these documents share similarities across states, each state may have specific requirements and regulations governing LLCs. It's important to craft an Operating Agreement that complies with state-specific laws to ensure full legal protection.

- All that matters in an Operating Agreement are the distribution of profits and losses. While distributions are a critical component, Operating Agreements cover a broad range of operational and governance issues, including management structure, voting rights, and procedures for adding or removing members. Overlooking these aspects can lead to future disputes and operational inefficiencies.

- Templates found online can fully replace personalized legal advice. Although online templates can serve as a helpful starting point, relying solely on them may result in a document that doesn't fully address specific business needs or meet state requirements. Customization with professional legal guidance ensures that an Operating Agreement aligns with both the unique aspects of the business and legal standards.

- An Operating Agreement is set in stone once signed. Businesses evolve, and so should their Operating Agreements. As changes occur within the company structure, operations, or ownership, revisiting and amending the Operating Agreement is crucial to reflect current operations and prevent legal complications.

- Small or family-owned businesses don’t need an Operating Agreement. No matter the size of the business or the relationship between members, having an Operating Agreement is essential. It formalizes business operations and helps prevent conflicts by clearly outlining the rights and responsibilities of all members.

Dispelling these misconceptions about Operating Agreements can protect LLC owners from future legal issues and ensure their business operates smoothly. It is advisable to consult with a legal professional to create or review an Operating Agreement, ensuring that it meets the specific needs and legal requirements of the business.

Key takeaways

An Operating Agreement is a fundamental document used by LLCs that sets forth the rights and responsibilities of the members and managers. It outlines the company's financial and functional decision-making in detail. Here are key takeaways about filling out and using the Operating Agreement form:

Customization is Key: The Operating Agreement should be customized to fit the specific needs of your LLC. Since each business is unique, the agreement should accurately reflect the structure, policies, and procedures of your LLC. Avoid using a "one-size-fits-all" template without making necessary modifications.

Details Matter: When filling out the Operating Agreement, it's crucial to provide detailed information about the ownership structure, member responsibilities, and the allocation of profits and losses. This clarity helps prevent misunderstandings and conflicts among members down the line.

Legal Compliance: Ensure that the Operating Agreement is in compliance with state laws. While not all states require LLCs to have an Operating Agreement, having one that follows state-specific regulations can aid in the protection of your LLC's limited liability status.

Updating is necessary: The Operating Agreement is not a static document. As your LLC grows and evolves, the agreement should be reviewed and updated accordingly. Changes in membership, management, or the financial structure of the LLC are all reasons to revisit and revise the agreement.

Other Forms

Residence Affidavit - Crucial for individuals needing to prove their residency for state benefits or legal requirements.

How to Create a Lease Agreement - Customizable to cater to different types of properties, such as apartments, houses, commercial spaces, and more.

How to Write a Rental Agreement for Family Member - By delineating the terms of the lease, it helps in resolving any disputes that may arise during the rental period.