Blank Prenuptial Agreement Form for Florida

Engaging in discussions about a Florida Prenuptial Agreement form might feel overwhelming for couples planning to marry, yet it stands as a crucial tool for managing financial affairs and protecting assets before entering into marriage. This legal document allows both parties to outline their financial rights and responsibilities during the marriage and, if necessary, establish the distribution of assets and debt in the event of divorce or death. In Florida, as in other states, there are specific legal requirements and considerations that must be met for a prenuptial agreement to be enforceable. This includes full disclosure of assets, a demonstration that the agreement was entered into voluntarily by both parties, and assurance that the terms are not unconscionably unfair at the time of execution. Crafting a Florida Prenuptial Agreement is a thoughtful process that requires careful consideration of current circumstances and future possibilities, offering couples a way to create a strong foundation for their partnership with clarity and transparency about their financial relationship.

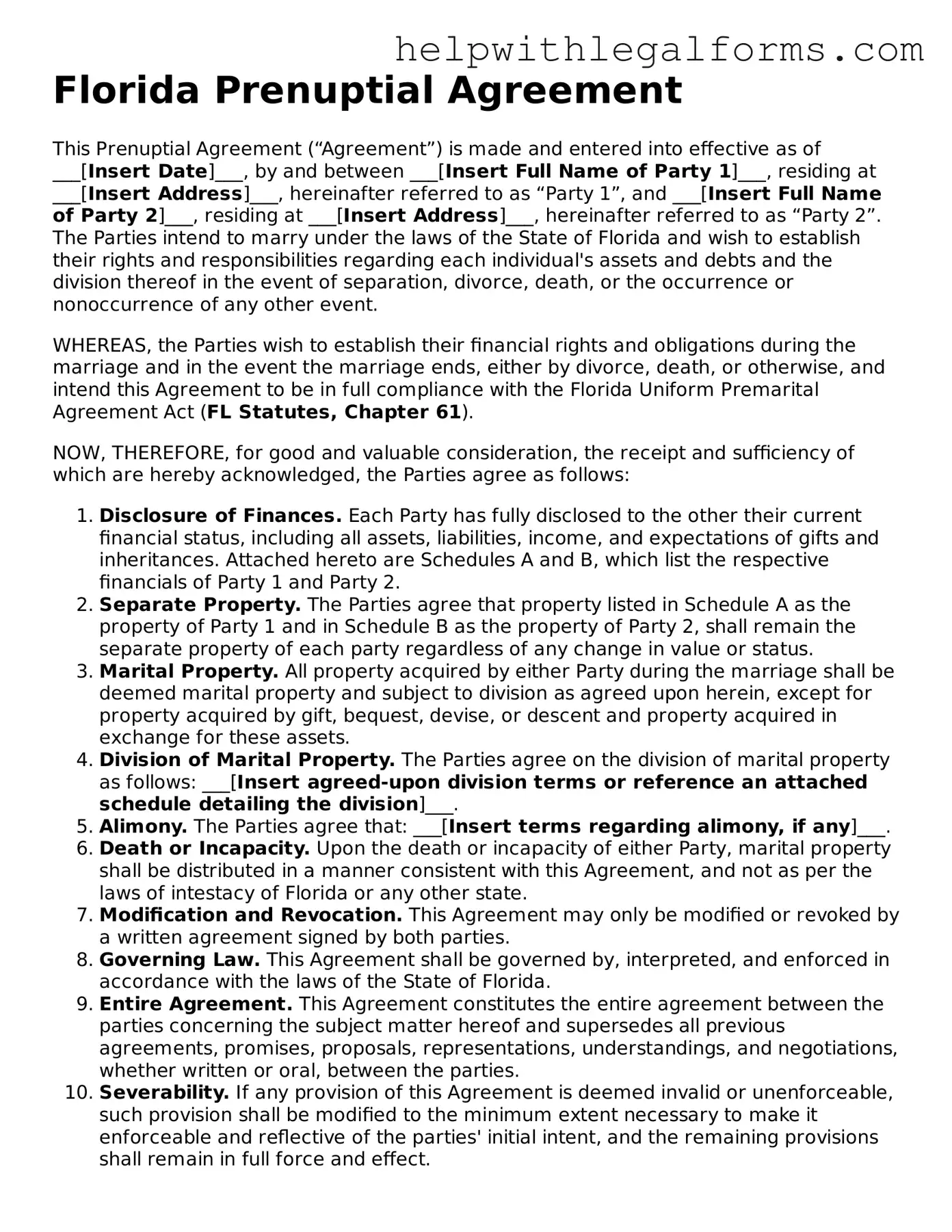

Example - Florida Prenuptial Agreement Form

Florida Prenuptial Agreement

This Prenuptial Agreement (“Agreement”) is made and entered into effective as of ___[Insert Date]___, by and between ___[Insert Full Name of Party 1]___, residing at ___[Insert Address]___, hereinafter referred to as “Party 1”, and ___[Insert Full Name of Party 2]___, residing at ___[Insert Address]___, hereinafter referred to as “Party 2”. The Parties intend to marry under the laws of the State of Florida and wish to establish their rights and responsibilities regarding each individual's assets and debts and the division thereof in the event of separation, divorce, death, or the occurrence or nonoccurrence of any other event.

WHEREAS, the Parties wish to establish their financial rights and obligations during the marriage and in the event the marriage ends, either by divorce, death, or otherwise, and intend this Agreement to be in full compliance with the Florida Uniform Premarital Agreement Act (FL Statutes, Chapter 61).

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

- Disclosure of Finances. Each Party has fully disclosed to the other their current financial status, including all assets, liabilities, income, and expectations of gifts and inheritances. Attached hereto are Schedules A and B, which list the respective financials of Party 1 and Party 2.

- Separate Property. The Parties agree that property listed in Schedule A as the property of Party 1 and in Schedule B as the property of Party 2, shall remain the separate property of each party regardless of any change in value or status.

- Marital Property. All property acquired by either Party during the marriage shall be deemed marital property and subject to division as agreed upon herein, except for property acquired by gift, bequest, devise, or descent and property acquired in exchange for these assets.

- Division of Marital Property. The Parties agree on the division of marital property as follows: ___[Insert agreed-upon division terms or reference an attached schedule detailing the division]___.

- Alimony. The Parties agree that: ___[Insert terms regarding alimony, if any]___.

- Death or Incapacity. Upon the death or incapacity of either Party, marital property shall be distributed in a manner consistent with this Agreement, and not as per the laws of intestacy of Florida or any other state.

- Modification and Revocation. This Agreement may only be modified or revoked by a written agreement signed by both parties.

- Governing Law. This Agreement shall be governed by, interpreted, and enforced in accordance with the laws of the State of Florida.

- Entire Agreement. This Agreement constitutes the entire agreement between the parties concerning the subject matter hereof and supersedes all previous agreements, promises, proposals, representations, understandings, and negotiations, whether written or oral, between the parties.

- Severability. If any provision of this Agreement is deemed invalid or unenforceable, such provision shall be modified to the minimum extent necessary to make it enforceable and reflective of the parties' initial intent, and the remaining provisions shall remain in full force and effect.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the first date written above.

_______________________________ _______________________________

Signature of Party 1 Signature of Party 2

State of Florida

County of ________

This document was acknowledged before me on ___[Insert Date]___ by ___[Insert Names of Both Parties]___, who is personally known to me or has produced identification as evidence.

_______________________________

Notary Public

My commission expires: ________

PDF Form Attributes

| Fact Number | Detail |

|---|---|

| 1 | Florida prenuptial agreements are governed by the Florida Family Law Rules of Procedure and the Florida Statutes, Chapter 61. |

| 2 | The agreement must be in writing and signed by both parties to be valid. |

| 3 | It can include provisions for division of property, alimony, and other financial matters in the event of a divorce or death of one of the parties. |

| 4 | Both parties must enter into the agreement voluntarily and without any coercion or undue influence. |

| 5 | Full and fair disclosure of all assets and liabilities by both parties is required for the agreement to be enforceable. |

| 6 | Each party is advised to have their own attorney review the agreement before signing. |

| 7 | The agreement becomes effective upon marriage. |

| 8 | It can only be amended or revoked in a writing signed by both parties after the marriage. |

| 9 | Florida courts will generally uphold a prenuptial agreement unless it was signed under fraud, duress, or if it's deemed unconscionable. |

Instructions on How to Fill Out Florida Prenuptial Agreement

A prenuptial agreement in Florida is a practical step for couples looking to outline the management of their financial affairs before marriage. As personal situations and state laws can be intricate, adopting the correct approach towards filling out this agreement ensures that all considerations regarding property, debts, and future earnings are appropriately addressed. Preparing this document requires meticulous attention to detail and a comprehensive understanding of both parties' assets and liabilities. The following steps are designed to guide you through the preparation process of a Florida Prenuptial Agreement form, aiding in the safeguarding of personal interests and facilitating a mutual understanding between partners.

- Begin by gathering all necessary financial documentation for both parties, including bank statements, mortgages, loan documents, and investment accounts. This thorough examination provides a solid foundation for discussions.

- Next, download or obtain the official Florida Prenuptial Agreement form from a reliable legal source to ensure compliance with state laws.

- Fill in the full legal names of both parties entering into the agreement, making sure to double-check the spelling and order of names as they appear on official identifications.

- Specify the date of the marriage ceremony. If the exact date has not been determined, provide an approximate timeframe for when the marriage is to take place.

- Detail all separate property owned by each individual, including real estate, financial assets, and personal property. Be as precise and exhaustive as possible to prevent future disputes.

- Clarify the handling of debts both current and future. This section should cover how debts incurred before and during the marriage will be managed and allocated between the two parties.

- Determine how future earnings will be treated within the marriage, including income, inheritances, or gifts received by either party.

- Outline any provisions for spousal support or alimony in the event of separation, divorce, or death. It is crucial to adhere to Florida's legal standards to ensure these provisions are enforceable.

- Decide upon the division of property and financial assets in case the marriage ends. Include criteria for division, taking into account contributions and acquisitions during the marriage period.

- Both parties should review the agreement in detail, preferably with separate legal counsel, to ensure understanding and agreement on all terms.

- Sign the document in the presence of a notary public. Both parties must sign the prenuptial agreement voluntarily, and their signatures must be witnessed and notarized to be valid under Florida law.

- Keep multiple copies of the signed agreement in a safe place where both parties can access them if needed. It's advisable to also share a copy with your legal advisors.

Completing the Florida Prenuptial Agreement form is a significant step that requires careful consideration and honesty from both individuals. It's a proactive approach to marriage that can mitigate future financial conflicts, ensuring that both parties enter into their union with clarity and confidence. By following the listed steps, couples can create a solid contractual foundation that respects their individual needs and preferences while complying with Florida law.

Crucial Points on This Form

What is a Florida Prenuptial Agreement?

A Florida Prenuptial Agreement is a legal document that couples enter into before they get married. This agreement outlines how assets and finances will be handled during the marriage and in the event of a divorce. It ensures both parties agree on the division of property, debts, and other financial responsibilities to prevent disputes in the future.

Who should consider signing a Prenuptial Agreement in Florida?

Prenuptial agreements are often considered by individuals who have significant assets, owe debts, have children from previous relationships, or anticipate receiving inheritances. They are beneficial for anyone who wants to protect their financial interests and ensure clarity and fairness in managing assets and responsibilities within the marriage.

What types of provisions can be included in a Florida Prenuptial Agreement?

Common provisions in a Florida Prenuptial Agreement include the division of property and debts, alimony or spousal support terms, and the rights to each party’s financial gains during the marriage. It can also outline how assets will be handled in the case of a spouse's death. However, it cannot negatively affect child support obligations or decide child custody issues in advance.

How can someone ensure their Florida Prenuptial Agreement is legally enforceable?

To ensure a Prenuptial Agreement is legally enforceable in Florida, both parties must fully disclose their financial information, enter into the agreement voluntarily without coercion, and have the agreement in writing. It is advisable for each person to have their lawyer review the agreement to ensure it meets all legal requirements and properly reflects their wishes.

Can a Prenuptial Agreement in Florida be modified or terminated?

Yes, a Prenuptial Agreement in Florida can be modified or terminated, but this must be done with the agreement of both parties. Any changes or the termination itself must be in writing and signed by both parties, following the same formality as the original agreement. It's recommended to consult a lawyer when making modifications to ensure that the new terms are enforceable.

Common mistakes

Filling out a prenuptial agreement in Florida requires careful attention to detail and an understanding of legal principles. However, many individuals navigating this process encounter common pitfalls. Here are four mistakes frequently made when completing the Florida Prenuptial Agreement form:

-

Not Seeking Legal Advice: One of the most significant mistakes is proceeding without consulting a lawyer. Each party should seek independent legal advice to ensure they fully understand their rights and the implications of the agreement. Without this guidance, individuals may unknowingly waive rights or agree to terms that are not in their best interest.

-

Omitting Full Disclosure: A prenuptial agreement is only valid if both parties provide a complete and honest disclosure of their assets and liabilities. Failure to do so can lead to the agreement being challenged or invalidated. It is crucial to list all assets, liabilities, income, and expectations of gifts and inheritances.

-

Using Vague Language: The terms outlined in the agreement must be clear and specific. Ambiguous language can result in disputes and potential legal battles in the future. It is essential to accurately describe the distribution of assets, responsibilities, and any other conditions in precise terms.

-

Ignoring Future Changes: Life circumstances can change dramatically. Failing to account for future events, such as the birth of children, inheritances, changes in financial status, or changes in state law, can render parts of the agreement ineffective or unfair. Provisions for modifying the agreement should be included to address how future changes will be handled.

When completing a prenuptial agreement, thoroughness, clarity, and foresight are paramount. By avoiding these mistakes, parties can contribute to a stronger, fairer agreement that respects the interests and intentions of both individuals.

Documents used along the form

When couples decide to marry in Florida, they often consider creating a prenuptial agreement. This legal document helps them define their financial rights and responsibilities during the marriage and in the event of a divorce. However, a prenuptial agreement is rarely the only document couples might need to secure their financial and legal affairs. Several other forms and documents often complement a Florida prenuptial agreement, ensuring comprehensive coverage of all necessary aspects. Let’s look at some of these crucial documents.

- Marriage License Application: Required for the legal recognition of a marriage in Florida, it’s the first step before any agreement can take effect.

- Will: Outlines how an individual’s assets will be distributed upon their death, ensuring that intentions in the prenuptial agreement are mirrored in their estate planning.

- Revocable Living Trust: Allows individuals to manage their assets during their lifetime and specify how these assets should be distributed after their death, potentially offering a seamless transition that a prenuptial agreement might reference.

- Durable Power of Attorney: Empowers a designated person to make financial and legal decisions on one’s behalf, crucial for scenarios not covered by the prenuptial agreement.

- Designation of Health Care Surrogate: Similar to a power of attorney, but for making healthcare decisions, ensuring a spouse or a chosen individual has the authority to make critical health decisions.

- Living Will: Specifies one’s wishes regarding medical treatment in circumstances where they are unable to communicate their decisions, working alongside the prenuptial agreement to cover unforeseen health crises.

- Postnuptial Agreement: Similar to a prenuptial agreement but executed after marriage. Couples might opt for this document to update or amend agreements made before marriage.

- Financial Affidavit: A sworn statement detailing an individual’s financials. It can be essential for the transparency required in prenuptial agreements, especially if there are significant changes to assets or liabilities.

- Change of Beneficiary Forms: Required to update beneficiaries on insurance policies, retirement accounts, and other accounts as agreed upon in the prenuptial agreement.

- Property Deeds: Legal documents that transfer property ownership. They may need to be updated to reflect the agreements made in a prenuptial regarding property acquisition and ownership.

In addition to a Florida prenuptial agreement, these documents provide a comprehensive framework for couples to manage their legal and financial affairs before and during their marriage. Each serves a specific purpose, ensuring that all aspects of a couple's life together are accounted for and protected according to their wishes. It’s always advisable to consult with a legal professional when preparing these documents to ensure they are executed correctly and reflect the couple's intentions accurately.

Similar forms

Postnuptial Agreement: Similar to a prenuptial agreement, a postnuptial agreement is drafted and signed after the marriage has taken place. It also outlines how assets, debts, and financial matters should be handled in the event of a divorce, much like a prenuptial agreement, but under the condition that the couple is already married.

Living Together (Cohabitation) Agreement: This document serves a similar purpose for couples who live together but are not married. It outlines how assets and finances are to be managed during the relationship and details the division of property should the relationship end, reflecting the financial arrangements aspects of a prenuptial agreement.

Last Will and Testament: While primarily used for estate planning purposes, a last will and testament shares similarities with a prenuptial agreement in that it specifies how assets are to be distributed upon one's death. A prenuptial agreement might influence or be influenced by what is included in a will, especially regarding assets acquired before the marriage.

Divorce Settlement Agreement: This document is created during the divorce process and outlines how assets, debts, custody, and support issues are resolved. Similar to a prenuptial agreement, it seeks to resolve financial and asset division matters, but it is drafted at the end of a marriage rather than the beginning.

Financial Affidavit: Often used in family law disputes such as divorce or child support cases, a financial affidavit documents an individual's financial standing. It shares a common goal with prenuptial agreements of disclosing financial assets and debts, though its application is generally in a dispute resolution context.

Property Settlement Agreement: In a divorce, this agreement details the division of property between spouses. It is similar to a prenuptial agreement in that it addresses the distribution of assets, but it is specifically tailored for situations where the marriage is being dissolved.

Marriage Separation Agreement: This contract outlines the terms by which a married couple agrees to live separately. While it covers common subjects found in a prenuptial agreement such as asset division and support matters, it is created to establish terms for a separation rather than preemptively addressing a potential divorce.

Trust Agreement: Although primarily used for estate planning to manage assets during one's lifetime and after death, a trust agreement can dovetail with a prenuptial agreement in handling assets. Both may specify how certain assets are to be managed or distributed, protecting those assets in a manner that reflects the intentions of the parties involved.

Life Insurance Trust: This specific type of trust agreement holds a life insurance policy within a trust as opposed to individual ownership. Its connection to a prenuptial agreement lies in its capability to specify how life insurance proceeds are to be distributed, potentially complementing a prenuptial agreement's provisions for asset distribution.

Dos and Don'ts

When preparing a Florida Prenuptial Agreement, both parties must be fully aware of their rights and the document's implications. Below are essential do's and don'ts to ensure the process goes smoothly and legally.

Do:Ensure full transparency.

Seek independent legal advice.

Disclose all assets, liabilities, and income.

Allow adequate time for consideration.

Regularly review and update the agreement.

Ensure the agreement is notarized.

Sign without understanding every term.

Include personal preferences and trivial matters.

Pressure or coerce the other party into signing.

Forget to consider the implications of state laws.

Assume it's only beneficial for the wealthier party.

Neglect proper legal procedure or formalities.

Following these guidelines can help protect both parties and ensure the prenuptial agreement stands up in court if ever challenged.

Misconceptions

When it comes to preparing for marriage in Florida, a prenuptial agreement is an important document that can help protect both parties' interests. However, there are several misconceptions surrounding the Florida prenuptial agreement form. Here are five common myths debunked to give you a clearer understanding of its purpose and provisions.

Only for the Wealthy: Many believe that prenuptial agreements are only necessary for those with substantial assets. This is not true. Couples of all financial backgrounds can benefit from a prenuptial agreement as it allows them to define their financial rights and responsibilities during the marriage and in the event of a divorce or death.

Prenups Cause Trust Issues: Another misconception is that suggesting a prenuptial agreement implies a lack of trust between partners. In reality, discussing a prenup can strengthen a relationship by encouraging open and honest communication about finances and expectations.

They Are Inflexible: Some people assume that once a prenuptial agreement is signed, it cannot be changed. However, these agreements can be modified or revoked at any time, as long as both parties agree to the changes in writing.

They Only Protect the Wealthier Partner: There's a common belief that prenuptial agreements only protect the interests of the wealthier spouse. This isn't accurate. A well-drafted prenup protects both individuals by specifying what is considered marital or separate property and how assets and debts will be divided.

Prenups Cover Child Support and Custody: Many think that prenuptial agreements can dictate child support and custody arrangements. In Florida, this is not the case. By law, child support and custody are determined based on the child's best interests at the time of the divorce, not prearranged in a prenup.

Understanding these misconceptions can help couples approach prenuptial agreements with a balanced perspective, recognizing them as a valuable tool for future financial planning and protection.

Key takeaways

When couples in Florida decide to marry, a prenuptial agreement can help protect their financial interests and outline the distribution of assets and debts in the event of a divorce or death. Understanding the key aspects of filling out and using the Florida Prenuptial Agreement form is crucial. Here are seven essential takeaways:

- Both parties should enter into the agreement voluntarily. Coercion or duress can render the agreement invalid.

- Full disclosure is critical. Both individuals must fully and accurately disclose their assets, liabilities, income, and expenses. Failure to do so could result in the agreement being set aside by a court.

- The agreement should be in writing. Oral prenuptial agreements are not recognized in Florida, making a properly executed document essential.

- Secure independent legal counsel for each party. This helps ensure that both individuals understand the agreement's terms and the rights they may be waiving.

- The agreement must be fair. While "fairness" can be subjective, an egregiously one-sided agreement could be challenged and potentially invalidated.

- Consider future changes in circumstances. The agreement can include provisions for changes in financial situations, such as the acquisition of assets or changes in income.

- The agreement must be signed before the wedding. For a prenuptial agreement to be valid in Florida, it must be executed (signed) before the marriage takes place.

By keeping these points in mind, couples can create a Florida Prenuptial Agreement that protects both parties' interests and stands up to legal scrutiny. Ensuring that the agreement is carefully drafted and reflective of both parties' intentions is fundamental to its effectiveness and enforceability.

Create Other Prenuptial Agreement Forms for US States

Texas Prenup - It serves to protect the financial interests of both parties, creating a sense of fairness and security.

Colorado Prenup - Understanding and signing a prenuptial agreement can significantly contribute to a stronger, more transparent marital relationship.

Maryland Prenup - A prenuptial agreement isn't just for the wealthy; it's a wise consideration for anyone wanting to define their financial relationship and expectations clearly.

Georgia Prenup - It is not just for the wealthy; it's a wise choice for anyone who wants to manage their financial matters smartly in a marriage.