Legal Prenuptial Agreement Form

In the landscape of marriage, the prenuptial agreement stands as a pivotal document, often surrounded by misconceptions and emotional weight. Its necessity, however, is hard to overlook in our modern society where individual financial independence is highly valued. At its core, this legal document serves to outline the ownership of personal and financial assets before marriage, providing a clear roadmap for asset division should the relationship end in divorce. Far from casting a shadow of doubt over a union, a well-crafted prenuptial agreement can offer a sense of security and fairness for both parties involved. It demands full transparency from both sides and encourages couples to engage in open, honest conversations about their financial situation and expectations for the future. This preemptive step can not only safeguard individual assets but also minimize potential conflicts and legal battles, ensuring that both parties are protected regardless of what the future holds.

State-specific Prenuptial Agreement Forms

Example - Prenuptial Agreement Form

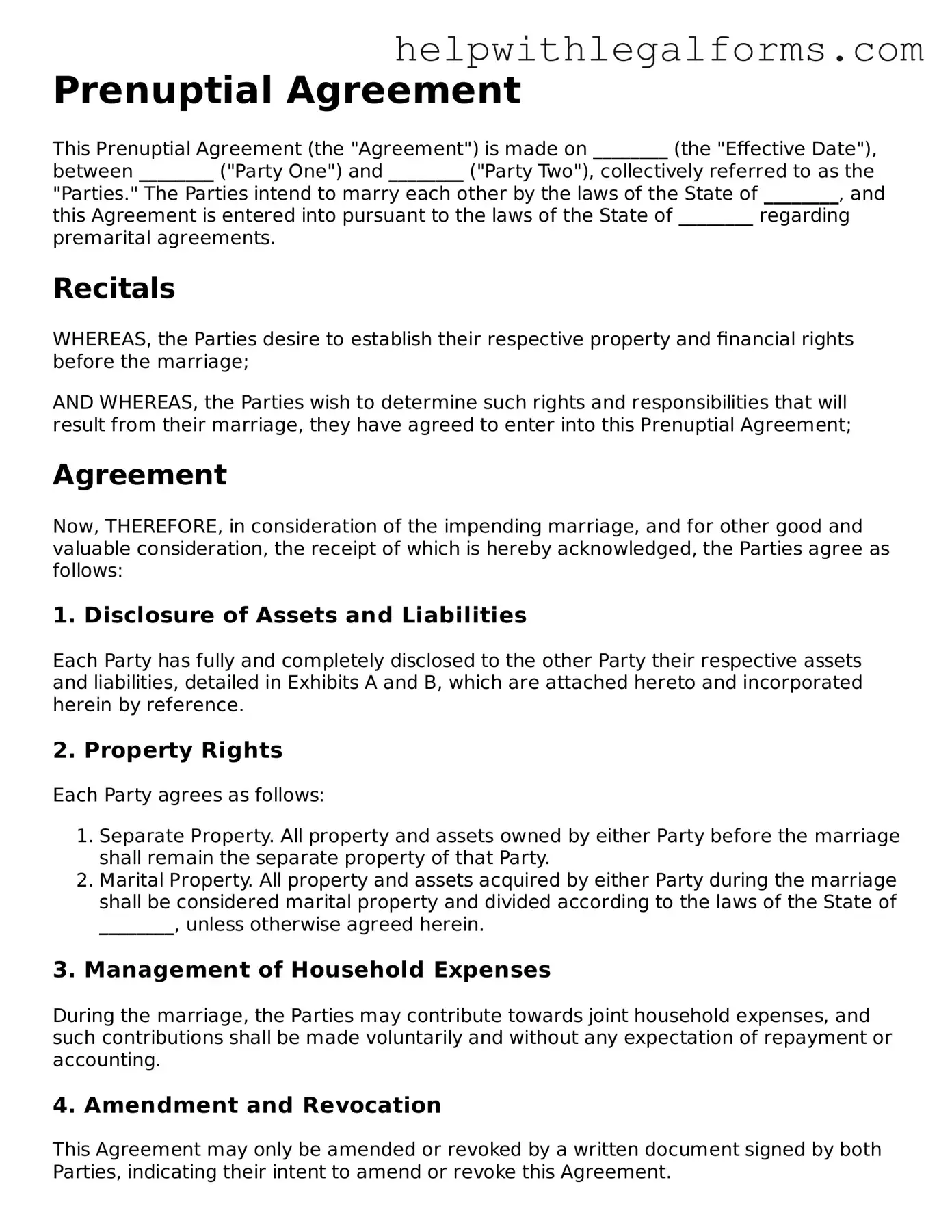

Prenuptial Agreement

This Prenuptial Agreement (the "Agreement") is made on ________ (the "Effective Date"), between ________ ("Party One") and ________ ("Party Two"), collectively referred to as the "Parties." The Parties intend to marry each other by the laws of the State of ________, and this Agreement is entered into pursuant to the laws of the State of ________ regarding premarital agreements.

Recitals

WHEREAS, the Parties desire to establish their respective property and financial rights before the marriage;

AND WHEREAS, the Parties wish to determine such rights and responsibilities that will result from their marriage, they have agreed to enter into this Prenuptial Agreement;

Agreement

Now, THEREFORE, in consideration of the impending marriage, and for other good and valuable consideration, the receipt of which is hereby acknowledged, the Parties agree as follows:

1. Disclosure of Assets and Liabilities

Each Party has fully and completely disclosed to the other Party their respective assets and liabilities, detailed in Exhibits A and B, which are attached hereto and incorporated herein by reference.

2. Property Rights

Each Party agrees as follows:

- Separate Property. All property and assets owned by either Party before the marriage shall remain the separate property of that Party.

- Marital Property. All property and assets acquired by either Party during the marriage shall be considered marital property and divided according to the laws of the State of ________, unless otherwise agreed herein.

3. Management of Household Expenses

During the marriage, the Parties may contribute towards joint household expenses, and such contributions shall be made voluntarily and without any expectation of repayment or accounting.

4. Amendment and Revocation

This Agreement may only be amended or revoked by a written document signed by both Parties, indicating their intent to amend or revoke this Agreement.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ________, without giving effect to any choice or conflict of law provisions.

6. Entire Agreement

This Agreement contains the entire understanding between the Parties and supersedes all prior discussions, negotiations, and agreements, whether oral or written, regarding the subject matter hereof.

7. Acknowledgment

Each Party acknowledges that they have had sufficient time to review this Agreement, consult with independent legal counsel, and fully understand its terms and consequences.

IN WITNESS WHEREOF, the Parties have executed this Prenuptial Agreement on the date first above written.

Party One: ____________________________________ Date: __________

Party Two: ____________________________________ Date: __________

PDF Form Attributes

| Fact | Detail |

|---|---|

| Definition | A prenuptial agreement is a written contract created by two people before they are married. It outlines the ownership of their respective assets and the division thereof in the event of divorce or death. |

| Purpose | To protect the assets of individual parties and clarify financial responsibilities during marriage. |

| State-Specific Forms | Yes. The requirements and validity of a prenuptial agreement vary from state to state. |

| Governing Law(s) | Uniform Premarital Agreement Act (UPAA) has been adopted by 28 states to provide consistency. However, specifics can vary widely by state. |

| Enforcement | For enforcement, a prenup must be in writing, signed by both parties, and entered into voluntarily without duress or undue influence. |

| Disclosure | Full and fair disclosure of all assets and liabilities is required by both parties for a prenup to be valid. |

| Amendment or Revocation | Prenuptial agreements can be amended or revoked only by a written agreement signed by both parties. |

| Benefits | Can safeguard one's estate plan, protect business interests, provide clarity on financial matters, and prevent lengthy legal disputes in case of divorce or death. |

| Limitations | Cannot make decisions about child custody or support that will adversely affect the rights of a child. |

Instructions on How to Fill Out Prenuptial Agreement

When couples decide to marry, they are also entering into a legal partnership. A prenuptial agreement is a practical tool for anticipating and arranging the financial aspects of this partnership, should it dissolve in the future. This document requires thoughtful reflection of current assets, liabilities, and future financial goals. Drafting a comprehensive and fair agreement necessitates careful attention to detail, ensuring both parties are protected. Below are steps to fill out a prenuptial agreement form successfully.

- Gather all necessary financial documents for both parties, such as bank statements, investment portfolios, property deeds, and any debt records. This preparation ensures that the agreement accurately reflects the couple's financial landscape.

- Both parties must decide if they want legal representation. While it's not mandatory, having a lawyer can help navigate the complexities of state laws and ensure the agreement's enforceability.

- Begin the form by entering the full legal names of both parties into the designated spaces at the top of the agreement.

- Carefully list all assets and liabilities separately for each person. Be as detailed as possible to avoid future disputes. This includes detailing any pre-marital property, inheritances, gifts, and anticipated acquisitions.

- Describe how property, assets, and debts will be handled both during the marriage and in the event of a separation, divorce, or death of one partner. This includes specifying any divisions, distributions, or management of financial matters.

- Include any clauses for spousal support or alimony, if applicable. Specify amounts, duration, and conditions under which it would be payable.

- Detail any agreements regarding wills, trusts, or life insurance policies designed to protect either party in the event of death.

- Discuss and outline the handling of any potential future businesses, detailing how it will be valued and divided, if necessary.

- State the governing law which will apply to the agreement. This is typically the law of the state in which the couple plans to reside.

- Both parties should carefully review the agreement, ensuring they fully understand and agree to its terms. It is crucial that this review is done voluntarily and without pressure.

- Have both parties sign and date the agreement in the presence of a notary public. The notarization process adds a layer of legal verification and enforceability to the document.

- Keep multiple copies of the notarized agreement in safe, but accessible locations. Each party should have a copy, and another should be stored with a trusted attorney or safe deposit box.

Completing a prenuptial agreement is a proactive step for couples to take in safeguarding their future financial well-being. While the process may seem straightforward, the implications of these agreements are significant. As such, thoroughness and honesty are paramount throughout every stage of drafting and finalizing the agreement. Taking these steps seriously ensures that the agreement serves its intended purpose, providing peace of mind for both partners.

Crucial Points on This Form

What is a Prenuptial Agreement?

A Prenuptial Agreement, often shortened to "prenup," is a written contract created by two people before they get married. This agreement outlines how assets and financial issues will be handled during the marriage and in the event of a divorce.

Who needs a Prenuptial Agreement?

Anyone with personal or business assets, debts, children from previous relationships, or who expects a substantial increase in income may benefit from a Prenuptial Agreement. It provides a clear legal framework that can protect both parties.

What can be included in a Prenuptial Agreement?

A Prenuptial Agreement can include terms for the division of property and debts, spousal support, and inheritance rights. It cannot include terms that would negatively affect the right to child support, child custody arrangements, or anything that violates public policy.

Is a Prenuptial Agreement enforceable?

Yes, if it meets certain legal requirements like full disclosure of assets, no evidence of coercion, and fairness at the time of its execution. However, its enforceability also depends on the state's laws where the couple resides or where the agreement is challenged.

Do I need a lawyer to create a Prenuptial Agreement?

While it's possible to draft a prenup without a lawyer, it's highly advisable to have legal representation. This ensures the agreement complies with state laws and that both parties' interests are fairly represented, making it more likely to be enforceable.

Can a Prenuptial Agreement be changed or revoked?

Yes, a Prenuptial Agreement can be modified or revoked at any time, as long as both parties agree to the changes in writing. This allows the agreement to evolve along with the marriage.

What happens if we do not have a Prenuptial Agreement?

Without a prenup, state laws will determine the division of property and financial obligations in the event of a divorce. This often results in a 50/50 division in community property states, which can significantly differ from the couple's intentions.

Does a Prenuptial Agreement make sense if we aren't wealthy?

Yes, a Prenuptial Agreement can be beneficial for couples at any financial level. It can protect future earnings, inheritance, and assets acquired during the marriage, as well as clarify financial responsibilities and expectations.

How soon before our wedding should we get a Prenuptial Agreement?

It's best to start the process several months before the wedding. This allows sufficient time for both parties to fully discuss and agree upon terms without pressure, helping to avoid claims of coercion that could invalidate the agreement.

Common mistakes

Prenuptial agreements, when executed properly, can provide couples with a solid financial foundation and peace of mind as they enter into marriage. However, errors in the preparation and execution of these documents can lead to unenforceable agreements and potential legal disputes. Here are nine common mistakes that people often make when filling out a Prenuptial Agreement form:

Not seeking independent legal advice: Both parties should have their own attorneys to ensure their interests are fully protected and that the agreement is fair and legally sound.

Failing to disclose all assets and liabilities: Complete transparency is crucial. Each party must disclose all assets and liabilities to avoid the agreement being challenged or invalidated.

Waiting until the last minute: This can lead to rushed decisions and might indicate coercion, potentially making the agreement voidable. It’s important to start the process well before the wedding.

Using ambiguous language: Precision in language helps in avoiding misunderstandings and litigation. Ambiguities can lead to parts of the agreement being interpreted in ways not intended by the parties.

Ignoring state laws: Prenuptial agreements are subject to state laws, which can vary significantly. Failing to comply with relevant state laws can render an agreement partially or completely unenforceable.

Omitting provisions for changes in circumstances: Life changes, such as the birth of children, substantial increases or decreases in income, and inheritances, should be considered. The agreement may need clauses that address how changes will affect its terms.

Including invalid provisions: Certain terms, such as those governing child custody or child support, cannot be included and may invalidate the entire agreement if challenged.

Lack of fairness: If the agreement is excessively unfair to one party, there is a risk that a court may find it unconscionable and refuse to enforce it.

Not updating the agreement: As circumstances change, the agreement should be reviewed and potentially updated to reflect the current situation of the parties.

Avoiding these mistakes can significantly help in creating a prenuptial agreement that is fair, enforceable, and reflective of each party's wishes. It is important to approach the process with diligence and thoroughness, respecting its potential impact on the future.

Documents used along the form

A prenuptial agreement form is a crucial document for couples who are planning to marry, as it outlines the property and financial rights of each spouse in the event of a divorce or the death of one partner. Alongside this form, several other documents should also be considered to ensure comprehensive legal and financial coverage. Here is a list of forms and documents that are often used together with a prenuptial agreement:

- Will/Last Testament: This document specifies how a person's assets and estate will be distributed upon their death. It can be particularly important to have alongside a prenuptial agreement to ensure all assets are allocated according to the individual’s wishes.

- Living Trust: A living trust helps manage a person's assets during their lifetime and distributes them upon their death, potentially avoiding probate. It can be a valuable complement to a prenup for managing and protecting assets.

- Power of Attorney: This legal document allows one person to make decisions on behalf of another, typically in financial or health-related matters. This document can be critical if one spouse becomes incapacitated.

- Health Care Proxy: Similar to a Powers of Attorney but specifically for making healthcare decisions. It designates someone to make medical decisions for you if you're unable to do so yourself.

- Postnuptial Agreement: This document is similar to a prenuptial agreement but is executed after the couple marries. It can be used to address changes in the couple's financial situation or to revise arrangements made in the prenuptial agreement.

- Financial Affidavit: A sworn statement of one's income, expenses, assets, and liabilities. It can be necessary for the process of drafting a fair and comprehensive prenuptial or postnuptial agreement.

- Life Insurance Policies: Ensures financial protection for the surviving spouse in the event of the other spouse's death. Drafting or updating policies to reflect the terms of a prenuptial agreement can be crucial.

- Property Agreements: These agreements can outline the terms for the division or ownership of specific properties outside of the broader prenuptial agreement terms.

- Marriage Certificate: Though not a legal agreement, the marriage certificate is often required when filing or executing various legal documents, making it an essential document for newlyweds.

Together with a prenuptial agreement, these documents can provide a comprehensive framework for legal and financial protection for both partners in a marriage. It’s always advisable to consult with legal and financial professionals when preparing these documents to ensure they meet your specific needs and are executed correctly.

Similar forms

A Postnuptial Agreement is similar to a Prenuptial Agreement, with the key difference being that it is entered into after a couple is married rather than before. Both documents outline how assets and liabilities are to be handled during the marriage and in the event of a divorce, separation, or death of one of the spouses.

A Will can be considered similar to a Prenuptial Agreement in that it specifies how one's assets should be distributed upon their death. While a Prenuptial Agreement can include provisions for the distribution of assets upon death, a Will specifically focuses on this aspect and comes into effect only after death.

A Trust is another legal document that shares similarities with a Prenuptial Agreement because it involves managing and distributing one's assets, either during their lifetime or after death. Trusts can be used to specify conditions under which assets are distributed, which can mirror some aspects of a Prenuptial Agreement related to asset distribution.

A Co-Habitation Agreement is often used by couples who live together without getting married. Like a Prenuptial Agreement, it outlines how assets and debts are divided in the event of separation, death, or other circumstances. It is a way for non-married couples to define their financial rights and obligations.

A Separation Agreement is drafted when a couple decides to separate but not divorce. It shares similarities with a Prenuptial Agreement in that it specifies arrangements for financial matters, property division, and sometimes child care. This document is prepared at the end of a relationship rather than the beginning, aiming to handle the dissolution of the marital assets and responsibilities.

Dos and Don'ts

Approaching a prenuptial agreement can feel overwhelming, but it's a significant step in ensuring clarity and fairness for both parties involved. To navigate this process smoothly, here are some do's and don'ts to keep in mind:

Do's

-

Discuss openly with your partner. Before filling out any paperwork, have an honest conversation with your partner about your finances, assets, and what you both expect from the agreement. This foundational step ensures that both parties are on the same page and can move forward with mutual understanding.

-

Seek independent legal advice. Each partner should have their own lawyer who can provide personalized guidance and ensure their interests are protected. This helps in understanding the legalities and implications of the agreement fully.

-

Be comprehensive in disclosing assets. List all assets, debts, and properties clearly and comprehensively. Transparency at this stage prevents complications and disputes down the line.

-

Consider future changes. Life is unpredictable. Include how potential changes, such as inheritance, children, or changes in income, will be handled within the agreement.

-

Keep the agreement fair and reasonable. The agreement should be equitable to both parties. An agreement perceived as heavily skewed in one party's favor may not be enforceable.

-

Review and update the agreement as needed. Over time, circumstances change. Periodically reviewing your agreement and making necessary amendments ensures it remains relevant and fair.

Don'ts

-

Rush through the process. Take your time to understand every aspect of the agreement. Rushing can lead to misunderstandings or oversights that could be problematic later.

-

Forget to consider debts. Just like assets, debts should be fully disclosed and considered. How existing and future debts are handled should be clearly outlined in the agreement.

-

Use generic templates without customization. While templates can be a good starting point, your agreement should be tailored to your specific situation. Avoid using a one-size-fits-all approach.

-

Ignore the emotional aspect. While a prenup is a financial agreement, it’s important to approach the discussion with sensitivity and care. This process can be stressful and stir up emotions, so it’s vital to be supportive and understanding towards each other.

-

Fail to plan for all possible outcomes. While no one likes to think about divorce or death, a prenup should address these possibilities to avoid future conflicts.

-

Attempt to include non-financial clauses. Stick to financial matters and avoid trying to enforce personal behavior through a prenuptial agreement, as these are typically not enforceable and can invalidate the agreement.

Misconceptions

Many people have misconceptions about Prenuptial Agreements. These documents are often misunderstood, which can lead to reluctance in discussing or considering them as part of the marriage process. Let's clear up four common misunderstandings:

- Prenuptial Agreements are only for the wealthy. This is not true. While it's common to associate these agreements with well-off individuals, they are actually beneficial for anyone who wants to protect their personal assets, manage their financial matters, or avoid potential disputes in the event of a divorce. It's about protecting your future, regardless of your current financial status.

- Signing a Prenuptial Agreement means you don’t trust your partner. Trust is a fundamental aspect of any relationship, but having a Prenuptial Agreement is not a sign of mistrust. Instead, it's a form of financial planning and a practical step to address the realities of marriage. It can actually strengthen the trust between partners by openly addressing potential future problems.

- Prenuptial Agreements only benefit one person. A common misconception is that these agreements are designed to favor only one party. In reality, a properly drafted Prenuptial Agreement should protect the interests of both parties. It's about ensuring fairness and clarity for both individuals, not about benefiting one at the expense of the other.

- Once signed, a Prenuptial Agreement cannot be changed. Circumstances and laws change, and so can Prenuptial Agreements. These documents are not set in stone. They can be modified or revoked as long as both parties agree to the changes in writing. This flexibility allows couples to adapt their agreement to suit their evolving needs and situations over time.

Key takeaways

A prenuptial agreement, often referred to as a "prenup," is a written contract created by two people before they marry. This agreement outlines how assets will be divided in the event of divorce or death. Understanding the key aspects of filling out and using this form can help ensure that it serves its intended purpose effectively. Here are four important takeaways:

- Full Disclosure is Critical: For a prenuptial agreement to be enforceable, both parties must fully disclose their assets, liabilities, and income. Hiding assets can result in the agreement being invalidated. It's essential that each party is forthcoming about their financial situation, providing an honest and complete account.

- Seek Independent Legal Advice: Each party should seek independent legal advice before signing a prenuptial agreement. This ensures that both individuals fully understand the terms and implications of the agreement. Independent legal advice can help protect the interests of both parties, making the agreement fairer and more durable.

- Consider Future Changes: Life circumstances change, and a prenuptial agreement should account for potential future changes. This can include provisions for children from the marriage, changes in wealth, and career changes. Tailoring the agreement to anticipate and adjust for future changes can prevent disputes and the need for modifications down the line.

- Review Periodically: As life changes, so should your prenuptial agreement. It's wise to review and possibly adjust the agreement periodically, especially after major life events like the birth of a child, significant changes in wealth, or changes in the law that may affect the agreement's terms or enforceability. This proactive approach can ensure that the agreement remains relevant and enforceable.

Understanding and applying these key takeaways when filling out and using a prenuptial agreement can lead to a more effective and equitable outcome for both parties. Such agreements not only protect the assets of each individual but can also provide peace of mind and clarity to the marital relationship.

Other Forms

Release of Liability - Formal relinquishment of one’s right to hold others accountable in the event of misfortune or harm.

Printable Jet Ski Bill of Sale - Signing this form ensures a clear transfer of property, reducing the risk of legal complications down the line.

Property Gift Deed Rules - It provides a straightforward solution for those wanting to gift assets without complicating their estate or incurring hefty taxes.