Blank Durable Power of Attorney Form for Maryland

When considering future planning, individuals often think about what will happen if they become unable to make decisions for themselves due to illness or incapacity. This is where a Maryland Durable Power of Attorney form plays a crucial role. It's a legal document that allows a person, known as the principal, to appoint someone else, called the attorney-in-fact or agent, to handle their financial affairs and make decisions on their behalf should they become incapacitated or unable to do so. Unlike a standard power of attorney, which becomes ineffective if the principal becomes incapacitated, the durable power remains in effect, providing peace of mind that one's financial matters will be taken care of by a trusted individual. The form covers a wide range of actions, from managing bank accounts and real estate transactions to handling investments and filing taxes, ensuring that the principal's financial obligations continue to be met. For anyone residing in Maryland, understanding and completing a Durable Power of Attorney form is a proactive step towards comprehensive life planning, safeguarding both their interests and those of their loved ones should the unexpected occur.

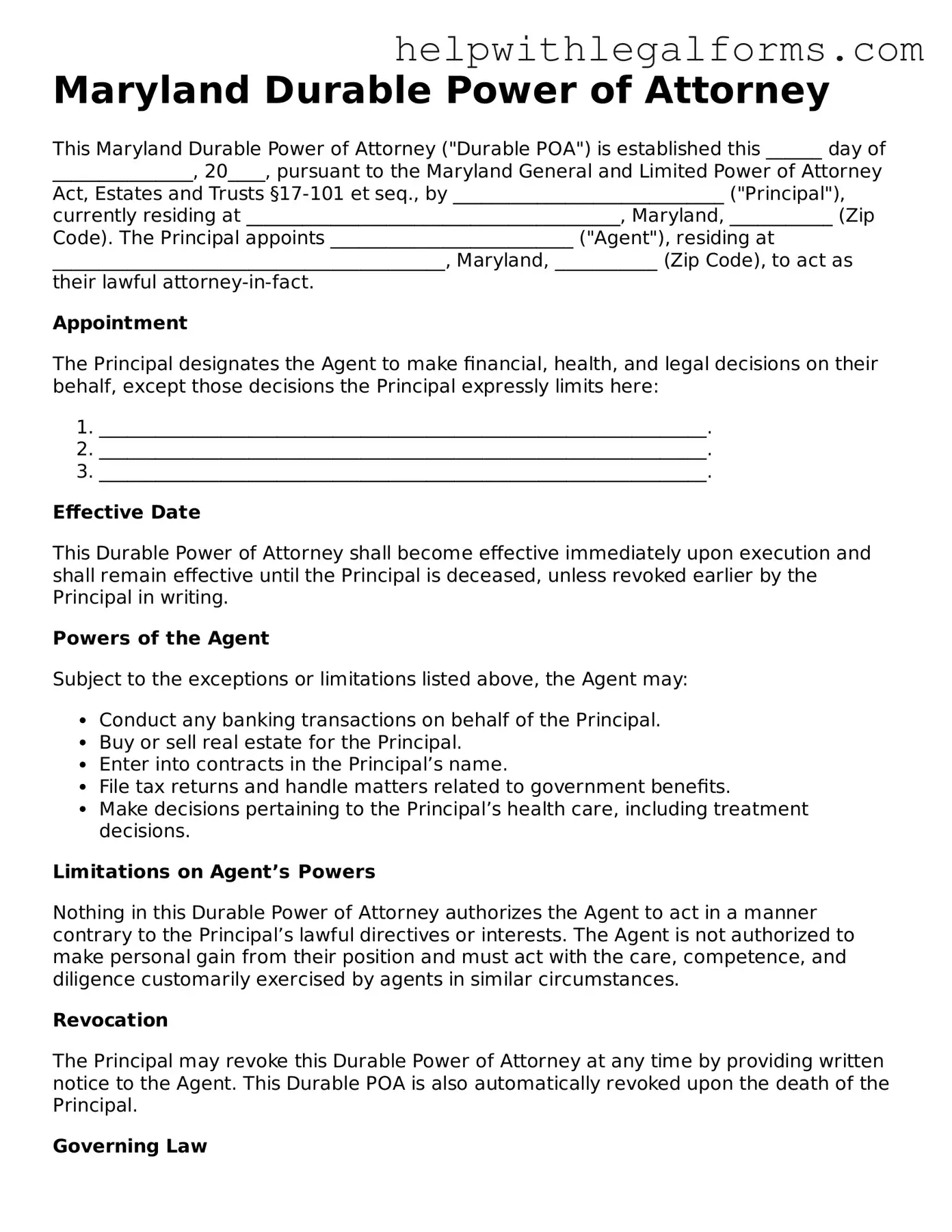

Example - Maryland Durable Power of Attorney Form

Maryland Durable Power of Attorney

This Maryland Durable Power of Attorney ("Durable POA") is established this ______ day of _______________, 20____, pursuant to the Maryland General and Limited Power of Attorney Act, Estates and Trusts §17-101 et seq., by _____________________________ ("Principal"), currently residing at ________________________________________, Maryland, ___________ (Zip Code). The Principal appoints __________________________ ("Agent"), residing at __________________________________________, Maryland, ___________ (Zip Code), to act as their lawful attorney-in-fact.

Appointment

The Principal designates the Agent to make financial, health, and legal decisions on their behalf, except those decisions the Principal expressly limits here:

- _________________________________________________________________.

- _________________________________________________________________.

- _________________________________________________________________.

Effective Date

This Durable Power of Attorney shall become effective immediately upon execution and shall remain effective until the Principal is deceased, unless revoked earlier by the Principal in writing.

Powers of the Agent

Subject to the exceptions or limitations listed above, the Agent may:

- Conduct any banking transactions on behalf of the Principal.

- Buy or sell real estate for the Principal.

- Enter into contracts in the Principal’s name.

- File tax returns and handle matters related to government benefits.

- Make decisions pertaining to the Principal’s health care, including treatment decisions.

Limitations on Agent’s Powers

Nothing in this Durable Power of Attorney authorizes the Agent to act in a manner contrary to the Principal’s lawful directives or interests. The Agent is not authorized to make personal gain from their position and must act with the care, competence, and diligence customarily exercised by agents in similar circumstances.

Revocation

The Principal may revoke this Durable Power of Attorney at any time by providing written notice to the Agent. This Durable POA is also automatically revoked upon the death of the Principal.

Governing Law

This Durable Power of Attorney shall be governed by the laws of the State of Maryland.

Signatures

Signed this ______ day of _______________, 20____.

Principal's Signature: ___________________________________________

Agent's Signature: _______________________________________________

Witness #1 Signature: ____________________________________________

Printed Name: ___________________________________________________

Witness #2 Signature: ____________________________________________

Printed Name: ___________________________________________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | A Maryland Durable Power of Attorney form allows you to appoint someone to manage your financial affairs. |

| Durability | This form remains valid even if the person who made it becomes incapacitated. |

| Governing Law | It is governed by the Maryland General and Limited Power of Attorney Act. |

| Revocation | It can be revoked at any time by the person who made it, as long as they are mentally competent. |

| Witness Requirement | It must be signed by at least two witnesses who are not the appointed agent. |

| Notarization | In Maryland, it is highly recommended for the form to be notarized to increase its credibility. |

Instructions on How to Fill Out Maryland Durable Power of Attorney

Preparing a Durable Power of Attorney (DPOA) in Maryland is a significant step in managing your affairs, ensuring that someone you trust can make decisions on your behalf if you're unable to do so. This document allows your appointed agent to handle your financial matters, which could include anything from managing your bank accounts to selling property. The process is straightforward but requires attention to detail to ensure that your desires are accurately and legally represented.

To properly complete the Maryland Durable Power of Attorney form, please follow these steps:

- Begin by downloading the most current Durable Power of Attorney form specific to Maryland. This ensures compliance with the state's legal requirements.

- Fill in your full legal name and address at the top of the document to establish your identity as the principal.

- Select and note the full legal name and address of the person you are appointing as your agent (also known as an "attorney-in-fact"). This individual will have the authority to act on your behalf.

- Clearly specify the powers you are granting to your agent. Maryland law allows you to grant broad general powers or to specify particular powers only. It's crucial to be clear and explicit about what your agent is authorized to do.

- If you wish to grant your agent the power to handle real estate transactions on your behalf, you may need to check specific provisions or include specific language, as Maryland law has particular requirements for this type of authority.

- Decide on the effective date of the Durable Power of Attorney. You can choose for it to become effective immediately or specify a triggering event that will cause it to take effect, such as the determination of incapacity by a medical professional.

- If you want your DPOA to be springing—meaning it only comes into effect under circumstances you define, such as incapacity—clearly describe these conditions in the document.

- Sign the form in the presence of a notary public. Maryland requires notarization for the Durable Power of Attorney to be legally valid.

- After notarization, make copies of the document. Provide one to your appointed agent and keep the original in a safe, accessible place. It's also wise to inform close family members or advisors of its location and your decisions.

By thoughtfully selecting your agent and specifying your wishes, you can ensure that your financial matters will be handled according to your preferences, offering peace of mind to both you and your loved ones. Completing the Maryland Durable Power of Attorney form is a step toward securing your future well-being and should be done with care and consideration.

Crucial Points on This Form

What is a Maryland Durable Power of Attorney?

A Maryland Durable Power of Attorney (DPOA) is a legal document that allows one person, known as the principal, to designate another individual, called the agent or attorney-in-fact, to make decisions on their behalf. This form is "durable," meaning it remains in effect even if the principal becomes incapacitated.

Why would someone need a Durable Power of Attorney in Maryland?

Having a Durable Power of Attorney is crucial for anyone who wants to ensure that their financial affairs can be managed by someone they trust, should they become unable to do so themselves due to illness, injury, or any other reason.

Who can be named as an agent in a DPOA in Maryland?

In Maryland, an agent in a DPOA can be any competent adult whom the principal trusts to manage their affairs. This can be a family member, friend, or even a professional like an attorney or accountant.

What responsibilities does an agent have?

An agent is expected to act in the principal's best interest, manage their affairs as indicated in the DPOA document, and avoid any conflicts of interest. The agent must also keep accurate records of all transactions made on behalf of the principal.

Can a Durable Power of Attorney in Maryland be revoked?

Yes, a Durable Power of Attorney can be revoked by the principal at any time, as long as they are mentally competent. This revocation must be made in writing and communicated to the agent and any institutions or individuals that were relying on the authority of the DPOA.

Does a Maryland DPOA need to be notarized or witnessed?

Yes, for a Durable Power of Attorney to be legally valid in Maryland, it must be signed by the principal in the presence of a notary public. Some forms may also require witnessing by two competent adults who are not named as agents in the document.

How long does a Durable Power of Attorney last in Maryland?

A Durable Power of Attorney in Maryland remains effective until it is revoked by the principal, the principal dies, or the document expires, if an expiration date is specified. Unlike some states, Maryland doesn't require periodic renewal of a DPOA for it to remain effective.

Can the agent make healthcare decisions for the principal under a Maryland DPOA?

No, a Durable Power of Attorney in Maryland typically covers financial and property matters. If someone wishes to have an agent make healthcare decisions on their behalf, they would need to complete a separate legal document known as an Advance Healthcare Directive or Healthcare Proxy.

Where can someone obtain a Durable Power of Attorney form in Maryland?

Durable Power of Attorney forms for Maryland can be obtained from a lawyer, online legal services, or through state government resources. It's highly advised to consult with an attorney to ensure the form meets all legal requirements and your specific needs.

Common mistakes

Not carefully specifying the powers granted: People often make the mistake of not being specific about the scope of authority they're giving. This can lead to confusion about whether the agent can make certain decisions.

Choosing the wrong person as an agent: It's critical to choose someone who is not only trustworthy but also capable of managing the responsibilities that come with the role. A poor choice can lead to mismanagement or abuse of the power granted.

Forgetting to designate a successor agent: Failure to appoint a successor can create a void if the original agent is unable or unwilling to perform their duties. Having a backup ensures continuity in management.

Lack of specificity regarding the duration: A Durable Power of Attorney remains in effect until the principal's death unless a specific timeframe is mentioned. Clarifying this can prevent unintended long-term delegation of power.

Omitting a date of execution: The document may not be considered valid if it doesn't clearly state when it was signed. A missing date can lead to questions about its validity.

Ignoring the need for a witness or notary: Maryland law requires that certain formalities like witnessing or notarization be completed for the document to be legally binding. Skipping these steps can invalidate the document.

Not providing clear instructions for determining incapacity: The durable nature means it remains effective if the principal becomes incapacitated. Without clear criteria for determining incapacity, it can be difficult to enact the power of attorney when needed.

Failing to specify limitations on the agent’s authority: Without clear boundaries, an agent might overstep their role. It’s important to outline what they can and cannot do.

Overlooking the need to update the document: Situations change, and so do relationships. Not updating your power of attorney to reflect current wishes and circumstances can lead to unintended outcomes.

Documents used along the form

When preparing a Maryland Durable Power of Attorney, you're taking a significant step toward managing your affairs. This important document is often just one part of a broader set of documents designed to ensure your well-being and peace of mind. Several other forms and documents frequently accompany a Durable Power of Attorney, each serving its unique purpose in your overall estate planning or in situations where you may not be able to make decisions for yourself. Here is a brief overview of up to eight other essential documents you might consider.

- Advanced Directive for Health Care: This document allows you to outline your preferences for medical treatment and end-of-life care, in case you become unable to communicate these wishes yourself.

- Living Will: Often included as part of an Advanced Directive, a Living Will enables you to express your desires regarding life-sustaining procedures if you are terminally ill or in a persistent vegetative state.

- Last Will and Testament: This vital document dictates how you want your assets distributed after your death. It can also appoint a guardian for minor children.

- Revocable Living Trust: Allows you to maintain control over your assets while alive but makes it easier to transfer them upon your death, potentially avoiding probate.

- Financial Information Sheet: Although not a formal legal document, compiling a list of accounts, passwords, and other financial information can be incredibly helpful for those managing your affairs.

- Authorization for Release of Medical Information: Gives designated individuals permission to access your medical records, which can be crucial in making informed healthcare decisions on your behalf.

- Funeral Planning Declaration: Enables you to specify your preferences for funeral arrangements and the handling of your remains.

- Letter of Intent: A non-binding document that provides additional context to your wishes and can guide your executor or personal representative in managing your estate.

Having a comprehensive set of documents to accompany your Maryland Durable Power of Attorney can make a world of difference in times of need. Each document serves a unique purpose, contributing to a well-rounded approach to estate planning and personal care. It's advisable to consult with a professional to ensure all documents are properly prepared and legally sound, reflecting your wishes accurately and effectively.

Similar forms

A Living Will: Similar to a Durable Power of Attorney (DPOA) for healthcare, a Living Will allows an individual to outline their wishes for medical treatment in scenarios where they are unable to communicate their decisions due to illness or incapacity. Both documents are crucial for healthcare planning, but a DPOA appoints an agent to make decisions on one's behalf, whereas a Living Will directly states one's healthcare preferences.

A General Power of Attorney: This document grants broad powers to another person, known as the agent, to act on behalf of the principal in a variety of matters, not limited to but including financial and business transactions. While both DPOA and General Power of Attorney designate an agent, the latter loses its effectiveness if the principal becomes incapacitated, unlike a DPOA which remains in effect.

A Healthcare Proxy: Much like a DPOA for healthcare, a Healthcare Proxy designates someone to make healthcare decisions on behalf of the principal if they are unable to do so. The difference often lies in the specifics of the legal document's language and the scope of authority granted, but both serve the purpose of ensuring that decisions are made according to the principal's wishes or best interests.

A Special or Limited Power of Attorney: This legal document allows the principal to grant specific powers to the agent for a limited task or duration, contrasting with the broader scope of a Durable Power of Attorney. For example, a Special Power of Attorney might authorize the agent to sell a particular property. It differs in its limitation of scope and, often, in its lack of durability concerning the principal's capacity.

A Springing Power of Attorney: This type of power of attorney becomes effective upon the occurrence of a specific event, usually the incapacity of the principal. Both a Springing Power of Attorney and a DPOA are designed to ensure that an agent has the authority to act when the principal cannot. However, a DPOA is generally effective immediately upon execution, whereas a Springing Power's effectiveness is contingent on a future event.

A Financial Power of Attorney: This document specifically grants an agent the authority to manage the principal's financial affairs. It shares similarities with a DPOA in that it can be made durable to remain in effect if the principal loses the capacity to make decisions. The key difference is its focus strictly on financial matters, whereas a DPOA could also encompass healthcare decisions if specified.

A Guardianship or Conservatorship Agreement: These legal arrangements involve the court appointment of a guardian or conservator to manage the personal and/or financial affairs of an individual deemed unable to do so themselves. Unlike a DPOA, which the individual arranges before incapacity, guardianship or conservatorship is usually established after a person is incapable of making their own decisions.

A Revocable Living Trust: In this arrangement, a grantor places assets into a trust for the benefit of beneficiaries, which can be managed by a trustee if the grantor becomes incapacitated or passes away. Similar to a DPOA, it allows for continued management of the individual's affairs without court intervention. However, it chiefly deals with asset management and distribution, rather than a broad range of personal and financial decisions.

A Medical Order for Life-Sustaining Treatment (MOLST): This medical order outlines a patient's preferences for receiving or not receiving life-sustaining treatment, including resuscitation. Like a DPOA for healthcare, it guides medical personnel in treatment decisions when the patient is unable to communicate. The key difference is that a MOLST is a doctor's order, while a DPOA appoints someone to make those decisions.

Dos and Don'ts

When completing the Maryland Durable Power of Attorney form, it is crucial to follow guidelines that help ensure the document is valid, accurate, and reflects your intentions clearly. Attention to detail can protect your interests and make certain your appointed agent can act on your behalf without unnecessary complications. Here are essential dos and don'ts to consider:

Do:- Thoroughly read and understand each section before filling it out. This understanding is key to tailoring the document to your needs.

- Provide complete information about yourself and your appointed agent, including full names, addresses, and contact details, to avoid any ambiguity.

- Be specific about the powers being granted to your agent. Clearly outline what they can and cannot do on your behalf.

- Sign the document in the presence of a notary public and witnesses, if required, to ensure the document is legally binding.

- Keep the original document in a safe but accessible place, and provide copies to your agent and other relevant parties.

- Regularly review and update the power of attorney as your circumstances or wishes change.

- Rush through the process without fully understanding the implications of granting someone else power of attorney.

- Use vague language that could lead to interpretation disputes or limit your agent's ability to act effectively on your behalf.

- Forgo seeking legal advice if you have questions or concerns about the document or the powers being granted.

- Neglect to notify your financial institutions and any other relevant parties of the power of attorney.

- Fail to specify a start and end date if you want the document to be effective only for a certain period.

- Overlook the importance of selecting a trustworthy and competent agent who respects your wishes and acts in your best interest.

Following these guidelines will help ensure your Maryland Durable Power of Attorney form effectively protects your interests and empowers your chosen agent to act on your behalf with confidence and legality.

Misconceptions

Many people have misconceptions about the Maryland Durable Power of Attorney (DPOA) form, which can lead to confusion and hesitation. Understanding the facts can help clear up these misunderstandings and make informed decisions about granting someone else authority to make decisions on your behalf. Here are ten common misconceptions:

- It's only for the elderly. People of all ages can benefit from a DPOA. Accidents or sudden illnesses can happen to anyone, making it important to have arrangements in place.

- You lose control over your decisions. The truth is, creating a DPOA allows you to choose who will make decisions for you, giving you more control, not less. You can specify the powers granted and make changes as long as you are competent.

- It's the same as a Last Will and Testament. A DPOA is entirely different; it covers decision-making on your behalf while you are alive but incapacitated, whereas a will applies after death.

- The appointed agent can do whatever they want. The agent is legally obligated to act in your best interests, following your express wishes as closely as possible.

- My spouse already has the legal authority. While spouses do have some decision-making rights, there are limits. A DPOA can ensure your spouse has the authority to manage all affairs without obstacles.

- It only covers financial decisions. Although financial matters are a significant component, a DPOA can also cover health care decisions and personal matters if you specify it.

- It's effective immediately upon signing. You have the option to specify when the DPOA becomes effective, such as immediately or upon a certain condition, like incapacitation.

- It's too complicated and expensive to set up. Creating a DPOA can be relatively straightforward, especially with the help of a professional. It is a cost-effective way to manage future uncertainties.

- Any form will do. Maryland law has specific requirements for a DPOA to be valid. Using a generic form without ensuring it meets state specifics can result in an invalid document.

- Once created, it can't be changed. As long as you are mentally competent, you can revoke or amend your DPOA at any time to reflect your current wishes.

Understanding these misconceptions can help individuals in Maryland make more informed decisions when considering a Durable Power of Attorney. It's an important step in planning for the future, providing peace of mind for both you and your loved ones.

Key takeaways

When preparing to complete and utilize the Maryland Durable Power of Attorney form, there are several key points to remember:

- Understanding what a Durable Power of Attorney (DPOA) entails is crucial. This legal document allows a person, known as the "principal," to designate another individual, referred to as the "agent" or "attorney-in-fact," to manage their financial affairs and decisions on their behalf, especially if the principal becomes incapacitated.

- It's important to select a trustworthy and responsible agent. This person will have significant control over financial matters, so choosing someone with the principal's best interests in mind is essential.

- The document must be completed accurately. Any errors or omissions can invalidate the document or cause legal disputes down the line.

- Maryland law requires that the Durable Power of Attorney form be signed in the presence of a notary public to ensure its validity.

- The principal can specify which powers to grant to the agent in the document. These powers can range from handling banking transactions, managing real estate assets, to making healthcare decisions.

- It's possible to appoint more than one agent, either to work together or to serve as a backup should the primary agent be unable to perform their duties.

- Discussing the contents of the DPOA with the chosen agent(s) before the document is finalized is advisable. This ensures that the agent understands their responsibilities and agrees to undertake them.

- Once the DPOA is completed and signed, it's important to keep the original document in a safe but accessible location. Copies should be given to the agent, financial institutions, and anyone else who might need it to carry out the principal's wishes.

Following these guidelines will help ensure that the Maryland Durable Power of Attorney form is filled out correctly and serves its intended purpose effectively.

Create Other Durable Power of Attorney Forms for US States

Durable Power of Attorney Pdf - Understanding the responsibilities it entails before signing can prevent potential misuse or misunderstanding.

Statutory Durable Power of Attorney Texas - Ensures your financial duties are carried out according to your wishes.

Durable Power of Attorney Florida Pdf - The decision to grant a Durable Power of Attorney should be made with careful consideration, taking into account the dynamics of your personal relationships.

Ct Power of Attorney Forms Free - It is an effective tool for delegating financial management during temporary absences or extended travels.