Blank Power of Attorney Form for Florida

In Florida, the Power of Attorney (POA) form serves as a critical legal instrument, allowing individuals to designate another person to make decisions on their behalf should they become unable to do so themselves. This delegation of authority can cover a wide range of matters, including financial affairs, health care decisions, and even everyday personal issues. It is essential that the document is crafted with clarity to ensure that the appointed agent fully understands their responsibilities and limitations. The state of Florida has specific requirements for these forms to be considered valid, including the necessity for the document to be signed in the presence of two witnesses and a notary public. Understanding these prerequisites, as well as the different types of POA available and their respective scopes, is vital for anyone looking to establish such an arrangement. This setup ensures that, regardless of unforeseen circumstances, individuals have a trusted person legally empowered to act in their best interest, underlines the need for a comprehensive approach to selecting an agent, and highlights the importance of the document's precision in reflecting the principal's wishes.

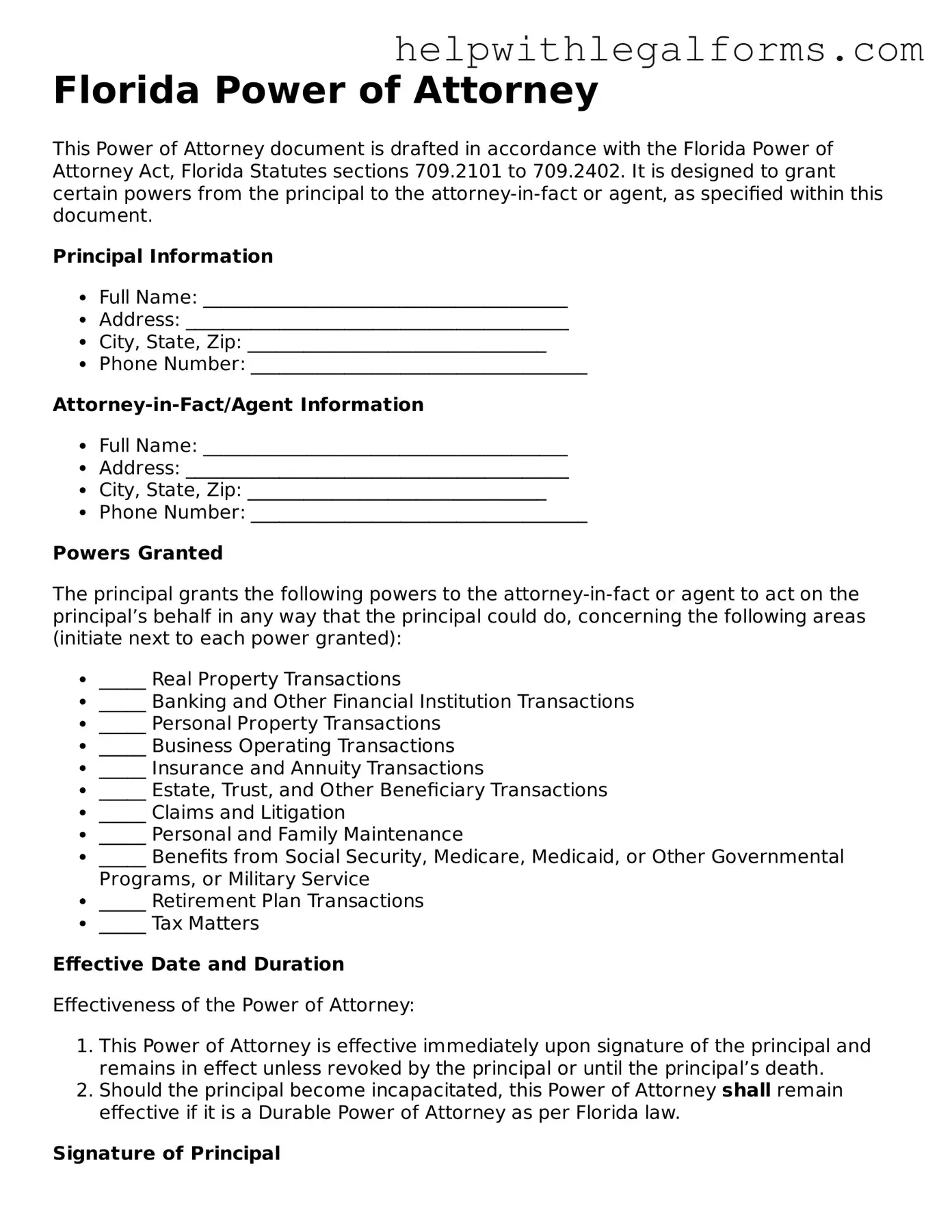

Example - Florida Power of Attorney Form

Florida Power of Attorney

This Power of Attorney document is drafted in accordance with the Florida Power of Attorney Act, Florida Statutes sections 709.2101 to 709.2402. It is designed to grant certain powers from the principal to the attorney-in-fact or agent, as specified within this document.

Principal Information

- Full Name: _______________________________________

- Address: _________________________________________

- City, State, Zip: ________________________________

- Phone Number: ____________________________________

Attorney-in-Fact/Agent Information

- Full Name: _______________________________________

- Address: _________________________________________

- City, State, Zip: ________________________________

- Phone Number: ____________________________________

Powers Granted

The principal grants the following powers to the attorney-in-fact or agent to act on the principal’s behalf in any way that the principal could do, concerning the following areas (initiate next to each power granted):

- _____ Real Property Transactions

- _____ Banking and Other Financial Institution Transactions

- _____ Personal Property Transactions

- _____ Business Operating Transactions

- _____ Insurance and Annuity Transactions

- _____ Estate, Trust, and Other Beneficiary Transactions

- _____ Claims and Litigation

- _____ Personal and Family Maintenance

- _____ Benefits from Social Security, Medicare, Medicaid, or Other Governmental Programs, or Military Service

- _____ Retirement Plan Transactions

- _____ Tax Matters

Effective Date and Duration

Effectiveness of the Power of Attorney:

- This Power of Attorney is effective immediately upon signature of the principal and remains in effect unless revoked by the principal or until the principal’s death.

- Should the principal become incapacitated, this Power of Attorney shall remain effective if it is a Durable Power of Attorney as per Florida law.

Signature of Principal

By signing below, the principal agrees to the terms of this Power of Attorney, affirming their understanding and consent to the delegation of authority as specified.

Date: ____________________________

Signature of Principal: __________________________________

Signature of Attorney-in-Fact/Agent

By signing below, the attorney-in-fact or agent agrees to the role and responsibilities bestowed by this Power of Attorney, including adherence to the principal’s wishes and acting in their best interest.

Date: ____________________________

Signature of Attorney-in-Fact/Agent: __________________________________

Acknowledgment by Witness(es)

This document was signed in the presence of the undersigned witnesses, who hereby affirm that the principal appeared to willingly and voluntarily sign this Power of Attorney and appeared to be of sound mind.

- Witness 1 Full Name: __________________________________

- Witness 1 Signature: _________________________________

- Witness 1 Date: ______________________________________

- Witness 2 Full Name: __________________________________

- Witness 2 Signature: _________________________________

- Witness 2 Date: ______________________________________

Notarization (if required)

This document was acknowledged before me on this date _______________ by [Name of Principal], who is personally known to me or who has produced ___________________ as identification.

Notary Public: __________________________________

Seal:

PDF Form Attributes

| Fact | Detail |

|---|---|

| 1. Definition | A Florida Power of Attorney (POA) form is a legal document that grants one person the authority to act on behalf of another person in financial, legal, or health-related matters. |

| 2. Types | There are several types, including General, Durable, Limited, and Health Care POAs, each serving different purposes and needs. |

| 3. Governing Law | The Florida Power of Attorney is governed by the Florida Statutes, Chapter 709, which outlines the execution requirements and scope of powers granted. |

| 4. Execution Requirements | For a POA to be valid in Florida, it must be signed by the principal, two witnesses, and it must be notarized. |

| 5. Durability | A Durable POA remains in effect if the principal becomes incapacitated, unlike a General POA, which becomes invalid under such circumstances. |

| 6. Termination | A POA in Florida can be terminated if the principal dies, revokes the POA, if a court invalidates the document, or if its purpose is accomplished. |

| 7. Health Care Surrogate Designation | This is a specific type of POA in Florida allowing a designated person to make healthcare decisions on the principal’s behalf if they become unable to do so themselves. |

Instructions on How to Fill Out Florida Power of Attorney

Filling out a Florida Power of Attorney (POA) form is an important step in entrusting someone else with the authority to make decisions on your behalf. This legal document can cover a variety of situations, from financial matters to healthcare decisions. Completing it accurately ensures that your wishes are clearly understood and followed. The process involves the following steps, each aimed at making sure the form is legally binding and reflective of your intentions.

- Gather all necessary information, including the full legal names, addresses, and contact details of both the principal (the person granting the authority) and the agent (the person receiving the authority).

- Choose the specific type of Power of Attorney form relevant to your needs. Florida offers several types, including General, Durable, Limited, Health Care, and others. Selecting the right form is crucial to ensuring it covers your requirements.

- Read the form thoroughly before you start filling it out. This ensures you understand the responsibilities and powers you're granting to the agent.

- Fill in the principal's information, including full legal name, address, and the effective date of the Power of Attorney.

- Add the agent's details, such as their full name and address. If you wish to appoint a successor agent (a backup, in case the primary agent cannot serve), include their information as well.

- Specify the powers being granted. This section is crucial as it outlines what the agent is authorized to do on your behalf. Be as clear and precise as possible to avoid any ambiguity.

- If you're filling out a Durable Power of Attorney, which remains in effect even if you become incapacitated, ensure the form includes language to that effect. This usually requires a specific statement acknowledging the POA's durability.

- Sign the form in the presence of two witnesses and a notary public. The witnesses should be adults who are not named as agents in the document.

- Have the agent sign the form, if required by the specific POA form you're using. Some forms require the agent's acknowledgment of their responsibilities and acceptance of the role.

- Store the completed form in a safe but accessible place, and provide copies to the agent, relevant family members, and any institutions (like banks or healthcare providers) that may need it.

After completing these steps, the Power of Attorney form will be legally effective. It's recommended to review the document periodically and update it if your circumstances or wishes change. Remember, this form can be revoked at any time, as long as you are mentally capable of making that decision. Informing your agent and any institutions holding copies of any revocation is also essential to ensure it is honored.

Crucial Points on This Form

What is a Power of Attorney form in Florida?

A Power of Attorney (POA) form in Florida is a legal document that grants an individual, known as the agent or attorney-in-fact, the authority to make decisions and act on behalf of another person, known as the principal. The scope of this authority can vary, covering financial, health, or specific decisions, depending on the type of POA form used. This document is used to ensure that a person's choices and responsibilities are handled appropriately when they are unable to do so themselves due to various reasons such as health issues or absence.

Who can serve as an agent under a Florida Power of Attorney?

In Florida, an agent, also referred to as an attorney-in-fact, must be a competent adult. The chosen individual should be someone the principal trusts completely, as they will have significant control over important decisions. While there are no strict legal restrictions preventing the appointment of out-of-state agents, it's often practical to choose someone local for ease of management and accessibility. It's worth noting that certain institutions like banks may have specific requirements or preferences for agents to follow.

How can a Florida Power of Attorney be revoked?

A Florida Power of Attorney can be revoked at any time by the principal as long as they are mentally competent. This revocation must be in writing and should clearly communicate the principal’s intention to revoke the power granted to the agent. It’s crucial to notify the agent and any institutions or individuals relying on the original POA of its revocation. For thoroughness, distributing copies of the revocation document to all relevant parties and securing a confirmation of receipt is advisable. In cases where the POA is recorded in public records, the revocation should be as well.

What happens if the Power of Attorney is abused?

If there is an abuse of power by the agent acting under a Florida Power of Attorney, it is essential to take immediate action. This can include revoking the existing POA, as previously mentioned, and possibly taking legal action against the agent for any misconduct or unauthorized transactions. Florida law allows for civil and criminal penalties against agents who abuse their powers. Those affected by the abuse should consult with a legal professional to understand their rights and the steps necessary to protect the principal's interests and seek restitution where applicable.

Common mistakes

When filling out the Florida Power of Attorney form, mistakes can happen easily. These errors can lead to issues down the line where wishes and instructions may not be carried out as intended. Here are four common mistakes:

-

Not specifying the scope of powers clearly - Many individuals make the mistake of not being explicit about the powers they are granting. This lack of clarity can lead to confusion and legal complications, particularly when the agent needs to act on the principal's behalf.

-

Choosing the wrong agent - The importance of choosing an agent who is trustworthy and capable of handling responsibilities cannot be overstated. An unsuitable agent can lead to mismanagement of affairs or failure to act in the principal's best interests.

-

Failing to specify a start and end date - Without clear start and end dates, it may be uncertain when the power of attorney comes into effect and when it expires. This can create legal challenges, especially in situations where timing is critical.

-

Not having the document witnessed or notarized - Depending on the state laws, a power of attorney may need to be witnessed or notarized to be considered valid. Neglecting this step can render the document legally ineffective.

Addressing these mistakes when filling out a Florida Power of Attorney form ensures that the document truly reflects the principal's wishes and can act in their best interest, making it a smooth process for all involved parties.

Documents used along the form

When preparing a Florida Power of Attorney (POA), it's crucial to consider other forms and documents that might be required or beneficial to accompany the POA. These documents can provide additional legal clarity, ensure personal wishes are respected, and enhance the efficacy of the POA. Below is an overview of commonly used forms and documents alongside a Florida Power of Attorney, each serving its unique purposes in personal and legal affairs management.

- Living Will: A document that outlines a person's wishes regarding medical treatment, should they become unable to communicate their decisions due to illness or incapacity. It's often paired with a POA to ensure healthcare preferences are honored.

- Health Care Surrogate Designation: Similar to a Healthcare POA, this document appoints someone to make medical decisions on behalf of another, complementing the POA by focusing on health care decisions.

- Last Will and Testament: Specifies how a person's assets and estate should be distributed after death. It works alongside a POA by addressing post-mortem wishes, while a POA is only effective during the grantor's lifetime.

- Advance Directives: Encompass various documents, including living wills and health care surrogate designations, that detail a person's preferences for end-of-life care and other healthcare decisions.

- Declaration of Preneed Guardian: Allows individuals to declare their preference for a guardian in the event of their incapacity, ensuring their choice is known and can be taken into consideration if guardianship becomes necessary.

- HIPAA Release Form: Authorizes the disclosure of an individual's health information to designated persons, crucial for a health care surrogate or attorney-in-fact to make informed decisions regarding the principal's health care.

- Revocation of Power of Attorney: A document that formally cancels a previously granted POA, making it essential for situations where the principal wishes to withdraw the authority given to their agent.

- Trust Agreement: Establishes a trust for managing assets, either during the grantor's lifetime or after death. It can complement a POA by specifying how assets within the trust should be handled.

- Durable Power of Attorney for Finances: Specifically authorizes an agent to manage the financial matters of the principal. While a general POA might include these powers, a durable POA for finances emphasizes financial decisions and continues in effect even if the principal becomes incapacitated.

Understanding the purpose and importance of each document in conjunction with a Florida Power of Attorney can significantly enhance an individual's legal preparedness. By thoughtfully considering and integrating these documents into one's legal planning, individuals can ensure their personal, health care, and financial matters are comprehensively addressed, respecting their wishes and providing clarity to those trusted to make decisions on their behalf.

Similar forms

Living Will - Like a power of attorney, a living will allows individuals to dictate their preferences for medical treatment in advance. Both documents are proactive measures, empowering others to make decisions based on the principal's wishes if they cannot express them due to incapacitation.

Healthcare Proxy - This document also shares similarities with a power of attorney, specifically a healthcare power of attorney. It designates someone to make medical decisions on behalf of the individual, should they become unable to make those decisions themselves.

Advanced Directive - Functioning similarly to a healthcare power of attorney, an advanced directive provides instructions on the type of care an individual wants, or does not want, if they become incapacitated. It helps guide healthcare providers and loved ones during difficult times.

Trust - Like a power of attorney, a trust can manage an individual's assets. However, a trust typically becomes effective immediately upon creation and continues after the individual's death, unlike a conventional power of attorney which often ceases upon the principal's death.

Will - A will outlines how a person's estate should be managed and distributed after their death. While this post-death document differs in timing from a power of attorney, which generally applies during the individual's lifetime, both entail designating individuals to carry out the principal's wishes.

Guardianship - Similar to a power of attorney, a guardianship allows someone to make decisions for another person, called a ward. However, guardianship is often established through a court process and can encompass broader decision-making powers, including personal, financial, and healthcare decisions.

Financial Management Agreement - This contract appoints an individual or institution to manage someone else’s financial affairs. It's similar to a financial power of attorney but can be more specific in its scope and is typically used for managing complex portfolios and investments.

Banking Power of Attorney - A specific form of power of attorney that authorizes someone to handle banking and financial transactions. While it's a type of power of attorney, its scope is limited to banking activities, demonstrating how powers of attorney can vary in breadth and specificity.

Durable Power of Attorney - Specifically, a durable power of attorney remains in effect even if the principal becomes incapacitated, unlike a general power of attorney that may not. This distinction underlines the importance of specifying the power of attorney's durability to ensure continuous decision-making capacity.

Dos and Don'ts

When filling out a Florida Power of Attorney (POA) form, it's important to navigate the process carefully to ensure the document fully represents your wishes and complies with state laws. Here are some do's and don'ts that can guide you through the process:

Do:- Read the instructions carefully before filling out the form to ensure you understand all the requirements and implications.

- Clearly identify the powers you are granting to your attorney-in-fact, making sure they align with your needs and intentions.

- Choose a trustworthy person to act as your attorney-in-fact, as they will have significant responsibilities.

- Specify any limitations on the powers you are granting to ensure they cannot be misinterpreted.

- Have the POA form notarized if required by Florida law, to add a layer of legal validation and protection.

- Keep the original form in a safe but accessible place, and provide copies to relevant parties, such as your attorney-in-fact or financial institutions.

- Review and update your POA as needed to reflect any changes in your wishes or situation.

- Use clear and concise language to avoid ambiguity.

- Ensure the form is signed and dated correctly, according to Florida regulations.

- Consult with a legal professional if you have any doubts or questions regarding the form or the process.

- Delay filling out a POA form until it’s too late; unexpected situations can arise, and having a POA in place is crucial.

- Fill out the form without fully understanding the extent of the powers you are granting.

- Choose an attorney-in-fact based solely on personal relationship without considering their ability to manage your affairs responsibly.

- Forget to specify an expiration date if you want the POA to be temporary.

- Overlook the importance of selecting alternate attorneys-in-fact, in case your first choice is unable or unwilling to serve.

- Use vague or ambiguous terms that could lead to misunderstandings or legal challenges.

- Leave any sections blank; if a section does not apply, indicate this clearly to avoid confusion.

- Fail to notify relevant parties, such as financial institutions or healthcare providers, about the POA and any subsequent changes.

- Assume the form's validity without proper witness and/or notarization, as required.

- Ignore the need for legal advice, especially if your situation involves complex assets, desires, or relationships.

Misconceptions

In understanding the complexities that come with legal designations and documents in Florida, especially concerning the Power of Attorney (POA) forms, several misconceptions often arise. These misunderstandings can significantly affect how individuals plan for their future and the future of their loved ones. Here, we address some of these misconceptions to clarify and provide insight into the reality of Power of Attorney forms in Florida.

- A single POA form covers all decisions. The belief that one POA document suffices for all types of decisions — financial, healthcare, and legal — is a common misconception. In reality, Florida law requires specific forms for different domains, distinguishing primarily between financial matters and healthcare decisions, necessitating separate documents for each area of authority.

- POA grants power after the principal's death. Another widespread misunderstanding is that a Power of Attorney remains valid after the principal (the person who grants the authority) has passed away. However, all POA authorities in Florida terminate upon the death of the principal. Executorship, often designated in a will, is what comes into play after the principal's demise, not the POA.

- Creating a POA means losing all personal control. Many people fear that by assigning a POA, they relinquish all control over their affairs. This is inaccurate. Florida's laws ensure that the principal retains autonomy and can specify the scope of the agent's powers, which can be as broad or as limited as the principal prefers. Furthermore, the principal can revoke the POA at any time as long as they are mentally competent.

- Any POA form from the Internet will suffice. While it's tempting to use a generic POA form found online to save time and money, this approach often leads to problems. Florida has specific requirements and nuances that must be reflected in a POA document for it to be valid. Without adhering to these state-specific guidelines, one risks creating a document that is legally ineffective in Florida.

- A notary's signature is all that's needed for a POA to be valid. While notarization is a crucial step in legitimizing a POA, simply having a notary's signature does not make the document valid in the eyes of Florida law. The document must comply with all legal requirements, including witness signatures and specific language that grants authority to the agent. These requirements are designed to ensure the document’s integrity and the principal's intentions are clearly articulated and legally recognized.

Addressing these misconceptions is key to ensuring that individuals are well-informed and prepared to make decisions about granting power of attorney. With accurate information and guidance, Floridians can navigate the process more effectively, safeguarding their interests and those of their loved ones.

Key takeaways

Filling out and using the Florida Power of Attorney (POA) form is a critical step in managing one’s affairs, be it for financial, healthcare, or other personal matters. Understanding the nuances of this legal document is crucial for those who wish to safeguard their interests or those of a loved one. Below are key takeaways aimed at providing clarity and guidance regarding the Florida POA form.

- Choose the Right Type of POA. Florida law recognizes different types of Power of Attorney documents, each serving unique purposes. These range from General Power of Attorney, which grants broad powers, to more specific ones like the Durable Power of Attorney, which remains in effect even if the principal becomes incapacitated. Identifying the one that best suits your needs is step one.

- Being Specific Matters. Clarity in outlining the scope of authority granted to the agent cannot be overstated. A well-drafted POA form should detail the specific powers the principal is transferring. This precision not only prevents future misunderstandings but also curtails the possibility of abuse.

- Florida's Legal Requirements Must Be Met. For a Power of Attorney to be valid in Florida, certain legal formalities must be observed. These include the requirement for the POA to be signed by the principal, in the presence of two witnesses, and notarized. Ignoring these formalities can render the document invalid.

- Understand the Revocation Process. Circumstances change, and there may come a time when revoking a POA becomes necessary. It's important to understand that this process involves more than just destroying the document. To officially revoke a POA in Florida, a formal revocation must be signed and, ideally, distributed to all parties who were given the original POA, and any institutions or agencies operating under its authority should be notified.

Adhering to these foundational principles will assist in ensuring that your Florida Power of Attorney form not only meets all legal benchmarks but also truly reflects your intentions and requirements. Remember, while the process can appear daunting, the peace of mind that comes with knowing your affairs are in capable hands is invaluable.

Create Other Power of Attorney Forms for US States

Financial Power of Attorney Oklahoma - An essential legal form that authorizes a trusted person to act on your behalf in various matters, including financial and health issues.

Ct Power of Attorney Form - A Power of Attorney can also specify the agent's compensation, if any, which can be particularly relevant if the agent will be managing complex or time-consuming tasks.

Power of Attorney Form Nj - Without a Power of Attorney, family members may face lengthy and costly court processes to obtain the right to make decisions on your behalf.