Blank Promissory Note Form for California

In the beautiful state of California, a vital tool often used in transactions involving the lending and borrowing of money is the California Promissory Note form. This form serves as a legally binding agreement, ensuring that the borrower promises to pay back the lender a certain amount of money within a predefined period. It's designed to protect both parties involved by clearly outlining the loan's terms, including interest rates, repayment schedule, and any collateral securing the loan. Whether it's for a personal loan between friends or family, or a more formal loan from a financial institution, the use of this form adds a layer of security and clarity to financial agreements. Understanding the major aspects and the importance of this form could make a huge difference in ensuring that financial dealings are handled professionally and smoothly, giving peace of mind to everyone involved.

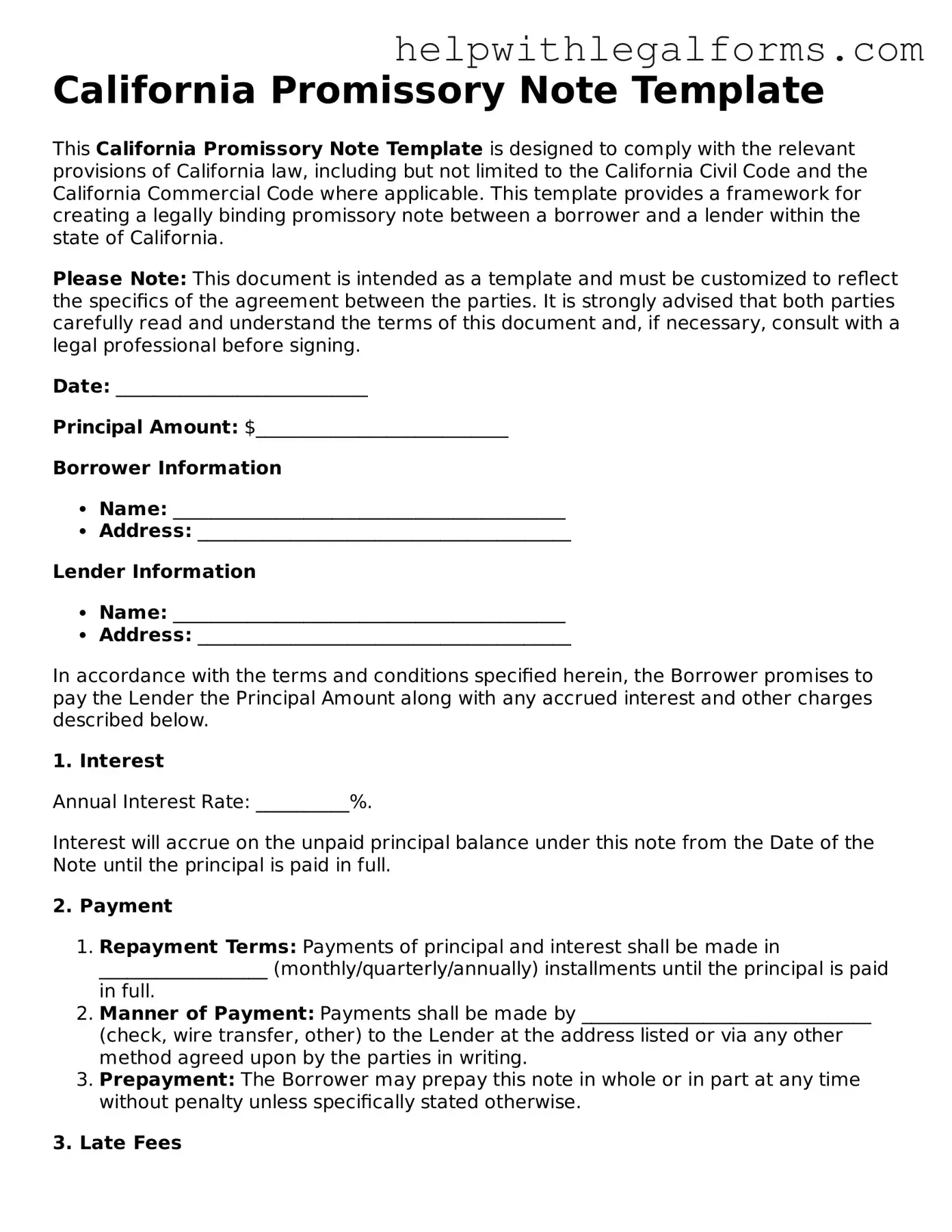

Example - California Promissory Note Form

California Promissory Note Template

This California Promissory Note Template is designed to comply with the relevant provisions of California law, including but not limited to the California Civil Code and the California Commercial Code where applicable. This template provides a framework for creating a legally binding promissory note between a borrower and a lender within the state of California.

Please Note: This document is intended as a template and must be customized to reflect the specifics of the agreement between the parties. It is strongly advised that both parties carefully read and understand the terms of this document and, if necessary, consult with a legal professional before signing.

Date: ___________________________

Principal Amount: $___________________________

Borrower Information

- Name: __________________________________________

- Address: ________________________________________

Lender Information

- Name: __________________________________________

- Address: ________________________________________

In accordance with the terms and conditions specified herein, the Borrower promises to pay the Lender the Principal Amount along with any accrued interest and other charges described below.

1. Interest

Annual Interest Rate: __________%.

Interest will accrue on the unpaid principal balance under this note from the Date of the Note until the principal is paid in full.

2. Payment

- Repayment Terms: Payments of principal and interest shall be made in __________________ (monthly/quarterly/annually) installments until the principal is paid in full.

- Manner of Payment: Payments shall be made by _______________________________ (check, wire transfer, other) to the Lender at the address listed or via any other method agreed upon by the parties in writing.

- Prepayment: The Borrower may prepay this note in whole or in part at any time without penalty unless specifically stated otherwise.

3. Late Fees

If any payment is more than __________ days late, the Borrower agrees to pay a late fee of $________ or ________% of the overdue amount, whichever is greater.

4. Default

In the event of default, the Lender may declare the entire outstanding balance under this note immediately due and payable. The Borrower agrees to pay all costs of collection, including reasonable attorney fees, should it become necessary to collect this note through legal action.

5. Governing Law

This note shall be governed by and construed in accordance with the laws of the State of California.

Signatures

This document is legally binding and has been entered into voluntarily by both parties. The undersigned agree to abide by and fulfill the terms of this note as set forth above.

Borrower Signature: __________________________ Date: __________________

Lender Signature: ___________________________ Date: __________________

PDF Form Attributes

| Fact Name | Detail |

|---|---|

| Governing Law | California Promissory Notes are governed by the state's laws, including the California Civil Code. |

| Interest Rate Limits | In California, the maximum interest rate on a personal loan primarily for personal, family, or household purposes is 10% per annum. |

| Types | There are two types of promissory notes in California: secured and unsecured. A secured note is backed by collateral, whereas an unsecured note is not. |

| Usury Law Exemptions | Some loans are exempt from California's usury laws, including those made by financial institutions such as banks and credit unions. |

| Enforceability | To be enforceable in California, a promissory note must be in writing and signed by the borrower or their authorized agent. |

Instructions on How to Fill Out California Promissory Note

Completing a California Promissory Note form marks a significant step in the process of formalizing a loan agreement. It’s essential for accurately documenting the terms, including repayment schedule, interest rate, and any collateral involved. This legal document binds the borrower to pay back the lender under the specified conditions. The steps below guide you through filling out this form correctly to ensure all parties understand their obligations and rights, which can prevent misunderstandings and legal disputes down the road.

- Identify the parties involved: Clearly write the legal names of the lender and the borrower at the top of the document. If there are co-signers, include their names as well.

- Specify the loan amount: Enter the principal amount of the loan in words and then in numbers to confirm the total amount being borrowed.

- Define the loan terms: Precisely outline the conditions under which the loan will be repaid. This includes the repayment schedule (e.g., monthly installments), the due date for the first payment, and the due date of the final payment.

- Detail the interest rate: State the annual interest rate in a percentage. Remember, this rate must comply with California’s usury laws to avoid being voided as illegal.

- Consider including a late fee: Decide if there will be a fee for late payments and the conditions under which it will be applied. Specify the amount or percentage of the late fee and after how many days a payment is considered late.

- Address collateral (if any): For secured loans, describe the collateral that will be used to secure the loan. Provide detailed information about the collateral to avoid any ambiguity.

- Outline the repayment plan: Elaborate on the agreed repayment structure – whether it is interest-only payments followed by a balloon payment or a more traditional amortizing loan.

- Include governing law: State that the agreement will be governed by the laws of California. This clarifies which state’s laws will apply in interpreting the document or in the event of a dispute.

- Signatures: Have both the lender and the borrower sign the promissory note. If applicable, witnesses or a notary public may also need to sign the document, depending on the nature of the loan and the specific requirements.

After completing these steps, all parties should have a copy of the signed promissory note. It serves as a legal instrument and a clear record of the loan's terms and conditions. Keeping accurate and easily accessible records can prove invaluable, especially if disagreements arise or a need to enforce the agreement emerges.

Crucial Points on This Form

What is a California Promissory Note?

A California Promissory Note is a legal document that records a loan agreement between two parties in the state of California. It outlines the amount of money borrowed, the interest rate if applicable, repayment schedule, and the obligations of the borrower. This document ensures there's a formal record of the loan, protecting both the lender and the borrower.

Do I need a witness or notary for my California Promissory Note?

While not always required, having a witness or notarizing your California Promissory Note can add an extra layer of legal protection. For simple personal loans, a witness might be sufficient. However, for larger loans or business-related loans, notarization is highly recommended to authenticate the document's validity and enforceability in court, if necessary.

Is there a difference between secured and unsecured Promissory Notes?

Yes, there is a significant difference. A secured Promissory Note requires the borrower to pledge an asset as collateral to guarantee the loan, such as real estate or a vehicle. If the borrower fails to repay, the lender has the right to seize the asset. An unsecured Promissory Note does not require collateral. These are often based on the borrower’s creditworthiness alone, making it riskier for the lender.

How can I enforce a Promissory Note in California if the borrower fails to pay?

If a borrower fails to make payments according to the terms of the Promissory Note, the lender has the right to take legal action. This might include suing for the balance owed, or, in the case of a secured loan, seizing the collateral. It's crucial to follow California's legal procedures, which may involve sending a formal demand letter before taking legal action.

Can I modify a Promissory Note after it has been signed?

Yes, a Promissory Note can be modified after it has been signed, but any changes must be agreed upon by both the lender and the borrower. The modification should be documented in writing, and both parties should sign the amendment. This ensures that the new terms are legally binding and that there's a clear record of the agreement's evolution.

Common mistakes

Filling out legal documents can sometimes feel like navigating through a maze without a map. Particularly with financial agreements like a Promissory Note in California, the devil is in the details. A Promissory Note is a binding legal document where one party promises to pay another party a specific amount of money, either over a set period of time or on demand. It’s a common financial instrument for personal loans, business loans, or real estate transactions. However, small mistakes can lead to big headaches. Understanding where others have stumbled can help you avoid making the same errors.

Here are 10 common mistakes people make when they fill out the California Promissory Note form:

- Not Specifying the Parties Clearly: Failing to include full, legal names of both the borrower and the lender can lead to confusion and enforceability issues.

- Leaving the Amount Blank or Uncertain: Not stating the exact loan amount in clear, unambiguous terms can create disputes down the road.

- Ignoring the Interest Rate: California law requires that a promissory note specifies an interest rate. Omitting this or setting an illegal rate can void the agreement.

- Overlooking Repayment Terms: Being vague about the repayment schedule (dates, amounts) leaves room for misunderstandings. It's crucial to detail whether payments are monthly, quarterly, etc., and if there's a final lump sum.

- Omitting Late Fees or Prepayment Penalties: If these terms are part of the agreement, they must be clearly noted. California has specific laws regarding the maximum allowable late fees and prepayment penalties.

- Missing Signatures: A promissory note must be signed by all parties involved to be legally binding. Skipping a signature invalidates the document.

- Forgetting to Date the Document: The date indicates when the agreement takes effect, an essential piece of information for enforcement and historical records.

- Not Specifying the Jurisdiction: It's essential to state that California law governs the note. This is especially important if either party resides in or the transaction occurs in another state.

- Ignoring Security Agreements: If the loan is secured by collateral, failing to reference or attach a separate security agreement can leave the lender unprotected.

- Overlooking Notarization: While not always required, notarizing the document can add a layer of legitimacy and help in the enforcement of the note.

Avoiding these common pitfalls can not only ensure your Promissory Note is legally solid but also protect the interests of all parties involved. It's always a good idea to review the document carefully and consider consulting a legal professional if you have any doubts or questions. This way, you’ll be confident that your financial agreement is clear, fair, and enforceable under California law.

In legal matters, attention to detail is not just important—it’s everything.

Documents used along the form

When managing financial agreements in California, particularly those involving loans, the California Promissory Note form is a crucial document. It's an agreement that details the money borrowed, repayment schedule, interest rates, and what happens in case of default. However, to ensure a comprehensive and secure transaction, other documents are often used in conjunction with a promissory note. These documents can provide additional legal protections, detail the collateral involved, or outline the responsibilities of each party in more depth. Below is a list of such documents, each serving a distinct but complementary role to the Promissory Note.

- Loan Agreement - A more detailed contract that includes the promissory note terms plus any additional legal conditions and covenants between the borrower and lender.

- Security Agreement - If the loan is secured with collateral, this agreement details the assets pledged by the borrower to guarantee the loan.

- Mortgage or Deed of Trust - For real estate transactions, this document secures the loan against the property being purchased and outlines the process for foreclosure if the loan is not repaid.

- Guaranty - This document is used if there is a third party guarantor on the loan, agreeing to repay the debt if the original borrower cannot.

- Amendment Agreement - If changes need to be made to the original terms of the promissory note, this document outlines those modifications and is signed by all parties.

- Release of Promissory Note - Once the loan is fully repaid, this document is issued to formally release the borrower from the obligations outlined in the promissory note.

- Notice of Default - If the borrower fails to meet the terms of the promissory note, this document formalizes the default status and outlines the lender's next steps.

- UCC-1 Financing Statement - For loans involving personal property as collateral, this document is filed to publicly announce the creditor's interest in the borrower's assets.

- Personal Financial Statement - Often required during the loan application process, this document provides a snapshot of the borrower's financial health and ability to repay the loan.

Together, these documents contribute to a solid legal framework for a lending transaction, addressing various elements like the terms of the loan, the responsibilities of the involved parties, and actions in case of disputes or defaults. Using these documents in conjunction with the California Promissory Note offers clarity, legal protection, and a structured path for both lenders and borrowers throughout the lifespan of the loan.

Similar forms

Loan Agreement: Much like a promissory note, a loan agreement details the terms between a borrower and a lender. However, it is more comprehensive, including clauses on dispute resolution and obligations of both parties.

Mortgage Agreement: A mortgage agreement secures a loan with real property. It's similar to a promissory note but focuses on the collateral (the property), specifying what happens if the borrower defaults.

IOU (I Owe You): An IOU is an acknowledgment of debt, simpler than a promissory note. While an IOU states that one party owes another, a promissory note details repayment terms.

Car Loan Agreement: This is a specific type of loan agreement for purchasing a vehicle, similar to a promissory note but detailing collateral (the vehicle) and potentially including terms about insurance and upkeep.

Personal Loan Agreement: Tailored for loans between individuals, this document is close in nature to a promissory note but may include more personalized terms, such as penalties for late payments.

Line of Credit Agreement: This agreement outlines the maximum amount a lender will allow a borrower to withdraw, similar to a promissory note. However, it's more flexible, allowing borrowing up to a set limit over time.

Student Loan Agreement: Similar to a promissory note, it specifies terms about a sum borrowed for education. It often includes special conditions, like grace periods after graduation.

Business Loan Agreement: Designed for transactions between businesses and lenders, it is more detailed than a promissory note, covering business-specific terms like financial covenants.

Rent-to-Own Agreement: Although focused on the rental and eventual purchase of property, this agreement shares similarities with promissory notes in detailing payment terms over time towards ownership.

Credit Card Agreement: This outlines the terms between the credit card company and the cardholder, including repayment. It is similar to a promissory note in how it details the obligation to repay borrowed funds.

Dos and Don'ts

When filling out the California Promissory Note form, it’s essential to follow specific guidelines to ensure the note's legality and enforceability. Below are eight dos and don'ts that can guide you through the process efficiently.

- Do include all relevant personal information about the lender and borrower, such as full legal names, addresses, and contact information. This clarity helps avoid any possible ambiguity regarding the parties involved.

- Do specify the loan amount in clear and unambiguous terms, ensuring that the figures are accurate and match any verbal agreements that have been made.

- Do clearly state the interest rate, keeping in mind that it must not exceed California's usury laws, to avoid rendering the promissory note unenforceable.

- Do outline the repayment schedule in detail, including the start date, the amount of each payment, the frequency of payments, and the due date for the final payment. This prevents any misunderstandings regarding expectations for repayment.

- Don't leave out any provisions regarding late fees or penalties for missed payments. Including these details helps to protect the lender’s interests and encourages timely repayment.

- Don't forget to specify the collateral, if any, that secures the loan. Clearly identifying collateral—such as real estate or other valuable property—adds another layer of security for the lender.

- Don't forego having the document signed and dated by both parties. These signatures are critical for the enforceability of the promissory note.

- Don't neglect to have the promissory note notarized if required, as this can add an extra level of legal validation, especially for larger loan amounts or for transactions that involve more risk.

By closely adhering to these do's and don'ts, individuals can create a legally binding and effective California Promissory Note that protects the interest of both the lender and the borrower. Always consider consulting with a legal professional to ensure that your promissory note meets all legal requirements and best practices.

Misconceptions

Many people have misconceptions about the California Promissory Note form, which can lead to confusion or even legal issues down the line. Let's clear up some of these misunderstandings:

It's just a formal IOU. People often think a promissory note is simply a more formal version of an IOU. While both documents acknowledge debt, a promissory note is legally binding and includes detailed repayment terms, interest rates, and the consequences of non-payment.

All promissory notes are the same. Another common misconception is that all promissory notes are identical, regardless of the state. However, California may have specific requirements and regulations that need to be included in the note for it to be valid in this state.

No need for a witness or notarization. Some people believe it's not necessary to have a witness or notarize a promissory note in California. While not always required, having the document witnessed or notarized can add a layer of protection and authenticity, making it easier to enforce the note if there's a dispute.

Interest rates can be as high as agreed upon. There's a misconception that the lender and borrower can set any interest rate they agree upon. In reality, California has usury laws that limit the maximum interest rate that can be charged. Ignoring these laws can render the note unenforceable and possibly expose the lender to legal penalties.

Verbal agreements are just as good. Some might think a verbal agreement can suffice instead of a written promissory note. However, verbal contracts can be incredibly difficult to prove and enforce, especially when involving significant amounts of money. A written promissory note lays out clear terms and protections for both parties.

You can't modify a promissory note once it's signed. People often assume that once a promissory note is signed, its terms are set in stone. In truth, if both the borrower and the lender agree, the terms can be modified. Such amendments should be documented in writing to avoid future misunderstandings.

Key takeaways

A California Promissory Note form is a legal agreement used to document a loan between two parties. It outlines the amount of money borrowed, the interest rate, and the repayment terms.

The interest rate on a promissory note must comply with California's usury laws. These laws limit the amount of interest that can be charged to avoid unfair lending practices.

It is crucial to specify the payment schedule clearly, indicating whether payments will be made monthly, quarterly, or on another basis. The form should detail the number of payments and the amount of each payment.

For secured loans, the promissory note should describe the collateral that secures the loan. This means listing the property or assets that the lender can claim if the borrower fails to repay the loan as agreed.

Both the lender and the borrower should sign the promissory note. Their signatures make the document legally binding and ensure that both parties agree to the terms written in the note.

Choose whether the loan will be secured or unsecured. A secured promissory note includes collateral, while an unsecured note does not, making the former less risky for the lender.

Include a co-signer if the borrower's credit history is uncertain. This adds another level of security for the lender, as the co-signer agrees to repay the loan if the primary borrower cannot.

Be aware of the potential need for a witness or notarization, depending on the loan amount and the specifics of the agreement. Some cases require these additional steps to further validate the promissory note.

Create Other Promissory Note Forms for US States

Connecticut Promissory Note - Having a Promissory Note can prevent misunderstandings and disputes between parties.

Loan Promissory Note - This legal document outlines the terms under which one party promises to repay a sum of money to another.