Legal Single-Member Operating Agreement Form

For individuals who venture into the business world as solo entrepreneurs, navigating the legalities can often feel like untangling a web of complex rules and requirements. Among the crucial documents that pave the way for a smoother entrepreneurial journey is the Single-Member Operating Agreement form. This form serves as a blueprint for your business, outlining essential operational, financial, and managerial details. It not only provides a comprehensive framework for decision-making and conflict resolution but also establishes the business as a separate entity, which is vital for personal asset protection. Despite operating solo, having this agreement in place can significantly enhance the credibility of your business in the eyes of banks, potential partners, and even within legal contexts. This document, tailored specifically for single-member LLCs, acts as a personal guide through the labyrinth of business ownership, ensuring that all your bases are covered from the outset.

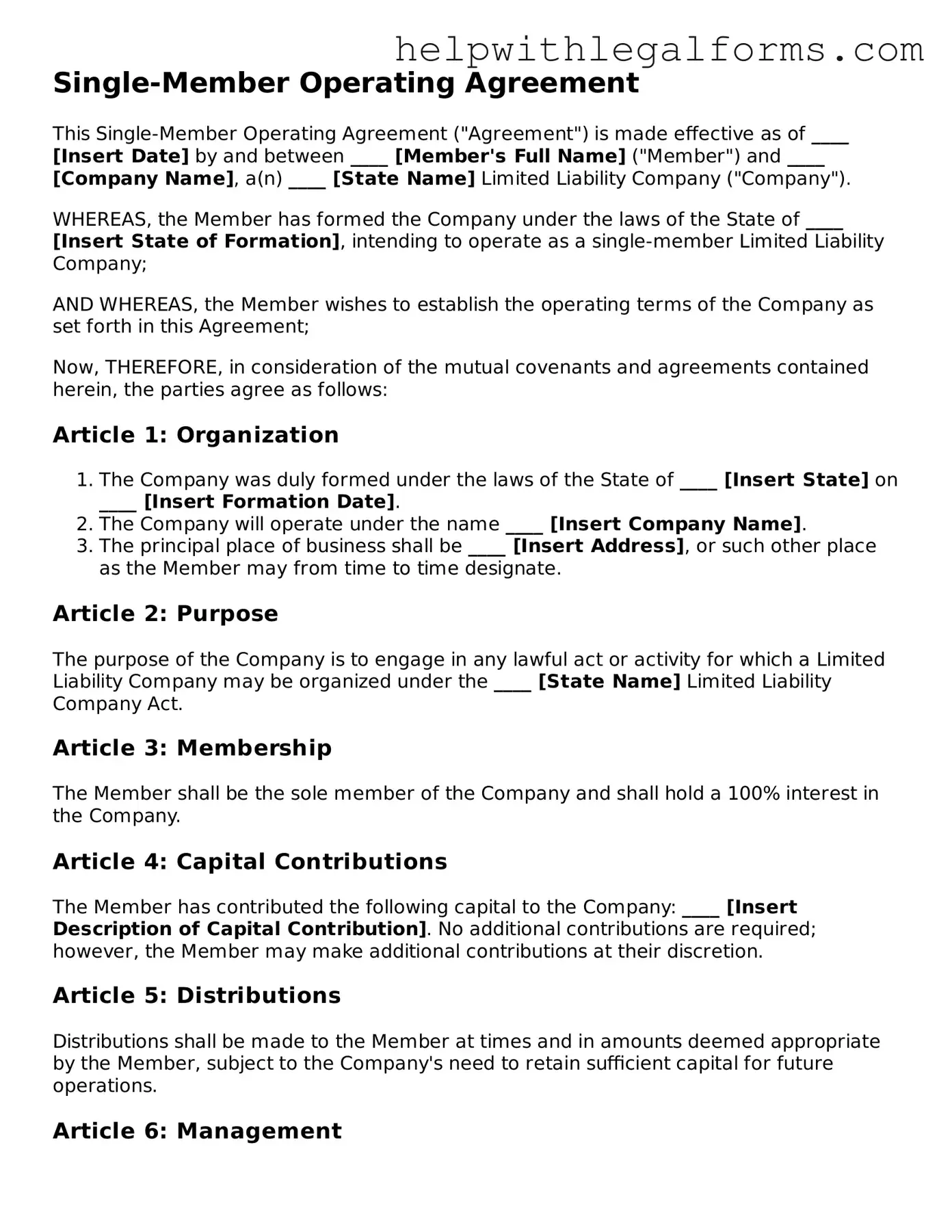

Example - Single-Member Operating Agreement Form

Single-Member Operating Agreement

This Single-Member Operating Agreement ("Agreement") is made effective as of ____ [Insert Date] by and between ____ [Member's Full Name] ("Member") and ____ [Company Name], a(n) ____ [State Name] Limited Liability Company ("Company").

WHEREAS, the Member has formed the Company under the laws of the State of ____ [Insert State of Formation], intending to operate as a single-member Limited Liability Company;

AND WHEREAS, the Member wishes to establish the operating terms of the Company as set forth in this Agreement;

Now, THEREFORE, in consideration of the mutual covenants and agreements contained herein, the parties agree as follows:

Article 1: Organization

- The Company was duly formed under the laws of the State of ____ [Insert State] on ____ [Insert Formation Date].

- The Company will operate under the name ____ [Insert Company Name].

- The principal place of business shall be ____ [Insert Address], or such other place as the Member may from time to time designate.

Article 2: Purpose

The purpose of the Company is to engage in any lawful act or activity for which a Limited Liability Company may be organized under the ____ [State Name] Limited Liability Company Act.

Article 3: Membership

The Member shall be the sole member of the Company and shall hold a 100% interest in the Company.

Article 4: Capital Contributions

The Member has contributed the following capital to the Company: ____ [Insert Description of Capital Contribution]. No additional contributions are required; however, the Member may make additional contributions at their discretion.

Article 5: Distributions

Distributions shall be made to the Member at times and in amounts deemed appropriate by the Member, subject to the Company's need to retain sufficient capital for future operations.

Article 6: Management

The Member shall have sole authority and control over all decisions related to the Company and its operations. The Member may designate agents or employees to perform certain tasks under the direction of the Member.

Article 7: Dissolution

The Company may be dissolved at any time with the written consent of the Member. Upon dissolution, the Company's assets shall be distributed first to satisfy any liabilities, and the remainder, if any, to the Member.

Article 8: Amendments

This Agreement may be altered, amended, or repealed only by the written consent of the Member.

Article 9: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ____ [Insert Governing State] without regard to its conflict of law principles.

IN WITNESS WHEREOF, the Member has executed and adopted this Single-Member Operating Agreement as of the date first above written.

Member: ____________________________________

Name: ____ [Member's Full Name]

Date: ____ [Insert Date]

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement is a legal document that outlines the operational procedures and financial decisions of a limited liability company (LLC) owned by one person. |

| Key Purpose | Its main purpose is to establish the rules and structure of the business, providing clarity on the management and operation while protecting the owner’s personal assets from the company's liabilities. |

| Legal Standing | Even though not all states require it, having it can lend credibility to the business and is important for maintaining the personal liability protection that an LLC provides. |

| State Variations | Different states have unique requirements for what should be included in the agreement, and some may have specific forms to be filled out. |

| Governing Laws | The agreement is governed by state laws where the LLC is registered. Each state has its own set of statutes that outline how LLCs should operate, affecting how Single-Member LLC Operating Agreements are drafted and enforced. |

Instructions on How to Fill Out Single-Member Operating Agreement

A Single-Member Operating Agreement is an important document for an individual owner of an LLC to establish the framework for the business's operations and financial decisions. This agreement outlines the ownership structure, operating procedures, and provides important legal protections for the single member. It's a proactive step towards ensuring the smooth operation of the LLC and safeguarding the owner's interests. To effectively complete this form, follow the steps below carefully.

- Begin by inserting the date the Operating Agreement will become effective.

- Enter the full legal name of the LLC as registered in your state.

- Specify the state in which your LLC was formed and operates.

- Detail the principal place of business including the full address. This should be where the main operations of the LLC occur.

- List the full name of the single member along with their address.

- Outline the capital contributions made by the member. This includes any initial amount paid into the LLC to start the business.

- Clearly state the distribution of profits and losses. As a single-member LLC, this will typically be 100% to the owner but detailing this solidifies financial operations.

- Describe the powers and duties of the member. This section covers the scope of what the member is responsible for within the LLC.

- If applicable, add any clauses related to the dissolution of the LLC. This might include steps to close the business and distribute any remaining assets.

- Have the single member sign and date at the bottom of the document to affirm their agreement to the terms outlined.

Completing the Single-Member Operating Agreement is a critical step for LLC owners to protect their personal assets and establish clear guidelines for the management and financial practices of their business. This document, once filled out, serves as a legal record of the operations and structure of the LLC and should be kept with the business records for future reference.

Crucial Points on This Form

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a document used by the sole owner of a Limited Liability Company (LLC) to outline the business's operational procedures and policies. This agreement serves as an official record that confirms the owner's complete control over the LLC, detailing the management structure, financial decisions, and rules for the business's operation. It's a crucial document to establish personal liability protection, separating the owner's personal assets from the business's liabilities.

Why do I need a Single-Member Operating Agreement if I'm the only member of the LLC?

Even as the sole proprietor within an LLC, having a Single-Member Operating Agreement is beneficial. It enhances your business's credibility by providing a formal structure, which can be advantageous when opening bank accounts or applying for loans. Moreover, it serves as evidence that your business is a separate entity, crucial for protecting your personal assets from business debts or lawsuits.

What key elements should be included in a Single-Member Operating Agreement?

A comprehensive Single-Member Operating Agreement should include the following elements: the formation details of the LLC, its duration, management and operation specifics, allocation of profits and losses, procedures for amending the agreement, and steps for dissolving the business. It can also specify the owner's duties and responsibilities to further clarify the business structure.

Do I need to file my Single-Member Operating Agreement with the state?

In general, you are not required to file your Single-Member Operating Agreement with any government agency. However, having it on file is crucial because it supports the legal and financial separation between the owner and the business. Though not a filed document, it should be kept with your important business records and updated as necessary.

Can a Single-Member Operating Agreement help in tax matters?

Yes, a Single-Member Operating Agreement can assist with tax matters by clearly outlining the business's financial and operational procedures. This clarity can help when you're filing taxes, ensuring that all deductions and credits are correctly claimed. Furthermore, it demonstrates to the IRS that your LLC is a legitimate business, operating separately from your personal interests.

How does a Single-Member Operating Agreement protect me personally?

This agreement establishes your LLC as a separate legal entity, which is key to protecting your personal assets (like your home, car, and personal savings) from business debts and legal actions. In the absence of this document, it might be easier for a court to pierce the corporate veil and hold you personally liable for business obligations.

Where can I get a Single-Member Operating Agreement?

You can draft a Single-Member Operating Agreement yourself, use online templates as a guide, or consult with a legal professional to create a customized agreement that fits your specific business needs. A tailored agreement ensures that all aspects of your business are covered comprehensively, providing a strong foundation for your business operations.

Common mistakes

When filling out a Single-Member Operating Agreement form, it's crucial to pay close attention to detail and to understand each section. Common mistakes can lead to misunderstandings or legal issues down the line. Here are five mistakes frequently encountered:

Not Fully Reading the Agreement Before Signing: One of the biggest mistakes is not thoroughly reading the entire agreement before signing. This may lead to agreeing to terms that are not fully understood or beneficial.

Incorrect Business Information: Providing incorrect business information, such as the wrong business name, address, or EIN, can invalidate the agreement or cause legal complications.

Omitting Required Signatures or Dates: Sometimes, individuals forget to sign or date the agreement. This oversight can lead to the document being considered invalid or unenforceable.

Not Tailoring the Agreement to Specific Needs: A single-member operating agreement can and should be customized to meet the unique needs of the business. Using a generic template without modifications may not fully protect the member’s interests or intentions.

Failing to Update the Agreement: As a business evolves, so should its operating agreement. Not updating the agreement to reflect changes in the business structure or operations is a common oversight that can lead to discrepancies and legal challenges.

In conclusion, while a Single-Member Operating Agreement form seems straightforward, careful attention to detail is essential. Avoiding these mistakes ensures the document is valid, enforceable, and reflective of the single member's intentions and the business needs.

Documents used along the form

When starting or running a single-member limited liability company (LLC), a Single-Member Operating Agreement is crucial. Yet, this critical document is often just one piece of the paperwork puzzle. Various other forms and documents complement or are necessary alongside it to ensure the smooth operation, compliance, and protection of your business. Here is a list of up to 10 important forms and documents that are commonly used together with a Single-Member Operating Agreement.

- Articles of Organization: Officially form and register your LLC with the state. This is the very first step in establishing your business's legal existence.

- Employer Identification Number (EIN) Application: Apply for an EIN from the IRS for tax purposes, even if you don't plan to hire employees immediately.

- Operating Agreement: Though you're a single-member LLC, having this sets forth rules for the operation of your business and outlines your financial and functional decisions.

- Business License Application: Depending on your business type and location, you might need one or more business licenses to operate legally.

- Sales Tax Permit: If you sell goods or services that are taxable, your state may require you to obtain this permit.

- Zoning Permits: Ensure that your business location complies with local zoning laws, crucial for businesses with a physical presence.

- Home Occupation Permit: If you're running your business from home, this permit allows you to operate in a residential area legally.

- Trademark Registration: Protect your brand and logo by registering them as trademarks with the USPTO.

- Annual Report Filing: Most states require LLCs to file an annual report to keep their legal status active.

- Business Bank Account Documentation: Separates your personal finances from your business finances, which is vital for protection and organization.

Each of these documents plays a vital role in establishing, protecting, and maintaining a single-member LLC. They work together to ensure your business aligns with legal requirements, operates smoothly, and thrives in its market. Understanding and having the right documentation in place is key to setting a solid foundation for your business's future success.

Similar forms

Partnership Agreement: Similar to a Single-Member Operating Agreement, a Partnership Agreement outlines the operations of a business, but it does so for businesses with two or more owners instead of just one. It specifies the rights, responsibilities, and share of profits (or losses) among the partners.

Shareholder Agreement: This document is used by corporations whereas a Single-Member Operating Agreement is for a sole proprietor with a limited liability company (LLC). Both agreements detail the management structure of the business and the distribution of profits, but a Shareholder Agreement applies to shareholders of a corporation.

Bylaws: Bylaws are for corporations much like how the Single-Member Operating Agreement serves an LLC. Both set out the rules and regulations for the business's internal governance, but bylaws are tailored to corporate operations, detailing procedures for meetings, elections, and other corporate actions.

Sole Proprietorship Declaration: This is a simple statement of business ownership and intent, used by sole proprietors without creating an LLC. While the Single-Member Operating Agreement also establishes sole ownership, it goes further by detailing operational practices and liability protections inherent to an LLC.

Employment Agreement: Though distinct in purpose, an Employment Agreement shares similarities with a Single-Member Operating Agreement because it outlines terms between parties—in this case, between an employer and an employee. Both documents detail conditions like duties, responsibilities, and compensation, although the Single-Member Operating Agreement focuses on owner relations with the LLC instead of with an employee.

Franchise Agreement: This agreement is between a franchisor and franchisee, specifying how the franchisee can operate under the franchisor's brand. It's similar to a Single-Member Operating Agreement in that it outlines business operations, roles, and financial arrangements. However, the Single-Member Operating Agreement applies to an individual's LLC business operations, not a franchise setup.

Dos and Don'ts

Filling out a Single-Member Operating Agreement is an important step in establishing the legal framework for your sole proprietorship within an LLC structure. To ensure that this document reflects your business accurately and provides the protection you need, consider the following dos and don'ts during the process:

Do:

- Review state requirements: Before drafting your agreement, ensure you understand your state's specific regulations and requirements for single-member LLCs. This foundational step helps ensure your agreement is both compliant and enforceable.

- Include detailed information: Your operating agreement should clearly outline the ownership structure, management details, and specific roles within the company, even if you are the sole member. This clarity can be crucial for future legal or business needs.

- Plan for future changes: Life is unpredictable. Including provisions for adding members, selling the business, or what happens in the event of your incapacity can save considerable headache and legal trouble down the line.

- Sign and date the document: A common oversight is failing to properly execute the operating agreement. Ensure it is signed and dated, as this formalizes the agreement and validates its commencement.

- Keep it accessible: After completing your Single-Member Operating Agreement, store it in a safe, easily accessible place. While not always required to be filed with the state, having it readily available for banks, legal disputes, or tax matters is essential.

Don't:

- Use overly complex language: While it may be tempting to make your agreement sound "legal," clarity should be your primary goal. Use clear, straightforward language to ensure the document is easily understood by all who might read it.

- Overlook important clauses: Certain clauses, such as dissolution procedures or what happens in the event of a legal dispute, might seem unnecessary for a single-member LLC. However, these provisions protect your interests and should not be overlooked.

- Forget to update the document: As your business evolves, so should your Operating Agreement. Forgetting to update it to reflect changes in your business structure, operations, or state law can lead to confusion or legal issues later.

- Rely solely on templates: While templates can be a helpful starting point, relying on them without customization to your specific business needs can result in a less effective agreement. Ensure your document is tailored to your unique situation.

- Assume it's unnecessary: Some business owners may think a Single-Member Operating Agreement is unnecessary since there are no partners. However, this document plays a critical role in legal and financial protection, and its importance should not be underestimated.

Misconceptions

When considering the structure and management of a single-member LLC, a Single-Member Operating Agreement form is often surrounded by misconceptions. These misunderstandings can significantly impact the LLC's operational clarity and legal protection. Below are seven common misconceptions regarding the Single-Member Operating Agreement, clarified to ensure individuals are well-informed.

- It's not legally required. While it's true that not all states mandate the creation of an Operating Agreement for a single-member LLC, this document is crucial for defining the business structure, operations, and the owner's liability. It provides a clear framework for the business and can be vital for protecting personal assets.

- It's only necessary if you have employees. This misconception overlooks the fundamental purpose of the Operating Agreement. Regardless of having employees, the agreement serves to establish the rules and protocols for the business, helping to manage expectations and obligations legally and financially.

- A generic form is sufficient. While using a generic form as a starting point is not inherently wrong, every single-member LLC has unique aspects that might not be adequately covered by a one-size-fits-all document. Customizing the agreement to reflect the specific needs and operations of the business is advisable.

- It doesn't impact taxes. The Operating Agreement itself may not directly change how a business is taxed, but it can include vital details about the management of finances, distributions, and profits that could affect tax planning and obligations. Clearly defining financial procedures can aid in accurate tax reporting.

- It's too complex to update. While the document may be comprehensive, it is designed to be amendable to accommodate the growth and changes within the business. An Operating Agreement should evolve alongside the company, and updates should be made to reflect current operations and goals.

- It's the same as forming an LLC. Forming an LLC with the state is a separate process from creating an Operating Agreement. The former is about legally establishing the business, while the latter deals with the internal operations and owner’s responsibilities within the company.

- Only the owner needs to review it. Although the single-member is the primary individual concerned, having a legal professional review the Operating Agreement can ensure that all provisions are in the owner’s best interest and that the document complies with current laws and practices. Additionally, potential investors or financial institutions might also review this agreement to understand the business structure.

By addressing these misconceptions, individuals can better appreciate the importance of a Single-Member Operating Agreement and how it serves to protect both them and their business. Properly drafting and understanding this document forms the bedrock of a well-organized legal and operational structure for the LLC.

Key takeaways

When you embark on the journey of setting up a single-member LLC, one essential document that you should be familiar with is the Single-Member Operating Agreement. This agreement may seem like just another piece of paperwork, but it's actually a powerful tool that can provide you with substantial protection and clarity. Here are some key takeaways about filling out and using the Single-Member Operating Agreement form:

- Provides Legal Protection: By outlining the operational procedures and rules of your business, the Single-Member Operating Agreement can help in safeguarding your personal assets from your business liabilities. This separation is crucial in maintaining the limited liability feature of an LLC.

- Establishes the Business as a Separate Entity: Having this agreement in place reinforces the distinction between you as an individual and your business. This is important not only for legal protection but also in dealings with banks, creditors, and in legal proceedings.

- Clarifies Succession Planning: It allows you to specify what happens to the business should you become unable to run it due to death or incapacitation. This clarity can be invaluable for ensuring the smooth continuation or dissolution of your business according to your wishes.

- Flexible to Fit Your Needs: The Single-Member Operating Agreement can be customized to suit the specific needs of your business. Unlike the more rigid bylaws that corporations need to adhere to, this agreement offers flexibility in governance and operations of your LLC.

- Helps Open Business Accounts: Financial institutions often require an operating agreement when opening a bank account in the name of the LLC. This document demonstrates that the business is properly organized and authorized to do business.

- State Requirements Vary: While not all states require an LLC to have an Operating Agreement, it is still highly recommended to have one. Moreover, understanding and complying with your state's specific requirements can save you from potential legal challenges down the line.

In conclusion, the Single-Member Operating Agreement is not just a formality; it's a crucial document that supports the structure, operation, and integrity of your LLC. Taking the time to draft this agreement thoughtfully can save you from a lot of hurdles and uncertainties in the future. Remember, peace of mind in business operations often starts with having the right documentation in place.