Blank Durable Power of Attorney Form for Georgia

In the state of Georgia, individuals have the ability to make critical decisions regarding their personal, financial, and health affairs, even when they are unable to do so themselves, through the creation of a Durable Power of Attorney form. This significant legal document grants a chosen representative, often referred to as an agent or attorney-in-fact, the authority to manage matters ranging from banking transactions to real estate decisions on the grantor's behalf. Unlike other power of attorney forms, the durable nature of this document ensures that the agent's authority remains in effect even if the principal becomes incapacitated, making it an essential part of estate planning and personal preparedness. The form's relevance and utility stretch across various scenarios, providing peace of mind to both the individual it protects and their loved ones. By understanding the major aspects of the Georgia Durable Power of Attorney form, individuals are better equipped to take proactive steps in managing their futures effectively.

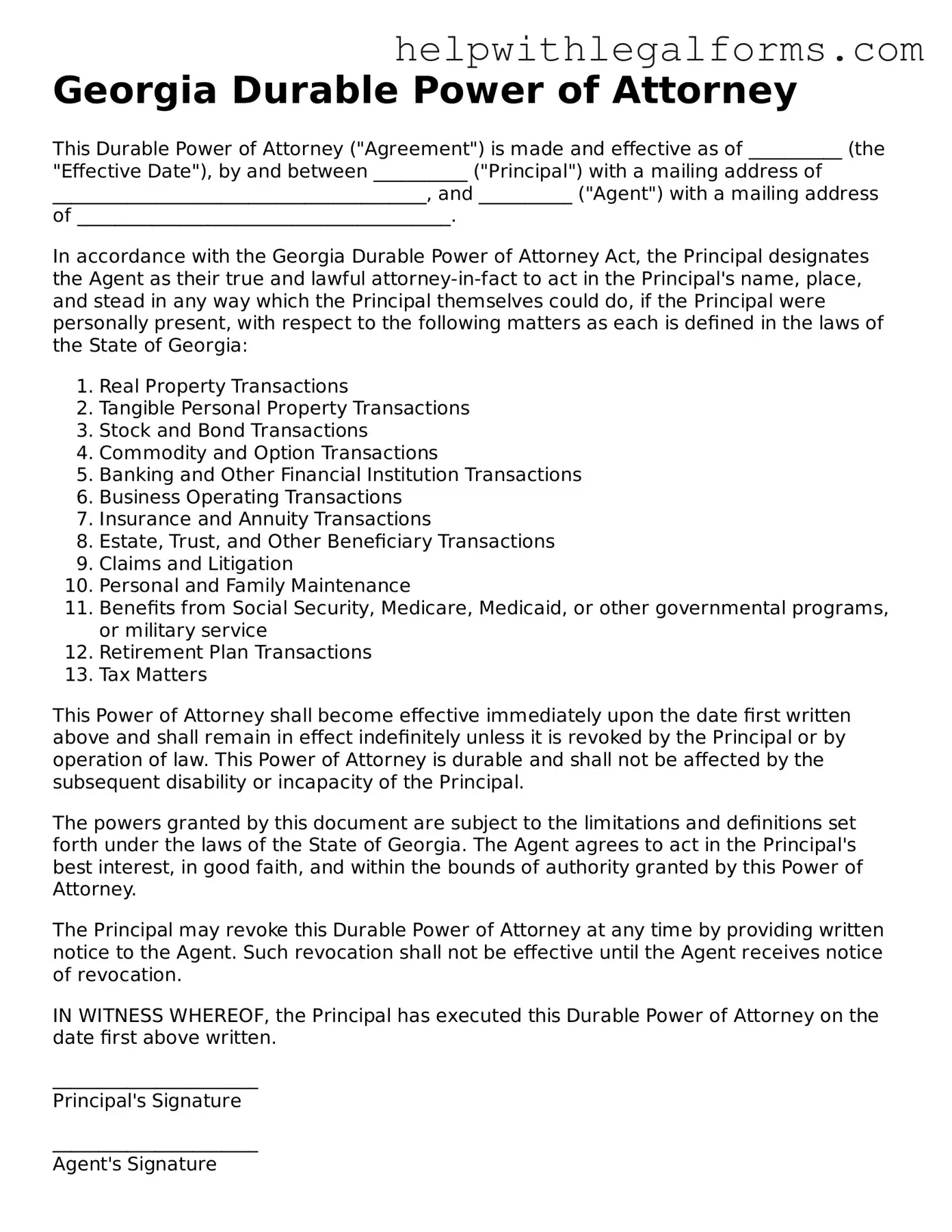

Example - Georgia Durable Power of Attorney Form

Georgia Durable Power of Attorney

This Durable Power of Attorney ("Agreement") is made and effective as of __________ (the "Effective Date"), by and between __________ ("Principal") with a mailing address of ________________________________________, and __________ ("Agent") with a mailing address of ________________________________________.

In accordance with the Georgia Durable Power of Attorney Act, the Principal designates the Agent as their true and lawful attorney-in-fact to act in the Principal's name, place, and stead in any way which the Principal themselves could do, if the Principal were personally present, with respect to the following matters as each is defined in the laws of the State of Georgia:

- Real Property Transactions

- Tangible Personal Property Transactions

- Stock and Bond Transactions

- Commodity and Option Transactions

- Banking and Other Financial Institution Transactions

- Business Operating Transactions

- Insurance and Annuity Transactions

- Estate, Trust, and Other Beneficiary Transactions

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement Plan Transactions

- Tax Matters

This Power of Attorney shall become effective immediately upon the date first written above and shall remain in effect indefinitely unless it is revoked by the Principal or by operation of law. This Power of Attorney is durable and shall not be affected by the subsequent disability or incapacity of the Principal.

The powers granted by this document are subject to the limitations and definitions set forth under the laws of the State of Georgia. The Agent agrees to act in the Principal's best interest, in good faith, and within the bounds of authority granted by this Power of Attorney.

The Principal may revoke this Durable Power of Attorney at any time by providing written notice to the Agent. Such revocation shall not be effective until the Agent receives notice of revocation.

IN WITNESS WHEREOF, the Principal has executed this Durable Power of Attorney on the date first above written.

______________________

Principal's Signature

______________________

Agent's Signature

State of Georgia

County of __________

This document was acknowledged before me on _________ (date) by __________ (name of Principal) and __________ (name of Agent).

______________________

Notary's Signature

My commission expires: __________

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | The Georgia Durable Power of Attorney form allows an individual to appoint someone they trust to manage their financial affairs. |

| 2 | This form remains effective even if the principal (the person making the designation) becomes incapacitated. |

| 3 | It is governed by the Georgia Code Title 10, Chapter 6B (Uniform Power of Attorney Act). |

| 4 | The appointed person, known as the agent, can handle tasks such as paying bills, managing investments, and buying or selling real estate. |

| 5 | The principal must sign the form in the presence of a notary public for it to be valid. |

| 6 | Choosing someone who is trustworthy and financially astute is crucial, as they will have significant power over the principal’s assets. |

| 7 | If the principal wishes to revoke the power of attorney, they must do so in writing and inform any institutions or parties that were relying on the original document. |

Instructions on How to Fill Out Georgia Durable Power of Attorney

Creating a Durable Power of Attorney (DPOA) in Georgia is an important step in planning for the future. This document allows you to appoint someone you trust to manage your financial affairs if you become unable to do so yourself. The process of filling out this form doesn't have to be daunting. By following these simple steps, you'll have your Power of Attorney in place, giving you peace of mind knowing that your affairs are in trusted hands.

- Gather the necessary information. Before you fill out the Georgia Durable Power of Attorney form, make sure you have the full legal names and addresses of the person you're appointing (the "agent") and any alternate agents in case your first choice is unable or unwilling to serve. Also, decide on the extent of powers you want to give and any specific instructions or limitations.

- Access the form. Obtain a current Georgia DPOA form. This can be from a legal forms website, from an attorney, or a reliable legal resource center.

- Fill out the "Principal" section by entering your full legal name and address, establishing you as the individual granting the power.

- In the "Agent" section, write the full legal name and address of your chosen agent. If you're naming an alternate agent, fill in their information as well.

- Specify the powers you are granting. The form may provide a list of standard powers with checkboxes next to each. Read each item carefully and check the boxes next to the powers you want to grant your agent. If you wish to add limitations or specific conditions, look for a section where you can provide custom instructions.

- Look for the "Special Instructions" section to provide any additional directions or limitations on the agent's power. This could include a limitation on how long the power of attorney lasts (although a Durable Power of Attorney typically remains in effect until the principal dies or revokes it).

- Sign and date the form in the presence of a notary public. Most states require that the Durable Power of Attorney be notarized to have legal effect. Verify if Georgia requires witnesses in addition to notarization.

- Have your agent sign the form, if required. Some forms may have a section for the agent to acknowledge their acceptance of the responsibilities being assigned.

- Store the completed form in a safe, accessible place. Inform your agent where the document is stored and provide copies to your financial institutions, attorney, or anyone else who may need it.

Remember, the Durable Power of Attorney is a powerful and vital tool for ensuring your affairs are managed according to your wishes should you be unable to do so yourself. Taking the time to fill it out carefully and correctly can save you and your loved ones a lot of potential stress and complications in the future.

Crucial Points on This Form

What is a Durable Power of Attorney (DPOA) in Georgia?

A Durable Power of Attorney in Georgia is a legal document that allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated, ensuring that their financial, legal, and health-related decisions can be managed according to their wishes.

How does one create a DPOA in Georgia?

To create a DPOA in Georgia, the principal must complete a Durable Power of Attorney form, which outlines the powers granted to the agent. This form must be signed by the principal in the presence of a notary public to be legally binding. Georgia law may have specific requirements regarding the content of the form and the signing process, so it is essential to consult current laws or an attorney to ensure compliance.

Who should be chosen as an agent in a DPOA?

Choosing an agent is a significant decision since this person will have the authority to make decisions on the principal’s behalf. It is crucial to select someone who is trustworthy, reliable, and capable of handling the responsibilities involved. This could be a family member, a close friend, or a professional advisor with the principal’s best interests in mind.

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney in Georgia can be revoked by the principal at any time, as long as they are mentally competent. To revoke a DPOA, the principal needs to communicate their intention to revoke it clearly, usually in writing, and notify the current agent as well as any institutions or individuals that were aware of the existing DPOA.

What powers can be granted with a DPOA in Georgia?

A DPOA in Georgia can grant the agent a wide range of powers, including managing bank accounts, paying bills, investing money, selling property, and handling other financial affairs. The scope of powers can be as broad or as limited as the principal wishes, with the ability to specify particular tasks or set limitations in the DPOA document.

When does a DPOA come into effect in Georgia?

The Durable Power of Attorney can be designed to come into effect as soon as it is signed, or it can be a “springing” DPOA, which means it only takes effect under circumstances defined in the document, such as when the principal becomes incapacitated. The principal’s preferences should be clearly stated in the document to avoid confusion.

Is a DPOA the same as a Medical Power of Attorney in Georgia?

No, a Durable Power of Attorney is typically focused on financial and legal decisions, whereas a Medical Power of Attorney, or healthcare proxy, specifically grants an agent the power to make healthcare decisions on the principal’s behalf. However, the principal can appoint the same person as their agent for both documents if they choose.

Do I need a lawyer to create a DPOA in Georgia?

While it is not legally required to have a lawyer to create a Durable Power of Attorney in Georgia, consulting with an attorney experienced in estate planning can be very beneficial. They can help ensure that the DPOA document accurately reflects the principal’s wishes and complies with current Georgia laws, providing peace of mind that the principal’s affairs will be handled as they desire.

Common mistakes

Filling out the Georgia Durable Power of Attorney form is a critical step in planning for the future. It allows you to appoint someone you trust to manage your financial affairs if you're unable to do so. However, errors can occur during this process, potentially complicating matters. Here are ten common mistakes to be aware of:

Not using the correct form: It's crucial to use the state-specific form for Georgia, as requirements can vary significantly between states.

Skipping details: Failing to complete every section thoroughly, leaving blank spaces where information is required, can invalidate the document.

Choosing the wrong agent: The importance of selecting an agent who is not only trustworthy but also capable of managing financial affairs cannot be overstated.

Forgetting to specify powers: Not clearly defining the scope of the agent's powers can lead to confusion and legal complications down the line.

Overlooking alternate agents: Neglecting to appoint an alternate agent can leave you without representation if your primary agent is unable or unwilling to serve.

Ignoring the need for witness signatures: Georgia law requires your durable power of attorney to be witnessed by competent adults, overlooking this can render the document invalid.

Failure to notarize: While not always legally required, notarizing the document can add a layer of legality and authenticity, making it harder to challenge.

Misunderstanding the form's durability: Some people might not realize that a "durable" power of attorney remains in effect if you become incapacitated, mistaking it for a general power of attorney which does not.

Not updating the document: Life changes such as divorce, relocation, or the death of an agent can necessitate updates to your durable power of attorney.

DIY without legal advice: While it’s possible to fill out the form on your own, consulting a legal professional can ensure that it meets all legal requirements and truly reflects your wishes.

Avoiding these mistakes can help ensure your Georgia Durable Power of Attorney form accurately conveys your wishes and is legally binding. Paying close attention to detail and possibly consulting with a legal professional can offer peace of mind that your financial matters will be in good hands, even if you're not able to manage them yourself.

Documents used along the form

When a person is planning their estate or needs to manage their affairs due to incapacity, a Durable Power of Attorney (DPOA) in Georgia is a critical document. However, it often works best in cooperation with other forms and documents to ensure comprehensive legal and financial preparations. Here are nine commonly used forms and documents that often accompany a Durable Power of Attorney for a well-rounded estate plan or management of affairs.

- Advance Directive for Health Care: This document lets individuals express their wishes regarding medical treatment and appoint someone to make health care decisions if they are unable to do so.

- Last Will and Testament: Specifies an individual's wishes regarding how their property and estate should be distributed after death.

- Living Will: Provides instructions for end-of-life care, detailing what types of life-sustaining measures should or should not be taken.

- Revocable Living Trust: Allows individuals to manage their assets during their lifetime and specify how those assets should be distributed upon their death, often bypassing probate.

- Financial Statement: A detailed document listing an individual's assets, liabilities, and other financial information, often used to give the appointed attorney-in-fact a clear picture of the financial situation.

- HIPAA Release Form: Permits healthcare providers to disclose health information to appointed individuals, often necessary for the person named in a healthcare power of attorney to make informed decisions.

- Designation of Preneed Guardian: Allows individuals to nominate a guardian in advance, in the event of future incapacity.

- Declaration of Guardian for Minor Children: Specifies an individual's choice for a guardian of their minor children, in the event of the parent's death or incapacity.

- Personal Property Memorandum: Linked to a will, this document allows for the designation of beneficiaries for personal property not specifically covered in the will.

Each of these documents plays a pivotal role in estate planning and personal affairs management. Together with a Durable Power of Attorney, they provide a comprehensive legal strategy to protect an individual's wishes and assets. It's advisable to consult with a legal professional when drafting these documents to ensure they align with Georgia laws and effectively reflect the individual's intentions.

Similar forms

General Power of Attorney: This document resembles a Durable Power of Attorney because it authorizes someone to act on your behalf in various matters. The key difference is it becomes null if the person who made it becomes incapacitated.

Medical Power of Attorney: Similar to a Durable Power of Attorney, a Medical Power of Attorney allows you to select someone to make healthcare decisions for you if you're unable to do so. It’s strictly limited to medical decisions, unlike the broader scope of a Durable Power of Attorney.

Living Will: A Living Will, like a Durable Power of Attorney, involves making decisions in advance, but it's specifically about your healthcare preferences in end-of-life situations. It doesn’t appoint someone to make decisions but declares your wishes directly.

Trust: A Trust can manage your assets while you're alive or after your death, somewhat like a Durable Power of Attorney. However, a Trust specifically involves transferring legal title of certain assets to trustees who manage them according to the Trust's terms.

Last Will and Testament: This document directs how your assets are distributed upon your death, making it similar to portions of a Durable Power of Attorney that deal with financial matters. However, it has no force while you're alive and only applies after death.

Advance Directive: An Advance Directive is akin to a Durable Power of Attorney in that it makes preparations for when you're unable to make your own decisions. It can include both a Living Will and a Medical Power of Attorney.

Limited Power of Attorney: A Limited Power of Attorney allows someone to act in your stead for specific, limited purposes. Like a Durable Power of Attorney, it grants authority to another person, but it's much more narrowly focused.

Financial Power of Attorney: This empowers someone to handle your financial affairs, closely mirroring the financial aspects of a Durable Power of Attorney. The difference mainly lies in its durability during the principal's incapacitation.

Guardianship: A court establishes Guardianship when determining someone is incapable of making their own decisions. While a Durable Power of Attorney is arranged before incapacity, both arrangements enable another party to make decisions on one's behalf.

Conservatorship: Similar to guardianship but often involving financial decisions, a Conservatorship is court-appointed. Unlike a Durable Power of Attorney, which the individual initiates, a conservatorship is usually established when the person is already incapacitated.

Dos and Don'ts

When filling out the Georgia Durable Power of Attorney form, it is crucial to approach the process with care and precision. This legal document grants another person the power to manage your financial affairs, and therefore, requires thorough attention. Below are guidelines highlighting the do's and don'ts to ensure the form is completed accurately and effectively.

Do's:

- Read the entire form carefully before beginning to fill it out. Understanding every section is key to ensuring you grant exactly the powers you intend.

- Clearly identify the person you are appointing as your agent, also known as the attorney-in-fact, by providing their full legal name and contact information. This ensures there is no ambiguity regarding who has been given authority.

- Be specific about the powers you are granting. If certain areas of your financial affairs should be managed by the agent, state these explicitly on the form.

- Include any special instructions or limitations to the agent’s power. This might involve specifying circumstances under which the power should be exercised or restricted.

- Sign the form in the presence of a notary public to validate its authenticity. Georgia law requires notarization for the document to be legally binding.

- Inform your agent about their appointment and discuss your expectations. Ensuring they understand their responsibilities and your financial goals is essential for a smooth operation.

Don'ts:

- Don’t leave any sections blank. If a section does not apply, mark it as "N/A" (not applicable) instead of leaving it empty to avoid any confusion.

- Don’t assume general descriptions of power will be understood the same way by everyone. Be clear about what each power entails.

- Avoid using terms that are ambiguous or could be interpreted in various ways. Clarity and precision in language are paramount.

- Don’t forget to regularly update the document. Personal circumstances and relationships change, and your Durable Power of Attorney should reflect your current situation and wishes.

- Don’t sign the document without a witness or notary public present, as this could lead to questions about its validity later on.

- Don’t appoint someone as your agent whom you do not completely trust. This person will have extensive control over your finances, so choosing someone reliable and responsible is critical.

Misconceptions

When discussing a Durable Power of Attorney (DPOA) in Georgia, it's crucial to clear up some common misunderstandings. This document is a powerful legal tool that allows someone to act on your behalf if you are unable to do so. However, misconceptions can lead to hesitancy or misuse. Here are four common misconceptions explained:

- It grants unlimited power immediately. Many believe that by signing a DPOA, they are immediately and completely relinquishing control over their affairs. This is not accurate. The DPOA in Georgia can be designed to only take effect under certain conditions, such as the principal's incapacitation, ensuring that the principal retains control until it is deemed necessary for the agent to step in.

- It is only for the elderly. There's a misconception that DPOA forms are only necessary for older adults. The truth is, life is unpredictable at any age. Accidents or sudden illnesses can happen to anyone, making it wise for adults of all ages to consider preparing a DPOA. It ensures that your affairs can be managed according to your wishes, no matter what happens.

- It overrides a will. Some individuals mistakenly believe that a DPOA can override their will upon their incapacity or death. However, the power of attorney ceases to be effective upon the principal's death. At that point, the directives in the person's will take precedence for distributing their estate and managing final affairs.

- It's too complex for individuals to set up on their own. While it's true that legal documents can often be complex, the process of setting up a DPOA in Georgia doesn't have to be daunting. Professional legal guidance can help simplify the process, ensuring that the document accurately reflects your wishes and complies with state laws. However, individuals should still thoroughly educate themselves and consider professional advice to ensure all legal requirements are met and that the document serves its intended purpose effectively.

Dispelling these misconceptions about the Durable Power of Attorney in Georgia helps individuals understand its importance and encourages more people to take steps to protect themselves and their families in uncertain times.

Key takeaways

When preparing to complete a Georgia Durable Power of Attorney (DPOA) form, it's crucial to understand its purpose and implications thoroughly. This legal document grants someone you trust the authority to handle your affairs if you are unable to do so yourself. Here are key takeaways to ensure you fill out and use the DPOA form effectively:

- Choose your agent wisely. The individual you appoint as your agent holds significant responsibility. This person will manage your financial affairs, which could include banking transactions, property management, and investment decisions. Choosing someone who is not only trustworthy but also has some financial acumen is advisable.

- Understand the powers you are granting. It's essential to know precisely what abilities you are giving to your agent. The DPOA can be as broad or as specific as you desire. For instance, you might authorize your agent to handle all your financial affairs or limit their powers to only certain activities.

- Consider adding a successor agent. Life is unpredictable. If your initial agent is unable or unwilling to serve at the necessary time, having a successor agent listed in your DPOA can ensure your affairs are still managed without interruption.

- Know the legal requirements. For a DPOA to be valid in Georgia, it must adhere to specific state laws. These requirements can include witness signatures, notarization, or other formalities.

- Discuss your decisions with your agent(s). Before finalizing the DPOA, have a thorough discussion with your chosen agent(s) about your expectations and the duties involved. It's crucial that they understand their responsibilities and agree to take on the role.

- Keep your document accessible. Once the DPOA is complete, store it in a safe yet accessible place. Your agent, family members, or trusted friends should know where to find it if they need to act on your behalf.

- Regularly review and update your DPOA. Over time, your situation or wishes might change. Regularly reviewing and, if necessary, updating your DPOA ensures that it always reflects your current preferences and circumstances. This might include changing your agent or modifying the powers granted.

Creating a Durable Power of Attorney is a proactive step towards ensuring your affairs are handled according to your wishes, even if you're not in a position to manage them yourself. By considering these key takeaways, you can approach this important task with confidence and clarity.

Create Other Durable Power of Attorney Forms for US States

Durable Financial Power of Attorney California - By appointing an agent, you're ensuring that someone familiar with your values and wishes can make decisions in line with your preferences.

Ct Power of Attorney Forms Free - This document is instrumental in ensuring that an individual’s financial plan is executed as intended, without interruptions.