Blank Durable Power of Attorney Form for New Jersey

A key tool for managing one's affairs, particularly in situations where one might not be able to do so personally due to health reasons or absence, is the New Jersey Durable Power of Attorney form. This critical document allows individuals to appoint a trusted person to act on their behalf, making decisions that range from financial to legal matters. Unlike standard power of attorney forms, the durable designation remains in effect even if the principal becomes incapacitated, ensuring continuous management and protection of their interests. It is essential for individuals looking to safeguard their future and ensure their affairs are handled according to their wishes, to understand the specifics of how to properly fill out and execute this form in accordance with New Jersey laws. The form not only designates who will make these decisions but also specifies the extent of the powers granted, allowing for tailored control over personal matters.

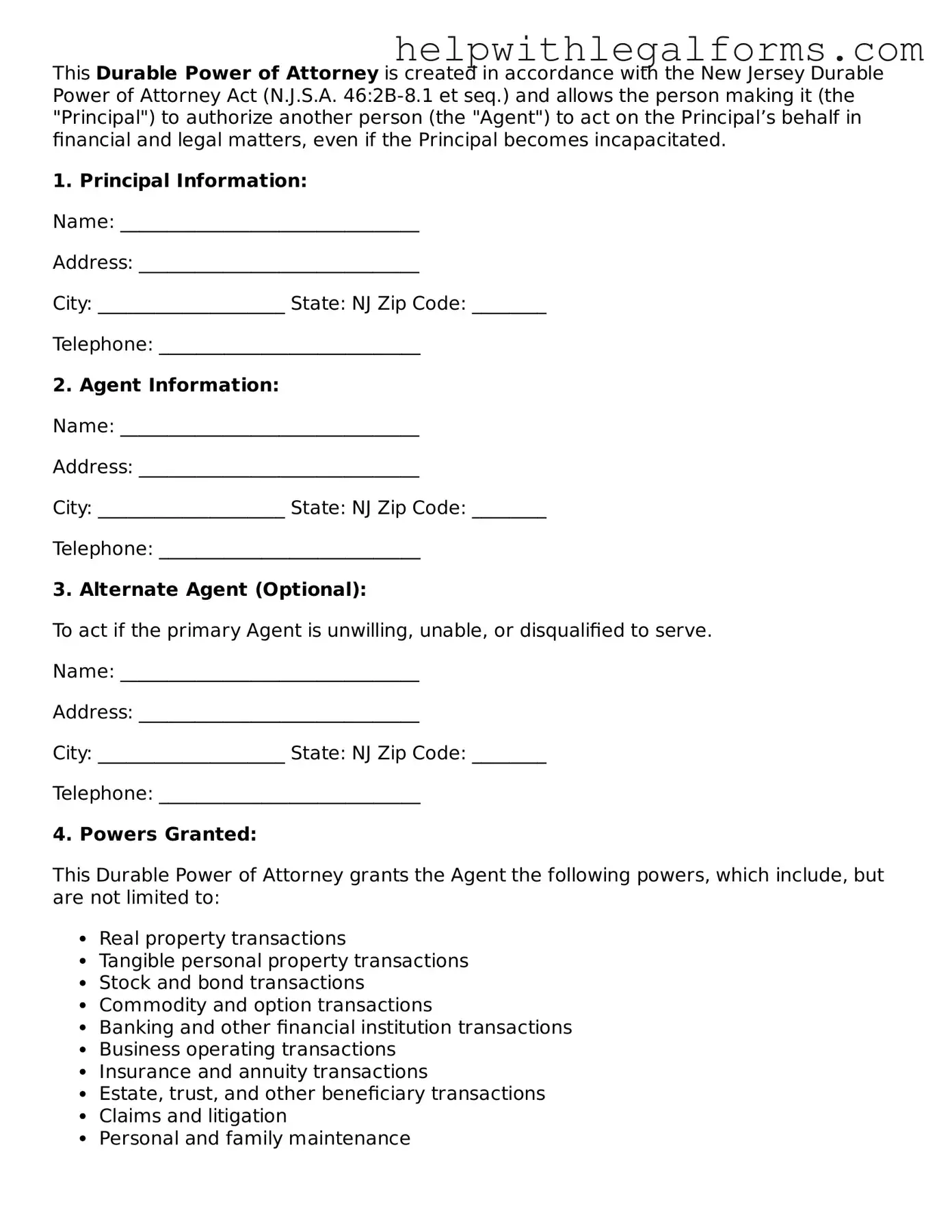

Example - New Jersey Durable Power of Attorney Form

This Durable Power of Attorney is created in accordance with the New Jersey Durable Power of Attorney Act (N.J.S.A. 46:2B-8.1 et seq.) and allows the person making it (the "Principal") to authorize another person (the "Agent") to act on the Principal’s behalf in financial and legal matters, even if the Principal becomes incapacitated.

1. Principal Information:

Name: ________________________________

Address: ______________________________

City: ____________________ State: NJ Zip Code: ________

Telephone: ____________________________

2. Agent Information:

Name: ________________________________

Address: ______________________________

City: ____________________ State: NJ Zip Code: ________

Telephone: ____________________________

3. Alternate Agent (Optional):

To act if the primary Agent is unwilling, unable, or disqualified to serve.

Name: ________________________________

Address: ______________________________

City: ____________________ State: NJ Zip Code: ________

Telephone: ____________________________

4. Powers Granted:

This Durable Power of Attorney grants the Agent the following powers, which include, but are not limited to:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

5. Special Instructions: (Optional)

________________________________________________________________________________

________________________________________________________________________________

6. Durable: This Power of Attorney is durable and will remain in effect even if I become incapacitated, unless it is revoked by me or by my death.

7. Governing Law: This Durable Power of Attorney will be governed by the laws of the State of New Jersey.

8. Signatures:

Principal's Signature: ____________________ Date: ____________

Agent's Signature: ______________________ Date: ____________

Alternate Agent’s Signature (if applicable): ______________________ Date: ____________

9. Acknowledgment by Notary Public:

This section to be completed by a Notary Public.

PDF Form Attributes

| Fact | Description |

|---|---|

| Governing Law | The New Jersey Durable Power of Attorney form is governed by the New Jersey Statutes Annotated, specifically sections 46:2B-8.1 to 46:2B-8.14. |

| Durability Provision | This form remains effective even if the principal becomes incapacitated, ensuring that the agent's authority to make decisions is not interrupted. |

| Scope of Authority | The form allows the principal to grant broad or limited financial powers to the agent, including but not limited to managing real estate, financial transactions, and personal property. |

| Signature Requirements | To be legally valid, the form must be signed by the principal and either notarized or witnessed by two adult individuals who are not the designated agent. |

| Revocation | The principal has the right to revoke the power of attorney at any time, as long as they are competent, through a written notice to the agent and any third parties relying on the document. |

Instructions on How to Fill Out New Jersey Durable Power of Attorney

If you're setting up a Durable Power of Attorney (DPOA) in New Jersey, it's a step toward ensuring that your affairs will be managed according to your wishes, should you become unable to do so yourself. This document empowers another person, often called the "agent," to make decisions on your behalf. Although the thought of filling out legal paperwork can be daunting, the process is straightforward if you follow these steps methodically.

- Begin by locating the official New Jersey Durable Power of Attorney form. This can often be found online through legal resources or obtained from an attorney.

- Read through the entire form before filling anything out to ensure you understand the scope and implications of the document.

- Clearly write your full legal name and address in the designated spaces at the top of the form. This identifies you as the "principal" — the person granting the authority.

- Select your "agent" – the individual who will act on your behalf. Write their full name and address in the assigned section. It's crucial to choose someone you trust implicitly.

- Detail the specific powers you are granting to your agent. This can range from broad financial decision-making authority to specific tasks like managing real estate properties or handling business transactions. Be as clear and specific as possible.

- If you wish to grant your agent authority to make healthcare decisions, ensure New Jersey law covers this in a separate Healthcare Proxy form and does not include it in this DPOA.

- Review the section on when the power of attorney becomes effective and how it can be terminated. Some are effective immediately, while others only in the event of your incapacitation. Fill in these sections according to your preferences.

- Sign and date the form in the presence of a notary public. New Jersey law requires your signature to be notarized to make the DPOA legally binding.

- Ask the notary public to complete their section, which will include their signature and stamp.

- Provide your agent with a copy of the completed, signed, and notarized DPOA. It's also wise to keep a copy in a safe place and possibly with an attorney.

Filling out a Durable Power of Attorney form is a significant step in planning for your future. It's about making choices today that will affect how your affairs are handled in the future, should you be unable to make those decisions yourself. It reflects thoughtful consideration for your well-being and the well-being of those around you. Following these steps carefully will help you ensure your DPOA accurately reflects your wishes and is legally sound.

Crucial Points on This Form

What is a Durable Power of Attorney (DPOA) in New Jersey?

A Durable Power of Attorney in New Jersey is a legal document that grants someone you choose the authority to make decisions on your behalf. This authority can cover a broad range of decisions, including financial, legal, and health-related matters. The "durable" aspect means that this power remains effective even if you become mentally incapacitated.

How do I choose my agent for a Durable Power of Attorney?

When selecting an agent for your Durable Power of Attorney, consider someone you trust deeply, such as a close family member or a long-time friend. This person should be reliable, financially savvy, and ideally, live close by. Most importantly, they must be willing to take on the responsibilities if needed. Discussing your expectations and the specifics of the DPOA with them is crucial before making your choice.

Can I revoke or change my Durable Power of Attorney?

Yes, you can revoke or change your Durable Power of Attorney at any time as long as you are mentally competent. To do so, you should provide written notice to your current agent and any institutions or individuals that were aware of the original document. Creating a new DPOA can also automatically revoke the previous one, but it's best to explicitly state the revocation in writing.

What happens if I don't have a Durable Power of Attorney in New Jersey?

Without a Durable Power of Attorney, your family may face significant difficulties if you become unable to manage your affairs due to illness or incapacity. They might have to petition the court for the right to make decisions on your behalf, a process that can be lengthy, stressful, and expensive. Having a DPOA in place ensures that someone you trust can easily step in to manage your affairs without court intervention.

Is a lawyer required to create a Durable Power of Attorney in New Jersey?

No, hiring a lawyer is not strictly necessary to create a Durable Power of Attorney in New Jersey. However, consulting with a lawyer who understands state-specific requirements can ensure that the document fulfills your needs and adheres to local laws. This can help prevent potential legal issues or disputes about the document's validity in the future.

Common mistakes

Filling out a New Jersey Durable Power of Attorney form is a critical step for ensuring that someone you trust can manage your affairs if you are unable to do so yourself. Unfortunately, mistakes can be made when completing this form, which might lead to unnecessary complications or even render the document invalid. Here are seven common mistakes to avoid:

-

Not specifying powers clearly. The form must clearly outline the specific powers granted to the agent. Vagueness can lead to confusion and misuse of authority.

-

Choosing the wrong agent. The importance of selecting a trusted individual cannot be overstated. This person will have significant control over financial or legal matters, so it's vital to choose wisely.

-

Ignoring the need for witnesses or notarization. Depending on New Jersey's current requirements, failing to properly witness or notarize the document can invalidate it. Always check the most recent requirements.

-

Failing to specify any limitations. If there are specific powers or time frames that the agent should not exceed, these must be mentioned explicitly. Without limitations, the agent could wield more power than intended.

-

Not considering alternates. If the primary agent is unavailable or unwilling to serve, having an alternate agent named ensures that your affairs will still be managed without needing to complete a new form.

-

Forgetting to discuss the responsibilities with the chosen agent. The agent should fully understand the responsibilities and expectations before accepting the role. This discussion can also serve as a verbal agreement on record.

-

Not updating the document periodically. Laws change, relationships evolve, and personal situations get updated. Regularly reviewing and updating the document ensures it reflects your current wishes and complies with any new laws.

By paying close attention to these details, you can better ensure your New Jersey Durable Power of Attorney accurately reflects your wishes and stands up under legal scrutiny.

Documents used along the form

When preparing for the future, especially in matters pertaining to health, finance, and personal care, a Durable Power of Attorney (DPOA) form is an essential document. However, it's often not the only document needed to ensure comprehensive planning and decision-making capabilities. Below is a list of additional forms and documents that are frequently utilized alongside a New Jersey Durable Power of Attorney form to create a more robust legal and care plan.

- Advance Directive for Health Care: This document allows individuals to specify their wishes for medical treatment and end-of-life care, should they become unable to make these decisions themselves. It often includes a living will and health care proxy.

- Living Will: Specifies the types of medical care a person wishes or does not wish to receive if they become incapacitated and unable to express informed consent, especially regarding life-sustaining treatment.

- Last Will and Testament: Details how a person’s property and assets should be distributed after their death. It can also nominate guardians for any minor children.

- Guardianship Designations: This can include temporary or permanent assignments made in anticipation of a situation where the individual may not be able to make personal care decisions.

- Revocation of Power of Attorney: A form used to cancel a previously granted power of attorney. It is crucial when changing agents or updating the power of attorney document.

- Trust Documents: If an individual has established any trusts, these documents are necessary to manage and control the distribution of assets within the trust structures.

- Financial Information Sheet: This isn’t a formal legal document, but compiling financial account information, insurance policies, real estate deeds, and other assets can be essential for the appointed attorney-in-fact to manage the principal's affairs effectively.

- Health Insurance Portability and Accountability Act (HIPAA) Authorization Form: Permits designated individuals to access your medical records and speak with health care providers about your health, assisting in making informed health decisions on your behalf.

- Bank Forms for Power of Attorney: Some financial institutions require their own specific forms to be completed in addition to a general power of attorney form to grant an agent access to accounts or safe deposit boxes.

- Real Estate Titles and Deeds: Important when managing, buying, or selling real estate on behalf of the principal, ensuring the attorney-in-fact has the authority to handle these transactions.

Together, these documents play critical roles in comprehensive estate planning and personal care management. It's important to consult with a legal professional to understand the specific requirements and implications of each document within the context of New Jersey law and to ensure that they reflect the individual's wishes accurately. Completing this suite of documents can provide peace of mind and certainty for both the individual and their loved ones during challenging times.

Similar forms

-

A Living Will allows individuals to outline their wishes regarding life-prolonging medical treatments in advance. Similarly, a Durable Power of Attorney (DPOA) for healthcare allows an appointed person to make healthcare decisions when the individual is incapable. Both documents are proactive steps in medical planning.

-

The General Power of Attorney grants broad powers to an agent, including handling financial and business transactions. A DPOA is similar but is notably different in that it remains in effect even if the principal becomes mentally incapacitated.

-

A Health Care Proxy designates someone to make healthcare decisions on one’s behalf. Like a DPOA for healthcare, it activates when the principal cannot make decisions themselves, ensuring their healthcare preferences are respected.

-

The Last Will and Testament details how a person's assets should be distributed after their death. While it operates posthumously, a DPOA is effective during the individual’s lifetime, particularly in situations of incapacitation, allowing for seamless management of affairs.

-

A Revocable Living Trust enables the grantor to specify how their assets should be managed during their lifetime and after their death. Like a DPOA, it can provide continuity in the management of the grantor's affairs, but it does so both during their lifetime and thereafter, without the need for court intervention.

-

Advance Healthcare Directive combines a living will and a healthcare power of attorney. It allows individuals to make known their medical treatment preferences and appoints an agent to make decisions on their behalf. It’s akin to a DPOA for healthcare, highlighting proactive involvement in one’s health care decisions.

Dos and Don'ts

Filling out a New Jersey Durable Power of Attorney form is a crucial step in managing your affairs. To ensure you do it correctly, here are five things you should do and five things you shouldn't.

Things You Should Do:

- Read the form carefully before you start filling it out. Understand every section to ensure your decisions are accurately reflected.

- Choose a trusted individual as your agent. This person will have a lot of control over your affairs, so it’s essential to pick someone who is reliable and has your best interests at heart.

- Be specific about the powers you grant your agent. The more detailed you are, the less room there is for confusion or misuse of authority.

- Get the form notarized, if required. This adds a level of legal protection and ensures that your document is officially recognized.

- Keep your document safe, but make sure it’s accessible to your agent(s) when needed. You might also want to provide copies to key family members or your attorney.

Things You Shouldn't Do:

- Don’t rush through the form. Taking your time to fill it out correctly is crucial to its effectiveness.

- Don’t choose an agent based solely on their relationship to you. Just because someone is a family member or close friend doesn’t mean they’re the best choice for managing your affairs.

- Don’t be vague about the powers you’re granting. Lack of clarity can lead to issues down the line, potentially causing more harm than good.

- Don’t forget to sign and date the form in the presence of the required witnesses or a notary, as per New Jersey law. An unsigned form is invalid.

- Don’t fail to review and update the form periodically. Your circumstances and relationships may change, necessitating adjustments to your Power of Attorney.

Misconceptions

Understanding the New Jersey Durable Power of Attorney (DPOA) is crucial for making informed decisions about one's future and ensuring their wishes are respected. However, misconceptions can often cloud judgment and lead to unintended outcomes. Here are six common misconceptions about the New Jersey Durable Power of Attorney form and explanations to dispel them.

- It only covers medical decisions. Many people believe that the DPOA is solely for healthcare decisions. In New Jersey, a Durable Power of Attorney can encompass a wide range of powers, including financial matters, real estate transactions, and personal affairs, in addition to healthcare directives.

- It takes effect immediately after signing. A common misconception is that once the DPOA is signed, the agent immediately gains control over the principal's affairs. The truth is that the DPOA can be structured to become effective immediately or upon the occurrence of a specific event, such as the principal's incapacity, depending on how it is drafted.

- The court supervises the agent's actions. While it's comforting to think there's oversight, in most cases, the agent under a DPOA operates without court supervision. This autonomy emphasizes the importance of choosing a trustworthy agent, as their actions are typically not monitored by a judge or third party.

- It's irrevocable once it's signed. Some people hesitate to sign a DPOA under the mistaken belief that it cannot be changed or revoked. In reality, as long as the principal is mentally competent, they can revise or revoke their DPOA at any time, allowing for flexibility as circumstances change.

- Any form will suffice. Not all DPOA forms are created equal. While various templates exist, New Jersey law has specific requirements for a DPOA to be considered valid. Using an ill-suited form could result in an invalid DPOA, failing to protect the principal's interests.

- A DPOA eliminates the need for a will. This is a particularly dangerous misconception. A DPOA is only effective during the principal's lifetime and does not address the distribution of assets upon death. A will is necessary to ensure that an individual's estate is distributed according to their wishes after they pass away.

Clearing up these misconceptions about the New Jersey Durable Power of Attorney ensures individuals are better prepared to make informed decisions regarding their futures and the management of their affairs. As always, consulting with a legal professional can provide guidance tailored to an individual's specific situation, helping to navigate the complexities of estate planning and the DPOA process.

Key takeaways

When it comes to creating a Durable Power of Attorney (POA) in New Jersey, there are several critical aspects that individuals should understand. This legal document grants another person the authority to make certain decisions on your behalf, and understanding its proper use and implications is essential for ensuring that your intentions are carried out effectively and legally.

- Choose an agent wisely: The agent, also known as the attorney-in-fact, should be someone you trust implicitly. This person will have significant power to make decisions about your finances, property, and potentially other aspects of your life if you become unable to make those decisions yourself. Consider their reliability, financial acumen, and willingness to take on such responsibilities.

- Understand the scope of the power: A Durable Power of Attorney in New Jersey can be as broad or as specific as you desire. It is crucial to comprehend exactly what powers you are granting to your agent. This could range from managing day-to-day financial affairs to making significant financial decisions. Specify clearly in the document the areas in which the agent has authority.

- Recognize the durability aspect: The term "durable" in regard to a Power of Attorney means that the document remains in effect if you become incapacitated. This is an essential feature that ensures your agent can manage your affairs without the need for court intervention, a process that could otherwise be lengthy and stressful for your loved ones.

- Follow New Jersey’s legal requirements: For a Durable Power of Attorney to be valid in New Jersey, it must meet certain state-specific requirements. These often include being in writing, signed by the principal (the person granting the power), and notarized. Additionally, certain forms of POAs must be witnessed by two individuals who are not named as agents in the document. Ensuring that your Durable Power of Attorney adheres to these legal formalities is critical for its effectiveness.

In conclusion, when filling out a Durable Power of Attorney form in New Jersey, it’s essential to invest the time and effort needed to understand and comply with state laws fully. This legal document offers peace of mind, knowing that your affairs will be managed according to your wishes, even if you're unable to oversee them yourself. Engaging with a legal expert to guide you through this process is often advisable to ensure that all legal requirements are met and that your document accurately reflects your intentions.

Create Other Durable Power of Attorney Forms for US States

Financial Power of Attorney Maryland - Creating a Durable Power of Attorney is a proactive step in comprehensive personal financial management.

Statutory Durable Power of Attorney Texas - Permits the agent to file taxes, access safe deposit boxes, and manage retirement accounts.