Blank Durable Power of Attorney Form for Colorado

Planning for the future involves careful consideration of one's personal and financial matters, especially when contemplating who will make decisions should one become unable to do so themselves. In Colorado, the Durable Power of Attorney (DPOA) form is a legal instrument that empowers an individual, known as the principal, to designate another person, referred to as the agent, to manage their financial affairs. This form is particularly significant because it remains in effect even if the principal becomes incapacitated or unable to make decisions on their own. The versatility of the DPOA form allows the principal to specify which powers the agent can exercise, ranging from handling financial transactions and managing property affairs to making investment decisions. Importantly, the form must be completed following Colorado law, which includes requirements for it to be signed in the presence of a notary or witness(es) to ensure its validity. This document is not only a cornerstone of sound financial planning but also an act of trust and foresight, enabling individuals to have peace of mind regarding the management of their affairs during unforeseen events.

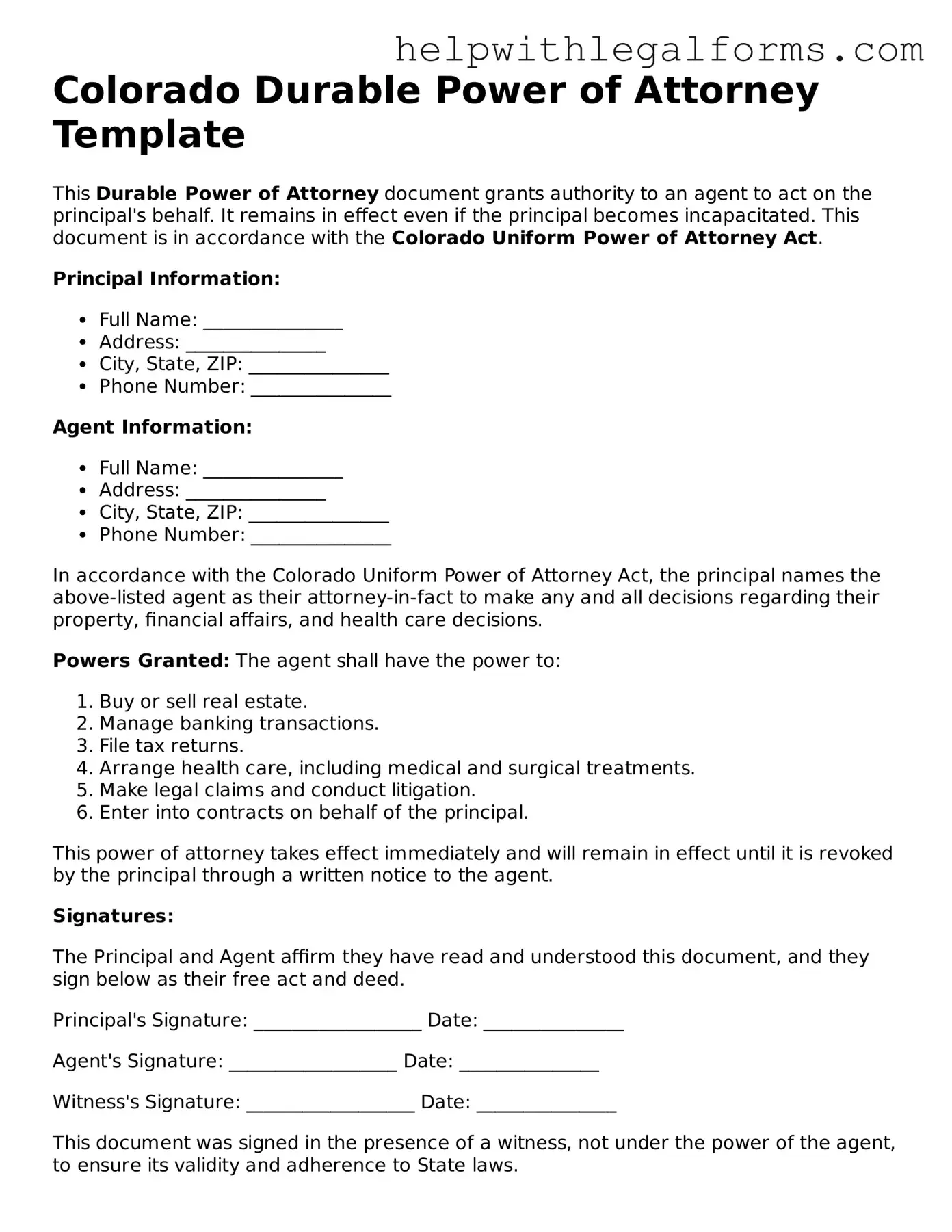

Example - Colorado Durable Power of Attorney Form

Colorado Durable Power of Attorney Template

This Durable Power of Attorney document grants authority to an agent to act on the principal's behalf. It remains in effect even if the principal becomes incapacitated. This document is in accordance with the Colorado Uniform Power of Attorney Act.

Principal Information:

- Full Name: _______________

- Address: _______________

- City, State, ZIP: _______________

- Phone Number: _______________

Agent Information:

- Full Name: _______________

- Address: _______________

- City, State, ZIP: _______________

- Phone Number: _______________

In accordance with the Colorado Uniform Power of Attorney Act, the principal names the above-listed agent as their attorney-in-fact to make any and all decisions regarding their property, financial affairs, and health care decisions.

Powers Granted: The agent shall have the power to:

- Buy or sell real estate.

- Manage banking transactions.

- File tax returns.

- Arrange health care, including medical and surgical treatments.

- Make legal claims and conduct litigation.

- Enter into contracts on behalf of the principal.

This power of attorney takes effect immediately and will remain in effect until it is revoked by the principal through a written notice to the agent.

Signatures:

The Principal and Agent affirm they have read and understood this document, and they sign below as their free act and deed.

Principal's Signature: __________________ Date: _______________

Agent's Signature: __________________ Date: _______________

Witness's Signature: __________________ Date: _______________

This document was signed in the presence of a witness, not under the power of the agent, to ensure its validity and adherence to State laws.

PDF Form Attributes

| Fact | Detail |

|---|---|

| Purpose | Allows an individual to grant authority to another person to make financial decisions on their behalf. |

| Governing Law | Colorado Revised Statutes Title 15 - Probate, Trusts, and Fiduciaries, specifically under Article 14 - Uniform Power of Attorney Act. |

| Validity | The form is valid once signed by the principal, in the presence of a notary public or two adult witnesses, as per Colorado law. |

| Duration | A durable power of attorney remains in effect even if the principal becomes incapacitated, unless explicitly stated otherwise. |

| Key Powers | Includes managing real estate, financial institutions, personal property, and operating businesses. |

| Limitations | Cannot be used for healthcare decisions; a separate medical power of attorney is required for those purposes in Colorado. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent, through a written notice. |

| Agent's Duties | The agent is bound by law to act in the principal's best interest, keep accurate records, and separate their personal finances from the principal's. |

| Special Considerations | Choosing an agent who is trustworthy and competent is critical, as they will have significant control over the principal's financial matters. |

Instructions on How to Fill Out Colorado Durable Power of Attorney

Filling out the Colorado Durable Power of Attorney form is an important step in managing your affairs, allowing someone you trust to legally make decisions on your behalf if you're unable to do so. This process can seem daunting, but by following these steps, you can complete the form accurately and ensure your wishes are respected. Remember, once completed, it is advisable to review this document with a legal professional to confirm it meets all legal requirements in Colorado.

- Start by downloading the official Colorado Durable Power of Attorney form from the Colorado Judicial Branch's website or a reputable legal forms provider.

- Read the entire form thoroughly before filling anything out. This ensures you understand the document's purpose and requirements.

- Enter your full legal name and address at the top of the form, where it asks for the "Principal's" information. The Principal is the person granting the power.

- Designate your "Agent" by providing their full legal name and address. This is the person you're giving authority to act on your behalf. Consider naming a successor Agent in case the first is unable or unwilling to act.

- Specify the powers you are granting to your Agent. The form may list common powers such as financial decisions, real estate transactions, and personal care decisions. Initial next to each power you are granting. If a power is not listed, you may add it under the "Special Instructions" section.

- For the document to be "Durable," meaning it remains in effect even if you become incapacitated, ensure the form states this clearly. Often, this is a standard statement included in the form but check to make sure.

- In the "Special Instructions" section, add any specific wishes or limitations on your Agent's power. This can include restrictions on selling property, making gifts, or any other important considerations.

- Date and sign the form in front of a notary public. Colorado law requires your signature to be notarized for the Durable Power of Attorney to be legally binding.

- Have the Agent sign the form as well, acknowledging their acceptance of the responsibilities being entrusted to them.

- Keep the original signed document in a safe but accessible place. Provide copies to your Agent, family members, or anyone else who may need it in an emergency.

By carefully completing the Colorado Durable Power of Attorney form as outlined, you're taking a significant step toward safeguarding your future and ensuring your affairs are managed according to your wishes. Regularly review and update the document as needed to reflect any changes in your life or relationship with your Agent.

Crucial Points on This Form

What is a Durable Power of Attorney (DPOA) in Colorado?

A Durable Power of Attorney in Colorado is a legal document that allows someone (the principal) to designate another person (the agent) to make decisions on their behalf, including financial and business decisions. This designation remains effective even if the principal becomes incapacitated, unable to make decisions on their own.

How do I choose an agent for my DPOA?

Choosing an agent for your DPOA is an important decision. This person should be someone you trust implicitly, such as a family member or close friend. Consider their ability to handle financial matters competently and their willingness to act in your best interest. It’s recommended to discuss this responsibility with them before naming them in your document.

Does a DPOA need to be notarized in Colorado?

Yes, in Colorado, for a Durable Power of Attorney to be legally valid, it must be notarized. The notarization process involves signing the document in front of a notary public who confirms your identity and acknowledges that you are signing the document voluntarily and under your own free will.

Is a witness required for a DPOA in Colorado?

Yes, Colorado law requires that a Durable Power of Attorney must be signed by the principal in the presence of a notary and one witness. The witness must be an adult and cannot be the agent named in the DPOA. The witness’s role is to verify the identity of the principal and attest to the principal’s apparent sound mind and free will in signing the document.

What powers can I grant with a DPOA in Colorado?

With a DPOA in Colorado, you can grant a wide range of powers to your agent, including the ability to buy or sell real estate, manage bank accounts, invest money, file taxes, and handle government benefits. You can choose to grant broad authority or specify particular actions you want your agent to have the power to execute.

When does a DPOA become effective in Colorado?

The effectiveness of a Durable Power of Attorney in Colorado can be immediate, or it can become effective upon the occurrence of a future event, usually the principal’s incapacity as determined by a physician. The terms regarding when the DPOA becomes effective should be clearly stated within the document itself.

Can I revoke a DPOA in Colorado?

Yes, as long as you, the principal, are of sound mind, you can revoke a Durable Power of Attorney at any time. To do so, you should provide written notice to your agent and any institutions or individuals that were relying on the DPOA. It's also recommended to destroy all copies of the original DPOA document.

Does a Colorado DPOA cover health care decisions?

No, a Durable Power of Attorney in Colorado typically covers financial and business decisions. Health care decisions are covered under a separate document known as a Medical Power of Attorney or Health Care Proxy. This document allows you to designate someone to make health care decisions on your behalf if you are unable to do so.

What should I do with my completed DPOA document?

Once your DPOA document is signed and notarized, you should give a copy to your agent and inform close family members of its existence. It’s also wise to keep the original in a safe yet accessible place, such as a fireproof safe. Additionally, consider giving a copy to your attorney, if you have one, and to any financial institutions with which you have accounts that the agent may need to access.

Common mistakes

-

Not specifying the powers granted - People often forget to clearly define the scope of authority they are giving. This can lead to confusion and legal issues regarding what decisions the agent can make.

-

Choosing the wrong agent - A common mistake is not considering if the person chosen as an agent has the capability or willingness to take on this responsibility. It's important that the agent is trustworthy and able to act in the principal's best interest.

-

Failing to sign in the presence of a notary - Colorado law requires the durable power of attorney form to be notarized. If this step is missed, the document may not be legally valid.

-

Not including a successor agent - If the first choice for an agent can no longer serve, having a successor agent named prevents the need for court intervention to appoint someone new.

-

Omitting dates - Forgetting to provide the date when the document takes effect or does not specify when or if it expires can create conflicts regarding its validity.

-

Ignoring the need for witnesses - Depending on the powers granted, Colorado law may require witnesses in addition to notarization. Not having the required witness signatures can invalidate the document.

-

Overlooking the termination clause - Without detailing under what conditions the power of attorney ceases to be effective, the document could remain in effect longer than intended.

-

Misunderstanding the form - Frequently, individuals fail to fully understand the legal implications of what they are signing, potentially leading to misuse of the power granted.

-

Not keeping the document accessible - After going through the effort of correctly filling out the form, some forget to inform relevant parties of its location, making it hard to find when needed.

In conclusion, when filling out the Colorado Durable Power of Attorney form, it is crucial to be meticulous and informed about each step. Avoiding these common mistakes ensures that your wishes are respected and can prevent unnecessary legal complications.

Documents used along the form

In the realm of legal preparation, especially within the context of estate planning and managing one’s affairs in the event of incapacity, the Colorado Durable Power of Attorney (DPOA) form stands as a pivotal document. It authorizes a designated agent to handle financial matters on behalf of the principal. However, to ensure a comprehensive approach to one’s legal and healthcare wishes, several other documents are often prepared and used in conjunction with the DPOA. These documents complement the DPOA by covering aspects not addressed by it, providing a full spectrum of legal readiness.

- Medical Power of Attorney: This document appoints a healthcare agent to make medical decisions on behalf of the principal if they become unable to do so. It is distinct from the DPOA, which primarily focuses on financial matters.

- Advance Directive: Also known as a living will, it outlines a person's wishes regarding end-of-life care and treatments. It operates in concert with the Medical Power of Attorney, guiding the healthcare agent's decisions.

- HIPAA Authorization Form: This form allows designated individuals to access the principal's medical records and speak with healthcare providers, facilitating informed decision-making about the principal’s health care.

- Last Will and Testament: Details how the principal’s assets should be distributed upon their death. It also can nominate guardians for any minor children.

- Revocable Living Trust: Allows the principal to manage their assets during their lifetime and specify how these should be handled after death. This can help avoid probate and maintain privacy.

- Declaration of Guardianship: In case the principal becomes incapacitated, this document specifies their preferred guardian for personal care or for managing their estate.

- Personal Property Memorandum: Often attached to a will or trust, it outlines the distribution of personal items not explicitly covered in those documents, allowing a more detailed instruction for cherished possessions.

To navigate the complexities of estate and incapacity planning effectively, one should consider these documents as part of a holistic approach, alongside the Colorado Durable Power of Attorney. Each document plays a vital role in ensuring that all areas of a person’s life and wishes are addressed comprehensively and according to their desires. While the DPOA addresses financial decisions, the combined effect of these documents ensures that healthcare decisions, end-of-life wishes, and asset distribution are all managed in alignment with the principal's expectations and values.

Similar forms

Medical Power of Attorney: This document, similar to a Durable Power of Attorney, allows an individual to appoint someone else to make healthcare decisions on their behalf should they become unable to do so themselves. The principal difference lies in the specific focus on health care decisions in the Medical Power of Attorney as opposed to the broader financial and legal authority typically granted in a Durable Power of Attorney.

General Power of Attorney: Like its durable counterpart, the General Power of Attorney grants an agent broad powers to act on the principal’s behalf. However, it ceases to be effective if the principal becomes incapacitated, making it less encompassing than a Durable Power of Attorney which remains in effect despite the principal’s incapacity.

Living Will: A Living Will, while distinct in purpose, shares the preemptive planning aspect of a Durable Power of Attorney. It documents specific wishes regarding medical treatment in end-of-life scenarios, ensuring that an individual’s preferences are respected even if they cannot communicate them at the time. Unlike a Durable Power of Attorney, which authorizes another to make decisions, a Living Will speaks directly to healthcare providers about treatment preferences.

Limited Power of Attorney: This document grants narrow, specific authority to an agent, as opposed to the comprehensive powers often included in a Durable Power of Attorney. The Limited Power of Attorney might authorize an agent to perform a particular transaction or handle specific affairs over a short period, and its efficacy can also be terminated upon the principal’s incapacitation, setting it apart from the durability aspect.

Revocable Living Trust: Similar to a Durable Power of Attorney in its ability to manage assets and affairs during the grantor's lifetime, a Revocable Living Trust also provides for continuity in management without court intervention. This arrangement differs primarily in its structure and the level of control retained by the grantor, who often serves as the initial trustee until incapacitation or death, at which point a successor trustee already designated takes over.

Advance Health Care Directive: This document combines elements of a Living Will and a Medical Power of Attorney by outlining specific treatment preferences and appointing an agent to make healthcare decisions. Like a Durable Power of Attorney, it’s designed to function upon the principal's inability to make decisions, ensuring that both care preferences and decision-making authority are clearly established ahead of time.

Last Will and Testament: Although fundamentally different in that it takes effect after death, a Last Will and Testament is similar to a Durable Power of Attorney in its forethought and in designating individuals to carry out the principal's wishes. Where a Durable Power of Attorney focuses on financial and legal decisions during the principal’s lifetime, a Last Will addresses the distribution of assets and guardianship determinations posthumously.

Dos and Don'ts

Filling out a Durable Power of Attorney (POA) form in Colorado is a significant step in planning for the future. This document allows you to appoint someone to manage your affairs if you become unable to do so. To ensure this process is completed accurately and your wishes are respected, here are several do's and don'ts to consider.

Do's:- Read the instructions carefully. Before filling out the form, make sure you understand every part of it. This will help you fill it out correctly.

- Choose a trusted person as your agent. This individual will have significant power over your affairs, so it’s crucial they are trustworthy and capable.

- Be specific about the powers you grant. The POA form allows you to specify exactly what your agent can and cannot do. Take your time to think this through.

- Sign the form in front of a notary public. Colorado law requires your Durable POA to be notarized to be legally valid.

- Keep the original document in a safe place. After notarization, store the document securely where your agent and loved ones can access it if needed.

- Don’t leave any sections blank. If a section does not apply, write “N/A” (not applicable) instead of leaving it blank to prevent unauthorized additions after you have signed the document.

- Don’t choose an agent based solely on personal relationships. Consider the person’s ability to handle financial and legal responsibilities responsibly.

- Don’t forget to inform your agent. Make sure the person you have nominated as your agent is aware and agrees to take on this responsibility.

- Don’t neglect to review and update the document regularly. Life changes such as a divorce, the death of the chosen agent, or moving to another state may necessitate updating the POA.

- Don’t underestimate the importance of legal advice. Consulting with a lawyer can provide clarity, ensure the form is filled out correctly, and offers peace of mind.

Misconceptions

When people consider the Colorado Durable Power of Attorney (DPOA), there are several misconceptions that can lead to confusion, hesitation, and sometimes improper planning. Understanding the facts can help clarify these misunderstandings:

It grants unlimited power: A common misconception is that a DPOA gives someone else absolute control over all decisions. In reality, the scope of authority can be specifically tailored to include as much or as little power as the principal desires.

It goes into effect immediately: While some DPOAs are structured to take effect as soon as they are signed, others—known as "springing" powers—won't become effective until the principal becomes incapacitated, depending on the exact wording and stipulations included in the document.

It's only for the elderly: People often think DPOAs are only necessary for older adults. However, adults of any age should have a DPOA in place as accidents or sudden illnesses can happen to anyone, necessitating someone to make decisions on their behalf.

It supersedes a will: A DPOA allows an agent to act on the principal's behalf regarding financial or health decisions while the principal is alive but incapacitated. A will, on the other hand, is a document that speaks after death, detailing how a person’s estate should be distributed. Each serves a different purpose.

It's irrevocable: Many believe once a DPOA is signed, it can't be changed or revoked. This is not true. As long as the principal is mentally competent, they can amend or revoke their DPOA at any time.

It eliminates the need for a guardian or conservator: While a DPOA can make the appointment of a guardian or conservator less likely, it does not remove the court's ability to appoint one if deemed necessary for the welfare of the principal.

All DPOAs are the same: This is a critical misunderstanding. The powers granted, the conditions under which it becomes active, and other specifics can vary significantly from one DPOA to another. It’s important to have a document that matches one's individual needs.

A DPOA covers medical decisions: In Colorado, a separate document, known as a Medical Power of Attorney, is required for healthcare decisions. A general durable power of attorney typically covers financial decisions unless specifically stated otherwise.

Signing a DPOA means losing control: This is a significant fear for many, but signing a DPOA doesn’t mean the principal loses their ability to make their own decisions. Instead, it ensures someone they trust can make decisions for them if they're unable to do so themselves.

It’s valid in all states: While many states will acknowledge an out-of-state DPOA, there are differences in laws and requirements. It’s advisable for individuals to have a DPOA that complies with the laws of the state where they live or own property.

Key takeaways

Understanding the Colorado Durable Power of Attorney (DPOA) form is essential for making informed decisions about your future and ensuring that your affairs are managed according to your wishes, should you become unable to do so yourself. Here are key takeaways to help guide you through filling out and using the form effectively:

- Choose Your Agent Wisely: The person you appoint as your agent holds significant power, making decisions about your finances, real estate, and other aspects of your life if you are incapacitated. Choose someone you trust implicitly, who understands your values and will act in your best interest.

- Be Specific About Powers Granted: The DPOA form allows you to specify the exact powers you entrust to your agent. You can grant broad authority, or limit their powers to certain activities or periods. Clearly define what your agent can and cannot do to avoid confusion and misuse of authority.

- Understand the Durable Nature: Unlike a general power of attorney, a Durable Power of Attorney remains in effect even if you become mentally incapacitated. This ensures continuity in managing your affairs but also underscores the importance of selecting an agent you trust completely.

- Legal Requirements Must Be Met: Colorado law requires the DPOA form to be signed by the principal (the person granting the power) in the presence of a notary public or witness (requirements vary by state). Ensuring that these legal formalities are correctly followed is crucial for the document to be valid and enforceable.

Remember, completing a Durable Power of Attorney is a profound step in planning for the future. It's advisable to consult with a legal professional who can provide guidance tailored to your situation, helping you to understand all implications and ensure that your rights and wishes are fully protected.

Create Other Durable Power of Attorney Forms for US States

Ct Power of Attorney Forms Free - Setting up a Durable Power of Attorney is particularly important for individuals with dependents, securing their financial welfare.

Statutory Durable Power of Attorney Texas - A proactive measure to prevent financial chaos in the event of sudden illness or accident.