Blank Operating Agreement Form for Florida

When it comes to setting up a limited liability company (LLC) in the Sunshine State, one document plays a pivotal role: the Florida Operating Agreement form. This internal document, not mandated by state law but highly recommended, outlines the operating procedures and financial decisions guiding the LLC's everyday business. It serves as a binding agreement among its members, detailing their rights, responsibilities, and the distribution of profits and losses. Beyond governance, the Operating Agreement helps to ensure that the LLC is seen as a separate entity, providing crucial liability protection for its members. Additionally, it offers flexibility, allowing members to structure their business in a way that best suits their needs, rather than being bound solely by state statutes. This agreement also comes into play when resolving disputes among members, making clear the procedures to follow, and thus, preserving the business's integrity and future. With the importance of this document in mind, understanding its key components, from the allocation of membership interests and management structure to voting rights and dissolution terms, is essential for anyone looking to establish an LLC in Florida.

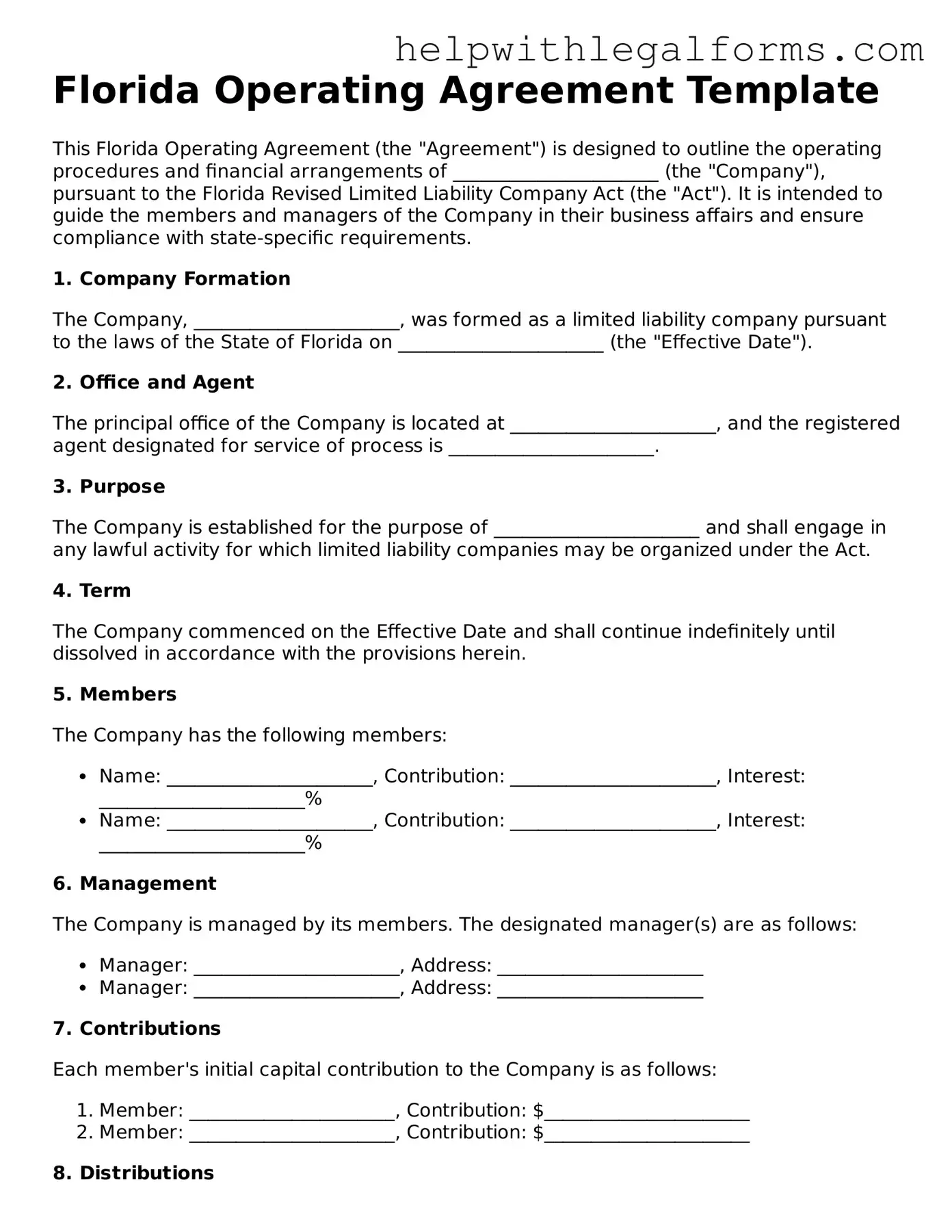

Example - Florida Operating Agreement Form

Florida Operating Agreement Template

This Florida Operating Agreement (the "Agreement") is designed to outline the operating procedures and financial arrangements of ______________________ (the "Company"), pursuant to the Florida Revised Limited Liability Company Act (the "Act"). It is intended to guide the members and managers of the Company in their business affairs and ensure compliance with state-specific requirements.

1. Company Formation

The Company, ______________________, was formed as a limited liability company pursuant to the laws of the State of Florida on ______________________ (the "Effective Date").

2. Office and Agent

The principal office of the Company is located at ______________________, and the registered agent designated for service of process is ______________________.

3. Purpose

The Company is established for the purpose of ______________________ and shall engage in any lawful activity for which limited liability companies may be organized under the Act.

4. Term

The Company commenced on the Effective Date and shall continue indefinitely until dissolved in accordance with the provisions herein.

5. Members

The Company has the following members:

- Name: ______________________, Contribution: ______________________, Interest: ______________________%

- Name: ______________________, Contribution: ______________________, Interest: ______________________%

6. Management

The Company is managed by its members. The designated manager(s) are as follows:

- Manager: ______________________, Address: ______________________

- Manager: ______________________, Address: ______________________

7. Contributions

Each member's initial capital contribution to the Company is as follows:

- Member: ______________________, Contribution: $______________________

- Member: ______________________, Contribution: $______________________

8. Distributions

Distributions shall be made to the members at the discretion of the managers or as otherwise agreed upon by the members, considering the Company's profitability and financial needs.

9. Dissolution

The Company may be dissolved upon the agreement of members holding a majority of the ownership interest or by other means as provided in this Agreement or under the Act.

10. Amendments

This Agreement may be amended only by written consent of members holding at least a majority of the interest in the Company.

IN WITNESS WHEREOF, the undersigned have executed this Florida Operating Agreement as of the latest date written below.

Member Name: ______________________, Signature: ______________________, Date: ______________________

Member Name: ______________________, Signature: ______________________, Date: ______________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a key document used by LLCs in Florida to outline the business' financial and functional decisions including rules, regulations, and provisions. |

| Governing Law | Florida Statutes, Chapter 605, specifically governs the creation and operation of LLC Operating Agreements in Florida. |

| Requirement Status | Although not legally required in Florida, having an Operating Agreement is highly recommended for LLCs. |

| Flexibility | The document is highly customizable to fit the specific needs of the LLC and its members. |

| Protects LLC Status | Helps to reinforce the limited liability status of the company by clearly separating the business from the personal assets of its members. |

| Scope of Content | Can include details on member contributions, allocation of profits/losses, management, voting rights, and procedures for adding or removing members. |

| Dispute Resolution | May contain provisions for dispute resolution among members, which can provide a clear path for resolving internal conflicts. |

Instructions on How to Fill Out Florida Operating Agreement

Once the decision to form a limited liability company in Florida has been made, completing an Operating Agreement is a vital step in the process. This document, while not mandatory to submit to the State, serves as an internal record that outlines the ownership and operating procedures of the LLC. It's crucial for the smooth operation and management of the business. Here are the steps to properly fill out the Florida Operating Agreement to ensure all necessary information is accurately captured and the agreement is comprehensive.

- Gather all required information about the LLC, including the official company name, principal place of business, and member details such as names and addresses.

- Decide on the LLC's management structure. Will it be member-managed or manager-managed? This decision will dictate how decisions are made within the company.

- Outline the initial capital contributions of each member. Detail the amount each member has contributed to the start-up of the LLC.

- Describe how profits and losses will be allocated among members. This is typically done in proportion to each member’s percentage of ownership, but the agreement can specify a different arrangement.

- Set forth the rules for holding meetings and taking votes. The Operating Agreement should detail how often meetings will be held, how members will be notified, and how votes will be counted.

- Include provisions for admitting new members and handling the departure of existing members. This section should outline the process for changes in membership.

- Specify the dissolution procedure. In the event the LLC is to be dissolved, the agreement should include steps for winding up business operations and distributing assets.

- Have all members sign the Operating Agreement. While Florida law does not require the Operating Agreement to be filed, having a signed copy ensures that all members have agreed to its terms.

With these steps completed, the LLC’s Operating Agreement will be fully prepared. This document acts as a foundational piece of the LLC, providing clear guidelines and protocols for its operation. Although it's not required to be filed with the Florida Secretary of State, keeping it in the company records and updating it as necessary is crucial for good business governance. It is recommended that the Operating Agreement be reviewed annually or whenever significant changes to the organization occur.

Crucial Points on This Form

What is an Operating Agreement?

An Operating Agreement is a key document used by Limited Liability Companies (LLCs) that outlines the business' financial and functional decisions including rules, regulations, and provisions. The purpose of this document is to govern the internal operations of the business in a way that suits the specific needs of the business owners. It can cover everything from the allocation of profits and losses to the management structure of the company.

Is an Operating Agreement required for LLCs in Florida?

No, LLCs in Florida are not legally required to have an Operating Agreement. However, it is highly recommended to create one. Even though it's not a legal requirement, having an Operating Agreement can help ensure that all business owners are on the same page regarding the company's operating procedures and expectations, and it can help protect the LLC's limited liability status.

What are the benefits of having an Operating Agreement for a Florida LLC?

Having an Operating Agreement for a Florida LLC provides several benefits, including clarity of financial and management arrangements among members, protection of the LLC's limited liability status, help in avoiding state default rules that may not be suitable for the LLC, and adding credibility to the business. It may also be required by banks when opening a business account, or by investors.

Can I write my own Operating Agreement for my Florida LLC, or do I need a lawyer?

Yes, you can write your own Operating Agreement for your Florida LLC. There are many templates and tools available that can help you draft an Operating Agreement. However, for more complex situations or if you want to ensure that your Operating Agreement fully protects your interests and complies with Florida law, consulting with a lawyer experienced in LLCs is recommended.

What should be included in a Florida LLC Operating Agreement?

An Operating Agreement for a Florida LLC should include details such as the LLC's name and principal place of business, the names of its members, how profits and losses will be allocated, how the LLC will be managed, voting rights and responsibilities of the members, provisions for admitting new members, and procedures for the dissolution of the LLC.

Can an Operating Agreement be modified?

Yes, an Operating Agreement can be modified if the members of the LLC agree to the changes. The process for making amendments should be included in the Operating Agreement itself, typically requiring a certain percentage of votes from the members. It's important to keep the Operating Agreement current to reflect any changes in the business structure or ownership.

What happens if an LLC does not have an Operating Agreement in Florida?

If an LLC does not have an Operating Agreement in Florida, the default LLC rules established by Florida statutes will apply. These default rules may not be conducive to the particular needs or desires of the LLC's members and can affect everything from financial decisions to how the LLC is managed. It's advisable for an LLC to draft an Operating Agreement to avoid any unwanted default provisions.

Common mistakes

When filling out the Florida Operating Agreement form for an LLC (Limited Liability Company), individuals often encounter a few common pitfalls. These mistakes can lead to potential legal issues or complications in the operation of the LLC. Identifying and understanding these errors can help ensure the form is completed accurately and effectively.

Not customizing the agreement to fit the specific needs of the LLC: Many individuals use a generic template without making necessary adjustments to suit their particular business. Each LLC is unique, and the operating agreement should reflect its specific requirements, including member roles, voting rights, and profit distribution.

Skipping important details: Some individuals might overlook or intentionally omit crucial information like how decisions are made, duties of members, or procedures for adding and removing members. This oversight can lead to disputes or confusion among members later on.

Ignoring state-specific requirements: Florida has particular requirements for LLC operating agreements. Missing state-specific clauses or not adhering to Florida law can invalidate parts of the agreement or, worse, the entire document.

Failing to have the agreement reviewed by a legal professional: Although not required, not obtaining legal advice might result in missed opportunities for protection or optimization according to state laws. A legal professional can offer critical insight into the agreement’s structure and content.

Not updating the agreement: As the LLC grows and evolves, so should its operating agreement. Failing to update the document to reflect changes in the business model, membership, or management structures can lead to operational inefficiencies or legal challenges.

Misunderstanding the implications of the agreement: Without a thorough understanding of the operating agreement’s contents, members might not fully grasp their rights, responsibilities, or the procedural steps required for making changes within the LLC. This misunderstanding can lead to unintentional non-compliance or internal disputes.

By avoiding these mistakes, individuals can create a solid foundation for their LLC and help guard against common legal challenges. It's important to approach the creation of an operating agreement with diligence and care, and when possible, seek the guidance of a legal professional.

Documents used along the form

When setting up or managing an LLC in Florida, the need for a comprehensive Operating Agreement is paramount. This foundational document outlines the operational structures and financial agreements of the business. However, it's not the only critical paperwork involved in the process. There are other forms and documents often used in conjunction with the Florida Operating Agreement that are vital for regulatory compliance, legal protection, and operational clarity. Understanding each is essential for a thorough and legally sound business setup.

- Articles of Organization: This is the initial document required to register an LLC with the State of Florida. It includes essential information such as the name of the LLC, its principal address, the names of its members, and the name and address of the registered agent who is authorized to receive legal papers on behalf of the LLC.

- Employer Identification Number (EIN) Application: Though not a form exclusive to Florida, the EIN, or Federal Tax Identification Number, is necessary for any LLC that plans to hire employees or open a bank account. Obtained from the IRS, this number is essentially the social security number for the business.

- Annual Report: Florida requires all LLCs to file an Annual Report with the Florida Division of Corporations. This report updates or confirms the details of the LLC, such as the address, registered agent, and names of managers or members. Failing to file can result in penalties and even dissolution of the LLC.

- Operating Agreement Amendment Form: While the initial Operating Agreement sets the foundation, changes in membership, management, or operations necessitate amendments to this document. The Operating Agreement Amendment Form is used to officially record any modifications to the original agreement, ensuring that it always accurately reflects the current structure and policies of the LLC.

Together, these documents form a legal and operational framework for LLCs operating within the state. They ensure compliance with Florida law while providing a clear roadmap for the internal workings of the company. Each plays a crucial role in the life of an LLC, from inception through ongoing management and compliance. As such, understanding and correctly implementing these forms and documents is crucial for any LLC operating in Florida.

Similar forms

Partnership Agreement: Similar to an Operating Agreement, a Partnership Agreement outlines the dealings between partners in a business venture. It defines the roles, contributions, and profit sharing among the partners, closely mirroring how an Operating Agreement structures the operations, financial arrangements, and member responsibilities within a Limited Liability Company (LLC).

Bylaws: Bylaws serve as the governing document for corporations, akin to how Operating Agreements serve LLCs. They detail the corporate structure, including the duties of executives, the process for handling shares, and the organization of corporate meetings. Both documents provide a framework that dictates how the entity is run, though Bylaws are specific to corporations whereas Operating Agreements are for LLCs.

Shareholder Agreement: This document is often used in corporations to outline the rights and obligations of shareholders, including how shares can be transferred and how important decisions are made. Although Operating Agreements cover LLC members, the essence of defining roles, rights, and obligations within a business entity is shared between these documents.

Employment Agreement: While an Employment Agreement outlines the terms of employment between an employer and an employee, including duties, compensation, and confidentiality clauses, Operating Agreements can contain similar provisions related to the roles and duties of members or managers within an LLC. Both documents serve to clarify expectations and safeguard the interests of the parties involved.

Founders’ Agreement: Founders’ Agreements are used in startups by the founding team to establish roles, ownership percentages, and how decisions will be made. Operating Agreements offer a similar foundation for LLCs by detailing member management, financial contributions, and how decisions are reached, thereby ensuring a common understanding among members.

Joint Venture Agreement: This type of agreement outlines the terms and goals of a joint venture between two or more parties. Its structure and purpose are quite similar to that of an Operating Agreement when an LLC is formed for a specific project or partnership. Both documents delineate roles, contributions, and profit-sharing strategies among the parties involved.

Non-Disclosure Agreement (NDA): An NDA is primarily concerned with the confidentiality of information. While an Operating Agreement covers a broad range of operational and management aspects of an LLC, it can also include clauses related to confidentiality, similar to an NDA. These clauses help protect the company’s sensitive information, mirroring the primary goal of an NDA within a broader operational context.

Dos and Don'ts

Filling out the Florida Operating Agreement form is a pivotal step for your LLC, setting the foundation for its operations and management structure. Here are nine crucial dos and don'ts to guide you through the process effectively and ensure your agreement aligns with both your business needs and Florida law.

- Do customize the agreement to fit the specific needs of your LLC. While templates can be a helpful starting point, tailoring the document to reflect your business structure and operations is essential.

- Do clearly outline the ownership percentages of each member, ensuring that there's no ambiguity about financial distributions or responsibilities.

- Do specify the process for admitting new members, including any necessary qualifications and the method by which current members will approve new ones.

- Do include detailed descriptions of each member's roles, responsibilities, and voting rights, to prevent misunderstandings and conflicts in the future.

- Do review Florida's specific requirements for Operating Agreements to ensure compliance. While the state provides flexibility, certain provisions may be mandatory.

- Don't leave any sections of the agreement blank. If a section does not apply, indicate this clearly to avoid the impression of an oversight or error.

- Don't use overly complex language or legal jargon unnecessarily. While the document should be comprehensive, it must also be understandable to all members.

- Don't forget to have every member review and sign the agreement. This not only ensures that everyone is on the same page but also that the document is legally binding.

- Don't overlook the need for periodic reviews and updates to the agreement. As your LLC grows and evolves, adjustments may be necessary to reflect changes in operations, membership, or the law.

Misconceptions

When forming an LLC in Florida, many entrepreneurs encounter the Operating Agreement, a crucial document for defining the structure and operating procedures of their business. However, misconceptions about this document can lead to confusion. Here are ten common misconceptions about the Florida Operating Agreement form:

All LLCs are legally required to have an Operating Agreement in Florida: While highly recommended, not all LLCs in Florida are legally required to have an Operating Agreement. Despite this, having one in place is beneficial for clarifying operational procedures and protecting the interests of all members.

The Operating Agreement needs to be filed with the state: In Florida, an Operating Agreement is an internal document and does not need to be filed with the state. Instead, it should be kept with the business records of the LLC.

There's one standard form for all LLCs: A common misconception is that there is a "one size fits all" Operating Agreement template. In reality, Operating Agreements should be tailored to meet the specific needs and structure of each LLC.

Operating Agreements are only necessary for multi-member LLCs: Single-member LLCs also benefit from having an Operating Agreement. It provides clarity on the operation of the business and adds a layer of protection to the owner's personal assets.

It’s okay to copy someone else’s Operating Agreement: While it might be tempting to use someone else’s Operating Agreement as your own, it’s crucial that your agreement is specifically designed to fit your LLC's operations and legal requirements.

You can't change an Operating Agreement once it's made: It's possible and sometimes necessary to amend the Operating Agreement as the business grows and changes. These amendments should be made in accordance with the procedures set out in the original agreement.

Operating Agreements are not necessary if you trust your business partners: Regardless of trust levels, having an Operating Agreement is critical. It ensures that there are clear rules in place for handling any possible disputes and sets out how decisions will be made.

The same Operating Agreement can be used in different states: Each state has its own set of laws governing LLCs. It's important that your Operating Agreement complies with Florida law specifically, as using a generic agreement might leave your LLC unprotected.

An attorney is not needed to draft an Operating Agreement: While it's possible to create an Operating Agreement without legal help, consulting with an attorney can ensure that the agreement fully protects your interests and complies with Florida law.

Operating Agreements only matter if there's a legal dispute: While Operating Agreements are indeed vital in resolving disputes, they also guide the day-to-day operations and decision-making processes within an LLC, contributing to the overall harmony and direction of the business.

Understanding these misconceptions and obtaining the correct information can significantly impact the success and legal compliance of your LLC in Florida. An Operating Agreement, tailored to your business's specific needs and legal requirements, is a cornerstone of your LLC's foundation.

Key takeaways

An Operating Agreement is crucial for any Florida based Limited Liability Company (LLC). It outlines the business's financial and functional decisions including rules, regulations, and provisions. The purpose is to govern the internal operations of the business in a way that suits the specific needs of the business owners. Here are six key takeaways to consider when filling out and using the Florida Operating Agreement form:

- Personal Asset Protection: The Operating Agreement helps to ensure that the members' personal assets are protected from the company's debts and obligations. This separation is vital for maintaining personal financial security.

- Clarification of Verbal Agreements: Although verbal agreements can be binding, it's important to have all agreements in writing to avoid misunderstandings. A well-drafted Operating Agreement will outline all the terms agreed upon by the members, reducing the risk of future conflicts.

- Flexibility: The Operating Agreement allows members to structure their financial and working relationships in the most advantageous way. This flexibility is not afforded by default state laws, which is what would govern the arrangements in the absence of an Operating Agreement.

- Validity in Other States: If your LLC operates in more than one state, having an Operating Agreement can help to prove that your LLC is a legitimate business. This is especially important if you’re doing business outside of Florida.

- Financial and Management Understandings: The Operating Agreement specifies how profits and losses are distributed among the members. It also delineates the management structure of the LLC, which can be member-managed or manager-managed.

- Prevents State Default Rules from Applying: Without an Operating Agreement, your LLC would be governed by the default rules of Florida. These default rules might not be suitable for your business model. Having an Operating Agreement ensures that the rules that govern your business are the ones that you’ve agreed upon.

It’s important to note that while Florida does not legally require an LLC to have an Operating Agreement, it’s highly advisable to create one. Doing so can safeguard your business, provide clear rules for operation, and prevent potential disputes among members. Consult with a legal professional to ensure that your Operating Agreement meets all necessary requirements and fully protects your interests.

Create Other Operating Agreement Forms for US States

Maryland LLC Agreement - Vital for setting out the allocation of profits and losses, directly affecting members' financial interests.

Operating Agreement for Llc Colorado - The Operating Agreement may dictate the schedule and protocol for regular member meetings.

How to Create an Operating Agreement for an Llc - This form helps to establish a clear financial structure, crucial for business planning.

Oklahoma Operating Agreement - Without an Operating Agreement, your LLC is subject to generic state rules that may not suit your business’s unique needs.