Blank Durable Power of Attorney Form for Florida

In Florida, residents have a powerful legal tool at their disposal to ensure their personal and financial affairs are managed according to their wishes, even if they become incapacitated. This tool is the Durable Power of Attorney form, a document that grants someone else the authority to make decisions on your behalf. It's crucial to understand the implications and structure of this form, as it has significant legal power. The person you choose, known as the agent, will have the ability to handle tasks such as paying bills, managing investments, and making healthcare decisions, depending on the specific powers you grant. Preparing this form carefully is essential, as it not only requires precise language to delineate the extent of power assigned but also must comply with Florida's legal requirements to be considered valid. Addressing this form's components with thoroughness will ensure that your wishes are honored, and your affairs are appropriately managed, providing peace of mind to both you and your loved ones.

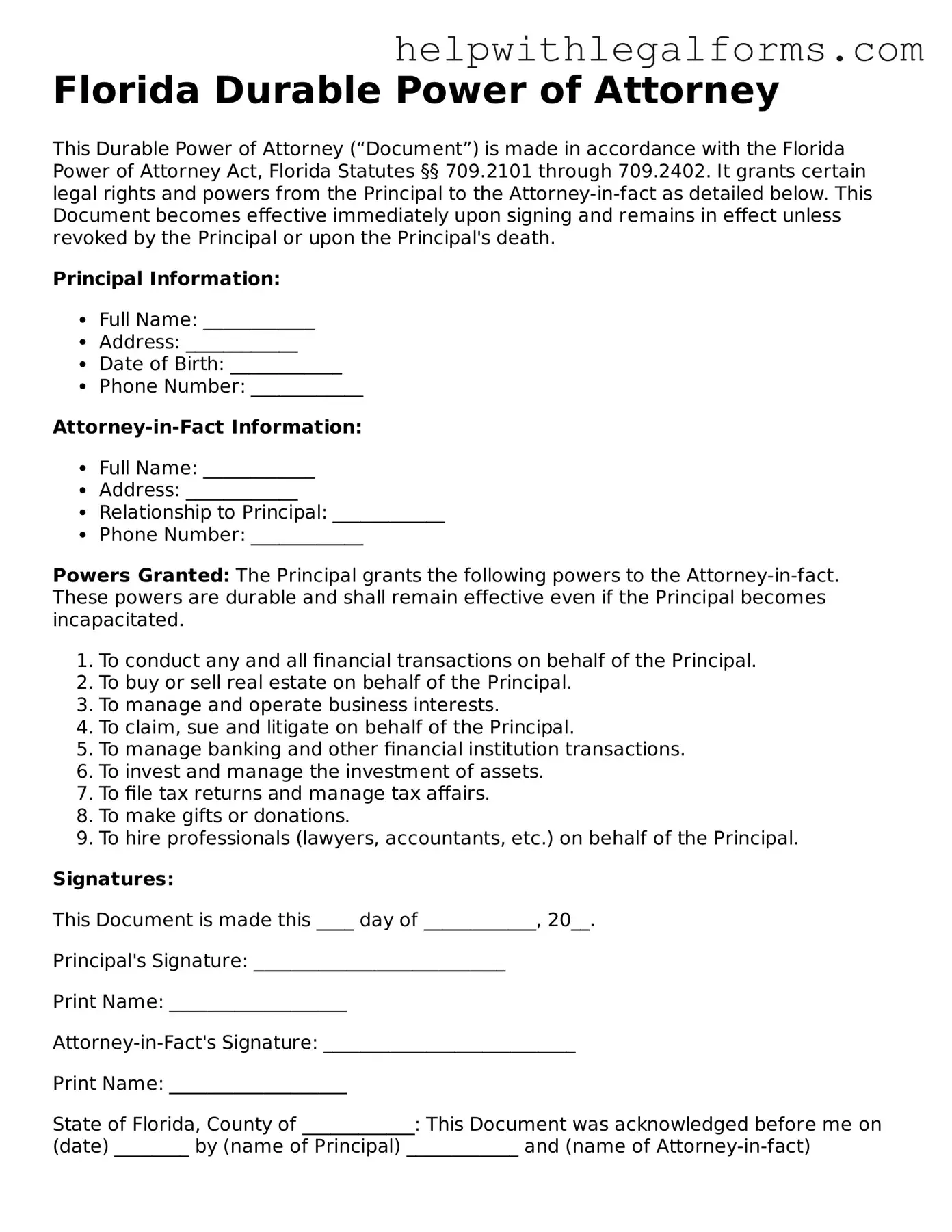

Example - Florida Durable Power of Attorney Form

Florida Durable Power of Attorney

This Durable Power of Attorney (“Document”) is made in accordance with the Florida Power of Attorney Act, Florida Statutes §§ 709.2101 through 709.2402. It grants certain legal rights and powers from the Principal to the Attorney-in-fact as detailed below. This Document becomes effective immediately upon signing and remains in effect unless revoked by the Principal or upon the Principal's death.

Principal Information:

- Full Name: ____________

- Address: ____________

- Date of Birth: ____________

- Phone Number: ____________

Attorney-in-Fact Information:

- Full Name: ____________

- Address: ____________

- Relationship to Principal: ____________

- Phone Number: ____________

Powers Granted: The Principal grants the following powers to the Attorney-in-fact. These powers are durable and shall remain effective even if the Principal becomes incapacitated.

- To conduct any and all financial transactions on behalf of the Principal.

- To buy or sell real estate on behalf of the Principal.

- To manage and operate business interests.

- To claim, sue and litigate on behalf of the Principal.

- To manage banking and other financial institution transactions.

- To invest and manage the investment of assets.

- To file tax returns and manage tax affairs.

- To make gifts or donations.

- To hire professionals (lawyers, accountants, etc.) on behalf of the Principal.

Signatures:

This Document is made this ____ day of ____________, 20__.

Principal's Signature: ___________________________

Print Name: ___________________

Attorney-in-Fact's Signature: ___________________________

Print Name: ___________________

State of Florida, County of ____________: This Document was acknowledged before me on (date) ________ by (name of Principal) ____________ and (name of Attorney-in-fact) ____________, who are personally known to me or who have produced ____________ as identification.

Notary Public: ___________________________

Commission Number: ____________

Expiration Date: ____________

Witnesses (Optional in Florida but Recommended):

- Witness 1 Signature: ___________________________

- Print Name: ___________________

- Witness 2 Signature: ___________________________

- Print Name: ___________________

Important Note: This Document grants significant powers to your Attorney-in-fact. It is strongly recommended that you consult with a lawyer to ensure your rights and interests are fully protected and that this Document achieves your intended legal effects.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Durable Power of Attorney form is governed by the Florida Statutes, Chapter 709, which covers Power of Attorney and similar instruments. |

| Durability Feature | Under the provisions of Chapter 709, a Durable Power of Attorney in Florida remains effective even if the principal becomes incapacitated, ensuring that the authorized agent can continue to act on the principal's behalf. |

| Principal Requirements | The individual granting authority, known as the principal, must be of sound mind at the time of signing the Florida Durable Power of Attorney form, affirming their understanding and consent to the delegation of authority to an agent. |

| Witnesses and Notarization | For a Florida Durable Power of Attorney to be legally binding, it must be signed by the principal in the presence of two witnesses and be notarized by a qualified notary public, as stipulated by state law. |

Instructions on How to Fill Out Florida Durable Power of Attorney

Upon deciding to establish a durable power of attorney in Florida, an individual is preparing to take a significant step towards ensuring their affairs are managed according to their wishes, even in circumstances where they're unable to make decisions themselves. This document provides the chosen representative, often referred to as the agent, the authority to handle financial and legal matters for the person creating the document, known as the principal. It's crucial for these forms to be completed meticulously, as inaccuracies or omissions can lead to legal complications or a failure to accurately reflect the principal's intentions. Here are the essential steps to take when filling out the Florida Durable Power of Attorney form.

- Gather all necessary information, including the full legal names, addresses, and contact details of the principal, the agent(s), and any successors (alternates) whom the principal wishes to assume the role if the original agent cannot serve.

- Review the powers being granted to the agent. These can include, but are not limited to, real estate transactions, banking, litigation, personal and family maintenance, and benefits from governmental programs or military service. Decide carefully which powers are to be assigned.

- Download the latest version of the Florida Durable Power of Attorney form from a reliable source, ensuring it adheres to current state laws.

- Enter the principal's details in the designated section of the form, followed by the information about the selected agent(s) and any successor agents.

- Specify the powers being granted to the agent. This typically involves ticking boxes next to predefined authorities or explicitly stating the powers in a dedicated section if the form allows. Precision is paramount to prevent ambiguity.

- If the form includes a section for special instructions, use this area to detail any specific wishes or limitations on the agent’s power. This could include stipulating that the agent must provide regular accounting to a third party or clarifying decisions that require prior consultation with family members or professionals.

- Visit a notary public with the designated agent(s) to sign the form in their presence, as Florida law requires durable power of attorney forms to be notarized. This step formalizes the document, making it legally binding.

- Distribute copies of the notarized form to relevant parties, such as financial institutions, doctors, or lawyers, to ensure they recognize the agent’s authority.

Completing the Florida Durable Power of Attorney form is a process that demands attention to detail and a clear understanding of the powers being granted. Once the document is properly filled out and signed, it serves as a robust legal tool, enabling the agent to act in the principal's best interest across a variety of circumstances. It's advisable for principals to discuss their intentions with the agents and, if necessary, consult with a legal professional to ensure the document achieves their desired outcome.

Crucial Points on This Form

What is a Durable Power of Attorney (DPOA) in Florida?

A Durable Power of Attorney in Florida is a legal document that allows you (the principal) to appoint someone else (your agent) to manage your financial affairs and make decisions on your behalf. This authority continues even if you become incapacitated or unable to make decisions for yourself.

Why do I need a Durable Power of Attorney?

Having a Durable Power of Attorney is important because it ensures that someone you trust can make decisions and act for you if you're unable to do so yourself. This can cover a wide range of matters, including paying bills, managing investments, and making real estate transactions. It's a key part of planning for the future, offering peace of mind for you and your loved ones.

How do I choose an agent for my DPOA in Florida?

Choosing an agent is a critical decision. This person should be someone you trust implicitly, such as a family member or close friend. You'll want to consider their honesty, reliability, and ability to handle financial matters. It's also wise to discuss this role with them to ensure they're willing and able to take on this responsibility.

Does my Durable Power of Attorney need to be witnessed or notarized in Florida?

Yes, Florida law requires that your DPOA is signed in the presence of two witnesses and notarized. The witnesses cannot be the person you have designated as your agent. This helps ensure the document is legally binding and can be recognized by financial institutions, courts, and other entities.

Can I revoke or change my Durable Power of Attorney?

Yes, as long as you're mentally competent, you can revoke or change your Durable Power of Attorney at any time. You should inform any parties that might be affected, especially the person you've named as your agent, and destroy all original copies of the old DPOA to prevent confusion.

What happens if I don't have a Durable Power of Attorney in Florida?

If you become incapacitated without a Durable Power of Attorney in place, it might be necessary for a court to appoint a guardian or conservator to make decisions on your behalf. This process can be lengthy, costly, and stressful for your loved ones. It also means losing control over who makes decisions for you.

Is a Durable Power of Attorney from another state valid in Florida?

In many cases, a Durable Power of Attorney created in another state will be recognized in Florida, especially if it complies with Florida's legal requirements. However, since state laws vary, it's a good idea to have it reviewed by a Florida lawyer to ensure it will be effective here.

Common mistakes

When filling out the Florida Durable Power of Attorney form, it's crucial for individuals to be thorough and precise to ensure their wishes are clearly communicated and legally valid. Here are some common mistakes that people often make during this process:

-

Not being specific about the powers granted. Many people fail to clearly specify which powers they are granting to their attorney-in-fact, leading to confusion or misuse of authority.

-

Choosing the wrong person as the attorney-in-fact. It's vital to select someone who is trustworthy, willing, and capable of handling your affairs, as this choice has significant consequences.

-

Failing to appoint a successor attorney-in-fact. Without a backup, if the initial attorney-in-fact cannot serve, the document may become useless.

-

Not specifying the conditions for the power of attorney to become effective. Some prefer their power of attorney to be effective immediately, while others may want it to spring into effect upon their incapacity. Not clarifying this can lead to issues.

-

Overlooking the requirement to have the document witnessed or notarized. Florida law requires specific witnessing and notarization for the document to be valid.

-

Not discussing the contents of the power of attorney with the appointed attorney-in-fact. Open communication ensures that the attorney-in-fact understands their responsibilities and your expectations.

-

Lack of specificity in granting financial powers. Without detailed instructions, the attorney-in-fact may be unsure of how to handle specific financial transactions.

-

Using a standard form without adapting it to personal needs. Each individual's situation is unique, and the document should reflect personal circumstances and wishes.

-

Forgetting to update the document. As life changes, so do relationships and preferences for who should act as attorney-in-fact.

-

Not consulting a legal professional. Failing to seek legal advice can lead to errors in the form's completion and misunderstandings about the document's effect, potentially rendering it invalid or ineffective.

Documents used along the form

When individuals prepare a Florida Durable Power of Attorney, a comprehensive document authorizing another person to manage affairs on their behalf, it's often part of a broader set of legal preparations. This broader set typically includes various forms and documents that work together to ensure a person’s wishes are fully understood and can be acted upon, especially in times when they might not be able to communicate these wishes themselves. Understanding these additional documents can provide a more complete framework for one’s legal and health care planning.

- Advanced Healthcare Directive (Living Will) – This document specifies a person's preferences for medical treatment in scenarios where they are unable to make decisions for themselves. It’s a crucial document that guides healthcare providers and loved ones on the types of life-sustaining treatments the individual would or would not want.

- Designation of Health Care Surrogate – Similar to a durable power of attorney but specifically focused on health care decisions. This document appoints someone to make medical decisions on behalf of the individual if they are incapacitated or otherwise unable to communicate their wishes.

- Last Will and Testament – Outlines how a person’s assets and estate will be distributed upon their death. It designates executors, guardians for any minor children, and specifies wishes for the handling of the individual's remains.

- Declaration of Pre-Need Guardian – This document allows individuals to specify their choice of guardian in the event they become mentally incapacitated. It can be crucial in avoiding family disputes and ensuring the individual's preferences are respected.

- HIPAA Release Form – The Health Insurance Portability and Accountability Act (HIPAA) keeps medical information private. This form grants specified individuals the ability to access the signee’s healthcare information, often necessary for making informed medical decisions on their behalf.

- Revocable Living Trust – Allows for the management of an individual’s assets during their lifetime and specifies how these assets are distributed upon their death. This can help avoid the often lengthy and costly probate process.

- Property Deed with Right of Survivorship – Not directly a document prepared with the Durable Power of Attorney but crucial for estate planning. It defines ownership of property so that upon one owner’s death, the property immediately transfers to the surviving owner without the need for probate.

- Do Not Resuscitate Order (DNR) – A critical medical order for individuals who do not wish to have cardiopulmonary resuscitation (CPR) performed if their heart stops or if they stop breathing. This order is typically prepared in consultation with a healthcare provider.

Together, these documents form a comprehensive legal strategy that not only designates who can make decisions on an individual's behalf but also guides these decisions in accordance with the individual’s specific wishes. Whether concerning financial affairs, medical care, or the distribution of assets after death, these forms and documents ensure that an individual's preferences are clearly articulated and legally enforceable. They provide peace of mind to the individual and clarity for family members and healthcare providers during challenging times.

Similar forms

Medical Power of Attorney: This document is similar to a Durable Power of Attorney (PoA) in that it grants someone else the authority to make decisions on your behalf. However, a Medical Power of Attorney is specifically focused on health care decisions. While a Durable PoA can cover a wide range of decisions including financial, legal, and personal matters, a Medical PoA is limited to decisions about medical treatment and health care when you are unable to make those decisions yourself.

General Power of Attorney: Like the Durable Power of Attorney, a General Power of Attorney allows you to appoint someone to make decisions and take actions on your behalf. The key difference is in the durability. A General Power of Attorney usually becomes invalid if you become mentally incapacitated. On the other hand, a Durable Power of Attorney is specifically designed to remain in effect even if you become unable to make decisions for yourself.

Springing Power of Attorney: Similar to a Durable Power of Attorney, a Springing Power of Attorney is also designed to allow someone else to handle your affairs. The main difference lies in the timing of when the power comes into effect. A Springing Power of Attorney only "springs" into action upon the occurrence of a specific event, such as the principal's incapacity, which must be clearly defined in the document. This contrasts with a Durable Power of Attorney, which is typically effective immediately upon execution, unless it specifically states otherwise.

Living Will: A Living Will resembles a Durable Power of Attorney in its forward-thinking approach to personal affairs, focusing rather on end-of-life care. It outlines your preferences for medical treatment in case you can't communicate them yourself. Though not granting decision-making power to another person, it guides healthcare providers about your wishes, similar to how a Durable PoA allows your appointed agent to make decisions according to your directives.

Limited Power of Attorney: This is a more specific version of the Durable Power of Attorney, designed to grant authority to another person to perform specific tasks or handle specific matters on your behalf. It differs from a Durable PoA in scope and duration. A Durable Power of Attorney is broader and remains in effect despite the principal's incapacity, whereas a Limited PoA is restricted to particular actions, transactions, or time periods.

Revocable Living Trust: A Revocable Living Trust is similar to a Durable Power of Attorney in that it can be used to manage your assets both during your lifetime and after your death. A key similarity is the ability to specify instructions for how your affairs should be handled if you become incapacitated or pass away. However, a Revocable Living Trust is a more complex instrument that involves transferring ownership of your assets into a trust, to be managed by a trustee for the benefit of your chosen beneficiaries.

Dos and Don'ts

Filling out the Florida Durable Power of Attorney form is a critical step in ensuring that your affairs are handled according to your wishes, should you become unable to manage them yourself. It is important to approach this task with care and consideration. Below are key dos and don'ts to guide you through this process:

- Do:

- Read through the entire form carefully before you start filling it out. This will give you a comprehensive understanding of the document and its requirements.

- Provide accurate and complete information. Ensure that the details of the principal, agent, and any successors are correctly filled in.

- Consider consulting with a legal professional. Given the importance and potential complexity of this document, seeking professional advice can ensure it is completed correctly and reflects your wishes accurately.

- Be specific about the powers you are granting. Clearly outline the extent and limitations of authority you are giving to your agent.

- Sign the document in the presence of a notary and witnesses as required by Florida law. This step is crucial for the document’s validity.

- Don't:

- Leave any sections blank. If a particular section does not apply, clearly mark it as "N/A" (not applicable) instead of leaving it empty.

- Assume your agent knows your wishes without discussing them. It is important to have a comprehensive conversation with the person you are appointing as your agent about your expectations and conditions.

- Rely on a generic form without ensuring it complies with Florida laws. State laws vary, and ensuring your form is valid in Florida is essential.

- Forget to update the document as your circumstances change. Review and revise your Durable Power of Attorney as necessary to reflect changes in your life, relationships, or preferences.

Misconceptions

In Florida, the Durable Power of Attorney (DPOA) is a legal document that allows someone to act on your behalf in financial and real estate matters if you become incapacitated. Despite its importance, there are several misconceptions surrounding its use and powers. Understanding the truths behind these misconceptions can help in making informed decisions.

All Durable Powers of Attorney are the same: A common misconception is that all Durable Powers of Attorney are standardized. In reality, the scope and powers granted through a DPOA can vary significantly based on the wording of the document and the specific powers granted. It's important to tailor the DPOA to your needs and to ensure it complies with Florida law.

A Durable Power of Attorney grants medical decision-making power: In Florida, a Durable Power of Attorney is primarily used for financial decisions and does not grant the agent authority to make medical decisions. For medical decisions, a separate document called a health care surrogate designation is used.

My spouse automatically has Durable Power of Attorney: Another common belief is that spouses have automatic rights to act on each other's behalf in legal and financial matters without a DPOA. However, to legally grant someone, even a spouse, the authority to make decisions on your behalf, a formally executed Durable Power of Attorney is required.

A Durable Power of Attorney goes into effect immediately after signing: While this can be true, it's not always the case. The DPOA can be structured to become effective immediately or only upon the occurrence of a specific event, such as the principal's incapacity. This flexibility allows the principal to control when the agent’s power begins.

Once signed, a Durable Power of Attorney cannot be changed: Many individuals wrongly believe that a DPOA cannot be modified or revoked. In fact, as long as the principal is mentally competent, they can amend or revoke a Durable Power of Attorney at any time.

A Durable Power of Attorney is only for the elderly: There is a misconception that DPOAs are only necessary for older adults. However, unexpected situations such as accidents or sudden illnesses can happen at any age, making a DPOA a valuable document for adults of all ages as part of a comprehensive estate plan.

Key takeaways

Filling out and using the Florida Durable Power of Attorney form is an important process that grants someone else the authority to act on your behalf. This power remains effective even if you become unable to make decisions for yourself. Here are key takeaways to consider:

- The person you choose to give power to is called the agent, and you're known as the principal. It's crucial that the agent is a person you trust completely, as they will have substantial control over your affairs.

- This form must be completed in accordance with Florida law, which means it not only needs to be filled out thoroughly but must also meet specific state requirements for it to be valid.

- The scope of the authority you grant can vary greatly. You have the option to give your agent broad powers, covering a wide range of decisions, or you can limit their powers to specific actions or events.

- It's important for the form to be signed in the presence of two witnesses and notarized. This step is required for the document to be legally binding in Florida.

- Communication is key. You should discuss your wishes and expectations with the person you're appointing as your agent. It is also wise to inform close family members or friends about the decision and the reasons behind it.

- Keep the original document in a safe but accessible place. Inform your agent, family, or a trusted friend about where it is stored. Copies can be given to your agent and any institutions, like banks or doctors' offices, which may need it.

By carefully considering these points and following the necessary steps, you can ensure that your affairs will be managed as you intend, even in situations where you're unable to make decisions yourself.

Create Other Durable Power of Attorney Forms for US States

Financial Power of Attorney Colorado - Allows for the management of personal and business finances in a manner consistent with your expectations.

Power of Attorney in New Jersey - Having a Durable Power of Attorney is akin to having a financial contingency plan that kicks in when you need it most.

Ct Power of Attorney Forms Free - This document plays a critical role in elder care planning, addressing potential incapacity due to aging.