Legal Promissory Note Form

In the world of lending and borrowing, clarity and mutual understanding lay the foundation for trust and fiscal responsibility. At the heart of this foundation often lies a critical, yet sometimes overlooked document: the Promissory Note. Serving as a formal acknowledgment of debt, this legally binding document delineates the terms and conditions under which money has been lent and will be repaid. Its significance cannot be understated, as it not only specifies the loan amount and repayment schedule but also outlines the interest rate, maturity date, and potential penalties for late payment. Moreover, the Promissory Note may detail collateral agreements, making it an indispensable tool for secured loans. Whether navigating personal loans between family members or facilitating complex financial transactions, understanding the nuances of this form can safeguard the interests of all parties involved and ensure a clear path toward repayment.

State-specific Promissory Note Forms

Promissory Note Document Subtypes

Example - Promissory Note Form

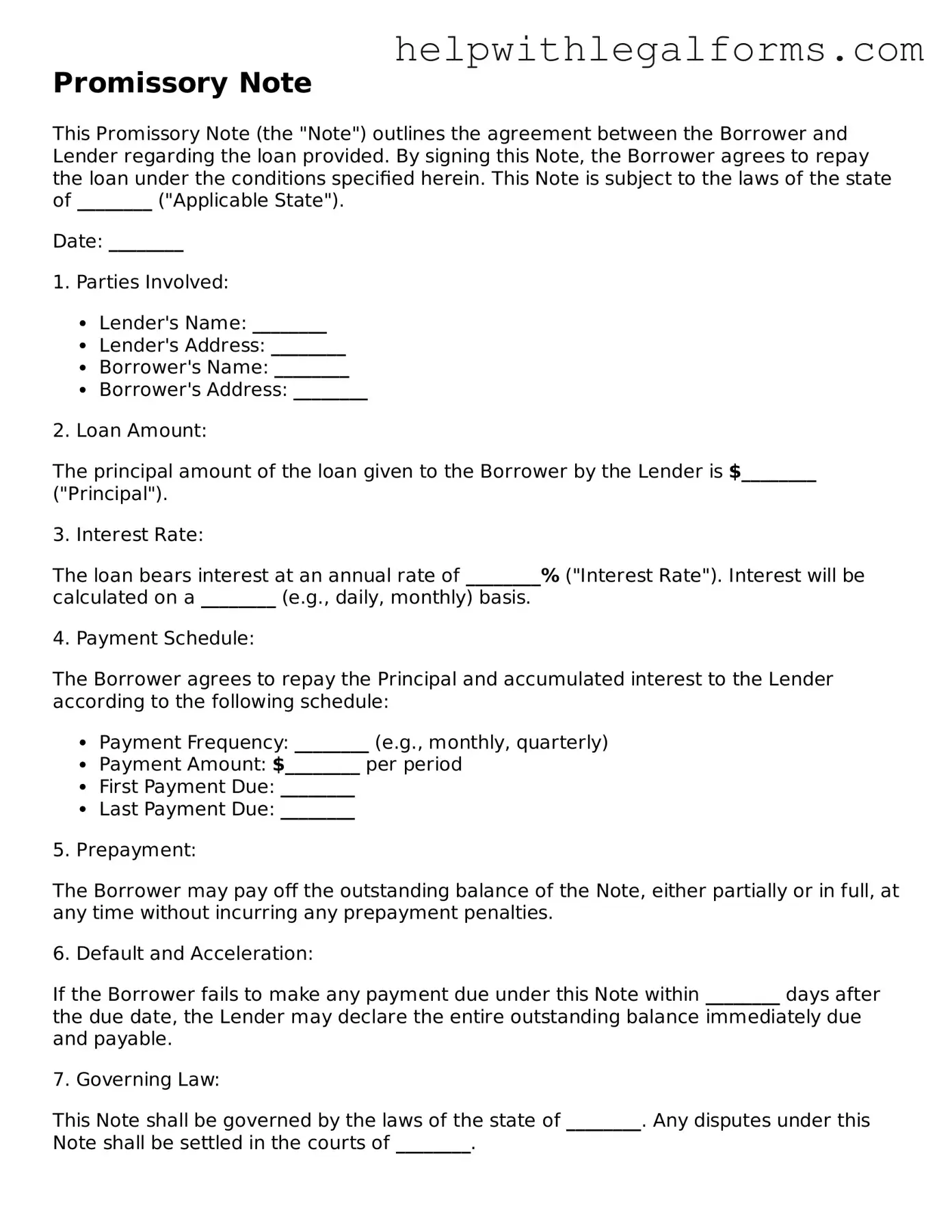

Promissory Note

This Promissory Note (the "Note") outlines the agreement between the Borrower and Lender regarding the loan provided. By signing this Note, the Borrower agrees to repay the loan under the conditions specified herein. This Note is subject to the laws of the state of ________ ("Applicable State").

Date: ________

1. Parties Involved:

- Lender's Name: ________

- Lender's Address: ________

- Borrower's Name: ________

- Borrower's Address: ________

2. Loan Amount:

The principal amount of the loan given to the Borrower by the Lender is $________ ("Principal").

3. Interest Rate:

The loan bears interest at an annual rate of ________% ("Interest Rate"). Interest will be calculated on a ________ (e.g., daily, monthly) basis.

4. Payment Schedule:

The Borrower agrees to repay the Principal and accumulated interest to the Lender according to the following schedule:

- Payment Frequency: ________ (e.g., monthly, quarterly)

- Payment Amount: $________ per period

- First Payment Due: ________

- Last Payment Due: ________

5. Prepayment:

The Borrower may pay off the outstanding balance of the Note, either partially or in full, at any time without incurring any prepayment penalties.

6. Default and Acceleration:

If the Borrower fails to make any payment due under this Note within ________ days after the due date, the Lender may declare the entire outstanding balance immediately due and payable.

7. Governing Law:

This Note shall be governed by the laws of the state of ________. Any disputes under this Note shall be settled in the courts of ________.

8. Signatures:

By signing below, both parties agree to the terms of this Note.

- Lender's Signature: ________ Date: ________

- Borrower's Signature: ________ Date: ________

PDF Form Attributes

| Fact Number | Fact Name | Fact Description |

|---|---|---|

| 1 | Definition | A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money either on demand or at a specified future date. |

| 2 | Legal Enforceability | As a legal document, a promissory note is enforceable in a court of law, providing protection to the lender. |

| 3 | Components | Key components usually include the amount lent, the interest rate, repayment schedule, and the consequences of default. |

| 4 | Maturity Date | The maturity date specifies when the loan amount is due to be paid back in full. |

| 5 | Interest Rate | Interest rate details outline the cost of borrowing the principal amount and can be structured as fixed or variable. |

| 6 | Governing Law | Each state may have specific laws governing promissory notes, impacting aspects like enforcement and interest rates. |

| 7 | Secured vs. Unsecured | Secured promissory notes are backed by collateral, whereas unsecured notes are not, posing a greater risk to the lender. |

| 8 | Default Consequences | In the event of default, provisions within the note can stipulate consequences, including acceleration of payment or legal action. |

| 9 | Signatures | The signatures of the involved parties legitimize the document, making it a binding agreement under the law. |

Instructions on How to Fill Out Promissory Note

When it comes to drafting a promissory note, the process is straightforward but requires attention to detail. This document, crucial for legally binding someone to repay a debt, outlines the terms of repayment, the interest rate, and the consequences of failing to repay. Below are the steps to fill out the form correctly, ensuring clarity and avoid potential disputes in the future.

- Gather necessary information: Before starting, make sure you have all relevant details, including the names and addresses of the borrower and lender, the loan amount, interest rate, and repayment schedule.

- Enter the date: At the top of the form, specify the date when the note is being created. This sets the timeline for repayment and can also serve as evidence in case of legal disputes.

- Write the names and addresses of the borrower and lender: Clearly print the full legal names and addresses of both parties involved. This identifies the obligor and obligee under the note.

- Specify the loan amount: Write down the amount of money being loaned in both words and numbers to prevent any confusion. This is the principal amount agreed upon by both parties.

- Detail the interest rate: Enter the annual interest rate that will be applied to the principal amount. Ensure this rate complies with state laws to avoid it being considered usurious.

- Outline the repayment schedule: Clearly state how and when repayments will be made, whether in installments or a lump sum, and specify the due dates for each payment. Include any grace periods or late fees if applicable.

- Include a co-signer (if necessary): If there's a co-signer, their information should be included to hold them equally responsible for the loan's repayment.

- Sign the form: The borrower (and co-signer, if applicable) must sign the promissory note. Depending on the amount or terms, notarization may be required to authenticate the document.

- Keep copies for records: Both the lender and borrower should keep signed copies of the note for their records. This ensures that both parties have access to the agreed terms and can serve as evidence if any disputes arise.

Upon completion, the promissory note becomes a legally binding document, holding the borrower accountable to repay their debt under the agreed terms. It's crucial for both parties to fully understand the commitment and ensure the terms are fair and reasonable.

Crucial Points on This Form

What is a Promissory Note?

A promissory note is a financial document in which one party promises in writing to pay a determinate sum of money to the other, either at a fixed or determinable future time or on demand of the payee, under specific terms.

Who needs a Promissory Note?

Individuals or businesses who intend to lend or borrow money may need a promissory note. It serves as a legal record of the loan and its repayment terms, providing protection for both the lender and the borrower.

What should be included in a Promissory Note?

A comprehensive promissory note should include the amount of money borrowed, the interest rate if applicable, the repayment schedule, collateral if the note is secured, and any late fees or penalties for default. It should also detail the obligations of the borrower and the rights of the lender.

Is there a difference between a Promissory Note and a Loan Agreement?

Yes. While both serve as binding legal documents that outline the terms of a loan, a loan agreement is more comprehensive and includes extensive details about the borrower and lender's obligations. A promissory note is typically simpler and focuses on the repayment of the loan.

Can a Promissory Note be legally enforced?

A promissory note, when correctly executed, is a legally binding document. This means it can be enforced in a court of law if the borrower fails to adhere to the terms of repayment agreed upon in the note.

How can one ensure a Promissory Note is legally binding?

To ensure a promissory note is legally binding, it should be in writing and contain signatures from all involved parties. It must also clearly outline the loan amount, repayment schedule, interest rate, and any other terms of agreement. Having the document witnessed or notarized can add an extra layer of legal protection.

Common mistakes

Not Specifying the Loan Amount Clearly: People often make the mistake of not writing the exact loan amount in words and numbers. This ambiguity can lead to disputes and confusion over the precise amount that was lent and needs to be repaid.

Omitting the Interest Rate: Failing to include the interest rate, or not specifying whether the loan is interest-bearing, is a common error. This oversight can affect the total amount to be repaid and may lead to legal complications.

Skipping the Repayment Schedule: Not delineating a clear repayment plan, including the due dates and the number of payments, often leads to misunderstandings about when the loan should be fully repaid.

Ignoring the Late Payment Penalties: Many forget to mention what the consequences will be if payments are made late or missed altogether. Detailing these penalties is crucial for enforcing the terms of the agreement.

Forgetting to Include Both Parties’ Full Details: The full names and addresses of both the lender and the borrower should be included. Neglecting this information can question the legitimacy of the promissory note.

Not Describing the Collateral, if Any: If the loan is secured with collateral, failing to describe the collateral adequately is a mistake. This description is essential for secured loans to ensure that the terms of securing the loan are clear.

Lack of Signatures: One of the most critical errors is not having the promissory note signed by both parties. Signatures legally bind the parties to the agreement, and without them, the document may not be enforceable.

It is imperative that each party thoroughly reviews the promissory note before signing to ensure all necessary information is accurately captured and clearly understood.

Documents used along the form

When dealing with the Promissory Note form, a legal document that outlines the terms under which one party promises to pay a sum of money to another, it's often just the tip of the iceberg in a larger sea of necessary paperwork. These documents complement the Promissory Note, ensuring clarity, legality, and the smooth execution of financial agreements. They vary from additional guarantees of payment to detailed agreements about the terms of repayment. Understanding these accompanying documents can greatly enhance one’s grasp of the financial and legal frameworks at play.

- Security Agreement: This document is pivotal when a Promissory Note is secured with collateral. A Security Agreement outlines the specifics of the assets pledged by the borrower as security for the obligation. It details what happens if the borrower defaults, including how the lender can take possession of the collateral. This agreement is crucial for securing the interests of the lender and clarifying the stakes for the borrower.

- Guaranty: Often used alongside a Promissory Note to provide an additional layer of security for the lender, a Guaranty is a promise made by a third party (the guarantor) to pay back the loan if the original borrower fails to do so. This document fleshes out the guarantor’s liability and the circumstances under which the guarantor would have to fulfill their obligation, adding another safeguard for the repayment of the loan.

- Loan Agreement: While a Promissory Note spells out the promise to pay, a Loan Agreement covers the broader terms and conditions of the loan. This might include the obligations and rights of both lender and borrower, representations and warranties, and detailed repayment schedules. Essentially, it provides the comprehensive framework within which the Promissory Note operates, offering a structured context for the loan’s administration.

- Amortization Schedule: Especially relevant for loans with installment payments, an Amortization Schedule is a table detailing each payment. It breaks down the amount going towards the principal versus interest over the life of the loan, showing the outstanding balance after each payment. This document is essential for both parties to track the repayment progress accurately.

In the financial realm, documents like the Promissory Note are rarely standalone. They are part of a network of forms and agreements designed to ensure every aspect of a loan is clearly defined, lawful, and agreed upon. By familiarizing oneself with these supplementary documents, individuals can navigate the complexities of financial agreements with greater confidence and understanding. Knowledge of these documents not only aids in ensuring the legal and fiscal responsibilities are upheld but also in fostering trust between the parties involved.

Similar forms

A Loan Agreement shares similarities with a Promissory Note as both outline the terms under which money has been borrowed and needs to be repaid. While a Promissory Note is generally simpler and may involve fewer details, a Loan Agreement is more comprehensive, detailing the obligations of both the lender and the borrower, including any collateral, repayment schedules, interest rates, and what happens if the loan is not repaid on time.

Mortgage Agreement also parallels a Promissory Note in its fundamental purpose, which is to document a loan's specifics. However, a Mortgage Agreement specifically ties the loan to the purchase of real estate as collateral, securing the loan by transferring a legal or equitable interest in the property to the lender. If the borrower fails to fulfill the terms of the loan, the lender may proceed with foreclosure. The Promissory Note in this context underscores the borrower's unconditional promise to repay the loan amount under agreed terms.

A Personal Guarantee is akin to a Promissory Note in the sense that it is a pledge towards the fulfillment of an obligation. While a Promissory Note is the debtor's promise to pay back a sum to the lender, a personal guarantee extends this promise to a third party, ensuring the lender that if the original borrower fails to repay the loan, the guarantor will take on the responsibility to settle the debt, thereby offering an additional layer of security to the lender.

IOU (I Owe You) document, although informal, holds resemblance to a Promissory Note by representing an acknowledgment of debt. However, the IOU is much more simplistic and generally doesn't include detailed terms of repayment, interest rates, or deadlines. It merely records that one party owes another a certain sum, without the formal promise to pay by a specific date or plan.

Last but not least, a Credit Agreement can be considered similar to a Promissory Note in components and purpose. Primarily used in business lending, a Credit Agreement details the loan between a borrower and lender, including commitments, terms, conditions, and covenants that govern the financial relationship. Like a Promissory Note, it solidifies a borrower's obligation to repay according to the agreed schedule, but it is more detailed and can cover various forms of credit facilities.

Dos and Don'ts

When dealing with a Promissory Note, it's essential to approach the document with care and attention to detail. This formal agreement requires preciseness to ensure that the terms are legally binding and clear to all parties involved. Here are several do's and don'ts to help guide you through the process:

- Do thoroughly review the entire form before you start filling it out. Understanding each section will make the process smoother and ensure you fill out the form correctly.

- Do use black ink or type your responses if the form is online. This ensures legibility and maintains a professional appearance.

- Do clearly specify the loan amount in words and numbers to avoid any confusion about the loan's size.

- Do include detailed information about the repayment schedule, such as the due dates and the amount of each payment, to prevent misunderstandings.

- Do make sure both the borrower and lender sign the promissory note. Their signatures are crucial for the document to be legally binding.

- Don't leave any sections blank. If a section does not apply, write “N/A” (not applicable) to indicate that you did not overlook anything.

- Don't rush through reading the terms and conditions. It's important to understand all legal obligations the promissory note entails.

- Don't forget to keep a copy of the signed promissory note for your records. Both the borrower and the lender should have a copy to refer back to if needed.

- Don't hesitate to consult with a legal professional if there are any terms or phrases you do not understand. Getting clarity on legal documents is essential to protect your interests.

Misconceptions

A promissory note might seem straightforward, but there are common misunderstandings that could lead to problems for both the lender and the borrower. Let's clear up some of these misconceptions.

All promissory notes are the same. It's a common belief that one promissory note is much like another. In reality, they can be vastly different, tailored to the specifics of each transaction. Factors such as the interest rate, repayment schedule, and what happens in case of a default can vary widely.

A verbal agreement is as good as a written one. While oral contracts can be enforceable, a written promissory note is crucial for ensuring that the terms are clear and legally binding. Without it, defending one's case in a disagreement can be challenging.

You don't need a lawyer to create a promissory note. Although it's true that you can draft a promissory note without legal assistance, consulting with a lawyer ensures that the note complies with state laws and addresses all potential issues. This can save a lot of headaches down the line.

Promissory notes are only for business loans. This is not the case. Promissory notes are used for a variety of loans, including personal loans between friends or family members. They provide a legal framework that outlines the loan's terms and conditions, offering protection to both sides.

If the borrower defaults, the lender immediately takes possession of the collateral. In fact, the process is not automatic. The lender must typically follow legal procedures to seize the collateral. This process varies by state and depends on the terms of the promissory note and related agreements.

Key takeaways

When filling out and using a Promissory Note form, it's crucial to handle the documentation with precision and clarity. The Promissory Note acts as a legally binding agreement between a borrower and a lender, specifying the conditions under which money is borrowed and must be paid back. Understanding the essentials can safeguard both parties' interests and help avoid any potential legal disputes down the line.

- Clearly Identify Both Parties: Make sure to fully and accurately identify the lender and borrower, including their legal names and addresses. This clarity is critical in enforcing the agreement.

- Detail the Loan Amount and Terms: The exact amount being lent and the repayment terms must be spelled out clearly in the note. This includes interest rates, repayment schedule, and any collateral securing the loan.

- Specify Repayment Schedule: The promissory note should detail when payments are due, the number of payments, and what happens if payments are late or missed. This helps both parties understand the timeline for repayment.

- Include Interest Rate Information: The applicable interest rate should be clearly stated, whether fixed or variable, including how it is calculated and applied.

- Clarify Security or Collateral, if Any: If the loan is secured with collateral, the promissory note must include a description of the collateral and conditions under which the lender can take possession if the loan is not repaid.

- Outline the Conditions for Default: Clearly define what constitutes a default on the loan, any grace periods, and the lender's rights in such a situation. This includes any acceleration clauses that require full repayment upon default.

- Signature Requirement: For the promissory note to be legally binding, it must be signed by the borrower, and sometimes the lender, depending on state law or agreement terms. Witness or notarization requirements vary by jurisdiction.

- Understand State Laws: Promissory notes are subject to state laws, which can vary significantly. It's important to understand and comply with the specific legal requirements in the state where the note is executed.

Using a promissory note form correctly can protect both the borrower and the lender, ensuring that the loan process is conducted fairly and transparently. Attention to detail and adherence to legal requirements are crucial in drafting an effective promissory note.

Other Forms

Divorce Settlement Agreement Template - The agreement can also address the division of retirement accounts, which is crucial for the financial wellbeing of both parties.

Letter of Support for Spousal Sponsorship - A strategic document, weaving together stories of companionship and love, to present a compelling case to immigration adjudicators.