Blank Operating Agreement Form for Colorado

When embarking on the journey of forming a Limited Liability Company (LLC) in Colorado, entrepreneurs and business founders are presented with the crucial task of drafting an Operating Agreement. This document, although not mandated by state law, plays an indispensable role in establishing the framework for the company's operations and governance. Within its pages, the Colorado Operating Agreement outlines the ownership structure, delineates the roles and responsibilities of its members, describes how decisions are made, and sets forth the procedures for handling profit distribution and resolving disputes. It is a bespoke contract that reflects the unique characteristics of the business, serving not only as a roadmap for the company's internal workings but also as a shield that safeguards members' personal assets by reinforcing the legal distinction between the members and the LLC. In essence, this form encapsulates the essence of the company's operating rules and ethos, laying a solid foundation upon which the business can build and grow in the competitive landscape of Colorado's economy.

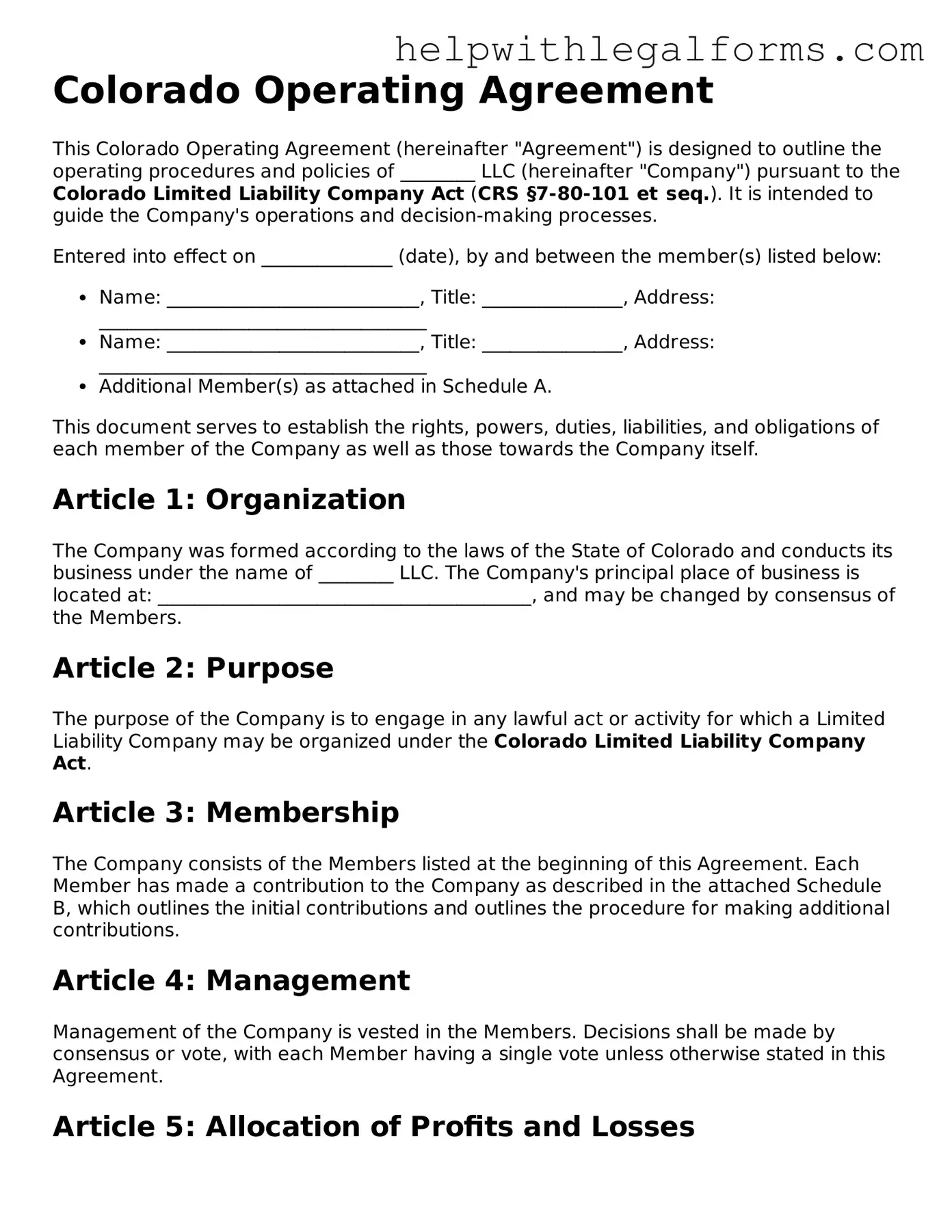

Example - Colorado Operating Agreement Form

Colorado Operating Agreement

This Colorado Operating Agreement (hereinafter "Agreement") is designed to outline the operating procedures and policies of ________ LLC (hereinafter "Company") pursuant to the Colorado Limited Liability Company Act (CRS §7-80-101 et seq.). It is intended to guide the Company's operations and decision-making processes.

Entered into effect on ______________ (date), by and between the member(s) listed below:

- Name: ___________________________, Title: _______________, Address: ___________________________________

- Name: ___________________________, Title: _______________, Address: ___________________________________

- Additional Member(s) as attached in Schedule A.

This document serves to establish the rights, powers, duties, liabilities, and obligations of each member of the Company as well as those towards the Company itself.

Article 1: Organization

The Company was formed according to the laws of the State of Colorado and conducts its business under the name of ________ LLC. The Company's principal place of business is located at: ________________________________________, and may be changed by consensus of the Members.

Article 2: Purpose

The purpose of the Company is to engage in any lawful act or activity for which a Limited Liability Company may be organized under the Colorado Limited Liability Company Act.

Article 3: Membership

The Company consists of the Members listed at the beginning of this Agreement. Each Member has made a contribution to the Company as described in the attached Schedule B, which outlines the initial contributions and outlines the procedure for making additional contributions.

Article 4: Management

Management of the Company is vested in the Members. Decisions shall be made by consensus or vote, with each Member having a single vote unless otherwise stated in this Agreement.

Article 5: Allocation of Profits and Losses

All profits and losses of the Company shall be allocated to the Members in proportion to their ownership interest in the Company, as detailed in Schedule C attached hereto.

Article 6: Meetings

Meetings of the Members shall be held at least annually or as needed, at a time and place decided by the Members. Special meetings can be called by any Member, provided notice is given according to the procedures outlined in this Agreement.

Article 7: Amendments

This Agreement may be amended only with the approval of at least a majority of the Members' interest in the Company. Written notice of proposed amendments must be provided to all Members at least __ days prior to voting.

Article 8: Dissolution

The Company may be dissolved upon the decision of the Members as per the guidelines set out in the Colorado Limited Liability Company Act. Upon dissolution, the Company's assets shall be distributed to the Members in proportion to their respective ownership interests after satisfying all debts and obligations.

Signatures

This Agreement, entered into at __________________________ (place), on the date first above written, by all the Members signifies their acceptance of the terms stated herein.

Member Name: ___________________________ Signature: ___________________________ Date: ____________

Member Name: ___________________________ Signature: ___________________________ Date: ____________

Attach additional signature lines as necessary.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a legal document outlining the ownership and operating procedures of an LLC in Colorado. |

| Governing Law | This form is governed by the Colorado Limited Liability Company Act found in Title 7, Article 80 of the Colorado Revised Statutes. |

| Applicability | Every LLC operating in Colorado is advised to adopt an Operating Agreement, although it is not mandated by state law. |

| Flexibility | The form allows for customization to suit the specific needs of the LLC, including provisions for management, distributions, and dissolution. |

| Signing Requirements | While not required by law to be filed or signed, having a signed copy can be beneficial for legal verification and internal conflicts. |

| Benefit | It helps protect personal assets from business liabilities, clarifies verbal agreements, and aids in conflict resolution among members. |

Instructions on How to Fill Out Colorado Operating Agreement

Filling out the Colorado Operating Agreement form is a crucial step for any LLC operating in Colorado. This document outlines the ownership structure, operational procedures, and financial arrangements of the business. By putting these details in writing, members of the LLC can ensure that there is a clear understanding of how various situations will be handled, which can help prevent conflicts in the future. It's important to complete this document carefully and thoroughly to ensure that all aspects of the LLC's operations are covered. Below, you'll find a step-by-step guide to help you navigate the process of filling out the Colorado Operating Agreement form.

- Start by gathering all necessary information about your LLC, including its name, principal place of business, and the names and addresses of all members.

- Review the default rules set by the state of Colorado for LLCs to understand how they apply to your business and what you might want to modify in your agreement.

- Clearly state the name of your LLC as it appears on your Certificate of Formation, ensuring it complies with Colorado state requirements.

- List all members of the LLC, along with their contributions to the company. This could include capital, property, or services.

- Outline the management structure of your LLC. Specify whether it will be managed by members or by appointed managers.

- Describe the rights and responsibilities of members and managers, including voting rights, profit distribution, and duties within the company.

- Determine how new members will be admitted to the LLC and how members can transfer or terminate their membership.

- Set forth the procedures for regular meetings, including how they will be called, voting rules, and quorum requirements.

- Detail the financial arrangements, including how profits and losses will be distributed among members.

- Include clauses for the dissolution of the LLC, providing a clear process for winding up its affairs.

- Review the entire agreement to ensure that all the information is correct and that it covers all relevant aspects of your LLC’s operations.

- Have all members sign and date the agreement. Ensure that each member receives a copy of the document for their records.

Once the Colorado Operating Agreement is fully completed and signed by all members, it does not need to be filed with the state. However, it should be kept on file by your LLC as an official record of your internal operations and procedures. This document is key to ensuring that all members are on the same page regarding the management and financial arrangements of the LLC, and it serves as a crucial reference in resolving any disputes that may arise.

Crucial Points on This Form

What is an Operating Agreement and why is it important for LLCs in Colorado?

An Operating Agreement is a formal document that outlines the ownership and operating procedures of a Limited Liability Company (LLC) in Colorado. This agreement is crucial as it ensures that all business owners are on the same page regarding the operations, financial arrangements, and how decisions are made within the LLC. Although the state of Colorado does not require LLCs to have an Operating Agreement, having one is highly recommended. It provides a clear framework for the business, helps to protect the members’ personal assets from legal disputes, and offers flexibility that the default state laws might not provide.

What should be included in a Colorado Operating Agreement?

A comprehensive Colorado Operating Agreement should include, but is not limited to, details about the ownership structure, distribution of profits and losses, management and voting rights, procedures for adding or removing members, and guidelines for the dissolution of the LLC. It may also cover specifics about meetings, how decisions are made, and any other arrangements that govern the operations of the LLC. Tailoring the agreement to suit the specific needs of your LLC is crucial for it to be effective.

Can an Operating Agreement be modified after it has been created?

Yes, an Operating Agreement can be modified after its initial creation. Most agreements will specify the process required for making amendments, which typically requires a certain percentage of votes from the membership. This flexibility allows an LLC to adapt to changes in the business environment, membership, or the law. However, it’s important to ensure that any modifications are documented in writing and agreed upon by all members to maintain clarity and avoid potential disputes.

How does having an Operating Agreement affect the legal status of an LLC in Colorado?

While the existence of an Operating Agreement does not affect the legal status of an LLC in Colorado - as an LLC is officially formed once it is registered with the Colorado Secretary of State - it plays a crucial role in governing the operations of the company. The Operating Agreement can influence how courts view the LLC, especially in disputes. By clearly outlining the management structure and the rights and responsibilities of members, it can help demonstrate that the LLC is operating as a separate entity, which is essential for maintaining limited liability protection. This protection separates the members' personal assets from the liabilities of the business, safeguarding them against claims and lawsuits against the LLC.

Common mistakes

In completing the Colorado Operating Agreement form, individuals often fall into several common pitfalls. Recognizing and avoiding these mistakes is crucial for ensuring the document accurately reflects the intentions of the LLC members and meets legal requirements. The following is a breakdown of five common errors:

- Skipping Details: Many people rush through filling out the form and leave out important details. This includes not specifying the rights and duties of members, the distribution of profits and losses, or the procedures for adding or removing members. These omissions can lead to disputes or confusion down the road.

- Not Tailoring the Agreement: Using a one-size-fits-all approach can be problematic. Colorado's Operating Agreement form should be customized to fit the specific needs of the LLC. Failure to tailor the agreement can result in inadequate protection for members or the LLC itself.

- Ignoring State Requirements: Every state has unique requirements for Operating Agreements. Individuals often neglect to ensure their document complies with Colorado's specific laws, which can render the agreement ineffective or invalid in certain scenarios.

- Inaccurate Information: Filling out the form with incorrect information, whether it's the names of the members, the business address, or the contributions of each member, can lead to legal complications. Accuracy is essential for the validity of the document.

- Lack of Review and Updates: Once filled out, the Operating Agreement is often forgotten. Not regularly reviewing and updating the document to reflect changes in the business or its members is a critical mistake. The agreement should evolve with the business.

To ensure the effectiveness of a Colorado Operating Agreement, individuals must approach the document with thoroughness and legal awareness. Avoiding these mistakes can help safeguard the LLC and its members from future legal challenges and operational issues.

Documents used along the form

When forming a Limited Liability Company (LLC) in Colorado, the Operating Agreement serves as a crucial framework for the company's operations, member roles, and financial decisions. Complementing the Operating Agreement, several other forms and documents often play a vital role in ensuring the smooth establishment and operation of the LLC. These additional documents not only help in complying with state and federal regulations but also in managing the company's internal and financial affairs efficiently. Below is a list of up to seven key documents that are commonly used alongside the Colorado Operating Agreement form.

- Articles of Organization: This is the primary document required to form an LLC in Colorado. It officially registers the LLC with the Colorado Secretary of State by providing basic information about the company, such as its name, principal office address, registered agent, and the names of the members.

- Employer Identification Number (EIN) Application: An EIN, obtained from the IRS, is necessary for tax purposes. It allows an LLC to open a bank account, hire employees, and comply with tax filings.

- Operating Agreement Amendment Form: If members decide to make changes to the initial Operating Agreement, this form is used to record those amendments officially.

- Annual Report: Colorado LLCs are required to file an annual report with the Secretary of State. This report keeps the state updated with current information regarding the company’s address, registered agent, and member information.

- Membership Certificates: These certificates serve as a physical representation of membership interest in the LLC. They specify the ownership percentage of each member.

- Management Resolutions: Used to document decisions and policies agreed upon by the members or managers of the LLC. These resolutions can cover a wide range of topics from the opening of bank accounts to the authorization of a company representative to enter into contracts on behalf of the LLC.

- Registered Agent Consent Form: This form is used to confirm that the person or entity agreed to act as the registered agent for the LLC, accepting legal documents on behalf of the company.

While each of these documents serves a specific purpose, together, they form a comprehensive legal and operational foundation for the LLC. Proper preparation and maintenance of these documents not only help in meeting legal requirements but also facilitate easier management and operation of the company. Seeking professional advice in preparing these documents can ensure accuracy and compliance with Colorado law, helping to set a solid foundation for the business's future success.

Similar forms

Partnership Agreement: Like an Operating Agreement, a Partnership Agreement sets out the terms and conditions between business partners. It covers aspects like profit sharing, dispute resolution, and the roles and responsibilities of each partner. While an Operating Agreement is used by LLCs, a Partnership Agreement serves a similar purpose for partnerships, detailing how the business operates and is managed among the partners.

Shareholders' Agreement: This document is used by corporations, much like an Operating Agreement is used by LLCs. A Shareholders' Agreement specifies the rights and obligations of shareholders, outlines the management of the company, how shares can be bought and sold, and how decisions are made. While the structure and purpose of the corporation differ from an LLC, the core principle of defining the relationship between the business owners and the operational guidelines of the business stays consistent.

Bylaws: Corporate bylaws are another document similar to an Operating Agreement but are specifically for corporations. Bylaws establish the rules and procedures for how the corporation will be governed and operate, including the frequency of meetings, the process for electing directors, and how officers are chosen and their roles. Although addressing a different business structure, bylaws play a comparable role in providing a framework for the company's internal management.

Buy-Sell Agreement: Although more specific in scope, a Buy-Sell Agreement shares some similarities with an Operating Agreement. This document outlines what happens to a business owner's shares in the event of death, disability, or departure. It effectively plans for the future of the business in terms of ownership transition, an aspect often covered under circumstances of member changes in an Operating Agreement for an LLC.

Dos and Don'ts

An operating agreement is a crucial document for any Colorado limited liability company (LLC). It outlines the ownership structure, operating procedures, and financial arrangements of the business. When drafting this document, certain practices should be adhered to for clarity, legal compliance, and the protection of all members involved. Here are five things you should do and five things you shouldn't do when filling out the Colorado Operating Agreement form.

Things You Should Do:

- Review Colorado's specific requirements for LLC operating agreements to ensure all necessary provisions are included.

- Clearly define each member's financial contribution and percentage of ownership in the LLC to avoid future disputes.

- Outline the process for admitting new members and what happens when a member wants to leave the LLC to ensure a smooth transition in either scenario.

- Specify the roles and responsibilities of members and managers, including who has the authority to make decisions on behalf of the LLC.

- Have all members review and sign the operating agreement, ensuring everyone understands and agrees to the terms.

Things You Shouldn't Do:

- Use vague or ambiguous language that can lead to misunderstandings and legal disputes among members.

- Ignore state-specific requirements that may be necessary for your operating agreement to be valid and enforceable in Colorado.

- Omit dispute resolution procedures which can help resolve disputes amicably and avoid costly litigation.

- Forget to update the operating agreement as the LLC grows or circumstances change, which can lead to outdated and ineffective provisions.

- Rely solely on generic templates without customizing the document to the specific needs and arrangements of your LLC.

Misconceptions

When it comes to establishing the framework for any Limited Liability Company (LLC), the Operating Agreement stands as a crucial document. In Colorado, as in other states, this document sets out the procedures, policies, and financial decisions of the business. However, several misconceptions often cloud the understanding of its importance and requirements. Below are eight common misconceptions about the Colorado Operating Agreement form that need clarification.

- It's mandatory to file the Operating Agreement with the state. In Colorado, there's no legal requirement to file your Operating Agreement with any state agency. This document is meant for internal use within the LLC to govern its operations.

- There's a standard, one-size-fits-all template. While there are templates available, there's no single 'correct' Operating Agreement. Each LLC should tailor its Operating Agreement to its specific needs, preferences, and business model.

- Only multi-member LLCs need an Operating Agreement. Even if you're the sole owner of an LLC, having an Operating Agreement is beneficial. It provides clarity on the business structure and can prove invaluable if disputes arise or for succession planning.

- Once created, the Operating Agreement cannot be changed. Operating Agreements should evolve with your business. Amendments can be made as long as they comply with the appropriate procedures outlined within the agreement and abide by Colorado law.

- The Operating Agreement doesn't impact taxes. Although it doesn't directly change your federal or state tax status, the Operating Agreement can specify how profits are distributed among members. These distributions can have tax implications for its members.

- Small or family-run LLCs don't need an Operating Agreement. No matter the size or nature of the business, an Operating Agreement helps prevent misunderstandings by clearly outlining member roles, responsibilities, and profit shares.

- Signing the Operating Agreement is enough. Simply signing the agreement isn't sufficient; members should also actively follow and enforce the provisions outlined in the document. It’s important for avoiding potential legal issues down the line.

- All members must agree on all parts of the Operating Agreement. While consensus is ideal, it's not always possible. Procedures for decision-making, including how disagreements are handled, should be included in the Operating Agreement. This way, even when unanimous agreement isn't reached, the LLC can still operate effectively.

Dispelling these misconceptions about the Colorado Operating Agreement is essential for business owners as they navigate the formation and management of their LLC. This document, while not filed with the state, is a cornerstone of a well-structured business, delineating the responsibilities, processes, and financial decisions of the company. Tailoring an Operating Agreement to fit the unique needs of your business, and regularly revisiting it for possible amendments, can help ensure the long-term success and adaptability of your LLC.

Key takeaways

An operating agreement is essential for defining your business structure, roles, and rules among members. In Colorado, while not legally required, it's highly beneficial for LLCs (Limited Liability Companies) to have one to ensure smooth operations and clarity among members.

The agreement should clearly outline the ownership percentages. This aspect covers how much of the LLC each member owns, typically based on their investment into the company. It prevents misunderstandings and conflicts.

Delineate member roles and responsibilities. For your LLC to function effectively, each member's responsibilities, powers, and duties should be clearly stated. This clarifies roles and helps avoid disputes.

Include provisions for adding or removing members. Businesses evolve, and your agreement should be flexible enough to accommodate changes in membership without disrupting the business operation.

Detail the profit and loss distribution method. Members need to know how and when profits and losses will be shared. This should mirror the ownership percentages or another agreed-upon formula.

Decision-making processes should be outlined. Whether decisions are made by majority vote, unanimous vote, or a different system, your operating agreement should specify this to prevent deadlock and conflict.

Plan for disputes. Despite best efforts, disputes may arise. Including a method for resolving disagreements within your operating agreement can save time, money, and relationships.

Consider the future. Think about what happens if a member wants to leave or if the business dissolves. Your agreement should cover buyout procedures and steps for winding up the business to ensure a smooth transition.

Ensure all members sign the agreement. Having every member's signature turns the operating agreement into a formal contract, binding them to its terms and providing legal protections.

Review and update regularly. As your business grows and changes, so should your operating agreement. Regular reviews ensure that it remains relevant and up-to-date with the current state of your LLC.

Create Other Operating Agreement Forms for US States

Ct Llc - Helps mitigate risks by allowing members to pre-define their liabilities and responsibilities.

How to Create an Operating Agreement for an Llc - It specifies the jurisdiction under which the agreement and any disputes will be governed.