Blank Durable Power of Attorney Form for Oklahoma

In navigating the intricate waters of legal preparations for future uncertainties, the Oklahoma Durable Power of Attorney form emerges as a crucial tool designed to ensure that an individual's financial and legal matters are managed according to their wishes, should they ever become incapacitated or unable to communicate their desires themselves. This document grants a trusted person, known as the agent or attorney-in-fact, the authority to make decisions on behalf of the principal—the person creating the power of attorney. The "durable" nature of this power means that the agent's authority persists even after the principal becomes incapacitated, differentiating it from other forms of power of attorney that may terminate under such circumstances. This legal instrument covers a broad range of actions, including managing bank accounts, signing checks, handling real estate transactions, and more, making it a cornerstone of comprehensive estate planning. It's designed to provide peace of mind, ensuring that the principal's affairs are in capable hands without the need for court intervention, which can be both time-consuming and costly. However, it's imperative for individuals to understand the implications of this form fully and to choose their agent wisely, as it places significant power and responsibility in the hands of another person.

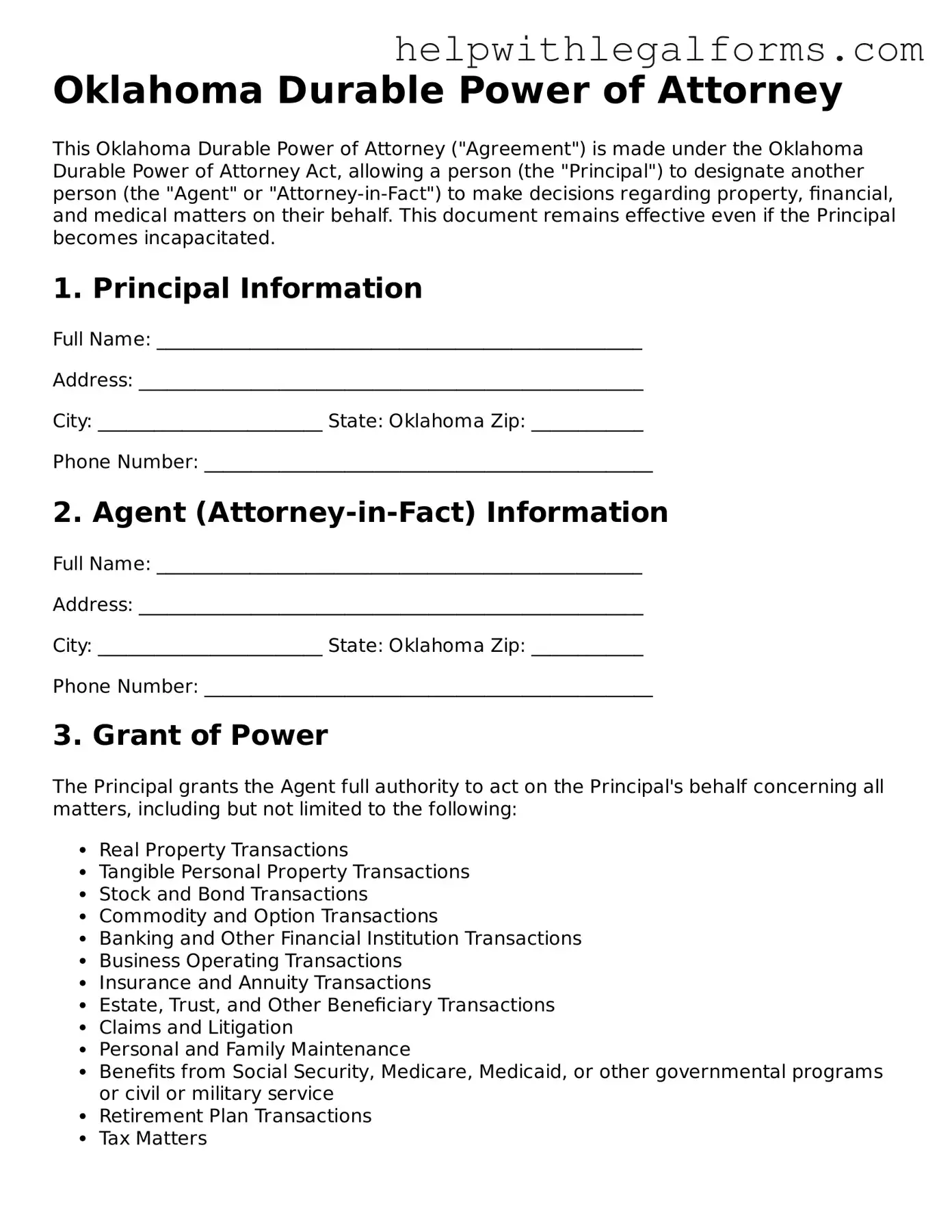

Example - Oklahoma Durable Power of Attorney Form

Oklahoma Durable Power of Attorney

This Oklahoma Durable Power of Attorney ("Agreement") is made under the Oklahoma Durable Power of Attorney Act, allowing a person (the "Principal") to designate another person (the "Agent" or "Attorney-in-Fact") to make decisions regarding property, financial, and medical matters on their behalf. This document remains effective even if the Principal becomes incapacitated.

1. Principal Information

Full Name: ____________________________________________________

Address: ______________________________________________________

City: ________________________ State: Oklahoma Zip: ____________

Phone Number: ________________________________________________

2. Agent (Attorney-in-Fact) Information

Full Name: ____________________________________________________

Address: ______________________________________________________

City: ________________________ State: Oklahoma Zip: ____________

Phone Number: ________________________________________________

3. Grant of Power

The Principal grants the Agent full authority to act on the Principal's behalf concerning all matters, including but not limited to the following:

- Real Property Transactions

- Tangible Personal Property Transactions

- Stock and Bond Transactions

- Commodity and Option Transactions

- Banking and Other Financial Institution Transactions

- Business Operating Transactions

- Insurance and Annuity Transactions

- Estate, Trust, and Other Beneficiary Transactions

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs or civil or military service

- Retirement Plan Transactions

- Tax Matters

4. Special Instructions

Any specific limitations on the Agent's power or special instructions are listed below:

________________________________________________________________

________________________________________________________________

________________________________________________________________

5. Durable Power of Attorney Effective Date

This Power of Attorney will become effective on ______________________ (date) and will remain in effect until the Principal revokes it in writing or passes away.

6. Third Party Reliance

Third parties may rely upon the representations of the Agent as to all matters relating to any power granted to the Agent, and no person who acts in reliance on the representation of the Agent or the authority granted within this document shall incur any liability to the Principal or to the Principal's heirs, assigns, or estate.

7. Revocation

The Principal may revoke this Durable Power of Attorney at any time by providing written notice to the Agent.

8. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Oklahoma.

9. Principal's Signature

By signing below, the Principal agrees to all terms and conditions of this Durable Power of Attorney.

Signature: ___________________________ Date: __________________

10. Agent's Acceptance

The Agent, by signing below, accepts the designation as Attorney-in-Fact under this Durable Power of Attorney and agrees to act in the Principal’s best interest to the best of the Agent's ability.

Signature: ___________________________ Date: __________________

11. Witness Acknowledgment

This document was signed in the presence of the following witnesses, who affirm that the Principal appears to be of sound mind and under no duress or undue influence.

- Witness 1: _____________________________________ Date: _____________

- Signature: ________________________________________________________

- Witness 2: _____________________________________ Date: _____________

- Signature: ________________________________________________________

12. Notary Acknowledgment

State of Oklahoma

County of _____________

On __________________ (date), before me, ____________________________ (name of notary), a Notary Public, personally appeared ________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In Witness Whereof, I hereunto set my hand and official seal.

Notary Signature: _____________________________

Seal:

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Oklahoma Durable Power of Attorney form is designed to allow an individual (the principal) to legally designate another individual (the agent) to manage their affairs, particularly in instances where the principal cannot do so themselves due to incapacity or absence. |

| Durability | This type of power of attorney remains in effect even if the principal becomes incapacitated, distinguishing it from other forms of power of attorney that may terminate upon the principal's incapacity. |

| Scope of Authority | The form allows the principal to grant broad or specific powers to the agent, which can include handling financial affairs, making healthcare decisions, or managing property and investments. |

| Revocation | The principal has the right to revoke the durable power of attorney at any time, as long as they are mentally competent. |

| Witness Requirement | Oklahoma law requires the durable power of attorney to be signed in the presence of a notary public or at least two adult witnesses, neither of whom should be the agent. |

| Governing Law | The Oklahoma Durable Power of Attorney is governed by the Oklahoma Uniform Durable Power of Attorney Act, found in Title 58, Sections 1071 through 1081 of the Oklahoma Statutes. |

| Form Availability | The form can be obtained from legal document providers, attorneys, or resources provided by the Oklahoma state government, ensuring that the document meets current legal standards and state-specific requirements. |

Instructions on How to Fill Out Oklahoma Durable Power of Attorney

Filling out the Oklahoma Durable Power of Attorney form is a critical step for anyone seeking to ensure that their affairs are handled according to their wishes, should they become unable to make decisions for themselves. This document empowers another individual, known as the agent, to make decisions regarding finances, property, and other legal matters on behalf of the person filling out the form. The following steps are designed to guide you through the process of completing this important form accurately and effectively.

- Gather all necessary information including full legal names, addresses, and contact details of both the principal (the person granting power) and the designated agent.

- Read through the entire form to understand the scope of authority being granted to the agent. Pay special attention to any specific powers that need to be initialed to be granted.

- In the designated section, enter the full legal name and address of the principal.

- Fill in the agent’s full legal name and contact information in the corresponding field.

- If the form allows the appointment of a successor agent, and if desired, provide the name and contact information for this individual.

- Review the powers being granted to the agent carefully. Initial next to each power the principal wishes to grant. If there are any powers the principal does not wish to grant, leave these sections blank.

- Check if the form requires the specification of any conditions or limitations on the agent's power. If so, clearly describe these in the space provided.

- Go through the form to ensure that all required sections have been completed and initialed as per the principal’s wishes.

- The principal must sign and date the form in the presence of a notary public. This step is crucial as the notarization gives the document legal validity.

- After notarization, deliver or securely store the form. Provide a copy to the agent, and consider informing financial institutions or other relevant entities of the power of attorney.

Completing the Oklahoma Durable Power of Attorney form accurately is essential for it to serve its intended purpose. By following these steps, you can help ensure that the document clearly reflects the principal’s wishes and meets all legal requirements. Remember, this form is a powerful legal document, and it’s advisable to consult with a legal professional if there are any uncertainties or concerns.

Crucial Points on This Form

What is a Durable Power of Attorney form in Oklahoma?

A Durable Power of Attorney (DPOA) form in Oklahoma is a legal document that allows you to appoint someone else, known as an agent or attorney-in-fact, to make decisions and act on your behalf. This includes managing your financial affairs, property, and other personal matters. The "durable" aspect means that the document remains effective even if you become incapacitated or unable to make decisions for yourself.

How do I choose an agent for my Durable Power of Attorney?

When selecting an agent for your DPOA, it's important to choose someone you trust completely. This person should be reliable, capable of handling financial matters, and willing to act in your best interest. Many people choose a close family member or friend, but you can select anyone you feel is suitable for the role.

Does the agent have unlimited power once I sign the Durable Power of Attorney?

No, the agent's power is limited to what is specified in the DPOA document. You can tailor the powers granted to your agent, limiting them to specific actions or broadening them to include a wide range of activities. It's important to clearly define what your agent can and cannot do on your behalf.

What happens if I change my mind after signing a Durable Power of Attorney?

If you decide to revoke or change your DPOA, you can do so at any time as long as you are still mentally competent. To revoke the power of attorney, you should provide written notice to your agent and any institutions or parties that were given a copy of the document. It's also recommended to destroy all copies of the old DPOA and to create a new one if you wish to appoint a different agent.

Is a Durable Power of Attorney effective immediately in Oklahoma?

Yes, in Oklahoma, a DPOA typically becomes effective immediately after it is signed and notarized, unless the document specifies otherwise. Some people choose to include a stipulation that the DPOA only becomes effective under certain conditions, such as a physician certifying that they have become incapacitated.

Do I need to have my Durable Power of Attorney notarized in Oklahoma?

Yes, for a Durable Power of Attorney to be legally valid in Oklahoma, it must be signed by the principal (the person creating the DPOA) in the presence of a notary public. The notary must acknowledge the signature to confirm its authenticity, which adds a level of legal protection.

Can my Durable Power of Attorney make healthcare decisions for me?

A standard Durable Power of Attorney in Oklahoma is designed for financial and property decisions and does not typically include healthcare decisions. If you want someone to make healthcare decisions on your behalf, you should complete a separate document known as a Healthcare Power of Attorney or an Advance Directive for Health Care.

Where should I keep my signed Durable Power of Attorney?

Once your DPOA is signed and notarized, keep the original document in a secure but accessible place. You should inform your agent of its location and consider providing copies to trusted family members or advisors. It's also wise to give a copy to your financial institutions and anyone else who might need it to recognize your agent's authority.

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form is a significant step in planning for future needs and ensuring that your affairs are managed according to your wishes should you become unable to do so yourself. In Oklahoma, as in many states, completing this document requires careful attention to detail. Unfortunately, people often make mistakes that can lead to complications or even result in the DPOA being invalid. Here are nine common errors to avoid:

Not customizing the document to fit individual needs. Many people use generic forms without considering their specific situation. Each individual's needs and wishes are different, making it important to tailor the DPOA accordingly.

Choosing the wrong agent. The person you designate as your agent (also known as the attorney-in-fact) will have significant power over your affairs. It’s vital to choose someone who is not only trustworthy but also capable of handling the responsibilities.

Failing to define the agent's powers clearly. If the DPOA does not clearly spell out what an agent can and cannot do, it can lead to confusion and potential abuse of power.

Omitting a successor agent. Life is unpredictable. If your first choice for agent is unable to serve for any reason, having a successor agent named ensures continuity in the management of your affairs.

Not updating the document. Situations change, and a DPOA made years ago may not reflect current wishes or relationships. Regularly reviewing and updating it is crucial.

Using unclear language. The wording in the DPOA should be clear and precise to avoid misinterpretation by financial institutions, healthcare providers, and others who will rely on it.

Ignoring state-specific requirements. States have different requirements for DPOAs to be legally valid. It’s important to ensure that the document complies with Oklahoma law.

Not having the document properly witnessed and notarized. In Oklahoma, a DPOA must be notarized and, depending on the powers granted, may also need to be witnessed. Failure to meet these requirements can render the document invalid.

Keeping the DPOA in an inaccessible place. Once executed, the DPOA should be stored in a secure, yet accessible location. The agent should know where it is and be able to access it when needed.

Avoiding these mistakes can help ensure that your Durable Power of Attorney effectively protects your interests and is ready for use when needed.

Documents used along the form

When preparing an Oklahoma Durable Power of Attorney, it's important to consider other key documents that could complement or enhance the legal and practical effectiveness of this arrangement. A Durable Power of Attorney allows you to appoint someone to manage your financial affairs if you become unable to do so. However, several other documents are often used alongside it to ensure comprehensive planning and protection. Here is a list of seven such documents and a brief description of each.

- Living Will: This document specifies your wishes regarding medical treatment if you become incapacitated and cannot communicate your decisions about end-of-life care.

- Healthcare Power of Attorney: Similar to a Durable Power of Attorney but specifically for healthcare decisions, this appoints someone to make medical decisions on your behalf if you're unable to do so yourself.

- Revocable Living Trust: This allows you to manage your assets while you're alive and specify how you'd like them distributed upon your death, potentially avoiding the need for probate.

- Last Will and Testament: This document outlines how you wish your property and affairs to be handled after your death, including naming guardians for any minor children.

- Advanced Directive: Often combined with a Living Will, it provides detailed instructions about the type of care you want if you're unable to make decisions due to illness or incapacity.

- HIPAA Release Form: This authorizes healthcare providers to disclose your health information to designated individuals, including those named in your Healthcare Power of Attorney.

- Declaration of Homestead: In some cases, this document helps protect your home from certain types of creditors, ensuring your residence is preserved for your dependents.

Gathering these documents together with your Oklahoma Durable Power of Attorney forms a robust legal framework that protects your interests across various aspects of life and death. Whether managing assets, making healthcare decisions, or enacting end-of-life wishes, each document serves a critical role in ensuring your affairs are handled according to your desires. Consulting with a legal professional can help ensure that all documents are properly prepared and legally sound, tailored to your specific needs and circumstances.

Similar forms

Living Will: A Durable Power of Attorney for healthcare decisions shares similarities with a Living Will, as both are advance healthcare directives. A Living Will specifically outlines a person’s preferences regarding medical treatment and life-sustaining measures in the event they become incapacitated and unable to communicate their wishes. Similarly, a Durable Power of Attorney for healthcare allows an individual to appoint someone else to make healthcare decisions on their behalf under the same conditions. Both documents ensure a person’s healthcare wishes are known and considered.

General Power of Attorney: The General Power of Attorney is closely related to the Durable Power of Attorney, with the primary difference being in their duration and durability. The General Power of Attorney typically ceases to be effective if the principal becomes incapacitated or mentally incompetent. In contrast, a Durable Power of Attorney is specifically designed to remain in effect or become effective upon the incapacitation of the principal, making it an essential tool for long-term planning.

Medical Power of Attorney: Similar to a Durable Power of Attorney for healthcare, a Medical Power of Attorney permits an individual to designate another person (often called a healthcare proxy or agent) to make healthcare decisions on their behalf if they’re unable to do so. While a Durable Power of Attorney can cover a wide range of decisions including healthcare, a Medical Power of Attorney focuses exclusively on healthcare decisions, highlighting the importance of having someone trusted to make critical health-related choices.

Springing Power of Attorney: The Springing Power of Attorney shares an important characteristic with certain Durable Powers of Attorney — both can be designed to become effective only under specified conditions, such as the principal’s incapacitation. This feature makes both types of Power of Attorney useful for individuals who prefer to maintain control over their affairs unless they are genuinely unable to do so. The key difference is that a Durable Power of Attorney can be effective immediately and continue through incapacitation, whereas a Springing Power of Attorney lies dormant until activated by the specified condition.

Dos and Don'ts

Filling out a Durable Power of Attorney form in Oklahoma is a significant step in planning for the future. It allows you to designate someone you trust to manage your financial affairs if you're unable to do so yourself. Here's a straightforward guide on what to do and what not to do during this crucial process.

Things You Should Do

Review the entire form carefully before filling it out. Ensure you understand every section and what powers you are granting.

Select a trusted individual as your attorney-in-fact. This should be someone you have absolute faith in to make decisions in your best interest.

Be specific about the powers you are granting. If there are certain decisions you do not wish your attorney-in-fact to make on your behalf, clearly state these exceptions.

Sign the document in the presence of a notary. Oklahoma law requires the Durable Power of Attorney to be notarized to ensure its validity.

Things You Shouldn't Do

Don't leave any sections incomplete. An incomplete form can lead to misunderstandings or disputes about your intentions.

Avoid choosing an attorney-in-fact based solely on their relationship to you. Instead, consider their ability to handle financial matters prudently and responsibly.

Don't neglect to discuss your wishes and expectations with the person you've chosen as your attorney-in-fact. Open communication can prevent future conflicts and ensure your wishes are carried out as intended.

Do not forget to keep a copy of the form in a safe place, and inform your attorney-in-fact where it is located. Also, consider providing copies to other trusted individuals or your attorney.

Creating a Durable Power of Attorney is a proactive step towards safeguarding your financial well-being. Following these guidelines can help ensure that your intentions are clearly communicated and respected, providing you and your loved ones with peace of mind.

Misconceptions

When discussing the Oklahoma Durable Power of Attorney (DPOA) form, there are several misconceptions that people frequently encounter. Clarifying these can help individuals make informed decisions when considering setting up a DPOA.

Misconception 1: A Durable Power of Attorney covers medical decisions. Many believe that a DPOA in Oklahoma permits the designated agent to make healthcare decisions on behalf of the principal. However, the DPOA specifically deals with financial and property matters. Health care decisions are covered under a separate document called a Health Care Power of Attorney or an Advance Directive for Health Care.

Misconception 2: The form is valid in all states once executed in Oklahoma. While many states may honor an Oklahoma DPOA, each state has its own laws and regulations regarding durable powers of attorney. Therefore, if the principal lives in Oklahoma but has property or spends significant time in another state, it's crucial to ensure the DPOA complies with the other state's laws or consider executing an additional power of attorney in that state.

Misconception 3: Once signed, the Durable Power of Attorney cannot be changed or revoked. The truth is, as long as the principal is of sound mind, they can amend or revoke their DPOA at any time. This flexibility allows individuals to respond to changes in their relationships or their financial situation.

Misconception 4: Creating a Durable Power of Attorney will result in loss of control over financial decisions. This is not the case. The principal retains control over their affairs and can specify how much authority the agent has. The DPOA simply allows the agent to act on the principal's behalf according to the permissions granted in the document.

Misconception 5: A lawyer must draft the Oklahoma Durable Power of Attorney for it to be valid. While it's advisable to consult with a legal professional to ensure that the DPOA meets all legal requirements and reflects the principal's wishes accurately, Oklahoma law does not require an attorney to draft the document. The principal can create their own DPOA as long as it complies with Oklahoma laws, including being signed, dated, and notarized.

Key takeaways

When it comes to managing one's own affairs, there are times where assistance is needed. In Oklahoma, the Durable Power of Attorney (DPOA) form is a legal document that allows an individual to designate someone else to make decisions on their behalf. Understanding the key components and considerations of this form can ensure that your interests are safeguarded. Here are six key takeaways to keep in mind when filling out and using the Oklahoma Durable Power of Attorney form:

- Choose Your Agent Wisely: The person you appoint as your agent (also known as an attorney-in-fact) will have significant power over your affairs. It's crucial to select someone who is trustworthy, reliable, and capable of handling the responsibilities that come with the role.

- Understand the Powers Granted: The Oklahoma DPOA form allows you to specify the exact powers your agent will have. These can range from managing your financial assets to making healthcare decisions on your behalf. Make sure you thoroughly understand each power you are granting.

- Consider the Durability Aspect: The "durable" nature of this Power of Attorney means that the agent’s authority continues even if you become incapacitated. This continuity is essential for seamless management of your affairs during unforeseen circumstances.

- Notarization is Required: For the DPOA to be legally valid in Oklahoma, it must be notarized. This means that after you and your agent sign the form, a notary public must also sign it, confirming the identity of the signers and their understanding of the document.

- Keep Copies Accessible: After the DPOA is notarized, ensure that copies are kept in a safe but accessible location. Your agent, family members, or anyone else you designate should know where to find it if they need to act on your behalf.

- Review and Update as Necessary: Life circumstances change, and so might your choice of agent or the powers you wish to grant. Regularly reviewing and, if necessary, updating your DPOA ensures that it remains aligned with your current wishes and needs.

Creating a Durable Power of Attorney is a proactive step in managing your future financial and medical well-being. It provides peace of mind, knowing that should you be unable to make decisions yourself, the person you trust the most is legally empowered to do so on your behalf. Always consult with a legal professional to ensure your DPOA accurately reflects your wishes and is executed according to Oklahoma laws.

Create Other Durable Power of Attorney Forms for US States

Financial Power of Attorney Maryland - Even if you’re young and healthy, having a Durable Power of Attorney is a wise precaution.

Statutory Durable Power of Attorney Texas - Effective immediately upon signing or triggered by specific events, based on your preference.

Ct Power of Attorney Forms Free - This legal document grants a chosen representative the authority to handle financial decisions on behalf of the person creating the form.