Blank Operating Agreement Form for Connecticut

For business owners who have embarked on the journey of forming a Limited Liability Company (LLC) in Connecticut, the Operating Agreement form stands as a critical document, outlining the internal operating procedures, financial decisions, and the roles of its members. Even though Connecticut does not legally require LLCs to have an Operating Agreement, crafting one is highly advisable as it serves to protect the business's limited liability status, helps in preventing misunderstandings by clarifying the verbal agreements among members, and ensures the business is run according to the owners’ specifications rather than default state laws. The form details a comprehensive framework for how the LLC will operate, including but not limited to the allocation of profits and losses, the process for adding or removing members, and the procedures for dissolving the business. By putting these agreements in writing, LLC members in Connecticut can establish clear guidelines and expectations, thereby fostering a stable and efficient business environment.

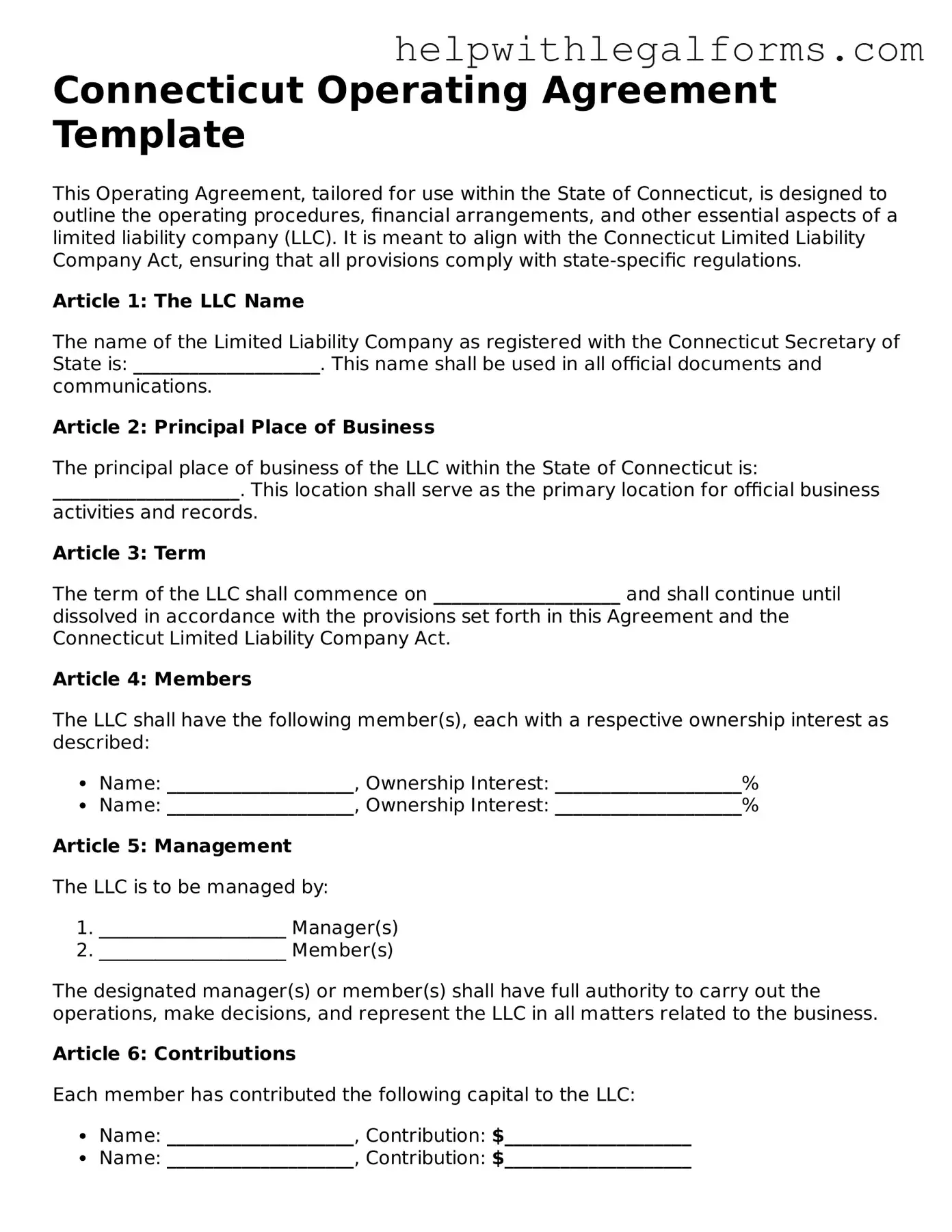

Example - Connecticut Operating Agreement Form

Connecticut Operating Agreement Template

This Operating Agreement, tailored for use within the State of Connecticut, is designed to outline the operating procedures, financial arrangements, and other essential aspects of a limited liability company (LLC). It is meant to align with the Connecticut Limited Liability Company Act, ensuring that all provisions comply with state-specific regulations.

Article 1: The LLC Name

The name of the Limited Liability Company as registered with the Connecticut Secretary of State is: ____________________. This name shall be used in all official documents and communications.

Article 2: Principal Place of Business

The principal place of business of the LLC within the State of Connecticut is: ____________________. This location shall serve as the primary location for official business activities and records.

Article 3: Term

The term of the LLC shall commence on ____________________ and shall continue until dissolved in accordance with the provisions set forth in this Agreement and the Connecticut Limited Liability Company Act.

Article 4: Members

The LLC shall have the following member(s), each with a respective ownership interest as described:

- Name: ____________________, Ownership Interest: ____________________%

- Name: ____________________, Ownership Interest: ____________________%

Article 5: Management

The LLC is to be managed by:

- ____________________ Manager(s)

- ____________________ Member(s)

The designated manager(s) or member(s) shall have full authority to carry out the operations, make decisions, and represent the LLC in all matters related to the business.

Article 6: Contributions

Each member has contributed the following capital to the LLC:

- Name: ____________________, Contribution: $____________________

- Name: ____________________, Contribution: $____________________

Additional contributions shall be subject to the terms outlined in this Agreement and agreed upon by all members.

Article 7: Distributions

Profits and losses shall be distributed to the members annually in proportion to their respective ownership interests, as described in Article 4, unless otherwise agreed upon.

Article 8: Changes and Amendments

Any changes or amendments to this Operating Agreement must be made in writing and require the unanimous consent of all members.

Article 9: Dissolution

Upon the dissolution of the LLC, assets shall be distributed to the members in accordance with their ownership interests after settling all debts and obligations.

This Operating Agreement is executed on ____________________ by the members, who affirm to comply with the terms set forth and all applicable laws and regulations of the State of Connecticut.

Member Signature: ____________________ Date: ____________________

Member Signature: ____________________ Date: ____________________

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | The Connecticut Operating Agreement form is designed for use by Limited Liability Companies (LLCs) established in Connecticut. |

| 2 | It serves as a formal document that outlines the operating procedures and the agreement between the LLC members. |

| 3 | This agreement is not mandatory under Connecticut law but is highly recommended for the clear establishment of financial and management structures. |

| 4 | Governing laws for the Connecticut Operating Agreement form are stipulated under the Connecticut Limited Liability Company Act. |

| 5 | It allows LLC members to document their capital contributions, profit distributions, decision-making processes, and membership changes. |

| 6 | Having an Operating Agreement in place can protect the members’ personal assets from the LLC's debts and liabilities. |

Instructions on How to Fill Out Connecticut Operating Agreement

Creating an Operating Agreement for your Connecticut-based limited liability company (LLC) is an important step towards establishing clear guidelines for the operation and management of your business. This legal document outlines key procedures, rights, and responsibilities for members, setting a solid foundation for your LLC's day-to-day activities and its long-term strategy. While the content of the form is crucial, the process of filling it out requires careful attention to detail to ensure that all information is accurate and reflective of the members' agreement. The steps below guide you through the process of filling out the Connecticut Operating Agreement form effectively.

- Begin by gathering all necessary information about your LLC, including the official company name, principal place of business, and the names and addresses of all members.

- State the purpose of your LLC. Be specific but concise in describing the nature of your business.

- Determine the LLC's duration. If your LLC has a specific end date, include this in the agreement; otherwise, note that it will continue indefinitely.

- Detail the capital contributions of each member. Include the amount and describe the form – whether cash, property, or services.

- Outline the management structure of the LLC. Specify whether it will be member-managed or manager-managed, and list the names and roles of the managers.

- Describe the process for allocating profits and losses amongst members. Typically, this is based on the percentage of ownership.

- Include provisions for holding meetings and taking votes. Mention the frequency of meetings, quorum requirements, and voting rights.

- Explain the process for adding or removing members, as well as procedures for members to exit the LLC.

- Detail any restrictions on transferring membership interests, highlighting any conditions that must be met for a transfer to be approved.

- Specify any circumstances that would trigger the dissolution of the LLC and the process for winding up its affairs.

- Sign and date the agreement. All members should review the document carefully, agree to its terms, and sign it to make it official.

After completing these steps, ensure that each member receives a copy of the agreement for their records. The Operating Agreement does not need to be filed with the state of Connecticut but should be kept with your essential business records. This document can always be amended by mutual consent of the LLC members if changes in the management or operation of the LLC occur. By diligently following these steps, you lay a strong groundwork for the governance and success of your LLC.

Crucial Points on This Form

What is the Connecticut Operating Agreement form and who needs it?

The Connecticut Operating Agreement form is a crucial document for any Connecticut-based Limited Liability Company (LLC). It outlines the operational procedures, financial decisions, and ownership structure among members of the LLC. Anyone who is either forming or currently part of an LLC in Connecticut should have this agreement in place to ensure clarity and protect the interests of all members involved.

How does a Connecticut Operating Agreement protect my LLC?

This agreement functions as a safeguard for your LLC by detailing the rights, powers, and obligations of each member. It sets clear expectations on how profits and losses are distributed, what happens when a member wants to leave or when the company dissolves, and how decisions are made. By having these details in writing, you reduce the risk of conflicts and provide a clear path for resolution, thereby protecting the legal and financial integrity of your LLC.

Can I create a Connecticut Operating Agreement if my LLC has only one member?

Yes, even single-member LLCs can and should create an Operating Agreement. Though Connecticut law does not require single-member LLCs to have an Operating Agreement, having one in place is beneficial. It reinforces the legal separation between the owner and the business, which can be crucial for liability protection and maintaining the structure of your LLC. It also provides a foundation for how your business operates and prepares it for potential growth or changes in ownership.

Are there legal requirements for what must be included in a Connecticut Operating Agreement?

While the state of Connecticut does not enforce a specific structure or content for an Operating Agreement, certain key elements are generally included to ensure effectiveness and compliance. These include the LLC's name and primary place of business, the duration of the LLC, the names of members and how ownership is structured, how profits and losses will be distributed, the management structure, and procedures for adding or removing members. Although not explicitly required by law, including these aspects can help ensure that your LLC operates smoothly and remains in good standing.

Common mistakes

When it comes to laying the foundational legal framework of a Limited Liability Company (LLC) in Connecticut, the Operating Agreement stands as a pivotal document. This agreement outlines the operational and financial decisions of the business, providing clarity and structure that can preemptively resolve potential disputes. However, despite its importance, individuals often navigate its completion with errors. Highlighted below are four common mistakes made when filling out the Connecticut Operating Agreement form:

Overlooking the Importance of Detail: Many neglect the necessity of including detailed provisions for scenarios such as dissolution, distribution, and ownership transfer. These omissions can lead to ambiguity and conflict among members down the line.

Failure to Define Management Structure: Not clearly defining whether the LLC will be member-managed or manager-managed can lead to operational inefficiencies and power imbalances, hindering decision-making processes.

Ignoring State-Specific Requirements: Each state has its unique set of rules governing LLCs. In Connecticut, overlooking these specific regulations when drafting your Operating Agreement can result in non-compliance issues, potentially jeopardizing the company’s legal standing.

Lack of Regular Updates: Failing to update the Operating Agreement as the company evolves is another common pitfall. As memberships change and the business grows, the document should reflect these developments to remain relevant and enforceable.

The process of drafting a comprehensive Operating Agreement requires a meticulous approach. Retaining the services of a legal professional can provide guidance, ensuring that the document meets all legal criteria and adequately reflects the intentions of its members. Every LLC member should prioritize the completion of this document with the seriousness and attention it warrants, recognizing that its value extends beyond a mere formality.

Documents used along the form

When forming a business in Connecticut, the Operating Agreement is a crucial document that outlines the management structure and operational guidelines of a Limited Liability Company (LLC). However, to fully establish and protect the business, several other important forms and documents are often required. These documents ensure compliance with state regulations, provide clarity on the ownership and structure of the business, and safeguard the company’s legal and financial standing. Below is a list of common forms and documents used alongside the Connecticut Operating Agreement.

- Articles of Organization: This is the primary document required to register an LLC with the state of Connecticut. It includes basic information about the company such as its name, purpose, office address, and the name and address of its registered agent.

- EIN Confirmation Letter: After obtaining an Employer Identification Number (EIN) from the IRS, the company receives a confirmation letter. This letter is essential for tax purposes and to open a business bank account.

- Membership Certificates: These certificates serve as physical proof of ownership in the LLC and detail the percentage each member owns.

- Operating Agreement Amendment: If any changes are made to the original Operating Agreement, those changes must be documented in an amendment. This ensures that the most current agreements between members are legally recognized.

- Annual Report: Most states require LLCs to submit an Annual Report, which updates the state on key information about the company. This may include details about members, addresses, and business activities.

- Meeting Minutes: Keeping record of major decisions and meetings is essential for maintaining transparency and accountability within the LLC. These documents can be crucial during legal or financial audits.

- Buy-Sell Agreement: This outlines what happens to a member’s interest in the company if they wish to leave the LLC, pass away, or become incapacitated. It is important for preventing disputes among members.

- Licenses and Permits: Depending on the nature of the business, certain local, state, or federal licenses and permits may be required to operate legally.

- Company Policy Documents: This can include employee handbooks, privacy policies, and other documents that outline the operational policies and procedures of the business.

Together with the Operating Agreement, these documents form a comprehensive legal framework that supports the establishment, management, and protection of an LLC in Connecticut. Proper preparation and maintenance of these documents help ensure the company operates smoothly and remains in good standing with both the state and federal authorities.

Similar forms

-

Partnership Agreement: Similar to an Operating Agreement, which outlines the ownership structure, financial contributions, and operational responsibilities within a Limited Liability Company (LLC), a Partnership Agreement serves the same function for partnerships. Both documents detail processes for decision-making, distribution of profits and losses, and rules for adding or removing members/partners. The key distinction lies in their application to different business entities, LLCs versus partnerships.

-

Shareholders' Agreement: This document parallels an Operating Agreement in that it governs the relationship among the shareholders of a corporation, much like how an Operating Agreement organizes the members of an LLC. It outlines the rights, responsibilities, and obligations of shareholders, details on the transfer of shares, and procedures for resolving disputes. Both agreements are crucial in establishing the groundwork for the business's internal structure and operations.

-

Bylaws: Corporate bylaws share similarities with an Operating Agreement in defining the rules and procedures for the internal governance of a corporation. While Operating Agreements apply to LLCs, bylaws fulfill a similar role for corporations, specifying the duties of directors and officers, the process for holding meetings, and other essential governance matters. Both documents are foundational to the effective and orderly function of their respective business entities.

-

Buy-Sell Agreement: This agreement is akin to certain provisions that may be found within an Operating Agreement, especially those dealing with the transfer of ownership interests. A Buy-Sell Agreement sets the terms under which a partner's or member's share can be bought out or sold, often triggered by specific events like death, disability, or retirement. It complements an Operating Agreement by providing a clear exit strategy for partners or members, thereby ensuring the continuity of the business's operations.

-

Employment Agreement: While an Operating Agreement focuses on the members of an LLC, it can include clauses that are similar to those found in an Employment Agreement, particularly regarding roles, responsibilities, and compensation of key employees. Employment Agreements detail the terms of employment, including duties, salary, and confidentiality provisions. Both documents can outline expectations and obligations to ensure clarity and mutual understanding among parties involved in the business.

Dos and Don'ts

When filling out the Connecticut Operating Agreement form, certain practices should be followed to ensure that the document is completed correctly and effectively. This agreement is crucial for defining the operations of a limited liability company (LLC), outlining the rights and responsibilities of the members, and establishing key financial and management decisions. Below are the recommendations on what should and shouldn't be done during the completion process:

Do's:

- Review Connecticut’s specific requirements for Operating Agreements to ensure compliance with state laws.

- Include detailed information about the membership structure, capital contributions, and distribution of profits and losses to avoid any potential disputes among members.

- Consult with an attorney or a legal professional experienced in Connecticut business law to tailor the agreement to your specific needs and confirm legal accuracy.

- Make sure all members review the agreement thoroughly before signing, to ensure understanding and agreement on all terms.

- Update the Operating Agreement as necessary to reflect changes in the company’s management structure, membership, or operations.

- Keep a signed copy of the Operating Agreement in a secure place with other important business documents.

Don'ts:

- Don’t use a generic Operating Agreement template without modifying it to reflect the specific needs and agreements of your LLC members.

- Don’t omit any sections of the form, even if they seem not to apply to your current situation; circumstances can change, and having a comprehensive agreement is prudent.

- Don’t include any provisions that conflict with Connecticut state law or federal law, as these could invalidate parts of the agreement or lead to legal complications.

- Don’t forget to have all members sign the Operating Agreement; an unsigned or partially signed agreement may not be legally enforceable.

- Don’t neglect to review and, if necessary, revise the Operating Agreement regularly to ensure it remains current and relevant.

- Don’t rely solely on verbal agreements or understandings between members; the Operating Agreement should document all important decisions and agreements.

Misconceptions

Many people have misconceptions about the Connecticut Operating Agreement form, especially when forming an LLC (Limited Liability Company). Here's a breakdown of some common misunderstandings:

It's mandatory to file with the state: A significant misconception is that the Operating Agreement needs to be filed with the Connecticut Secretary of State. In reality, while it's critical to have an Operating Agreement for outlining the structure and operating rules of your LLC, this document is internal and does not need to be submitted to the state.

One size fits all: People often think that a standard Operating Agreement will suit all LLCs. However, each company is unique, and the Operating Agreement should reflect the specific arrangements, rules, and procedures that match the needs of the business and its members. Tailoring the document is essential for it to be effective.

Only multi-member LLCs need it: There's a common belief that Operating Agreements are only necessary for LLCs with more than one member. However, even single-member LLCs benefit from having an Operating Agreement. It helps establish the business as a separate entity, provides clarity on its operations, and can offer protection for the owner.

An attorney is required to draft it: While having a lawyer draft your Operating Agreement can ensure completeness and compliance with Connecticut law, it's not a requirement. Many LLC owners create their own agreements using templates or guides. However, for complex arrangements or to ensure the agreement meets all legal requirements and best protects the members' interests, consulting with an attorney could be beneficial.

Once created, it cannot be changed: Another misunderstanding is that once an Operating Agreement is made, it's set in stone. In truth, it's a flexible document that can (and often should) be updated as the business grows or changes. Member agreements are necessary for amendments, so it's important to include a process for updates in the agreement itself.

Key takeaways

An Operating Agreement is a critical document for any LLC operating in Connecticut. It outlines the structure of the organization, member roles, and how the LLC will be run. While the state of Connecticut does not require LLCs to file this document, drafting one is highly recommended for the smooth operation and protection of the business. Here are nine key takeaways to keep in mind when filling out and using the Connecticut Operating Agreement form:

- Customization is Key: The Operating Agreement should be tailored to fit the specific needs and structure of your LLC. There is no one-size-fits-all; each document is unique to the LLC it represents.

- Clarify Member Roles and Responsibilities: Clearly defining the roles, responsibilities, and rights of each member helps in preventing misunderstandings and conflicts within the organization.

- Outline the Financial Structure: Include detailed information on the financial contributions of each member, the distribution of profits and losses, and how financial decisions will be made.

- Define the Management Structure: Decide whether your LLC will be member-managed or manager-managed and outline the corresponding decision-making processes.

- Detailed Records are Essential: The Operating Agreement should include provisions for maintaining accurate and detailed records of the LLC’s operations, financial affairs, and membership changes.

- Process for Adding or Removing Members: Establish clear procedures for how new members can be added to the LLC and under what circumstances a member can be removed.

- Specify Dissolution Procedures: Include instructions for the potential dissolution of the LLC, detailing how assets will be distributed among members if the business is wound down.

- Signatures Matter: Ensure that all members sign the Operating Agreement to make it legally binding. It’s a gesture that demonstrates their acknowledgment and agreement to adhere to its terms.

- Regular Updates: The Operating Agreement is not a static document. It should be reviewed and updated regularly to reflect any changes in the LLC’s operation, membership, or the law.

By taking these key points into consideration, you can ensure that your Connecticut LLC’s Operating Agreement serves as a robust foundation for your business, safeguarding both its operations and its members.

Create Other Operating Agreement Forms for US States

Maryland LLC Agreement - Lends structure to meetings and votes, establishing how, when, and where they occur and what constitutes a quorum.

Oklahoma Operating Agreement - For single-member LLCs, it reinforces the separation between personal and business assets, offering an extra layer of legal protection.