Blank Operating Agreement Form for Oklahoma

In the heart of America, Oklahoma stands as a beacon for entrepreneurs and business enthusiasts aiming to plant the seeds of their visions into fertile ground. Establishing a Limited Liability Company (LLC) in this state is marked by a pivotal document: the Operating Agreement. This comprehensive form serves as the skeleton of your company, outlining the structure, governing policies, member roles, and financial management in detail. Although Oklahoma does not mandatorily require an LLC to have an Operating Agreement, having one in place is widely recognized as a best practice. It not only provides clarity and direction for the management team but also safeguards the business owners' personal assets by reinforcing the legal distinction between personal and business liabilities. This document serves as a contract among members, detailing their mutual obligations, and lays the groundwork for resolving potential disputes, thereby ensuring the smooth operation of the company. Tailored to fit the unique requirements of each business, the Oklahoma Operating Agreement is a vital tool for steering your LLC toward its goals with a clear vision and a solid foundation.

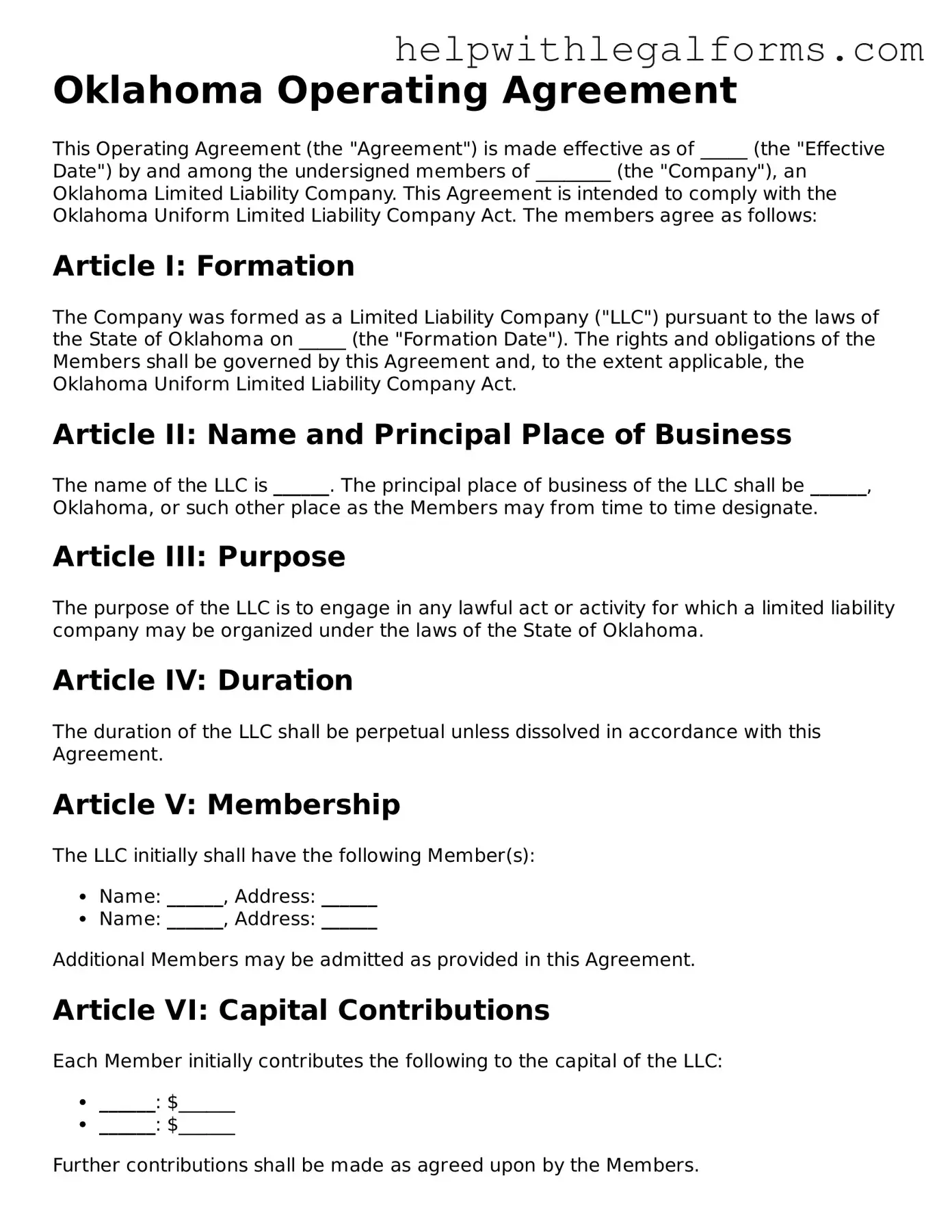

Example - Oklahoma Operating Agreement Form

Oklahoma Operating Agreement

This Operating Agreement (the "Agreement") is made effective as of _____ (the "Effective Date") by and among the undersigned members of ________ (the "Company"), an Oklahoma Limited Liability Company. This Agreement is intended to comply with the Oklahoma Uniform Limited Liability Company Act. The members agree as follows:

Article I: Formation

The Company was formed as a Limited Liability Company ("LLC") pursuant to the laws of the State of Oklahoma on _____ (the "Formation Date"). The rights and obligations of the Members shall be governed by this Agreement and, to the extent applicable, the Oklahoma Uniform Limited Liability Company Act.

Article II: Name and Principal Place of Business

The name of the LLC is ______. The principal place of business of the LLC shall be ______, Oklahoma, or such other place as the Members may from time to time designate.

Article III: Purpose

The purpose of the LLC is to engage in any lawful act or activity for which a limited liability company may be organized under the laws of the State of Oklahoma.

Article IV: Duration

The duration of the LLC shall be perpetual unless dissolved in accordance with this Agreement.

Article V: Membership

The LLC initially shall have the following Member(s):

- Name: ______, Address: ______

- Name: ______, Address: ______

Additional Members may be admitted as provided in this Agreement.

Article VI: Capital Contributions

Each Member initially contributes the following to the capital of the LLC:

- ______: $______

- ______: $______

Further contributions shall be made as agreed upon by the Members.

Article VII: Distribution of Profits and Losses

Profits and losses shall be allocated and distributed among the Members in proportion to their respective capital contributions, or as otherwise agreed in writing by all Members.

Article VIII: Management

Management of the LLC shall be vested in the Members. Decisions regarding the operation of the LLC shall be made by a majority vote of the Members unless otherwise provided in this Agreement.

Article IX: Amendments

This Agreement can be amended only by a written agreement signed by all Members.

Article X: Dissolution

The LLC may be dissolved upon the occurrence of any of the following:

- The unanimous agreement of the Members;

- The sale or other disposition of substantially all of the assets of the LLC;

- The death, retirement, resignation, expulsion, bankruptcy, or dissolution of a Member or the occurrence of any other event that terminates the continued membership of a Member in the LLC unless the remaining Members agree to continue the business of the LLC;

- Any other event causing dissolution under the laws of the State of Oklahoma.

Article XI: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Oklahoma.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the date first written above.

Member Signature: ________________________

Member Name (Print): _____

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | An Oklahoma Operating Agreement is designed to outline the operating procedures, financial decisions, and ownership structure of a limited liability company (LLC) within the state of Oklahoma. |

| Flexibility | This agreement allows LLC members to structure their financial and working relationships in a way that suits their business best, offering significant flexibility beyond statutory requirements. |

| Governing Law | The form and execution of an Oklahoma Operating Agreement are governed by the Oklahoma Limited Liability Company Act, which sets the legal framework for LLCs in Oklahoma. |

| Not Mandatory, But Recommended | Although not legally required by the state, having an Operating Agreement is highly recommended for LLCs in Oklahoma as it provides clarity and protection for the business operations and its members. |

| Conflict Resolution | It includes provisions for dispute resolution among members, which can help prevent costly and time-consuming litigation, ensuring smoother operational flow. |

Instructions on How to Fill Out Oklahoma Operating Agreement

Filling out an Operating Agreement form for an LLC in Oklahoma is a critical step in establishing your business's legal and operational framework. This document outlines the ownership structure, member roles, and management processes, ensuring clarity and understanding between all parties involved. The process might seem daunting at first, but breaking it down into manageable steps can simplify it.

Here are the steps needed to fill out the Oklahoma Operating Agreement form:

- Determine the type of LLC your business will be (single-member or multi-member) and ensure that all members agree on the terms that will be outlined in the agreement.

- Gather all necessary information, including the official name of the LLC, principal place of business, names and addresses of all members, and the registered agent's information.

- Decide on the management structure of the LLC (member-managed or manager-managed) and who the managers will be, if applicable.

- Outline the capital contributions of each member, including the amount and the percentage of ownership each contribution represents.

- Specify the process for distributing profits and losses among members and how often these distributions will occur.

- Define the voting rights of each member, noting how decisions will be made and what constitutes a majority or unanimous decision.

- Include any provisions for adding or removing members, as well as any buyout or buy-sell rules, should a member decide to leave the LLC.

- Detail the procedure for dissolving the LLC, including the division of assets and liabilities among members.

- Have all members review the Operating Agreement to ensure accuracy and completeness. Make any necessary revisions.

- Finally, all members must sign the agreement, making it legally binding. Consider having the signatures notarized for added legal validity.

Once completed, the Operating Agreement serves as a guiding document for the management and operation of the LLC. It might not be filed with the state of Oklahoma, but it should be kept on record by all members and updated as needed to reflect changes in the business structure or operations.

Crucial Points on This Form

What is an Oklahoma Operating Agreement?

An Oklahoma Operating Agreement is a legally binding document that outlines the operational procedures, financial decisions, and roles of the members within a Limited Liability Company (LLC) operating in Oklahoma. It serves as a guidebook for how the business is run and helps prevent conflicts among members by providing clear guidelines.

Is an Operating Agreement required for LLCs in Oklahoma?

While the state of Oklahoma does not legally require LLCs to have an Operating Agreement, it’s highly recommended to create one. Having this document in place can provide legal protection, clarify operational procedures, and ensure that the business operates according to the owners' intentions rather than default state laws.

What are some key elements to include in an Oklahoma Operating Agreement?

An effective Oklahoma Operating Agreement should include details such as: the LLC’s name and principal place of business, member contributions, profit and loss distribution, management structure, member voting rights, protocols for adding or removing members, and procedures for dissolving the business. Each of these elements helps in clearly defining the structure and operations of the LLC.

Can an Operating Agreement be modified after it is initially drafted?

Yes, an Operating Agreement can be modified if needed. However, the process for making amendments should be outlined within the original agreement. Typically, changes require a certain percentage of member approval, ensuring that all members have a say in any modifications to the agreement.

Who needs to sign the Operating Agreement in an Oklahoma LLC?

Typically, all members of the LLC need to sign the Operating Agreement to make it effective. This ensures that all members have reviewed, agreed upon, and are bound by the terms of the agreement. For single-member LLCs, the sole owner should sign the document to formalize the operating procedures and protections.

How does an Operating Agreement protect members of an LLC?

An Operating Agreement protects members by specifying their financial and managerial rights, detailing dispute resolution methods, and reducing misunderstandings by having clear-cut rules for the operation of the company. It can also offer protection against personal liability in certain situations, distinguishing members' personal assets from the company's debts and obligations.

Should an Oklahoma LLC file its Operating Agreement with the state?

No, an Operating Agreement is an internal document and does not need to be filed with the state of Oklahoma. However, keeping an updated copy within company records is important for legal and administrative purposes. It may need to be presented to financial institutions, future business partners, or in court if disputes arise.

What happens if an Oklahoma LLC operates without an Operating Agreement?

Operating without an Operating Agreement leaves the LLC and its members susceptible to state default laws governing LLCs, which might not align with the members' preferences for the operation of the company. This can lead to disputes among members and uncertainty about the distribution of profits, management decisions, and other operational aspects of the LLC.

Common mistakes

When individuals or business entities set about to fill out the Oklahoma Operating Agreement form, which is a critical document for setting the operational framework of a Limited Liability Company (LLC) within the state, several common errors can occur. These mistakes can have significant repercussions, including legal complications or misunderstandings between members of the LLC. Here's a detailed look at four prevalent errors:

-

Not Tailoring the Agreement to Fit the Specific LLC: A frequent oversight is the use of a generic template without modifications. Each LLC has unique needs and operational structures. Failing to customize the Operating Agreement to reflect these specifics can lead to a lack of clarity on important issues such as profit distribution, roles, and responsibilities of members, and protocols for adding or removing members.

-

Omitting Dispute Resolution Methods: Many forget to include or inadequately outline the procedures for resolving disputes among members. Without a clear, predefined process, resolving conflicts can become more complicated and costly, potentially requiring arbitration or legal intervention.

-

Ignoring or Improperly Detailing Financial Provisions: A critical component often overlooked is the detailing of financial arrangements. These include capital contributions, profit sharing, and management of financial losses. Ambiguities or omissions in this area can lead to disputes and financial mismanagement.

-

Failure to Sign the Document: Surprisingly, a common mistake is that members do not formally sign the Operating Agreement or they fail to keep an updated version that reflects current membership. An unsigned agreement is typically not legally binding, which could lead to significant operational and legal challenges.

It's essential to approach the creation and maintenance of the Operating Agreement with diligence and attention to detail. This document is not only a legal requirement but also a blueprint for the smooth operation of the LLC. Avoiding these mistakes can help ensure the longevity and success of the business.

Documents used along the form

When forming an LLC in Oklahoma, the Operating Agreement serves as a critical document outlining the LLC's operational and financial arrangements, member duties, and more. It acts as a guide for running the LLC and helps protect members' personal assets. However, creating an LLC doesn't stop with just an Operating Agreement. Several other important documents are often needed to fully establish and maintain the LLC's legal and operational framework. These documents ensure compliance with state laws and regulations, help in the organization's management, and provide a clear structure for business operations.

- Articles of Organization: This is the founding document of any LLC in Oklahoma. It officially registers the LLC with the state and includes essential information such as the LLC's name, address, and the names of its members.

- Employer Identification Number (EIN) Application: The EIN, or Federal Tax Identification Number, is required for an LLC to open a bank account and handle employee payroll. It's obtained from the IRS.

- Annual Certificate: This document is filed annually with the Oklahoma Secretary of State to keep the LLC's information current and comply with state laws.

- Operating Licenses and Permits: Depending on the type of business and its location, various local, state, and federal licenses or permits may be required to legally operate.

- LLC Membership Certificates: These certificates serve as physical proof of ownership in the LLC and outline the percentage of the company that each member owns.

- Minutes of Meeting: Keeping records of major decisions made during LLC meetings is crucial for legal and operational reasons. This document formalizes those decisions.

- Buy-Sell Agreement: This outlines what happens to an LLC member's share of the company if they wish to leave the LLC, die, or become incapacitated. It helps prevent future conflicts among members.

Together with the Operating Agreement, these documents form the backbone of a well-organized LLC, providing clear guidelines and procedures for governance, compliance, and everyday operations. Properly managing these documents can significantly help in avoiding legal pitfalls and ensuring the smooth operation of the LLC. Being familiar with these documents is crucial for anyone involved in forming or managing an LLC in Oklahoma.

Similar forms

Partnership Agreement: Like an operating agreement, a partnership agreement outlines the business structure, operations, and the responsibilities of each partner. Both documents facilitate the smooth running of a business by setting clear expectations and guidelines. While an operating agreement is used by LLCs, a partnership agreement serves a similar purpose for partnerships.

Bylaws for Corporations: Corporate bylaws and operating agreements serve as the backbone for business operations but for different types of entities. Bylaws govern the internal management of a corporation, detailing the roles of directors and officers, meeting procedures, and shareholder relations, akin to how an operating agreement structures an LLC.

Shareholder Agreement: This is similar to an operating agreement for businesses with shareholders. It outlines the rights, obligations, and protections of the shareholders but applies to corporations instead of LLCs. Both types of documents help in preventing conflicts by making clear each party's involvement in the business.

Employment Agreement: Employment agreements detail the terms of employment, including duties, duration, and compensation, much like operating agreements define the roles, responsibilities, and financial benefits for the members of an LLC. Both ensure mutual understanding and agreement between the parties involved.

Co-founder Agreement: Essential for startups, a co-founder agreement outlines the responsibilities, equity split, and dispute resolution mechanisms among founders. Its role in setting up clear expectations among the founders is similar to how an operating agreement structures relations and expectations among members of an LLC.

Franchise Agreement: Franchise agreements govern the relationship between franchisors and franchisees, detailing rights, obligations, and operational guidelines. Operating agreements serve a similar role within an LLC, setting forth the operational structure and member guidelines.

Joint Venture Agreement: This document outlines the terms and conditions between two parties seeking to undertake a joint business endeavor. It shares similarities with an operating agreement by defining the role of each party, profit sharing, and governance, tailored to collaboration between the entities rather than within a single entity.

Non-Disclosure Agreement (NDA): Although an NDA is primarily designed to protect confidential information, it can be part of broader business agreements, including operating agreements, where protecting sensitive information is critical. Both agreements often include clauses that safeguard against the unauthorized sharing of proprietary information.

Dos and Don'ts

When completing the Oklahoma Operating Agreement form, careful attention to detail is crucial. This document outlines the structure and operations of a Limited Liability Company (LLC) in Oklahoma, ensuring clarity and understanding among members. Below are recommended practices to follow and pitfalls to avoid for a smooth and effective completion process.

Do:

Review the form in its entirety before filling it out. This preliminary step ensures a comprehensive understanding of what information is required and helps prevent omissions.

Ensure accuracy in the details provided. This includes the correct spelling of names, addresses, and precise financial contributions of members. Accuracy is critical for legal and operational clarity.

Discuss and confirm the allocation of profits, losses, and voting rights with all members before documenting them. These decisions impact the LLC's operations and member relations.

Keep the language clear and straightforward. While the document might have legal implications, clarity is key to avoiding misunderstandings among members and enforcing the agreement's terms.

Sign and date the agreement in the presence of a notary. Though not always mandated by law, having the document notarized adds a level of official recognition and can help in the enforcement of its terms.

Don't:

Rush through filling out the form. Haste can lead to errors that could complicate the LLC's operations or lead to disputes among members.

Override the standard operating agreement template with provisions that conflict with Oklahoma state law. All terms must comply with state regulations to ensure the document's enforceability.

Neglect to review the agreement periodically. As the business evolves, the agreement should be amended to reflect changes in operations, membership, and capital contributions.

Forget to provide each member with a copy of the agreement. Transparency and access ensure all members are informed of their rights and obligations.

Underestimate the importance of professional advice. Consultation with a legal or financial advisor can provide insights into complex aspects of the agreement and how they might impact the LLC.

Misconceptions

When it comes to an Operating Agreement in Oklahoma, there are a number of misunderstandings that can lead to confusion. It's crucial to clarify these misconceptions to ensure that business owners are informed about the importance and impact of this document.

It's only for multi-member LLCs: One of the most common misconceptions is that Operating Agreements are only necessary for LLCs with more than one member. In reality, a single-member LLC can also benefit significantly from having an Operating Agreement in place, as it provides a clear framework for the business's operations and can offer additional legal protection.

The state doesn't require it, so it's not important: Although it's true that Oklahoma does not strictly require an LLC to have an Operating Agreement, suggesting it's unimportant is misleading. This document plays a critical role in governing the LLC, detailing the operational and financial arrangements among members, and can help avoid disputes in the future.

It's too complicated to create: Many believe creating an Operating Agreement is a complex and daunting task, requiring extensive legal knowledge. However, with available templates and resources, along with professional legal assistance when necessary, drafting an Operating Agreement can be a manageable and straightforward process.

All Operating Agreements are the same: This is far from the truth, as each LLC's Operating Agreement should be tailored to fit the specific needs and structure of the business. A one-size-fits-all approach is not advisable, as it may not adequately address or protect the unique aspects of your business.

Once signed, it cannot be changed: Operating Agreements are not set in stone. As a business evolves, its Operating Agreement can and should be updated to reflect changes in the company’s operations, membership, or management structure. It ensures the document remains relevant and useful.

It's only necessary if you plan to go to court: While it's true that an Operating Agreement can be incredibly useful in a legal dispute, its value extends far beyond the courtroom. It helps ensure smooth daily operations, outlines the decision-making processes, and sets the groundwork for the financial arrangements among members.

It doesn't matter if it's not in writing: Verbal agreements can lead to misunderstandings and are difficult to enforce. Having a written Operating Agreement ensures that all members have a clear understanding of the terms and conditions of the business arrangement, which can prevent conflicts and provide a secure legal foundation for the LLC.

Key takeaways

When navigating the process of structuring your business, the Oklahoma Operating Agreement serves as a critical document for LLCs operating within the state. This legally binding agreement outlines the operations of the LLC and sets forth the rights and responsibilities of its members. Understanding its importance and specifics can ensure your business operates smoothly and in compliance with state laws. Below are key takeaways to guide you through filling out and using the Oklahoma Operating Agreement.

- Customization is key: The Oklahoma Operating Agreement is flexible and can be tailored to fit the unique needs of your LLC. It's not a one-size-fits-all document; rather, it should accurately reflect the operational structure and policies of your business.

- It's not mandatory, but highly recommended: While the state of Oklahoma does not legally require LLCs to have an Operating Agreement, having one in place is highly advised. It not only provides legal protections but also assists in ensuring that courts respect your personal liability protection.

- Clarifies verbal agreements: Verbal agreements among LLC members are prone to misunderstandings and are difficult to enforce. An Operating Agreement serves as a written record of member agreements on various aspects of the LLC’s operation, reducing potential conflicts.

- Financial and managerial roles are defined: The Operating Agreement should clearly outline each member's contributions, share in profits, and responsibilities in managing the LLC. This clarity can prevent disputes and ensure a smooth operation.

- Procedures for changes and dissolution: The document should specify processes for altering the agreement, adding or removing members, and dissolving the business. Planning for the future can help avoid legal headaches and conflicts.

- Protection of the LLC’s status: An Operating Agreement helps to reinforce the separation between the members’ personal assets and the business liabilities, which is crucial for maintaining the limited liability shield.

- State-specific requirements: Be aware that Oklahoma may have specific requirements or provisions that need to be included in your Operating Agreement. Familiarity with Oklahoma state law, or consultation with a legal professional, can help ensure compliance.

Filling out and using an Oklahoma Operating Agreement is a significant step in safeguarding your business and its members. It not only provides a clear framework for the operation of your LLC but also helps ensure that your business practices are in line with state law. Given its importance, drafting this document with care and thorough consideration of the specific needs of your business is essential. In some instances, seeking legal advice can further ensure that your Operating Agreement fully serves its intended purpose.

Create Other Operating Agreement Forms for US States

Llc Filing Fee - They also detail the process for amending the agreement, ensuring the document can evolve with the business.

Florida Llc Operating Agreement - It establishes the LLC’s independence as a business entity, helping to maintain its limited liability status.

Form New Jersey Llc - It's a key tool in defining the financial contributions of members, detailing how profits and losses are distributed within the company.

Operating Agreement for Llc Colorado - It typically describes the process for transferring membership interests, safeguarding the continuity of the business.