Blank Promissory Note Form for Connecticut

Entering into a financial agreement can feel like navigating through a maze, especially when it involves lending or borrowing money. In the picturesque state of Connecticut, individuals and entities look towards a legal instrument that not only secures the lender's interests but also provides clear terms for the borrower—a Promissory Note. This contractual agreement, subtle in its complexity, delineates the repayment schedule, interest rates, and the consequences of non-payment, serving as a formal acknowledgment of the debt owed. The Connecticut Promissory Note form, a vital document tailored to the state's regulations, ensures that all parties are on the same page, reducing misunderstandings and disputes. Whether the loan is for buying a car, financing a home renovation, or investing in a dream business, understanding the nuances of this form is crucial for a seamless transaction. It acts as a guiding star, offering peace of mind to both the lender and the borrower by laying down a clear path for financial interaction within the legal framework of Connecticut.

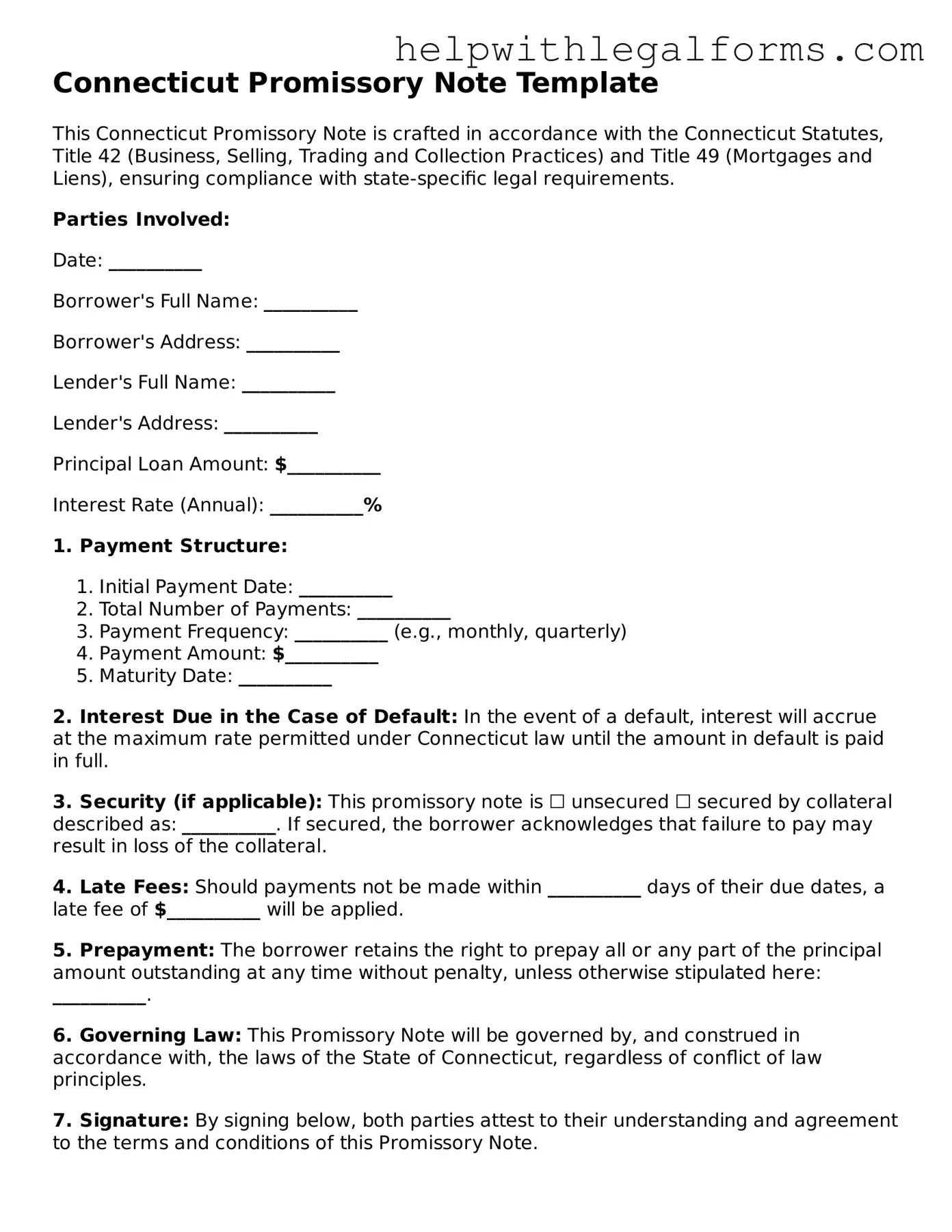

Example - Connecticut Promissory Note Form

Connecticut Promissory Note Template

This Connecticut Promissory Note is crafted in accordance with the Connecticut Statutes, Title 42 (Business, Selling, Trading and Collection Practices) and Title 49 (Mortgages and Liens), ensuring compliance with state-specific legal requirements.

Parties Involved:

Date: __________

Borrower's Full Name: __________

Borrower's Address: __________

Lender's Full Name: __________

Lender's Address: __________

Principal Loan Amount: $__________

Interest Rate (Annual): __________%

1. Payment Structure:

- Initial Payment Date: __________

- Total Number of Payments: __________

- Payment Frequency: __________ (e.g., monthly, quarterly)

- Payment Amount: $__________

- Maturity Date: __________

2. Interest Due in the Case of Default: In the event of a default, interest will accrue at the maximum rate permitted under Connecticut law until the amount in default is paid in full.

3. Security (if applicable): This promissory note is ☐ unsecured ☐ secured by collateral described as: __________. If secured, the borrower acknowledges that failure to pay may result in loss of the collateral.

4. Late Fees: Should payments not be made within __________ days of their due dates, a late fee of $__________ will be applied.

5. Prepayment: The borrower retains the right to prepay all or any part of the principal amount outstanding at any time without penalty, unless otherwise stipulated here: __________.

6. Governing Law: This Promissory Note will be governed by, and construed in accordance with, the laws of the State of Connecticut, regardless of conflict of law principles.

7. Signature: By signing below, both parties attest to their understanding and agreement to the terms and conditions of this Promissory Note.

Borrower's Signature: __________ Date: __________

Lender's Signature: __________ Date: __________

PDF Form Attributes

| Fact Number | Detail |

|---|---|

| 1 | A Connecticut Promissory Note is a legally binding document between a borrower and a lender, where the borrower promises to repay the lender. |

| 2 | This form can be secured or unsecured, indicating whether or not collateral backs the loan. |

| 3 | Under Connecticut law, promissory notes are subjected to both state statutes and potentially to the Uniform Commercial Code (UCC) when dealing with commercial transactions. |

| 4 | Interest rates on these notes must comply with Connecticut’s usury laws, which cap the maximum rate unless an exception applies. |

| 5 | For a promissory note to be considered valid in Connecticut, it must be signed by both the borrower and the lender. |

| 6 | Details such as the principal amount, interest rate, repayment schedule, and any collateral should be clearly stated in the note. |

| 7 | The document may include provisions on late fees, default conditions, and acceleration clauses. |

| 8 | If a promissory note is lost, destroyed, or stolen, Connecticut law provides methods for reestablishing the note under certain conditions. |

| 9 | An essential element of the promissory note is the promise to pay, which distinguishes it from other types of agreements or contracts. |

| 10 | Digital or electronic signatures are generally accepted on promissory notes in Connecticut, as aligning with the state's adaptation of the Electronic Signatures in Global and National Commerce Act (E-SIGN). |

Instructions on How to Fill Out Connecticut Promissory Note

Upon deciding to enter into a loan agreement in Connecticut, individuals will utilize a promissory note as a crucial document. This document formalizes the understanding between the borrower and lender, specifying the loan amount, interest rate, repayment schedule, and other essential terms. It serves as a binding commitment from the borrower to repay the loan under the agreed conditions. Ensuring accurate completion of the Connecticut Promissory Note form is imperative for protecting the interests of both parties involved. The following steps are designed to guide through the process, promoting clarity and compliance.

Steps for Filling Out the Connecticut Promissory Note Form

- Identify the type of promissory note: Determine whether it is secured or unsecured. A secured promissory note requires collateral as security for the loan, while an unsecured note does not.

- Include the date: Clearly write the date when the promissory note is being created at the top of the document.

- Enter the parties' information: Provide the legal names and addresses of both the borrower and the lender.

- Specify the principal amount: Clearly state the total amount of money being loaned.

- Detail the interest rate: Indicate the annual interest rate that will be applied to the principal amount. Ensure it complies with Connecticut's legal limits.

- Define the repayment schedule: Outline how the loan will be repaid, including the frequency of payments (monthly, quarterly, etc.), the amount of each payment, and the due date for the final payment.

- Include late fees and penalties: If applicable, detail any fees or penalties for late payments or non-compliance with the terms of the agreement.

- State the governing law: Specify that the promissory note is governed by the laws of the state of Connecticut.

- Signature section: Reserve a section at the end of the document for both the borrower and the lender to sign and date, indicating their agreement to the terms outlined in the promissory note.

After the Connecticut Promissory Note form is filled out, both parties should review the document carefully to confirm that all the information is accurate and reflects their agreement. Each party should retain a copy for their records. This document will serve as a legal point of reference should any disputes arise regarding the loan agreement. Ensuring thorough and accurate completion of the Connecticut Promissory Note form is essential for a clear, enforceable agreement.

Crucial Points on This Form

What is a Connecticut Promissory Note?

A Connecticut Promissory Note is a legal document that outlines the details of a loan agreement between two parties in the state of Connecticut. It documents the amount of the loan, the interest rate, repayment schedule, and the obligations of the borrower to repay the lender under specified terms.

Is a Connecticut Promissory Note legally binding?

Yes, a Connecticut Promissory Note is legally binding if it is properly executed, containing all necessary signatures and adhering to Connecticut state laws. Both the borrower and the lender should keep a copy of the signed document.

Do I need a witness or notary for a Connecticut Promissory Note?

While not always required, having a witness or notarizing the promissory note can add an extra layer of legal protection and validity. It is recommended to consider notarization or a witness to ensure the enforceability of the document.

What should be included in a Connecticut Promissory Note?

A Connecticut Promissory Note should include the date of the agreement, names and addresses of both the borrower and lender, the principal loan amount, interest rate, repayment schedule, late fees, and the signatures of both parties.

How is interest determined for a Connecticut Promissory Note?

Interest on a Connecticut Promissory Note must comply with Connecticut's usury law limitations unless a specific exemption applies. The parties can agree on the interest rate, but it must not exceed the legal limit.

What happens if the borrower fails to repay according to the Connecticut Promissory Note?

If the borrower fails to comply with the repayment terms outlined in the promissory note, the lender may pursue legal action to recover the owed amount. This might include suing for the balance due and any interest and fees stipulated in the agreement.

Can I modify a Connecticut Promissory Note after it's been signed?

Yes, a Connecticut Promissory Note can be modified, but any changes must be agreed upon by both the borrower and lender. The modification should be in writing and attached to the original promissory note, with both parties providing new signatures.

Is there a specific format for a Connecticut Promissory Note?

While there is no rigid format mandated by law, a Connecticut Promissory Note should be drafted clearly and include all essential terms of the loan agreement. Clarity and completeness are key to ensure it is legally binding.

Can a Connecticut Promissory Note be used for both secured and unsecured loans?

Yes, a Connecticut Promissory Note can be structured as either secured or unsecured. A secured note is backed by collateral that the borrower agrees to forfeit to the lender if they fail to repay the loan, while an unsecured note is not backed by any collateral.

Where can I find a template for a Connecticut Promissory Note?

Templates for Connecticut Promissory Notes can be found online through legal websites, or you can consult a legal professional to draft a customized promissory note that meets your specific needs and complies with Connecticut law.

Common mistakes

When filling out the Connecticut Promissory Note form, individuals often aim to be diligent. However, common mistakes can happen, leading to complications down the line. Understanding these errors can prevent future disputes and ensure the agreement is legally sound.

Not Specifying the Type of Note: Failing to identify whether the note is secured or unsecured. A secured promissory note includes collateral that the lender can claim if the borrower defaults. In contrast, an unsecured note does not include this protection for the lender.

Omitting Key Information: Forgetting to include important details like the full names and addresses of both the borrower and the lender. This fundamental information establishes who is involved in the agreement.

Inaccurate Loan Amount: Not listing the exact amount of money being loaned can lead to confusion and potential legal disputes. It is crucial to state the precise figure both in words and numbers.

Vague Repayment Terms: Being unclear about the repayment schedule, whether it involves regular payments or a lump sum, and failing to specify due dates. Clarity in these terms helps prevent misunderstandings regarding expectations.

Overlooking Interest Rate: Not mentioning the interest rate or incorrectly calculating it can significantly affect the repayment amount. The interest rate must be clearly defined and comply with Connecticut’s usury laws to avoid rendering the note unenforceable.

Forgetting Late Fees and Penalties: Failing to outline the consequences of late payments leaves the lender without enforceable penalties, diminishing the note's effectiveness in ensuring timely repayment.

Ignoring Governing Law: Not specifying that Connecticut law governs the note can lead to ambiguity, especially if disputes arise. Identifying the governing law assures that any legal matters will be handled under Connecticut’s jurisdiction.

Lack of Signatures: The promissory note must be signed by both the borrower and the lender to be legally binding. Skipping this critical step can render the document nothing more than an informal agreement, lacking legal enforceability.

By avoiding these eight common mistakes, individuals can ensure their Connecticut Promissory Note is complete, clear, and legally binding. This diligence protects both parties and facilitates smoother financial transactions.

Documents used along the form

When dealing with financial agreements, particularly in Connecticut, a Promissory Note often requires additional documents to ensure a comprehensive and enforceable contract. These documents provide clarity, secure the loan, and safeguard both lender and borrower interests. Understanding each document's function will help in navigating through the complexities of financial transactions.

- Loan Agreement - This document outlines the detailed terms and conditions of the loan. While a Promissory Note acknowledges that a debt exists and promises repayment, a Loan Agreement goes further to specify the interest rate, repayment schedule, and what happens in the case of a default.

- Security Agreement - Often used alongside a Promissory Note for secured loans, this agreement grants the lender a security interest in a specific asset or property (collateral) of the borrower. If the borrower defaults, the lender has the right to seize the collateral to recover the outstanding loan amount.

- Guaranty - A Guaranty is a promise by a third party (the guarantor) to repay the loan if the borrower fails to do so. This document is crucial for lenders as it provides an additional layer of security for the loan.

- Amortization Schedule - This is a table detailing each periodic payment on a loan over time. An amortization schedule breaks down the amounts going towards principal and interest and showcases the balance after each payment is made, helping both parties keep track of the loan's progress.

- Notice of Default - This document serves as a formal notification from the lender to the borrower that they have failed to meet their obligations under the Promissory Note or accompanying agreements. The Notice of Default specifies the nature of the default and often provides a grace period for the borrower to remedy the situation.

Together, these documents play pivotal roles in the lifecycle of a loan, from initiation through to repayment or, in less fortunate scenarios, default resolution. Each document interlocks with the others to provide a solid legal framework, minimizing risks and clarifying the responsibilities of all parties involved. Being familiar with these forms and documents can significantly ease the process and ensure that both lenders and borrowers are well-protected and informed.

Similar forms

I.O.U. (I Owe You): Similar to a promissory note, an I.O.U. is a straightforward acknowledgment of debt, but it is less formal and typically lacks detailed repayment terms. Both serve as written promises to pay a specified sum of money to another party.

Loan Agreement: This document is similar to a promissory note in that both outline the borrower's promise to repay a sum of money to the lender. However, a loan agreement is more comprehensive, often including detailed terms regarding repayment schedule, interest rates, and consequences of default.

Mortgage: A mortgage is a loan agreement where the borrowed amount is used to purchase real property. Similar to a promissory note, it involves a promise to repay the loan under agreed terms, but it also grants the lender a security interest in the property as collateral for the debt.

Debenture: Often used by companies to borrow money, a debenture is like a promissory note in that it is a written promise to repay the borrowed amount. However, debentures are secured by the company's assets and may offer terms for converting debt into company shares, a feature not found in typical promissory notes.

Personal Guarantee: Similar to a promissory note in its function as a commitment to pay, a personal guarantee involves a third party agreeing to repay the debt if the original borrower defaults. It differs in that it is not a primary obligation to pay, but rather a secondary promise that depends on the borrower's failure to pay.

Bill of Exchange: A bill of exchange is similar to a promissory note as both are written orders for the payment of a specified amount of money to a specified person. However, a bill of exchange involves three parties (the drawer, the drawee, and the payee) and is commonly used in international trade, whereas a promissory note is a two-party instrument.

Dos and Don'ts

When filling out the Connecticut Promissory Note form, it's important to ensure accuracy and completeness. Below are essential do's and don'ts to consider.

- Do ensure you read the form in its entirety before beginning. Understanding all sections is crucial for filling it out correctly.

- Do provide complete information for all parties involved, including full legal names, addresses, and contact information.

- Do be precise when entering the loan amount. Write the figures clearly and confirm there are no discrepancies.

- Do specify the interest rate clearly. This rate must comply with Connecticut state laws to avoid being considered usurious.

- Do outline the repayment schedule in detail, including start dates, frequency of payments, and any grace periods allowed.

- Do include specifics about the late fees and consequences of default. These terms must be fair and reasonable.

- Do review the form for any optional clauses that may apply to your situation, such as prepayment penalties or acceleration clauses.

- Do sign and date the form in front of a notary public if required. This step is often necessary to add legal weight to the document.

- Don't leave blank spaces. If a section does not apply, mark it as "N/A" or "not applicable" to demonstrate that it was considered and found to be irrelevant.

- Don't use vague language. The terms should be clear and concise to prevent misunderstandings and disputes.

Misconceptions

The Connecticut Promissory Note form is often surrounded by misconceptions that can lead to confusion and misunderstanding. Clearing up these misconceptions is essential for anyone drafting, signing, or working with a promissory note in Connecticut. Here are eight common misconceptions explained:

- All Promissory Notes Are the Same: Many believe that all promissory notes are identical, regardless of the jurisdiction. However, Connecticut law might impose specific requirements or nuances that can significantly alter the form and content of the note. It is important that the promissory note comply with Connecticut laws to ensure its enforceability.

- Legal Assistance Is Not Necessary: Another common misconception is that drafting a promissory note is simple and does not require legal assistance. In reality, the assistance of a legal professional can help ensure that the note is compliant with state laws, contains all necessary terms, and protects the interests of all parties involved.

- Verbal Agreements Are Just As Binding: A verbal agreement in Connecticut is not as enforceable as a written promissory note when it comes to debt agreements. The lack of a written document can lead to challenges in proving the terms of the loan, interest rates, repayment schedule, and other critical details.

- Interest Rates Can Be Arbitrarily Set: There's a belief that parties can set any interest rate they agree upon. However, Connecticut law limits the maximum interest rate that can be charged. Charging an interest rate above this limit can render the note unenforceable and lead to legal penalties.

- A Promissory Note Guarantees Payment: While a promissory note is a legal instrument that obligates the borrower to pay back the sum borrowed, it does not guarantee that the lender will be repaid. The ability of the lender to collect depends on the borrower's financial situation and willingness to pay.

- Only the Borrower Needs to Sign the Note: It's a misconception that only the borrower’s signature is required on the promissory note. Connecticut law may require witnesses or a notary public to validate the signature, depending on the nature of the note and the amount of the loan.

- Any Type of Payment Structure Can Be Used: While promissory notes offer flexibility in payment structures, the agreed-upon structure must meet legal standards and be clearly outlined in the note. Ambiguities in payment terms can lead to disputes and legal challenges.

- There's No Need to Specify the Use of Funds: Lastly, many believe there’s no need to specify how the borrowed funds will be used. Though not always legally required, specifying the use of funds can protect both parties by setting clear expectations regarding the purpose of the loan.

Understanding these misconceptions can help individuals navigate the complexities of the Connecticut Promissory Note form more effectively, ensuring that the legal document serves its intended purpose and protects the interests of both the lender and the borrower.

Key takeaways

When it comes to creating and utilizing a Connecticut Promissory Note form, being well-informed is crucial. This document is key when one party (the borrower) promises to repay a sum of money to another party (the lender) under specific terms. Here are eight essential takeaways for ensuring that its completion and use are both effective and compliant with Connecticut law:

- Understand the Legal Requirements: Connecticut has specific laws that govern promissory notes. It's important to know these laws to ensure the note is legally binding and enforceable. This includes understanding the interest rate limits and the necessity of certain disclosures.

- Identify the Parties Clearly: The full legal names and addresses of both the lender and the borrower should be stated clearly. This clarity avoids any confusion about the parties' identities.

- Detail the Loan Amount: Specify the exact amount of money being loaned. This amount should be written in both words and numbers to prevent any ambiguities.

- Define Repayment Terms: Clearly outline how and when the loan will be repaid. This includes the repayment schedule, whether it's in installments, a lump sum, and the due date(s) for payments.

- Specify the Interest Rate: Clearly state the interest rate on the loan. Remember to comply with Connecticut's usury laws to avoid unenforceable interest rates.

- Address Late Fees and Penalties: If there are any fees or penalties for late payments, these should be detailed in the note. Outlining the consequences of late or missed payments upfront can help prevent future disputes.

- Include a Clause on Acceleration: An acceleration clause enables the lender to demand immediate repayment of the entire loan balance upon certain breaches, such as missed payments. Including this clause offers protection for the lender.

- Ensure Proper Execution: For a promissory note to be legally binding in Connecticut, it must be signed by all parties involved. Depending on the amount and terms, you may also need to have the signatures witnessed or notarized.

By paying close attention to these key points, parties can create a promissory note that is both compliant with Connecticut law and clear in its expectations and obligations. This careful preparation can help safeguard the interests of both lender and borrower, and provide a solid foundation for their financial transaction.

Create Other Promissory Note Forms for US States

Promissory Note New York - The document can be either secured or unsecured, impacting the lender’s recourse in case of non-payment.

Georgia Promissory Note - This form is widely used in personal and business finance as evidence of debt and the intention to repay it.