Blank Durable Power of Attorney Form for Texas

Embarking on the journey of understanding legal forms can often feel like navigating through a dense forest without a map. One such crucial document that stands out for its power and potential to provide peace of mind in uncertain times is the Texas Durable Power of Attorney form. This form is a lifeline, enabling individuals to appoint someone they trust to manage their financial affairs if they're unable to do so themselves. It's not just any legal form; it's a beacon of foresight, allowing people to safeguard their financial future and ensure their affairs are handled according to their wishes. Unlike its non-durable counterpart, this durable version remains in effect even if the person who made it becomes incapacitated, offering a seamless continuation of financial management without court intervention. Whether it's handling bank transactions, real estate deals, or managing other significant matters, the Texas Durable Power of Attorney equips the designated agent with the authority to act robustly and responsibly, ensuring that life's unforeseen turns don't lead to financial turmoil.

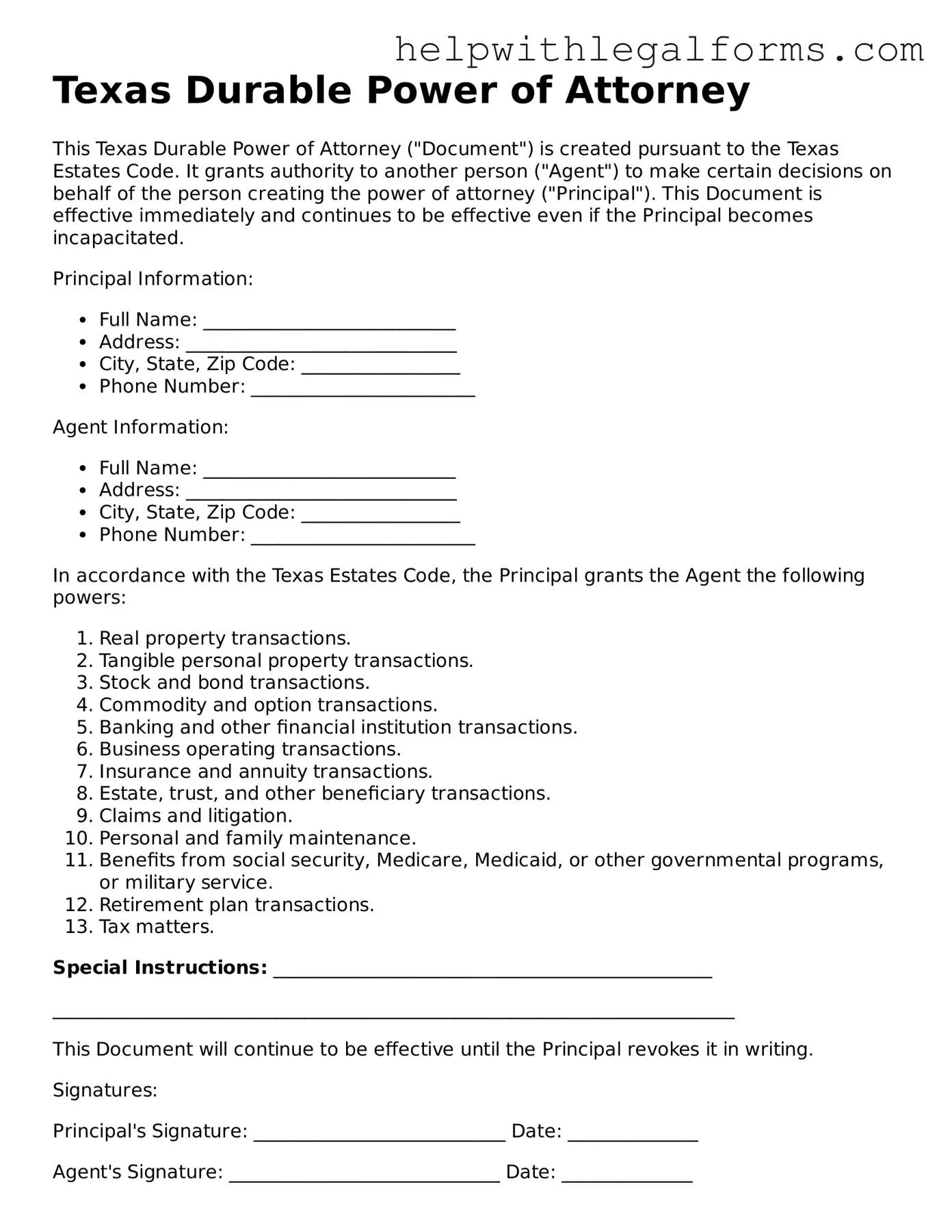

Example - Texas Durable Power of Attorney Form

Texas Durable Power of Attorney

This Texas Durable Power of Attorney ("Document") is created pursuant to the Texas Estates Code. It grants authority to another person ("Agent") to make certain decisions on behalf of the person creating the power of attorney ("Principal"). This Document is effective immediately and continues to be effective even if the Principal becomes incapacitated.

Principal Information:

- Full Name: ___________________________

- Address: _____________________________

- City, State, Zip Code: _________________

- Phone Number: ________________________

Agent Information:

- Full Name: ___________________________

- Address: _____________________________

- City, State, Zip Code: _________________

- Phone Number: ________________________

In accordance with the Texas Estates Code, the Principal grants the Agent the following powers:

- Real property transactions.

- Tangible personal property transactions.

- Stock and bond transactions.

- Commodity and option transactions.

- Banking and other financial institution transactions.

- Business operating transactions.

- Insurance and annuity transactions.

- Estate, trust, and other beneficiary transactions.

- Claims and litigation.

- Personal and family maintenance.

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service.

- Retirement plan transactions.

- Tax matters.

Special Instructions: _______________________________________________

_________________________________________________________________________

This Document will continue to be effective until the Principal revokes it in writing.

Signatures:

Principal's Signature: ___________________________ Date: ______________

Agent's Signature: _____________________________ Date: ______________

Witnesses (if required by state law):

Witness 1 Signature: ___________________________ Date: ______________

Witness 2 Signature: ___________________________ Date: ______________

This Document was created on the basis of current laws and regulations. It is advisable to consult legal counsel to ensure that it meets the Principal's specific needs and is in compliance with current Texas law.

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | The Texas Durable Power of Attorney form allows individuals to appoint an agent to make financial decisions on their behalf. |

| 2 | It remains effective even if the principal becomes incapacitated, ensuring continuous management of their financial matters. |

| 3 | Under the Texas Estates Code, specifically Sections 751.001 through 751.251, this form is regulated. |

| 4 | The chosen agent gains broad or limited financial powers, depending on the principal's preferences, as stated in the form. |

| 5 | For the form to be valid, it must be signed in the presence of a notary public. |

| 6 | It does not cover healthcare decisions; a separate document, known as a Medical Power of Attorney, is necessary for that purpose. |

| 7 | The principal has the flexibility to revoke the form at any time, as long as they are mentally competent. |

Instructions on How to Fill Out Texas Durable Power of Attorney

After you've decided to create a Durable Power of Attorney in Texas, the process ahead involves carefully completing a form. This legal document empowers someone else to make decisions on your behalf. It's a vital step for ensuring that your affairs are managed according to your wishes, even if you're unable to handle them yourself. The following instructions are designed to guide you through each step, ensuring the form is filled out accurately and effectively.

- Begin by downloading the latest version of the Texas Durable Power of Attorney form from a trusted government or legal website. Ensure the form is specific to Texas, as laws may differ from state to state.

- Fill in your full legal name and complete address in the designated sections at the top of the form. This identifies you as the principal—the person granting power to someone else.

- Identify your agent (also known as the attorney-in-fact), the person you are granting authority to act on your behalf. Include their full legal name, complete address, and contact information. Make sure the person you choose is trustworthy and capable of managing your affairs.

- Detail the specific powers you are granting to your agent. The form typically includes a list of standard powers, such as handling financial and real estate transactions, making healthcare decisions, and dealing with government benefits. Check the boxes next to the powers you wish to assign.

- If you wish to grant your agent powers not listed on the form, use the space provided to specify additional authorities. Be clear and precise in your descriptions to avoid any confusion.

- Decide on the durability of the Power of Attorney. If you want the document to remain in effect even if you become incapacitated, check the relevant box that specifies the document is "durable." Without this specification, the power of attorney could become void if you are deemed unable to make decisions.

- Appoint a successor agent, if desired. This is the person who will take over if your first agent is unable or unwilling to serve. Provide the same detailed information for your successor agent as you did for your initial agent.

- Review the execution requirements for a Texas Durable Power of Attorney, which typically include the need for it to be signed by two witnesses and notarized. Each state has different requirements, so it's crucial to follow Texas laws precisely.

- Sign and date the form in the presence of two adult witnesses who are not named as agents in the document. Each witness must also sign the form, attesting to your mental competence and voluntary signing.

- Finally, take the form to a notary public. The notary will verify your identity, witness your signing of the document, and affix their seal, making the Durable Power of Attorney legally binding.

Once complete, share copies of the Durable Power of Attorney with your agent, successor agent (if applicable), and any institutions (like banks or healthcare providers) that may need it. With this document in place, you can have peace of mind knowing that your affairs will be managed according to your wishes, even in unforeseen circumstances.

Crucial Points on This Form

What is a Texas Durable Power of Attorney?

A Texas Durable Power of Attorney is a legal document that allows an individual (the principal) to designate another person (the agent or attorney-in-fact) to make decisions on their behalf regarding financial, estate, and business matters. The "durable" aspect means that the document remains in effect even if the principal becomes incapacitated.

Who can serve as an agent under a Durable Power of Attorney in Texas?

In Texas, an agent must be a competent adult. The principal can choose a trusted family member, friend, or professional advisor to serve as their agent. The chosen individual should be someone the principal trusts to manage their affairs responsibly and in their best interest.

How do I execute a Durable Power of Attorney in Texas?

To execute a Durable Power of Attorney in Texas, the document must be signed by the principal in the presence of a notary public. Texas law does not require witnesses for the signing of a Durable Power of Attorney, but it is advised to have one or two witnesses to further prove the validity of the document if ever challenged.

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney can be revoked at any time by the principal, as long as the principal is still mentally competent. To revoke it, the principal should notify the agent in writing and retrieve all copies of the document. Additionally, it may be beneficial to inform any financial institutions and other parties that were relying on the Durable Power of Attorney of the revocation.

Does a Durable Power of Attorney grant health care decision-making authority?

No, a Durable Power of Attorney in Texas is designed for financial and business decisions, not health care decisions. For health care decisions, a separate legal document called a Medical Power of Attorney should be executed.

What happens if the principal becomes incapacitated without a Durable Power of Attorney in Texas?

If a person becomes incapacitated without having a Durable Power of Attorney in place, a court process, often called guardianship or conservatorship, may be necessary. Through this process, the court will appoint someone to make decisions on behalf of the incapacitated person. This process can be time-consuming, expensive, and stressful for family members.

Common mistakes

Filling out a Texas Durable Power of Attorney form is a crucial step for ensuring your affairs can be handled according to your wishes, should you become unable to manage them yourself. However, mistakes can be made during this process. Here are four common errors to avoid.

Not specifying powers clearly. Many individuals fail to clearly outline the specific powers their agent will hold. This can lead to confusion or legal challenges, as the agent may not know the extent of what they are authorized to do or may overstep their bounds.

Choosing the wrong agent. The role of an agent is significant and requires trust and reliability. A common mistake is appointing an agent based on relationship status alone, such as a family member, without considering if they have the skills or willingness to act in the best interest of the principal.

Failing to update the document. Life changes, and so do relationships and circumstances. Not updating the Durable Power of Attorney to reflect current wishes and situations can lead to an outdated document that doesn’t serve the principal's best interests anymore.

Not having the form properly witnessed or notarized. In Texas, for a Durable Power of Attorney to be valid, specific witnessing and notarization requirements must be met. Skimping on these formalities can invalidate the document, rendering it useless when it’s most needed.

When completing a Durable Power of Attorney form, it's critical to approach the task with attention to detail and an understanding of its importance. Steering clear of these common mistakes can help ensure that the document will effectively serve its intended purpose.

Documents used along the form

When preparing for the future, particularly in terms of legal and medical decision-making, a Texas Durable Power of Attorney (DPOA) forms a critical document. It allows an individual to designate another person to make decisions on their behalf should they become unable to do so themselves. However, to ensure comprehensive coverage and to address all aspects of one's life and wishes, several other documents are often used in conjunction with the DPOA. These documents complement the DPOA, providing a more detailed and complete legal and medical directive.

- Medical Power of Attorney - This document allows an individual to appoint someone to make healthcare decisions for them if they are incapacitated. It differs from the Durable Power of Attorney in its exclusive focus on healthcare decisions.

- Advance Healthcare Directive/Living Will - Specifies the individual’s wishes regarding medical treatment and life-sustaining measures in the event they can no longer communicate their desires.

- HIPAA Release Form - Authorizes healthcare providers to share the individual’s health information with designated persons, often the same individuals named in the DPOA or Medical Power of Attorney.

- Last Will and Testament - Dictates how an individual’s property and assets are to be distributed upon their death. While not related to incapacity, it is a crucial document in overall estate planning.

- Declaration of Guardian in Advance of Need - Allows an individual to name their preferred guardian (for themselves and/or their minor children) in the event a court decides one is needed.

- Directive to Physicians and Family or Surrogates - Often part of an Advance Healthcare Directive, this document outlines wishes concerning end-of-life care and treatment.

- Financial Statements - While not formal legal documents, keeping updated financial records, including accounts, property, and investments, is crucial for the person appointed in the DPOA to manage the individual's affairs effectively.

- Trust Documents - If the individual has created any trusts, these documents are necessary for the appointed attorney-in-fact to understand and manage assets held in trust according to the individual’s wishes.

- Letter of Intent - A non-legally binding document that provides additional guidance and personal wishes about the individual's assets, funeral arrangements, or care. This can assist those managing the estate or making decisions on the individual’s behalf.

Each of these documents plays a vital role in comprehensive estate planning, complementing the Texas Durable Power of Attorney to ensure all aspects of the individual’s legal, financial, and healthcare needs are addressed. Effective planning with these documents provides not just legal protection but also peace of mind for both the individual and their family, knowing preferences and wishes are documented and can be respected and followed.

Similar forms

Medical Power of Attorney: This document allows you to designate someone to make healthcare decisions on your behalf if you're unable to do so. Both forms entrust significant authority to another individual, but while a Durable Power of Attorney often covers a broad range of legal and financial powers, a Medical Power of Attorney is specifically for healthcare decisions.

General Power of Attorney: Like a Durable Power of Attorney, a General Power of Attorney grants broad powers to another person. The key difference is in durability; a General Power of Attorney usually becomes invalid if the principal becomes incapacitated, whereas a Durable Power of Attorney is designed to remain in effect even after incapacitation.

Springing Power of Attorney: This document becomes effective under conditions specified by the principal, such as the event of incapacitation. Both this and a Durable Power of Attorney can be designed to activate when certain conditions are met. However, the Durable Power of Attorney can be effective immediately upon signing, not just upon future conditions.

Limited Power of Attorney: A Limited Power of Attorney grants specific powers to the agent for a limited purpose or time, in contrast to the broad and enduring authorities imparted by a Durable Power of Attorney. It's used for singular transactions or defined tasks.

Living Will: This document outlines your wishes regarding end-of-life medical care. Both a Living Will and a Durable Power of Attorney for healthcare decisions allow you to plan for future healthcare situations, but a Living Will specifies your wishes directly, whereas a Power of Attorney appoints someone else to make decisions for you.

Revocable Living Trust: In a Revocable Living Trust, you can manage your assets during your lifetime and dictate their distribution upon your death. Similar to a Durable Power of Attorney, it can help manage your affairs without court intervention. However, it specifically deals with asset management and distribution, rather than granting broad legal powers.

Last Will and Testament: This document allows you to direct how your estate should be distributed after your death. Although a Last Will and Testament takes effect after death, while a Durable Power of Attorney is for managing your affairs during your lifetime, both are essential tools for estate planning.

Advance Directive: An Advance Directive, like a Living Will and Medical Power of Attorney, allows you to set forth your medical care preferences and appoint someone to make healthcare decisions if you're incapacitated. It combines elements of both documents and relates to a Durable Power of Attorney by preparing for the possibility of future incapacitation.

Guardianship Appointment: This involves designating someone to make personal, medical, and often financial decisions for another, typically a minor or an incapacitated adult. While a Durable Power of Attorney and a Guardianship Appointment can both enable someone to manage your affairs, setting up a guardianship is a court-supervised process and might afford the guardian broader decision-making powers.

Dos and Don'ts

Filling out a Texas Durable Power of Attorney (POA) form is an essential step in managing your affairs. It allows you to appoint an agent to handle your financial and legal matters if you are unable to do so. When completing this form, accuracy and clarity are paramount. To ensure the process is done correctly, here are important do’s and don’ts to consider.

- Do read the entire form carefully before beginning. Understanding each section will help in selecting the right powers for your agent.

- Do choose an agent who is trustworthy and capable of managing your affairs. This person should have integrity and a good understanding of your wishes.

- Do be specific about the powers you are granting. The Texas Durable Power of Attorney form allows you to give broad or limited authority to your agent. Clearly define these powers to avoid any confusion.

- Do sign the form in the presence of a notary public. This step is crucial for the document to be legally binding.

- Don't leave any sections incomplete. An incomplete form can lead to misunderstandings or challenges to the document’s validity.

- Don't forget to discuss your decision with the chosen agent. They should be fully aware of their responsibilities and agree to take on this role.

- Don't use vague or ambiguous language. Precision is key in legal documents to ensure your exact wishes are followed.

- Don't hesitate to seek professional advice. If you have any doubts or questions, consulting with an attorney can provide clarity and peace of mind.

Misconceptions

Understanding the Texas Durable Power of Attorney form is essential for ensuring your wishes are carried out by someone you trust, in case you're unable to make decisions for yourself. There are several myths that can confuse people, leading to hesitations or mistakes when preparing this important document. Let's clear up six common misconceptions.

- It takes away your control immediately. Many believe that once you sign a Texas Durable Power of Attorney, you lose your ability to manage your affairs. That's not true. You maintain control over all decisions and actions until you become incapacitated or unable to make those decisions yourself.

- Only for the elderly. Another common misconception is that these forms are only for older adults. In reality, any adult can face situations where they're unable to make decisions due to illness or accidents. It's wise for all adults to have a plan in place.

- It covers medical decisions. Some confuse the Durable Power of Attorney with a Medical Power of Attorney. However, in Texas, the Durable Power of Attorney only allows the designated agent to make financial and legal decisions, not healthcare ones.

- It's too complicated to set up without a lawyer. While legal advice can be beneficial, Texas provides resources and forms designed to make it easier for individuals to set up a Durable Power of Attorney on their own. Always ensure you're using the most current form and follow the instructions carefully.

- Any form will work. It's crucial to use the specific form for Texas. Durable Power of Attorney laws can vary significantly by state, so a form that's valid in one state may not be valid in another. Make sure you're using a form designed to comply with Texas law.

- Once signed, it's irreversible. Many hesitate to sign a Durable Power of Attorney out of fear it can't be changed. However, as long as you're competent, you can revoke or update your Durable Power of Attorney at any time to reflect your current wishes and circumstances.

Dispelling these misconceptions can help you better understand the importance and flexibility of a Durable Power of Attorney, ensuring you're prepared for the future with confidence.

Key takeaways

When considering the Texas Durable Power of Attorney (POA) form, it's important to understand its function and how to properly complete and use it. Below are seven key takeaways to guide you through this essential legal document, ensuring your rights and wishes are respected even when you can't voice them yourself.

- Understand what "Durable" means: The term "durable" indicates that the power of attorney remains in effect even if you become incapacitated. This critical feature ensures your designated agent can manage your affairs when you're unable to do so.

- Choose your agent wisely: Your agent is the person you appoint to make decisions on your behalf. Select someone you trust implicitly, as they’ll have significant power over your financial and, potentially, healthcare decisions.

- Be specific: The Texas Durable POA form allows you to grant broad or limited powers to your agent. It’s crucial to be clear about which powers you're transferring. If you only want them to handle certain assets or make specific types of decisions, state this explicitly.

- Sign in the presence of a notary: For your Durable Power of Attorney to be valid in Texas, you must sign it in the presence of a notary public. This step ensures that the document is legally binding and recognized.

- Inform relevant parties: Once the POA is completed and notarized, inform any relevant institutions or individuals, especially those with whom your agent will be dealing, such as banks, brokers, or medical professionals, about this arrangement.

- Review and update regularly: Over time, your situation or your relationship with your chosen agent might change. It’s wise to review your Durable Power of Attorney periodically to ensure it still reflects your wishes and that your appointed agent is still the right choice.

- Understand revocation process: You have the right to revoke your Durable Power of Attorney at any time, as long as you're competent. To do so, you must inform your agent and any institutions that were relying on the document in writing.

Handling a Texas Durable Power of Attorney with care and diligence ensures your affairs will be managed according to your wishes, providing peace of mind to you and your loved ones.

Create Other Durable Power of Attorney Forms for US States

Ct Power of Attorney Forms Free - It remains effective even if the person who made it becomes mentally incapacitated, ensuring continuous management of their finances.

Financial Power of Attorney Colorado - Minimizes disputes among family members by clearly outlining who has decision-making authority.