Blank Durable Power of Attorney Form for Connecticut

The Connecticut Durable Power of Attorney form represents a significant legal instrument through which an individual, known as the principal, can appoint someone they trust, referred to as the agent or attorney-in-fact, to manage their financial and legal affairs. This could include decisions regarding real estate, banking transactions, and personal and family maintenance, among others. One of the key characteristics that distinguishes this document from other power of attorney forms is its durability, meaning it remains effective even if the principal becomes incapacitated or unable to make decisions themselves. The ability to specify the extent of the agent’s powers, alongside the assurance that these powers endure through the principal’s incapacity, makes this form a critical component in financial planning and personal care arrangements. The flexibility to choose when the document becomes effective—either immediately upon signing or upon the occurrence of a future event, typically the principal’s incapacity—provides further customization to meet the unique needs and preferences of each individual. Ensuring the form is completed accurately and reflects the principal’s wishes requires careful consideration and, often, the guidance of legal professionals.

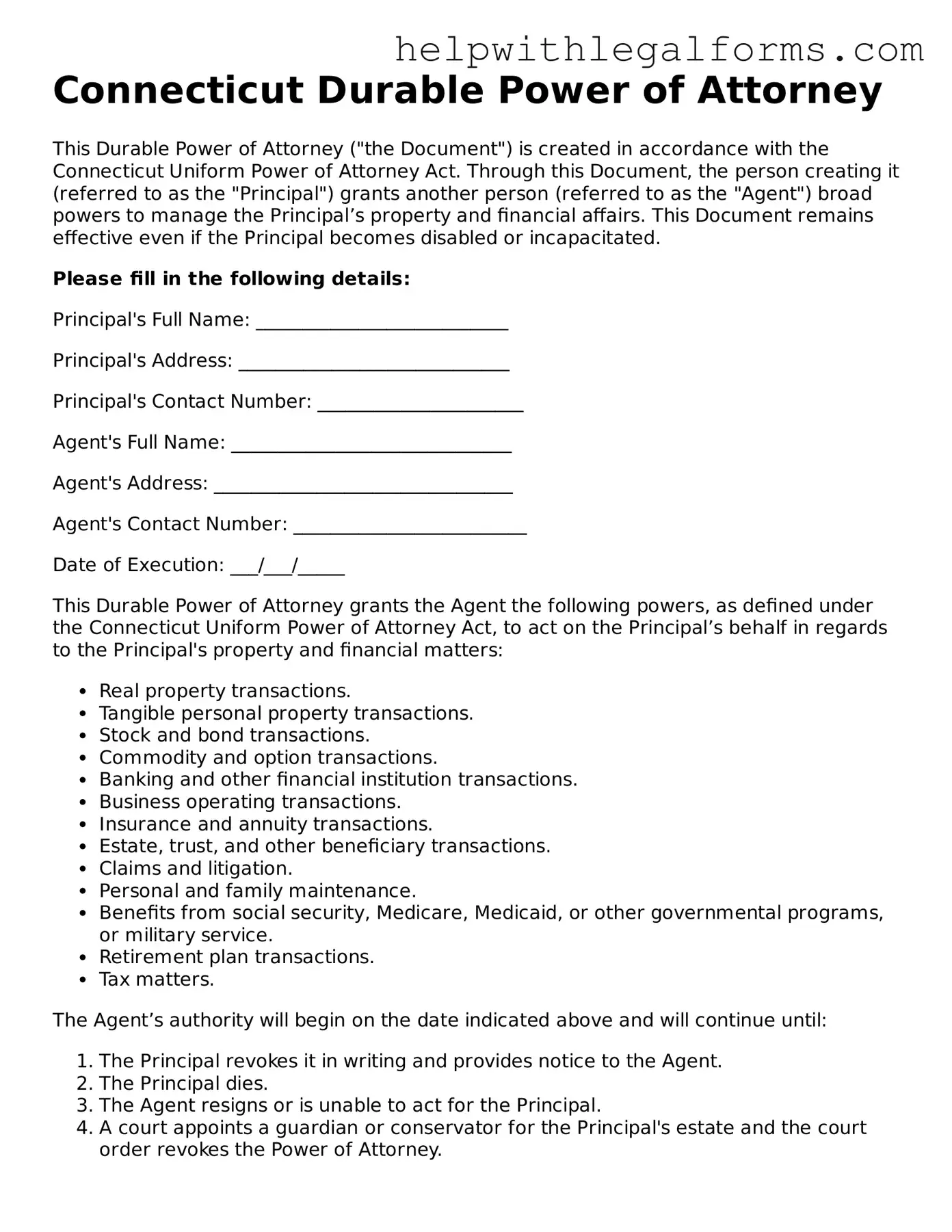

Example - Connecticut Durable Power of Attorney Form

Connecticut Durable Power of Attorney

This Durable Power of Attorney ("the Document") is created in accordance with the Connecticut Uniform Power of Attorney Act. Through this Document, the person creating it (referred to as the "Principal") grants another person (referred to as the "Agent") broad powers to manage the Principal’s property and financial affairs. This Document remains effective even if the Principal becomes disabled or incapacitated.

Please fill in the following details:

Principal's Full Name: ___________________________

Principal's Address: _____________________________

Principal's Contact Number: ______________________

Agent's Full Name: ______________________________

Agent's Address: ________________________________

Agent's Contact Number: _________________________

Date of Execution: ___/___/_____

This Durable Power of Attorney grants the Agent the following powers, as defined under the Connecticut Uniform Power of Attorney Act, to act on the Principal’s behalf in regards to the Principal's property and financial matters:

- Real property transactions.

- Tangible personal property transactions.

- Stock and bond transactions.

- Commodity and option transactions.

- Banking and other financial institution transactions.

- Business operating transactions.

- Insurance and annuity transactions.

- Estate, trust, and other beneficiary transactions.

- Claims and litigation.

- Personal and family maintenance.

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service.

- Retirement plan transactions.

- Tax matters.

The Agent’s authority will begin on the date indicated above and will continue until:

- The Principal revokes it in writing and provides notice to the Agent.

- The Principal dies.

- The Agent resigns or is unable to act for the Principal.

- A court appoints a guardian or conservator for the Principal's estate and the court order revokes the Power of Attorney.

- Any other event that terminates the Document as provided by Connecticut law occurs.

I, the undersigned Principal, declare that I understand the contents of this Document, and I voluntarily sign it, granting the powers herein to my chosen Agent. This Document is signed in the presence of a witness, whose signature appears below.

Principal's Signature: _____________________________

Date: ___/___/_____

Witness's Full Name: _____________________________

Witness's Address: ______________________________

Witness's Signature: _____________________________

Date: ___/___/_____

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Connecticut Durable Power of Attorney form is governed by the Connecticut Uniform Power of Attorney Act, which is found in Sections 1-350 to 1-353b of the General Statutes of Connecticut. |

| Durability | This form remains effective even if the person who made it, known as the principal, becomes physically or mentally incapacitated. |

| Agent Authority | The individual chosen by the principal in this form to act on their behalf is known as the agent or attorney-in-fact. This individual has the authority to make financial and other specified decisions for the principal. |

| Required Signatures | The Connecticut Durable Power of Attorney form must be signed by the principal and either witnessed by two adults who are not the agent or acknowledged before a notary public. |

| Springing Powers | The form can be structured to only become effective upon the occurrence of a specific event, such as the principal's incapacitation, making it a "springing" power of attorney. |

Instructions on How to Fill Out Connecticut Durable Power of Attorney

Creating a durable power of attorney in Connecticut is a crucial step that allows you to appoint someone you trust to handle your financial affairs if you ever become unable to do so yourself. This document ensures your financial matters are managed according to your wishes, even when you're not in a position to oversee them directly. Here’s a straightforward guide to help you fill out the Connecticut Durable Power of Attorney form correctly.

- Start by downloading the latest version of the Connecticut Durable Power of Attorney form from a reliable source to ensure it complies with current state laws.

- Enter your full name and address in the designated spaces at the top of the form to identify yourself as the principal (the person making the power of attorney).

- Fill in the full name and address of the person you are appointing as your agent (also known as an attorney-in-fact). This should be someone you trust implicitly to manage your finances.

- Review the powers you are granting to your agent, which are listed in the form. These typically include handling financial transactions, managing real estate, and making investment decisions, among other responsibilities. If there are specific powers you wish to withhold, make note of these exceptions in the appropriate section.

- If you want to grant your agent broad authority to act on your behalf, ensure that the relevant option is checked or initialed according to the form's instructions.

- Decide if your durable power of attorney will become effective immediately or only if you become incapacitated. Mark your choice clearly on the form.

- If the form includes sections for specifying any special instructions or limitations on the agent's power, complete these areas with clear, concise language.

- Check the form for a section that requires witness signatures, notary public stamps, or both. Connecticut law may require your durable power of attorney to be witnessed, notarized, or both to be legally valid.

- Sign and date the form in the presence of any required witnesses or a notary public, as specified by Connecticut law. Ensure your agent also signs the form if required.

- Keep the original document in a safe but accessible place, and provide your agent with a copy. It’s also wise to inform close family members or your attorney of its location and contents.

Filling out the Connecticut Durable Power of Attorney form is a major step in ensuring your financial matters are handled responsibly and according to your wishes. Always verify you have the most current form and understand each step to avoid any potential legal issues. Consider consulting with a legal professional to ensure your durable power of attorney effectively represents your interests.

Crucial Points on This Form

What is a Connecticut Durable Power of Attorney?

A Connecticut Durable Power of Attorney is a legal document allowing one person, known as the principal, to appoint another person, the agent, to manage their financial affairs. This arrangement continues to be effective even if the principal becomes incapacitated.

Who can serve as an agent under a Connecticut Durable Power of Attorney?

Any competent adult, such as a trusted family member, friend, or an attorney, can serve as an agent. The chosen individual should be someone the principal trusts deeply, as they will have significant authority over the principal's finances.

Can I specify what my agent can and cannot do?

Yes. When creating a Durable Power of Attorney in Connecticut, the principal can outline specific powers they wish to grant to their agent. These can range widely, from handling daily financial tasks to making major decisions about property or investments. The principal can also set limitations to these powers if they choose.

Is the Connecticut Durable Power of Attorney effective immediately?

It depends on how the document is structured. The principal can choose for it to take effect immediately upon signing or specify that it only becomes active upon the occurrence of a future event, such as the principal's incapacitation.

How can I revoke a Durable Power of Attorney in Connecticut?

The principal can revoke their Durable Power of Attorney at any time, as long as they are mentally competent. This is typically done by notifying the agent and all relevant financial institutions in writing and destroying all copies of the document.

Does a Connecticut Durable Power of Attorney need to be notarized?

Yes, for the document to be legally effective, it must be signed in the presence of a notary public. This formalizes the process and adds a layer of protection against fraud.

What happens if my agent is unable or unwilling to serve?

If your initially selected agent is unable or unwilling to serve, and you have named a successor agent in your Durable Power of Attorney, the successor agent will take over. If no successor is mentioned, you may need to create a new document.

Is a Connecticut Durable Power of Attorney valid in other states?

While many states may recognize an out-of-state Durable Power of Attorney, specific requirements can vary. It's advisable to create a new Durable Power of Attorney if you move to another state, to ensure it complies with local laws.

Do I need a lawyer to create a Durable Power of Attorney in Connecticut?

While it's not required to have a lawyer, consulting with one can be beneficial. A lawyer can help ensure that the document accurately reflects your wishes and provides advice on the powers granted to the agent.

What should I do with my completed Connecticut Durable Power of Attorney?

Once executed, the Durable Power of Attorney should be kept in a secure but accessible location. Copies should be given to your agent, any successor agents, and perhaps a trusted family member. It's also wise to inform your financial institutions of the arrangement.

Common mistakes

Filling out a Connecticut Durable Power of Attorney (POA) form can appear straightforward at first glance. However, it's a critical legal document that grants someone else the authority to make decisions on your behalf, typically concerning financial affairs, if you become unable to do so. A Power of Attorney is as powerful as it is delicate, requiring careful attention to detail. Below are nine common mistakes people often make when completing this form. Steering clear of these errors can help ensure that your interests are adequately protected and your wishes are accurately reflected.

- Not tailoring the document to specific needs - A generic form might not cover all the unique aspects of your financial situation or personal wishes. It's essential to customize the POA to reflect your circumstances accurately.

- Choosing the wrong agent - The person you appoint to manage your affairs, your agent, should be someone you trust implicitly. Failing to consider the agent's capability, trustworthiness, and willingness to serve can lead to issues down the line.

- Using unclear language - Ambiguities in the wording can lead to interpretations that might not align with your intentions. Clear, precise language helps ensure your desires are unambiguously understood.

- Forgetting to specify powers - The POA should clearly outline what the agent can and cannot do. A lack of specificity can either unduly limit the agent's ability to act on your behalf or grant more power than intended.

- Failing to include a durability provision - For a Power of Attorney to remain effective if you become incapacitated, it must contain specific language making it "durable." Without this, the document's value is significantly diminished in critical times.

- Not setting a term - While some may desire their POA to be indefinite, others might benefit from setting a specific term, ensuring that the document only remains in effect for a desired period or until certain conditions are met.

- Omitting a succession plan - What happens if your first choice for agent can no longer serve? Failing to name an alternate can lead to complications and potentially require court intervention.

- Neglecting to date and sign the document properly - A POA form that is not correctly dated or signed might not be legally valid. This seems basic, yet it's an astonishingly common mistake.

- Forgetting to get it witnessed or notarized, if required - Connecticut law has specific requirements for how a POA must be executed to be valid, including witnessing and notarization in some instances. Skipping these steps can render the document ineffective.

When you take the time to fill out a Connecticut Durable Power of Attorney correctly, you provide yourself and your loved ones with peace of mind, knowing that your financial affairs will be managed according to your wishes, regardless of what happens. Avoiding these common mistakes can help ensure that your Power of Attorney is a robust, effective tool for managing your affairs.

Documents used along the form

When someone in Connecticut decides to arrange a Durable Power of Attorney (DPOA), it's often a step within a broader plan to manage their affairs, should they become unable to do so themselves. A DPOA is a powerful tool, authorizing someone else to make legal and financial decisions on your behalf. However, to ensure comprehensive coverage of one's wishes, several other documents are frequently used in conjunction with a DPOA. Each document plays a distinct role in safeguarding an individual’s interests, making the ensemble of these documents a robust legal shield for various aspects of one’s life.

- Last Will and Testament: This document outlines how your property will be distributed after your death. It can also specify guardians for any minor children.

- Living Will: A living will clarifies your preferences regarding end-of-life care. It's used if you're unable to communicate your health care wishes directly.

- Health Care Proxy: Similar to a DPOA, but specifically for health care decisions, this designates someone to make medical decisions for you if you can't make them yourself.

- Living Trust: This allows you to put your assets in a trust to be managed by a trustee for the benefit of your chosen beneficiaries, potentially avoiding probate.

- Do Not Resuscitate (DNR) Order: A medical order stating you do not want CPR or other life-saving treatments if your heart stops or if you stop breathing.

- Declaration of Homestead: Protects the value of your home from creditors, providing security for your residence in financial or legal situations.

- Funeral and Burial Instructions: This document communicates your wishes for your funeral and burial arrangements, easing decision-making for your loved ones.

- Document of Anatomical Gift: Indicates if you want to donate your organs and tissues at the time of your death.

- Financial Inventory: Though not a formal legal document, a comprehensive list of your assets, liabilities, account numbers, and contacts can be invaluable in managing your estate.

- Personal Information Document: Contains essential personal details, contacts for close family, friends, and advisors, and may include your social security number, online account logins, and other vital data.

Together, these documents complement the Connecticut Durable Power of Attorney form, creating a cohesive plan that addresses not only your financial and legal needs but also your health care preferences and personal wishes. Crafting this suite of documents requires thoughtful consideration and, often, the guidance of legal counsel to ensure that your directives are clear and legally binding. The goal is not only to provide peace of mind for you but also to ease the burden on your loved ones by making your wishes clearly known and easily executable.

Similar forms

Living Will: A living will is similar to a durable power of attorney (POA) in that it allows you to express your preferences regarding medical treatment in advance. While a living will speaks to your health care wishes directly, a durable POA appoints someone else to make health care decisions on your behalf if you're unable to do so.

General Power of Attorney: This document also grants someone else the authority to make decisions on your behalf, much like a durable POA. However, a general power of attorney typically becomes invalid if you become incapacitated, whereas a durable POA remains in effect.

Health Care Proxy: Similar to a durable POA for health care, a health care proxy allows you to designate an agent to make health care decisions for you if you’re incapable. The main similarity is the delegation of decision-making authority regarding your health.

Springing Power of Attorney: This form of POA becomes effective only under circumstances that you specify, such as in the event of incapacitation. Like a durable POA, it allows you to plan for the future, but it has a triggering event for its activation.

Guardianship or Conservatorship: These legal processes appoint someone to manage your affairs if you're unable to do so, similar to how a durable POA designates an agent for you. The main difference is that courts are involved in establishing guardianship or conservatorship.

Financial Power of Attorney: This document specifically allows someone to handle your financial affairs. Like a durable POA, it can be made durable to remain in effect if you become incapacitated, focusing on financial decisions.

Advance Directive: An advance directive is a broader term that can include living wills and other types of health care directives, including a durable POA for health care. It outlines your preferences for medical care if you can't make decisions yourself.

Trust: A trust can manage your assets during your lifetime and after your death. While different in structure, a durable POA similarly allows you to appoint someone to manage your affairs, often including finances, though its powers usually cease at death, unlike a trust.

Do Not Resuscitate (DNR) Order: While a DNR specifically instructs health care professionals not to perform CPR if your heart stops or if you stop breathing, it's similar to a durable POA for health care in that it's a document expressing your health care wishes for specific situations.

Dos and Don'ts

Filling out a Durable Power of Attorney (DPOA) form in Connecticut allows you to appoint someone you trust to manage your affairs if you're unable to do so. Completing this form accurately is crucial for ensuring your wishes are respected. Below are important dos and don'ts to keep in mind:

Do:- Thoroughly read the form before you start filling it out to understand all the sections and what's expected.

- Choose a trustworthy individual (or individuals) to act as your agent, someone who understands your wishes and can act in your best interest.

- Be specific about the powers you are granting to your agent to avoid any confusion or ambiguity about their authority.

- Sign the form in the presence of a notary public to ensure its legality.

- Keep a copy of the completed form in a safe place where your agent and loved ones can access it if needed.

- Inform your agent, family, and possibly your healthcare provider about the existence of the DPOA and discuss your wishes with them.

- Consider reviewing and updating the DPOA periodically, especially after major life events such as marriage, divorce, or the birth of a child.

- Rush through the form without carefully considering each section and your decisions.

- Choose an agent based solely on familial relationships without considering their ability and willingness to act on your behalf.

- Leave any sections incomplete; an incomplete form may lead to unnecessary complications and legal questions.

- Forget to date and sign the form, as these steps are essential for the form's validity.

- Overlook the importance of selecting an alternate agent in case your primary agent is unable or unwilling to perform the duties.

- Fail to consider the potential need for restrictions or limitations on your agent's power, which can provide an additional layer of protection.

- Assume that your agent knows your wishes without clear, direct communication; make sure to discuss your intentions and expectations explicitly.

By following these guidelines, you will be better prepared to create a Connecticut Durable Power of Attorney that accurately reflects your wishes and protects your interests.

Misconceptions

Understanding the Connecticut Durable Power of Attorney (DPOA) form is essential for making informed decisions. However, several misconceptions can lead to confusion. Addressing these misconceptions head-on can help in clarifying the true nature and implications of the document.

Only for the Elderly: A common misconception is that DPOA is only for older adults. In reality, it's a crucial document for anyone over the age of 18 to ensure their affairs are handled according to their wishes in case they're unable to make decisions themselves due to illness or incapacitation.

Immediate Loss of Control: Many people wrongly believe that creating a DPOA means they immediately lose control over their financial or healthcare decisions. The truth is, the DPOA only takes effect under the conditions specified in the document, often at the point when the individual is deemed unable to make decisions for themselves.

Permanence: Another misconception is that once a DPOA is signed, it cannot be changed or revoked. In fact, as long as the person who created the DPOA is mentally competent, they can modify or revoke it at any time.

A Standardized Form Fits All: The belief that one standard DPOA form fits everyone's needs is incorrect. Connecticut law requires the DPOA to be tailored to the individual's specific circumstances and needs, potentially requiring legal advice to ensure it's properly executed and effective under state laws.

Automatically Covers Healthcare Decisions: The assumption that a DPOA automatically includes healthcare decisions is false. Connecticut separates powers of attorney for healthcare and finances into different documents. Make sure to execute a healthcare power of attorney or advance directive if you want to cover healthcare decisions.

Court Involvement Is Required: Some believe that court approval is necessary for a DPOA to be valid. This is not the case. For a DPOA to be legally binding in Connecticut, it must meet state-specific requirements, such as signature and notarization, without needing court validation.

Only Financial Matters: It's a common belief that DPOAs are only concerned with financial matters. While financial affairs are a significant part of many DPOAs, they can also grant authority over a range of other matters, including real estate transactions, business operations, and personal affairs depending on how it is drafted.

Key takeaways

The Connecticut Durable Power of Attorney form is a critical legal document that allows an individual to appoint someone else to manage their affairs in case they become incapacitated. Here are six key takeaways about filling out and using this form:

- Choose a reliable agent. The person you designate as your agent should be someone you trust implicitly, as they will have broad powers to manage your financial affairs.

- Be detailed. When filling out the form, be as specific as possible about the powers you are granting. This clarity can prevent future misunderstandings and legal challenges.

- Understand the durability aspect. A "durable" power of attorney remains in effect even if you become incapacitated, making it different from a standard power of attorney that would terminate under such circumstances.

- Consider appointing a successor agent. If your first choice can no longer serve for any reason, having a successor agent named ensures that your affairs will continue to be managed without interruption.

- Keep it up to date. Life changes, such as a move to another state or changes in your personal relationships, may necessitate updates to your Durable Power of Attorney.

- Legal advice is valuable. Given the potential complexities and the significance of this document, consulting with a legal professional can ensure that it accurately reflects your wishes and complies with current Connecticut laws.

Create Other Durable Power of Attorney Forms for US States

Durable Power of Attorney Pdf - Creating a Durable Power of Attorney ensures your affairs are managed by a trusted person, rather than by a court-appointed stranger.

Durable Financial Power of Attorney California - This form is an indispensable tool in comprehensive estate planning, enabling you to dictate how your affairs are handled.

Financial Power of Attorney Colorado - Designed to ensure your financial and personal affairs are handled in accordance with your wishes.