Blank Power of Attorney Form for California

In the sunny state of California, the Power of Attorney form stands as a crucial document, empowering individuals to designate someone else to make decisions on their behalf. This pivotal legal instrument stretches across various facets of one’s life, from managing financial affairs to overseeing health-related decisions. It's designed to offer peace of mind, ensuring that, in the event of incapacity or absence, there’s a trusted person in place to act in one’s best interest. The form encompasses a range of powers, tailored to meet diverse needs and circumstances, and it is crafted within the parameters of California law to ensure both its validity and efficacy. Whether applied in the context of estate planning, medical directives, or day-to-day financial management, the Power of Attorney form is a testament to the importance of preparation, trust, and the seamless transition of authority. Understanding its use and implications is key for anyone looking to safeguard their interests or those of a loved one in California.

Example - California Power of Attorney Form

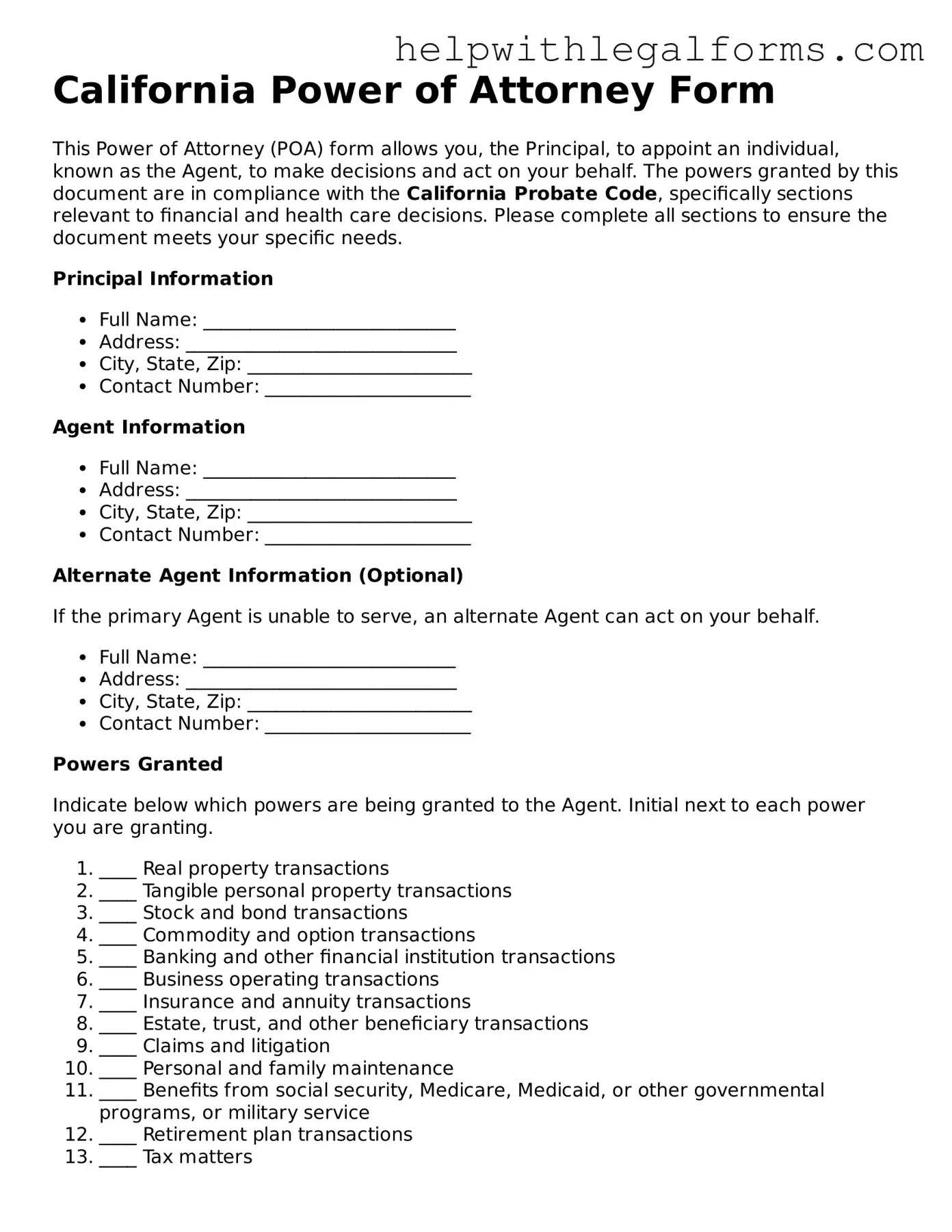

California Power of Attorney Form

This Power of Attorney (POA) form allows you, the Principal, to appoint an individual, known as the Agent, to make decisions and act on your behalf. The powers granted by this document are in compliance with the California Probate Code, specifically sections relevant to financial and health care decisions. Please complete all sections to ensure the document meets your specific needs.

Principal Information

- Full Name: ___________________________

- Address: _____________________________

- City, State, Zip: ________________________

- Contact Number: ______________________

Agent Information

- Full Name: ___________________________

- Address: _____________________________

- City, State, Zip: ________________________

- Contact Number: ______________________

Alternate Agent Information (Optional)

If the primary Agent is unable to serve, an alternate Agent can act on your behalf.

- Full Name: ___________________________

- Address: _____________________________

- City, State, Zip: ________________________

- Contact Number: ______________________

Powers Granted

Indicate below which powers are being granted to the Agent. Initial next to each power you are granting.

- ____ Real property transactions

- ____ Tangible personal property transactions

- ____ Stock and bond transactions

- ____ Commodity and option transactions

- ____ Banking and other financial institution transactions

- ____ Business operating transactions

- ____ Insurance and annuity transactions

- ____ Estate, trust, and other beneficiary transactions

- ____ Claims and litigation

- ____ Personal and family maintenance

- ____ Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- ____ Retirement plan transactions

- ____ Tax matters

Special Instructions (Optional)

Provide any specific limitations or special instructions you wish to apply to the Agent's powers:

________________________________________________________

________________________________________________________

Effective Date and Duration

- Effective Date: _________________________

- Duration:

- _____ This Power of Attorney shall become effective immediately and will remain in effect indefinitely unless specified otherwise.

- _____ This Power of Attorney shall become effective upon the incapacity of the Principal and will remain in effect indefinitely unless specified otherwise.

Signatures

This document must be signed and dated by the Principal, the Agent, and an adult witness or notary public as required by California law.

- Principal's Signature: ______________________ Date: ________

- Agent's Signature: _________________________ Date: ________

- Alternate Agent's Signature (if applicable): ______________ Date: ________

- Witness/Notary Public Signature: _____________ Date: ________

Note: This document must be reviewed regularly to ensure it continues to reflect your wishes and remains in compliance with current California law. Consult with a legal professional if you have any questions or require assistance.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A California Power of Attorney (POA) form lets someone appoint another person to manage their financial affairs or make decisions on their behalf. |

| Governing Law | The California Probate Code, starting with Section 4000, governs Power of Attorney forms in California. |

| Types Available | California offers several types of POA forms, including General, Durable, Limited, Medical, and Tax. |

| Principal & Agent | The person creating the POA is called the "principal," while the person granted authority is known as the "agent" or "attorney-in-fact." |

| Durability | A POA is considered "durable" if it remains in effect even after the principal becomes incapacitated, unless it states otherwise. |

| Signing Requirements | The principal must sign the POA form in the presence of two adult witnesses or a notary public in California. |

| Revocation | The principal can revoke a POA at any time, as long as they are mentally competent, by signing a revocation form or creating a new POA. |

| Limitations | An agent cannot make decisions regarding the principal's health care unless specified in an Advance Health Care Directive form. |

Instructions on How to Fill Out California Power of Attorney

Filling out a Power of Attorney form in California allows you to choose someone to act on your behalf in financial or legal matters, should you be unable to do so yourself. Whether it's managing your finances, buying or selling real estate, or handling other legal matters, designating a person you trust to make these decisions is crucial. Here's how to correctly fill out the form to ensure your wishes are honored and your affairs are handled appropriately.

- Start by downloading the most recent California Power of Attorney form from the state’s judicial website or obtaining a copy from a local legal forms provider.

- Read the instructions on the form carefully. California may offer several types of Power of Attorney forms, so make sure you're filling out the right one for your needs.

- Enter your full legal name and address in the designated section at the top of the form to identify yourself as the Principal.

- Specify the full legal name and address of the person you are appointing as your Attorney-in-Fact (Agent). This person will have the authority to act on your behalf.

- Clearly outline the specific powers you are granting to your Attorney-in-Fact. If the form includes checkboxes for different powers (like financial decisions, real estate transactions, etc.), mark only the boxes that apply to your situation.

- If you wish to limit the powers or specify conditions, include a clear description of these limitations in the space provided.

- Decide on the duration of the Power of Attorney. If it's a durable Power of Attorney, it remains in effect even if you become incapacitated. If it's non-durable, it will terminate if you become incapacitated. Fill in the start and end dates if applicable.

- Your signature is required to make the document legally binding. Sign the form in the presence of a notary public or as otherwise instructed by California law.

- Have the Attorney-in-Fact sign the form if required. This step varies depending on the specific form and the requirements in California.

- Keep the original document in a safe place and provide a copy to your Attorney-in-Fact. It's also wise to share a copy with your financial institutions and anyone else who may need to recognize the authority of your designated Agent.

By following these steps, you can ensure that the person you trust is legally empowered to make important decisions on your behalf, with clear guidelines and limitations laid out as you see fit. Remember, laws can change, so it’s important to check for the most current information or consult with a legal advisor to ensure your Power of Attorney form meets all requirements and accurately reflects your wishes.

Crucial Points on This Form

What is a California Power of Attorney (POA) form?

A California Power of Attorney form is a legal document that allows an individual, known as the principal, to appoint another person, known as the agent or attorney-in-fact, to make decisions and act on their behalf. These decisions can be related to financial matters, health care, or any other legal actions the principal specifies within the document.

Who can be appointed as an agent in a California POA?

Any competent adult can be appointed as an agent under a California Power of Attorney form. This includes a trusted family member, friend, or even a professional like an attorney. The chosen agent should be someone reliable, trustworthy, and capable of handling the responsibilities the principal assigns to them.

Are there different types of Power of Attorney forms in California?

Yes, California recognizes several types of Power of Attorney forms, each designed for different purposes. For instance, there are General Power of Attorney forms for broad financial powers, Durable Power of Attorney forms that remain in effect even if the principal becomes incapacitated, Limited PoA forms for specific transactions, and Health Care PoA forms for medical decisions.

Is a California POA form legally binding once signed?

Yes, a California Power of Attorney form becomes legally binding once it is signed by the principal, as long as it meets the state's legal requirements. This includes being signed in the presence of a notary public or two adult witnesses, depending on the type of POA and the powers granted in it.

What happens if the principal becomes incapacitated without a Durable POA in place?

If the principal becomes incapacitated without a Durable Power of Attorney in place, there may be no legally authorized person to make decisions on their behalf. In such cases, it might be necessary for a court to intervene and appoint a conservator or guardian, a process that can be lengthy and costly.

Can a Power of Attorney be revoked?

Yes, a principal can revoke a Power of Attorney at any time, as long as they are mentally competent. The revocation must be done in writing, and all interested parties, including the agent, should be notified. For the revocation to be effective, it should also be notarized and, in some cases, recorded or filed with certain institutions, like banks or the county recorder's office.

Does a California POA need to be notarized?

For a Power of Attorney to be legally binding in California, it generally needs to be notarized, especially if it grants real estate transaction powers. However, the exact requirements can vary depending on the type of POA. It's always best to consult the specific legal requirements or seek legal advice to ensure compliance.

What should be done if an agent abuses their power?

If there's suspicion that an agent is abusing their power under a POA, it is crucial to act quickly. The principal, if capable, can revoke the POA and take legal action against the agent. If the principal is incapacitated, a concerned party may need to involve the courts to seek the agent's removal and potentially pursue legal remedies for any harm caused.

Is a California Power of Attorney form valid in other states?

While many states recognize Power of Attorney forms executed in other states, there might be exceptions or specific requirements for out-of-state POAs to be considered valid. It's advisable to consult with a legal professional to ensure a California Power of Attorney form is recognized and can be effectively used in another state.

Common mistakes

When filling out a California Power of Attorney form, many individuals can encounter a variety of pitfalls. Steering clear of these common mistakes ensures your intentions are clearly communicated and your legal documents are effective. Here’s a detailed list of errors to avoid:

Not choosing the right form. In California, there are different forms for healthcare directives, financial matters, and other specific uses. It’s vital to pick the one that matches your needs.

Skipping the specifics. A Power of Attorney document must clearly outline the powers you’re granting. Some individuals forget to detail what their agent can and cannot do, leading to confusion or misuse of the authority.

Ignoring the need for a durable Power of Attorney. Regular powers of attorney end if you become incapacitated. If you wish your agent to act on your behalf even if you're unable to make decisions yourself, a durable Power of Attorney is essential.

Failing to appoint an alternate agent. Life is unpredictable. If your first choice for an agent cannot serve, not having an alternate can complicate matters significantly.

Overlooking the signature requirements. California law is specific about how a Power of Attorney must be signed and witnessed or notarized. Missing these critical steps can render the document invalid.

Not reviewing the document regularly. Life changes such as marriage, divorce, or a falling out can affect your choices for an agent. Regularly reviewing and updating your Power of Attorney ensures it always reflects your current wishes.

Assuming a Power of Attorney is a substitute for a will. While a Power of Attorney grants someone authority to act on your behalf, it does not cover the distribution of your assets upon your death. For that, you need a will or estate plan.

Awareness and careful attention to detail can prevent these errors, securing your interests and ensuring your chosen agent can act in your best interest efficiently and legally.

Documents used along the form

When it comes to managing your legal and financial affairs in California, the Power of Attorney (POA) form is an essential tool that allows someone else to act on your behalf. However, to fully address your needs and ensure that all bases are covered, it's often necessary to use additional forms and documents alongside the POA. Here's a list of nine other forms and documents frequently used in conjunction with a California Power of Attorney to help guide you through the process.

- Advance Health Care Directive - This document lets you outline your preferences for medical treatment and end-of-life care, and appoint someone to make health care decisions for you if you're unable to do so yourself.

- Living Will - Often included as part of the Advance Health Care Directive, a living will specifies your wishes regarding life-sustaining treatment if you're terminally ill or permanently unconscious.

- Will - A will is a legal document that details how you want your property and assets to be distributed after you pass away. It also allows you to nominate a guardian for any minor children.

- Trust - A trust is a legal arrangement that allows you to title your assets to the trust for management during your lifetime and specifies how these assets are to be passed on after your death.

- Durable Financial Power of Attorney - Specifically deals with financial matters, allowing the person you designate (your agent) to make financial decisions on your behalf.

- Medical Power of Attorney - Similar to the Advance Health Care Directive, this document designates someone to make health care decisions for you if you're incapacitated, but it focuses solely on healthcare decisions.

- Authorization to Release Health Care Information - This form gives your doctor or health care provider permission to disclose your medical information to the person you've designated.

- Do Not Resuscitate (DNR) Order - A DNR is a medical order signed by a doctor telling health care providers not to perform CPR if your heart stops or if you stop breathing.

- Power of Attorney for Child Care - This document allows you to grant someone authority to make decisions regarding the care, custody, and property of your child for a certain period.

Utilizing these forms and documents in conjunction with a California Power of Attorney can comprehensively address your health care wishes, financial matters, and the care of your dependents. Each document serves a unique purpose, contributing to a well-rounded legal plan that ensures your wishes are respected and your loved ones are taken care of. It's always a good idea to consult with a legal professional to understand which documents are suitable for your specific needs and how they work together to protect your interests.

Similar forms

-

Living Will: Much like a Power of Attorney (POA), a living will allows individuals to outline their wishes regarding medical treatment should they become unable to communicate their decisions due to illness or incapacitation. However, while a POA designates another person to make decisions on one's behalf, a living will specifies the individual's direct wishes concerning life-sustaining treatment.

-

Medical Power of Attorney: This document closely resembles a general Power of Attorney but is tailored specifically for healthcare decisions. It grants a designated agent the authority to make healthcare-related decisions on behalf of the principal when they are not in a position to do so themselves. It underscores the trust placed in the agent to act in the best interests of the principal regarding health care issues.

-

Last Will and Testament: Similar to a POA in its function of planning for future events, a Last Will and Testament goes into effect after the individual's death. It directs the distribution of the person's assets and may designate guardians for minor children, thereby ensuring that the individual’s wishes are respected even posthumously.

-

Trust: A trust shares the anticipatory nature of a POA, allowing an individual to manage and protect their assets both during their lifetime and after. While a POA appoints another person to act on one's behalf, a trust establishes a legal entity to hold property, often providing more detailed management and distribution plans for assets.

-

Durable Power of Attorney: Specifically designed to remain in effect even if the principal becomes mentally incapacitated, a durable POA is a specific kind of POA that endures beyond the principal's ability to make decisions. This ensures that the agent can manage affairs without interruption, a critical distinction from a standard POA, which typically becomes invalid if the principal loses mental capacity.

-

Financial Power of Attorney: Tailored exclusively for financial decisions, this document lets the principal appoint an agent to handle financial matters on their behalf. It is similar to a general POA but focuses strictly on financial activities such as banking, investments, and the management of property, providing peace of mind that one's financial affairs can be managed even during periods of incapacity.

-

Advance Healthcare Directive: This document combines elements of a living will and a medical power of attorney, allowing individuals to detail their healthcare preferences and appoint an agent to make healthcare decisions on their behalf, should they become unable to do so. It offers a comprehensive approach to planning for healthcare decisions, reflective of the thoughtful planning evident in a Power of Attorney.

Dos and Don'ts

Filling out a California Power of Attorney (POA) form is an important process that allows someone else to make decisions on your behalf. To ensure the form is correctly filled out and legally binding, follow these guidelines on what you should and shouldn't do.

- Do ensure you understand the different types of POA available, such as general, durable, or health care, and choose one that best suits your needs.

- Do clearly identify the person you are appointing as your agent (sometimes referred to as the attorney-in-fact) and make sure they accept this responsibility.

- Do be specific about the powers you are granting to your agent. Clarify which decisions they can make on your behalf to avoid any confusion.

- Do discuss your wishes and instructions with the person you are appointing to ensure they understand your preferences and expectations.

- Do have the POA document reviewed by a legal professional if you have any doubts or questions. This can prevent legal issues later on.

- Don't leave any sections of the form blank. If a section does not apply to your situation, fill in with "N/A" (not applicable) to ensure all parts are completed.

- Don't forget to sign and date the POA form in the presence of a notary public or required witnesses, as this step is necessary for the document to be legally binding.

- Don't choose an agent who you do not fully trust. This person will have significant power over your affairs, so it's important to select someone reliable and trustworthy.

- Don't neglect to inform close family members or others who may be directly affected by the POA of your decision. Transparency can prevent conflicts and misunderstandings.

- Don't fail to review and possibly update your POA periodically. Circumstances change, and your POA should reflect your current wishes and situations.

Misconceptions

The California Power of Attorney (POA) is a legal document that grants one person the authority to act on behalf of another in legal matters or financial decisions. However, several misconceptions surround its use and implications. It is important to correct these misunderstandings to ensure individuals are making informed decisions regarding their legal affairs.

All Powers of Attorney are the same: Many believe that a POA is a universal document, but in reality, there are different types including those for healthcare decisions, financial affairs, and limited transactions. Each serves a specific purpose and grants different levels of authority.

A POA grants unlimited power: Contrary to this belief, the scope of power can be specifically tailored. The person creating the POA (the principal) can restrict what the chosen representative (the agent) can and cannot do.

A POA is effective after the principal's death: In fact, a POA becomes null and void when the principal dies. The authority to manage the deceased's affairs then typically passes to the executor of the will or is determined through probate court if there is no will.

Only a lawyer can draft a POA: While it's advisable to seek legal advice, especially for complex situations, California law does not require a lawyer to draft this document. Various forms are available that allow individuals to create their own POA, provided it meets state requirements.

A POA can make medical decisions: This is only true if the document is specifically a Healthcare Power of Attorney. A General Power of Attorney does not grant this type of authority unless it explicitly includes healthcare decision-making powers.

Creating a POA means you lose control over your affairs: This is a common fear, but unfounded. A POA can be designed to come into effect only under circumstances you specify, such as incapacitation. Moreover, it can be revoked at any time as long as you are mentally competent to do so.

A handwritten POA is not legally valid: California recognizes handwritten (or "holographic") POAs if they meet specific requirements. Although creating a formal, typed document is preferable for clarity and to avoid disputes, a handwritten POA can be valid if it clearly outlines the scope of authority and is properly executed.

Dispelling these myths is crucial for ensuring that individuals make well-informed decisions concerning their POA documents. Awareness and understanding of the law can help protect interests and ensure that one's affairs are managed according to their wishes.

Key takeaways

When navigating the complexities of the California Power of Attorney (POA) form, individuals are afforded a means by which they can authorize another person to make crucial decisions on their behalf. This authorization can cover a broad array of responsibilities, ranging from financial to healthcare decisions. The following key takeaways are intended to shed light on crucial aspects of filling out and using the POA form effectively in California.

- Choose an Agent Wisely: The cornerstone of a POA form is the designation of an agent, also known as an attorney-in-fact. This selection process demands thoughtful consideration, as the agent will be entrusted with significant responsibilities and the authority to make decisions on the principal's (the person granting the power) behalf. It is paramount that this agent is not only trustworthy but also possesses the requisite acumen to handle the duties assigned, especially under circumstances that may involve complex financial or health care decisions.

- Understand the Different Types of POA: California law recognizes several types of POA, each serving distinct purposes. These include General POA, Limited POA, Health Care POA, and Durable POA. A General POA grants broad powers to the agent, encompassing a wide range of actions. In contrast, a Limited POA restricts the agent's authority to specific duties or timeframes. A Health Care POA gives the agent the power to make medical decisions, while a Durable POA remains in effect even if the principal becomes incapacitated. Choosing the right type is crucial and should align with the principal’s needs and intentions.

- Comply With Signing Requirements: For a POA to be legally binding in California, it must meet specific signing requirements. These requirements dictate that the POA form be signed by the principal, or in the principal’s name by another individual in the principal's presence and under the principal’s direction. This signing process must also be observed by two adult witnesses who are not named as agents in the document, or alternatively, it must be notarized. Ensuring that these requirements are met is critical to the form’s validity.

- Keep Records and Provide Notice: After completing the POA form, it is advisable for both the principal and the agent to keep copies of the document. Additionally, any entities or individuals likely to be affected by this arrangement, such as banks, healthcare providers, or family members, should be notified of the agent’s authority. This step is essential for facilitating the smooth execution of the agent’s powers and for preempting any potential challenges to the agent’s authority.

Understanding these key takeaways can significantly aid individuals in making informed decisions when it comes to creating and implementing a Power of Attorney in California. By approaching this process with the necessary due diligence and attention to detail, principals can ensure that their interests are safeguarded and that their designated agents are empowered to act effectively on their behalf.

Create Other Power of Attorney Forms for US States

Ga Poa Form - It allows you to choose someone you trust to act in your best interest.

Durable Power of Attorney Maryland - A Power of Attorney is a legal document allowing one person to act on another's behalf in financial or health matters.

Financial Power of Attorney Oklahoma - Designed to ensure your affairs are handled as you would wish, by delegating authority to a trusted person of your choosing.

Basic Power of Attorney Template - Facilitates the delegation of decision-making authority from a principal to a trusted agent.