Legal Power of Attorney Form

In navigating life's unpredictable nature, individuals often find peace of mind by ensuring their affairs, especially legal and financial, are managed according to their wishes even if they are unable to oversee them personally. This foresight leads to the creation and utilization of a Power of Attorney form, an essential legal document that authorizes another person, known as the agent or attorney-in-fact, to make decisions and act on behalf of the principal. The versatility of this form lies in its ability to be tailored to specific needs, ranging from broad, general authority over all affairs to limited, singular transactions. With variations like durable, springing, medical, or financial, the Power of Attorney is designed to fit different scenarios, each with its stipulations and duration. Its establishment requires adherence to state laws, ensuring the document's validity and the protection of the interests of all parties involved. By providing a legal pathway for delegated decision-making, the Power of Attorney form plays a crucial role in personal and estate planning strategies, ensuring that an individual's health, legal, and financial preferences are respected and implemented according to their precise wishes.

State-specific Power of Attorney Forms

Power of Attorney Document Subtypes

Example - Power of Attorney Form

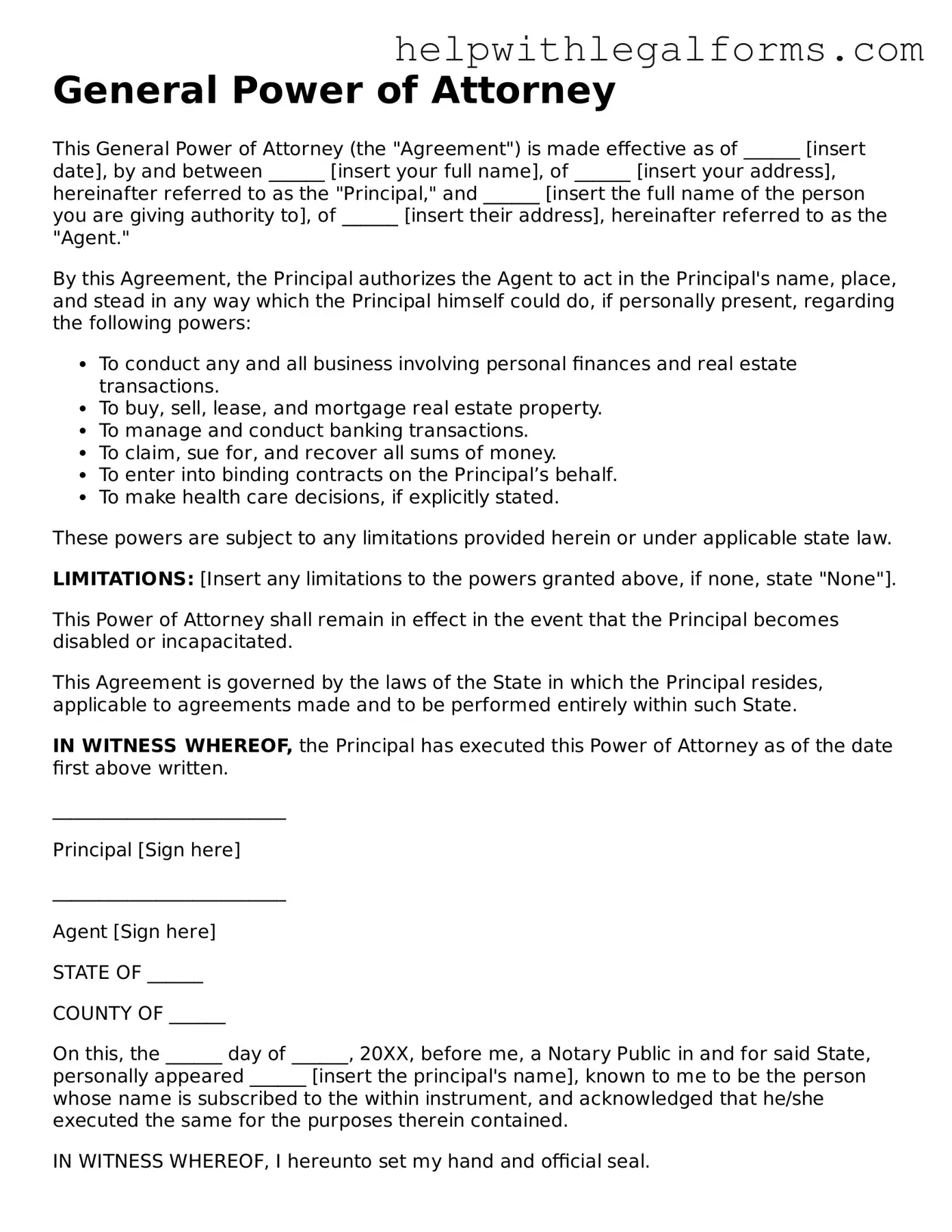

General Power of Attorney

This General Power of Attorney (the "Agreement") is made effective as of ______ [insert date], by and between ______ [insert your full name], of ______ [insert your address], hereinafter referred to as the "Principal," and ______ [insert the full name of the person you are giving authority to], of ______ [insert their address], hereinafter referred to as the "Agent."

By this Agreement, the Principal authorizes the Agent to act in the Principal's name, place, and stead in any way which the Principal himself could do, if personally present, regarding the following powers:

- To conduct any and all business involving personal finances and real estate transactions.

- To buy, sell, lease, and mortgage real estate property.

- To manage and conduct banking transactions.

- To claim, sue for, and recover all sums of money.

- To enter into binding contracts on the Principal’s behalf.

- To make health care decisions, if explicitly stated.

These powers are subject to any limitations provided herein or under applicable state law.

LIMITATIONS: [Insert any limitations to the powers granted above, if none, state "None"].

This Power of Attorney shall remain in effect in the event that the Principal becomes disabled or incapacitated.

This Agreement is governed by the laws of the State in which the Principal resides, applicable to agreements made and to be performed entirely within such State.

IN WITNESS WHEREOF, the Principal has executed this Power of Attorney as of the date first above written.

_________________________

Principal [Sign here]

_________________________

Agent [Sign here]

STATE OF ______

COUNTY OF ______

On this, the ______ day of ______, 20XX, before me, a Notary Public in and for said State, personally appeared ______ [insert the principal's name], known to me to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

_________________________

Notary Public

My commission expires: ______

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) form is a legal document that grants one person or entity the authority to act on another person's behalf in legal and financial matters. |

| Types | Common types include General, Durable, Special or Limited, and Health Care POAs, each serving different purposes and granting varying levels of authority. |

| Durability | A Durable Power of Attorney remains in effect even if the principal becomes mentally incapacitated, whereas a non-durable POA does not. |

| State-Specific Forms | POA forms must comply with the laws of the state where it will be used. This can include specific signing requirements and witness or notarization rules. |

| Execution Requirements | Depending on the state, executing a POA may require witnessing, notarization, or both. Some states have very specific requirements regarding who must be present. |

| Revocation | The principal can revoke a POA at any time as long as they are mentally competent, through a written notice to the agent and any relevant third parties. |

| Governing Laws | Each state has its own statutes that govern the creation, use, and termination of POAs. These laws outline the legal requirements and protections for both the principal and the agent. |

Instructions on How to Fill Out Power of Attorney

Filling out a Power of Attorney form is a significant step in ensuring your affairs are managed according to your wishes, should you become unable to do so yourself. This process can seem daunting, but by following these steps, you will be able to complete the form accurately and effectively. It's important to approach this task with clear information and to seek assistance if needed to ensure your intentions are properly documented and recognized.

- Gather all necessary personal information, including your full legal name, address, and identification details, as well as those of the person you are appointing as your attorney.

- Read through the whole form before beginning to fill it out, to understand all the requirements and sections you need to complete.

- Fill in your details in the designated section at the beginning of the form. Ensure that your name and address are entered exactly as they appear on your official documents.

- In the section labeled “Attorney,” input the full legal name, address, and contact details of the person you are choosing to act on your behalf. It's crucial that these details are accurate to avoid any future confusion or legal issues.

- Specify the powers you are granting to your attorney. This could include making financial decisions, managing real estate, or handling business transactions. Be clear and precise in your language to prevent misinterpretation.

- If the form allows, outline any limitations to the powers you are granting. This might include restrictions on selling property or limits on the duration of the power of attorney.

- Look for a section regarding the effective date and duration of the power of attorney. Fill in the date from which the document will become effective, and, if applicable, when it will expire.

- Review the requirement for witnesses. Many states require that the signing of a Power of Attorney be witnessed by one or more impartial individuals. Ensure you understand these requirements to make your document legally binding.

- Sign the form in the presence of a notary, if required. The necessity of notarization varies by state, but it generally adds a layer of legal assurance to the document.

- Give a copy of the completed form to your attorney-in-fact and keep several copies in a safe place. Inform a trusted family member or friend where you store the document.

After completing these steps, your Power of Attorney form will be ready to use. It's a proactive measure to ensure your matters are managed seamlessly, even in your absence. Remember, the document can be updated or canceled at any time, provided you are competent to do so. Regular reviews and updates to your Power of Attorney can help keep it aligned with your current wishes and circumstances.

Crucial Points on This Form

What is a Power of Attorney form?

A Power of Attorney (POA) form is a legal document that allows one person (the principal) to appoint another person (the agent or attorney-in-fact) to make decisions or take actions on their behalf. These decisions can range from financial matters, such as managing bank accounts, to health care decisions, depending on the type of POA.

How do I choose someone to act as my Power of Attorney?

Choosing someone to act as your Power of Attorney is a significant decision. You should select someone you trust completely since they will have considerable control over your affairs. It could be a family member, a close friend, or a trusted advisor. Consider their ability to handle financial matters, their proximity to where you live (for handling day-to-day matters), and how well they understand your wishes.

Are there different types of Power of Attorney?

Yes, there are several types of Power of Attorney, each serving different purposes. A General Power of Attorney grants broad powers to the agent in matters ranging from financial to personal affairs. A Limited or Special Power of Attorney provides the agent with powers for a specific task or for a limited time. A Healthcare Power of Attorney allows the agent to make medical decisions on behalf of the principal, and a Durable Power of Attorney remains in effect if the principal becomes incapacitated.

Can a Power of Attorney be revoked?

Yes, a Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. This revocation should be done in writing, and all parties who were given a copy of the original POA should be notified. Additionally, depending on the state, filing the revocation with a court or government office might be necessary to finalize the process.

Common mistakes

Filling out a Power of Attorney (POA) form is a significant legal step that allows someone to act on your behalf in various matters, including financial, legal, and health decisions. It’s essential to approach this document diligently to ensure it accurately reflects your wishes and is legally valid. Unfortunately, many people make mistakes during this process, ultimately affecting the document's effectiveness or validity. Here are ten common mistakes to avoid:

Not choosing the right type of POA: There are different types of Powers of Attorney - general, durable, and medical, among others. Each serves a different purpose. It's crucial to select the one that best suits your needs.

Failing to specify powers clearly: Vagueness in outlining the exact powers granted can lead to confusion and misuse. Being detailed about what the agent can and cannot do is critical.

Selecting an inappropriate agent: The agent's role is pivotal. Choosing someone who is not trustworthy or capable of managing your affairs can have dire consequences.

Ignoring the need for a successor agent: Life is unpredictable. If your first-choice agent can no longer serve, having a successor agent ensures your affairs are still managed without interruption.

Omitting a termination date: Some POAs are meant to be temporary. Not specifying an expiration date when necessary can lead to the POA remaining in effect longer than desired.

Not understanding the document: Signing a legal document without fully understanding its contents and implications is a mistake. If anything is unclear, seeking clarification from a professional is advisable.

Failing to comply with state laws: POA requirements can vary by state. Ensuring the form complies with local laws is key to its validity.

Neglecting to witness or notarize the form, if required: Many states require the POA to be signed in the presence of witnesses or a notary to be legally binding.

Forgetting to distribute copies to relevant parties: Banks, healthcare providers, and other relevant entities should have copies of the POA to recognize the agent's authority.

Not updating the POA as circumstances change: Life changes such as divorce, relocation, or a change in your health condition can necessitate updates to your POA to ensure it still serves your best interests.

To navigate the complexities of this crucial document effectively, it’s wise to consult legal professionals who can provide guidance tailored to your specific circumstances and needs.

Documents used along the form

When preparing a Power of Attorney (POA), understanding the landscape of necessary and complementary documents is essential. A POA grants someone the authority to act on your behalf in specific or general legal and financial matters. However, due to the breadth of situations where a POA might be applicable, several other forms and documents are often used in tandem with it. These additional documents ensure thorough preparation and legal clarity for all involved parties.

- Advance Healthcare Directive – This document specifies a person's healthcare preferences in case they become unable to make these decisions themselves. It often accompanies a POA when preparing for future health-related decisions.

- Living Will – Similar to an advance healthcare directive, a living will outlines a person’s desires regarding life-sustaining treatment. It becomes effective under specific, typically severe conditions.

- Will – Detailing how an individual’s estate will be distributed upon their death, a will is a fundamental document that can work alongside a POA, particularly in estate planning scenarios.

- Trust – A trust controls the distribution of a person's estate and can be established to operate during their lifetime or after. It's an essential document for managing assets within estate planning.

- Guardianship Designation – This form allows an individual to designate a guardian for minor children or dependent adults, ensuring their care in the event of the individual's incapacity or death.

- Health Insurance Portability and Accountability Act (HIPAA) Release Form – This form grants designated individuals the right to access your medical records, complementing a healthcare POA by providing the necessary information to make informed decisions.

- Financial Records Release – This authorizes designated parties to access your financial records. When combined with a financial POA, it provides a comprehensive view of personal finances, allowing for informed management and decisions.

- Durable Power of Attorney for Finances – While a general POA might include financial decision-making, a durable POA for finances specifically remains in effect if you become incapacitated.

- Letter of Intent – A document that provides additional information and instructions that might not be explicitly mentioned in a will or trust. It can include personal sentiments or specific wishes regarding various assets or funeral arrangements.

While a Power of Attorney is a powerful tool on its own, the complexity of legal and personal affairs often necessitates additional documentation. Each document serves a unique purpose, yet when used together, they create a holistic approach to planning and managing both present and future concerns. The coordination of these documents ensures that an individual's health, financial, and personal preferences are respected and followed, providing peace of mind for everyone involved.

Similar forms

Will: Similar to a Power of Attorney (POA), a Will outlines a person's wishes regarding the distribution of their assets after their death. Both documents are preventative, prepared in advance to manage future outcomes regarding an individual's financial, personal, or health-related affairs.

Living Will: This document, like a POA, specifies individual preferences for medical treatment in situations where they are unable to communicate these wishes themselves. A Living Will, however, is specifically designed to address end-of-life care decisions, whereas a POA can cover a broader range of decision-making powers, including financial and legal decisions.

Healthcare Proxy: Similar to a Healthcare Power of Attorney, a Healthcare Proxy appoints someone else to make medical decisions on behalf of the individual if they are unable to do so. Both documents focus on health-related decisions, ensuring that the wishes of the individual regarding medical treatment are respected.

Trust: Like a POA, a Trust can manage assets on behalf of another person. A Trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Both Trusts and POAs are established to manage, protect, and distribute an individual's assets, sometimes under specific conditions or circumstances.

Advance Directive: An Advance Directive, similar to a Medical Power of Attorney, allows an individual to outline their health care preferences in advance. This includes decisions about life support and other treatments. Both documents ensure that a person’s healthcare wishes are known and considered if they cannot communicate them.

Guardianship: This legal process, like a POA, grants someone the authority to make decisions for another person, often in relation to minors or individuals who cannot make decisions for themselves due to incapacity. However, guardianship is usually more permanent and comprehensive, often requiring a court process.

Durable Power of Attorney: Specifically, this variant of a POA remains in effect even if the individual becomes incapacitated. Both standard POAs and Durable POAs are designed to grant someone else the authority to make decisions on one’s behalf, but the durability provision ensures that this authority continues despite changes in the individual’s mental state.

Business Power of Attorney: Similar to a general POA, a Business Power of Attorney grants authority to someone else to make decisions and act on behalf of a business or an individual in business matters. This can include signing documents, making financial decisions, and managing business transactions. Both documents are about delegating decision-making powers, albeit in different contexts.

Dos and Don'ts

Filling out a Power of Attorney (POA) form is a critical process that grants someone else the authority to make decisions on your behalf. This document can cover a broad range of responsibilities, from financial decisions to medical care. To ensure that the POA accurately reflects your wishes and is legally valid, here are some essential dos and don'ts to consider:

Do:

- Choose a trusted individual. Select a person who is trustworthy and capable of making decisions that align with your best interests. This individual could be a family member, friend, or professional advisor.

- Be specific about the powers granted. Clearly outline the duties and responsibilities you are delegating. You can specify whether the POA is for healthcare, financial decisions, or both, and under what circumstances it should take effect.

- Consult with a legal expert. Seek advice from an attorney to ensure that the POA form complies with your state’s laws and addresses all necessary legal requirements. This step can help prevent any issues with the document's validity down the road.

- Notarize the document. Many states require the POA to be notarized to be considered valid. Even if your state does not mandate it, having the document notarized can add an extra layer of authenticity and help prevent challenges to its validity.

Don't:

- Procrastinate. Don’t wait until it’s too late. A POA is most useful when created well before it’s actually needed. Accidents or sudden illness can occur at any time, and having a POA in place ensures that your affairs can be managed without delay.

- Use generic forms without customization. While generic POA forms can be a good starting point, simply filling one out without adjustments to your specific situation can lead to problems. Tailor the document to your needs for the best protection.

- Forget to revoke old POAs. If you’re creating a new POA, make sure to legally revoke any previous versions to avoid confusion about your current wishes and who has the authority to act on your behalf.

- Overlook the importance of communication. Failing to communicate your wishes and the specifics of the POA to the designated individual, as well as to important people in your life, can lead to misunderstandings and complications. Ensure everyone involved is informed.

Misconceptions

When it comes to understanding the Power of Attorney (POA) form, many individuals hold misconceptions. These misunderstandings can significantly impact their decisions regarding legal planning and the management of their affairs or those of their loved ones. Here, we clear up some of the most common misconceptions:

A Power of Attorney grants unlimited power. This is not the case; the scope of authority granted to an agent under a POA can be specifically tailored. The document can designate powers as broadly or narrowly as the principal desires, allowing control over which affairs the agent can handle.

One Power of Attorney document is the same as any other. In reality, there are different types of POA documents, such as healthcare, durable, and financial POAs, each serving different purposes and granting different levels of authority.

Creating a Power of Attorney means you lose control over your affairs. This misconception is widely held but false. The principal retains control over their affairs and can revoke or change the POA at any time as long as they are mentally competent.

A Power of Attorney is effective after the principal’s death. Actually, all powers granted through a POA terminate upon the principal's death. At that point, the executor of the estate, as designated in the will, takes over.

The agent under a Power of Attorney can make decisions regarding the principal’s will. This is incorrect; an agent under a POA does not have the authority to alter the principal’s will or make decisions about the distribution of the estate upon the principal's death.

A Power of Attorney document overrules a will. This is a common misunderstanding. A POA and a will serve different purposes and are operative at different times. A will comes into effect after death, while a POA is only effective during the principal’s lifetime.

Creating a Power of Attorney is a complex and expensive process. While it’s important to take the creation of a POA seriously, it doesn't have to be overly complicated or costly. Many individuals can effectively establish a POA with the help of legal professionals without incurring exorbitant fees.

A spouse automatically has Power of Attorney for their partner. Marriage does grant some rights, but it does not automatically bestow a Power of Attorney. A legally binding POA document is necessary to grant one spouse the authority to act on behalf of the other in specified matters.

Understanding these misconceptions can help individuals make more informed decisions regarding their legal planning, ensuring that their affairs are managed according to their wishes. It's always advisable to seek the guidance of a legal professional when drafting or executing a Power of Attorney document to ensure that it accurately reflects the principal's intentions and complies with state law.

Key takeaways

When preparing to fill out and use a Power of Attorney form, understanding a few key points can ensure the process goes smoothly and your interests are properly safeguarded. These documents are crucial for authorizing someone else to make decisions on your behalf, so it's important to approach them with care.

- Choosing the right agent is the first crucial step when filling out a Power of Attorney form. This person will have significant power over your finances, health, or other aspects of your life, depending on the type of Power of Attorney you choose. It's essential to select someone who is not only trustworthy but also capable of handling the responsibilities that come with this role.

- Understanding the different types of Power of Attorney forms is critical. Some forms grant broad powers, such as a General Power of Attorney, while others are more specific, such as a Medical Power of Attorney or a Limited Power of Attorney. Knowing which type best suits your needs will help ensure that you are granting only the powers necessary for your situation.

- Clearly stating the powers granted is vital. When filling out the form, be as specific as possible about what your agent can and cannot do. This clarity will help prevent any confusion or abuse of power and ensure that your agent acts within the bounds of their authority.

- Finally, complying with state requirements is essential for the Power of Attorney to be valid. Each state has its regulations regarding how these documents must be executed, such as needing to be notarized or witnessed by one or more adults who are not named as agents in the document. Ensuring all legal requirements are met can prevent complications later.

Other Forms

Personal Loan Form - The document can stipulate the use of the loan, restricting the borrower from using the funds for unintended purposes.

Standard Lease Agreement Pdf Ontario - An agreement detailing a tenant's right to live in a property and the payment terms for that right.

Purchase Contract - Outlines termination provisions, detailing under what circumstances the agreement can be called off.