Blank Operating Agreement Form for California

In the realm of business, particularly for limited liability companies (LLCs) operating within the borders of California, establishing a strong foundation for governance, financial decisions, and the rights of its members is essential. This foundation is often laid down in the form of an Operating Agreement, a vital document that, although not mandated by law in California, is highly recommended for a myriad of reasons. Its significance extends beyond mere formality; the Operating Agreement serves as the backbone of an LLC, dictating operational procedures, ownership structure, and conflict resolution mechanisms, among other facets. It is a customizable blueprint that allows members to tailor the workings of their entity to fit their specific needs and goals, offering a layer of protection and clarity not just to the business's members, but also to its potential creditors or legal opponents. This document transcends being a simple piece of paper; it is a roadmap for dispute resolution, a guide for decision-making, and a safeguard for the company's future against unforeseen legal challenges. Operating without such an agreement in California leaves an LLC at the mercy of default state laws, potentially leading to undesirable outcomes in times of member disagreements or legal entanglements. Understanding the major aspects of the California Operating Agreement form is, therefore, not just a task but a necessity for any LLC desirous of longevity and success within the competitive and rigorous environment of the Golden State.

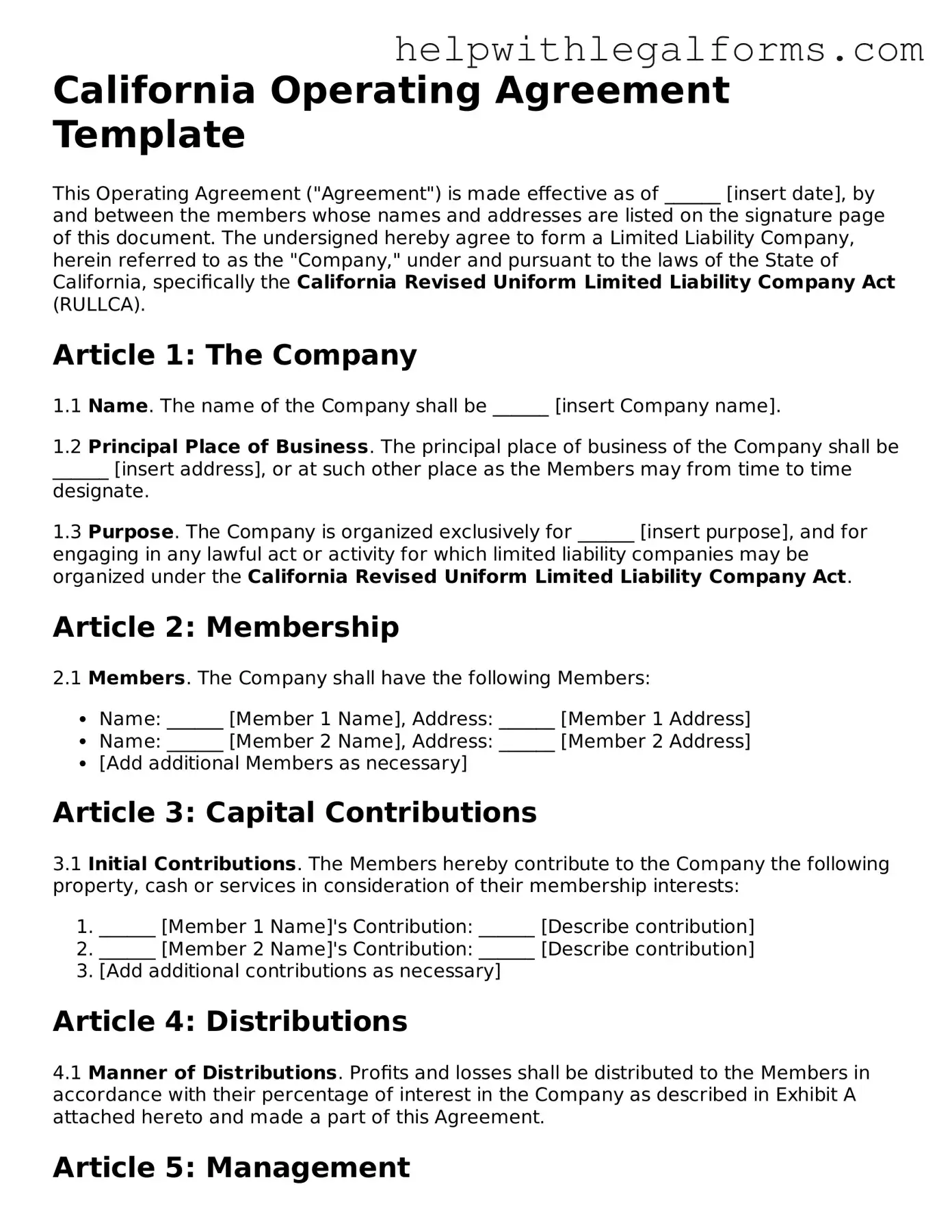

Example - California Operating Agreement Form

California Operating Agreement Template

This Operating Agreement ("Agreement") is made effective as of ______ [insert date], by and between the members whose names and addresses are listed on the signature page of this document. The undersigned hereby agree to form a Limited Liability Company, herein referred to as the "Company," under and pursuant to the laws of the State of California, specifically the California Revised Uniform Limited Liability Company Act (RULLCA).

Article 1: The Company

1.1 Name. The name of the Company shall be ______ [insert Company name].

1.2 Principal Place of Business. The principal place of business of the Company shall be ______ [insert address], or at such other place as the Members may from time to time designate.

1.3 Purpose. The Company is organized exclusively for ______ [insert purpose], and for engaging in any lawful act or activity for which limited liability companies may be organized under the California Revised Uniform Limited Liability Company Act.

Article 2: Membership

2.1 Members. The Company shall have the following Members:

- Name: ______ [Member 1 Name], Address: ______ [Member 1 Address]

- Name: ______ [Member 2 Name], Address: ______ [Member 2 Address]

- [Add additional Members as necessary]

Article 3: Capital Contributions

3.1 Initial Contributions. The Members hereby contribute to the Company the following property, cash or services in consideration of their membership interests:

- ______ [Member 1 Name]'s Contribution: ______ [Describe contribution]

- ______ [Member 2 Name]'s Contribution: ______ [Describe contribution]

- [Add additional contributions as necessary]

Article 4: Distributions

4.1 Manner of Distributions. Profits and losses shall be distributed to the Members in accordance with their percentage of interest in the Company as described in Exhibit A attached hereto and made a part of this Agreement.

Article 5: Management

5.1 Management of the Company. Management of the Company shall be vested in the Members. The Members shall have the right to make all decisions regarding the business, operations, and policies of the Company, unless otherwise stipulated in this Agreement.

Article 6: Amendments

6.1 Any amendment to this Agreement shall be in writing and signed by all Members.

Article 7: Governing Law

7.1 This Agreement shall be governed by and construed in accordance with the laws of the State of California, without giving effect to any choice or conflict of law provision or rule.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

Member's Signature: ______ [Signature]

Print Name: ______ [Print Name]

Date: ______ [Date]

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The California Operating Agreement form is used by LLCs (Limited Liability Companies) to outline the company's financial and functional decisions including rules, regulations, and provisions. The purpose of the form is to govern the internal operations of the business in a way that suits the specific needs of the business owners. |

| Governing Law | This form is governed by the California Revised Uniform Limited Liability Company Act, found in the California Corporations Code. This act sets the legal framework for the formation and operation of LLCs within the state, and the Operating Agreement must comply with its provisions. |

| Flexibility | One of the key features of the California Operating Agreement is its flexibility. The document allows LLC owners (also known as members) the ability to structure their financial and working relationships in a way that best suits their business. This can cover everything from the division of profits and losses to the management structure and procedures for adding new members. |

| Not Mandatory, But Recommended | While not legally required in California, having an Operating Agreement is highly recommended. It provides clarity and helps to prevent misunderstandings among members by setting clear guidelines and expectations for the business's operation. Additionally, it can offer members legal protection by reinforcing the limited liability status of the LLC. |

Instructions on How to Fill Out California Operating Agreement

When forming a Limited Liability Company (LLC) in California, one crucial step is to create an Operating Agreement. This document sets the rules for the ownership and operation of the business. Although not filed with the state, it's essential for defining the rights and responsibilities of the members. Here's how to fill out this important document to ensure clarity and prevent misunderstandings among members.

- Gather all necessary information about your LLC, including the business name, principal place of business, and the names and addresses of all members.

- Decide on the management structure of your LLC. Will it be member-managed or manager-managed? This determines who has the authority to make decisions on behalf of the company.

- Determine how profits and losses will be distributed among the members. This can be based on the amount of capital each member contributes or any other method agreed upon.

- Outline the procedure for adding or removing members from the LLC. This includes how new members can join and the circumstances under which a member can leave or be removed.

- Specify the voting rights of each member. Usually, voting power is in proportion to ownership percentages, but you can set different terms if all members agree.

- Define how meetings will be held, including how often, where, and the required notice for a meeting. Also, establish the quorum needed for a vote to take place.

- Include any clauses for the dissolution of the LLC, detailing how the company can be dissolved and the process for distributing assets upon dissolution.

- Discuss whether the Operating Agreement can be amended and, if so, the procedure for making amendments.

- Have all members review the Operating Agreement to ensure it accurately reflects their understanding and agreements.

- Sign and date the Operating Agreement. Make sure all members receive a copy, and store the original in a safe place for future reference.

By carefully completing the California LLC Operating Agreement, you lay a solid foundation for the management and operation of your LLC. This document not only helps in preventing potential conflicts but also ensures that the business operates smoothly and efficiently. Remember, while the state of California doesn't require an Operating Agreement to be filed, having one in place is a wise practice for any LLC.

Crucial Points on This Form

What is an Operating Agreement?

An Operating Agreement is a legal document that outlines the ownership and member duties of a Limited Liability Company (LLC). This agreement is important because it provides a clear framework for the operations of the LLC, helping to ensure that all members are on the same page and reducing potential conflicts. While not required by every state, having an Operating Agreement is considered best practice for LLCs.

Do California LLCs have to have an Operating Agreement?

Yes, in California, while the law doesn't require LLCs to file their Operating Agreements with the state, it does require that an Operating Agreement is created and maintained. This requirement helps to ensure that there is a clear record of the structure and policies of the LLC that can be referred to if disputes arise.

Can an Operating Agreement be modified?

Yes, an Operating Agreement can be modified if the conditions for modifications set forth in the agreement itself are met. Usually, this requires a certain percentage of member votes. It's important for LLCs to regularly review and update their Operating Agreement to reflect the current operation and agreement between LLC members.

What should be included in a California Operating Agreement?

An Operating Agreement in California should include details such as the LLC's name and address, the term of the LLC, the names of the members, how the LLC will be managed, the capital contributions of each member, how profits and losses will be distributed, rules for meetings and votes, and provisions for adding or removing members. It may also outline procedures for dissolution of the LLC.

Is an Operating Agreement required for a single-member LLC in California?

Yes, even if an LLC has only one member, California law still requires the LLC to have an Operating Agreement. While it may seem unnecessary for a single-member LLC, the Operating Agreement can provide important documentation for the LLC's operational structure and for financial and legal institutions that require it.

Where should the Operating Agreement be kept?

The Operating Agreement should be kept in a safe and accessible place. It's not required to be filed with the state, but it should be readily available for all LLC members to review. It's also wise to keep a copy with any documents related to the LLC, such as its formation paperwork and tax documents.

Are there any penalties for not having an Operating Agreement in California?

While California does not impose specific penalties for not having an Operating Agreement, not having one can lead to complications. It can lead to conflicts among members without a written agreement to resolve disputes. Additionally, without an Operating Agreement, the LLC may be treated under default state laws, which might not be favorable for the LLC members.

How does an Operating Agreement protect the members of an LLC?

An Operating Agreement protects LLC members by outlining the ownership structure, operational procedures, and financial arrangements. This can prevent disputes by setting clear expectations for how decisions are made and profits are shared. Furthermore, it helps to ensure that personal assets are protected from business liabilities by reinforcing the separation between members and the business.

Can I write my own Operating Agreement for my California LLC?

Yes, you can write your own Operating Agreement for your California LLC. However, it is highly recommended to consult with a legal advisor to ensure that the agreement meets all legal requirements and adequately covers all aspects of the LLC's operations. This can help prevent legal issues and ensure that the agreement is enforceable.

Common mistakes

When filling out the California Operating Agreement form, people often make mistakes due to a lack of understanding or attention to detail. This document is crucial for defining the operational structure and policies of a Limited Liability Company (LLC) in California. Avoiding these common errors can save time, legal troubles, and ensure the document's validity. Here are six frequent mistakes:

Not customizing the agreement to fit the specific needs of the LLC. A one-size-fits-all approach can overlook unique aspects of the business or its members.

Omitting details about the distribution of profits and losses. It's vital to clearly state how the LLC will handle these financial aspects to prevent future disputes.

Failure to specify the roles and responsibilities of members and managers. This can lead to confusion and operational inefficiencies within the business.

Ignoring the process for adding or removing members. The agreement should outline how changes in membership are to be handled to ensure smooth transitions.

Lack of provisions for dispute resolution. Without a predetermined method for resolving conflicts, the LLC risks facing lengthy and costly legal battles.

Forgetting to update the agreement as the business evolves. The initial agreement may not suffice as the business grows and changes, necessitating regular reviews and updates.

By addressing these errors, LLC members in California can create a more effective and binding Operating Agreement that safeguards the interests of all parties involved.

Documents used along the form

When starting a business in California, particularly an LLC (Limited Liability Company), an operating agreement is crucial. It outlines the governance and financial decisions of the business. However, to fully establish and protect your business, several other forms and documents are often utilized alongside the California Operating Agreement. Each serves a unique purpose in ensuring that your business complies with legal requirements, benefits from certain protections, and operates smoothly.

- Articles of Organization: This is a mandatory document for forming an LLC in California. It officially registers your business with the state and includes basic information such as the LLC's name, address, and the names of its members.

- Employer Identification Number (EIN) Application: An EIN, also known as a Federal Tax Identification Number, is required for tax reporting purposes. This document is submitted to the IRS to obtain your EIN, which is necessary for opening bank accounts and hiring employees.

- Statement of Information: California requires LLCs to file a Statement of Information within 90 days of forming and every two years thereafter. It updates the state on the LLC’s activities and contact information.

- Operating Agreement Amendment: If members decide to change any terms in the Operating Agreement, this document officially records those changes. It ensures that all members agree to the modifications and keeps the agreement current.

- Membership Certificates: These are formal documents that prove ownership in the LLC. They’re issued to members and can be important for financial transactions or proving business ownership.

- Minutes of Meeting: While not always legally required for LLCs, keeping records of major decisions made during meetings helps in maintaining corporate veil protection and organizing business affairs.

- Business Plan: Technically not a legal document, a business plan is crucial for outlining your business goals, strategies, and how you plan to operate. It is essential for securing funding and guiding your business’s growth.

- Trademark Registration: If your LLC has a unique name, logo, or slogan, registering it as a trademark can protect it from being used by others. This process involves filling out an application with the U.S. Patent and Trademark Office.

- Non-Disclosure Agreement (NDA): To protect your business’s proprietary information, having employees, contractors, and other third parties sign an NDA is a good practice. It legally binds them from disclosing confidential information.

Each document plays a pivotal role in establishing, protecting, and managing your LLC. While some are required by law, others are instrumental in safeguarding your business interests and ensuring operational efficiency. Understanding and utilizing these documents effectively can provide a solid foundation for your business's long-term success.

Similar forms

Partnership Agreement: Like an Operating Agreement, a Partnership Agreement outlines the governance of a business operated by two or more individuals who share profits and losses. It details each partner's rights, responsibilities, and share of profits, paralleling the Operating Agreement's role in an LLC by structuring management and financial arrangements among partners.

Shareholder Agreement: This document, used in corporations, is comparable to an Operating Agreement as it governs the relationship among the shareholders and the corporation itself. It includes provisions on the sale of shares, dispute resolution, and management decisions, similar to how Operating Agreements detail the operations and member interactions within an LLC.

Bylaws: Corporate bylaws serve a role in corporations akin to that of the Operating Agreement in LLCs. They provide a framework for the company's operational procedures, including the roles and duties of directors and officers, meeting protocols, and other internal governance issues. Both documents are fundamental for outlining the structure and rules of a business entity.

Buy-Sell Agreement: Functioning similarly to certain aspects of an Operating Agreement, a Buy-Sell Agreement outlines what happens if a member wants to sell their interest, dies, or becomes disabled. It's pivotal for defining the process for business transition, mirroring how Operating Agreements might include clauses for the continuity or dissolution of the LLC under specified conditions.

Employment Agreement: Although generally pertaining to the relationship between employers and employees, Employment Agreements share similarities with Operating Agreements in that they might delineate roles, responsibilities, compensation, and conditions of employment. For LLC members who are actively involved in the business, the Operating Agreement might similarly outline duties and profit distributions.

Member Control Agreement: Specific to LLCs, a Member Control Agreement is very much like an Operating Agreement but is typically used when there are detailed and specific arrangements that need to be documented outside of the standard Operating Agreement. It governs the relationships among members, including how decisions are made, rights to profits and losses, and procedures for adding or removing members.

Dos and Don'ts

When you're filling out the California Operating Agreement form for your LLC, it's crucial to pay attention to detail and ensure that your document accurately reflects the structure and rules of your business. Here are some dos and don'ts to guide you through the process:

- Do review the default state laws. Understand how they apply to your LLC to decide if you want to customize your agreement differently.

- Do include all members' names and their contribution details. It's important for maintaining clear records and understanding each member's stake in the company.

- Do clearly outline the process for admitting new members. This ensures everyone is on the same page and knows the procedure should the situation arise.

- Do specify the duties and powers of members and managers. A clear distribution of responsibilities helps prevent conflicts and confusion.

- Do describe the procedure for distributing profits and losses. This keeps financial expectations consistent and transparent among members.

- Don't leave any sections blank. If a section doesn't apply, indicate with "N/A" (not applicable) to show it was consciously skipped.

- Don't be vague about any terms or agreements. Clarity and specificity prevent misunderstandings and potential disputes in the future.

- Don't forget to have all members sign the agreement. Unsigned agreements are often not legally enforceable.

- Don't overlook the need for regular updates. As your LLC grows and evolves, so should your Operating Agreement to reflect current operations and member agreements.

Misconceptions

When forming a Limited Liability Company (LLC) in California, the Operating Agreement is a critical document that shapes the structure and operating procedures of the business. Despite its importance, many misconceptions exist about what the California Operating Agreement form is and what it should include. Let's demystify some of these misconceptions.

Only multi-member LLCs need an Operating Agreement. Even single-member LLCs can benefit from having an Operating Agreement. It adds credibility to the LLC, helping to ensure that the courts and financial institutions see it as a separate business entity.

The Operating Agreement is optional. While not explicitly required by California state law, having one is strongly advised. It provides clarity on the governance and financial arrangements of the LLC, helping to avoid future disputes.

There's a one-size-fits-all template. Each LLC's needs are unique, and the Operating Agreement should reflect that. A template can be a good starting point, but it should be customized to fit the specific needs of your LLC.

You can't change the Operating Agreement. It can (and should) evolve with your business. Amendments can be made to the Operating Agreement as the company grows and changes, subject to the amendment procedures set out within the document itself.

It only covers the distribution of profits. The Operating Agreement covers a wide range of issues, including the allocation of losses, management structure, voting rights, and procedures for adding or removing members.

All members must have an equal share. The Operating Agreement allows LLCs to outline the ownership percentage of each member, which doesn't necessarily have to be equal. It can be based on capital contribution, effort, or other agreed-upon metrics.

The state reviews and approves Operating Agreements. Operating Agreements are internal documents. The California Secretary of State does not review or approve these agreements; they are for the LLC members' records.

It's too complicated to write without a lawyer. While having a lawyer can be beneficial, especially for complex arrangements, many LLCs draft their Operating Agreement with available resources and templates, customizing them as necessary.

Operating Agreements are public documents. They are internal documents and do not need to be filed with the state. This means they remain private, accessible only to the members of the LLC.

It must be created when you form your LLC. Though it's wise to have your Operating Agreement in place early, you can create or modify it at any point in the life of your LLC as long as all members agree.

Understanding these misconceptions can help you see the Operating Agreement in a new light. It's a flexible, powerful tool for defining your LLC's structure and rules, and it works best when tailored to your specific business needs. Don't overlook its potential to safeguard your LLC and help it thrive.

Key takeaways

When dealing with the California Operating Agreement form for limited liability companies (LLCs), there are several crucial takeaways to keep in mind. This document is pivotal for outlining the management structure, financial arrangements, and operational guidelines of an LLC within California. Understanding these key points can help ensure the proper completion and utilization of the form:

- The California Operating Agreement is not required by state law to be filed with the California Secretary of State, but it is highly recommended to have one. The document serves as a private contract among members.

- Having a comprehensive Operating Agreement in place can help prevent misunderstandings among members by clearly defining each member's rights, responsibilities, and proportions of profits and losses.

- While the state of California does not mandate a specific format for the Operating Agreement, it must adhere to all state statutes regulating LLCs. This means it cannot contain any provisions that are inconsistent with California law.

- The Operating Agreement should be kept up to date. As the LLC grows or undergoes changes (such as changes in membership, management structure, or capital contributions), the agreement should be amended to reflect these changes accurately.

- Key components to include in a comprehensive Operating Agreement are: the LLC's name and primary address, the term (duration) of the LLC, the names of the members, the management structure (managed by members or managers), capital contributions, how profits and losses will be distributed, and rules for meetings and voting.

- The Agreement also typically lays out the procedure for adding new members, transferring membership interests, and dissolving the LLC. These provisions are critical for the smooth operation and eventual winding up of the business.

- It's advisable for all members to review and sign the Operating Agreement, as this can help ensure that everyone has a clear understanding and agrees to the terms. This can also be important for legal and financial accountability.

- Last but not least, while the Operating Agreement does not need to be filed with any government agency, it should be kept with the business’s permanent records. Having easy access to this document can be invaluable in the event of disputes or when dealing with banks and other financial institutions.

Adhering to these guidelines can significantly aid in the smooth formation and operation of an LLC in California. The Operating Agreement is a foundational document that, while not legally mandatory, serves as a critical tool for governance and conflict resolution within an LLC.

Create Other Operating Agreement Forms for US States

Llc Operating Agreement Template New York - Crucial for estate planning purposes, outlining the process for transfer of ownership in the event of a member's death.

Ct Llc - It provides a framework for financial contributions, detailing how much each member invests into the LLC.

Llc Filing Fee - The Operating Agreement specifies the process for adding new members, resolving disputes, and potentially dissolving the LLC.