Blank Power of Attorney Form for New Jersey

When it comes to managing one's affairs, especially during unforeseen circumstances, having a Power of Attorney (POA) in place is a proactive step towards ensuring peace of mind and security. In New Jersey, the Power of Attorney form serves as a legal document that authorizes one person to make decisions on behalf of another. This encompasses a broad range of authorities, from financial decisions and property management to medical directives. Crafting a Power of Attorney necessitates a clear understanding of its purposes, the types available—such as a durable, nondurable, or medical POA—and the specific requirements mandated by New Jersey law to ensure its validity. With such a form, individuals can appoint a trusted person to act in their best interest, providing a safeguard for both the individual and their loved ones. It's crucial that the selected agent understands their responsibilities and the scope of their powers, as this role requires a high level of trust and integrity. This document plays a pivotal role in estate planning, ensuring that one's affairs are handled according to their wishes, even in their absence or during incapacitating circumstances.

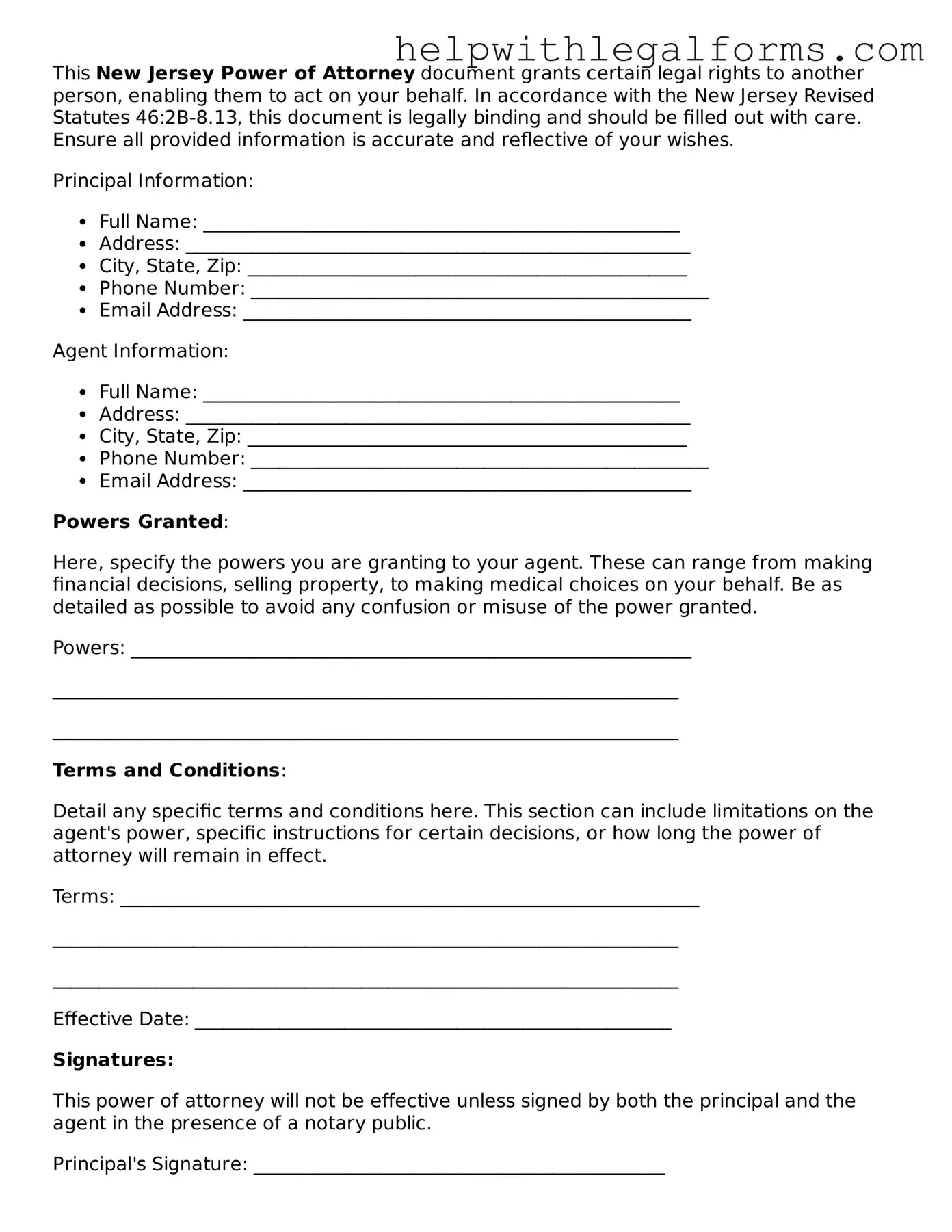

Example - New Jersey Power of Attorney Form

This New Jersey Power of Attorney document grants certain legal rights to another person, enabling them to act on your behalf. In accordance with the New Jersey Revised Statutes 46:2B-8.13, this document is legally binding and should be filled out with care. Ensure all provided information is accurate and reflective of your wishes.

Principal Information:

- Full Name: ___________________________________________________

- Address: ______________________________________________________

- City, State, Zip: _______________________________________________

- Phone Number: _________________________________________________

- Email Address: ________________________________________________

Agent Information:

- Full Name: ___________________________________________________

- Address: ______________________________________________________

- City, State, Zip: _______________________________________________

- Phone Number: _________________________________________________

- Email Address: ________________________________________________

Powers Granted:

Here, specify the powers you are granting to your agent. These can range from making financial decisions, selling property, to making medical choices on your behalf. Be as detailed as possible to avoid any confusion or misuse of the power granted.

Powers: ____________________________________________________________

___________________________________________________________________

___________________________________________________________________

Terms and Conditions:

Detail any specific terms and conditions here. This section can include limitations on the agent's power, specific instructions for certain decisions, or how long the power of attorney will remain in effect.

Terms: ______________________________________________________________

___________________________________________________________________

___________________________________________________________________

Effective Date: ___________________________________________________

Signatures:

This power of attorney will not be effective unless signed by both the principal and the agent in the presence of a notary public.

Principal's Signature: ____________________________________________

Date: ____________________________________________________________

Agent's Signature: _______________________________________________

Date: ____________________________________________________________

Notary Acknowledgment:

State of New Jersey

County of ________________________________

On this __________ day of ________________, 20____, before me, a notary public, personally appeared ______________________________ (Name of Principal), known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: ________________________________________

My Commission Expires: _________________________________________

PDF Form Attributes

| Fact | Detail |

|---|---|

| Definition | A Power of Attorney (POA) in New Jersey is a legal document that grants someone the authority to act on another person's behalf in legal, financial, or health matters. |

| Key Legislation | The New Jersey Power of Attorney Act, N.J.S.A. 46:2B-8.1 et seq., governs the creation and use of Power of Attorney forms in New Jersey. |

| Types | Several types of POA are available in New Jersey, including General, Durable, Limited, and Health Care POA, each serving different purposes. |

| Duration | A POA can be durable, meaning it remains in effect if the principal becomes incapacitated, or non-durable, meaning it terminates upon the principal's incapacitation. |

| Health Care Proxy | Separate from a POA, a Health Care Proxy allows an individual to make medical decisions on another's behalf when they are unable to do so themselves. |

| Requirements | To be valid, a New Jersey POA must be signed by the principal or by another individual in the principal's presence and at their direction, and it must be notarized or witnessed by two adults not named as the agent. |

| Revocation | A POA can be revoked at any time by the principal as long as they are mentally competent, through a written notice to the agent. |

| Agent's Authority | The agent, also known as the attorney-in-fact, is granted authority to act within the scope specified in the POA document, which can include managing financial affairs, real estate transactions, and other legal matters. |

| Filing Requirements | While not always required, filing a POA with the appropriate local or state office can be necessary for real estate transactions and certain financial dealings. |

Instructions on How to Fill Out New Jersey Power of Attorney

Filling out a New Jersey Power of Attorney form is a critical task that authorizes another person to make decisions on your behalf, primarily pertaining to financial or legal matters. This document, when properly completed, serves as a legal representation of your trust in the appointed individual. The process requires attention to detail to ensure that every section is accurately filled out, reflecting your intentions clearly and unequivocally. Below is a step-by-step guide on how to fill out the New Jersey Power of Attorney form, designed to make the process as straightforward as possible.

- Start by downloading the most current version of the New Jersey Power of Attorney form from a reliable source.

- Enter your full legal name and address in the designated section to establish your identity as the principal.

- In the following section, write the full name and address of the person you're appointing as your agent. This individual will act on your behalf under the powers you grant them in this document.

- Specify the powers you are granting your agent by checking the appropriate boxes or detailing them in the provided spaces. Be as specific as possible to avoid any ambiguity regarding your agent's authority.

- If you wish to grant your agent broad powers, make sure to review each category of powers listed and initial next to the powers you are granting.

- For powers that require specific mention, such as real estate transactions, gifting, or healthcare decisions, clearly detail these in the space provided.

- Indicate any special instructions or limitations to the powers granted to your agent. This section is crucial for tailoring the Power of Attorney to your specific needs and circumstances.

- Determine the duration of the Power of Attorney. You can specify an expiration date or condition under which the power will cease, or indicate that it will remain in effect until you revoke it or pass away.

- Review the document carefully, ensuring that all information provided is accurate and that you have not missed any critical sections.

- Sign and date the form in the presence of a notary public. In New Jersey, your signature must be notarized for the Power of Attorney to be considered valid.

- Have your appointed agent sign the form, if required. Some versions of the form may require the agent to acknowledge their acceptance of the responsibilities being assigned to them.

- Store the completed form in a safe and accessible place. Provide your agent with a copy or inform them of where to find the document if needed.

Completing the New Jersey Power of Attorney form is a proactive step in managing your affairs and ensuring that your interests are protected even when you cannot act on your own behalf. By carefully selecting your agent and specifying their powers with clarity, you create a solid legal foundation for your future needs.

Crucial Points on This Form

What is a Power of Attorney form in New Jersey?

A Power of Attorney (POA) form in New Jersey is a legal document that allows a person (the principal) to designate another person (the agent) to make decisions and act on their behalf. These decisions can pertain to financial, medical, or personal affairs. The scope of authority given to the agent can be broad or limited, depending on how the POA is set up.

How do I create a Power of Attorney in New Jersey?

To create a Power of Attorney in New Jersey, the principal needs to complete a POA form that includes details about the powers being granted, the principal's information, and the agent's information. The form must be signed by the principal and, in some cases, may require notarization or witnesses. It is strongly recommended to consult with an attorney to ensure that the POA meets all legal requirements and accurately reflects the principal’s wishes.

Who can serve as an agent under a Power of Attorney?

Any competent adult can serve as an agent under a Power of Attorney in New Jersey. This can be a family member, friend, or even a professional like an attorney. It's important that the principal trusts the individual, as they will be making decisions on the principal's behalf. The agent should also be willing and able to carry out the responsibilities given to them under the Power of Attorney.

When does a Power of Attorney become effective?

A Power of Attorney in New Jersey can become effective immediately upon signing, or it can be set up to become effective upon the occurrence of a specific event, such as the principal's incapacity. The timing should be clearly stated in the POA document to avoid any confusion. Springing POAs, which are activated by a specific event, require clear definition of the event within the document.

Can a Power of Attorney be revoked in New Jersey?

Yes, a Power of Attorney can be revoked at any time by the principal as long as the principal is mentally competent. To revoke a POA, the principal should provide written notice to the agent and to any institutions or individuals that were relying on the original POA. Destroying all original copies of the POA and creating a new POA (if desired) are also steps the principal should take.

What happens if my Power of Attorney is not recognized by third parties?

In New Jersey, if a third party refuses to recognize a validly executed Power of Attorney, the state law provides specific remedies. The principal or agent may need to consult with an attorney to determine the best course of action. This may involve providing additional documentation to the third party or seeking a court order to compel acceptance of the POA.

Common mistakes

Not specifying the powers granted clearly. People often overlook the importance of detailing the specific powers they are granting to their agent. This vagueness can lead to misunderstandings and legal complications.

Choosing the wrong agent. The agent's role is pivotal. Sometimes individuals select an agent based on personal relationships rather than considering if the person is trustworthy and capable of handling their affairs responsibly.

Failing to designate a successor agent. If the original agent is unable or unwilling to serve, having a successor agent ensures that there is no interruption in the management of the person's affairs.

Not specifying an expiration date. Without a clear expiration date, a Power of Attorney could remain in effect longer than the person intended, potentially leading to abuse of power.

Skipping the notarization process. In New Jersey, notarization is crucial for the validity of the Power of Attorney. Trying to cut corners by skipping this step can render the document legally ineffective.

Omitting the sign and date section. Surprisingly, many people forget to sign or date the form, which is a basic but critical requirement for the document's legality.

Ignoring the need for witnesses. Similar to notarization, having witnesses sign the form is a requirement that adds an extra layer of legitimacy and protection against fraud.

Not understanding the difference between durable and non-durable Powers of Attorney. This confusion can lead to a document that does not align with the person's needs, especially in cases of incapacity.

Failure to provide copies to relevant parties. After completing the form, distributing copies to financial institutions, the agent, and keeping one for personal records is essential for the Power of Attorney to be acknowledged and accepted in transactions.

Documents used along the form

When someone decides to create a Power of Attorney (POA) in New Jersey, it marks an important step in planning for future financial and health care decisions. This document allows a person to appoint someone else to make decisions on their behalf. However, the POA is just one of several documents that can be crucial for comprehensive planning. Here are eight other forms and documents often used in conjunction with a New Jersey POA.

- Advance Health Care Directive: This document lets individuals express their wishes about medical treatment and end-of-life care if they become unable to communicate. It may include a living will and a health care proxy or durable power of attorney for health care.

- Will: A will is a legal document that specifies how a person's assets should be distributed after their death. It can also appoint a guardian for any minor children.

- Trust: Trusts are arrangements where one party, known as the trustee, holds legal title to property for the benefit of others, called beneficiaries. A trust can be used to manage assets before and after death.

- HIPAA Release Form: This form allows health care providers to disclose an individual’s health information to specified parties, making it easier for agents under a POA or health care directive to obtain the necessary information.

- Financial Information Release Form: Similar to the HIPAA release, this form authorizes financial institutions to share an individual's financial information with designated representatives.

- Guardianship Appointment: This legal process appoints an individual to make personal and medical decisions for a minor or an adult who has become incapacitated.

- Living Trust: A living trust is a type of trust created during a person’s lifetime to hold and manage assets. It can help avoid probate and provide a mechanism for managing one's affairs without a court-appointed guardian or conservator.

- Durable Financial Power of Attorney: This specific type of POA remains in effect even if the person who made it becomes incapacitated, allowing the appointed agent to handle their financial matters.

In planning for the future, it's important to understand how these documents interact and support one another. Together, they form a network of legal protections, guiding healthcare decisions, financial management, and the disposition of assets in accordance with an individual's wishes. Consulting with a legal professional can help ensure that these documents are properly executed and that they work together effectively to achieve the individual's objectives.

Similar forms

Medical Directive (Advanced Healthcare Directive): This document, much like a Power of Attorney (POA), enables individuals to appoint someone to make decisions on their behalf. However, it specifically relates to medical and healthcare decisions. The Medical Directive comes into play when a person cannot communicate their wishes due to medical reasons, akin to how a POA assigns decision-making authority in various aspects of a person’s life, including financial, legal, and personal affairs.

Living Will: Similar to a POA, a Living Will allows an individual to outline their preferences for medical care in anticipation of a situation where they might not be able to make decisions for themselves. While a POA can grant broad authority to an agent, including decisions that fall outside of healthcare, a Living Will focuses exclusively on medical treatment preferences, especially concerning end-of-life care.

Last Will and Testament: This document shares the concept of appointing another person to act on one’s behalf, known as an executor, in the context of managing and distributing the individual’s estate after their death. Both a Last Will and a POA handle the delegation of responsibilities and decision-making authority, but a Last Will and Testament comes into effect after the person’s passing, whereas a POA usually ceases to be effective at that time.

Durable Financial Power of Attorney: This is a specific type of Power of Attorney that exclusively addresses financial decisions and remains in effect even if the principal becomes incapacitated. It shares the foundational concept of authorizing someone else to make decisions on one's behalf with a general POA but is limited to financial matters. The durability aspect makes it akin to a general POA but with the added provision that it survives the incapacitation of the principal.

Trust: Trust agreements appoint a trustee to manage the assets placed within the trust for the benefit of the trust beneficiaries, working under similar principles as a POA by delegating authority from the grantor to another party. While trusts typically deal with the management and distribution of assets, a POA might encompass a wider range of activities. Nonetheless, both involve assigning the responsibility of one’s affairs to another.

Dos and Don'ts

When filling out a New Jersey Power of Attorney (POA) form, it's crucial to approach the process with due care. The document grants someone else the authority to make decisions on your behalf, so ensuring accuracy and clarity is paramount. Here are some guidelines to help you navigate filling out the form:

Do:

- Read the entire form carefully before you start to understand what information and decisions are required from you.

- Use a pen with black ink to ensure the form is legible and can be photocopied or scanned without issues.

- Include the full legal names and contact information for both the principal (you) and the agent (the person you are granting power to).

- Be specific about the powers you are granting to your agent. If you wish to limit the scope of their authority, make sure those limits are clearly written.

- Have the form notarized if required, as this makes the document more formally recognized and may help in its acceptance by institutions that the agent interacts with.

- Inform your agent that you have chosen them and discuss your expectations and the extent of their responsibilities.

- Keep a copy of the completed form in a safe but accessible place, and give copies to your agent and any institutions that might require it, like your bank.

- Review and update the POA as necessary, especially if your relationship with your agent changes or if you want to adjust their powers.

Don't:

- Leave any sections of the form blank. If a section does not apply, write ‘N/A’ (not applicable) to show that you did not overlook it.

- Sign the form without a witness or notary present if it is required by the state of New Jersey, as failing to do so may result in the form not being legally enforceable.

In conclusion, taking your time to accurately complete the New Jersey Power of Attorney form and following these guidelines will help ensure that the document reflects your wishes and can be properly used by your agent when needed.

Misconceptions

Understanding the New Jersey Power of Attorney (POA) form is crucial for making informed decisions. However, there are several misconceptions about how POAs work in New Jersey. Let's dispel some of the most common misunderstandings.

All Power of Attorney forms are the same. One common misconception is that a POA form used in one state is just as valid in another, including New Jersey. However, each state has its specific requirements and forms. New Jersey law specifies particular conditions that must be met for a POA to be considered valid within the state.

A Power of Attorney grants unlimited control. Many people think signing a POA gives the appointed person (the agent) unlimited power over their affairs. In truth, the scope of authority granted by a POA in New Jersey can be as broad or as specific as you choose, allowing you to tailor the powers given to your agent according to your needs and preferences.

Once appointed, an agent's power is irrevocable. Some believe that once a Power of Attorney is signed, it cannot be changed or revoked. However, as long as you, the principal, are mentally competent, you can amend or revoke the POA at any time. It's essential to understand this flexibility in managing your affairs.

You only need a POA when you're incapacitated. It's a common belief that a Power of Attorney is only useful if you become unable to make decisions for yourself. While it's true a POA is vital in such circumstances, it can also be incredibly useful in other situations, such as allowing someone to handle specific financial transactions on your behalf when you're unavailable.

Creating a Power of Attorney is a complex legal process. Many are under the impression that establishing a POA involves a complicated and lengthy legal process. In reality, creating a Power of Attorney in New Jersey can be straightforward, especially with the help of an attorney to ensure it meets all legal requirements and accurately reflects your wishes.

Dispelling these myths helps ensure you're better informed about the Power of Attorney in New Jersey, allowing you to make choices that best suit your needs and circumstances.

Key takeaways

Filling out and using the New Jersey Power of Attorney form is a significant step for anyone seeking to authorize someone else to make decisions on their behalf. Here are key takeaways to help guide you through this process:

- Choose Wisely: The person you appoint as your agent will have significant power over your affairs. It's crucial to choose someone you trust completely.

- Clearly Define Powers: Be specific about the powers you are granting. The form allows you to designate financial, legal, and health-related decision-making powers, among others.

- Durability: Decide whether the Power of Attorney should be durable. A durable Power of Attorney remains in effect if you become incapacitated.

- Witnesses and Notarization: New Jersey law requires your Power of Attorney to be witnessed by two adults or notarized to be legally valid.

- Legal Advice: Considering the implications, consulting with a lawyer can ensure that the document meets all legal requirements and accurately reflects your wishes.

- Revocation: You retain the right to revoke the Power of Attorney at any time, as long as you are competent. Ensure you understand the process for revocation.

- Keep Records: After completing the form, give a copy to your agent and keep the original in a safe, easily accessible place. Inform close family members or trusted friends where it is stored.

Create Other Power of Attorney Forms for US States

New York State Power of Attorney Form 2023 Pdf - Establishing a Power of Attorney is a proactive step in safeguarding one’s welfare and ensuring affairs are handled according to personal wishes.

Durable Power of Attorney Maryland - The power can extend to making gifts on behalf of the principal, an aspect important for estate planning and tax purposes.

Basic Power of Attorney Template - Used by individuals seeking to entrust their legal affairs to another, often in case of illness or absence.