Blank Promissory Note Form for Florida

In the realm of financial agreements, the promissory note stands as a pivotal document, capturing in writing the promise to pay a specific sum of money under outlined conditions. Within the jurisdiction of Florida, these instruments are shaped by both statutory and case law, adapting to the nuances of state requirements and legal interpretations. The Florida Promissory Note form is a tailored embodiment of these principles, serving as an essential tool for lenders and borrowers alike in ensuring clarity and enforceability of their agreement. This form delineates the amount borrowed, interest rates, repayment schedule, and the consequences of default, among other critical terms. Its significance is further magnified by the flexibility it offers, accommodating both secured and unsecured loans. Consequently, its preparation demands a thorough understanding of Florida’s legal context to safeguard the interests of the parties involved and uphold the note's validity under state law.

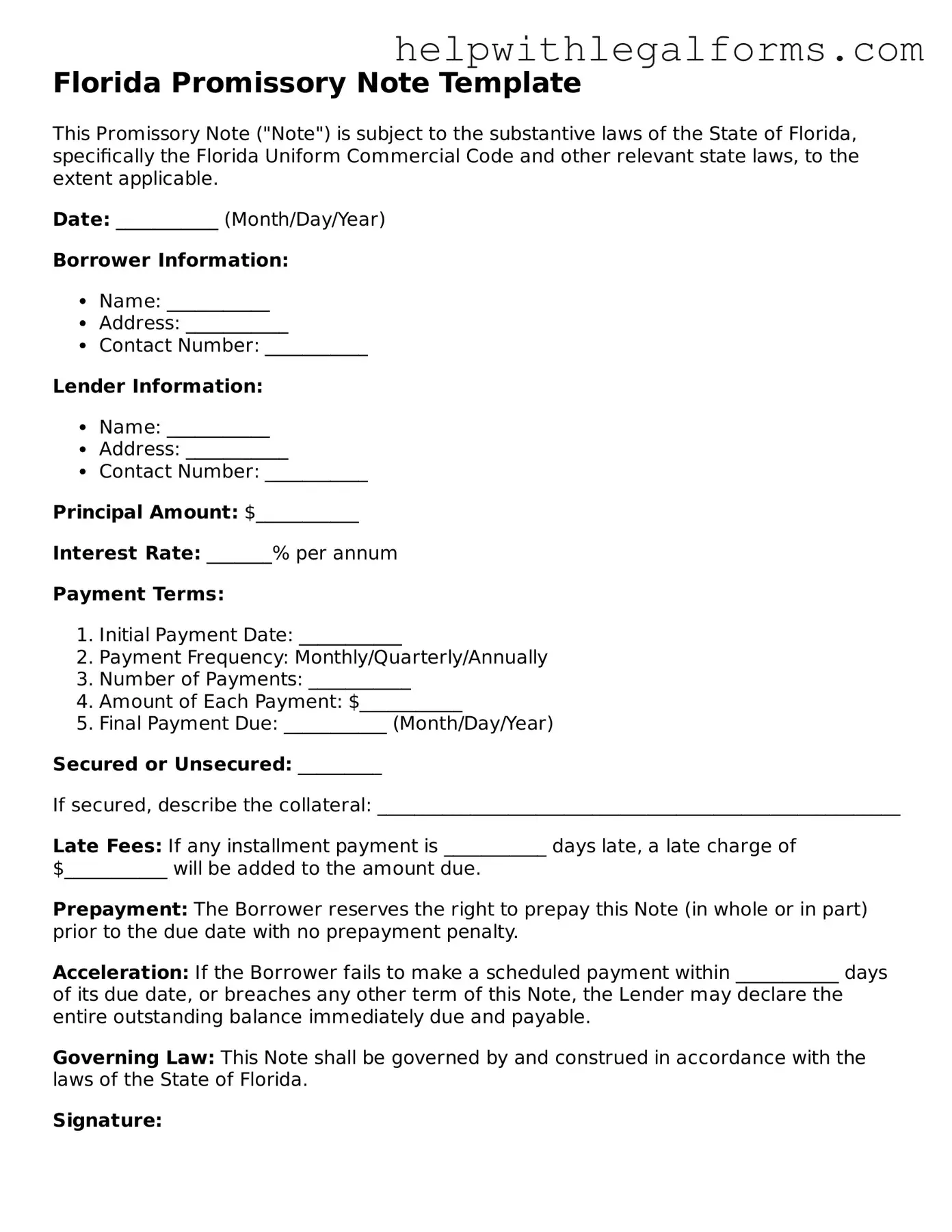

Example - Florida Promissory Note Form

Florida Promissory Note Template

This Promissory Note ("Note") is subject to the substantive laws of the State of Florida, specifically the Florida Uniform Commercial Code and other relevant state laws, to the extent applicable.

Date: ___________ (Month/Day/Year)

Borrower Information:

- Name: ___________

- Address: ___________

- Contact Number: ___________

Lender Information:

- Name: ___________

- Address: ___________

- Contact Number: ___________

Principal Amount: $___________

Interest Rate: _______% per annum

Payment Terms:

- Initial Payment Date: ___________

- Payment Frequency: Monthly/Quarterly/Annually

- Number of Payments: ___________

- Amount of Each Payment: $___________

- Final Payment Due: ___________ (Month/Day/Year)

Secured or Unsecured: _________

If secured, describe the collateral: ________________________________________________________

Late Fees: If any installment payment is ___________ days late, a late charge of $___________ will be added to the amount due.

Prepayment: The Borrower reserves the right to prepay this Note (in whole or in part) prior to the due date with no prepayment penalty.

Acceleration: If the Borrower fails to make a scheduled payment within ___________ days of its due date, or breaches any other term of this Note, the Lender may declare the entire outstanding balance immediately due and payable.

Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of Florida.

Signature:

By signing below, the Borrower and the Lender agree to the terms of this Promissory Note.

Borrower's Signature: ___________ Date: ___________

Lender's Signature: ___________ Date: ___________

PDF Form Attributes

| Fact Number | Fact Detail |

|---|---|

| 1 | The Florida Promissory Note is a legal document that outlines the terms of a loan between two parties in Florida. |

| 2 | It is recognized and enforceable under Florida law, specifically under Title XXXIX Commercial Relations, Chapter 673 Uniform Commercial Code: Negotiable Instruments. |

| 3 | The note details the principal amount of money borrowed, the interest rate applied, and the repayment schedule. |

| 4 | Interest rates on a promissory note in Florida must comply with the state's usury laws to prevent illegal interest charges. |

| 5 | Both secured and unsecured forms of promissory notes are available, depending on whether collateral is used to guarantee repayment. |

| 6 | Signatures from both the borrower and lender are required to make the document legally binding. |

| 7 | Co-signers can be included in the Florida Promissory Note for additional security for the lender. |

| 8 | If the borrower defaults on the note, the lender has the right to pursue legal action or collection efforts in accordance with Florida law. |

| 9 | Electronic signatures are acknowledged as valid and legally binding in Florida, adding convenience to the execution of promissory notes. |

Instructions on How to Fill Out Florida Promissory Note

Once you've decided to create a Florida Promissory Note, it's crucial to understand the steps involved in completing this form. This document serves as a formal agreement between a borrower and a lender, outlining the repayment terms for a loan. The process can seem daunting at first, but by following these detailed instructions, you can ensure that your Promissory Note is filled out accurately and effectively. It's important for both parties to review the document thoroughly before signing to protect their interests and ensure a clear understanding of their obligations.

- Start by filling in the date at the top of the form in the format MM/DD/YYYY. This is the date on which the agreement is being made.

- Enter the full legal names of the borrower and the lender. Make sure to include any co-signers if applicable.

- Specify the principal amount of the loan in US dollars. This should be the amount being lent, without interest.

- Detail the interest rate per annum. This percentage represents the cost of borrowing the principal sum and should be in compliance with Florida's usury laws.

- Describe the repayment terms. This includes how often payments will be made (e.g., monthly, quarterly), the amount of each payment, and the start date of the first payment.

- If there are any prepayment terms, indicate them. This section is where you note if the borrower can pay off the loan early without penalty or if there is a prepayment penalty.

- Include any collateral securing the loan. If the loan is secured, describe the collateral that the borrower is offering.

- List the full names and addresses of both the borrower and the lender at the end of the agreement. This ensures that all parties are correctly identified and can be contacted regarding the note.

- Both the borrower and the lender must sign and date the promissory note. If there are co-signers, they must also sign the document.

- Consider having the signatures witnessed or notarized for added legal validity, although this is not a requirement under Florida law.

Following these steps carefully will help you complete the Florida Promissory Note correctly. It's a good practice for both parties to retain a copy of the signed document for their records. This note serves as a binding agreement, so it's crucial to ensure that all information is accurate and that both the borrower and the lender understand their responsibilities and rights under this contract. Ensuring everything is in order from the start can prevent misunderstandings and disputes down the line.

Crucial Points on This Form

What is a Florida Promissory Note?

A Florida Promissory Note is a legal document that outlines the details of a loan between two parties in Florida. It includes important terms such as the amount of the loan, the interest rate, repayment schedule, and the obligations of the borrower to repay the lender.

Is a Florida Promissory Note legally binding?

Yes, a Florida Promissory Note is legally binding. Once both parties sign the document, they agree to the terms laid out within it, making it enforceable under Florida law.

Do I need a witness or notary for a Florida Promissory Note?

While not always required, having a witness or notarizing your Florida Promissory Note can add a layer of protection and validity. For secured loans, it's especially recommended to notarize the document to validate the security agreement.

What is the difference between a secured and an unsecured Florida Promissory Note?

A secured promissory note is backed by collateral. If the borrower fails to repay the loan, the lender can seize the collateral. An unsecured promissory note does not have this backing, making it riskier for the lender since there is no collateral to recover in case of default.

How can I enforce a Florida Promissory Note if the borrower doesn't pay?

If a borrower defaults on repayment, the lender has the right to take legal action to enforce the note. This could include suing for the balance owed or seizing collateral if the note is secured. In Florida, the statute of limitations on promissory notes is typically five years for taking legal action.

Can I charge any interest rate on a Florida Promissory Note?

Florida law limits the interest rate you can charge on a promissory note. The maximum legal interest rate is 18% per annum for sums below $500,000, and 25% per annum for sums of $500,000 or above. Charging more can result in penalties and the note being considered usurious.

What should be included in a Florida Promissory Note?

A Florida Promissory Note should include the names and addresses of the borrower and lender, the loan amount, interest rate, repayment schedule, maturity date, and any collateral. It should also have clauses related to late fees, default provisions, and any other terms agreed upon by the parties.

Can parties modify a Florida Promissory Note after signing it?

Yes, the parties can modify a Florida Promissory Note after signing it, but any amendment should be done in writing and signed by both the lender and the borrower. Oral agreements to modify the note are not enforceable under Florida law.

Is a Promissory Note necessary for personal loans between family and friends in Florida?

Although it might seem formal, using a promissory note for personal loans between family and friends in Florida is advisable. It clarifies the terms of the loan, protecting the relationship and ensuring that both parties understand their rights and obligations.

Common mistakes

-

Not specifying the terms of repayment in clear, unambiguous language. Clarity is key when defining how and when payments should be made. This includes stating exact amounts, due dates, and the total number of payments. Without this specificity, the agreement can become a source of conflict between the lender and borrower.

-

Omitting the interest rate or failing to articulate whether it's fixed or variable. Interest rates significantly affect the total amount that needs to be repaid. Florida law has specific caps on interest rates; if the rate on your promissory note exceeds this limit, it could be considered usurious and, thus, illegal.

-

Forgetting to include late fees and repercussions for defaulting. It's unpleasant to think about, but outlining what happens if payments are late or not made at all is crucial. These terms should cover any late fees, the grace period before a payment is considered late, and any actions the lender can take if the borrower defaults on the loan.

-

Failing to document the security agreement, if applicable. Some promissory notes are secured with collateral. If your agreement includes this provision, the details of the collateral—what it is, its value, and conditions for seizure—should be clearly recorded. This ensures both parties understand what's at stake if the loan is not repaid.

-

Not obtaining signatures from all parties involved or witnesses, when necessary. A promissory note must be signed by both the borrower and the lender to be legally binding. In Florida, depending on the sum of the loan, it might also need to be witnessed or notarized. Skipping this step can invalidate the entire agreement.

When filling out a promissory note in Florida, ensuring every detail is meticulously accounted for can prevent legal headaches down the road. It's more than just filling out a form—it's crafting a legal agreement that protects both borrower and lender. If there's any uncertainty, consulting with a legal professional familiar with Florida's specific requirements can be invaluable.

Documents used along the form

When dealing with financial transactions, such as loans in Florida, a promissory note is a key document. However, this form is often accompanied by other legal documents to ensure clarity, legal compliance, and protection for all parties involved. Below is a list of documents that are commonly used alongside the Florida Promissory Note to make financial agreements more comprehensive.

- Mortgage Agreement: This document secures the loan by using the borrower's property as collateral. It outlines the rights and responsibilities of the borrower and lender concerning the property.

- Deed of Trust: Similar to a Mortgage Agreement, this document involves a third party, known as a trustee, who holds the title to the property until the loan is paid in full.

- Loan Agreement: A comprehensive contract that includes the promissory note's terms, such as interest rates and repayment schedule, along with other conditions and covenants of the loan.

- Security Agreement: This document gives the lender a security interest in a specific asset that is not real estate, acting as collateral for the loan.

- Guaranty: An agreement where a third party agrees to be responsible for the loan payments if the original borrower fails to make them.

- Amendment Agreement: Used to document any changes to the terms of the original promissory note or related agreements.

- Release of Promissory Note: This document is a receipt that acknowledges the borrower's full repayment of the loan, releasing them from their obligations under the promissory note.

- Notice of Default: A written notification sent to a borrower indicating that they have failed to make their required payment by the due date.

- Acceleration Notice: A notice from the lender to the borrower declaring that due to an event of default, the full balance of the loan is immediately due and payable.

- Subordination Agreement: This agreement changes the priority order of claims against the borrower’s assets, usually in favor of the new lender.

The use of these documents, in conjunction with a Florida Promissory Note, creates a well-structured legal framework that delineates the obligations and protections of all parties in a financial transaction. It's advisable for individuals to consult with a legal professional to ensure that all documents are correctly prepared and legally sound, tailored to their specific needs and circumstances.

Similar forms

Mortgage Agreement: Similar to a promissory note, a mortgage agreement is a documented promise. However, it specifically secures a loan on a piece of real estate. While the promissory note signifies the borrower's promise to repay the loan, the mortgage agreement ties that promise to the physical property as collateral.

Loan Agreement: This is a comprehensive document that outlines the terms of a loan, similar to how a promissory note delineates the repayment structure. The difference is that a loan agreement often includes additional clauses and details, such as provisions for breach of contract and conditions of the borrowing.

IOU (I Owe You): An IOU is a simple acknowledgment of debt, much like a promissory note. However, it is less formal and typically doesn’t include specific repayment terms. An IOU simply notes that one party owes another, without the detailed schedule and interest terms usually found in promissory notes.

Bill of Sale: A bill of sale is a document that records the transfer of ownership of an asset, similar to how a promissory note records the agreement to repay a debt. Both serve as legal proof of an agreement between two parties, though they concern different types of transactions.

Lease Agreement: This document outlines the terms under which one party agrees to rent property from another party, similar to how a promissory note specifies the terms of a loan. Both include specific terms agreed upon by both parties and establish a formal relationship with obligations.

Bond: A bond is a type of investment that represents a loan made by an investor to a borrower, typically a corporation or government. Like a promissory note, a bond includes the terms for repayment of the principal, along with interest. However, bonds are usually used in larger financial transactions and are tradable in the financial markets.

Credit Agreement: This agreement outlines the terms of credit extended from a lender to a borrower. Similar to a promissory note, it details repayment obligations and interest. A credit agreement, however, often relates to revolving credit, such as a credit card or line of credit, rather than a single loan amount.

Rental Agreement: Similar to a lease agreement, a rental agreement specifies the conditions under which one party can rent property from another. Although it generally pertains to shorter periods, akin to a lease, it forms a legally binding contract that outlines responsibilities, much like a promissory note details financial responsibilities.

Security Agreement: A security agreement provides a lender a security interest in an asset that is pledged as collateral for a loan, similar to a mortgage. This document complements a promissory note by specifying what assets are being used as security, ensuring the lender can recover losses if the borrower defaults.

Student Loan Agreement: Specifically designed for educational loans, this document outlines the borrower's promise to repay borrowed money for tuition and other school-related expenses. Like a promissory note, it specifies the amount borrowed, interest rate, repayment schedule, and the obligations of the borrower.

Dos and Don'ts

When filling out the Florida Promissory Note form, adhering to certain guidelines can protect both the borrower and the lender, ensuring that the agreement is enforceable and clear. Here are essential do's and don'ts to consider during the process:

Do's:

- Clearly identify the parties: Ensure the names and addresses of both the borrower and the lender are accurately detailed to avoid any confusion about who is obligated or entitled under the note.

- Specify loan details: Include the loan amount in words and numbers, the interest rate, and the repayment schedule. This clarity helps prevent misunderstandings regarding the loan terms.

- Outline the consequences of default: Clearly state the actions that will be taken if the borrower fails to make timely payments. This may include late fees or acceleration of the repayment schedule.

- Sign and date the document: Both parties should sign and date the form. In some cases, it may also be beneficial to have the signatures notarized to further authenticate the document.

Don'ts:

- Overlook state laws: Failing to comply with Florida's specific legal requirements can render the promissory note unenforceable. It’s important to understand these laws or consult with a professional to ensure compliance.

- Leave blanks: Do not leave any sections of the form blank. If a section does not apply, it's advisable to note that it is not applicable (N/A) to avoid potential alterations after signing.

- Forget to provide a copy to both parties: After the promissory note is completed and signed, both the borrower and the lender should retain a copy for their records. This ensures that both have evidence of the agreement and its terms.

- Use vague language: Ambiguities in the promissory note can lead to disputes and legal challenges. Make sure that all terms, including repayment plans and obligations, are described in clear, unambiguous language.

Misconceptions

When dealing with Florida's Promissory Note forms, several misconceptions can lead to confusion and mismanagement of expectations. It's crucial to debunk these myths to ensure individuals are fully informed and can navigate their financial agreements with clarity.

All Promissory Notes in Florida are the same: The belief that one form fits all situations is incorrect. The terms within a Promissory Note can vary vastly depending on the specific agreements between the lender and the borrower. These terms might include the repayment schedule, interest rates, and what happens in case of a default.

Verbal agreements are as binding as written Promissory Notes in Florida: While verbal agreements can be enforceable, a written Promissory Note is far more reliable and easier to prove in court. Florida law requires that for a Promissory Note to be legally binding, it must be in writing and signed by both the lender and the borrower.

A notary signature is always required for a Florida Promissory Note: Not all Promissory Notes require notarization to be considered valid. Although having a notarized Promissory Note can add a layer of authenticity and might be necessary under specific circumstances, it is not a legal requirement for enforceability in Florida.

You can’t alter a Promissory Note once it's been signed: Amendments can be made to a Promissory Note after it has been signed, provided that both parties agree to the changes in writing. Any modification should be attached to the original Note to ensure clarity and legal standing.

A Promissory Note is only about the repayment of the principal amount: A Promissory Note can include various terms beyond the repayment of the principal. It may specify interest rates, late payment fees, collateral agreements, and actions in case of default, making it a comprehensive legal document.

There's no need for a Promissory Note if you trust the other party: Trust is fundamental, but a Promissory Note serves as a clear record of the agreement and can prevent misunderstandings. It provides a legal framework that protects both the lender and the borrower, regardless of their personal relationship.

Only financial institutions can issue Promissory Notes: Individuals can also create and issue Promissory Notes. This flexibility allows private lending between friends, family members, or acquaintances to be formalized, providing a structured and legal way to manage personal loans.

Correcting these misconceptions ensures that individuals entering into a Promissory Note agreement in Florida do so with accurate knowledge and expectations. This awareness helps in making informed decisions, ultimately fostering a legally sound and respectful lending relationship.

Key takeaways

When dealing with the Florida Promissory Note form, individuals should pay careful attention to ensure that this financial document is filled out and used correctly. The form plays a crucial role in formalizing loan agreements between parties, thereby helping to protect the interests of both lenders and borrowers. Below are key takeaways to consider when navigating through this process:

- Understand the Purpose: A Promissory Note in Florida serves as a legal agreement that obligates a borrower to repay a loan to a lender, under specific conditions. It is imperative to understand its legal significance.

- Clarify Loan Details: The form must clearly outline the loan amount, interest rate, repayment schedule, and maturity date. Accurate details prevent misunderstandings between the parties involved.

- Specify Interest Rates: Florida law requires that the interest rate on a promissory note must not violate state usury laws. It's important to verify the current legal limits to set a compliant interest rate.

- Include Parties' Information: Full names and addresses of the lender and borrower should be clearly stated. This ensures that all parties are properly identified and can be contacted if necessary.

- Detail the Repayment Plan: Whether the loan is to be repaid in installments, a lump sum, or upon demand, the terms should be explicitly stated to avoid any future disputes.

- Consider Secured vs. Unsecured Note: Decide whether the loan will be secured by collateral. If so, details of the collateral must be included within the note, distinguishing it from an unsecured note.

- Signatures Are Essential: The Promissory Note must be signed by the borrower and, in some cases, co-signed by a guarantor to ensure its enforceability. Witness signatures may also be required.

- Keep Records: Both parties should keep a signed copy of the note. This document serves as a key record of the loan agreement and may be needed for future reference.

- Understand State Laws: Being familiar with Florida's laws regarding promissory notes, including limitations on interest rates and enforcement procedures, is critical for ensuring that the agreement is legally compliant.

By taking these considerations into account, parties can ensure that the Promissory Note is accurately completed and serves its intended purpose of providing clarity and legal recourse in lending agreements. Compliance with state laws and attention to detail in the document's preparation can significantly reduce the risk of disputes and enhance the enforceability of the agreement.

Create Other Promissory Note Forms for US States

Free Promissory Note Template Texas - This document legally binds the borrower to repay their debt, offering lenders a sense of security and a clear pathway to recourse if necessary.

Promissory Note New York - Correct execution of a promissory note form requires acknowledgment and signatures from all involved parties, validating its terms.

Promissory Note Colorado - Signature lines for witnesses or notaries may be included, adding an additional layer of formalization and security.