Blank Power of Attorney Form for Georgia

Understanding the Georgia Power of Attorney form is crucial for anyone seeking to ensure their affairs are handled according to their wishes, should they become unable to manage them personally. This legal document grants another person the authority to make decisions on one’s behalf, covering a vast range of matters from financial to healthcare decisions. Its flexibility accommodates various needs and preferences, with the ability to specify powers granted and their duration. Whether preparing for unexpected health issues, planning long-term financial management, or simply ensuring a trusted individual can act when you're not available, the Power of Attorney form is a foundational piece of any comprehensive planning strategy. The state of Georgia has specific requirements and provisions for these forms, making it essential for residents to familiarize themselves with the nuances to effectively utilize the power this document offers. Crafting this form with care not only protects the principal’s interests but also guides the designated agent in honoring their responsibilities with clear directives.

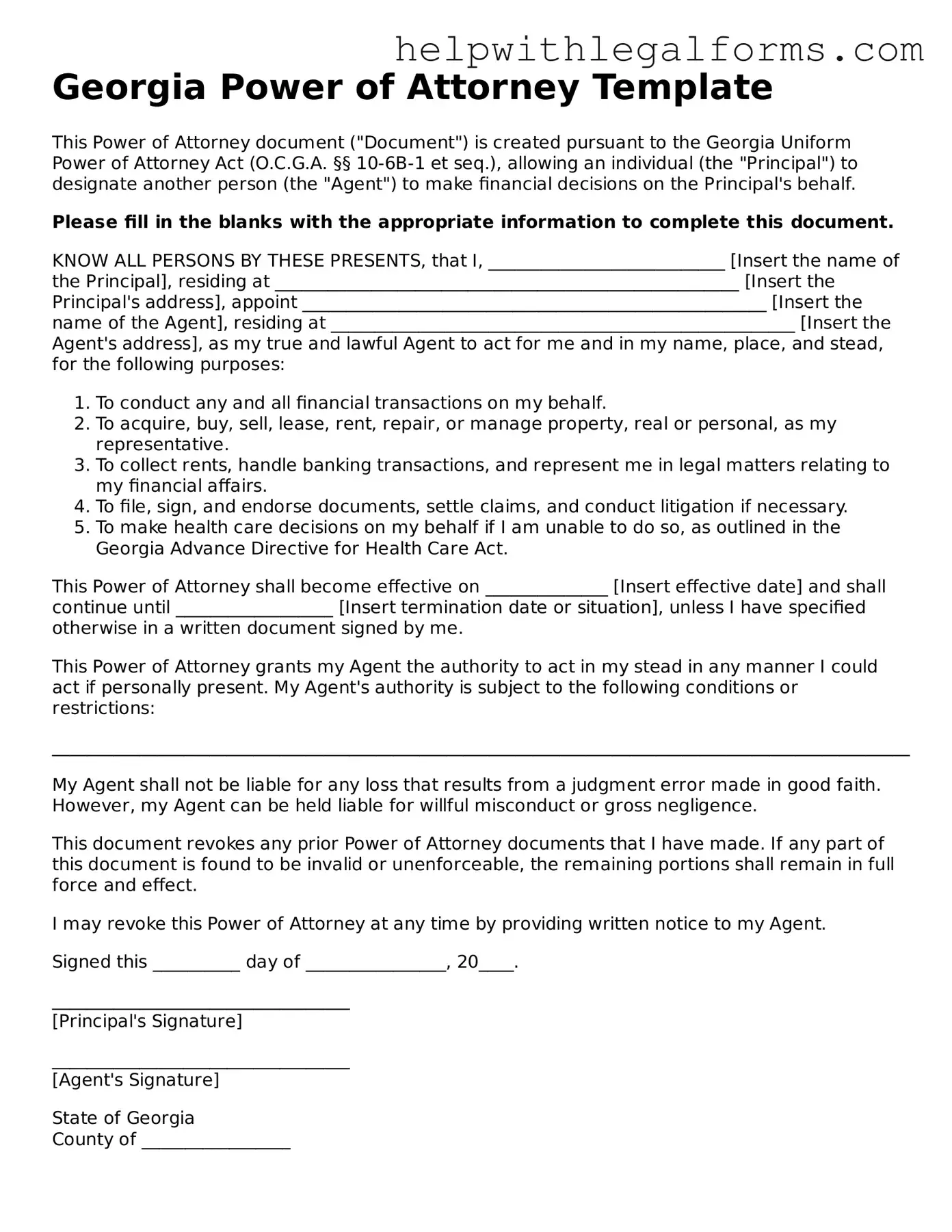

Example - Georgia Power of Attorney Form

Georgia Power of Attorney Template

This Power of Attorney document ("Document") is created pursuant to the Georgia Uniform Power of Attorney Act (O.C.G.A. §§ 10-6B-1 et seq.), allowing an individual (the "Principal") to designate another person (the "Agent") to make financial decisions on the Principal's behalf.

Please fill in the blanks with the appropriate information to complete this document.

KNOW ALL PERSONS BY THESE PRESENTS, that I, ___________________________ [Insert the name of the Principal], residing at _____________________________________________________ [Insert the Principal's address], appoint _____________________________________________________ [Insert the name of the Agent], residing at _____________________________________________________ [Insert the Agent's address], as my true and lawful Agent to act for me and in my name, place, and stead, for the following purposes:

- To conduct any and all financial transactions on my behalf.

- To acquire, buy, sell, lease, rent, repair, or manage property, real or personal, as my representative.

- To collect rents, handle banking transactions, and represent me in legal matters relating to my financial affairs.

- To file, sign, and endorse documents, settle claims, and conduct litigation if necessary.

- To make health care decisions on my behalf if I am unable to do so, as outlined in the Georgia Advance Directive for Health Care Act.

This Power of Attorney shall become effective on ______________ [Insert effective date] and shall continue until __________________ [Insert termination date or situation], unless I have specified otherwise in a written document signed by me.

This Power of Attorney grants my Agent the authority to act in my stead in any manner I could act if personally present. My Agent's authority is subject to the following conditions or restrictions:

__________________________________________________________________________________________________

My Agent shall not be liable for any loss that results from a judgment error made in good faith. However, my Agent can be held liable for willful misconduct or gross negligence.

This document revokes any prior Power of Attorney documents that I have made. If any part of this document is found to be invalid or unenforceable, the remaining portions shall remain in full force and effect.

I may revoke this Power of Attorney at any time by providing written notice to my Agent.

Signed this __________ day of ________________, 20____.

__________________________________

[Principal's Signature]

__________________________________

[Agent's Signature]

State of Georgia

County of _________________

This document was acknowledged before me on ________ [date] by _________________________________ [name of Principal] and _________________________________ [name of Agent].

__________________________________

[Signature of Notary Public]

My Commission Expires: _______________

This Power of Attorney is not effective unless it is signed in the presence of a Notary Public or two witnesses who are not the Agent or named as a successor Agent.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Power of Attorney form is governed by the Georgia Code, Title 10, Chapter 6B (Uniform Power of Attorney Act). |

| Types of Powers | Georgia recognizes several types of powers of attorney, including General, Limited, Health Care, and Durable Powers of Attorney. |

| Notarization Requirement | For a Power of Attorney to be valid in Georgia, it must be signed in the presence of a notary public. |

| Witness Requirement | Besides notarization, the document must also be signed by two witnesses, who cannot be the agent or relatives of the principal or agent. |

| Durability | A Power of Attorney in Georgia can be made "durable," meaning it remains in effect if the principal becomes incapacitated, but it must explicitly state this intention. |

Instructions on How to Fill Out Georgia Power of Attorney

Filling out a Georgia Power of Attorney (POA) form is an important step in ensuring your affairs can be managed by someone you trust in case you're unable to do so yourself. It's crucial the form is completed accurately to reflect your wishes clearly. Whether you're managing financial matters, healthcare decisions, or both, following these step-by-step instructions will help you navigate the process smoothly.

- Start by gathering all necessary information, including your full legal name, address, and the details of the person you are appointing as your attorney-in-fact (the individual who will make decisions on your behalf).

- Read through the entire form before filling anything out to understand all sections and ensure all necessary parts are included for your specific needs.

- In the designated sections, write your full name and address along with the full name and address of your chosen attorney-in-fact.

- Clearly specify the powers you are granting your attorney-in-fact. This could range from broad authority to handle all your affairs to specific powers limited to particular assets or decisions.

- If you wish to impose any limitations on the powers granted, detail these restrictions clearly in the space provided.

- Indicate the duration for which the power of attorney will remain in effect. Some POAs are durable, meaning they stay in effect even if you become incapacitated, while others may be limited to a certain period or until a specific event occurs.

- Review the requirements for witnesses and/or notarization specific to Georgia, as these may change. Typically, your signature and that of your attorney-in-fact must be witnessed by at least two individuals who are not parties to the agreement and/or acknowledged before a notary public.

- Sign and date the form in the presence of the required witnesses and/or notary, and ensure your attorney-in-fact does the same.

- Keep the original signed document in a safe place, and provide your attorney-in-fact with a copy. It's also wise to give copies to other relevant parties, such as your financial institutions or healthcare providers.

After completing the form, it's important to remember that this document can be revoked at any time, as long as you are mentally competent. To do so, a written revocation should be prepared and distributed to your attorney-in-fact and any other parties who received the original POA. Keeping your Georgia Power of Attorney form up to date ensures that it accurately reflects your current wishes and circumstances.

Crucial Points on This Form

What is a Power of Attorney form in Georgia?

A Power of Attorney (POA) form in Georgia is a legal document that allows one person (the "principal") to grant another person (the "agent" or "attorney-in-fact") the authority to act on their behalf. This may include handling financial transactions, making healthcare decisions, or dealing with property matters, among other responsibilities.

Who can be an agent under a Georgia Power of Attorney?

In Georgia, an agent must be an adult of sound mind, which means they should be capable of making informed decisions and understanding the responsibilities bestowed upon them by the POA. The chosen agent can be a trusted family member, friend, or even a professional like a lawyer or financial advisor, depending on the principal's preferences.

Are there different types of Power of Attorney forms in Georgia?

Yes, there are various types of POA forms available in Georgia, each serving different purposes. These include the General Power of Attorney, Limited Power of Attorney, Durable Power of Attorney, Medical Power of Attorney, and Springing Power of Attorney. Each type offers different levels of authority and conditions under which they become effective or terminate.

What makes a Power of Attorney "Durable" in Georgia?

A Power of Attorney is considered "durable" in Georgia if it remains in effect even after the principal becomes incapacitated or unable to make decisions for themselves. For a POA to be durable, specific language must be included in the document stating that the principal's incapacitation will not terminate the agent's authority.

How can a Power of Attorney be terminated in Georgia?

A POA in Georgia can be terminated in several ways: when the principal revokes it, when the principal dies, if the POA has a specific end date and that date is reached, if its sole purpose is fulfilled, or, in the case of a non-durable POA, if the principal becomes incapacitated. Additionally, a POA terminates if the agent is unable to carry out their duties and there's no successor agent named.

Does a Georgia Power of Attorney need to be notarized?

Yes, for a Power of Attorney to be legally valid in Georgia, it must be signed in the presence of a notary public. This helps protect against fraud and ensures that the principal is signing the document of their own free will and understands its implications.

Can a Power of Attorney be used to make healthcare decisions in Georgia?

Yes, a specific type of POA known as a Medical Power of Attorney or Healthcare Power of Attorney allows the agent to make healthcare decisions on behalf of the principal. This includes decisions about medical treatments, healthcare providers, and even end-of-life care, depending on what authority the principal grants in the document.

Is a lawyer required to create a Power of Attorney in Georgia?

While it is not legally required to have a lawyer to create a Power of Attorney in Georgia, consulting with a lawyer can ensure that the document accurately reflects the principal's wishes, complies with Georgia law, and addresses all necessary legal and financial matters. A lawyer can also help in choosing the right type of POA and agent for the principal's needs.

Common mistakes

When individuals set out to complete the Georgia Power of Attorney (POA) form, they often intend to secure their futures and protect their interests. However, the process can be fraught with complexities. Attention to detail is imperative, as overlooking certain aspects can lead to unintended outcomes. Here are eight common mistakes to avoid:

Not specifying powers clearly: The scope of authority granted to the agent must be precisely delineated. Vague or overly broad language can result in confusion or misuse of power.

Choosing the wrong agent: The designated agent should be someone trustworthy and capable of managing your affairs. Failure to select an agent with the right competencies and character can lead to mismanagement or abuse of the appointed powers.

Ignoring the need for a successor agent: Life is unpredictable. If the original agent is unable to fulfil their duties, having a successor agent in place ensures continuity in managing your affairs without interruption.

Overlooking state-specific requirements: Each state has its own legal requirements for executing a POA. Neglect of Georgia’s specific stipulations can render the document invalid or unenforceable.

Failing to specify an expiration date: Without a clear termination date, a POA could remain in effect longer than desired. It's important to decide whether the power of attorney should be durable (continuing after incapacity) or springing (coming into effect upon a certain event, such as incapacitation).

Not having the document witnessed properly: Georgia law requires certain formalities, like witnessing or notarization, for a POA to be legally valid. Failing to comply with these requirements can invalidate the document.

Overlooking the need for notarization: Similar to proper witnessing, notarization can be a crucial requirement for the enforceability of the POA in Georgia. Not all states require notarization, but assuming Georgia’s laws do not can be a critical mistake.

Delaying the execution of the POA: Time is of the essence. Delaying the creation and execution of a POA until it is urgently needed can result in not having the document ready when it becomes necessary. This can significantly complicate the management of one's affairs during times of incapacity.

Understanding and avoiding these common pitfalls can ensure the Power of Attorney document fulfills its intended purpose effectively and safeguards the principal’s interests in accordance with Georgia law.

Documents used along the form

When preparing a Georgia Power of Attorney (POA) form, it's important to consider the broader legal and practical framework. The POA form is a powerful document that grants someone the authority to act on your behalf in legal matters. However, it is often just one piece of the puzzle. Several other documents can complement the POA, ensuring comprehensive planning and protection for various aspects of your life. Let’s explore some of these documents that are frequently used alongside the Georgia Power of Attorney form to form a more complete legal strategy.

- Advance Directive for Health Care: This document allows you to specify your preferences for medical care if you become unable to make decisions for yourself. It combines a living will and health care power of attorney, where you can appoint an agent to make healthcare decisions on your behalf and outline your wishes regarding treatment and end-of-life care.

- Will: A will is a crucial document that dictates how you want your property and assets distributed after your death. It can designate guardians for minor children and also appoint an executor to oversee the distribution of your estate, complementing the POA by covering aspects not necessarily addressed by it.

- Revocable Living Trust: This allows you to retain control over your assets during your lifetime, with the benefit of transferring ownership to designated beneficiaries upon your death without going through probate. This document can work in tandem with a POA, especially if you become incapacitated and unable to manage your trust.

- Durable Financial Power of Attorney: While a general POA might cover a broad array of legal powers, a durable financial POA specifically addresses financial matters. It remains in effect if you become mentally incapacitated, ensuring that someone can manage your finances, from paying bills to handling investments.

- Living Will: Although the Advance Directive for Health Care often includes a living will, some prefer to have a standalone document that expressly outlines their wishes for end-of-life care, separate from appointing a health care agent. This can simplify discussions with loved ones and healthcare providers.

Combining a Georgia Power of Attorney form with these documents can provide a comprehensive legal framework for managing your affairs. Whether you’re planning for future health care decisions, ensuring your financial matters are in order, or outlining the distribution of your estate, each document serves a pivotal role. Together, they form a cohesive strategy that protects your interests and wishes, offering peace of mind to both you and your loved ones.

Similar forms

- Living Will:

Just like a Power of Attorney, a Living Will speaks on your behalf when you can't. However, it specifically dictates your wishes regarding medical treatments and life support measures in situations where you're unable to communicate due to severe illness or incapacitation. It's a guiding document for doctors and caregivers, very much how a Power of Attorney directs actions on your financial or legal affairs.

- Health Care Proxy:

This document is a close cousin to the Power of Attorney, focusing on health care decisions. By appointing a health care proxy, you designate someone to make medical decisions for you if you're unable to do so. This role is similar to the agent in a Power of Attorney, entrusted with making choices that align with your wishes and best interests.

- Trust:

A Trust and a Power of Attorney share the concept of entrusting someone with your affairs. In the case of a Trust, you're transferring ownership of your assets to the trust, managed by a trustee for the benefit of your chosen beneficiaries. The trustee's role mirrors that of the agent in a Power of Attorney, managing assets and making decisions, but within the confines of the trust's instructions.

- Last Will and Testament:

Both a Last Will and Testament and a Power of Attorney are pivotal in estate planning. Your Last Will outlines what happens to your assets after you pass away, while a Power of Attorney is effective during your lifetime, allowing someone to act on your behalf in financial, legal, or medical matters. They complement each other in ensuring your wishes are honored at different stages.

- Advance Directive:

Similar to a Power of Attorney, an Advance Directive, often incorporating both a Living Will and a Health Care Proxy, guides choices about your healthcare when you're incapacitated. This document explicitly outlines what medical actions you prefer, ensuring that your healthcare wishes are followed when you cannot voice them yourself.

- Guardianship or Conservatorship Papers:

Though these documents come into play through a court order rather than personal planning, their purpose aligns closely with that of a Power of Attorney. They appoint someone to manage the personal and/or financial affairs of another who's incapable of doing so themselves due to various reasons, including minor status or incapacity. This appointed guardian or conservator assumes responsibilities similar to an agent designated in a Power of Attorney.

Dos and Don'ts

When filling out the Georgia Power of Attorney form, it is important to follow specific guidelines to ensure the document is legally sound and accurately reflects your intentions. Below is a list of things you should and shouldn't do during this process.

- Do carefully select your agent. Choose someone who is trustworthy and capable of handling your affairs. This person should have both the ability and the integrity to act in your best interest.

- Don't choose an agent without discussing it with them first. Make sure the person you want to appoint as your agent is willing and able to take on the responsibilities.

- Do be specific about the powers you are granting. Clearly outline what your agent can and cannot do on your behalf. Being specific can help prevent abuse of power and confusion in the future.

- Don't leave any sections incomplete. An incomplete form may be considered invalid or cause delays when your agent needs to act on your behalf.

- Do review the form with a legal professional if possible. A lawyer can help ensure that the form complies with Georgia law and truly reflects your wishes.

- Don't use vague language. Ambiguity in a Power of Attorney can lead to disputes and legal challenges. Use clear and precise language to describe the powers granted.

- Do sign and date the document in the presence of the required witnesses or a notary. Georgia law mandates specific witnessing or notarization requirements for a Power of Attorney to be valid.

- Don't forget to inform close family members or trusted friends. Letting others know about the Power of Attorney and who your agent is can prevent confusion and conflicts later.

- Do keep the original document in a safe but accessible place. Make sure your agent knows where to find the Power of Attorney document when it becomes necessary to use it.

Misconceptions

Discussing legal documents can sometimes feel like navigating a maze, especially with something as critical as a Power of Attorney (POA) in Georgia. Let's clear up some common misconceptions to help make this journey a bit easier:

- All POAs are the same. This isn't true. In Georgia, there are different types of POA forms for various purposes, such as healthcare decisions or financial matters. Each serves a unique role and has different requirements.

- Setting up a POA means losing control. Many people worry that by granting someone else power of attorney, they're giving up their autonomy. However, a POA can be as broad or as specific as you wish, allowing you to retain control over the decisions that matter most to you.

- A POA grants someone the right to do whatever they want with your assets. This misconception frightens many. In reality, the scope of authority granted to an agent under a POA can be limited and should be clearly outlined in the document.

- You can only choose one person as your agent. Actually, Georgia law allows you to appoint co-agents or a succession of agents, offering flexibility in how your affairs are managed.

- Only family members can be agents. While many choose family members to serve as their agent, you can appoint anyone you trust, including friends or professional advisors.

- A POA is effective even after death. A common misunderstanding is that a POA remains in effect after the principal's death. However, in Georgia, a POA is no longer valid once the person who made it passes away.

- A POA can't be revoked. This is not the case. As long as you are mentally competent, you can revoke your POA at any time for any reason.

- Creating a POA requires a lawyer. While it's wise to consult with a legal professional to ensure your document meets all legal requirements, Georgia law does not mandate that a lawyer must create your POA.

- You don't need a POA if you're young and healthy. Life is unpredictable. A POA can be a critical part of your personal legal plan, ensuring that someone can legally act on your behalf if you're unexpectedly unable to do so yourself.

- A notary must always notarize a Georgia POA. Georgia law requires that your POA be signed by you and witnessed by two individuals, but not all POAs must be notarized. However, notarization can add a level of legal resilience to the document, so it's often recommended.

Understanding these misconceptions can empower you to make informed decisions about your legal documents, bringing peace of mind to you and your loved ones.

Key takeaways

Filling out and using the Georgia Power of Attorney (POA) form is a significant step that allows you to legally authorize someone else to make decisions on your behalf. It's a powerful tool, especially in situations where you might not be able to make those decisions yourself due to health issues or other reasons. Here are four key takeaways to keep in mind:

- Choose the right agent: The person you appoint as your agent holds considerable responsibility. This individual will make decisions on your behalf, affecting your health, finances, and legal affairs. Pick someone you trust implicitly, who understands you well, and who will act in your best interest.

- Be specific about powers granted: The Georgia POA form allows you to specify exactly what powers your agent will have. You can grant them broad authority or limit them to specific actions. It's crucial to tailor the POA to your needs, ensuring your agent has just the right amount of power to handle your affairs without overstepping.

- Understand the legal requirements: The Georgia POA must comply with state laws to be valid. This includes having it signed in the presence of a notary public and, depending on the type, witnessing by one or more adults. Failing to meet these requirements could invalidate the document.

- Keep it accessible: Once the POA form is completed and signed, store it in a secure yet accessible place. Your agent, a trusted family member, or a lawyer should know where it is and be able to retrieve it when needed. Copies may also be required for financial institutions or healthcare providers.

Create Other Power of Attorney Forms for US States

Durable Power of Attorney Maryland - For business owners, it's a tool to ensure the continuity of operations without legal hiccups in case of sudden incapacity.

Poa Form Texas - Establishing a Power of Attorney can be a key component of estate planning, alongside wills and trusts.

Power of Attorney Form Nj - Signing a Power of Attorney should be done while the individual is mentally competent and understands the document's implications.

Power of Attorney Forms California - Facilitates financial management for individuals with extensive or complicated assets.