Blank Prenuptial Agreement Form for New York

In the bustling streets of New York, where ambitions soar as high as the skyscrapers and life moves at a breakneck speed, the concept of marriage merges traditional love with modern practicality. In this context, the New York Prenuptial Agreement form stands as a testament to the latter, offering couples a way to define their financial future before tying the knot. This forward-thinking document, often seen through the lens of wealth protection, encompasses far more than just the preservation of assets. It serves as a platform for couples to communicate openly about their financial views and expectations, thereby fortifying their relationship against unforeseen financial disputes. Specifically, the form addresses the division of property, details regarding spousal support, and, importantly, adheres to New York's unique legal requirements, ensuring that the agreement is not only comprehensive but also legally binding. As couples navigate the complexities of merging their lives, this agreement acts not only as a safeguard but also as a blueprint for a harmonious partnership, underscoring the importance of preparedness in both love and finance.

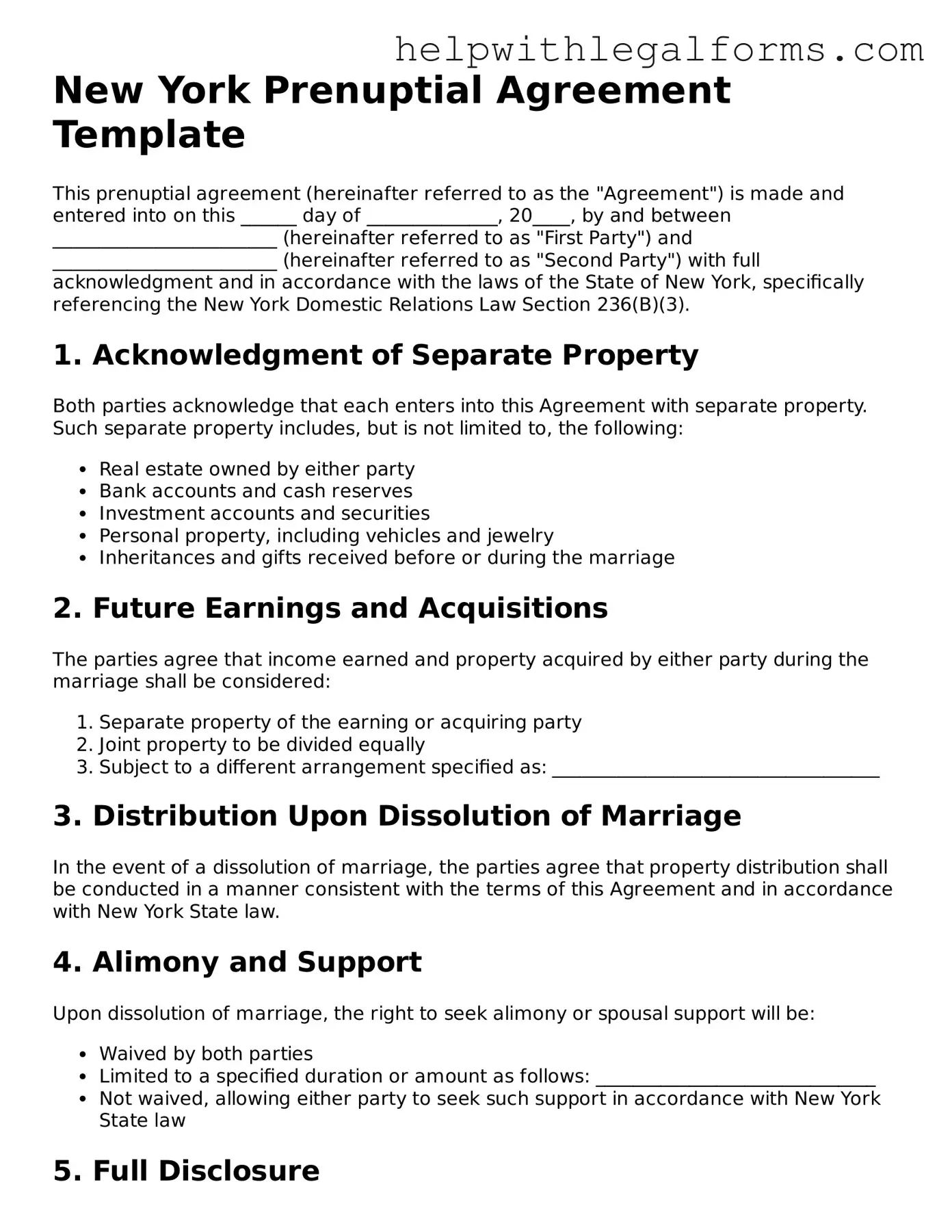

Example - New York Prenuptial Agreement Form

New York Prenuptial Agreement Template

This prenuptial agreement (hereinafter referred to as the "Agreement") is made and entered into on this ______ day of ______________, 20____, by and between ________________________ (hereinafter referred to as "First Party") and ________________________ (hereinafter referred to as "Second Party") with full acknowledgment and in accordance with the laws of the State of New York, specifically referencing the New York Domestic Relations Law Section 236(B)(3).

1. Acknowledgment of Separate Property

Both parties acknowledge that each enters into this Agreement with separate property. Such separate property includes, but is not limited to, the following:

- Real estate owned by either party

- Bank accounts and cash reserves

- Investment accounts and securities

- Personal property, including vehicles and jewelry

- Inheritances and gifts received before or during the marriage

2. Future Earnings and Acquisitions

The parties agree that income earned and property acquired by either party during the marriage shall be considered:

- Separate property of the earning or acquiring party

- Joint property to be divided equally

- Subject to a different arrangement specified as: ___________________________________

3. Distribution Upon Dissolution of Marriage

In the event of a dissolution of marriage, the parties agree that property distribution shall be conducted in a manner consistent with the terms of this Agreement and in accordance with New York State law.

4. Alimony and Support

Upon dissolution of marriage, the right to seek alimony or spousal support will be:

- Waived by both parties

- Limited to a specified duration or amount as follows: ______________________________

- Not waived, allowing either party to seek such support in accordance with New York State law

5. Full Disclosure

Both parties affirm that they have provided a full disclosure of their assets and liabilities to the other party. A detailed description of disclosed assets and liabilities is attached hereto as Exhibit A and Exhibit B, respectively.

6. Amendment and Revocation

This Agreement may only be amended, revoked, or terminated by a written document signed by both parties. Any changes to this Agreement must also be made in writing and signed by both parties to be valid.

7. Governing Law

This Agreement shall be governed by and interpreted in accordance with the laws of the State of New York.

8. Signatures

This Agreement is signed willingly and voluntarily by both parties, with a full understanding of its terms and effects, on the dates and at the places specified below:

First Party Signature: _______________________________ Date: _________________

Second Party Signature: _____________________________ Date: _________________

Witness Signature: ___________________________________ Date: _________________

PDF Form Attributes

| Fact | Detail |

|---|---|

| Governing Law | Domestic Relations Law Section 236(B)(3) |

| Function | Outlines financial rights and responsibilities during and after marriage |

| Requirements for Validity | Must be in writing, signed by both parties, and notarized |

| Scope of Agreement | Can include property division, spousal support, and inheritance, but not child support or custody |

Instructions on How to Fill Out New York Prenuptial Agreement

Filling out a New York Prenuptial Agreement form is a significant step for engaged couples. It's a forward-thinking move designed to clarify financial matters and protect assets before entering into marriage. While it may not be the most romantic venture, it's practical and can save a lot of potential stress down the line. To ensure everything is set properly, make sure to follow each step closely. The following instructions will guide you through the process, helping you complete the form with confidence.

- Begin by gathering all necessary information. This includes both partners' full legal names, addresses, dates of birth, and a comprehensive list of individual assets, debts, and financial obligations.

- Download or obtain a copy of the New York Prenuptial Agreement form. Make sure it's the latest version to ensure compliance with current state laws.

- Read the entire form first before filling anything out. This will give you a full understanding of what information is required and where it needs to be filled in.

- Fill in the personal information section for both parties. This includes names, addresses, and any other identifying information the form requests.

- Detail each party's assets, liabilities, and income. Be thorough and accurate. Attach additional pages if necessary, ensuring they are signed and dated.

- Discuss and decide on how property will be managed during the marriage, including earnings, property acquisition, and management of debts. Record these decisions in the designated section of the form.

- If applicable, outline how assets and liabilities will be handled in the case of divorce or death. This part is crucial for clarifying expectations and plans.

- Review the agreement together. Make sure both parties understand and agree to all the terms laid out in the document. Consider consulting with legal counsel to ensure the agreement’s terms are fair and enforceable under New York law.

- Have both parties sign and date the form in the presence of a notary public. Notarization is an essential step for the agreement to be legally binding.

- Store the completed agreement in a safe place. Both parties should keep a copy, and consider having a digital copy for backup.

Completing a New York Prenuptial Agreement requires attention to detail and a clear understanding between partners. Throughout the process, maintain open communication to ensure that the agreement reflects both parties' wishes and interests. Remember, this document is designed to offer peace of mind and clarity as you move forward into marriage. It is not a reflection of trust issues but a smart financial planning tool.

Crucial Points on This Form

What is a New York Prenuptial Agreement?

A New York Prenuptial Agreement is a legal document that couples sign before getting married. This agreement outlines the management of financial matters, property division, and future support in the event of a divorce or separation. It serves to protect individual assets and reduce conflicts should the marriage end.

Who should consider signing a Prenuptial Agreement in New York?

Couples who wish to clearly define their financial rights and responsibilities during marriage often consider a Prenuptial Agreement. It's particularly advisable for individuals entering the marriage with significant assets, debts, or children from previous relationships. Understanding and agreeing upon these matters beforehand can prevent difficulties and legal battles later on.

Are there any requirements for a Prenuptial Agreement to be valid in New York?

To be considered valid in New York, a Prenuptial Agreement must be in writing and signed by both parties. It requires full disclosure of each party's financial situation at the time of signing. Additionally, the agreement must be executed voluntarily, without pressure or deceit, and it must be notarized. It's also important for the agreement to be fair and not so one-sided at the time of signing that it could be deemed unconscionable.

Can a New York Prenuptial Agreement cover child support or custody issues?

While a Prenuptial Agreement can address financial provisions for children from a previous relationship, it cannot legally dictate terms for child support or custody of future children. Decisions about child support and custody are determined by the courts at the time of divorce, based on the child's best interests.

Is it necessary to have a lawyer when creating a New York Prenuptial Agreement?

While not strictly necessary, it's highly recommended that each party seeks independent legal advice when drafting a Prenuptial Agreement. A lawyer can help ensure that the agreement is fair, comprehensible, and enforceable under New York law. Legal advice can also help protect individual rights and clarify the legal implications of the agreement.

Common mistakes

When filling out the New York Prenuptial Agreement form, people often make several common mistakes. These errors can range from minor oversights to significant legal missteps that may affect the enforceability of the agreement. Understanding these mistakes can help individuals prepare a more accurate and legally sound document.

Not fully disclosing all assets and liabilities. Transparency is key in these agreements.

Failing to obtain independent legal advice. Each party should have their own lawyer.

Using unclear or ambiguous language which can lead to misinterpretations.

Forgetting to update the agreement as financial situations change over time.

Not considering the impact of state laws on the agreement. New York law has specific requirements.

Signing without understanding all the terms. It is crucial to comprehend what is agreed upon.

Omitting a provision for spousal support, which may be necessary depending on the circumstances.

Making these mistakes can significantly impact the effectiveness and enforceability of a prenuptial agreement. Parties should take care to ensure that their agreement is completed correctly and reflects their wishes accurately.

Documents used along the form

When entering into a prenuptial agreement in New York, couples often gather various documents to ensure a comprehensive understanding of each party's assets and obligations. This preparation not only facilitates transparency but also helps in tailoring the agreement to best suit the couple's unique circumstances. The following documents, often used alongside a New York prenuptial agreement, play a crucial role in creating a foundation for honest discussions and informed decisions about the future.

- Financial Statements: Detailed reports of each person’s current financial status, showcasing assets, liabilities, income, and expenses. These are pivotal in outlining what will be considered separate property and what may be marital property.

- Business Valuation Reports: For those owning businesses, these reports assess the company's value. They're instrumental in determining how a business will be regarded within the prenup.

- Real Estate Appraisals: Documents providing the value of real property owned by either party. These appraisals are essential for deciding how real estate will be handled in the agreement.

- Debt Statements: Overviews of any debts that each individual may have, including but not limited to credit card debt, loans, and mortgages. Understanding debts is crucial as it affects decisions on financial responsibilities.

- Estate Planning Documents: Including wills, trusts, and estate plans, these documents can offer insights on each party’s intentions for their assets, possibly syncing or affecting prenup terms.

- Insurance Policies: Life, health, and property insurance documents that may need coordination with the terms of the prenuptial agreement to ensure adequate protection and designations conform to the couple's wishes.

- Investment Records: Information on stocks, bonds, retirement accounts, and other investments that can affect asset division and future financial planning within the marriage.

- Previous Divorce Decrees: For those who have been married before, these documents highlight past marital financial resolutions that could impact the new prenuptial agreement.

- Tax Returns: Recent tax return documents provide a clear picture of each individual’s financial history and earnings. This is beneficial for a full disclosure of finances.

Gathering these documents is a step toward thorough preparation for a prenuptial agreement. Each couple’s situation is unique, and therefore, the relevance of different documents can vary. However, having a complete set of these documents can illuminate the financial landscape of both parties. This illumination not only ensures that the prenuptial agreement is fair and equitable but also helps in building mutual trust and understanding before marriage. Engaging in this process thoughtfully and meticulously can lay a strong foundation for a future together, built on clarity and mutual respect.

Similar forms

Postnuptial Agreement: Similar to a Prenuptial Agreement, but it's executed after a couple gets married rather than before. Both documents outline how assets and liabilities should be handled during the marriage and in the event of divorce, separation, or death.

Will: Like a Prenuptial Agreement, a Will specifies how an individual’s assets are to be distributed upon their death. Though focusing on post-mortem asset distribution, both documents help manage assets and ensure they are allocated according to an individual’s wishes.

Trust: A Trust manages the distribution of a person’s assets by transferring its benefits and obligations to different parties. Similar to a Prenuptial Agreement, it can protect assets and dictate specific terms for asset management and distribution.

Financial Power of Attorney: This document grants someone authority to handle your financial affairs if you become unable to do so. Like a Prenuptial Agreement, it involves forward planning regarding assets, but it focuses on management rather than distribution upon personal events.

Living Will: While a Prenuptial Agreement deals with financial and asset-related decisions, a Living Will expresses wishes regarding medical treatment if one becomes incapacitated. Both types of documents allow an individual to make crucial decisions in advance, affecting their future and welfare.

Dos and Don'ts

Filling out a prenuptial agreement in New York is a critical step for couples planning to marry, aiming to outline the handling of financial matters and assets in the event of a divorce or death. Below are ten essential dos and don'ts to guide you through the process efficiently and effectively.

Dos:

- Do engage in open and honest communication with your partner about your financial situations and expectations regarding the agreement.

- Do hire separate legal counsel to ensure both parties' interests are represented fairly and to reinforce the enforceability of the agreement.

- Do disclose all assets, liabilities, income, and expenses completely and accurately. Full transparency is key to a valid and enforceable agreement.

- Do consider future changes in circumstances, including potential children, career changes, or inheritances when discussing the terms.

- Do ensure the agreement is in writing, as oral agreements are generally not enforceable in the context of prenuptial arrangements.

- Do review and understand all the terms before signing. If something is unclear, seek clarification from your attorney.

- Do include provisions for dispute resolution, such as mediation or arbitration, should issues arise in interpreting the agreement.

- Do ensure both parties sign the agreement well before the wedding date to avoid any claims of duress or pressure.

- Do keep copies of the signed agreement in a safe place, with each party having a copy.

- Do review the agreement periodically with legal counsel, particularly if your financial situation significantly changes.

Don'ts:

- Don't rush the preparation of the prenuptial agreement. Allow ample time for negotiation and reflection to prevent any future disputes.

- Don't sign the agreement without a thorough understanding of its terms and implications. Knowledge is vital for both parties.

- Don't use generic forms without customization. Tailor the agreement to your specific needs and state laws to ensure its validity.

- Don't forget to consider the impact of state laws, particularly New York's unique legal stipulations regarding marital property.

- Don't coerce or pressure your partner into signing the agreement, as this could render it unenforceable.

- Don't ignore potential tax implications of the agreement. Consult with a financial advisor or tax professional for guidance.

- Don't fail to update the agreement after significant life events, such as the birth of children, to ensure it reflects your current wishes and circumstances.

- Don't overlook non-financial contributions, such as child care or homemaking, in determining equitable arrangements.

- Don't rely solely on the prenuptial agreement for estate planning purposes. Consider it as part of a broader strategy, including wills and trusts.

- Don't allow emotional considerations to override practical and financial planning. While prenuptial agreements can be seen as unromantic, they are a practical tool for protecting both parties.

Misconceptions

Many people have misconceptions about the New York Prenuptial Agreement form. These misunderstandings can cloud the judgment of couples contemplating marriage. Let's clear up some of these misconceptions:

Prenups are only for the wealthy. A common misconception is that prenuptial agreements are exclusively for those with substantial assets. However, these agreements can also protect future earnings and help manage debt responsibilities, beneficial for individuals at all income levels.

Prenups show a lack of trust. Another myth is that requesting a prenup indicates a lack of trust between partners. In reality, discussing a prenup encourages open and honest communication about finances, which can strengthen a relationship.

Prenups decide child custody and support. Some believe prenups can dictate child custody and support arrangements. However, in New York, decisions about children must be made based on their best interests at the time of separation or divorce, not predetermined in a prenup.

Prenups are ironclad. While prenups are legally binding, they are not bulletproof. Courts may overturn prenuptial agreements if they find them to be unconscionable, signed under duress, or if full disclosure was not made at the time of signing.

You can include personal obligations. Couples often think they can include personal duties, such as household chores, in their prenup. However, New York prenuptial agreements are focused on financial and legal matters, not personal obligations.

Prenups are expensive and complicated to create. The belief that prenups are only for those who can afford expensive attorneys is misleading. While it’s advisable to have legal counsel, the cost and complexity can vary widely, making prenups accessible for many couples.

Prenups must be finalized far in advance of the wedding. While it's wise to finalize a prenup well before the wedding to avoid any claims of duress, New York law does not set a specific timeline. It's more important that both parties have adequate time to consider the agreement.

Signing a prenup means you expect to divorce. This is a common fear, but signing a prenup is more about preparation and protection. Like insurance, a prenup provides a safety net, hoping it will never be needed but offering peace of mind if it is.

Understanding these misconceptions can help couples approach the topic of prenuptial agreements in New York with a clearer perspective, focusing on the mutual benefits and protections such agreements can offer.

Key takeaways

When considering a prenuptial agreement in New York, knowing how to properly fill out and use the form is crucial for protecting your assets and ensuring your financial future. Here are key takeaways to guide you through the process:

- Understand what a prenuptial agreement can and cannot do. It’s important to know that while these agreements can cover property division, alimony, and inheritance rights, they cannot dictate terms related to child custody or support.

- Disclose all assets and liabilities fully and honestly. Transparency is crucial when filling out a prenuptial agreement. Any attempt to hide assets can result in the agreement being invalidated.

- Seek independent legal advice. Both parties should have their own attorneys. This ensures that each person's interests are fully represented and understood, preventing conflicts of interest.

- Consider the timing. Do not wait until the last minute. Introducing a prenuptial agreement close to the wedding date can lead to claims of undue pressure, possibly affecting the agreement's enforceability.

- Ensure the agreement is fair and reasonable. For a prenuptial agreement to be enforceable in New York, it must not be unconscionable or grossly unfair to one party at the time of signing.

- Follow New York legal requirements for a valid agreement. This includes ensuring that the agreement is in writing, signed by both parties, and notarized. Oral prenups are not considered valid.

- Remember that circumstances change. Life happens, and with it, financial and personal situations evolve. Consider including clauses that account for significant future changes, such as the birth of children.

- Keep it updated. Review and potentially update your prenuptial agreement periodically, especially after major life events or significant changes in financial status, to ensure it still reflects your wishes and circumstances.

Filling out and using a New York prenuptial agreement form responsibly can set a strong foundation for your marriage. It’s more than just a legal document; it’s a detailed conversation about your future together, ensuring you both enter your union with clear expectations and plans.

Create Other Prenuptial Agreement Forms for US States

Oklahoma Prenup - Can specify conditions related to alimony, property distribution, and debt responsibilities if the marriage ends.

New Jersey Prenup - By setting clear expectations from the start, it can prevent misunderstandings and conflicts over finances in the future.

Georgia Prenup - Can safeguard one's financial independence, ensuring that both parties retain control over their own finances.