Legal Durable Power of Attorney Form

Understanding the importance of a Durable Power of Attorney (DPOA) form is essential for anyone who wants to ensure their affairs are handled according to their wishes should they become unable to make decisions for themselves. This critical legal document grants a trusted individual, known as the agent or attorney-in-fact, the authority to manage financial, legal, and sometimes medical decisions on the behalf of the person who executes the form, known as the principal. Its durability means that the agent's power remains effective even if the principal becomes mentally incapacitated, distinguishing it from other forms of power of attorney that may terminate under such circumstances. Planning with a DPOA can provide peace of mind to both the person granting the authority and their loved ones by ensuring that the principal's affairs are managed efficiently and with their best interests in mind, regardless of future health outcomes. Therefore, properly executing a DPOA involves thoughtful consideration of the agent's responsibilities and the conditions under which the power is granted, revoked, or terminated.

State-specific Durable Power of Attorney Forms

Example - Durable Power of Attorney Form

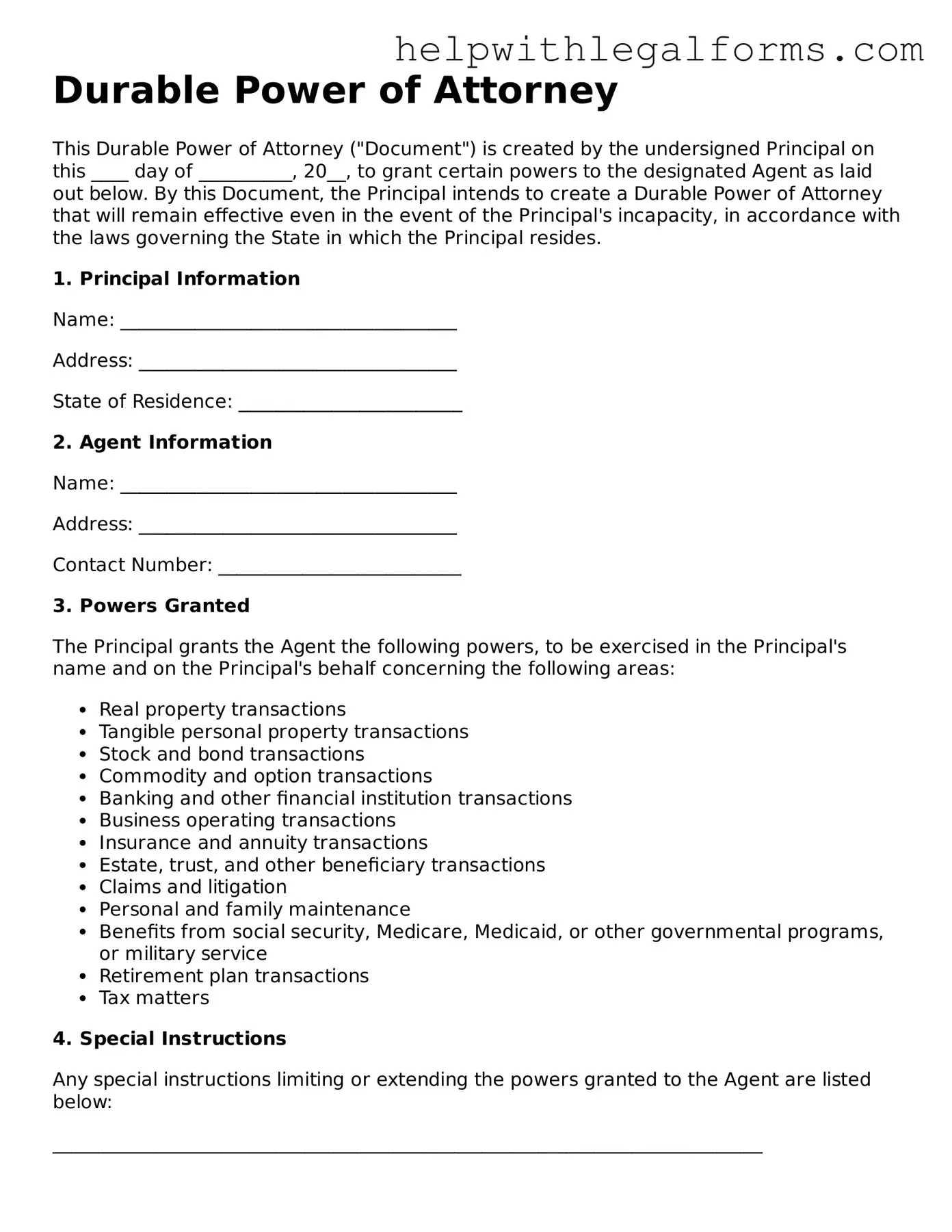

Durable Power of Attorney

This Durable Power of Attorney ("Document") is created by the undersigned Principal on this ____ day of __________, 20__, to grant certain powers to the designated Agent as laid out below. By this Document, the Principal intends to create a Durable Power of Attorney that will remain effective even in the event of the Principal's incapacity, in accordance with the laws governing the State in which the Principal resides.

1. Principal Information

Name: ____________________________________

Address: __________________________________

State of Residence: ________________________

2. Agent Information

Name: ____________________________________

Address: __________________________________

Contact Number: __________________________

3. Powers Granted

The Principal grants the Agent the following powers, to be exercised in the Principal's name and on the Principal's behalf concerning the following areas:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

4. Special Instructions

Any special instructions limiting or extending the powers granted to the Agent are listed below:

____________________________________________________________________________

____________________________________________________________________________

5. Durable Power of Attorney Effective Date

This Durable Power of Attorney is effective immediately upon signing and will continue to be effective regardless of the Principal's subsequent incapacity or disability.

6. Termination

This Durable Power of Attorney will remain in effect until it is revoked by the Principal or upon the Principal's death. The Principal may revoke this Document at any time by providing written notice to the Agent.

7. Governing Law

This Durable Power of Attorney shall be governed by the laws of the State of ___________________________.

8. Signatures

Principal's Signature: ___________________________ Date: ___________

Agent's Signature: ___________________________ Date: ___________

Witness #1 Signature: ___________________________ Date: ___________

Witness #2 Signature: ___________________________ Date: ___________

Acknowledgment by Notary Public

State of ____________

County of ___________

On this, the ____ day of ____________, 20__, before me, a Notary Public, personally appeared _______________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

______________________________________

Notary Public

My Commission Expires: _________________

PDF Form Attributes

| Fact Name | Detail |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) form allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf, even if the principal becomes incapacitated. |

| Scope of Authority | The form can grant broad or specific powers to the agent, covering areas such as financial, real estate, and medical decisions. |

| Durability Aspect | The "durable" nature means that the agent's power remains in effect even if the principal loses the ability to make decisions for themselves. |

| Governing Laws | While DPOA forms are widely recognized, the specific laws and requirements vary by state, making it crucial to use a state-specific form and comply with local requirements for validity. |

Instructions on How to Fill Out Durable Power of Attorney

Upon deciding to establish a Durable Power of Attorney, individuals are making a significant step toward planning for their future. This legal document enables one to appoint a trusted person to manage their financial affairs in case they become unable to do so due to mental or physical incapacity. It's crucial to approach this task with attentiveness and precision, ensuring that all the necessary details are accurately captured to reflect the granter's wishes. The following steps will guide through the process of filling out this essential form.

- Gather personal information, including the full legal names and addresses of both the principal (the person granting the power) and the designated attorney-in-fact (the person being granted the power).

- Choose the powers to be granted. These can range from broad financial management rights to more specific duties like handling real estate transactions, managing business operations, or dealing with tax matters. Specify these powers clearly to avoid any ambiguity.

- Clarify the duration of the power. Although a Durable Power of Attorney remains in effect if the principal becomes incapacitated, it can be designed to start immediately or upon the occurrence of a specified condition, such as a doctor certifying the principal's incapacity.

- Include any special instructions or limitations you wish to impose on the attorney-in-fact's powers, ensuring these instructions are clear and concise.

- Select a successor attorney-in-fact, if desired. This step is optional but recommended as a precaution if the primary attorney-in-fact is unable or unwilling to serve.

- Review the document thoroughly. Before signing, it is crucial to review the entire document to ensure all the information is accurate and reflects your wishes correctly.

- Sign the document in the presence of a notary public. Most states require that the principal's signature on a Durable Power of Attorney be notarized to be legally valid. Additionally, some states may require witness signatures.

- Store the completed form in a secure, accessible location. Inform your attorney-in-fact and any relevant family members or friends where it can be found should it become necessary to use it.

Completing a Durable Power of Attorney is a proactive approach to safeguard one's financial wellbeing. By following these outlined steps, individuals can ensure that their affairs will be managed according to their preferences, providing peace of mind for themselves and their loved ones.

Crucial Points on This Form

What is a Durable Power of Attorney (DPOA)?

A Durable Power of Attorney is a legal document that grants someone you choose the authority to make decisions on your behalf if you are unable to do so yourself. Unlike a standard Power of Attorney, it remains in effect even if you become mentally incapacitated.

Why would someone need a DPOA?

Someone might need a DPOA to ensure that their affairs, especially financial decisions and healthcare matters, can be managed by a trusted person if they become incapacitated due to illness, injury, or any other reason. It's a proactive measure to avoid legal complications in critical times.

Who can be appointed as an agent in a DPOA?

Any competent adult whom you trust can be appointed as an agent in a DPOA. Common choices include spouses, adult children, siblings, or close friends. It's essential to choose someone who is reliable and understands your wishes and preferences.

How does one create a Durable Power of Attorney?

Creating a DPOA involves selecting an agent, determining the powers you wish to grant, and completing a DPOA form that complies with your state's laws. It must be signed, witnessed, and, in some states, notarized to be legally valid.

Can a Durable Power of Attorney be revoked?

Yes, as long as you are mentally competent, you can revoke a DPOA at any time. You should provide written notice of the revocation to your current agent and to any institutions or parties that were informed of the original DPOA.

Are there different types of Durable Power of Attorney?

Yes, there are primarily two types: a Durable Power of Attorney for Healthcare, which allows your agent to make healthcare decisions for you, and a Durable Power of Attorney for Finances, which covers financial decisions and transactions.

What happens if I don’t have a DPOA and I become incapacitated?

If you become incapacitated without a DPOA in place, your family might have to go to court to have someone appointed as your guardian or conservator. This process can be time-consuming, expensive, and stressful.

Does a DPOA override a living will?

In general, a DPOA and a living will complement each other. While a living will expresses your wishes regarding life-sustaining treatment, a healthcare DPOA gives someone the authority to make broader healthcare decisions for you, including executing your wishes outlined in your living will.

Is a lawyer required to create a DPOA?

While you are not legally required to use a lawyer to create a DPOA, consulting with an attorney experienced in estate planning can ensure that the document meets all legal requirements of your state and accurately reflects your wishes.

How long does a Durable Power of Attorney last?

A DPOA lasts until the principal's death unless revoked earlier by the principal while they are still of sound mind. However, ensure it is regularly updated to reflect any changes in your situation or state law.

Common mistakes

-

Not specifying the powers granted thoroughly. Many people don't realize the importance of being detailed about the powers they are granting. A Durable Power of Attorney should clearly outline what the agent can and cannot do. Without precise instructions, the agent might make decisions that don't align with the principal's wishes.

-

Choosing the wrong agent. The significance of selecting someone who is not only trustworthy but also capable of making decisions under pressure cannot be overstated. Sometimes, people choose an agent based on emotional relationships rather than practicality, which might lead to problems in the decision-making process when the principal is incapacitated.

-

Failing to consider state laws. Durable Power of Attorney laws can vary significantly from one state to another. Individuals often overlook this fact and use a generic form that might not comply with their state's regulations, potentially making the document invalid.

-

Not updating the document. Life changes such as divorce, death, or even a change in the relationship with the chosen agent can affect the relevance of a Durable Power of Attorney. Failing to update the document to reflect these changes can result in an ineffective or inappropriate document during a time of need.

-

Ignoring the need for a witness or notary. In many states, for a Durable Power of Attorney to be legally binding, it must be either witnessed or notarized, sometimes both. People often overlook this requirement and submit the form without the necessary legal witnesses or notarization, leading to disputes about its validity.

Documents used along the form

When managing affairs, either for oneself or a loved one, it's essential to be thoroughly prepared. A Durable Power of Attorney (POA) form is a critical document that allows someone to make decisions on behalf of another person, usually in relation to financial matters or healthcare decisions. However, it is seldom the only document required to ensure comprehensive management and protection. There are several other forms and documents often used in conjunction with a Durable Power of Attorney, each serving a unique and valuable role in safeguarding interests and ensuring wishes are honored.

- Living Will: This document specifies a person's wishes regarding medical treatment in circumstances where they are no longer able to express informed consent, especially concerning end-of-life care.

- Health Care Proxy: Similar to a Durable Power of Attorney for health care decisions, this appoints someone to make medical decisions on another's behalf should they become incapacitated.

- Last Will and Testament: Outlines how an individual's assets and estate will be distributed upon their death. It also specifies guardianship of minor children if applicable.

- Revocable Living Trust: Allows an individual to control their assets while alive but ensures that these assets are transferred to beneficiaries without the need for probate upon death.

- Advance Directive: Combines a Living Will and Health Care Proxy, detailing wishes for medical treatment and appointing someone to make decisions when one is unable.

- HIPAA Authorization Form: Permits specified individuals to access one's medical records, making it easier for chosen agents or loved ones to make informed health care decisions.

- Financial Information Sheet: Lists all financial accounts, insurance policies, and other relevant financial information, aiding the person holding the Durable Power of Attorney in managing assets effectively.

- Guardianship Designation: Allows individuals to name a guardian for their minor children or themselves in case of incapacitation, covering aspects not addressed by other forms.

- Letter of Intent: A non-legal document that provides additional instructions, wishes, or explanations about one’s estate or other documents. It can be particularly helpful in guiding executors and beneficiaries.

Each of these documents plays a vital role in comprehensive planning and can offer peace of mind to all parties involved. While a Durable Power of Attorney addresses many concerns, pairing it with the appropriate supporting documents ensures that one's health, financial affairs, and legacy are well-managed and protected according to their wishes. It’s a step towards full preparedness, helping to navigate complex situations with clarity and confidence.

Similar forms

Living Will: Like a Durable Power of Attorney (DPOA), a Living Will outlines an individual's wishes regarding medical treatment in circumstances where they are no longer able to communicate their decisions. Both documents ensure personal wishes are honored, though the DPOA also allows the appointment of an agent to make decisions on the principal's behalf.

Medical Power of Attorney: This document also parallels the DPOA in permitting an individual to designate another person, known as an agent, to make healthcare decisions for them if they become incapacitated. The main difference is the Medical Power of Attorney strictly covers healthcare decisions, while the DPOA can also extend to financial and other personal matters.

General Power of Attorney: Similar to a DPOA, a General Power of Attorney grants broad powers to an agent, including managing financial affairs, buying or selling property, and other general matters. The key distinction is that a General Power of Attorney ceases to be effective if the principal becomes incapacitated, unlike the DPOA which remains in effect precisely because of its durability clause.

Special or Limited Power of Attorney: This document is designed to grant an agent authority to perform specific acts or make decisions in particular situations, mirroring the DPOA's function of delegating decision-making power. The difference lies in the scope and duration of the authority, with the DPOA typically offering broader and more enduring powers.

Revocable Living Trust: Although primarily used for estate planning, the Revocable Living Trust shares a common purpose with the DPOA in managing assets. In both cases, an individual can appoint a trusted person to oversee their affairs. The distinction is that a trust is focused on asset management and can avoid probate, while a DPOA covers a wider range of powers not limited to financial matters.

Dos and Don'ts

Filling out a Durable Power of Attorney (DPA) form is a significant step that requires careful consideration and precision. This legal document empowers someone else to act on your behalf in financial matters should you become unable to do so yourself. Here are important dos and don’ts to keep in mind:

- Do carefully select your agent. This should be someone you trust completely, as they will have considerable power over your financial affairs.

- Do be specific about the powers you are granting. It’s essential to clarify what your agent can and cannot do on your behalf to prevent any misuse of the document.

- Do consult a legal professional. While it may seem straightforward, understanding the nuances of a DPA can prevent future legal headaches. A professional can offer tailored advice for your situation.

- Don't leave any sections blank. If a section does not apply to your situation, it's safer to write "N/A" rather than leaving it empty to prevent unauthorized alterations.

- Don't forget to sign and date the form in the presence of the required witnesses or a notary, depending on your state’s laws. This step is crucial for the form’s legality.

- Don't neglect to inform your agent about their appointment. Ensure they understand their responsibilities and are willing to take on the role.

By following these guidelines, you can ensure that your Durable Power of Attorney form is correctly filled out. This document plays a crucial role in managing your affairs during unexpected circumstances, making its accuracy and legality paramount.

Misconceptions

Many people have misunderstandings about the Durable Power of Attorney (DPOA) form, which can lead to confusion and even missed opportunities for planning ahead. Below are four common misconceptions and the truths behind them.

It grants unlimited power: A common misconception is that a Durable Power of Attorney gives the agent absolute power over all affairs. The truth is, the person creating the DPOA can specify exactly what powers the agent has, including limits on those powers. This allows for customized control over financial and legal decisions.

It's effective immediately after signing: While some DPOAs are indeed effective immediately, others are drafted as "springing" powers of attorney, which means they only become effective upon the occurrence of a specific event, typically the incapacity of the principal. This feature helps those who are cautious about granting authority too soon.

It is only for the elderly: Another common misconception is that DPOAs are only necessary for senior citizens. However, unexpected illness or accidents can happen at any age, making it wise for adults of all ages to prepare a DPOA. This ensures that someone can legally make decisions if you’re unable to do so yourself.

It overrides a will: Some believe that a Durable Power of Attorney can override decisions made in a will. This is not accurate. A DPOA is only effective during the lifetime of the person who made it. Upon their death, the authority granted by the DPOA ends, and the terms of the will then take precedence for the estate.

Understanding the truths behind these misconceptions can lead to more informed decisions about creating a Durable Power of Attorney, part of ensuring that your wishes are respected, and your affairs are in order, even if you're unable to manage them yourself.

Key takeaways

When preparing and utilizing a Durable Power of Attorney (DPOA) form, it's important to understand its purpose and ensure it's correctly filled out to reflect your wishes accurately. A DPOA is a legal document that allows you to appoint someone else to manage your financial affairs if you are unable to do so yourself due to illness or incapacity. Here are four key takeaways about filling out and using the DPOA form:

- Choose Your Agent Carefully: The person you appoint as your agent will have significant power and responsibility. They will manage your finances, including paying bills, making investment decisions, and handling real estate transactions. It's crucial to choose someone you trust implicitly, who understands your financial values and is capable of handling these responsibilities. Consider the individual's financial acumen, integrity, and ability to act in your best interest.

- Be Specific About Powers Granted: The DPOA form allows you to specify exactly which powers your agent will have. You can grant broad authority or limit them to specific acts. Detailing the powers helps prevent misunderstandings and ensures your agent acts within the boundaries you've set. It's important to carefully consider which powers are necessary for your agent to manage your affairs effectively.

- Understand the Durable Nature: Unlike a traditional power of attorney, a durable power of attorney remains in effect if you become incapacitated. This feature is essential for the document to serve its purpose, as it ensures that your agent can act on your behalf without the need for court intervention at a time when you may be unable to manage your affairs. Make sure the form you use clearly states its durability.

- Fulfill Legal Requirements: Each state has its own legal requirements for executing a DPOA. These may include witness signatures, notarization, or specific language that must be included in the document. Ensuring that your DPOA complies with your state's laws is crucial for the document to be valid and effective. It's recommended to consult legal guidance to ensure all requirements are met.

Proper preparation and understanding of the DPOA can provide peace of mind that your financial matters will be handled according to your wishes, even if you are not able to oversee them yourself. It's a key component of a comprehensive estate plan.

Discover Other Types of Durable Power of Attorney Documents

Poa Dmv - It is specifically designed to handle affairs related to a single vehicle or multiple vehicles owned by the principal.

Revoking Power of Attorney Form - This legal document is essential for properly concluding a Power of Attorney arrangement and avoiding potential legal complications.