Blank Operating Agreement Form for New York

Starting a business in New York entails numerous steps and legal requirements, one of the most critical being the creation of an Operating Agreement. This document serves not just as a formal guideline for the management structure of a Limited Liability Company (LLC), but also details the rights and responsibilities of its members, the allocation of profits and losses, and procedures for resolving disputes. Although New York State does not legally require an LLC to file this document with the state, drafting an Operating Agreement is highly advised. Doing so not only provides a clear roadmap for the operation of the business but also helps in protecting the personal liabilities of its members against legal actions and business debts. The absence of an Operating Agreement leaves the LLC under the default rules of the state, which may not always be in the best interest of the business or its members. As such, a well-thought-out Operating Agreement tailored to the specific needs of the business can be one of its most valuable assets.

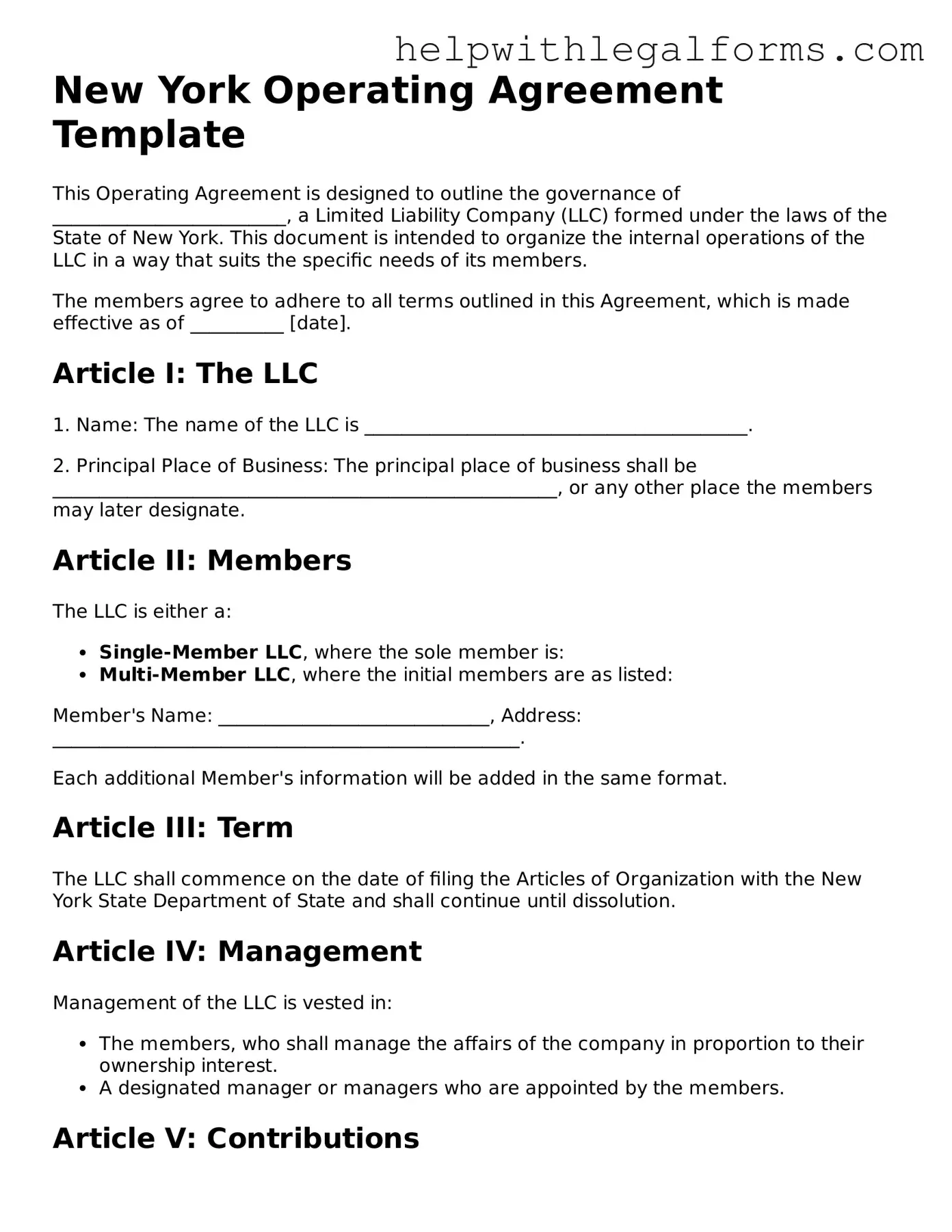

Example - New York Operating Agreement Form

New York Operating Agreement Template

This Operating Agreement is designed to outline the governance of _________________________, a Limited Liability Company (LLC) formed under the laws of the State of New York. This document is intended to organize the internal operations of the LLC in a way that suits the specific needs of its members.

The members agree to adhere to all terms outlined in this Agreement, which is made effective as of __________ [date].

Article I: The LLC

1. Name: The name of the LLC is _________________________________________.

2. Principal Place of Business: The principal place of business shall be ______________________________________________________, or any other place the members may later designate.

Article II: Members

The LLC is either a:

- Single-Member LLC, where the sole member is:

- Multi-Member LLC, where the initial members are as listed:

Member's Name: _____________________________, Address: __________________________________________________.

Each additional Member's information will be added in the same format.

Article III: Term

The LLC shall commence on the date of filing the Articles of Organization with the New York State Department of State and shall continue until dissolution.

Article IV: Management

Management of the LLC is vested in:

- The members, who shall manage the affairs of the company in proportion to their ownership interest.

- A designated manager or managers who are appointed by the members.

Article V: Contributions

Each member’s contribution to the LLC’s capital is as follows:

Member's Name: _____________________________, Contribution: $_________________.

Further contributions shall be determined according to the procedure outlined by the members.

Article VI: Distributions

Profits and losses shall be allocated, and distributions made to the members as follows:

- According to the percentage of each member's ownership interest in the LLC.

- Any other method agreed upon by the members and documented in writing.

Article VII: Changes to the Operating Agreement

Any changes to this Operating Agreement must be agreed upon by all members in writing.

Article VIII: Dissolution

The LLC may be dissolved upon the agreement of the members as governed by New York state law.

IN WITNESS WHEREOF, the undersigned members have executed this Operating Agreement as of the last date written below.

Member's Name: _____________________________, Signature: _____________________________, Date: __________.

Member's Name: _____________________________, Signature: _____________________________, Date: __________.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose of the Operating Agreement | Defines the internal operating rules of a limited liability company (LLC) in New York. |

| Governing Law | New York Consolidated Laws, Limited Liability Company Law - Article 2, Section 417. |

| Mandatory Status | Although not required to be filed with the state, an operating agreement is mandatory for LLCs formed in New York. |

| Flexibility in Structure | Allows the LLC members to outline the company’s financial and functional decisions including rules, regulations, and provisions. |

| Protection of Personal Assets | Separates personal assets from the business assets of the LLC members, offering protection from personal liability. |

| Specification of Ownership Percentages | Details each member's percentage of ownership in the LLC. |

| Distribution of Profits and Losses | Outlines how the LLC's profits and losses are distributed among its members. |

| Management Structure | Defines whether the LLC will be managed by its members or by appointed managers. |

| Procedure for Adding or Removing Members | Establishes the process for adding new members to the LLC or removing existing members. |

Instructions on How to Fill Out New York Operating Agreement

Filling out an Operating Agreement form for a New York based Limited Liability Company (LLC) is a step that should not be overlooked. This document outlines the operating procedures, financial decisions, and rules that will govern the partnership. It's a critical component in ensuring clarity and preventing disputes between members down the line. While the process might seem daunting at first, breaking it down into steps can simplify it significantly.

- Gather necessary information including the LLC's official name, the address of the principal place of business, and the names and addresses of all members.

- Decide on the management structure of the LLC – whether it will be managed by its members or by appointed managers.

- Detail the members' contributions to the LLC. This could include capital, property, services, or other agreed-upon contributions.

- Set forth the procedure for distributing profits and losses among members. Typically, this is done either in proportion to each member’s contribution or based on percentages agreed upon by all members.

- Outline the guidelines for holding meetings, including the frequency, the process for calling a meeting, and the required quorum for making decisions.

- Include provisions for admitting new members, which should specify any conditions or contributions required for membership.

- Describe the process for member exits or transfers of membership interest. This section should address what happens in the event a member wishes to leave, dies, or becomes incapacitated.

- Specify a method for amending the Operating Agreement. Since businesses evolve, having a clear process for making changes is crucial.

- Decide on how disputes among members will be resolved. Options might include mediation, arbitration, or court action.

- Finally, ensure all members sign the Operating Agreement to acknowledge their understanding and agreement to its terms.

After completing the steps, it's essential to keep the Operating Agreement in a safe but accessible place. It's not submitted to any state agency but must be available for reference or if legally requested. The operating agreement serves as a foundational document that will guide the LLC's operations, so treating it with importance and keeping it up to date is key to the organization's success and harmony among its members.

Crucial Points on This Form

What is an Operating Agreement in the context of a New York LLC?

An Operating Agreement is a legal document for a Limited Liability Company (LLC) in New York that outlines the ownership structure and operating procedures of the business. Although not filed with the state, it is a crucial internal document that governs the financial and functional decisions of the LLC, including rules, regulations, and provisions for the business's operation. It helps to ensure that all members are on the same page and reduces the risk of future conflicts.

Is an Operating Agreement required for New York LLCs?

Yes, unlike in some states, New York requires LLCs to adopt an Operating Agreement. The agreement can be entered into before, at the time of, or within 90 days after the filing of the Articles of Organization with the New York State Department of State. This requirement applies whether the LLC has one member (a so-called "single-member LLC") or multiple members. Although it doesn't need to be filed with any state agency, it must be kept on file by the LLC and made available upon request.

What are the key components of a New York Operating Agreement?

A comprehensive Operating Agreement for a New York LLC typically includes but is not limited to: the LLC's name and primary place of business, information about the members and how additional members may be admitted, capital contributions from members, how profits and losses will be distributed, management structure and voting rights, procedures for meetings and taking votes, guidelines for transferring membership interest, and procedures for dissolving the business. It may also address specific industry or company-specific concerns and contingencies for resolving disputes among members.

Can an Operating Agreement be modified after it has been adopted?

Yes, an Operating Agreement can be modified post-adoption if necessary. However, the process for making amendments should ideally be included within the original agreement itself to streamline the procedure. Most agreements require a certain percentage of votes from the members to approve any changes. It's important that all amendments are documented in writing and acknowledged by all members to maintain clarity and prevent future disputes.

Common mistakes

Filling out the New York Operating Agreement form is an important step for any limited liability company (LLC) operating in New York. This document outlines the ownership and operating procedures of your LLC, ensuring that all members are on the same page and protecting the business's legal standing. Unfortunately, common mistakes can lead to complications down the line. Here are seven errors often made during this process:

Not creating an agreement at all. Some believe it’s optional since New York doesn't require an LLC to submit this document to the state. However, not having an Operating Agreement leaves your LLC vulnerable to default state laws that may not suit your business's specific needs.

Skipping important details. Every Operating Agreement should contain clear details about the roles of its members, their contributions, and how profits and losses are distributed. Vagueness can lead to disputes among members.

Using generic templates without customization. While online templates are a good starting point, every LLC is unique. It’s crucial to tailor your Operating Agreement to reflect the specific operation, management, and organization of your LLC.

Forgetting to update the agreement. As your LLC grows and evolves, so should your Operating Agreement. Failing to update it to reflect changes in membership, management, or business operations can lead to outdated practices and disagreements.

Not defining the process for adding or removing members. This oversight can cause confusion and conflict when the time comes to alter the membership of your LLC. A clear process should be established to handle these changes.

Ignoring dispute resolution. Without a predetermined method of resolving disputes outlined in your Operating Agreement, you risk lengthy and potentially costly legal battles. It’s better to decide on arbitration, mediation, or another form of dispute resolution in advance.

Not having all members review and sign the agreement. Every member should fully understand and agree to the terms of the Operating Agreement. Failure to do so can lead to members not feeling bound by its terms, undermining the efficacy of the agreement.

Avoiding these mistakes requires careful attention to detail and an understanding of your LLC's specific needs. Therefore, it might be best to seek professional advice to ensure that your Operating Agreement fully protects your business and reflects the wishes of all members involved.

Documents used along the form

When setting up or managing a Limited Liability Company (LLC) in New York, the Operating Agreement is a crucial document that outlines the operational procedures and the financial agreements among its members. However, to fully establish and maintain an LLC's functionality and compliance with New York's state regulations, several other forms and documents are often required either during the formation process or throughout the lifespan of the LLC. These documents serve to provide clarity, ensure legal compliance, and facilitate various operational aspects of the LLC.

- Articles of Organization (Form DOS-1336): This is the primary document needed to officially form an LLC in New York. It includes basic information about the LLC, such as its name, purpose, office location, and the designated service of process agent.

- Employer Identification Number (EIN) Application: Issued by the IRS, the EIN or federal tax identification number is essential for tax purposes, hiring employees, and opening business bank accounts.

- Biennial Statement (Form DOS-1556): Every two years, LLCs must file this statement with New York State, updating their address and contact information for the public record.

- Operating Agreement Amendment Form: If members of the LLC decide to change any terms in the Operating Agreement, this form documents those changes and must be kept with the original agreement.

- Membership Certificates: These certificates serve as a physical representation of each member’s ownership interest in the LLC.

- LLC Resolution to Open a Bank Account: This is a document that authorizes the LLC to open a bank account under its name, specifying who within the company has the authority to conduct banking transactions.

- New York State Tax Registration: LLCs may need to register for specific state taxes, such as sales tax or employer taxes, depending on the nature of the business and whether it hires employees.

- Registered Agent Consent Form: If the LLC appoints a registered agent different from the one listed in the Articles of Organization, this form records the consent of the designated individual or service to act as the agent for service of process.

- Foreign LLC Application (Form DOS-1361): If an LLC formed in another state wishes to do business in New York, it must file this application to receive authority to operate within New York State.

- Dissolution Form (DOS-1359-f): When it's time to close the LLC, this form is filed with New York State to formally dissolve the business entity.

This collection of forms and documents, used alongside an Operating Agreement, is integral in navigating the legal landscape of forming and operating an LLC in New York. Each document plays a specific role in ensuring that the LLC meets state requirements, maintains operational clarity among members, and protects the legal entity's rights and responsibilities. The continued attention to and maintenance of these documents help in safeguarding the interests of the LLC and its members.

Similar forms

A Bylaws document for a corporation closely mirrors the function of an Operating Agreement for a Limited Liability Company (LLC). While an Operating Agreement sets out the structure and operating procedures of an LLC, Bylaws serve a similar purpose for corporations. They outline the rules, roles, and responsibilities within the corporation, dealing with aspects such as corporate governance, director meetings, and shareholder rights.

A Partnership Agreement shares similarities with an Operating Agreement because both establish the framework for a business entity's operational and financial decisions. A Partnership Agreement outlines the terms of a partnership between two or more individuals, including contributions, profit sharing, and dispute resolution. This mirrors how an Operating Agreement describes the operations of an LLC, the members' contributions, and the distribution of profits and losses.

The Shareholders' Agreement of a corporation can be compared to an LLC's Operating Agreement in its function of detailing the rights and obligations of the entity's stakeholders. The Shareholders' Agreement focuses on the management of shareholdings, buy-sell provisions, and voting rights, very much like how an Operating Agreement outlines the LLC members' rights, responsibilities, and percentages of ownership.

A Buy-Sell Agreement bears resemblance to certain aspects of an Operating Agreement, particularly in the way it handles the transfer of ownership interests. Such an agreement is often part of or akin to an Operating Agreement, stipulating what happens if an owner wishes to sell their part, dies, or becomes incapacitated. It controls the situations where ownership stakes may change hands, ensuring the business’s and remaining owners' interests are protected.

Dos and Don'ts

When forming a Limited Liability Company (LLC) in New York, the Operating Agreement is a crucial document that outlines the ownership and operating procedures of your LLC. While it is not filed with the state, this internal document is vital for the smooth operation and governance of your LLC. Below are five recommended actions to take and five to avoid when completing your New York Operating Agreement.

Do:

- Ensure accuracy of all information: Double-check all entries for accuracy, including names, addresses, and the distribution of profits and losses. Mistakes can lead to misunderstandings or legal issues down the line.

- Be thorough: Include all necessary sections, such as membership structure, voting rights, management, distributions, and procedures for adding or removing members. A comprehensive agreement leaves less room for future disputes.

- Implement a dispute resolution process: Clearly outline a procedure for resolving disputes among members. This can save time, preserve relationships, and potentially avoid costly litigation.

- Consult with all members: Engage all members in the drafting process to ensure that the agreement reflects a mutual understanding and consent about the LLC's operation and management.

- Seek legal advice: Consider consulting with a legal professional who can provide advice tailored to your specific situation, ensuring that the agreement complies with New York law and adequately protects all members' interests.

Don't:

- Use a generic template without customization: While templates can serve as a starting point, it's important to tailor your Operating Agreement to the specific needs and agreement of your LLC's members.

- Omit any member's information: Ensure that the agreement accurately reflects all current members and their respective ownership percentages, roles, and responsibilities. Exclusions can lead to legal complications.

- Ignore state-specific requirements: New York may have unique requirements that are not addressed by generic agreements. Neglecting these can render your agreement non-compliant, undermining its effectiveness.

- Forget to update the agreement: The Operating Agreement should evolve with your LLC. Failing to update it to reflect changes in membership, structure, or operation can lead to discrepancies and disputes.

- Underestimate the importance of a written agreement: Verbal agreements or handshake deals may seem convenient, but they offer little security or clarity when issues arise. A written agreement is essential for establishing clear guidelines and protections for all members.

Misconceptions

When forming a limited liability company (LLC) in New York, an Operating Agreement is often mentioned as a crucial document. However, misconceptions about this form can lead to confusion. Clarifying these misunderstandings can help ensure that business owners are well-informed and prepared. Below are eight common misconceptions about the New York Operating Agreement form:

- It's not required by law. Many believe that forming an LLC in New York doesn't require an Operating Agreement. However, New York state law actually mandates that all LLCs have an Operating Agreement in place, even if there is only one member in the LLC.

- It must be filed with the state. Unlike articles of organization, the Operating Agreement is not filed with the State of New York. It is an internal document but must be kept on file by the LLC members.

- One size fits all. Another common misconception is that there is a standard, one-size-fits-all Operating Agreement that all New York LLCs can use. In reality, the agreement should be tailored to the specific needs and structure of your business. Each LLC may require different provisions based on its unique circumstances.

- Only multi-member LLCs need one. Even if you are the sole member of your LLC, New York law still requires you to have an Operating Agreement. This document can provide clarity and protection regarding the operation of the business and its assets.

- It's only needed at the start of the business. Some may think that the Operating Agreement is only necessary at the formation of the LLC. However, it should be reviewed and potentially updated as the business grows, changes, and enters into new circumstances.

- It has no real legal standing. Contrary to this belief, the Operating Agreement is a legally binding document for the members of the LLC. It governs the operational and financial decisions of the business, and courts will refer to it in the event of a legal dispute between members.

- It's too complicated to create without a lawyer. While it's true that legal advice can be invaluable, especially for complex arrangements, many resources are available to help LLC members draft their Operating Agreements. Care must be taken to ensure that the agreement complies with New York law and accurately reflects the members' intentions.

- All disputes can be resolved internally if there's an Operating Agreement. Although an Operating Agreement can provide mechanisms for dispute resolution, not all conflicts may be resolved internally. In some cases, arbitration or legal intervention may still be necessary.

Understanding these misconceptions about the New York Operating Agreement can empower LLC members to better manage their business’s needs and legal obligations. It's crucial to approach the creation and maintenance of this document thoughtfully, ensuring it accurately reflects the structure and practices of the LLC while complying with New York law.

Key takeaways

When setting up a Limited Liability Company (LLC) in New York, one important document that helps govern the entity is the Operating Agreement. Although it may seem daunting at first, understanding the key aspects of this form can simplify the process. Here are seven essential takeaways for anyone filling out and using the New York Operating Agreement form:

- The Operating Agreement is not filed with the state. Unlike the Articles of Organization, the Operating Agreement is an internal document. It should be kept with the LLC’s records and made available to all members.

- It must be compliant with New York State law. The document outlines the ownership and member duties, so it’s important to ensure that it does not contain provisions that are in direct conflict with New York laws.

- The document covers important financial and managerial decisions. This includes how profits and losses are distributed, the process for adding or removing members, and how decisions are made among members.

- Flexibility is a key advantage. The Operating Agreement allows members to structure their financial and working relationships in a way that suits their business. This flexibility can be particularly beneficial for operations that do not fit into a one-size-fits-all model.

- It helps prevent misunderstandings among members. By clearly outlining the roles, responsibilities, and expectations of each member, the Operating Agreement can reduce conflicts.

- Amendments can be made to the Operating Agreement. As the business grows and changes, so too can the agreement. It's crucial to have a provision within the agreement that outlines the process for making amendments.

- Having a lawyer review the Operating Agreement can be beneficial. Even if the form seems straightforward, legal advice can ensure that the agreement fully protects the members’ interests and complies with applicable laws.

Successfully managing the ins and outs of the Operating Agreement can set a solid foundation for the LLC, contributing to a clearer operational structure and avoiding potential legal pitfalls down the line. Paying attention to these key aspects can go a long way in ensuring that the business runs smoothly and that all members understand their rights and obligations within the company.

Create Other Operating Agreement Forms for US States

Form New Jersey Llc - It serves as a legal document that can resolve disputes among members by referring back to the agreed-upon rules and procedures.

Maryland LLC Agreement - Details the process for amending the agreement, ensuring the document remains relevant over time.

Oklahoma Operating Agreement - An Operating Agreement ensures that the business is run according to the members’ vision rather than default state laws governing LLCs.