Blank Operating Agreement Form for Maryland

When starting a business in Maryland, particularly a Limited Liability Company (LLC), one critical step in ensuring the smooth operation and legal compliance of the entity is the creation of an Operating Agreement. While the state of Maryland does not legally require LLCs to have an Operating Agreement, having one is highly advisable. This document serves as a foundational charter that outlines the management structure, operating procedures, and financial arrangements among members. It plays a crucial role in preempting potential disputes by clearly defining member roles, contributions, profit distributions, and the procedures for handling the departure or addition of members. Furthermore, an Operating Agreement enhances the credibility of the business, providing a formal document that can be beneficial in lending situations and when dealing with other business entities. Drafting a comprehensive Operating Agreement tailored to the specifics of your business can safeguard its future, streamline its operations, and provide peace of mind to all members involved.

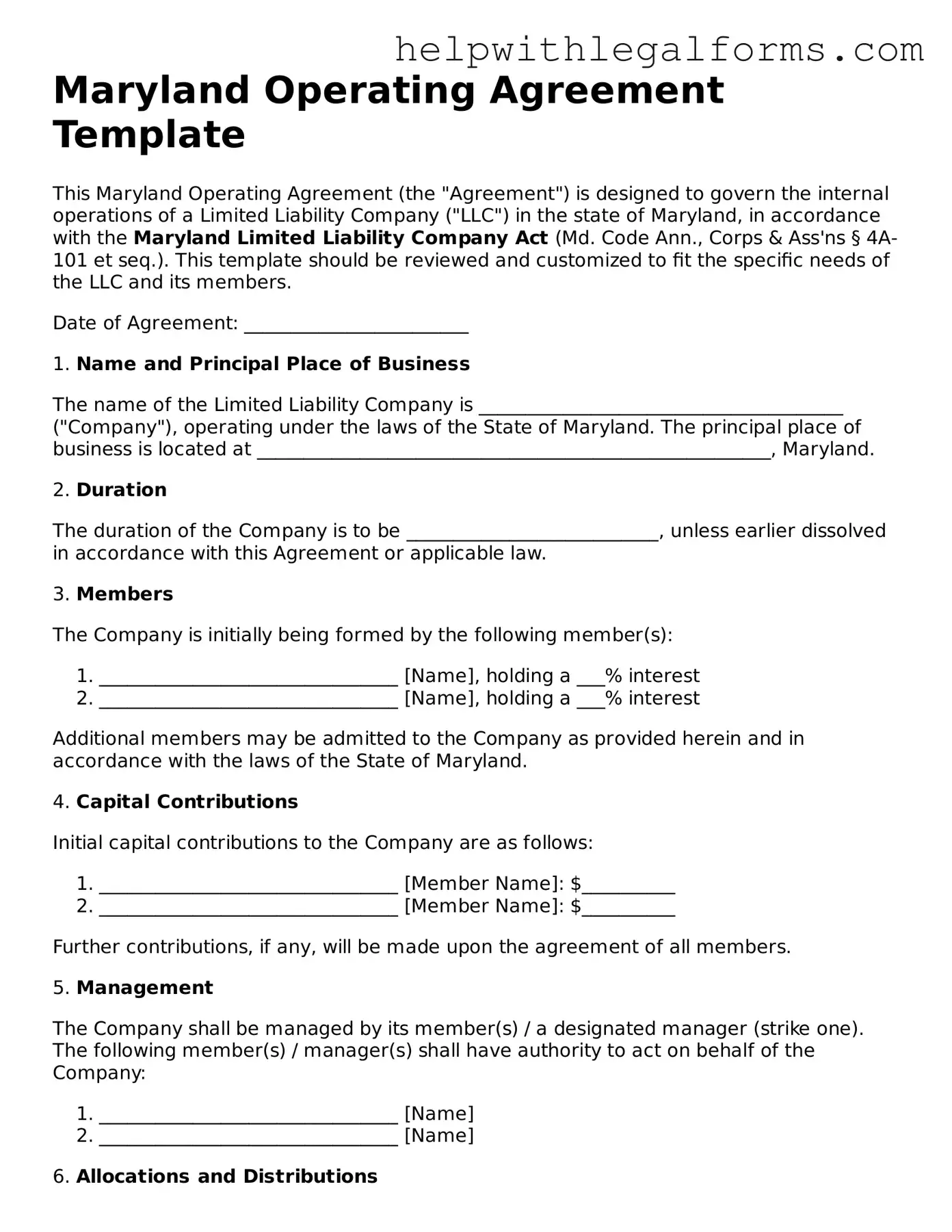

Example - Maryland Operating Agreement Form

Maryland Operating Agreement Template

This Maryland Operating Agreement (the "Agreement") is designed to govern the internal operations of a Limited Liability Company ("LLC") in the state of Maryland, in accordance with the Maryland Limited Liability Company Act (Md. Code Ann., Corps & Ass'ns § 4A-101 et seq.). This template should be reviewed and customized to fit the specific needs of the LLC and its members.

Date of Agreement: ________________________

1. Name and Principal Place of Business

The name of the Limited Liability Company is _______________________________________ ("Company"), operating under the laws of the State of Maryland. The principal place of business is located at _______________________________________________________, Maryland.

2. Duration

The duration of the Company is to be ___________________________, unless earlier dissolved in accordance with this Agreement or applicable law.

3. Members

The Company is initially being formed by the following member(s):

- ________________________________ [Name], holding a ___% interest

- ________________________________ [Name], holding a ___% interest

Additional members may be admitted to the Company as provided herein and in accordance with the laws of the State of Maryland.

4. Capital Contributions

Initial capital contributions to the Company are as follows:

- ________________________________ [Member Name]: $__________

- ________________________________ [Member Name]: $__________

Further contributions, if any, will be made upon the agreement of all members.

5. Management

The Company shall be managed by its member(s) / a designated manager (strike one). The following member(s) / manager(s) shall have authority to act on behalf of the Company:

- ________________________________ [Name]

- ________________________________ [Name]

6. Allocations and Distributions

Profits and losses shall be allocated, and distributions made to the Company’s members in proportion to their ownership interests, or as otherwise agreed in writing by all members.

7. Member Meetings

Meetings of members shall be held annually at a time and place fixed by the members or as otherwise specified in this Agreement. Special meetings may be called by any member holding more than 20% interest in the Company or as mutually agreed upon by the members.

8. Transfer of Membership Interest

A member may not transfer their interest in the Company without the prior written consent of a majority of the other members, except as otherwise provided in this Agreement or required by law.

9. Dissolution

The Company shall be dissolved upon the occurrence of any event specified in this Agreement or as required by the Maryland Limited Liability Company Act.

10. Amendments

This Agreement may only be amended or modified by a written document signed by all members of the Company.

IN WITNESS WHEREOF, the undersigned have executed this Maryland Operating Agreement as of the date first above written.

___________________________ _________________________

Member Name Date

___________________________ _________________________

Member Name Date

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Maryland Operating Agreement is used by LLCs to outline the company's financial and functional decisions, including rules, regulations, and provisions. The purpose is to govern the internal operations of the business in a way that suits the specific needs of the business owners. |

| Legal Requirement | While not legally required in Maryland, it is highly recommended that LLCs create an Operating Agreement to establish clear operating procedures and protect the business owners' interests. |

| Governing Law | The Maryland Operating Agreement is governed by the Maryland Code, specifically under the Maryland Limited Liability Company Act. |

| Flexibility | The agreement allows LLCs the flexibility to structure their financial and working relationships in a way that is most beneficial to the business owners. This can include provisions for the allocation of profits and losses, ownership percentages, and responsibilities of the members. |

| Dispute Resolution | Many Operating Agreements include terms for dispute resolution among members, which can help avoid litigation and ensure that any disagreements among members can be resolved internally. |

| Customization | The form can be highly customized to meet the specific needs of the LLC. This means that any terms that are not prohibited by law or the Maryland Limited Liability Company Act can be included in the Operating Agreement. |

Instructions on How to Fill Out Maryland Operating Agreement

Once you've decided to form an LLC in Maryland, completing an Operating Agreement is a vital next step—even though it's not a state requirement. This document sets the groundwork for your business's operations and outlines the ownership and member duties, helping to prevent misunderstandings down the line. Let's walk through the steps to fill out your Maryland Operating Agreement effectively, ensuring your LLC is poised for success.

- Gather all necessary information about your LLC, including the business name, principal place of business, and the names and addresses of all members.

- Decide on the LLC's management structure. Will it be member-managed or manager-managed? This decision will influence the rest of your agreement.

- Outline the allocation of profits and losses among members. This should be done in proportion to each member's investment or an agreed-upon arrangement.

- Describe the process for admitting new members to the LLC. This should include any financial contributions required and how these contributions affect existing allocations of profit and loss.

- Set forth the procedures for meetings and voting. This includes how often meetings will be held, how members will be notified, and the voting rights of each member.

- Detail the transferability of membership interests. Specify the conditions under which a member can transfer their interest in the LLC and any rights the other members have to purchase this interest before it is sold to a third party.

- Include dissolution procedures. Clearly articulate the circumstances under which the LLC may be dissolved and the steps for winding up its affairs.

- Specify any restrictions on members' ability to compete with the LLC during or after their membership.

- Have all members review the Operating Agreement to ensure it accurately reflects their understanding and intentions. Resolve any discrepancies before moving forward.

- Once all members agree to the terms of the Operating Agreement, have each member sign and date the document. Keep this document on file with your other important business records.

Completing your Maryland LLC Operating Agreement marks a significant step in formalizing the structure and operation of your business. This strategically important document will serve as a guide for decision-making and conflict resolution as your business grows and evolves. Remember, while Maryland does not require you to file this document, it should be treated with the same importance as any other foundational business document.

Crucial Points on This Form

What is a Maryland Operating Agreement?

A Maryland Operating Agreement is a legal document that outlines the ownership structure, management policies, and operational procedures of a Limited Liability Company (LLC) established in Maryland. It serves as a guide for decision-making and helps to ensure that all members are on the same page regarding the business's operations.

Do I need an Operating Agreement for my Maryland LLC?

While Maryland state law does not require LLCs to have an Operating Agreement, it is highly recommended. An Operating Agreement can provide legal protection, help to define financial and management arrangements among members, and prevent misunderstandings that might arise out of verbal agreements. It becomes even more critical if your LLC has more than one member.

What should be included in a Maryland Operating Agreement?

An effective Maryland Operating Agreement includes details on the LLC's ownership structure, member roles and responsibilities, profit sharing, rules for meetings and voting, processes for adding or removing members, and procedures for dissolving the business, among other terms. It's also wise to include any other agreements pertinent to your business operations.

Can I write my own Maryland Operating Agreement?

Yes, you can write your own Maryland Operating Agreement. However, it's essential to ensure that it complies with state laws and includes all necessary information to avoid future disputes. Many opt to consult with an attorney or use an attorney-reviewed template to make sure their agreement is comprehensive and legally sound.

How does an Operating Agreement protect my Maryland LLC?

An Operating Agreement protects your Maryland LLC by establishing clear rules and procedures for business operations, which can prevent disputes among members. It also helps to affirm your LLC's status as a separate entity from yourself, which is crucial for liability protection. Furthermore, having a detailed Operating Agreement can make your business more appealing to investors and can be required by banks when opening a business account.

Can I change my Maryland Operating Agreement?

Yes, your Maryland Operating Agreement can be changed. It's advisable to include a provision within the agreement itself on how amendments should be made, such as requiring a unanimous vote or a majority. Changes should be documented and agreed upon by all members to remain effective and legally binding.

Do I need to file my Maryland Operating Agreement with the state?

No, you do not need to file your Maryland Operating Agreement with the state. The document is meant to be held internally by the members of the LLC and does not need to be submitted to any state agency. However, it's important to keep it in a safe location where it can be easily accessed when needed.

How does a Maryland Operating Agreement differ from Articles of Organization?

The Articles of Organization is a mandatory document that needs to be filed with the Maryland State Department to officially form your LLC. It includes basic information about your business, such as the LLC's name, address, and the names of its members. In contrast, the Operating Agreement is a comprehensive internal document that outlines how the LLC will be run, detailing the rights and responsibilities of its members, among other operational guidelines.

What happens if I don't have an Operating Agreement for my Maryland LLC?

Without an Operating Agreement, your Maryland LLC would be governed by default state laws concerning LLC operations, which may not suit your business's specific needs or preferences. Additionally, without the protections offered by an Operating Agreement, your personal assets might be at greater risk if your LLC faces legal action. It's beneficial to create an Operating Agreement to establish clear rules tailored to your business and provide additional legal protection.

Common mistakes

When filling out the Maryland Operating Agreement form for a Limited Liability Company (LLC), people often encounter several common pitfalls. Avoiding these mistakes can help ensure the form is completed accurately, providing clear and legally sound guidelines for the operation of the LLC. Here are some of the most frequent errors:

Not customizing the agreement to fit the unique needs of the LLC. Using a generic template without adjustments can lead to issues that don't reflect the actual operation of your business.

Failing to include all members of the LLC, thereby omitting crucial input and consent from some parties who have a stake in the company.

Overlooking important clauses such as dispute resolution, dissolution procedures, or the process for adding or removing members. These details are critical for managing future changes and conflicts.

Misunderstanding member roles and contributions, leading to inaccuracies in stating who is responsible for what within the company and how profits, losses, and contributions are managed.

Not specifying the management structure clearly, whether it’s member-managed or manager-managed. This ambiguity can create operational confusion.

Leaving out details on how ownership percentages are calculated, especially if it’s not simply divided by capital contributions. This omission can lead to disputes over profit sharing and losses.

Including language that conflicts with Maryland state law, which can render parts of the agreement unenforceable or the entire agreement invalid.

Not properly defining the fiscal year or accounting methods, which is essential for financial planning, reporting, and tax filing.

Forgetting to have the agreement signed and dated by all members, making it difficult to enforce the terms agreed upon.

Ignoring the need for a buy-sell agreement within the Operating Agreement, a critical component that outlines what happens if a member wants to sell their interest, dies, or becomes disabled.

By paying close attention to these details, you can create a more effective and legally sound Operating Agreement. It's advisable to consult with a legal professional to ensure that your agreement fully complies with Maryland state laws and best serves the interests of all members involved.

Documents used along the form

When setting up a limited liability company (LLC) in Maryland, the Operating Agreement is a critical document that outlines the operating procedures and financial arrangements among its members. However, this document does not stand alone in the formation or the ongoing legal compliance of the LLC. There are several other forms and documents commonly used in conjunction with the Maryland Operating Agreement to ensure the smooth setup and operation of the business. These documents serve a variety of purposes, from establishing the legal existence of your business to managing its operations and compliance requirements.

- Articles of Organization: This is the foundational document filed with the Maryland State Department to officially form your LLC. It includes essential details about your business, such as the LLC's name, purpose, office address, and registered agent.

- EIN Confirmation Letter (CP-575): After obtaining an Employer Identification Number (EIN) from the IRS, businesses receive this letter, which serves as official confirmation of the EIN. It's essential for tax administration purposes as well as opening a business bank account.

- Operating Agreement Amendment Form: If members of the LLC decide to make changes to the Operating Agreement, this form documents those amendments. It ensures that all modifications are agreed upon and legally recognized.

- Annual Report: Most LLCs in Maryland are required to file an annual report with the State Department. This report updates the state on any changes in the company’s address, management structure or ownership.

- Business License Application: Depending on the nature of the LLC's activities and its location, it may need to apply for one or more business licenses to operate legally within Maryland or other jurisdictions.

- Membership Certificates: These documents serve as physical evidence of ownership interest in the LLC. They include details like the member's name, the date of issuance, and the membership interest percentage.

- Meeting Minutes Form: While Maryland LLCs are not required to hold meetings, keeping records of decisions made during any meetings is a good practice. This form helps document these meetings systematically.

- Registered Agent Acceptance Form: This form is used when the LLC appoints a new registered agent or when the initial registered agent agrees to their appointment. It’s crucial for ensuring that the agent has consented to receiving legal documents on behalf of the LLC.

In addition to the Maryland Operating Agreement, these documents collectively support the legal and operational structure of an LLC. Each plays a specific role in ensuring the business meets its legal obligations, secures its rights, and follows proper procedures for management and compliance. Familiarity with these forms and documents can significantly contribute to the successful management and longevity of an LLC in Maryland.

Similar forms

-

Partnership Agreement: Similar to an Operating Agreement, a Partnership Agreement outlines the arrangements between partners of a business, detailing the basic operational structure, financial management, and profit distribution. Though primarily for partnerships, it mirrors the Operating Agreement's purpose in LLCs by defining roles, responsibilities, and rules for business operations.

-

Shareholders' Agreement: This document is akin to an Operating Agreement but for corporations, specifically focusing on the relationships among shareholders and the management of company affairs. Similarities include provisions on the transfer of shares, dispute resolution methods, and decisions making processes, aiming to ensure smooth governance and operation of the corporation.

-

Bylaws: Corporate bylaws serve a similar function for corporations as Operating Agreements do for LLCs, setting the internal rules and procedures for the business's operation. They outline the structure of the company, detailing the roles and powers of directors and officers, procedures for shareholder meetings, and other governance matters. Although tailored for corporations, bylaws share the goal of providing a clear operational framework.

-

Buy-Sell Agreement: Although more specific in scope, a Buy-Sell Agreement shares common elements with an Operating Agreement, particularly in its provision for the continuity and stability of the business. It outlines the process for transferring ownership interests in cases such as death, disability, or retirement of a member, ensuring the company's smooth transition and operation. This agreement complements the broader operational strategies outlined in an Operating Agreement.

Dos and Don'ts

When filling out the Maryland Operating Agreement form, there are specific steps you should follow to ensure accuracy and compliance. This document is crucial for defining the operations of your LLC and protecting your personal liability. Here's a list of what you should and shouldn't do during the process.

What You Should Do:

- Review other operating agreements for similar businesses to understand common practices and terms used.

- Ensure all member names and contributions are accurately listed and clearly detailed.

- Define the process for adding or removing members to avoid future disputes.

- Include detailed descriptions of members' rights and responsibilities to provide clarity on operational roles.

- Sign the document in front of a notary to add an extra layer of legitimacy and legal standing.

What You Shouldn't Do:

- Don't skip detailing any agreements on profit sharing and loss allocation, as this can lead to conflicts later on.

- Avoid using unclear language that might be open to interpretation to prevent ambiguity in the agreement.

- Don't forget to specify the succession plan in case a member wants to leave the LLC or passes away.

- Refrain from ignoring state-specific requirements that must be included in the agreement.

- Avoid neglecting to update the agreement when changes in the LLC's management or operations occur.

Misconceptions

Many misconceptions exist about the Maryland Operating Agreement form for LLCs. Clearing these up can help business owners better understand their importance and how they function within the state's legal framework. Here are five common misunderstandings about this vital document:

- It's legally required to have an Operating Agreement in Maryland. While it’s highly recommended for the smooth operation and protection of your business, the State of Maryland does not require LLCs to have an Operating Agreement. This misunderstanding might lead some business owners to overlook the document’s importance in defining the financial and management structure of the company amongst its members.

- A single template fits all businesses. Although templates can provide a helpful starting point, thinking one template fits every business is a misconception. Specific needs, strategies, and structures of your LLC should be reflected in your Operating Agreement, necessitating customization to ensure it fully represents your business operations and agreements among members.

- Only multi-member LLCs need an Operating Agreement. Single-member LLCs might think an Operating Agreement is unnecessary. However, having this document, even for a sole proprietor, adds legitimacy, provides clear rules for the operation, and can offer essential protections for your business assets and agreements.

- The Operating Agreement doesn't impact taxes. While it's true that an Operating Agreement itself does not determine federal tax status, it can influence how the LLC is treated for state tax purposes. Moreover, it specifies the fiscal decisions and distributions among members, playing a critical role in the financial structure of your company.

- Once signed, the Operating Agreement cannot be changed. Flexibility is one of the key strengths of LLCs, and this extends to the Operating Agreement. As your business evolves, your agreement can and should be updated to reflect changes in management, membership, and business operations. This ensures the document remains relevant and valuable over time.

Key takeaways

Filling out and properly utilizing the Maryland Operating Agreement form is a pivotal step towards ensuring the smooth operation of a Limited Liability Company (LLC) within the state. This document, though not mandated by state law, offers comprehensive benefits that bolster the strength and clarity of the internal function and structure of your LLC. Below are five key takeaways to consider while handling this important form.

- Customization to Fit Your LLC's Needs: The flexibility of an Operating Agreement allows each LLC to tailor provisions specific to their operations, management structure, and ownership. This is crucial for establishing clear guidelines tailored to the unique needs of your business.

- Protection of Limited Liability Status: By clearly defining the operations, structure, and rules of your LLC, the Operating Agreement reinforces the company's status as a separate legal entity. This is paramount for protecting members' personal assets from business liabilities.

- Resolution of Internal Disputes: The Operating Agreement serves as a reference point for solving any misunderstandings or disputes among members. By setting forth the procedures for conflict resolution, decision making, and other critical operations, it helps ensure smooth and continuous operations.

- Override State Default Rules: In the absence of an Operating Agreement, your LLC operations will be governed by Maryland's default state laws. These defaults may not always be in the best interest of your LLC's members. Drafting your own agreement allows you to override these defaults with provisions more favorable to your LLC's specific situation.

- Documentation of Member and Managerial Rights and Responsibilities: An essential function of the Operating Agreement is to document the rights, powers, duties, liabilities, and obligations of each member and manager. This clarity can prevent misunderstanding and mitigate potential internal conflicts.

Thorough consideration and meticulous attention to detail in filling out and using the Maryland Operating Agreement form cannot be overstressed. It’s not just a matter of satisfying a legal formality but a proactive step towards safeguarding your business’s future, ensuring its successful management and operation, and protecting its members' interests. Therefore, taking the time to draft and regularly update this document is highly advised for all Maryland LLCs.

Create Other Operating Agreement Forms for US States

Oklahoma Operating Agreement - It encourages detailed planning and foresight, covering various scenarios and outlining procedures for dealing with unexpected events.

Llc Operating Agreement Template New York - Can be used to specify any unique characteristics of your LLC, allowing for customization beyond basic legal requirements.

Llc Filing Fee - By clearly stating each member’s contributions and ownership stake, it can prevent misunderstandings and conflicts about equity and rewards.

Form New Jersey Llc - Preparation of an Operating Agreement requires careful consideration and understanding of the business, ensuring a comprehensive and effective document.