Blank Operating Agreement Form for Texas

Starting a business in Texas often leads to the formation of a Limited Liability Company (LLC), a popular choice for entrepreneurs due to its flexibility and protection for its members' personal assets. Central to the efficient operation and legal health of an LLC is the Texas Operating Agreement form, even though the state does not legally require it. This document serves multiple critical functions: it outlines the ownership structure, delineates the distribution of profits and losses, sets forth procedures for adding or removing members, and details the managerial structure and operational protocols. By establishing clear rules and expectations for all members, the Operating Agreement plays a pivotal role in preventing disputes and ensuring the LLC operates smoothly. Furthermore, although Texas does not mandate having this agreement, drafting one can provide substantial legal protection and clarity for business operations, making it an invaluable tool for LLCs in the state.

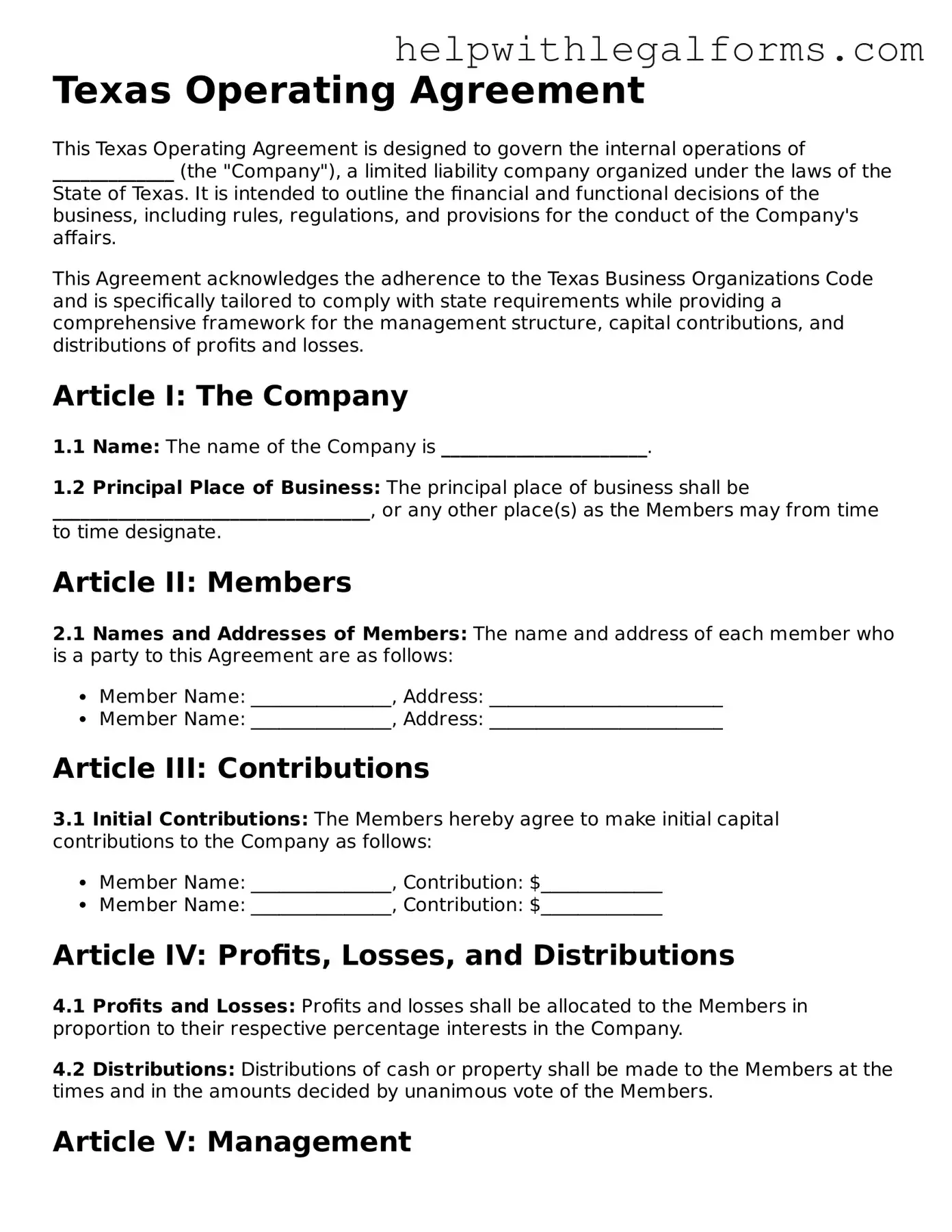

Example - Texas Operating Agreement Form

Texas Operating Agreement

This Texas Operating Agreement is designed to govern the internal operations of _____________ (the "Company"), a limited liability company organized under the laws of the State of Texas. It is intended to outline the financial and functional decisions of the business, including rules, regulations, and provisions for the conduct of the Company's affairs.

This Agreement acknowledges the adherence to the Texas Business Organizations Code and is specifically tailored to comply with state requirements while providing a comprehensive framework for the management structure, capital contributions, and distributions of profits and losses.

Article I: The Company

1.1 Name: The name of the Company is ______________________.

1.2 Principal Place of Business: The principal place of business shall be __________________________________, or any other place(s) as the Members may from time to time designate.

Article II: Members

2.1 Names and Addresses of Members: The name and address of each member who is a party to this Agreement are as follows:

- Member Name: _______________, Address: _________________________

- Member Name: _______________, Address: _________________________

Article III: Contributions

3.1 Initial Contributions: The Members hereby agree to make initial capital contributions to the Company as follows:

- Member Name: _______________, Contribution: $_____________

- Member Name: _______________, Contribution: $_____________

Article IV: Profits, Losses, and Distributions

4.1 Profits and Losses: Profits and losses shall be allocated to the Members in proportion to their respective percentage interests in the Company.

4.2 Distributions: Distributions of cash or property shall be made to the Members at the times and in the amounts decided by unanimous vote of the Members.

Article V: Management

5.1 Management of the Company: The Company shall be managed by its Members. Each Member shall have authority and control over the business to the extent of their ownership interest.

Article VI: Miscellaneous

6.1 Amendments: This Operating Agreement can only be amended with the written consent of all the Members.

6.2 Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

Signatures

In witness whereof, the undersigned have executed this Operating Agreement as of the ___ day of ___________, 20__.

- Member Name: _______________ Signature: ________________________

- Member Name: _______________ Signature: ________________________

PDF Form Attributes

| Fact | Detail |

|---|---|

| Definition | An Operating Agreement is a legal document outlining the governance and operating procedures of a Limited Liability Company (LLC) in Texas. |

| Governing Law | The Texas Business Organizations Code governs the creation and operation of LLCs and their Operating Agreements within the state of Texas. |

| Requirement | While Texas law does not mandate LLCs to have an Operating Agreement, it is highly recommended to create one. |

| Purpose | It serves to establish the financial and operational decisions of the business, including rules, regulations, and provisions for the structure of the LLC. |

| Flexibility | The Operating Agreement allows LLC members to structure their financial and working relationships in the most beneficial way for the business. |

| Legal Status | An Operating Agreement is an internal document and is not filed with the state of Texas, but it is legally binding among the members of the LLC. |

| Protection | A well-crafted Operating Agreement can help protect members’ personal assets from the LLC’s debts and liabilities. |

Instructions on How to Fill Out Texas Operating Agreement

After deciding to form an LLC in Texas, one of the critical steps is completing the Operating Agreement. This document outlines the operational procedures, financial distributions, and management structure among members of the LLC. Ensuring it is filled out correctly is paramount. By following the steps detailed below, individuals can accurately complete the Texas Operating Agreement form, paving the way for a clear operational path for their LLC. This process requires attention to detail and clear communication among all members involved.

- Compile all necessary information about the LLC, including the company name, the primary place of business, and the names and addresses of all members.

- Define the LLC's management structure. Decide whether it will be member-managed or manager-managed and document the decision in the Operating Agreement.

- Determine the LLC's fiscal year and how profits and losses will be distributed among members. This should be in alignment with discussions among members and should be clearly stated to prevent future disputes.

- Outline the process for adding or removing members to ensure continuity and clarity within the business operations.

- Specify any contributions made by members, including capital, property, or services, and document how and when these contributions were made.

- Agree upon the voting rights of each member, including how decisions will be made and the process for resolving disputes.

- Include a dissolution clause detailing how the LLC will be dissolved if necessary. This should cover asset distribution, obligation settlement, and the required vote for dissolution.

- Review the Operating Agreement with all members present to ensure accuracy and understanding. Any changes required should be made at this time.

- Ensure all members sign the Operating Agreement. Keep this document with the LLC’s records and distribute copies to all members.

Once the Operating Agreement is completed, this will not be the end of the road for setting up an LLC. The next steps involve registering the LLC with the state of Texas and complying with any applicable state regulations. This may include obtaining necessary permits, licenses, and ensuring ongoing compliance with state law. Though the journey to establish an LLC involves several steps, a thoroughly completed Operating Agreement is a cornerstone for a well-structured business.

Crucial Points on This Form

What is a Texas Operating Agreement?

An Operating Agreement is a legal document outlining the governing structure and operating procedures of an LLC in Texas. It covers the rights, duties, and obligations of the members and managers, the distribution of profits and losses, procedures for adding or removing members, and the steps for dissolving the business. Although not legally required in Texas, having one is highly recommended for clarity and protection of the LLC members.

Do I need an Operating Agreement for my Texas LLC?

While Texas law does not mandate the creation of an Operating Agreement for LLCs to operate, it's strongly advised to have one. This document provides a clear framework for the operation of your LLC, helps in resolving internal disputes, and protects your business’s limited liability status, ensuring that your personal assets are separated from those of the business.

Can I write an Operating Agreement by myself?

Yes, you can draft an Operating Agreement on your own; however, it's advisable to consult with a legal professional. This ensures that your agreement complies with Texas laws and addresses all necessary aspects of your business’s operation. A well-crafted Operating Agreement can also help in preventing future disputes or misunderstandings among members.

What are the key components to include in a Texas Operating Agreement?

A comprehensive Operating Agreement should include the LLC’s name and primary address, members’ contribution and ownership percentages, voting rights and responsibilities, management structure, process for distributing profits and losses, rules for meetings and votes, provisions for adding or removing members, and guidelines for dissolving the LLC.

How does an Operating Agreement protect the members of an LLC?

An Operating Agreement safeguards LLC members by setting clear expectations and roles, which helps prevent conflicts. It also establishes the LLC as a separate business entity, which is crucial for protecting members' personal assets from the business’s liabilities. Furthermore, it provides legal documentation that can be useful in court to support the members' intentions and the LLC’s operational structure.

Can an Operating Agreement be modified?

Yes, an Operating Agreement can be modified if all members agree to the changes. The agreement should outline the process for amendments, typically requiring a certain percentage of votes. It's important to keep the Operating Agreement up-to-date to reflect the current structure and policies of the LLC, as well as compliance with any changes in Texas law.

Where should the Operating Agreement be stored?

While the Operating Agreement doesn't need to be filed with the state, it should be kept in a safe location where all members can access it. Common storage places include with your other important business documents, with a legal advisor, or in a secure digital format. This ensures that the document can be referenced or amended as needed.

Common mistakes

When individuals or entities fill out the Texas Operating Agreement form, making mistakes can lead to significant legal complications and financial risks for all parties involved in the limited liability company (LLC). Understanding these common errors can help ensure the agreement is correctly executed, fulfilling its role to govern the LLC's operations in a manner that protects all members' interests. The following are some of the frequently made mistakes:

Not fully completing the form. Sometimes, parts of the agreement may be left blank, either inadvertently or intentionally, due to uncertainty on how to answer. This oversight can lead to ambiguities or disputes among members about the LLC’s operations and management.

Failure to detail the distribution of profits and losses. Often, the agreement may not specify how profits and losses are to be allocated among members. Without clear definitions, disagreements can arise, potentially leading to legal disputes and putting the LLC's operation at risk.

Omitting the description of members' responsibilities. It is crucial to clearly delineate the roles, responsibilities, and powers of each member. Neglect can result in mismanagement and inefficiencies, adversely affecting the LLC's performance and profitability.

Ignoring the procedures for adding or removing members. Many operating agreements fail to outline the specific processes for how new members can join the LLC or how current members can exit. This oversight can lead to confusion and conflict when such situations inevitably arise.

Not updating the agreement. An operating agreement is not a set-it-and-forget-it document. As the business evolves, so too should the agreement. Failing to update it to reflect changes in the company's structure, strategy, or operations can make the document obsolete and irrelevant.

It is essential for those involved in completing the Texas Operating Agreement form to approach this task with diligence and attention to detail. Consulting with legal counsel can help ensure that the document is accurately filled out and fully serves its purpose of safeguarding the LLC and its members' interests.

Documents used along the form

When setting up a business in Texas, especially a Limited Liability Company (LLC), an Operating Agreement form is crucial. However, to ensure the business is fully compliant and operational, several other forms and documents are often required. Below is a list of documents frequently used alongside the Texas Operating Agreement form. These documents cover a range of needs from formation to tax compliance, and operational licenses, providing a comprehensive view of the paperwork needed.

- Articles of Organization: This is the primary document needed for registering an LLC with the Texas Secretary of State. It contains essential information about the business, including its name, address, and the names of its members.

- Employer Identification Number (EIN): Issued by the IRS, the EIN is required for tax administration purposes. It's necessary for hiring employees, opening a bank account, and filing company taxes.

- Franchise Tax Registration: Texas LLCs may need to register for Franchise Tax, which is based on the LLC’s earnings. This registration is essential for tax compliance within the state.

- Operating Permits and Licenses: Depending on the business type and its location, various permits and licenses may be necessary to operate legally within the city or county.

- Buy-Sell Agreement: This document outlines what happens to a member's interest in the LLC if they wish to leave the company, pass away, or become incapacitated.

- Membership Certificates: Even though not legally required, issuing membership certificates to the owners can formalize the ownership structure within the LLC.

- Company Resolution to Open a Bank Account: Banks often require a specific resolution from the LLC’s members authorizing the opening of a bank account in the company's name.

- Annual Report: Some states require LLCs to file an annual report. While Texas does not require an annual report for LLCs, keeping regular records of business activities is recommended.

- Minute Book: A collection of documents including the Operating Agreement, meeting minutes, and other vital company records. Although not filed with the state, it's crucial for maintaining corporate veil protection.

- Loan Agreements: If the business plans to borrow money, loan agreements outline the terms and conditions of such arrangements, protecting both the lender and the borrower’s interests.

While the Texas Operating Agreement is a key document for any LLC, the complementary documents listed above are also vital for the legal and successful operation of a business. Entrepreneurs should ensure they gather and properly file these documents to avoid any legal or operational issues down the line.

Similar forms

An Articles of Incorporation document is similar to the Operating Agreement in that both establish the framework for a business entity. The Articles of Incorporation, however, are used to legally form a corporation, while the Operating Agreement outlines the operations of a Limited Liability Company (LLC). Despite their differences, they share the purpose of providing a structured outline for the governance of the business.

A Partnership Agreement also shares similarities with an Operating Agreement as it details the arrangements between partners involved in a business venture. Both documents include provisions for the management structure, distribution of profits and losses, and the procedure for resolving disputes. However, a Partnership Agreement is tailored for businesses operated by two or more individuals who are not forming an LLC.

Similarly, a Shareholder Agreement outlines the relationships between the shareholders of a corporation, which parallels the function of an Operating Agreement that governs the relationship among members of an LLC. Both address key operational concerns such as the transfer of ownership, voting rights, and distribution of dividends. The key distinction lies in the type of business structure they are designed for.

The Bylaws of a corporation serve a purpose similar to that of an Operating Agreement, in that they set forth the internal rules and procedures for the governance of the entity. Bylaws are to a corporation what the Operating Agreement is to an LLC, detailing the rights and responsibilities of directors, officers, and stockholders, compared to the members of an LLC.

Finally, a Buy-Sell Agreement is comparable to certain provisions within an Operating Agreement that deal with the transfer of an owner's interest in the company. While a Buy-Sell Agreement is specifically focused on the conditions under which ownership may change hands, such as the retirement, death, or exit of a business owner, the Operating Agreement may encompass broader operational guidelines in addition to addressing the transfer of member interests.

Dos and Don'ts

When filling out a Texas Operating Agreement form, several essential do's and don'ts should be followed to ensure that the document accurately reflects the understanding and agreement between the members of a Limited Liability Company (LLC). Adhering to these guidelines can protect the interests of all parties involved and help avoid potential legal complications in the future.

Do's:

- Review state requirements: Before you start, ensure you're familiar with Texas state regulations regarding LLC operating agreements to ensure your document is compliant.

- Be clear and specific: Use precise language to describe the roles, responsibilities, rights, and obligations of each member to prevent misunderstandings.

- Include all relevant details: Cover all aspects of the business, such as capital contributions, profit distribution, and procedures for adding or removing members.

- Consult with all members: Ensure that all members review the draft before it’s finalized to confirm that it accurately represents their intentions and agreements.

- Seek professional advice: Consider consulting with a legal or financial advisor to ensure that the operating agreement is comprehensive and adheres to state laws.

- Sign and date the document: Have all members sign the operating agreement to validate its enforceability and keep it on file with your LLC records.

- Update as necessary: Review and update the operating agreement as the business evolves or as members change to ensure it remains relevant and accurate.

Don'ts:

- Overlook state-specific requirements: Do not ignore the specific legal requirements and guidelines provided by Texas law for LLC operating agreements.

- Use vague language: Avoid terms and phrases that are open to interpretation to minimize the risk of disputes among members.

- Exclude any members: Make sure that every member has the opportunity to review and contribute to the operating agreement to ensure fairness and inclusivity.

- Forget to address dispute resolution: Do not leave out provisions for resolving disputes among members; this is crucial for managing disagreements efficiently.

- Rely solely on template forms: While templates can be a useful starting point, relying entirely on them without customization to your specific business can lead to gaps in your agreement.

- Skip the details of financial arrangements: Failing to clearly outline financial contributions, distributions, and procedures for financial decision-making can lead to conflicts later.

- Fail to update the document: Do not treat the operating agreement as a static document; it should evolve with your business and reflect any significant changes in membership or operation.

Misconceptions

When entrepreneurs in Texas embark on the exciting journey of forming a Limited Liability Company (LLC), they might have preconceived notions about the Operating Agreement that governs the operation of their business. It's important to clarify some common misconceptions to ensure they are setting their LLC up for success.

Misconception 1: An Operating Agreement isn't necessary in Texas. Many believe that since Texas law doesn't require an LLC to have an Operating Agreement, it's an optional document. However, this underestimates its importance. An Operating Agreement is crucial as it outlines the governance and financial arrangements between the members, helping prevent misunderstandings and providing a clear framework for resolving disputes.

Misconception 2: A standard template is sufficient for all businesses. While the internet is flooded with one-size-fits-all Operating Agreement templates, relying solely on these generic documents can be a misstep. Every business is unique in its structure, operations, and goals. Tailoring the Operating Agreement to fit specific business needs can protect the interests of all members more effectively.

Misconception 3: Only multi-member LLCs need an Operating Agreement. This misconception could lead single-member LLC owners to overlook the value of having an Operating Agreement. Even for a single-member LLC, an Operating Agreement can delineate the structure of the business, solidify the separation between personal and business assets, and enhance the credibility of the business in the eyes of banks and other institutions.

Misconception 4: Once created, the Operating Agreement doesn't need to be revisited. Just as a business evolves over time, so too should its Operating Agreement. It's wise to review and potentially update the Agreement to reflect changes in the business structure, member roles, or operational procedures. This ensures the document remains relevant and continues to serve its purpose effectively.

Understanding these misconceptions is the first step toward recognizing the critical role of an Operating Agreement in the successful operation of a Texas LLC. While starting a business is an exciting venture, ensuring that its foundational documents are in order can significantly contribute to its long-term stability and success.

Key takeaways

The Texas Operating Agreement form plays a crucial role in defining the operating procedures and structure of a Limited Liability Company (LLC) within the state of Texas. Understanding how to properly fill out and use this document is essential for any business owner seeking to establish an LLC. Here are six key takeaways to guide you through this process:

- Filling out the Texas Operating Agreement requires thorough attention to detail. Every aspect of the LLC’s operations, from the allocation of profits and losses to the roles and responsibilities of members, must be clearly outlined to ensure smooth functioning.

- The Operating Agreement is not filed with the state. Unlike the Articles of Organization, the Texas Operating Agreement is an internal document. However, having it on hand is vital for legal protection and clarity over the business's internal operations.

- Although Texas law does not mandate an LLC to have an Operating Agreement, drafting one is considered best practice. This document provides a clear framework for business operations and helps prevent potential disputes among members by setting out clear rules and expectations.

- Customization is key. The Texas Operating Agreement should be tailored to fit the specific needs of your LLC. Avoid using a one-size-fits-all approach, as this might not comprehensively cover your LLC’s unique aspects.

- Make sure to include provisions for changes or amendments. As your business evolves, your Operating Agreement may need updates. Having a process in place for making amendments ensures that the document remains relevant and up-to-date.

- Seek professional advice. While filling out the Texas Operating Agreement, it’s highly recommended to consult with a legal expert. They can provide insights and guidance to ensure that the agreement complies with Texas laws and adequately protects your interests.

Correctly drafting the Texas Operating Agreement lays a solid foundation for your LLC, fostering a structured and harmonious business environment. Always ensure that every member reviews and agrees to the Operating Agreement before finalizing it, to guarantee that it reflects a mutual understanding of how the business should be run.

Create Other Operating Agreement Forms for US States

Form New Jersey Llc - The Operating Agreement form enables the designation of a managing member, streamlining management tasks and responsibilities.

Florida Llc Operating Agreement - This document serves as a formal agreement between members of an LLC, detailing roles, responsibilities, and financial arrangements.