Blank Operating Agreement Form for Georgia

In the realm of business, particularly when it involves the intricate workings of Limited Liability Companies (LLCs) within the vibrant economic landscape of Georgia, the Operating Agreement form stands as a cornerstone document. Tailored to guide the structural, managerial, and operational protocols of an LLC, this comprehensive document serves not only as a legal testament to the agreed-upon processes and policies among its members but also as a shield protecting those members' personal liability against business debts and decisions. From delineating the percentages of ownership and distribution of profits and losses to specifying the procedural norms for including new members and resolving internal disputes, the Georgia Operating Agreement is meticulously crafted to ensure clarity and security for all parties involved. Moreover, while not mandatory according to Georgia state law, the foresight in drafting and ratifying such an agreement exhibits a level of professionalism and dedication to transparency that significantly boosts the integrity and credibility of the LLC. Consequently, the absence of this agreement not only diminishes the structural robustness of the company but also potentially complicates legal and financial disputes. It is, therefore, a document of paramount importance, embodying the principles and aspirations upon which the LLC intends to build its future.

Example - Georgia Operating Agreement Form

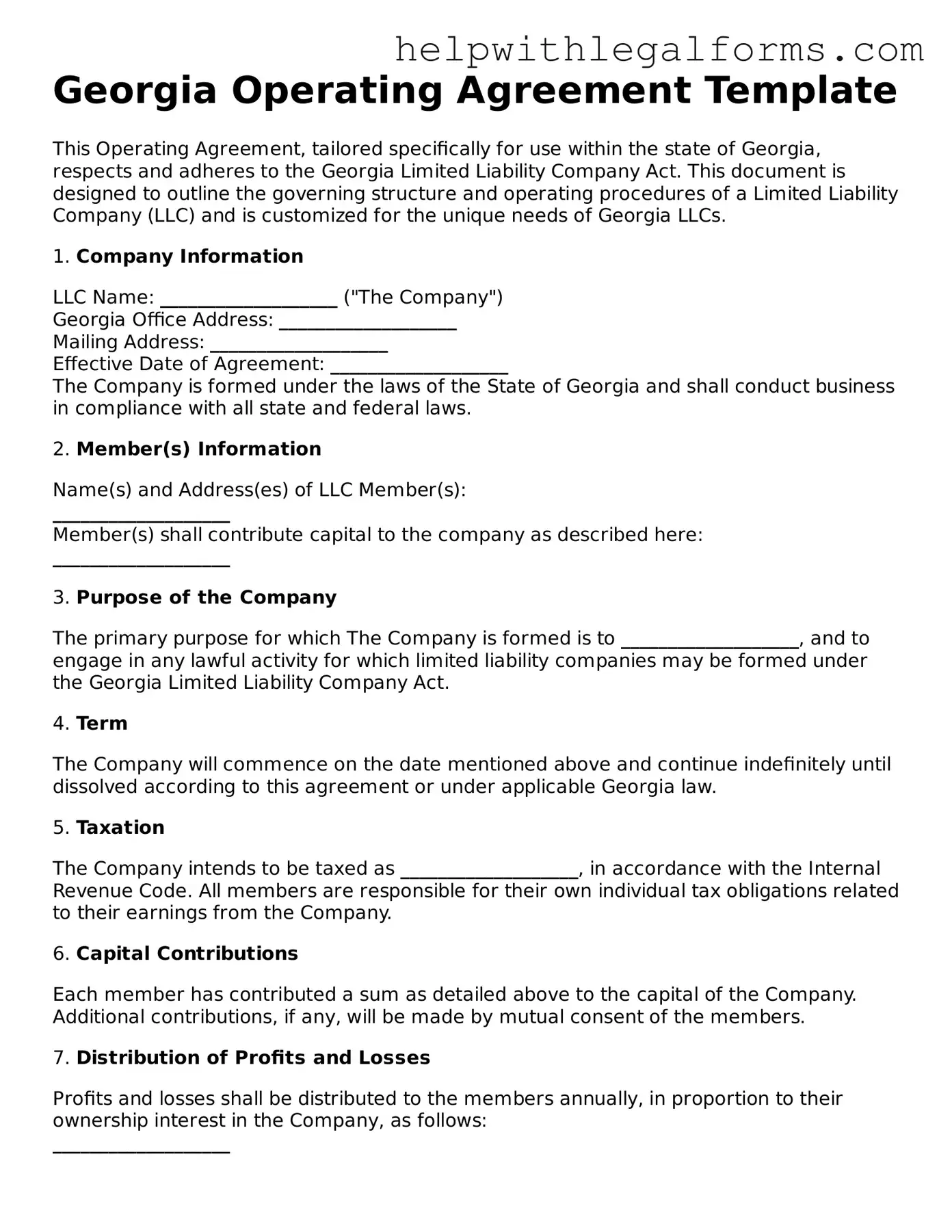

Georgia Operating Agreement Template

This Operating Agreement, tailored specifically for use within the state of Georgia, respects and adheres to the Georgia Limited Liability Company Act. This document is designed to outline the governing structure and operating procedures of a Limited Liability Company (LLC) and is customized for the unique needs of Georgia LLCs.

1. Company Information

LLC Name: ___________________ ("The Company")

Georgia Office Address: ___________________

Mailing Address: ___________________

Effective Date of Agreement: ___________________

The Company is formed under the laws of the State of Georgia and shall conduct business in compliance with all state and federal laws.

2. Member(s) Information

Name(s) and Address(es) of LLC Member(s):

___________________

Member(s) shall contribute capital to the company as described here:

___________________

3. Purpose of the Company

The primary purpose for which The Company is formed is to ___________________, and to engage in any lawful activity for which limited liability companies may be formed under the Georgia Limited Liability Company Act.

4. Term

The Company will commence on the date mentioned above and continue indefinitely until dissolved according to this agreement or under applicable Georgia law.

5. Taxation

The Company intends to be taxed as ___________________, in accordance with the Internal Revenue Code. All members are responsible for their own individual tax obligations related to their earnings from the Company.

6. Capital Contributions

Each member has contributed a sum as detailed above to the capital of the Company. Additional contributions, if any, will be made by mutual consent of the members.

7. Distribution of Profits and Losses

Profits and losses shall be distributed to the members annually, in proportion to their ownership interest in the Company, as follows:

___________________

8. Management

The Company will be managed by: __________ (Member-Managed / Manager-Managed).

For a Member-Managed company, all members shall participate in the management and decision-making processes of the Company. For a Manager-Managed company, the designated Manager(s) will have authority to carry out the operations of the Company, subject to any limitations set forth in this Agreement or under applicable law.

Manager(s) Name and Address (if applicable): ___________________

9. Meetings

Meetings of the members shall be held at least annually at a time and place agreed upon by the members. Special meetings may be called as needed.

10. Dissolution

The Company may be dissolved by the consent of members owning a majority of the Company's interest or as required by Georgia law. Upon dissolution, the Company's assets will be liquidated, and any proceeds will be distributed to the members in proportion to their ownership shares, after settling all debts and obligations.

11. Amendments

This Operating Agreement can only be amended in writing with the consent of members owning a majority of the Company's interest.

In creating this Operating Agreement, the members affirm their commitment to abide by the terms laid out herein and conduct their business in accordance with the laws of the State of Georgia.

Date: ___________________

Member Signature(s): ___________________

PDF Form Attributes

| Fact | Description |

|---|---|

| Purpose | Defines the LLC's operating, financial, and managerial structure. |

| Governing Law | Subject to Georgia state laws. |

| Flexibility | Allows members to establish their own rules regarding the internal affairs of the LLC. |

| Not Mandatory | Not legally required in Georgia, but highly recommended. |

| Modification | Can be amended with the agreement of the LLC members. |

Instructions on How to Fill Out Georgia Operating Agreement

Getting your business off the ground in Georgia is an exciting time. Among the documents you'll need is the Operating Agreement for your LLC. This crucial form outlines the ownership structure, operational details, and guidelines for financial decisions within your company. Filling out this form accurately is essential for establishing clear rules among members and for legal protection. The steps to complete this form are straightforward, ensuring you can focus on the more thrilling aspects of running your business.

- Start by gathering all necessary information, including the full legal names of all members, the official name of your LLC, and the primary location of your business operations.

- Enter the date the agreement is being made.

- Specify the duration of your LLC's existence. If it's intended to be perpetual, note that explicitly.

- List the names and addresses of the LLC members. Add their contribution details: how much each member has invested into the LLC.

- Outline the management structure. Indicate whether your LLC will be member-managed or manager-managed, and identify the members or managers who will have authority to make decisions.

- Describe the allocation of profits and losses among members. This often corresponds to the percentage of ownership but can vary based on the agreement.

- Detail the process for adding or removing members, as well as any conditions or limitations related to membership changes.

- Include provisions for the dissolution of the LLC, specifying the conditions under which it may be dissolved and the method for distributing assets.

- Clarify the rules for meetings, including how often they will occur, how members will be notified, and the quorum required for decisions to be made.

- Add any additional clauses or rules relevant to your LLC's operations that haven't been covered in the previous steps.

- Ensure all members review the Operating Agreement thoroughly. Discuss and resolve any concerns.

- Have each member sign and date the agreement. It's recommended to have the signatures notarized to authenticate them further.

After completing the Georgia Operating Agreement form, keep it in a safe place where all members can access it if needed. Although it's not required to be filed with the state, having it on file is crucial for resolving any disputes and guiding the operation of your LLC. With this task out of the way, you can proceed with confidence, knowing the foundation of your business structure is solidly laid out.

Crucial Points on This Form

What is a Georgia Operating Agreement?

An Operating Agreement is a legal document that outlines the ownership and member duties of a Limited Liability Company (LLC) in Georgia. It is a critical document that governs the internal operations of the LLC in a way that suits the specific needs of its members. While the state of Georgia does not require LLCs to have an Operating Agreement, it's highly recommended to have one.

Why is an Operating Agreement important for an LLC in Georgia?

Having an Operating Agreement is important for several reasons: it ensures that the business operates according to the members' wishes rather than default state laws, minimizes disputes between members by clearly defining roles and responsibilities, enhances the LLC's liability protection by reinforcing its separate legal status, and may be required by banks when opening business accounts or securing financing.

What should be included in a Georgia Operating Agreement?

A comprehensive Georgia Operating Agreement should include details on the LLC's management structure, distribution of profits and losses, member contributions, voting rights and procedures, rules for adding or removing members, and procedures for dissolving the business, among others. Tailoring the agreement to fit the LLC's specific needs is critical.

Can I write my own Operating Agreement for my Georgia LLC?

Yes, members of an LLC can write their own Operating Agreement. While legal assistance can help ensure that the agreement meets all legal requirements and adequately protects the interests of all members, it's not mandatory. Various resources and templates can guide members in drafting an agreement that suits their business.

Do I need to file the Operating Agreement with the state of Georgia?

No, you do not need to file your Operating Agreement with the state of Georgia. The agreement is an internal document that you should keep with your business records. However, having it on hand is important for legal disputes, financial transactions, or when dealing with government agencies.

How can I change my Georgia Operating Agreement?

Changes to the Operating Agreement typically require the approval of the LLC's members according to the provisions set out in the agreement itself. Most agreements outline specific procedures for making amendments, such as a minimum vote requirement. It's important to document any changes and ensure all members have access to the updated agreement.

What happens if an LLC in Georgia does not have an Operating Agreement?

If an LLC in Georgia does not have an Operating Agreement, the state's default LLC rules and statutes will govern its operations. This may not always align with the owners' wishes and can lead to conflicts or inefficiencies. Additionally, not having an agreement can undermine the LLC's liability protection by blurring the lines between the business and its members' personal affairs.

Common mistakes

When filling out the Georgia Operating Agreement form, individuals often encounter common pitfalls that can lead to misunderstandings or legal complications. An Operating Agreement is crucial for defining the structure of a Limited Liability Company (LLC) in Georgia, outlining the rights and responsibilities of its members, and setting the procedures for business operations. To assist in avoiding common errors, here is an expanded list:

Not customizing the agreement to fit the specific needs of the business. Using a generic template without adjustments reflects a lack of understanding of the unique aspects of the business.

Failing to include all the members and their correct percentages of ownership. This oversight can lead to disputes and confusion regarding profits, losses, and voting rights.

Omitting details on how profits and losses are distributed. Without clear instructions, interpreting the financial arrangements can become problematic.

Ignoring the procedures for adding or removing members. This can create legal hurdles if the need arises to change the membership structure.

Overlooking the need for a detailed description of members' roles and responsibilities. This lack of clarity can result in operational inefficiencies and conflicts among members.

Not specifying the process for meetings and voting. This can lead to governance issues and hinder the decision-making process.

Skipping the inclusion of a dissolution procedure. Without it, terminating the LLC can become complex and contentious.

Forgetting to outline the process for amending the Operating Agreement. As businesses evolve, this oversight can make necessary changes difficult to implement.

Failure to have all members sign the agreement. An unsigned agreement can undermine its enforceability and the legitimacy of the business structure.

Not consulting with a legal professional. This can result in an incomplete or incorrect understanding of Georgia's legal requirements, putting the LLC at risk.

To avoid these mistakes, it's imperative for members of an LLC to approach the Operating Agreement with diligence and attention to detail. Considering the operation's specific requirements and seeking professional advice can ensure the formation of a robust and effective agreement that serves the business well over time.

Documents used along the form

When forming a business entity such as a Limited Liability Company (LLC) in Georgia, the Operating Agreement is often at the center of necessary documentation, serving as a critical contract that outlines the operational and financial decisions of the business. However, this form is just one part of a comprehensive documentation suite that may be required for complete legal and operational compliance. Other forms and documents frequently accompany the Operating Agreement to ensure the LLC is properly established, compliant with state laws, and prepared for future business activities. The following list elaborates on some of these essential documents.

- Articles of Organization: This is the foundational document required to officially form an LLC in the state of Georgia. It contains vital information including the LLC's name, address, and the names of its members. It must be filed with the Georgia Secretary of State.

- EIN Confirmation Letter (IRS Form SS-4): After applying for an Employer Identification Number (EIN) from the IRS, businesses receive this confirmation letter. An EIN is necessary for tax purposes and to open a business bank account.

- Georgia State Tax Identification Number Application: Similar to an EIN, but for state tax purposes. This document registers the LLC with the Georgia Department of Revenue to handle state taxes.

- Operating Agreement Amendment(s): Any changes made to the Operating Agreement after its initial adoption must be documented through formal amendments. These documents are essential for maintaining up-to-date records of the LLC's operational and financial arrangements.

- Annual Registration Form: Georgia requires LLCs to file an annual registration with the Secretary of State, which includes current contact information and details about the business's management structure.

- Business License Application: Depending on the nature of the LLC’s activities and its location, it may need to obtain one or more business licenses or permits from local, state, or federal authorities.

- Operating Permit(s): If the LLC's business involves regulated activities, specific operating permits may be required from state or local agencies to legally conduct business.

- Membership Certificates: Although not legally required, these certificates can serve as official records of ownership interest in the LLC, resembling stock certificates in a corporation.

- Bank Resolution: This document authorizes specific members or employees of the LLC to open and manage accounts in the name of the LLC. It is typically required by banks when opening a business bank account.

Each of these documents plays a vital role in the formation, operation, and compliance of an LLC. Together with the Operating Agreement, they form a complete legal framework that supports the business’s structure, clarifies member roles and responsibilities, ensures state and federal compliance, and prepares the entity for future growth. It’s important for LLC members to understand these documents thoroughly and to keep them updated as their business evolves.

Similar forms

Bylaws: Bylaws serve as the foundation for how a corporation is run, similar to how an Operating Agreement structures the operations of a limited liability company (LLC). Both documents outline the organization's rules, roles, and responsibilities of its members or directors, albeit for different types of entities.

Partnership Agreement: This document outlines the agreement between partners in a business, similar to an Operating Agreement that sets the terms among members of an LLC. Both agreements cover profit sharing, management duties, and what happens in case of a dissolution.

Shareholder Agreement: Often used within corporations, a Shareholder Agreement specifies the rights and obligations of the shareholders, akin to how an Operating Agreement specifies those for LLC members. Both aim to manage expectations and responsibilities to smooth the business's operation.

Employment Contract: Like an Operating Agreement, an Employment Contract outlines the duties and expectations between parties. Where the Operating Agreement outlines members' roles within the company, an Employment Contract specifies the terms of employment for workers, including their responsibilities, benefits, and the conditions for termination.

Non-Disclosure Agreement (NDA): An NDA protects confidential information from being disclosed. Similarly, Operating Agreements often contain confidentiality clauses to safeguard the business's proprietary information and trade secrets.

Indemnity Agreement: This agreement protects individuals or businesses from liability for damages. Operating Agreements may include indemnification provisions to protect members against debts or obligations incurred by the LLC, highlighting a focus on limiting individual liability.

Commercial Lease Agreement: Used for renting business properties, these agreements outline terms similar to how an Operating Agreement might define the use of property or assets owned by the LLC. Both establish usage rights, maintenance responsibilities, and duration terms.

Loan Agreement: Loan Agreements detail the terms under which financing will be provided, similar to sections of an Operating Agreement that may detail capital contributions from members and terms for future financial infusions or distributions.

Buy-Sell Agreement: This document outlines how a person’s share of a business may be reallocated if they die or choose to leave. Operating Agreements often cover similar ground by detailing what happens when a member wants out, dies, or if new members are admitted.

Dos and Don'ts

When filling out the Georgia Operating Agreement form, it is crucial to ensure accuracy and completeness to define the operational structure and financial decisions for the LLC. Below are essential dos and don'ts to consider:

- Do review the entire form before you start filling it out to ensure you understand the required information.

- Do use the exact legal name of your LLC, matching it to the name registered with the Georgia Secretary of State.

- Do specify each member's contribution, roles, and responsibilities clearly to avoid future disputes.

- Do discuss and agree upon how profits and losses will be distributed among the members before filling out the relevant section.

- Do consider consulting with a legal professional to ensure the agreement is comprehensive and adheres to Georgia state laws.

- Don't rush through the process; take your time to ensure all information is accurate and complete.

- Don't omit any sections or leave blanks; if a section does not apply, mark it as "N/A" to indicate it was intentionally left blank.

- Don't use informal language or nicknames; ensure all communication is professional and uses legal names and terminology.

- Don't forget to have all members review the final document before signing, to ensure everyone agrees to the terms laid out in the agreement.

Misconceptions

When it comes to forming a Limited Liability Company (LLC) in Georgia, the Operating Agreement plays a crucial role. However, there are several misconceptions surrounding this document that need clarification. Here is a list of common misunderstandings:

- It’s mandatory by law to have one. While highly recommended, Georgia does not legally require LLCs to have an Operating Agreement. Nevertheless, having one can provide clarity and protection for the business operations.

- Any template will do. Not all templates are created equal. A generic template may not cover specific needs or meet the particular requirements of your business. Tailoring the agreement to fit the LLC's operations is key.

- Only multi-member LLCs need one. Even if you're a single-member LLC, an Operating Agreement is beneficial. It can help establish your business as a separate entity, adding an extra layer of protection.

- It's only about the financial and operational processes. While those are important aspects, the Operating Agreement also covers topics like succession planning, dispute resolution mechanisms, and the roles and responsibilities of members and managers.

- You can’t change it once it’s written. The Operating Agreement is a dynamic document. It can and should be updated as the business grows and changes. Members can make amendments following the process outlined in the agreement itself.

- It doesn’t matter if it’s not in writing. A verbal agreement can lead to misunderstandings and disputes down the road. A written Operating Agreement helps ensure all members are on the same page and is enforceable in court if necessary.

- It's too complicated and expensive to create. While drafting an Operating Agreement requires careful consideration, it doesn’t have to be an overwhelming process. Resources and professionals can help streamline the process, and the investment is often worth the clarity and protection it provides.

- The state will intervene if there’s no Operating Agreement. The state does not typically interfere in the operations of an LLC unless there's a dispute or legal action. Without an Operating Agreement, state default rules will apply, which might not be in the best interest of the members.

- Having an Operating Agreement will automatically protect you from legal liability. While it’s an essential tool for liability protection, simply having an Operating Agreement is not a bulletproof shield against legal liability. Members must adhere to the agreement and operate the LLC properly to maintain this protection.

Understanding these misconceptions can help you navigate the process of creating and maintaining your Georgia LLC's Operating Agreement more effectively. Remember, this document is the backbone of your LLC, providing a clear framework for your business operations and relations among members.

Key takeaways

Understanding the essentials of filling out and using the Georgia Operating Agreement form is crucial for anyone starting or running a Limited Liability Company (LLC) in Georgia. This document, although not legally required by the state, plays a significant role in establishing clear operational guidelines and structures for businesses. Here are key takeaways to bear in mind:

- Customization Is Key: Each LLC's business operations and ownership structures are unique. The Operating Agreement should be customized to reflect your LLC's specific needs and operations. Tailoring this document helps ensure that all members are on the same page and reduces potential conflicts.

- It's Not Required, But Highly Recommended: While the state of Georgia does not mandate the filing of an Operating Agreement with any state agency, having one in place is highly advisable. This agreement offers a clear framework for the business’s financial and functional decisions, guiding the LLC's operations and providing a level of protection for all members involved.

- Legal Protection: An Operating Agreement can add an extra layer of protection to the LLC members' personal assets. It helps reinforce your LLC’s status as a separate entity, which is essential in situations of legal disputes or business debts.

- All Members Should Have a Copy: After finalizing the Operating Agreement, ensure that all members receive a copy. This practice guarantees every member knows their rights, responsibilities, and the operational framework of the LLC, fostering transparency and accountability within the business.

Create Other Operating Agreement Forms for US States

Llc Filing Fee - Operating Agreements may include clauses on membership changes, such as the addition, resignation, or expulsion of members.

Oklahoma Operating Agreement - Preparation of this agreement requires thoughtful consideration, making it a foundational tool for strategic business planning.

Operating Agreement for Llc Colorado - An Operating Agreement can streamline the process for making major business decisions, such as loans or investments.