Legal Real Estate Power of Attorney Form

Handling real estate transactions can often be complex and time-consuming, especially for those who find themselves unable to manage these tasks personally due to various reasons such as travel, health issues, or time constraints. This is where the Real Estate Power of Attorney form becomes an invaluable tool. It grants a trusted individual, often referred to as an agent or attorney-in-fact, the authorization to act on behalf of the principal—the person making the appointment—in matters related to real estate. This could encompass a wide range of activities from buying, selling, managing, to even refinancing property on the principal's behalf. Understanding the scope, limitations, and the critical nature of the legal document is essential for anyone considering its use. It ensures that the principal's real estate affairs are handled according to their wishes, providing peace of mind that these matters are in capable hands. However, it's also crucial for the principal to remember that choosing a reliable and trustworthy agent cannot be overstated, as this person will have significant control over potentially valuable property assets.

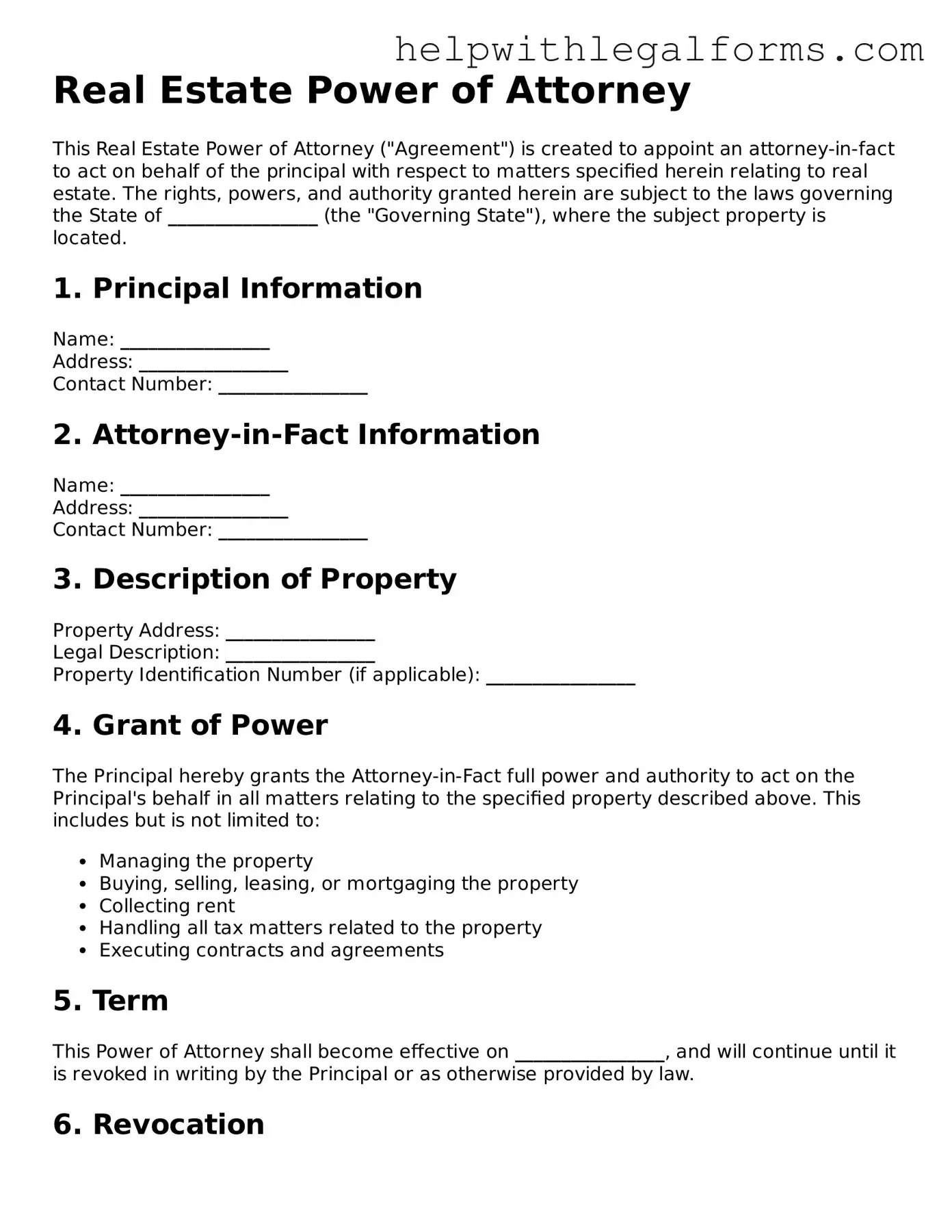

Example - Real Estate Power of Attorney Form

Real Estate Power of Attorney

This Real Estate Power of Attorney ("Agreement") is created to appoint an attorney-in-fact to act on behalf of the principal with respect to matters specified herein relating to real estate. The rights, powers, and authority granted herein are subject to the laws governing the State of ________________ (the "Governing State"), where the subject property is located.

1. Principal Information

Name: ________________

Address: ________________

Contact Number: ________________

2. Attorney-in-Fact Information

Name: ________________

Address: ________________

Contact Number: ________________

3. Description of Property

Property Address: ________________

Legal Description: ________________

Property Identification Number (if applicable): ________________

4. Grant of Power

The Principal hereby grants the Attorney-in-Fact full power and authority to act on the Principal's behalf in all matters relating to the specified property described above. This includes but is not limited to:

- Managing the property

- Buying, selling, leasing, or mortgaging the property

- Collecting rent

- Handling all tax matters related to the property

- Executing contracts and agreements

5. Term

This Power of Attorney shall become effective on ________________, and will continue until it is revoked in writing by the Principal or as otherwise provided by law.

6. Revocation

The Principal may revoke this Power of Attorney at any time by providing written notice to the Attorney-in-Fact. Such revocation shall not affect any liability in respect of actions taken before the notice of revocation was received.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ________________. Any disputes arising under or in connection with this Agreement shall be subject to the jurisdiction of the courts of the Governing State.

8. Signatures

This document must be signed and dated by the Principal and the Attorney-in-Fact to be effective.

Principal's Signature: ________________________________ Date: _________________________

Attorney-in-Fact's Signature: _________________________ Date: _________________________

Witnessed by:

Signature: ________________________________ Date: _________________________

Print Name: ________________________________

This document was executed in the State of ________________.

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | Grants authority to an agent to act on behalf of the principal in real estate matters. |

| Scope of Authority | Can include buying, selling, managing, or refinancing real estate. |

| Durability | May be durable or non-durable; durable powers remain effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke it at any time, as long as they are competent. |

| State-Specific Forms | Forms and requirements can vary significantly by state. |

| Governing Laws | Vary by state; typically governed by state statutes related to powers of attorney and real estate transactions. |

| Witness and Notarization | Most states require the document to be witnessed and notarized to be legally binding. |

| Limitations | The agent cannot use the power to benefit themselves unless expressly permitted by the form. |

Instructions on How to Fill Out Real Estate Power of Attorney

A Real Estate Power of Attorney is a legal document that grants someone the authority to manage real estate transactions on your behalf. It can include buying, selling, managing, or refinancing property. Properly completing this form is crucial to ensure your real estate affairs are handled according to your wishes. Follow these steps carefully to fill out the form correctly.

- Determine the type of powers to grant. Decide if the Power of Attorney will cover all real estate transactions or only specific acts.

- Choose the agent. Select a trusted individual to act as your agent. This person will have the authority to make real estate decisions on your behalf.

- Identify the principal. The principal is the person granting the power. Provide full legal name, address, and contact information.

- Specify the properties. Clearly list the properties involved. Include addresses and legal descriptions to avoid any ambiguity.

- Define the term. Detail when the Power of Attorney will start and when it will end. Note if it will cease upon a specific event or continue indefinitely.

- Detail the powers granted. Precisely outline what your agent is allowed to do. This can range from selling a particular property to handling all transactions related to a piece of real estate.

- Notarization. Many states require the Real Estate Power of Attorney to be notarized to be valid. Ensure the document is signed in front of a notary public.

- Witnesses. Some jurisdictions may also require the Power of Attorney to be signed by witnesses. Check your local laws to see if this is necessary and, if so, ensure the presence of the required number of witnesses during the signing.

- Provide copies to relevant parties. Once completed, provide a copy to your agent and any institutions or individuals that might be involved in your real estate transactions, such as banks or real estate agencies.

After filling out the Real Estate Power of Attorney form, it's important to discuss the contents and the powers you've granted with the appointed agent. This ensures they understand their responsibilities and your expectations. Additionally, consider informing your attorney or legal advisor about the arrangement for further guidance and to address any potential implications this may have on your overall estate plan.

Crucial Points on This Form

What is a Real Estate Power of Attorney?

A Real Estate Power of Attorney is a legal document that grants an individual (the agent) the authority to make decisions regarding another person's (the principal's) real estate properties. This includes buying, managing, or selling property on the principal's behalf.

Who can be appointed as an agent?

Anyone the principal trusts can be appointed as an agent. This can be a family member, a close friend, or a trusted advisor. The chosen agent should be reliable, trustworthy, and, ideally, have some knowledge of real estate.

Is a Real Estate Power of Attorney form legally binding in all states?

Yes, a Real Estate Power of Attorney is legally binding in all states, but the specific requirements, such as witness signatures and notarization, can vary from state to state. It's important to check the local laws to ensure the form meets all legal criteria.

How does one revoke a Real Estate Power of Attorney?

To revoke a Real Estate Power of Attorney, the principal must write a revocation document that explicitly states the intention to revoke the power granted to the agent. This document also needs to be notarized and, in many cases, recorded with the same authorities where the original Power of Attorney was recorded.

Can a Real Estate Power of Attorney be used for a single transaction?

Yes, you can draft a Real Estate Power of Attorney to be specific for a single transaction. In this case, the document will detail the scope and limitations of the agent’s power, which will be limited to that particular transaction.

What happens if the principal becomes incapacitated?

If the Real Estate Power of Attorney is durable, it remains in effect even if the principal becomes incapacitated. This ensures that the agent can continue to manage the real estate affairs without interruption. Without a durable clause, the power of attorney would automatically terminate if the principal becomes incapacitated.

Does the agent get compensated for their services?

Compensation for the agent is not required but can be stipulated in the Real Estate Power of Attorney form. The terms of compensation, if any, should be clearly outlined in the document to avoid any future disputes.

Can an agent sell property to themselves?

Generally, an agent cannot sell the property to themselves without express, written permission from the principal. This is considered a conflict of interest and could nullify the transaction unless the Power of Attorney specifically allows such actions.

What is the difference between a general Power of Attorney and a Real Estate Power of Attorney?

A General Power of Attorney grants broad powers to the agent across a wide range of the principal’s affairs, whereas a Real Estate Power of Attorney specifically limits the agent's authority to real estate matters only. This means the agent can only make decisions and take actions related to the principal's real estate properties.

Common mistakes

When managing real estate matters, a Power of Attorney (POA) form is a powerful document that grants someone else the authority to act on your behalf. However, errors can occur during completion, which may lead to unintended consequences. Below are common mistakes to watch out for:

- Not specifying the powers granted. Without clear definitions, it’s difficult for the agent to act effectively and within legally intended bounds.

- Choosing the wrong agent. Selecting someone who is not trustworthy or lacks understanding of real estate matters can lead to mismanagement of your property.

- Failing to mention the duration. Without stating when the POA starts and ends, it might not be effective when needed or could remain in effect longer than desired.

- Omitting required signatures. The absence of critical signatures, such as those of the principal, the agent, or witnesses, can invalidate the document.

- Not complying with state laws. Real estate laws vary by state, and failing to adhere to specific state requirements can render the POA invalid.

- Not getting it notarized. Some states require notarization for the document to be legally binding.

Avoiding these mistakes ensures that the Real Estate Power of Attorney form aligns with your intentions and complies with legal standards. It’s advisable to consult with a professional who can guide you through the process and help avoid pitfalls.

Documents used along the form

When managing real estate transactions, a Real Estate Power of Attorney (POA) is a critical document that authorizes someone else to handle property matters on your behalf. However, this document does not stand alone in the process. To ensure comprehensive management and legal compliance, several other forms and documents often complement the Real Estate POA. Here is a concise overview of these essential forms and documents, which together provide a solid foundation for any real estate transaction or management task.

- Purchase Agreement - This document outlines the terms and conditions under which a property will be sold, including the purchase price, closing date, and any contingencies that must be met before the sale can proceed.

- Deed - The deed is a crucial document that transfers property ownership from the seller to the buyer. It contains a description of the property, the names of the old and new owners, and should be filed with the county recorder’s office.

- Title Search Report - A title search examines public records to confirm the property’s legal ownership and identify any claims, liens, or encumbrances on the property, ensuring the buyer receives a clear title.

- Home Inspection Report - This report provides a detailed examination of the property’s condition, highlighting any issues or repairs that may need to be addressed. It’s a critical tool for negotiating repairs or adjusting the purchase price.

- Appraisal Report - An appraisal report assesses the property's value. Lenders often require appraisals to ensure the property is worth more than the loan amount.

- Mortgage Agreement - For buyers who are financing the purchase, a mortgage agreement details the loan’s terms, including interest rates, payment schedule, and the rights of the lender in case of default.

- Closing Statement (HUD-1) - This detailed accounting statement itemizes all of the costs associated with the transaction, including fees, taxes, and other charges, for both the buyer and seller at closing.

- Insurance Policies - Property insurance documents are required to protect against losses from events like fires or floods. Lenders typically require proof of insurance before closing on the property.

- Disclosure Statements - Sellers must provide disclosure statements that reveal any known defects or issues with the property. These documents are crucial for avoiding future disputes and ensuring transparency.

Together with the Real Estate POA, these documents form a comprehensive suite that addresses various aspects of property transactions - from sale negotiation and legal formalities to financial arrangements and property condition assessment. These documents collectively help ensure that all parties are fully informed and agreeable to the terms of the real estate transaction, minimizing risks and smoothing the path to a successful and legally sound conclusion.

Similar forms

General Power of Attorney: This document, similar to a Real Estate Power of Attorney, grants broad powers to an agent to manage the principal's affairs. While the Real Estate Power of Attorney focuses specifically on real estate transactions, a General Power of Attorney covers a wide range of actions including financial transactions and business operations, making it broader in scope but similar in the delegation of authority.

Limited Power of Attorney: Often used for a specific purpose or time period, a Limited Power of Attorney shares the concept of granting authority to another party, akin to the Real Estate Power of Attorney. However, its scope is restricted to specific tasks beyond just real estate matters, such as selling a car or managing certain financial accounts, showcasing its narrower focus but similar foundational principle of delegation.

Durable Power of Attorney: This type of power of attorney is akin to the Real Estate Power of Attorney in that it allows an agent to act on behalf of the principal. The key similarity lies in the durability aspect, which means the document remains in effect even if the principal becomes incapacitated. While a Durable Power of Attorney can apply to various domains including healthcare and finances, it shares with the Real Estate Power of Attorney the critical feature of enduring legal validity during incapacity.

Medical Power of Attorney: A Medical Power of Attorney grants an agent the right to make healthcare decisions on behalf of the principal, which parallels the Real Estate Power of Attorney's feature of allowing someone else to make decisions in a specific area. The difference lies in the realm of decisions being made—healthcare versus real estate—yet both documents establish a trusted individual's authority to act in the best interest of the principal when they are unable to do so themselves.

Financial Power of Attorney: This document specifically allows an agent to handle the principal's financial matters, from paying bills to managing investments. Similar to the Real Estate Power of Attorney, which grants authority in real estate transactions, a Financial Power of Attorney empowers someone to act on the principal's behalf in financial matters specifically. Both serve to ensure someone trusted can manage key aspects of a person’s life, reflecting their similarity in purpose.

Springing Power of Attorney: Shares the fundamental principle of delegating authority to another, just like the Real Estate Power of Attorney. The distinctive feature of a Springing Power of Attorney is that it becomes effective only under certain conditions, typically the principal's incapacitation. This conditional aspect sets it apart, yet it closely aligns with the general concept of permitting someone else to make decisions on one's behalf, seen in the Real Estate Power of Attorney.

Dos and Don'ts

When dealing with a Real Estate Power of Attorney form, it is crucial to approach the task with care and precision. This document grants legal authority to someone else to act on your behalf in matters related to real estate, so it's important to do it right. Here are some vital dos and don'ts to keep in mind:

Things You Should Do

- Verify the identity and trustworthiness of the person you are appointing as your agent. This individual will have significant power over your property, and it is essential they are both reliable and capable of handling these responsibilities.

- Be specific about the powers you are granting. Clearly outline what your agent can and cannot do with your property to prevent any abuse of power or misunderstandings.

- Include a start and end date. Specifying the duration of the power of attorney ensures that your agent's authority is clear and time-bound.

- Consult with a legal professional. Before finalizing the document, it's wise to have a lawyer review it. They can ensure that it complies with local laws and fully protects your interests.

Things You Shouldn't Do

- Don't use vague language. Ambiguities in the document can lead to disputes or misuse of authority. Be as precise and clear as possible in describing the scope of your agent's power.

- Don't neglect to specify limitations. It's important to explicitly define what your agent cannot do with your property to avoid any overreach of their authority.

- Don't forget to keep a record. Always keep a copy of the signed and finalized document for your records. It's also a good idea to let a trusted third party hold a copy in case questions arise in the future.

- Don't fail to inform relevant parties. Make sure that family members, financial institutions, and anyone else who might be affected are aware that you've granted someone else power of attorney over your real estate.

Misconceptions

When discussing Real Estate Power of Attorney (POA), several misconceptions can mislead individuals about its function, scope, and importance. It is crucial to dispel these myths to make informed decisions regarding property management and legal representation. Below are nine common misconceptions accompanied by explanations to clarify each point.

- A Real Estate POA grants unlimited power. Contrary to this belief, a Real Estate POA is specifically designed to grant authority within the realm of real estate transactions. This means the appointed person can act on behalf of the principal strictly in matters related to real estate, such as buying, selling, or managing property.

- It is irreversible. Many assume that once a Real Estate POA is executed, it cannot be revoked. However, the principal has the right to revoke or change the POA as long as they are legally competent to make such decisions.

- Only family members can be appointed. While family members are commonly chosen, the principal is free to appoint anyone they trust to manage their real estate affairs, including friends or professional advisors.

- The same POA document works everywhere. Real estate laws vary by state, and a POA that is valid in one state might not be recognized in another. It is essential to ensure the document complies with the legal requirements of the state where the property is located.

- Creating a POA is a long and expensive process. While legal guidance is advisable to avoid errors, creating a POA does not necessarily require extensive time or resources. Forms and assistance are readily available, often requiring only notarization to become effective.

- A Real Estate POA can force the sale of a principal’s property against their will. The agent under a POA acts on behalf of the principal and is bound by a fiduciary duty to act in the principal's best interest. Any action taken must align with the principal’s wishes and legal authority granted in the document.

- It becomes effective immediately upon signing. This is not always the case. A Real Estate POA can be tailored to become effective immediately, or it can be springing, meaning it only takes effect under conditions specified by the principal, such as incapacity.

- Any type of POA can be used for real estate transactions. A general POA might not be suitable for specific real estate transactions, which often require a specialized Real Estate POA. This ensures the document meets specific legal criteria for real estate dealings.

- The agent under a POA can change the terms of the POA. The agent has the authority to act within the confines of the powers expressly granted by the POA document. They cannot alter the terms, expand their powers, or transfer their authority to someone else.

Understanding these intricacies is vital for anyone considering the creation or use of a Real Estate Power of Attorney. Clearing up these misconceptions empowers individuals to make more informed choices, ensuring their property and interests are managed according to their wishes.

Key takeaways

Understanding the Real Estate Power of Attorney (POA) form is vital for anyone looking to grant or receive authority in real estate transactions. This legal document can significantly impact those involved, providing either broad or narrow legal authority to act on another's behalf in matters related to property. Here are five key takeaways about filling out and using the Real Estate Power of Attorney form:

- The Real Estate Power of Attorney form must be completed with accuracy and detail, specifying the powers granted. This precision ensures that the agent knows the extent of their authority and legal boundaries.

- Choosing the right agent is crucial. This person will have significant control over your real estate affairs, so it's vital to select someone who is trustworthy, reliable, and has an understanding of real estate matters.

- The form must comply with state laws. Real estate laws vary from state to state, and so do the requirements for a Power of Attorney form. Ensuring the form meets your state's legal requirements is essential for its validity.

- The Real Estate Power of Attorney can be revoked. If circumstances change, the principal has the right to revoke the power of attorney, provided this action is done in accordance with state laws, which typically require a written notice of revocation.

- Notarization and witnesses may be required. To enhance the legal standing of the Power of Attorney form, many states require the document to be notarized and/or witnessed. This process helps prevent fraud and confirms the principal's identity and their intention to grant power of attorney.

When used correctly, the Real Estate Power of Attorney is a powerful tool that can facilitate real estate transactions when you are unable to be present. However, it requires careful consideration and understanding to ensure it serves its intended purpose without unintended consequences.

Discover Other Types of Real Estate Power of Attorney Documents

Power of Attorney Form California - This form empowers your agent to act swiftly and efficiently, minimizing the potential for disputes or confusion among family members.

Poa Dmv - Owners can ensure their vehicle obligations are met in their absence by issuing this form to a trusted individual.