Blank Promissory Note Form for Colorado

When entering into a lending agreement in Colorado, participants often rely on a document known as a Promissory Note to outline the terms of their arrangement. This form, integral to many personal and business financial dealings, serves as a legal commitment by the borrower to repay a specified sum of money to the lender under agreed-upon conditions. The significance of the Colorado Promissory Note extends beyond its function as a mere record of a loan. It meticulously details interest rates, repayment schedules, and the consequences of default, thus safeguarding the interests of both parties involved. Moreover, in the event of a dispute, this document can be pivotal in legal proceedings, providing clear evidence of the agreed-upon terms. As such, understanding the various components and legal implications of the Promissory Note is essential for individuals navigating the lending landscape in Colorado, ensuring they are fully informed and their financial transactions are secure.

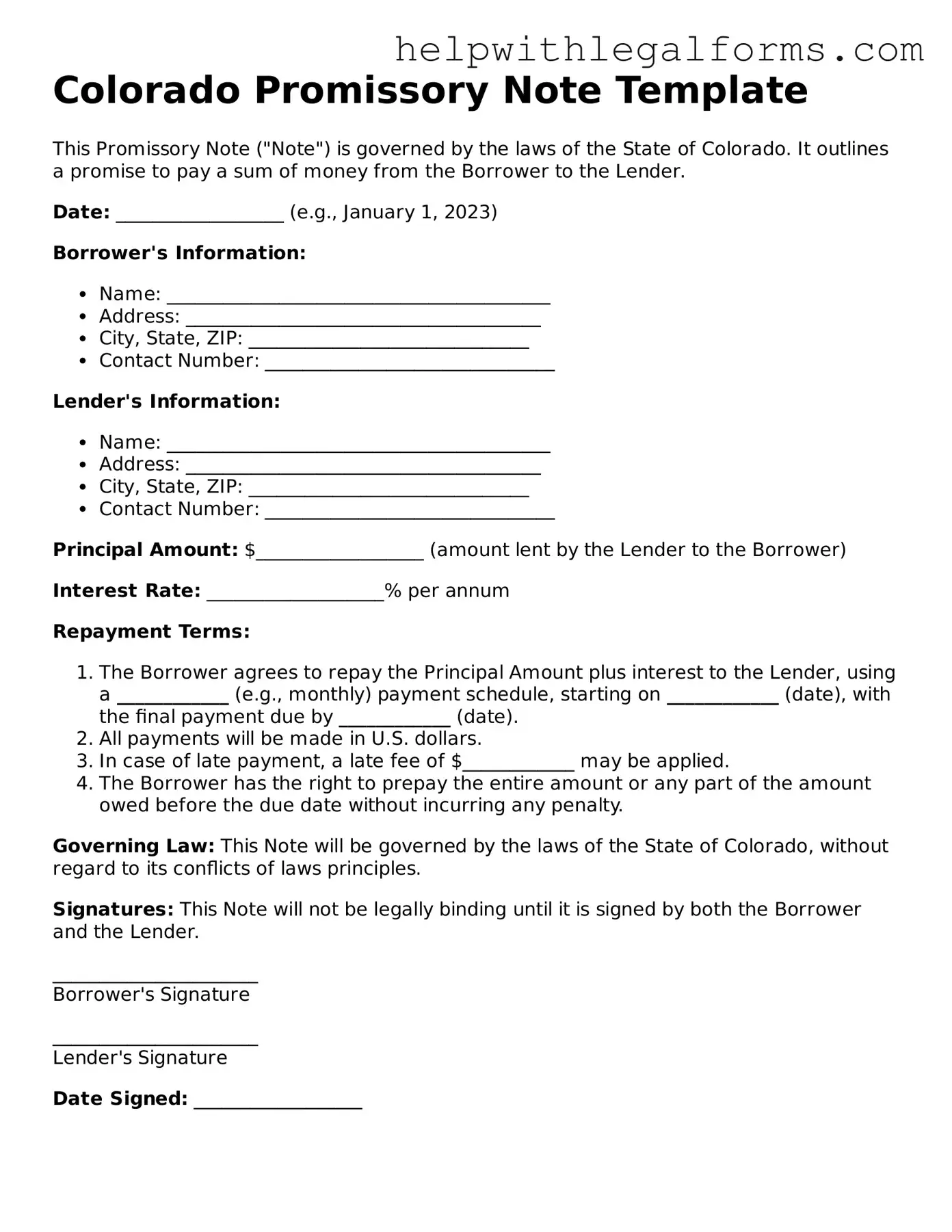

Example - Colorado Promissory Note Form

Colorado Promissory Note Template

This Promissory Note ("Note") is governed by the laws of the State of Colorado. It outlines a promise to pay a sum of money from the Borrower to the Lender.

Date: __________________ (e.g., January 1, 2023)

Borrower's Information:

- Name: _________________________________________

- Address: ______________________________________

- City, State, ZIP: ______________________________

- Contact Number: _______________________________

Lender's Information:

- Name: _________________________________________

- Address: ______________________________________

- City, State, ZIP: ______________________________

- Contact Number: _______________________________

Principal Amount: $__________________ (amount lent by the Lender to the Borrower)

Interest Rate: ___________________% per annum

Repayment Terms:

- The Borrower agrees to repay the Principal Amount plus interest to the Lender, using a ____________ (e.g., monthly) payment schedule, starting on ____________ (date), with the final payment due by ____________ (date).

- All payments will be made in U.S. dollars.

- In case of late payment, a late fee of $____________ may be applied.

- The Borrower has the right to prepay the entire amount or any part of the amount owed before the due date without incurring any penalty.

Governing Law: This Note will be governed by the laws of the State of Colorado, without regard to its conflicts of laws principles.

Signatures: This Note will not be legally binding until it is signed by both the Borrower and the Lender.

______________________

Borrower's Signature

______________________

Lender's Signature

Date Signed: __________________

PDF Form Attributes

| Fact | Description |

|---|---|

| Definition | A Colorado Promissory Note is a legal agreement that outlines the terms under which one party promises to repay a sum of money to another party. |

| Types | There are two main types: secured and unsecured. A secured promissory note is backed by collateral, whereas an unsecured note is not. |

| Governing Laws | In Colorado, promissory notes are governed by both state laws and, if applicable, federal laws such as the Uniform Commercial Code (UCC) as adopted by Colorado. |

| Interest Rate Limits | Colorado law caps the maximum interest rate that can be charged on a promissory note unless agreed otherwise by the parties involved. |

| Enforcement | If the borrower fails to repay according to the terms of the note, the lender may take legal action to enforce repayment. |

| Signature Requirements | The borrower must sign the promissory note for it to be considered valid and enforceable under Colorado law. |

| Co-signer Provision | Colorado promissory notes may include a co-signer, who becomes equally responsible for the repayment of the note. |

Instructions on How to Fill Out Colorado Promissory Note

When dealing with financial transactions, a Promissory Note is an essential legal document that outlines the details of a loan between two parties. In Colorado, completing a Promissory Note form correctly is crucial to ensure that the agreement is legally binding and clear to both the borrower and the lender. This document should clearly state the loan amount, interest rate, repayment schedule, and what happens if the borrower fails to repay the loan. Here is a straightforward guide to help you fill out a Colorado Promissory Note form accurately.

- Start by entering the date the Promissory Note is being created at the top of the document. This date is critical as it marks when the agreement comes into effect.

- Write the full legal names and addresses of both the borrower and the lender. It’s important to include any co-signers if applicable.

- Specify the principal loan amount in US dollars. This is the original sum of money being loaned, without any interest.

- Detail the interest rate. This should be an annual rate, agreed upon by both parties. Remember, Colorado law might limit the maximum interest rate you can charge, so it's wise to check current regulations.

- Outline the repayment schedule. This includes how often payments will be made (monthly, quarterly, etc.), the amount of each payment, and when the first payment is due. Also, state when the loan will be fully repaid.

- Include options for late payments and consequences for default. Specify any grace period for late payments and the fees or penalties for failing to make payments on time.

- Choose whether the loan is secured or unsecured. If it’s secured, describe the collateral that will guarantee the loan.

- Insert any co-signer agreements if someone besides the borrower is guaranteeing the loan.

- Specify the governing state law, which would be Colorado for this Promissory Note. This means that in the event of any legal disputes, Colorado laws will apply.

- Finally, both the borrower and lender must sign and date the document. Witnesses or notarization may also be required, depending on the type of loan and local regulations.

Filling out a Colorado Promissory Note with attention to detail ensures that the financial agreement is clear and enforceable. This document serves as a legally binding contract between the borrower and the lender, laying a solid foundation for the financial transaction. By following these steps, you can complete a Promissory Note that protects both parties' interests and complies with Colorado law.

Crucial Points on This Form

What is a Colorado Promissory Note?

A Colorado Promissory Note is a form of legal document that acts as a written promise for the borrower to pay back a specific amount of money to the lender. This document outlines the payment amount, interest rate, repayment schedule, and the terms of what happens if the borrower fails to repay the loan. It is used in personal and business transactions within the state of Colorado.

Do I need to notarize my Colorado Promissory Note?

In Colorado, it is not a requirement for a promissory note to be notarized for it to be considered valid and enforceable. However, having the document notarized can add a level of verification and may deter potential disputes by clearly affirming the identity of the parties involved.

What are the necessary elements to include in a Colorado Promissory Note?

To ensure that a Colorado Promissory Note is comprehensive and enforceable, it should include the amount borrowed, interest rate, payment schedule, maturity date, details of both the borrower and the lender, any collateral securing the loan (if it is a secured note), and the signatures of both parties involved.

What is the difference between a secured and an unsecured Promissory Note?

A secured Promissory Note is one where the borrower pledges collateral (e.g., property or vehicles) to guarantee repayment. If the borrower fails to repay the loan, the lender has the right to seize the collateral. An unsecured Promissory Note does not involve any collateral. This type makes the lender more vulnerable, as there is no asset to claim if the borrower defaults on the loan.

How can I enforce a Promissory Note in Colorado if the borrower does not pay?

If a borrower fails to make payments as agreed, the lender has the right to take legal action to enforce the Promissory Note. The lender can file a lawsuit in the appropriate Colorado court to seek repayment. If the note is secured, the lender may also be able to take possession of the collateral without going to court.

Can I charge any interest rate I want in a Colorado Promissory Note?

No. The interest rate on a promissory note in Colorado must comply with the state's usury laws, which cap the maximum interest rate that can be charged. Charging interest above the legal limit may not only jeopardize the enforceability of the note but could also result in penalties.

What happens if a Promissory Note is lost or destroyed?

If a Promissory Note is lost or destroyed, the lender should immediately inform the borrower of the situation. Generally, the lender can require the borrower to sign a new note that includes a statement regarding the destruction or loss of the original note. It is advisable to take legal counsel to ensure the right steps are followed to maintain the note's enforceability.

Is a Promissory Note required for all loans in Colorado?

While not every loan in Colorado legally requires a Promissory Note, using one is strongly recommended. This document provides a clear record of the loan's terms and conditions, helping to protect the rights of both the borrower and the lender. It can serve as crucial evidence of the agreement should any disputes arise.

Common mistakes

Filling out a Colorado Promissory Note form might seem straightforward, but it's easy to make mistakes. These errors can complicate things down the line, either by causing misunderstandings or even legal issues. Here are ten common mistakes people often make:

Not being specific about the payment schedule. A vague schedule can lead to disagreements.

Failing to include a clear interest rate, or not specifying if the rate is fixed or variable. This can result in conflicts about how much is owed.

Omitting late fees or not detailing when they apply. This can make it difficult to enforce penalties if payments are late.

Skipping details about the collateral, if the note is secured. Without this, the lender may have trouble enforcing the security agreement.

Not including all parties' full legal names and addresses, which can lead to confusion about the agreement's participants.

Forgetting to state what happens if the borrower defaults. This oversight can complicate legal actions in the event of non-payment.

Not detailing the conditions under which the note can be prepaid. This can cause disputes if the borrower wants to settle early.

Failing to specify jurisdiction — the law under which the note is governed. This is crucial for resolving any legal disputes.

Not having the note witnessed or notarized, depending on state requirements, which can question its legality.

Leaving off the date of the agreement, which can affect the enforcement and validity of the note.

Avoiding these mistakes can make the promissory note stronger and more enforceable. It's about protecting all parties involved and ensuring that the agreement is clear and fair.

Documents used along the form

When dealing with financial transactions, particularly lending and borrowing in Colorado, a Promissory Note is commonly used to outline the terms of the agreement between the parties involved. However, to ensure the agreement is clear, enforceable, and comprehensive, several other forms and documents are often utilized alongside the Promissory Note. Each document serves a specific purpose, enhancing the legal and financial framework of the transaction.

- Loan Agreement: Provides detailed terms of the loan beyond the repayment schedule, including the interest rate, collateral requirements, and what happens in the case of default. This complements the basic information found in a Promissory Note.

- Security Agreement: If the loan is secured, this document outlines the collateral pledged by the borrower. It details the rights of the lender to seize the collateral if the borrower defaults on the loan.

- Guaranty: An agreement where an additional party guarantees the loan, promising to repay if the original borrower fails to do so. This provides an extra layer of security for the lender.

- Amortization Schedule: A table detailing each payment over the life of the loan, breaking down how much goes towards the principal and how much towards interest. This ensures both parties understand the repayment structure.

- Mortgage Agreement: Relevant when the loan is backed by real estate, this document secures the property as collateral for the loan and outlines the specifics of this arrangement.

- Deed of Trust: Used in place of a traditional mortgage in some cases, this document involves a third party (trustee) who holds the title until the loan is paid off.

- UCC-1 Financing Statement: Filed with the state, this form is used to publicly declare the lender's interest in the collateral offered by the borrower, essential for secured loans.

- Late Fee Notice: Outlines the procedure and fees applicable if payments are made after their due date. This ensures the borrower is aware of the consequences of late payments.

Combining a Promissory Note with these additional documents can significantly strengthen the legal rights and protections for all parties involved in a loan agreement. By clearly defining responsibilities, terms, and consequences, the risks associated with lending and borrowing are minimized, fostering a fair and transparent financial transaction.

Similar forms

Mortgage Agreement: Similar to a promissory note, a mortgage agreement involves a borrower promising to repay a loan used to purchase real estate. Both documents outline payment terms, interest rates, and the consequences of failing to make payments.

Loan Agreement: Like a promissory note, a loan agreement is a binding contract between a borrower and a lender that specifies the loan amount, interest rate, repayment schedule, and terms of loan repayment. However, a loan agreement often includes more detailed provisions than a promissory note.

IOU (I Owe You): An IOU is a simple acknowledgment of debt, similar to a promissory note. While an IOU states an amount owed by one party to another, it is less formal and lacks the detailed repayment terms typically found in a promissory note.

Lease Agreement: A lease agreement, similar to a promissory note, establishes the terms under which one party agrees to rent property owned by another party. It specifies payment amounts and due dates, similar to the way a promissory note outlines loan repayments.

Bill of Sale: A bill of sale, like a promissory note, is a written document that records a transaction between two parties. However, it’s used to transfer ownership of goods, rather than to outline a promise to pay a debt.

Credit Agreement: This document is similar to a promissory note as it involves a borrower’s promise to repay a debt under agreed terms and conditions. A credit agreement typically relates to lines of credit or credit cards, detailing interest rates, payment schedules, and penalties for late payments.

Personal Guarantee: Similar to a promissory note, where an individual promises to repay a loan, a personal guarantee is a commitment by an individual to be liable for the debts or obligations of a borrower in case of default.

Security Agreement: A security agreement complements a promissory note by detailing the collateral that secures a loan. It ensures that the lender has a legal claim to the asset in case the borrower fails to fulfil their repayment obligations under the promissory note.

Installment Sales Contract: Similar to promissory notes, installment sales contracts involve payment for goods or services over a period, rather than all at once. These documents specify payment amounts, dates, and consequences for non-payment, like promissory notes do for loan repayments.

Dos and Don'ts

When filling out the Colorado Promissory Note form, it’s important to pay careful attention to the details to ensure the note is valid and enforceable. Here are six dos and don'ts to consider:

Do:

Include clear identification of both the borrower and lender with full names and addresses to prevent any misunderstandings or confusion.

Specify the loan amount in words and numbers to eliminate discrepancies and ensure both parties are in agreement on the principal amount.

Clearly outline the repayment terms, including the interest rate, repayment schedule, and any late fees, to set clear expectations for repayment.

Ensure the interest rate complies with Colorado's usury laws to avoid rendering the agreement unenforceable.

Sign and date the promissory note in the presence of a witness or notary, if required, to authenticate the document and add an extra layer of legal protection.

Keep a signed copy of the promissory note for both the borrower's and lender's records to prevent any future disputes over the terms of the loan.

Don’t:

Forget to include a clause about the governing law (Colorado law), as it will determine how the note is interpreted and enforced.

Omit mentioning whether the note is secured or unsecured. This detail clarifies if collateral is backing the loan, which is crucial information for both parties.

Underestimate the importance of specifying a clear course of action in case of default, as it can help streamline resolution efforts if the borrower fails to meet repayment obligations.

Leave out any details regarding prepayment, such as if the borrower can pay off the note early without incurring penalties. This can impact financial planning for both parties.

Fail to review the completed form for accuracy and completeness before signing. Even small mistakes or omissions can lead to misunderstandings or legal challenges down the line.

Ignore the need for legal consultation if there is any uncertainty about the form or its implications. A professional can provide valuable guidance tailored to your specific situation.

Misconceptions

When it comes to financial agreements, few documents are as commonly misunderstood as the Colorado Promissory Note form. Many think they know what this form entails, but often, their understanding is shaded by misconceptions. Let's clear up five of the most common misconceptions:

All Colorado Promissory Notes are the same: A common belief is that there's a one-size-fits-all template for Colorado Promissory Notes. In reality, the form should be tailored to the specific agreement between the borrower and the lender. This customization ensures that the terms reflect the agreement accurately, including the repayment plan, interest rate, and any collateral involved.

Only financial institutions can issue Promissory Notes in Colorado: This is not true. Any individual or entity can create a Promissory Note as long as they are lending money to someone else. These notes serve as a legal agreement between any two parties and do not require the lender to be a bank or a similar financial institution.

Signing a Promissory Note means you immediately have to repay the loan: While signing a Promissory Note means you agree to pay back the borrowed amount, it doesn't mean that repayment starts immediately. The note should specify when repayment is to begin and outline the schedule for repayment, whether in installments or a lump sum by a certain date.

Promissory Notes are only for large amounts of money: While it's true Promissory Notes are often used for significant loans, such as for purchasing a home or a car, they can be used for any amount. These notes make any loan, no matter how small, a legally binding agreement, providing protection and clarity for both the lender and the borrower.

A verbal agreement is as good as a written Promissory Note in Colorado: Relying on a verbal agreement is risky and not recommended. A written Promissory Note provides a clear, enforceable record of the loan's terms and conditions. Without this documentation, it can be challenging to enforce the terms of the loan or prove that the agreement exists should disputes arise.

Understanding these key aspects of Colorado Promissory Notes can help both lenders and borrowers navigate their financial arrangements more effectively, ensuring that both parties are protected and all terms are clearly defined.

Key takeaways

The Colorado Promissory Note form is a valuable tool for documenting a loan agreement between two parties. It serves as a legally binding document that outlines the terms under which money is borrowed and must be repaid. To ensure clarity and avoid potential disputes, here are key takeaways to consider when filling out and using this form:

- Understand the Types: Colorado offers both secured and unsecured promissory notes. A secured note requires collateral as a security for the loan, offering protection to the lender, while an unsecured note does not. Choose the type that best suits the agreement.

- Include All Relevant Details: Clearly lay out the loan terms, including the amount borrowed, interest rate, repayment schedule, and any late fees. Precise terms reduce misunderstandings.

- Legal Requirements: The form must comply with Colorado's legal requirements, including any caps on interest rates to avoid it being considered usurious. Familiarize yourself with these aspects to ensure legality.

- Signatures are Essential: For the note to be legally binding, both the borrower and the lender must sign it. Consider notarization or witnesses to add an extra layer of legal protection.

- Keep Records: Both parties should keep a copy of the signed promissory note. This document serves as a legal record and can be crucial in case of disputes or for tax purposes.

- Understand the Consequences of Default: The document should specify what constitutes a default and the consequences thereof. This might include late fees, acceleration of the debt, or legal action.

In conclusion, a well-prepared Colorado Promissory Note can help prevent future disputes and protect both the borrower and lender’s interests. Therefore, paying close attention to the details and ensuring full compliance with Colorado laws is of the utmost importance when drafting this document.

Create Other Promissory Note Forms for US States

Loan Promissory Note - It acts as a financial instrument that can be sold or transferred to another party.

Promissory Note New York - Repayment terms can range from simple, with no interest, to more complex arrangements involving compound interest.