Blank Prenuptial Agreement Form for California

At the threshold of marriage, couples are often swept up in the romance and excitement of starting a new life together, sometimes overlooking the practicality and foresight needed in planning their future. Among the essential tools for marital planning is the California Prenuptial Agreement form, designed to protect the financial interests and rights of both parties in the event of a separation, divorce, or unexpected life event. While discussing financial matters may seem daunting or unromantic to some, the reality is that a well-crafted prenuptial agreement can provide a strong foundation for open communication and financial understanding between partners. This legal document, tailored to comply with California law, outlines the distribution of property, assets, and debts, and can also include terms for spousal support. Notably, the form must be entered into voluntarily, with full transparency and without any undue pressure, reflecting the shared values and goals of the couple. It stands as a testament to mutual respect and foresight, ensuring that both individuals have a clear understanding of their financial rights and responsibilities within the marriage.

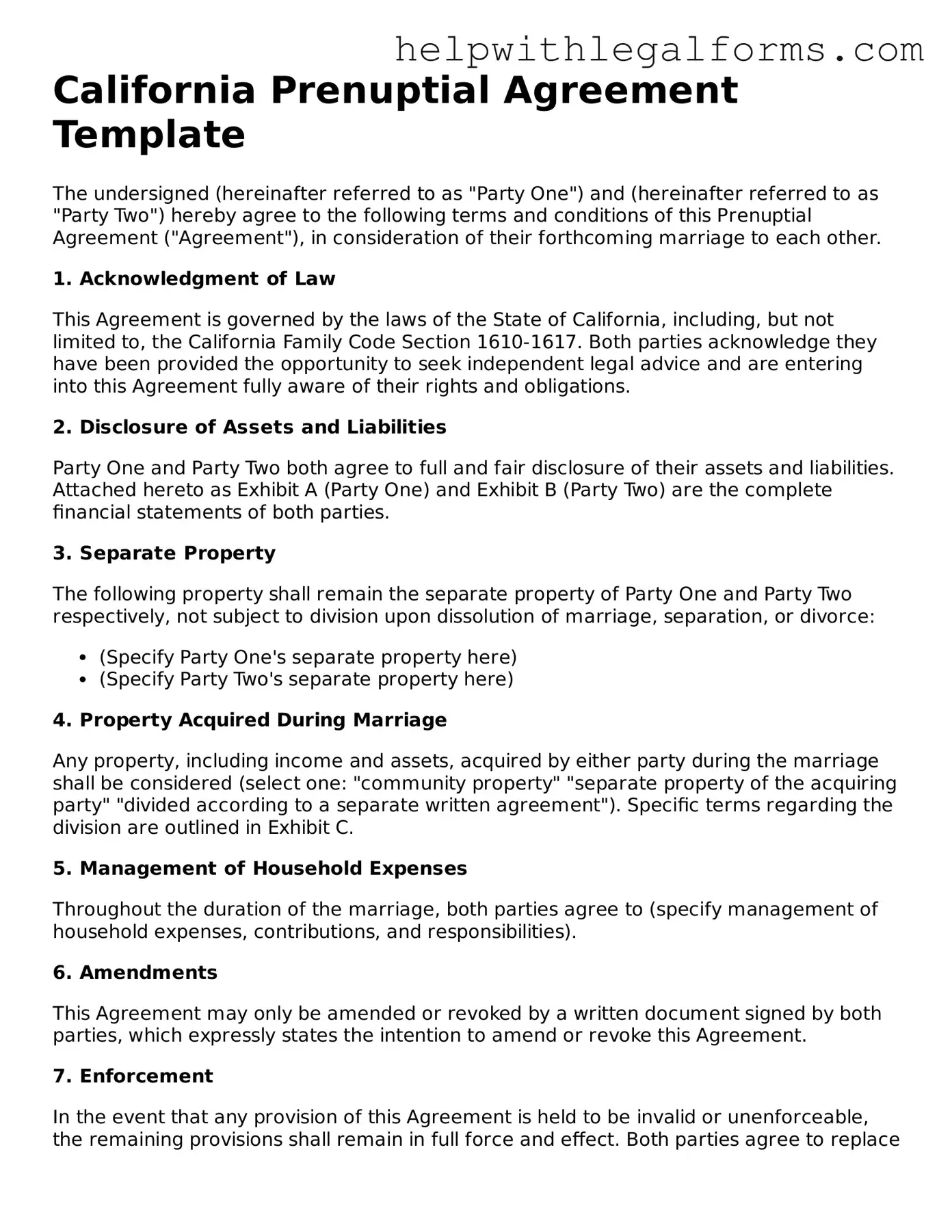

Example - California Prenuptial Agreement Form

California Prenuptial Agreement Template

The undersigned (hereinafter referred to as "Party One") and (hereinafter referred to as "Party Two") hereby agree to the following terms and conditions of this Prenuptial Agreement ("Agreement"), in consideration of their forthcoming marriage to each other.

1. Acknowledgment of Law

This Agreement is governed by the laws of the State of California, including, but not limited to, the California Family Code Section 1610-1617. Both parties acknowledge they have been provided the opportunity to seek independent legal advice and are entering into this Agreement fully aware of their rights and obligations.

2. Disclosure of Assets and Liabilities

Party One and Party Two both agree to full and fair disclosure of their assets and liabilities. Attached hereto as Exhibit A (Party One) and Exhibit B (Party Two) are the complete financial statements of both parties.

3. Separate Property

The following property shall remain the separate property of Party One and Party Two respectively, not subject to division upon dissolution of marriage, separation, or divorce:

- (Specify Party One's separate property here)

- (Specify Party Two's separate property here)

4. Property Acquired During Marriage

Any property, including income and assets, acquired by either party during the marriage shall be considered (select one: "community property" "separate property of the acquiring party" "divided according to a separate written agreement"). Specific terms regarding the division are outlined in Exhibit C.

5. Management of Household Expenses

Throughout the duration of the marriage, both parties agree to (specify management of household expenses, contributions, and responsibilities).

6. Amendments

This Agreement may only be amended or revoked by a written document signed by both parties, which expressly states the intention to amend or revoke this Agreement.

7. Enforcement

In the event that any provision of this Agreement is held to be invalid or unenforceable, the remaining provisions shall remain in full force and effect. Both parties agree to replace any invalid provision with a valid one which most closely represents the intentions of the parties.

8. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California, without regard to its conflict of law principles.

9. Signatures

This Agreement is entered into voluntarily, with full knowledge of its significance and intentions to be legally bound.

Party One's Name: ________________________________________

Party One's Signature: ____________________________________

Date: ___________________

Party Two's Name: ________________________________________

Party Two's Signature: ____________________________________

Date: ___________________

Exhibit A - Financial Statement of Party One

(Attach detailed financial statement here)

Exhibit B - Financial Statement of Party Two

(Attach detailed financial statement here)

Exhibit C - Division of Property Acquired During Marriage

(Specify terms here)

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The California Prenuptial Agreement form is governed by the California Family Code, Division 4, Part 5 (Premarital Agreements). |

| Full Disclosure Requirement | Parties must provide full and fair disclosure of their assets and liabilities to each other before signing the agreement. |

| Legal Representation | Each party has the right to independent legal representation, and it's highly recommended to ensure the agreement is enforceable. |

| Enforceability Conditions | The agreement must be in writing and signed by both parties to be enforceable. It cannot promote divorce or violate public policy. |

| Amendments and Revocation | Any amendments or revocation of the agreement must be in writing and signed by both parties. |

Instructions on How to Fill Out California Prenuptial Agreement

Stepping into marriage is a significant life event that combines both emotional and financial aspects of one's life. A California Prenuptial Agreement form is a tool that helps couples to clearly outline their financial rights and responsibilities before getting married. It's a practical step to manage expectations and prevent potential disputes in the future. Filling out this form might seem daunting, but by following these straightforward steps, the process will become much simpler and more manageable.

- Start by gathering all necessary financial information, including assets, liabilities, income, and expectations of inheritances or gifts. This ensures that the agreement is comprehensive and accurate.

- Both parties should carefully read the form to understand all the sections and what information is required. This understanding is crucial for accurately completing the form.

- Fill in the personal information for both parties. This typically includes full legal names, addresses, and dates of birth. Be sure to double-check the spelling and information accuracy.

- Detail the assets each party currently owns, including real estate, bank accounts, investments, and personal property. Be as specific as possible, providing values and descriptions.

- List any liabilities, such as loans, debts, or obligations, that either party may have. Again, specificity is key to providing a clear financial picture.

- Discuss and outline how property, assets, and debts will be handled during the marriage. This includes decisions on how future earnings, acquisitions, and debts will be managed.

- Agree upon any provisions for spousal support in the event of separation, divorce, or other partnership dissolutions.

- If there are any special agreements or conditions, such as business ownership, inheritance rules, or education expenses, make sure to include these details in the designated sections.

- Both parties must review the completed agreement, ensuring that it reflects their understanding and intentions accurately. It’s often recommended to review the document with legal counsel to ensure it meets all legal requirements.

- Once both parties agree to the terms, sign and date the agreement in the presence of a notary public. This formalizes the document, making it a legally binding contract.

- Keep the original signed agreement in a safe place, and consider making copies for each party to retain for their records.

Completing a California Prenuptial Agreement is a step toward open communication and financial understanding between partners. Although it requires effort and careful thought, its benefits can significantly impact the clarity and security of your financial relationship. Remember, this form is not just about protecting assets; it’s about starting your marriage with honesty, trust, and a strong foundation.

Crucial Points on This Form

What is a prenuptial agreement in California?

In California, a prenuptial agreement, often referred to as a "prenup," is a legal document that a couple signs before getting married. This agreement outlines how their assets and finances will be handled both during the marriage and in the event of a divorce. It can cover a wide range of matters, including property division, debt responsibility, and spousal support. The intention is to provide clarity and protect each person's interests, making it easier to resolve these issues if the marriage ends.

Who should consider getting a prenuptial agreement in California?

Any couple planning to marry in California might consider a prenuptial agreement, especially those entering the marriage with significant assets, debts, or children from previous relationships. It's also valuable for individuals who wish to protect their business interests or ensure that specific family heirlooms remain with certain family members. Essentially, if you have particular wishes about how your and your future spouse's finances and assets should be handled during marriage or upon divorce, a prenup might be right for you.

How can I ensure my prenuptial agreement is enforceable in California?

To ensure your prenuptial agreement is enforceable in California, it must be written, signed voluntarily by both parties, and notarized. Both individuals should have ample time to review the agreement with their own lawyers before signing to prevent claims of undue influence or unfairness. The agreement cannot contain any provisions that violate public policy or California law, such as waiving the right to child support. Full disclosure of assets and debts by both parties is also required, as concealment can render the agreement invalid.

Can a prenuptial agreement be modified or revoked after marriage?

Yes, in California, a prenuptial agreement can be modified or revoked after the marriage has taken place, but this must be done in writing. Both parties must agree to the changes or the revocation and sign the new document or amendment. As with the original agreement, it's wise to have legal representation review the modifications or revocation to ensure it remains enforceable and reflects both parties' intentions and best interests.

Common mistakes

When filling out the California Prenuptial Agreement form, many individuals can make errors that may impact the effectiveness of their agreement. Attention to detail and understanding of the form's requirements are crucial for a legally binding document. Here are five common mistakes:

-

Not disclosing all financial information completely. One of the most critical aspects of a prenuptial agreement is the full disclosure of all assets, liabilities, income, and expenses by each party. Failure to disclose or intentionally hiding assets can result in the agreement being invalidated.

-

Failing to read the agreement carefully. Sometimes, in the rush to complete the form, individuals do not thoroughly review every section. This oversight can lead to misunderstandings or unintended terms being included in the agreement.

-

Not obtaining independent legal advice. Both parties should seek independent legal advice before signing the agreement. This ensures that both have a clear understanding of the agreement's terms and implications. Agreements signed without independent legal advice can be challenged in court.

-

Using ambiguous language. The language used in the agreement should be clear, precise, and unambiguous. Ambiguous terms can lead to disputes and may result in the agreement not being enforced as intended.

-

Forgetting to sign or improperly executing the agreement. For a prenuptial agreement to be valid, it must be signed by both parties. Moreover, California law may require specific procedures for signing, such as the presence of witnesses or notarization. Ignoring these requirements can render the agreement invalid.

By avoiding these common mistakes, couples can ensure their prenuptial agreement in California is valid and enforceable. This agreement plays a crucial role in protecting each party's interests, so it's essential to approach it with care and diligence.

Documents used along the form

When preparing for marriage, a couple may decide to create a prenuptial agreement in California. This agreement can help protect each person's assets and clarify financial responsibilities during the marriage. However, the prenuptial agreement is just one of many documents that couples might consider as part of their financial and legal planning. Various other forms and documents can complement a prenuptial agreement, providing further clarity and legal protection for both parties. Here are ten commonly used documents with brief descriptions of their purposes:

- Will: A legal document that outlines how a person’s assets should be distributed after their death. Couples often update or create new wills to reflect their wishes post-marriage.

- Advance Health Care Directive: Specifies a person's healthcare preferences in case they become unable to make decisions for themselves. This includes appointing someone to make decisions on their behalf.

- Power of Attorney: Grants a designated person the authority to make financial or legal decisions for someone else, useful in scenarios where one might become incapacitated.

- Marital Settlement Agreement: Used in the event of divorce, this document outlines the terms of the separation, including asset division and alimony. While prenuptial agreements cover similar ground, marital settlement agreements are drafted at the time of divorce.

- Financial Affidavit: A sworn statement that details an individual's financial situation. This is often used in prenuptial agreement discussions to ensure full financial disclosure.

- Life Insurance Policy: Specifies beneficiaries in the event of one’s death. Couples often review and adjust their policies to reflect their marriage.

- Postnuptial Agreement: Similar to a prenuptial agreement but created after marriage, this document outlines how assets and responsibilities are handled during the marriage or in the event of a divorce.

- Property Deed: A legal document that conveys ownership of real estate. Couples purchasing property together, or one transferring property to both names, will require updated deeds.

- Business Ownership Agreements: If one or both partners own a business, agreements such as buy-sell or partnership agreements help dictate what happens to the business if circumstances change.

- Beneficiary Designations: Forms that specify beneficiaries for financial accounts and retirement plans, ensuring that assets are distributed as wished in the event of death.

Together, these documents can form a comprehensive legal and financial plan for couples, complementing a California prenuptial agreement by covering a broader range of scenarios and decisions. It's important for individuals to consult legal and financial professionals when drafting these documents to ensure they accurately reflect their wishes and comply with current laws.

Similar forms

A Postnuptial Agreement is similar to a Prenuptial Agreement, but it is entered into after a couple gets married rather than before. Both documents serve to outline the division of assets, debts, and provide for financial arrangements, should the marriage dissolve. The timing of the agreement is the primary difference.

A Co-habitation Agreement is similar to a Prenuptial Agreement in that it sets out the financial arrangements between parties living together. Though typically used by couples who are not married, it addresses many of the same issues such as asset division, responsibility for debts, and support obligations. The key difference lies in the legal recognition of the relationship status.

A Will is similar to a Prenuptial Agreement in that it specifies how a person's assets should be distributed in the event of their death. While a Prenuptial Agreement covers the distribution of assets upon the dissolution of marriage, a Will takes effect after one’s death. Both documents ensure personal wishes are honored regarding asset distribution.

A Trust is similar because it's another way to manage and protect assets, specifying how these should be handled or distributed, which is a central theme in Prenuptial Agreements. Trusts are set up during a person’s lifetime and can be utilized to distribute assets before or after death, without the requirements of probate, offering a level of privacy and control over one's financial legacy similar to a Prenuptial Agreement.

A Buy-Sell Agreement among business owners shares similarities with a Prenuptial Agreement as it outlines what happens to a partner’s share of the business if certain events occur, such as death, divorce, or departure. This kind of agreement specifies how a partner's interest in the business is handled, ensuring the business's continuity and stability, akin to how a Prenuptial Agreement seeks to manage assets and responsibilities within a marriage.

Dos and Don'ts

Prenuptial agreements are legal tools used by couples to outline the distribution of their assets and responsibilities before marriage. When filling out a California Prenuptial Agreement form, it is crucial to approach it with caution and precision to ensure that it holds up in court if ever needed. Here are some recommended dos and don’ts.

What to Do:

- Seek Independent Legal Advice: Both parties should have their own attorneys to ensure that their individual interests are represented and protected.

- Disclose All Assets and Liabilities: Full transparency is required. Both parties must disclose their complete financial situations including all assets, debts, and income.

- Understand Every Clause: It’s crucial that both parties fully understand the terms and conditions of the agreement. If something isn’t clear, ask for clarification.

- Consider Future Changes: Address how future events like parenthood, career changes, or inheritance will affect the agreement.

- Sign Well Before the Wedding: To avoid any implications of duress, sign the agreement well in advance of your wedding date.

- Keep the Agreement Fair and Reasonable: An agreement that heavily favors one side may be contested in court. Aim for fairness and reasonableness.

- Document and Notarize: Ensure the agreement is properly documented and notarized, as this adds an extra layer of legality and formality.

What Not to Do:

- Don’t Rush the Process: Give yourselves plenty of time to discuss, revise, and understand the agreement. Rushing can lead to oversights or imbalances.

- Don’t Hide Assets or Liabilities: Concealing assets or debts can result in the agreement being invalidated.

- Don’t Use Generic Templates Without Modification: Every couple’s situation is unique. A generic template may not cover your specific needs and could be contested.

- Don’t Forget to Update: As circumstances change, it’s important to review and possibly update your agreement to reflect your current situation.

- Don’t Include Personal Preferences: The agreement should focus on financial matters and not include personal preferences about non-financial marital issues.

- Don’t Skimp on Legal Advice: Trying to save on legal fees by not hiring a lawyer or not seeking proper legal counsel can result in a poorly drafted agreement.

- Don’t Ignore State Laws: State-specific laws can greatly impact prenuptial agreements. Failing to adhere to these can render the agreement void.

Misconceptions

When discussing the California Prenuptial Agreement form, several misconceptions often surface, leading to confusion and misunderstanding about its purposes, implications, and legal requirements. It's crucial to clear up these misconceptions to ensure parties entering into a prenuptial agreement do so with clarity and realistic expectations.

- All assets are split 50/50 if the marriage ends: A common misconception is that, in California, all assets are automatically divided evenly in the event of a divorce, regardless of what the prenuptial agreement stipulates. In reality, a well-crafted prenuptial agreement can set terms that differ significantly from California’s community property laws, allowing spouses to designate certain assets as separate property.

- Prenuptial agreements are only for the wealthy: This belief undermines the value of prenuptial agreements for people across all financial spectrums. While wealthy individuals may have more assets to protect, prenuptial agreements can also address debt allocation, inheritance issues, and financial responsibilities during the marriage, benefiting people at all income levels.

- Signing a prenup means you don't trust your partner: Rather than indicating a lack of trust, a prenuptial agreement can enhance a couple's understanding of each other’s fiscal views and expectations. It encourages open discussion about finances, a critical aspect of marital success, and offers an opportunity to address potential future financial disputes preemptively.

- You can include child support and custody arrangements: There's a false belief that prenuptial agreements can dictate child custody and support outcomes in the event of a divorce. However, California law is clear that child support and custody are determined based on the child's best interests at the time of the divorce, not preemptively in a prenuptial agreement.

- Prenuptial agreements are set in stone: Many think once a prenuptial agreement is signed, it cannot be modified or revoked. Contrary to this belief, spouses can alter or cancel their agreement anytime, as long as both parties agree to the changes in writing.

- Without a prenup, you will lose everything if the marriage ends: Some believe that without a prenuptial agreement, they are at risk of losing all their assets in a divorce. While it's true that California’s community property law divides marital property evenly, each party still retains their separate property acquired before the marriage or received as a gift or inheritance. Additionally, the courts consider various factors to ensure a fair distribution of marital assets.

Understanding these misconceptions is vital for any couple contemplating a prenuptial agreement in California. With accurate information, they can make informed decisions that reflect their values, protect their interests, and foster a stronger partnership.

Key takeaways

Filling out and using a California Prenuptial Agreement form is an important step for couples preparing for marriage. It serves as a mutual understanding about financial matters and assets before entering into marriage. Here are key takeaways to ensure that both parties benefit fairly and their rights are protected.

- Understand the legal requirements. California law, especially the Uniform Premarital Agreement Act, governs prenuptial agreements. Both parties must enter into this agreement voluntarily, with full and fair disclosure of all financial assets and liabilities. Therefore, it's critical to ensure that the form meets all state-specific legal standards and requirements for it to be enforceable.

- Seek independent legal advice. Both parties should have their own attorneys review the agreement before signing. This helps ensure that each person fully understands the terms and their implications. Independent legal advice can also safeguard against claims of undue influence or unfairness later on.

- Be meticulous with financial details. Full transparency is key in preparing a prenuptial agreement. Both parties must disclose all financial assets, liabilities, income, and expectations of gifts and inheritances. Leaving out information can not only undermine the trust between partners but also potentially render the agreement invalid or unenforceable.

- Consider future changes. Life circumstances, such as having children, changes in career, or health issues, may impact the couple's financial situation and the fairness or applicability of the prenuptial agreement terms. It's wise to include provisions for revisiting and, if necessary, amending the agreement to reflect significant changes.

- Understand its limitations. While a prenuptial agreement can cover a wide range of financial aspects, including property division and spousal support in the event of divorce or death, there are limitations. For instance, it cannot dictate terms regarding child support or custody. Familiarizing oneself with these limitations can prevent misunderstandings and unrealistic expectations.

Taking these key points into consideration can significantly contribute to the effectiveness and enforceability of a California Prenuptial Agreement. Both parties' interests are better protected when they approach this document thoughtfully and with careful planning, ensuring a solid foundation for their future together.

Create Other Prenuptial Agreement Forms for US States

Oklahoma Prenup - Not only for the wealthy; it is a practical step for anyone wanting to clarify financial rights and responsibilities.

New Jersey Prenup - Marriage under certain financial terms can be particularly reassuring for couples entering a second or subsequent marriage.