Blank Durable Power of Attorney Form for New York

The intricacies of planning for future financial management can be streamlined with the New York Durable Power of Attorney form, a critical legal document empowering an individual to act on another's behalf in financial matters. Its construction ensures continuity in financial decision-making, even in circumstances where the principal might become incapacitated, making it an invaluable tool for proactive personal finance management. Designed with flexibility in mind, it allows the principal to specify the extent of power granted to the agent, ranging from broad authority across various financial domains to more limited, specified acts. Furthermore, its durable nature signifies that the agent's authority persists beyond the principal's incapacitation, a feature distinguishing it from other forms of power of attorney. Given its significant implications, both the drafting and execution of this form are guided by stringent legal criteria, aiming to protect the interests of all parties involved. This emphasis on legal formalities underscores the importance of thorough understanding and careful consideration in its utilization, ensuring it aligns with the principal's long-term financial strategy and personal wishes.

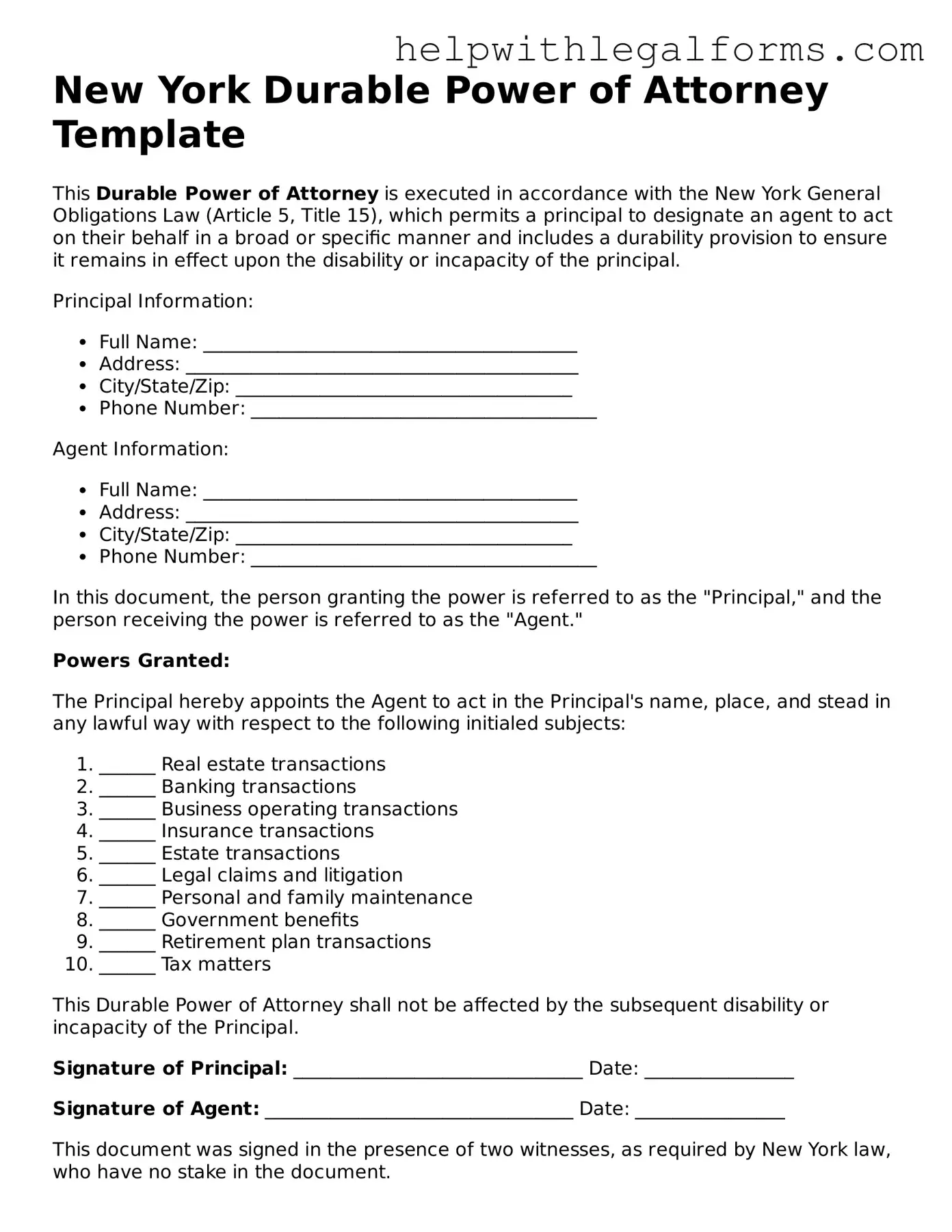

Example - New York Durable Power of Attorney Form

New York Durable Power of Attorney Template

This Durable Power of Attorney is executed in accordance with the New York General Obligations Law (Article 5, Title 15), which permits a principal to designate an agent to act on their behalf in a broad or specific manner and includes a durability provision to ensure it remains in effect upon the disability or incapacity of the principal.

Principal Information:

- Full Name: ________________________________________

- Address: __________________________________________

- City/State/Zip: ____________________________________

- Phone Number: _____________________________________

Agent Information:

- Full Name: ________________________________________

- Address: __________________________________________

- City/State/Zip: ____________________________________

- Phone Number: _____________________________________

In this document, the person granting the power is referred to as the "Principal," and the person receiving the power is referred to as the "Agent."

Powers Granted:

The Principal hereby appoints the Agent to act in the Principal's name, place, and stead in any lawful way with respect to the following initialed subjects:

- ______ Real estate transactions

- ______ Banking transactions

- ______ Business operating transactions

- ______ Insurance transactions

- ______ Estate transactions

- ______ Legal claims and litigation

- ______ Personal and family maintenance

- ______ Government benefits

- ______ Retirement plan transactions

- ______ Tax matters

This Durable Power of Attorney shall not be affected by the subsequent disability or incapacity of the Principal.

Signature of Principal: _______________________________ Date: ________________

Signature of Agent: _________________________________ Date: ________________

This document was signed in the presence of two witnesses, as required by New York law, who have no stake in the document.

Witness #1 Signature: _______________________________ Date: ________________

Print Name: ___________________________________________

Witness #2 Signature: _______________________________ Date: ________________

Print Name: ___________________________________________

This document should not be used without consulting a licensed attorney in your area to ensure it adequately meets your needs and complies with state law.PDF Form Attributes

| Fact | Description |

|---|---|

| Governing Law | <New York General Obligations Law sections 5-1501 to 5-1514. |

| Purpose | Allows someone to appoint an agent to manage their financial affairs. |

| Durability | Remains effective even if the person becomes incapacitated. |

| Agent's Authority | The agent can handle tasks such as paying bills, managing investments, and making real estate transactions. |

| Revocation | The form can be revoked at any time by the person who created it, as long as they are of sound mind. |

Instructions on How to Fill Out New York Durable Power of Attorney

A Durable Power of Attorney (DPOA) in New York is a legal document that allows an individual, known as the principal, to designate another person, called an agent, to manage their financial affairs. This arrangement becomes especially crucial if the principal becomes unable to make decisions on their own. Completing this form requires careful attention to detail and precision, ensuring that all decisions regarding one's financial management are in trustworthy hands. Below are step-by-step instructions to fill out the New York Durable Power of Attorney form.

- Gather required information: Before starting, make sure you have all necessary information including the full legal names, addresses, and contact details of the principal and the agent(s).

- Choose an Agent: Decide who you will appoint as your agent. This person will act on your behalf, so choose someone you trust completely.

- Fill out the form: Enter the principal’s full legal name and address in the designated fields at the beginning of the form.

- Appoint your Agent(s): Write the name(s), address(es), and contact details of your chosen agent(s) in the relevant section.

- Grant Authority: Specify the powers you are giving to your agent. This involves going through each section of the form and initialing next to the powers you want your agent to have. If you want your agent to have all listed powers, you may initial the "All of the Above" option.

- Special Instructions: If you have any specific wishes or limitations on your agent's power, detail these in the provided space for "Special Instructions".

- Appoint a Successor Agent (optional): If desired, appoint a successor agent in case the primary agent is unable to serve. Include the successor's full name, address, and contact information.

- Signatures: The principal must sign and date the form in the presence of a notary public. The agent(s) may also need to sign, depending on state requirements.

- Notarization: Take the completed form to a notary public for notarization. The notary will verify the identity of the signers and their understanding and willingness to sign the document.

- Make Copies: Create copies of the notarized document. Provide one to your agent, keep the original in a safe place, and consider giving copies to key individuals such as your attorney, family members, or financial institutions where you have accounts.

Once these steps are completed, the Durable Power of Attorney is in effect. It's a powerful document that requires trust and careful consideration in its execution. Remember, the purpose of this document is to ensure that your financial affairs are handled according to your wishes by someone you trust, in the event that you're not able to manage them yourself. It's also prudent to review and, if necessary, update your DPOA periodically, especially after significant life events such as marriage, divorce, or the death of an agent.

Crucial Points on This Form

What is a Durable Power of Attorney (DPOA) in New York?

A Durable Power of Attorney in New York is a legal document that allows you to appoint someone, known as an agent, to make decisions on your behalf should you become unable to do so. The “durable” element means the document remains in effect even if you become incapacitated, ensuring your financial, real estate, and other matters can be managed without court intervention.

How do I choose an agent for my DPOA?

Choosing an agent for your Durable Power of Attorney is a crucial decision. The agent should be someone you trust implicitly, such as a family member or close friend. Consider their ability to handle financial matters responsibly and their willingness to act in your best interest. It’s also sensible to appoint a successor agent in case your primary choice is unable to serve.

What powers can I grant my agent under a New York DPOA?

You can grant your agent a wide range of powers, including handling banking transactions, managing real estate assets, dealing with tax and insurance matters, and investing on your behalf. It’s important to tailor the powers to your needs and specify them clearly in the document to prevent any misuse.

Is a lawyer required to create a Durable Power of Attorney in New York?

While you’re not legally required to have a lawyer to create a Durable Power of Attorney, consulting one can be beneficial. A lawyer can help ensure the document meets all legal requirements in New York, is tailored to your specific situation, and that you fully understand the powers and limitations you’re granting to your agent.

How do I make my New York DPOA legally binding?

To make your Durable Power of Attorney legally binding in New York, you and your agent must sign the document in the presence of a notary public. New York law may require witnesses to your signature as well, so it’s important to follow the specific requirements to ensure your DPOA is enforceable.

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time as long as you are of sound mind. To do so, you should provide written notice to your agent and any institutions or individuals that were aware of the document. For thoroughness, revoking the DPOA in writing and having it notarized is recommended to ensure there is a formal record of revocation.

Common mistakes

Filling out the New York Durable Power of Attorney (POA) form is a crucial process that allows individuals to appoint someone they trust to manage their affairs, should they become unable to do so themselves. However, due to its legal and practical implications, errors can occur. Understanding these mistakes is vital for ensuring the form is valid and serves its intended purpose effectively. Here are six common mistakes people make when completing this form:

-

Not specifying powers clearly - It's essential to delineate the agent's powers with clarity. Ambiguity can lead to confusion and misuse of authority, potentially leading to decisions that are not in the best interest of the person granting the power.

-

Choosing the wrong agent - The importance of selecting an agent who is trustworthy and capable of handling responsibilities cannot be overstated. An ill-chosen agent can lead to mismanagement, or worse, exploitation of finances and assets.

-

Failing to include a successor agent - Life is unpredictable. If the primary agent is unable to serve, having no successor agent can complicate matters further, necessitating a court intervention to appoint a new agent.

-

Omitting special instructions - Special instructions can guide the agent to act in specific ways under certain circumstances, aligning their decisions more closely with the principal's wishes and values.

-

Not understanding the form’s implications - Many individuals fill out the form without fully grasping its implications, including the extent of power it grants. This oversight can lead to unexpected consequences.

-

Improper execution - Adhering to New York's legal requirements for executing the form is crucial. Failure to correctly sign, witness, or notarize the document can render it invalid.

Avoiding these mistakes requires a careful and informed approach. Here are additional pointers to ensure accuracy and completeness:

Review the form and its instructions thoroughly before filling it out.

Consider consulting with a legal professional to clarify any uncertainties and confirm the form meets all legal requirements.

Communicate with your chosen agent and any successor agents about their roles and your expectations.

Maintain a clear record of all documents and instructions related to the POA, and share them with your agent.

By avoiding common pitfalls and taking a methodical approach to filling out the New York Durable Power of Attorney form, individuals can ensure that their affairs will be managed according to their wishes, providing peace of mind for themselves and their loved ones.

Documents used along the form

When managing your affairs, especially in planning for eventualities where you may not be able to make decisions for yourself, the New York Durable Power of Attorney form is a crucial document. However, to ensure comprehensive coverage and preparedness, several other forms and documents are typically needed alongside it. These additional documents complement the durable power of attorney by addressing various aspects of personal, financial, and health care decision-making that a single document cannot fully encompass.

- Health Care Proxy: This document allows you to appoint someone to make healthcare decisions on your behalf if you become unable to make those decisions yourself. It is an essential element of a well-rounded advance directive plan.

- Living Will: Often used in conjunction with the Health Care Proxy, a Living Will specifies your wishes regarding medical treatment if you are incapacitated and cannot communicate your decisions. It guides healthcare providers and your health care agent in making decisions that align with your preferences.

- Last Will and Testament: This document specifies how your assets should be distributed upon your death. It also allows you to appoint an executor who will manage the estate’s distribution according to your wishes. It does not take effect until after your death and operates independently of the Durable Power of Attorney.

- Revocation of Power of Attorney: A critical document that allows you to cancel or revoke a previously granted power of attorney. It is an essential tool for maintaining control over who has the authority to act on your behalf.

- Advance Directive: An overarching term that includes Health Care Proxies, Living Wills, and other directives. It is crucial for outlining your preferences for treatment and care in situations where you cannot speak for yourself.

- Designation of Guardian for Minor Children: If you have minor children, this document is vital as it appoints a guardian for them in the event of your incapacitation or death, ensuring they are cared for by someone you trust.

- Designation of Standby Guardian: Similar to the designation of a guardian for minor children, this document specifies a standby guardian who can immediately take over caregiving duties for a specified period, usually in situations where the primary parent or guardian becomes suddenly unable to provide care.

- HIPAA Release Form: This form allows designated individuals to access your medical records, making it easier for your health care agent to make informed decisions about your health care. It is often used in tandem with a Health Care Proxy.

Together with the New York Durable Power of Attorney, these documents form a comprehensive legal framework that ensures your wishes are respected and your loved ones are cared for, even when you cannot make decisions for yourself. Each document has a specific function, addressing different scenarios and preferences in personal, medical, and financial matters. It's crucial to consult with legal professionals who can guide the decision-making process, ensuring each document is correctly drafted and legally binding. Proper preparation and legal advisement safeguard your interests and provide peace of mind to you and your family.

Similar forms

Living Will: Much like a Durable Power of Attorney, a Living Will lets people state their wishes for healthcare in advance, should they become unable to make those decisions themselves. It acts as a guide for family and healthcare providers on what types of life-sustaining treatments someone does or does not want if they are critically ill or at the end of life. Both documents are about planning ahead for situations where you might not be able to express your wishes.

Healthcare Proxy: This document, also known as a healthcare power of attorney, is similar to a Durable Power of Attorney but is specifically focused on health care decisions. It allows someone to name a person (a proxy or agent) to make health decisions for them if they're unable to make those decisions themselves. The Durable Power of Attorney can also encompass healthcare decisions if specified, but it can apply to a broader range of decisions beyond healthcare.

General Power of Attorney: A General Power of Attorney is like a Durable Power of Attorney because it grants someone else the authority to act on your behalf. The key difference is that a General Power of Attorney usually becomes invalid if you become mentally incapacitated. In contrast, a Durable Power of Attorney is designed to stay in effect even if you are unable to make decisions for yourself, due to its "durability" feature.

Last Will and Testament: While serving different purposes, both a Durable Power of Attorney and a Last Will and Testament involve planning for the future. A Last Will and Testament becomes effective after someone passes away, detailing how they want their assets distributed and other final wishes. Meanwhile, a Durable Power of Attorney is effective during the person's lifetime, focusing on who will manage their affairs if they cannot. These documents together provide comprehensive coverage for personal and estate planning.

Dos and Don'ts

When filling out the New York Durable Power of Attorney form, it’s crucial to understand its significance. This document grants another person the right to make legal decisions on your behalf. To ensure the form is filled out correctly and your intentions are clearly stated, follow these do's and don'ts.

- Do read the entire form before starting, to understand all the requirements and sections.

- Do ensure the agent chosen is someone you trust completely with your affairs.

- Do use clear, precise language to define the scope of power you are granting.

- Do include any specific instructions or limitations to the agent’s power if necessary.

- Do sign the form in the presence of a notary public to ensure its legality.

- Do keep a copy of the signed document in a safe and accessible place.

- Do inform the chosen agent about their role and responsibilities.

- Do review and possibly update the document as your situation or wishes change.

- Do use a professional legal advisor if you have any doubts or complex requirements.

- Do indicate clearly if you intend the power of attorney to be effective immediately or upon a certain event, such as incapacity.

- Don't leave any sections blank; incomplete forms may lead to misunderstandings or legal issues.

- Don't use vague language that could be open to interpretation.

- Don't forget to date the document, as the date can be critical in legal proceedings.

- Don't choose an agent without discussing it with them first; they need to be willing and able to take on the responsibility.

- Don't assume the form doesn’t need to be notarized; a notarized form is usually a legal requirement for validity.

- Don't neglect to tell family members or other relevant parties about the Power of Attorney.

- Don't use an outdated form; ensure you have the most current version applicable in New York.

- Don't give more power than necessary; tailor the powers granted to your specific needs.

- Don't hesitate to revoke the document if circumstances change and it’s no longer required or if you wish to appoint someone else.

- Don't forget to sign and initial each page if required, to prevent unauthorized alterations.

Misconceptions

When it comes to making important decisions about legal documents, ensuring you have the right information is crucial. The New York Durable Power of Attorney (POA) form is a legal document that allows someone to act on your behalf in financial matters. However, there are numerous misconceptions about this form that can confuse individuals. Here are eight common misunderstandings and the facts to set the record straight.

- It remains effective after death. A significant misconception is that a durable power of attorney remains in effect after the principal's death. In reality, all powers granted through this document cease upon the death of the principal. The executor or administrator of the estate then manages the deceased's affairs according to the will or state law.

- It covers health care decisions. Many people mistakenly believe that the durable power of attorney grants the agent authority to make health care decisions. However, this form only covers financial and certain legal decisions. Health care decisions require a separate document, typically referred to as a Health Care Proxy or Medical Power of Attorney in New York.

- There’s only one standard form. While New York provides a statutory form for the durable power of attorney, this doesn’t mean it’s the only valid format. The law allows for customization to suit individual needs, provided it complies with New York legal requirements. You can add or restrict powers given to your agent as necessary.

- It’s effective immediately upon signing. This is often the case, but not always. The principal can specify that the power of attorney come into effect upon a certain event, such as the principal's incapacitation. This is known as a "springing" durable power of attorney, offering an additional layer of control and security.

- Any form downloaded from the internet will suffice. While it’s true that there are various templates available online, not all of them may comply with New York's specific legal requirements. Using an incorrect or outdated form could render the power of attorney invalid. It’s crucial to ensure that any document used complies with current New York State law.

- It grants unlimited power. Even though the term "durable" implies a broad granting of authority, the principal can actually set limitations on the agent's power. The form allows for specificity in what the agent can and cannot do on behalf of the principal.

- No one can challenge its validity once signed. The validity of a durable power of attorney can be challenged in court. If someone believes the principal was not of sound mind or was under undue influence at the signing, they can contest it. Ensuring that the document is properly executed, preferably with the help of a legal professional, can help prevent such challenges.

- It’s too complicated for an individual to complete without legal help. While seeking advice from a legal professional is always recommended, especially for complex situations, the New York durable power of attorney form is designed to be filled out by individuals. Instructions are provided to guide the user through the process, making it accessible for most people to complete on their own if they choose.

Understanding these key points about the New York Durable Power of Attorney can help dispel common myths and encourage more informed decision-making. It’s always best to consult with a legal professional when drafting any legal document to ensure it meets your specific needs and complies with state laws.

Key takeaways

A Durable Power of Attorney (POA) in New York is a legal document that allows an individual, known as the "principal," to appoint someone they trust, called an "agent," to manage their financial affairs. This arrangement is especially important if the principal becomes unable to make decisions due to illness or incapacitation. Here are key takeaways everyone should understand when dealing with a New York Durable Power of Attorney form:

- The Durable Power of Attorney form becomes effective immediately unless stated otherwise in the document. It's important for the principal to specify if they want the powers to commence at a future date or event.

- Choosing an agent is a significant decision as this person will have the authority to make financial decisions on the principal's behalf. It's crucial to select someone who is trustworthy and capable of managing financial matters.

- It is possible to appoint more than one agent. The principal can decide whether these agents must act together (jointly) or if they can act independently of one another.

- Specifying the powers granted to the agent is a critical step. The New York Durable POA form allows for broad financial powers or limited to certain activities or transactions, depending on the principal's preferences.

- The durability aspect means that the POA remains in effect even if the principal becomes incapacitated, ensuring continuous management of the principal’s financial matters without court intervention.

- A Springing Power of Attorney is an option wherein the POA only becomes effective upon the occurrence of a specific event, usually the incapacitation of the principal. If this option is preferred, it must be clearly defined within the document.

- Filling out the form correctly is imperative. Mistakes or omissions can invalidate the document or cause delays when the power of attorney is needed most.

- The form must be signed and notarized to be legally binding. In New York, witnesses may also be required, so it’s important to check the most current state requirements.

- Finally, it's advisable to consult with a legal professional when completing a Durable Power of Attorney form. They can provide guidance tailored to the individual's specific circumstances and ensure that the document meets all legal requirements.

Dealing with a Durable Power of Attorney can seem daunting, but understanding these key points will help ensure that individuals are well-prepared to establish a POA that effectively meets their needs and provides for the seamless management of their affairs.

Create Other Durable Power of Attorney Forms for US States

Durable Power of Attorney Florida Pdf - This form can be revoked or amended as long as you are mentally competent, offering flexibility as your situation changes.

How to Get Power of Attorney in Oklahoma - It assures that your financial and personal dignity are upheld during times when you might not be able to advocate for yourself.

Statutory Durable Power of Attorney Texas - Lays out clear guidelines for both everyday and complex financial transactions.

Financial Power of Attorney Colorado - Remains in effect even if the principal becomes mentally incapacitated, ensuring continuous management.