Blank Power of Attorney Form for New York

The New York Power of Attorney form is a crucial document that empowers another person to make decisions on your behalf, ranging from financial to healthcare matters. This legal form plays a significant role in planning for unforeseen circumstances, ensuring your affairs are handled according to your wishes if you are unable to do so yourself. Not only does it provide peace of mind knowing that someone you trust is appointed to manage your matters, but it also stipulates the extent to which this appointed agent can operate. The matters covered can be as broad or as specific as required, from handling everyday financial transactions to making significant medical decisions. Moreover, the form must be completed and executed in accordance with New York State laws, which include specific requirements for notarization and witness signatures to validate the document. This not only ensures the document’s legality but also protects all parties involved. Understanding the nuances of this form and tailoring it to suit individual needs requires thoughtful consideration, underpinning its importance in effective legal and personal planning.

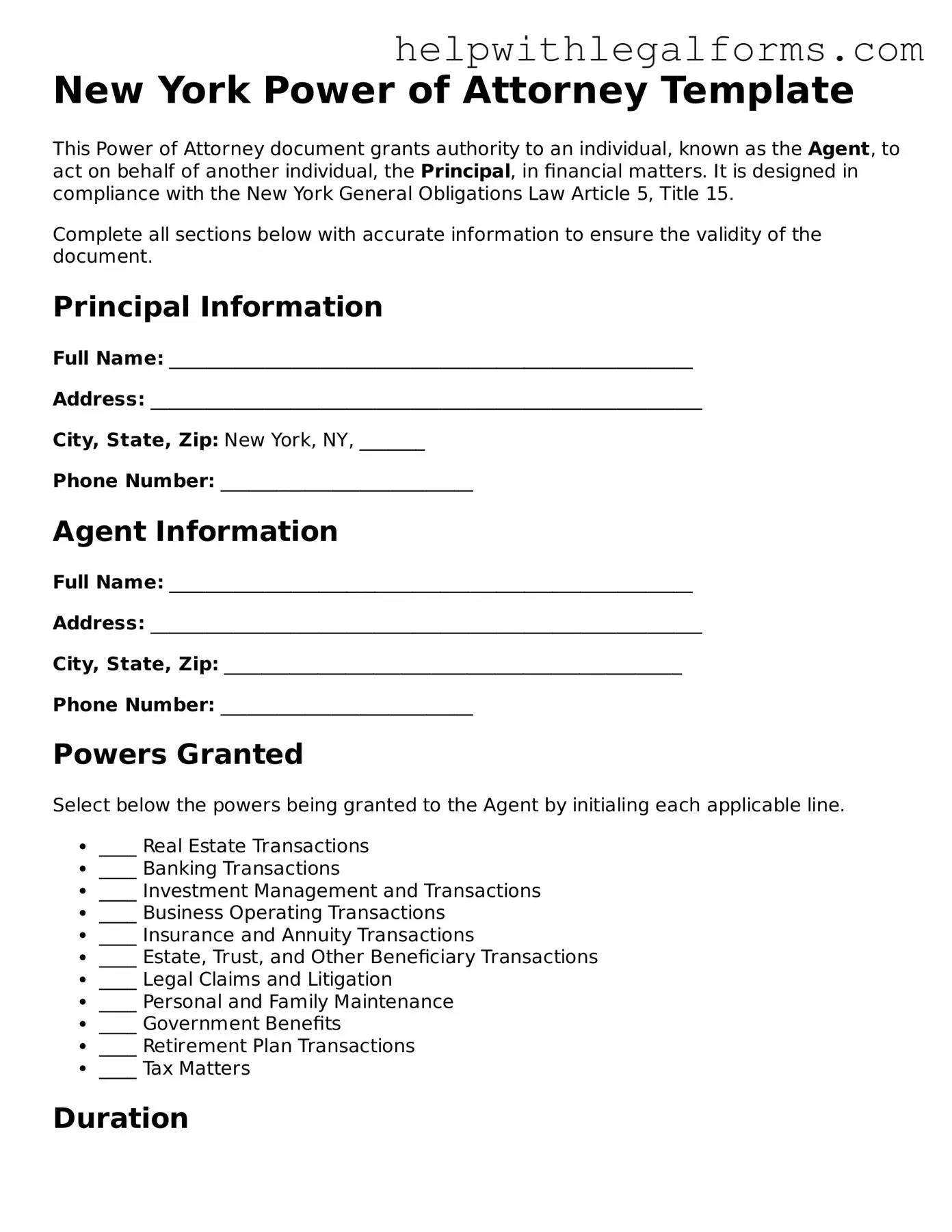

Example - New York Power of Attorney Form

New York Power of Attorney Template

This Power of Attorney document grants authority to an individual, known as the Agent, to act on behalf of another individual, the Principal, in financial matters. It is designed in compliance with the New York General Obligations Law Article 5, Title 15.

Complete all sections below with accurate information to ensure the validity of the document.

Principal Information

Full Name: ________________________________________________________

Address: ___________________________________________________________

City, State, Zip: New York, NY, _______

Phone Number: ___________________________

Agent Information

Full Name: ________________________________________________________

Address: ___________________________________________________________

City, State, Zip: _________________________________________________

Phone Number: ___________________________

Powers Granted

Select below the powers being granted to the Agent by initialing each applicable line.

- ____ Real Estate Transactions

- ____ Banking Transactions

- ____ Investment Management and Transactions

- ____ Business Operating Transactions

- ____ Insurance and Annuity Transactions

- ____ Estate, Trust, and Other Beneficiary Transactions

- ____ Legal Claims and Litigation

- ____ Personal and Family Maintenance

- ____ Government Benefits

- ____ Retirement Plan Transactions

- ____ Tax Matters

Duration

This Power of Attorney shall become effective on the date signed and shall remain in effect

Until: ________________________ (Date) OR until the Principal is incapacitated, unless a Durable Power of Attorney is selected.

Third Party Reliance

The validity of this document is governed by the New York General Obligations Law Article 5, Title 15, ensuring that third parties may rely on the Agent’s authority granted hereunder unless the third party has actual knowledge the Power of Attorney has been revoked or terminated.

Signatures

To be legally binding, this Power of Attorney must be signed in the presence of a Notary Public or two witnesses not related to the Principal or Agent.

_____________________________________ ________________________________

Signature of Principal Date

_____________________________________ ________________________________

Signature of Agent Date

Notarization (If Applicable)

This section to be completed by a Notary Public.

State of New York )

County of ___________ )

On this ___ day of _______________, 20__, before me, _______________________________ (name of notary), personally appeared ________________________________________ (name of Principal), known to me to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

______________________________________

Notary Public

My Commission Expires: _______________

PDF Form Attributes

| Fact Number | Description |

|---|---|

| 1 | <The New York Power of Attorney form allows individuals to appoint someone else to manage their financial affairs. |

| 2 | This form must be signed in the presence of a notary public to be legally valid. |

| 3 | The person creating the Power of Attorney is known as the "Principal," while the appointed individual is the "Agent." |

| 4 | Under the New York General Obligations Law (Sections 5-1501 to 5-1514), the Power of Attorney form is standardized. |

| 5 | Principals can specify whether they grant their agents broad or limited powers. |

| 6 | The form can be revoked at any time by the Principal, as long as the Principal is competent. |

Instructions on How to Fill Out New York Power of Attorney

Filling out a New York Power of Attorney form is a significant step in planning for future financial management and decision-making. It allows you to appoint someone you trust to handle your affairs if you're unable to do so. The process involves specifying your agent, the powers you're granting, and any conditions or limitations. Below is a step-by-step guide designed to make this important task straightforward and understandable.

- Begin by gathering all necessary information, including the full legal names and addresses of the principal (you) and the agent(s) you are appointing.

- Find the most current New York Power of Attorney form. It's crucial to use the latest version to ensure compliance with New York law.

- Enter your name and address in the designated section at the top of the form, establishing you as the principal.

- Fill in the name(s) and address(es) of your chosen agent(s) in the specified fields. If you are appointing more than one agent, indicate whether they are to act jointly or independently.

- Specify the powers you are granting to your agent. This can include, but is not limited to, real estate transactions, handling financial matters, and making healthcare decisions. Be as clear and detailed as necessary to convey your wishes.

- If you wish to impose any specific limitations on the powers granted, clearly describe these in the provided space. If more room is needed, you may attach additional pages.

- Choose the effective date of the Power of Attorney. You can make it effective immediately or specify a future date/event that will trigger its activation.

- Decide on the duration of the Power of Attorney. It can be indefinite, expire on a specific date, or upon the occurrence of a certain event.

- Read the instructions regarding the signing and witnessing of the form carefully. New York law may require your signature to be notarized and/or witnessed by disinterested parties.

- Sign and date the form in the presence of the necessary witnesses and/or notary. Ensure your agent(s) also sign(s) if required by the form.

- Keep the original safe but accessible. Give copies to your agent(s) and possibly your attorney, doctor, or family members, depending on your specific situation and the powers granted.

After completing the New York Power of Attorney form, the next steps involve legal and personal considerations. It's wise to have a conversation with your appointed agent(s) about your wishes, guiding them on how to handle specific situations. Additionally, you may want to consult with a legal professional to ensure that all aspects of your financial and healthcare decisions are covered adequately. This proactive approach not only secures your interests but also provides peace of mind for you and your loved ones.

Crucial Points on This Form

What is a Power of Attorney (POA) form in New York?

A Power of Attorney form in New York is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions and act on their behalf. This document can cover a broad range of actions, including financial, real estate transactions, and personal matters. The form must comply with New York State laws to be valid.

How do I create a Power of Attorney in New York?

To create a Power of Attorney in New York, the principal must complete the state-specific POA form, ensuring all required fields are filled accurately. The document must be signed by the principal, in the presence of a notary public and, depending on the POA type, may require the agent(s) to sign it as well. It's recommended to seek legal advice to ensure the form meets all legal requirements.

Who can be designated as an agent in a New York POA?

Any competent adult can be designated as an agent in a New York Power of Attorney. This can be a trusted family member, friend, or even a professional like an attorney. It's crucial that the chosen agent is reliable and willing to take on the responsibilities detailed in the POA.

Is a New York Power of Attorney form durable?

Yes, a New York Power of Attorney can be durable, meaning it remains in effect even if the principal becomes incapacitated. For a POA to be considered durable, it must include specific language stating that the document will continue to operate despite the principal's incapacity. Without such language, the POA would no longer be valid if the principal becomes unable to make decisions.

Can a Power of Attorney be revoked in New York?

Yes, the principal has the right to revoke a Power of Attorney at any time, as long as they are mentally competent. This is typically done by notifying the agent in writing and destroying all copies of the POA document. It is also recommended to inform any financial institutions or other parties that were relying on the POA of its revocation.

What happens if my Power of Attorney is not recognized in New York?

If your Power of Attorney is not recognized in New York, it may be due to a lack of compliance with New York laws or procedural errors in executing the document. In such cases, it might be necessary to re-execute the document according to New York standards or seek legal advice to address any specific issues preventing its recognition.

Do I need a lawyer to create a Power of Attorney in New York?

While it's not legally required to have a lawyer create a Power of Attorney in New York, consulting with a legal professional can ensure that the document fully meets your needs and complies with state laws. A lawyer can provide valuable advice on choosing an agent and specifying the powers granted.

How long does a New York Power of Attorney last?

A New York Power of Attorney lasts until its expiration date, if one is specified in the document, until the principal revokes it, or until the principal dies. If the POA is durable, it remains in effect even if the principal becomes incapacitated, but it does not extend beyond the principal's death.

What should I do if my agent is not acting in my best interests?

If you believe your agent is not acting in your best interests, it is essential to act swiftly. If you are capable, you can revoke the Power of Attorney, effectively removing the agent's authority. If you are incapacitated and cannot revoke the POA, a family member or another interested party may need to seek legal intervention to protect your interests.

Common mistakes

Not specifying the powers granted: People often fail to clearly define the extent of authority they are giving their agent, resulting in confusion and potential misuse of power.

Choosing the wrong agent: Selecting an agent without thoroughly considering their reliability, trustworthiness, and capability to handle responsibilities can lead to problems.

Forgetting to specify a duration: Without a clearly defined start and end date, the power of attorney may not be effective when needed or could remain in effect longer than intended.

Omitting a successor agent: Failing to name a successor agent can leave the principal without representation if the original agent cannot serve.

Ignoring the need for witnesses or notary: Neglecting the legal requirement for witnesses or a notary public to sign the document can invalidate the power of attorney.

Lack of specificity in powers granted: When people do not specify the duties and limitations of the agent’s powers, it leads to ambiguity and potential overreach.

Not reviewing and updating: Failure to periodically review and, if necessary, update the power of attorney to reflect changes in circumstances or intentions can render it ineffective.

Using a generic form without customization: Relying on a standard form without tailoring it to specific needs and state laws may result in a document that does not fully protect the principal’s interests.

Common mistakes can undermine the effectiveness of a New York Power of Attorney form. Being mindful of these pitfalls and taking steps to avoid them ensures that the document serves its intended purpose. Detailed attention to the selection of an agent, the scope of powers granted, and compliance with legal formalities is key to establishing a robust and functional power of attorney.

Documents used along the form

The New York Power of Attorney (POA) form is a powerful document that allows an individual, known as the principal, to designate another person, known as the agent, to make decisions on their behalf. This legal instrument can cover a range of decisions including financial, health care, and property. Completing a POA form is just one step in preparing for future uncertainties. Often, several other forms and documents might be utilized alongside the New York POA form to ensure a comprehensive legal strategy. These auxiliary documents each serve a unique purpose, complementing the POA and providing a robust framework for managing one's affairs effectively.

- Health Care Proxy: This document appoints someone to make healthcare decisions for you if you're incapable of making them yourself. It is specifically tailored to health decisions, unlike a general POA, which can cover a wide range of decisions.

- Living Will: A living will specifies your wishes regarding medical treatment in situations where you are unable to communicate your decisions. This can guide your healthcare proxy or aid in medical decision-making directly.

- Standby Guardianship Form: This form is essential for parents or guardians. It allows them to appoint a standby guardian for their children in the event of incapacity.

- Last Will and Testament: This document outlines how your assets should be distributed upon your death. While a POA deals with decisions during your lifetime, a last will and testament takes effect after death.

- Revocable Living Trust: A revocable living trust is a document that allows you to manage your assets during your lifetime and specify how they should be distributed upon your death, avoiding probate.

- Durable Power of Attorney for Finances: Although a general POA may include financial decision-making, a durable POA for finances remains in effect if you become mentally incapacitated, ensuring continuity in financial affairs management.

- Declaration of Homestead: In some circumstances, this legal document protects your home from creditors during your lifetime. Though not directly related to decision-making authority like a POA, it's part of securing one's assets.

Together with the New York Power of Attorney form, these documents can create a comprehensive estate and health care planning strategy that safeguards an individual's decisions about their assets, health care, and guardianship. It is advisable to consult with a legal professional when preparing these documents to ensure they accurately reflect your wishes and are executed in accordance with New York law. This step is crucial for securing peace of mind for both you and your loved ones.

Similar forms

Living Will: Similar to a Power of Attorney, a Living Will specifies an individual's preferences in medical treatments when they are no longer able to make decisions for themselves. Both documents allow individuals to communicate their wishes about future scenarios ahead of time.

Healthcare Proxy: This document, much like a Power of Attorney, allows an individual to designate another person to make healthcare decisions on their behalf. The key similarity lies in the delegation of decision-making authority when the person cannot do so independently.

Durable Power of Attorney for Health Care: Similar to a standard Power of Attorney, this document specifically grants someone else the ability to make healthcare decisions for the person, enduring even when the individual loses mental capacity, thus overlapping in purpose and effect.

Financial Power of Attorney: This grants another person the authority to manage financial matters for the individual, mirroring the broader Power of Attorney's approach in authorizing agents to act on one's behalf, but specifically focuses on financial transactions.

Advanced Directive: An advanced directive encompasses aspects of both a Living Will and a Healthcare Proxy, akin to a Power of Attorney by guiding medical care preferences and designating decision-making authority in medical circumstances when the person is incapacitated.

Trust: While different in purpose, a Trust agreement, similar to a Power of Attorney, involves handing over control to another party for managing one's assets, albeit generally for the benefit of a third party. Both documents facilitate the management of one’s affairs through designated representatives.

Guardianship or Conservatorship Documents: These documents establish legal guardianship over another individual or their property, akin to a Power of Attorney in that they transfer decision-making power, but through a court appointment process for situations of incapacity or disability.

Will: A Will specifies how a person's estate should be distributed after their death, sharing with a Power of Attorney the fundamental concept of making preemptive decisions to guide future actions regarding one's estate or health, albeit a Power of Attorney ceases to be effective upon the person's death.

Bank Forms Allowing Another to Cash Checks: These forms are functionally similar to a Financial Power of Attorney but are more limited in scope, allowing only for the cashing or deposit of checks. This narrow authority showcases the principle of delegating financial tasks to another, paralleling the broader capabilities granted by a Power of Attorney.

Dos and Don'ts

When filling out the New York Power of Attorney form, several practices can help ensure the document is effective and legally binding. Below, you'll find a list of dos and don'ts to guide you through the process.

Do:

- Completely and accurately fill out all required information. This includes the full legal names and addresses of both the principal and the agent.

- Specify the powers granted with clear and precise language to avoid ambiguity and potential disputes.

- Include any special instructions or limitations on the agent’s authority. This ensures the principal's wishes are honored.

- Have the document notarized. While not always required, notarization can add an extra layer of legal validity and acceptance.

- Provide copies of the signed document to relevant parties, such as financial institutions or healthcare providers, to inform them of the agent’s authority.

Don't:

- Leave blank spaces or unanswered questions on the form, as this could lead to confusion or challenges to the document's validity.

- Use vague language when detailing the scope of the agent’s powers; specificity is key to effective execution.

- Forget to sign and date the form in the presence of a notary public and the required witnesses to ensure its enforceability.

- Assume the form doesn’t need to be updated. Revisit and potentially update the Power of Attorney if situations or relationships change.

Approaching the New York Power of Attorney form with care and attention to these guidelines can help safeguard the interests of all parties involved. Always consider consulting a legal professional to ensure that the form accurately reflects your intentions and complies with current laws.

Misconceptions

When it comes to legal documents, misunderstandings can lead to significant consequences. The New York Power of Attorney (POA) form is no exception. Let's clarify some common misconceptions to help ensure that when you're navigating these waters, you're as informed as possible.

Misconception 1: A Power of Attorney grants unlimited power. Many people believe that by signing a POA, they're giving away carte blanche over their affairs. In reality, the scope of authority granted to an agent under a New York POA can be customized. You can specify which powers you are transferring, ensuring your agent only has the authority you're comfortable with.

Misconception 2: Once signed, a Power of Attorney is irrevocable. This assumption can deter people from creating a POA. However, a POA in New York can be revoked at any time by the principal (the person who made the POA) as long as they are mentally competent. This flexibility ensures that if your circumstances or trust in the agent changes, you can adjust your legal documents accordingly.

Misconception 3: A Power of Attorney survives the death of the principal. Some think that a POA is a tool for managing affairs after death. However, a POA is only effective during the lifetime of the principal. Once the principal passes away, the authority granted through the POA ends, and the estate's management transitions to the executor as outlined in the will.

Misconception 4: A New York Power of Attorney is valid in all states. While many states may honor a New York POA, it's not guaranteed. Each state has its own laws and regulations regarding the recognition and validity of out-of-state POAs. It's crucial to verify whether your New York POA will be acknowledged if you move or have assets in another state.

Misconception 5: You only need a Power of Attorney if you're elderly. A common belief is that POAs are only necessary for the aging population. However, unexpected situations can happen at any age, making it prudent for adults of all ages to consider having a POA. It ensures that someone can legally manage your affairs if you become unable to do so yourself, regardless of your age.

Tackling these misconceptions head-on can empower you to make informed decisions about your legal and financial planning. Understanding the nuances of a New York Power of Attorney ensures that you're taking steps to protect yourself and your assets in the most effective way possible.

Key takeaways

When preparing to use the New York Power of Attorney (POA) form, it's important to understand the specifics of how to fill it out correctly and the implications of using it. Here are key takeaways to guide individuals through this process:

Choose the Right Type of POA: New York offers several types of Power of Attorney forms, including General, Limited, and Durable. Each serves a different purpose. A General POA grants broad powers, a Limited POA grants specific powers, and a Durable POA remains in effect even if the person becomes incapacitated.

Fill Out the Form Completely: Ensuring that every section of the New York POA form is filled out accurately is critical. Any missing or incorrect information can lead to delays or the form being considered invalid.

Clearly Define the Powers Granted: Be explicit about the powers you are giving to your agent. This can include managing your financial affairs, making healthcare decisions, or handling real estate transactions.

Choose Your Agent Wisely: Your agent will have significant control over your affairs, so it's important to select someone who is trustworthy, understands your wishes, and is capable of acting in your best interest.

Sign in the Presence of a Notary Public: To ensure its legality, the New York POA form must be signed by the principal (the person granting the power) in the presence of a Notary Public or certain other authorized individuals.

Keep the Original Document in a Safe Place: Once the form is completed and notarized, keep the original document in a secure location. Copies should be given to the agent and any institutions or individuals that may need it to recognize the agent's authority.

Review and Update Regularly: Circumstances change, and it may be necessary to update the POA form. Regularly review the document to ensure it still reflects your wishes and make any necessary amendments.

Create Other Power of Attorney Forms for US States

Power of Attorney Forms California - Requires clear identification of the principal, the agent, and the powers granted to the agent.

Financial Power of Attorney Oklahoma - Facilitates the appointment of a trusted person to make critical decisions on your behalf, covering personal, financial, and medical areas.

Power of Attorney '' Florida Pdf - Revocation of this power is possible at any time by the principal, provided they are competent to do so.

Ct Power of Attorney Form - State laws vary widely in terms of what is required for a Power of Attorney to be legally valid, making it essential to know and follow your state's specific guidelines.