Blank Durable Power of Attorney Form for California

Planning for the future involves preparing for all eventualities, and one of the most crucial steps residents of California can take is establishing a Durable Power of Attorney. This legal document ensures individuals have their financial matters managed by a chosen representative should they become unable to do so themselves, due to illness or incapacity. By granting this authority, one can rest assured that their affairs are in trusted hands, avoiding costly court proceedings or potential disputes among family members. The Durable aspect of the Power of Attorney signifies that the document’s validity isn't affected by the principal’s subsequent incapacity, a key feature that differentiates it from other power-of-attorney forms. Within the boundaries of the law, this document has vast flexibility, allowing the principal to specify exactly what powers the agent can exercise, thereby providing a tailored approach to managing one’s financial life. It’s a proactive measure that not only secures an individual’s financial well-being but also gives peace of mind to them and their loved ones, highlighting the importance of understanding and correctly executing this powerful legal tool.

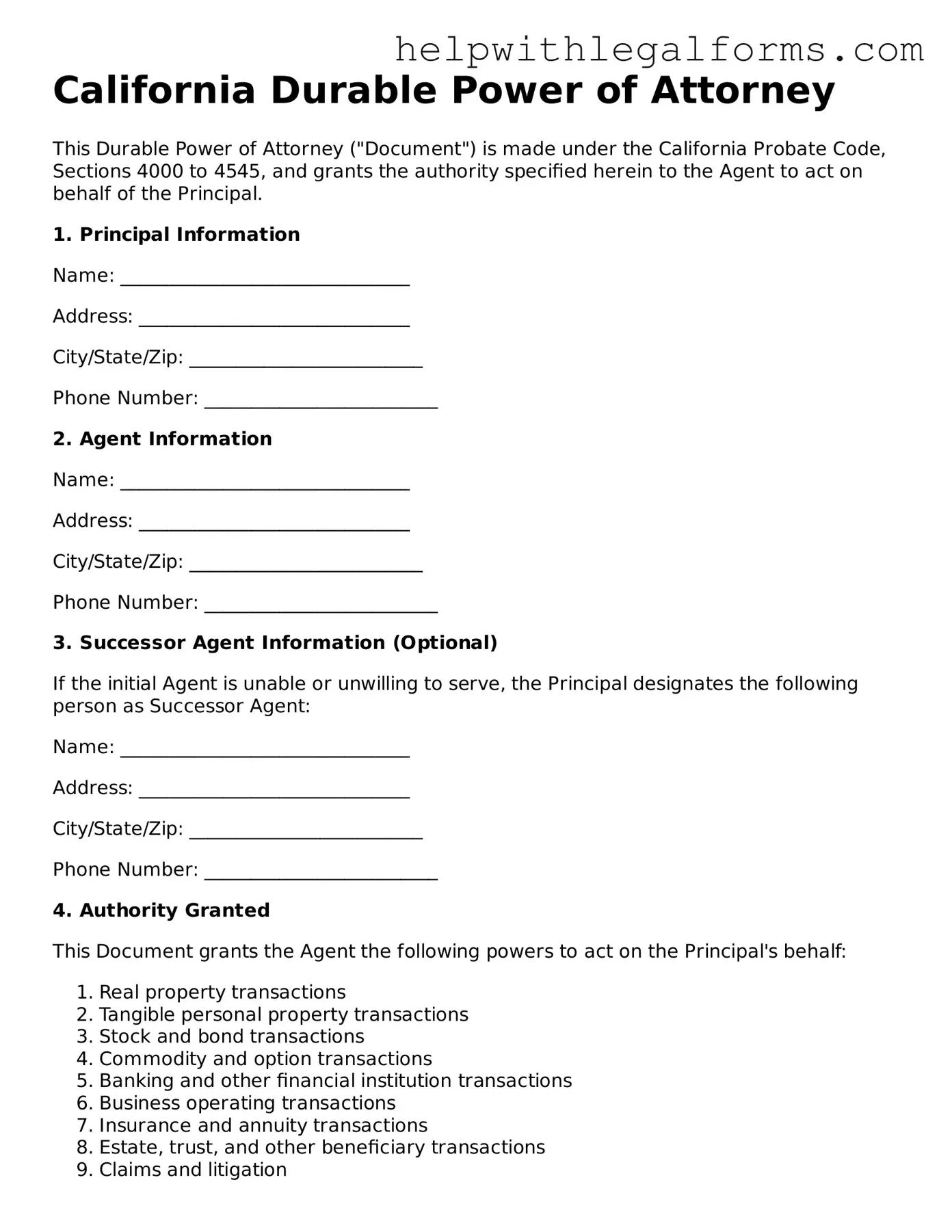

Example - California Durable Power of Attorney Form

California Durable Power of Attorney

This Durable Power of Attorney ("Document") is made under the California Probate Code, Sections 4000 to 4545, and grants the authority specified herein to the Agent to act on behalf of the Principal.

1. Principal Information

Name: _______________________________

Address: _____________________________

City/State/Zip: _________________________

Phone Number: _________________________

2. Agent Information

Name: _______________________________

Address: _____________________________

City/State/Zip: _________________________

Phone Number: _________________________

3. Successor Agent Information (Optional)

If the initial Agent is unable or unwilling to serve, the Principal designates the following person as Successor Agent:

Name: _______________________________

Address: _____________________________

City/State/Zip: _________________________

Phone Number: _________________________

4. Authority Granted

This Document grants the Agent the following powers to act on the Principal's behalf:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

5. Durable Nature of the Power of Attorney

This Power of Attorney will continue to be effective even if the Principal becomes incapacitated or disabled.

6. Execution

This Document must be signed and dated by the Principal in the presence of two witnesses or a notary public as required by California law.

Principal's Signature: _______________________________ Date: ____________

Witness #1 Signature: _______________________________ Date: ____________

Witness #2 Signature: _______________________________ Date: ____________

or

Notary Public Signature: _______________________________ Date: ____________

Notary Public Seal:

This California Durable Power of Attorney is intended to be valid in the state of California, and any use outside of the state should comply with the respective state's laws or it should be modified to meet those standards.

PDF Form Attributes

| Fact | Description |

|---|---|

| Purpose | A California Durable Power of Attorney form is used to grant someone else the authority to make certain financial decisions on one’s behalf. |

| Durability | This form remains effective even if the principal becomes incapacitated, making it "durable." |

| Governing Law | The form is governed by the California Probate Code, specifically sections 4000 to 4465. |

| Principal | The person creating the Power of Attorney is known as the principal. |

| Agent | The individual granted authority by the principal is referred to as the agent or attorney-in-fact. |

| Scope of Authority | The principal can define the scope of the agent's authority, from broad financial powers to specific acts. |

| Witnesses | The signing of the form must be witnessed by two adults or acknowledged by a notary public in California. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are mentally competent. |

| Effective Date | The document can become effective immediately or upon the occurrence of a specified event, often the incapacity of the principal. |

| Requirements for Validity | The form must be completed in accordance with California law, including proper execution and any required witnessing or notarization. |

Instructions on How to Fill Out California Durable Power of Attorney

When a person decides to establish a Durable Power of Attorney (DPOA) in California, they are taking a significant step towards ensuring their financial matters are managed according to their wishes, especially if they become unable to do so themselves. The process involves filling out a specific form correctly. The following instructions are designed to guide one through this important task, ensuring clarity and compliance with state requirements.

- Locate the official California Durable Power of Attorney form. This document is readily available online through the California Judicial Branch website or at a local legal stationery store.

- Read through the form carefully before filling in any information. Understanding every section is crucial to making informed decisions.

- Enter the full legal name and address of the principal—the person who is granting the power of attorney.

- Specify the name and address of the agent or attorney-in-fact—the person who will be granted the authority to act on behalf of the principal. If alternate agents are desired, include their information as well.

- Detail the powers that are being granted. The form allows the principal to specify whether the agent has broad or limited financial powers. Mark the appropriate boxes that apply.

- If the principal wishes to grant authority for real estate transactions, they must include the legal description of the property involved. It's wise to attach a separate sheet if the space provided is insufficient.

- Indicate the duration of the Durable Power of Attorney. If it is to remain effective indefinitely, specify this by stating it does not expire unless revoked. Conversely, if there is a specific end date, that date should be clearly mentioned.

- The principal must sign and date the form in the presence of a notary public or two adult witnesses, depending on state requirements. The rules regarding witnesses can vary, so it's important to follow California's specific regulations to ensure the document's validity.

- The agent(s) may also need to sign the form, acknowledging their acceptance of the responsibilities. Check the document to confirm if this step is necessary.

- Lastly, file the completed form safely. While it’s not required to file it with any government office, it’s crucial the agent or attorney-in-fact and any relevant institutions have access to this document when needed.

Following these steps will help ensure that the Durable Power of Attorney form is filled out accurately, reflecting the principal's wishes and complying with California law. It's advisable for both the principal and the agent to keep copies of the completed form. Additionally, seeking advice from a legal professional can provide further assurance that all aspects of the DPOA meet the specific needs and circumstances of the principal.

Crucial Points on This Form

What is a California Durable Power of Attorney?

A California Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to designate another person, known as the agent or attorney-in-fact, to manage their financial affairs and make decisions on their behalf. This arrangement continues to be effective even if the principal becomes incapacitated.

How does one create a Durable Power of Attorney in California?

To create a Durable Power of Attorney in California, the principal must complete a form that specifies the powers being granted to the agent. The document has to be signed by the principal and, depending on the powers granted, may require notarization. It is recommended to consult with a legal professional to ensure that the form is completed correctly and reflects the principal's wishes accurately.

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney can be revoked at any time by the principal as long as they are mentally competent. The revocation must be done in writing, and the written document should be shared with the current agent and any institutions or entities that were relying on the original Durable Power of Attorney.

What happens if the designated agent in the Durable Power of Attorney is unable or unwilling to serve?

If the designated agent is unable or unwilling to serve, the Durable Power of Attorney can designate an alternate agent to take over the responsibilities. If an alternate agent is not listed and the initial agent cannot serve, the principal will need to create a new Durable Power of Attorney if they are still competent to do so. If this is not possible, it may become necessary for a court to appoint a conservator or guardian.

Common mistakes

Filling out a California Durable Power of Attorney (DPOA) form is a significant step in managing one’s affairs, should they become unable to do so. However, errors can often occur during this process, undermining the document’s effectiveness and potentially leading to complications down the road. Below are five common mistakes that people make when completing this vital form.

-

Not specifying the powers granted clearly. It is crucial to delineate explicitly which powers the agent can exercise. Vague or overly broad language can lead to confusion and legal challenges, whereas too narrow a scope might render the agent unable to deal effectively with all affairs.

-

Choosing the wrong agent. The person appointed as the agent holds a significant amount of responsibility and power. Electing someone without the proper trust, competence, or willingness to act in the principal's best interest can lead to poor management of the principal’s affairs or, worse, abuse of power.

-

Failing to consider alternates. Life is unpredictable. Should the primary agent be unwilling or unable to serve, having no alternate agent specified can complicate matters significantly. It's wise to appoint a successor agent to ensure continuity in managing the principal’s affairs.

-

Overlooking the need for witnesses or notarization. Depending on the state’s requirements, a DPOA may need to be either witnessed, notarized, or both to be legally valid. In California, neglecting this step can render the document unenforceable, leaving the Principal’s affairs in limbo.

-

Not updating the document. Life changes such as divorce, the death of an agent, or moving to a new state can impact the relevance and legality of a DPOA. Failing to update the document to reflect these changes can lead to an outdated DPOA that does not accurately represent the principal's wishes and may not be legally valid.

Understanding and avoiding these mistakes can help ensure that a Durable Power of Attorney form effectively and accurately reflects the principal's wishes, safeguarding their welfare and affairs.

Documents used along the form

When handling personal affairs, especially in preparation for or during times of incapacity, having the right documents in place is crucial. The California Durable Power of Attorney (DPOA) form is one essential tool, allowing individuals to appoint an agent to make financial decisions on their behalf. However, this form is often just part of a broader legal strategy. Several other forms and documents commonly complement the DPOA, each serving a unique purpose in ensuring one's wishes are respected and affairs are well-managed.

- Advance Health Care Directive (AHCD) - This document is analogous to the DPOA but for health care decisions. It lets an individual appoint a health care agent to make medical decisions on their behalf if they become unable to do so. This directive can also include specific wishes regarding medical treatments and end-of-life care.

- Living Will - Often confused with the AHCD but serves a slightly different purpose. A Living Will specifically outlines an individual's preferences for end-of-life medical care. While it's sometimes integrated into the AHCD, it's crucial for detailing what measures should or should not be taken.

- Last Will and Testament - This legal document outlines how an individual wants their assets distributed after their death. It can appoint guardians for minor children and express wishes that aren't covered by a DPOA, which only remains effective during the individual's lifetime.

- Revocable Living Trust - A flexible tool for estate planning that allows an individual (the trustor) to manage their assets during their lifetime and specify how these assets should be distributed upon their death. It can help avoid probate and manage privacy concerns, working alongside a DPOA for a comprehensive plan.

- HIPAA Release Form - This document allows designated persons to access an individual's medical records and speak with healthcare providers. It's crucial for agents under a DPOA or AHCD to have the necessary information to make informed decisions.

In sum, the California Durable Power of Attorney form is often just the beginning of a thorough and thoughtful approach to legal preparedness. By understanding and potentially integrating these additional documents, individuals can ensure a more comprehensive strategy for managing their health care, financial affairs, and legacy. Consulting with a legal professional can help in tailoring these documents to fit one's unique needs and circumstances, providing peace of mind and well-rounded protection.

Similar forms

A Medical Power of Attorney allows a person to appoint someone else to make medical decisions on their behalf, similar to how a Durable Power of Attorney grants authority for financial matters. Both documents become active under specific conditions, such as the principal's incapacity.

A General Power of Attorney gives an agent broad powers to handle the principal's affairs. Unlike the Durable Power of Attorney, its effectiveness typically ceases if the principal becomes incapacitated, highlighting the durability feature of the latter.

A Limited or Special Power of Attorney specifies certain powers to be executed by the agent, for instance, selling a property. It contrasts with the comprehensive nature of a Durable Power of Attorney, which generally encompasses a wide range of financial transactions.

A Living Will directs medical care preferences in case of terminal illness or permanent unconsciousness. While it doesn't appoint an agent like a Durable Power of Attorney, it serves a similar anticipatory role in personal affairs management.

Advance Healthcare Directive combines aspects of a Living Will and Medical Power of Attorney, outlining medical care preferences and appointing someone to make health care decisions. It parallels the Durable Power of Attorney in preparing for incapacity, albeit focused on health decisions.

The Trust Agreement, especially a Revocable Living Trust, allows property management during the grantor's life and after death. Like a Durable Power of Attorney, it provides a mechanism for handling affairs without court intervention, although it's focused on estate planning.

A Guardianship or Conservatorship Agreement is court-appointed authority to manage the affairs of someone unable to do so themselves. This contrasts with a Durable Power of Attorney, which is a private arrangement made before incapacity.

A Springing Power of Attorney takes effect upon the occurrence of a specific event, such as the principal's incapacity. It is similar to a Durable Power of Attorney in its capacity to endure the principal's incapacity but differs in its activation trigger.

The Financial Information Release form permits disclosure of an individual's financial information to third parties. While more limited in scope, it shares the Durable Power of Attorney’s aim of allowing chosen individuals to act in the principal's financial interests.

A Last Will and Testament dictates the distribution of an individual's estate after their death. Although it operates posthumously, unlike the Durable Power of Attorney, which functions during the principal’s lifetime, it similarly ensures that the principal’s wishes are honored.

Dos and Don'ts

When managing the essential task of filling out the California Durable Power of Attorney form, adhering to specific do's and don'ts is paramount. This document grants another individual the authority to make decisions on your behalf, underscoring the necessity for meticulous attention to detail. Below are key recommendations to ensure the process is handled correctly and efficiently.

Do's:

- Read the entire form carefully before starting to fill it out to ensure you understand all the provisions and requirements.

- Choose a trusted individual who understands your values and wishes to act as your agent, as this person will make significant decisions on your behalf.

- Clearly specify the powers you are granting to your agent, including any limitations you wish to impose.

- Include alternate agents in case your primary agent is unable or unwilling to serve, ensuring continuity in your affairs.

- Use precise and unambiguous language to avoid any potential misunderstandings or misinterpretations of your intentions.

- Consult with a legal professional if you have any doubts or questions regarding the form or the extent of the powers granted.

- Ensure that the form is properly signed and dated in the presence of a notary public or the required witnesses, according to California law.

- Inform your agent and any alternate agents that they have been designated, and discuss your expectations and wishes with them.

- Keep the original document in a secure yet accessible location, and provide copies to your agent and any relevant institutions (banks, healthcare providers).

- Regularly review and update the document as needed to reflect any changes in your circumstances or wishes.

Don'ts:

- Don't choose an agent without thoroughly considering their trustworthiness, capability, and willingness to act in your best interest.

- Don't leave any sections blank; if a section does not apply, clearly mark it as “N/A” (Not Applicable) to demonstrate that it was not overlooked.

- Don't use vague or general language when specifying powers, as this can lead to confusion and complications.

- Don't forget to specify the duration of the power of attorney if it is intended to be limited to a certain period.

- Don't neglect to sign and date the form according to the legal requirements, as failing to do so will render it invalid.

- Don't fail to discuss your intentions and the contents of the document with your chosen agent, ensuring they are fully aware of their role and responsibilities.

- Don't store the document in a place where it cannot be easily accessed when needed, as delays can hinder your agent’s ability to act on your behalf.

- Don't forget to revoke the power of attorney formally if you change your mind or want to appoint a different agent, ensuring to communicate this change appropriately.

- Don't assume one form fits all situations; consider consulting a legal professional to ensure the document meets your specific needs and is executed correctly.

- Don't underestimate the importance of routinely updating the document to address changes in your life, your agent's situation, or the law.

Misconceptions

Understanding the California Durable Power of Attorney (DPOA) is vital for making informed decisions about future incapacity or financial management. However, misconceptions about the DPOA can lead to confusion and potential legal complications. Here are seven common misconceptions:

It grants unlimited power: Many believe a DPOA allows the agent to do as they please. However, the form specifies powers granted, requiring the agent to act in the principal's best interests.

It's effective immediately upon signing: While a DPOA can be effective immediately, it can also be structured to become effective only upon the principal's incapacitation, known as a "springing" power.

It covers medical decisions: A common misunderstanding is that a DPOA includes healthcare decisions. In reality, a separate document, an Advance Health Care Directive, is needed for medical decisions in California.

It's irrevocable: People often think once executed, a DPOA cannot be changed. However, as long as the principal is mentally competent, they can revoke or amend it at any time.

It continues after death: The authority granted under a DPOA ends upon the principal's death. At that point, the executor of the estate, as named in a will, takes over.

A notary is always required: While notarization is highly recommended for the purpose of authenticity and is required for real estate transactions in many cases, California law does not always require a DPOA to be notarized. Witnessing requirements might suffice for some powers.

Only family members can be agents: There's a belief that only relatives can be appointed as agents. The truth is, any trusted adult, including friends or professionals, can be designated, provided they act in good faith on behalf of the principal.

Dispelling these misconceptions ensures individuals are better prepared to execute a DPOA that accurately reflects their wishes and legal requirements. Always consult with a legal professional when preparing a DPOA to ensure it meets your needs and complies with California law.

Key takeaways

When addressing the need to manage one's financial affairs during unforeseen circumstances, the California Durable Power of Attorney (DPOA) form plays a pivotal role. It serves as a legal document that authorizes a designated person, known as an agent, to make financial decisions on someone else’s behalf. Understanding the nuances of filling out and using this form can ensure that your financial endeavors are seamlessly managed, according to your wishes, in times when you might not be able to do so yourself. Here are some vital takeaways to consider:

- Choosing the right agent is crucial. The person you appoint will have significant control over your financial matters, including but not limited to, managing your bank accounts, making investment decisions, and handling property transactions. It’s imperative to select someone who is not only trustworthy but also capable of handling financial responsibilities with your best interests in mind.

- The form must be California-compliant. Laws regarding Durable Power of Attorney can vary significantly from one state to another. Ensure that the form you’re using complies with the specific legal requirements set forth by the state of California. This compliance is necessary to prevent any legal hurdles that might arise from using a non-conforming document.

- Clear specification of powers is essential. The document should clearly outline the extent of powers you are granting to your agent. You have the option to grant wide-ranging powers or limit them to specific actions and decisions. Clarity in this area prevents any ambiguity regarding the agent’s authority, making it easier for financial institutions and other entities to follow the DPOA’s directives.

- Understand the revocation process. Circumstances change, and there might come a time when you wish to revoke the powers granted through your DPOA. Being knowledgeable about the revocation process enables you to swiftly and effectively make changes, should your relationship with your agent change or if you decide to appoint a new agent. The revocation must be done in writing, delivered to the current agent, and, in most cases, officially recorded or noted with any financial institutions or entities previously informed of the DPOA’s existence.

The Durable Power of Attorney is a potent tool in managing your financial affairs when you cannot do so yourself. As with any legal document, careful consideration and understanding are paramount in ensuring that it serves its intended purpose without complication. Whether you're contemplating filling one out now or in the future, these key takeaways can guide you through the process with greater ease and confidence.

Create Other Durable Power of Attorney Forms for US States

Durable Power of Attorney Pdf - Such a form is invaluable in times of unexpected health crises, allowing quick and effective decision-making.

Financial Power of Attorney Colorado - Provides a legal foundation for agents to make essential decisions on healthcare and living arrangements.

Statutory Durable Power of Attorney Texas - Designed to ensure your financial goals continue to be met, even during tough times.

Financial Power of Attorney Maryland - Choosing someone you trust is crucial, as they will have significant control over your financial matters.