Blank Promissory Note Form for Georgia

In the realm of financial agreements in Georgia, the Promissory Note form stands as a pivotal document for individuals seeking to formalize a loan arrangement. This document not only outlines the amount of money being borrowed but also meticulously details the repayment schedule, interest rates, and the consequences of failing to meet the agreed-upon terms. It’s an essential tool for both lenders and borrowers, offering legal protection and clarity for both parties involved. The Georgia Promissory Note form is designed to comply with state laws, ensuring that all provisions are enforceable and that the agreement meets all the required legal standards. From personal loans between family members to more formal lending scenarios, this form serves as a backbone for financial transactions, encapsulating the commitment of the borrower to repay the lent sum under the conditions laid out. Its role in financial dealings within Georgia cannot be understated, providing a foundation of trust and legal recourse, which underpins the dynamics of lending and borrowing in the state.

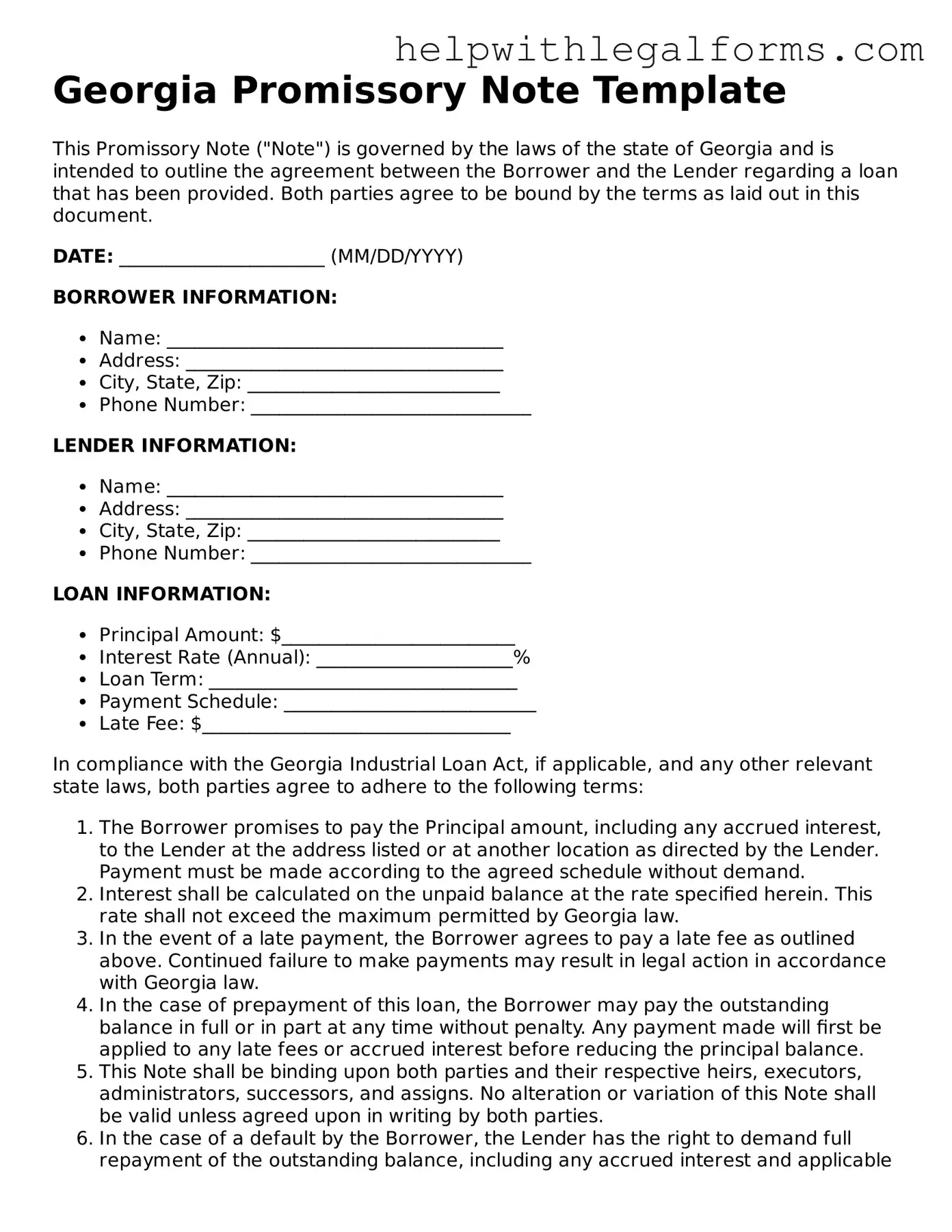

Example - Georgia Promissory Note Form

Georgia Promissory Note Template

This Promissory Note ("Note") is governed by the laws of the state of Georgia and is intended to outline the agreement between the Borrower and the Lender regarding a loan that has been provided. Both parties agree to be bound by the terms as laid out in this document.

DATE: ______________________ (MM/DD/YYYY)

BORROWER INFORMATION:

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip: ___________________________

- Phone Number: ______________________________

LENDER INFORMATION:

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip: ___________________________

- Phone Number: ______________________________

LOAN INFORMATION:

- Principal Amount: $_________________________

- Interest Rate (Annual): _____________________%

- Loan Term: _________________________________

- Payment Schedule: ___________________________

- Late Fee: $_________________________________

In compliance with the Georgia Industrial Loan Act, if applicable, and any other relevant state laws, both parties agree to adhere to the following terms:

- The Borrower promises to pay the Principal amount, including any accrued interest, to the Lender at the address listed or at another location as directed by the Lender. Payment must be made according to the agreed schedule without demand.

- Interest shall be calculated on the unpaid balance at the rate specified herein. This rate shall not exceed the maximum permitted by Georgia law.

- In the event of a late payment, the Borrower agrees to pay a late fee as outlined above. Continued failure to make payments may result in legal action in accordance with Georgia law.

- In the case of prepayment of this loan, the Borrower may pay the outstanding balance in full or in part at any time without penalty. Any payment made will first be applied to any late fees or accrued interest before reducing the principal balance.

- This Note shall be binding upon both parties and their respective heirs, executors, administrators, successors, and assigns. No alteration or variation of this Note shall be valid unless agreed upon in writing by both parties.

- In the case of a default by the Borrower, the Lender has the right to demand full repayment of the outstanding balance, including any accrued interest and applicable late fees. The Lender may also pursue any other legal remedies available under Georgia law.

By signing below, both the Borrower and the Lender acknowledge they have read, understand, and agree to the terms of this Promissory Note.

BORROWER'S SIGNATURE: _______________________________ DATE: _______________

LENDER'S SIGNATURE: _________________________________ DATE: _______________

PDF Form Attributes

| Fact Number | Fact Detail |

|---|---|

| 1 | Georgia Promissory Note forms are legal documents used to document a loan agreement between a lender and a borrower. |

| 2 | The form outlines the repayment terms including the loan amount, interest rate, repayment schedule, and maturity date. |

| 3 | Under Georgia law, the maximum interest rate that can be charged is stipulated by state usury laws, unless an exception applies. |

| 4 | In case of default, the promissory note outlines the rights of the lender to demand full repayment or take legal action. |

| 5 | Unsecured and secured are the two types of promissory notes; secured notes require collateral, whereas unsecured notes do not. |

| 6 | Georgia Promissory Notes can be used for personal loans, business loans, real estate purchases, and vehicle loans. |

| 7 | They must be signed by both the borrower and the lender to be considered legally binding. |

| 8 | The presence of a co-signer is optional and depends on the agreement between the lender and borrower. |

| 9 | Governed by Georgia law, these forms should be in compliance with all state regulations, including the Georgia Fair Lending Act and the Georgia Industrial Loan Act. |

Instructions on How to Fill Out Georgia Promissory Note

Filling out a Georgia Promissory Note form involves a series of straightforward steps. This legal document is crafted to facilitate the process of lending money, ensuring that the borrower agrees to repay the lender under the terms and conditions agreed upon. Whether funds are borrowed from a financial institution or an individual, completing this form correctly is critical for its enforcement and effectiveness. Follow these steps methodically to ensure that every section of the form is accurately filled out, making the agreement legally binding and protecting the interests of both parties involved.

- Begin by entering the date the promissory note is being executed in the top right corner of the form.

- In the “Borrower” section, provide the full legal name and address of the person or entity borrowing the money.

- In the “Lender” section, enter the full legal name and address of the person or entity lending the money.

- Specify the principal amount of money being loaned in the “Principal Amount” section, in both words and figures.

- Detail the interest rate per annum in the “Interest” section, ensuring compliance with Georgia's legal statutes to prevent the agreement from being considered usurious.

- Under “Payment,” enumerate the terms of repayment. This includes the total number of payments, the amount of each payment, and the due date for the first payment and subsequent payments.

- In the “Due Date” section, state the final deadline by which the loan must be completely repaid.

- If applicable, provide details regarding collateral in the “Security” section to specify any assets that the borrower agrees to pledge as security for the loan.

- Both parties should review all sections of the note to ensure accuracy and mutual understanding of the terms.

- Have the borrower sign and date the bottom of the form. If required, a co-signer should also sign and date.

- Ensure the lender or an authorized representative signs and dates the form, which validates the agreement.

- It may be necessary to have the signatures notarized, depending on the loan amount and the agreement between the parties. If so, ensure a notary public can officially witness the signing and affix their seal.

Once all parties complete these steps and the document is fully executed, the Georgia Promissory Note becomes a legally enforceable contract, obligating the borrower to repay the loan under the conditions outlined. Retain copies of the signed promissory note for the records of both the borrower and lender, ensuring that both have access to this important agreement throughout the duration of the loan.

Crucial Points on This Form

What is a Georgia Promissory Note?

A Georgia Promissory Note is a written agreement between two parties - the borrower and the lender - outlining the terms under which money is borrowed and must be paid back. This document is legally binding in Georgia and includes details such as the amount borrowed, interest rate, repayment schedule, and any collateral securing the loan.

Is a Promissory Note legally binding in Georgia?

Yes, in Georgia, a promissory note is a legally binding document when it is executed in accordance with state laws. It must contain certain elements, such as a clear promise to repay the sum borrowed, to be enforceable. Both the borrower and lender should sign the document, making a legal commitment to adhere to its terms.

Do I need to notarize a Promissory Note in Georgia?

Notarization is not a legal requirement for a promissory note to be valid in Georgia. However, having the document notarized can add a layer of verification and may help in the enforcement of the note, should that become necessary.

What should be included in a Georgia Promissory Note?

To ensure completeness, a Georgia Promissory Note should include the date the note was issued, the amount of the loan, interest rate, repayment terms (including schedule and due dates), information about the borrower and lender, and any collateral securing the loan. Signatures from both parties are also essential for the document's validity.

Can I enforce a Promissory Note in Georgia if it's not paid?

If a borrower fails to meet the payment obligations outlined in a promissory note, the lender can enforce the note in a Georgia court. The enforcement process may involve filing a lawsuit to recover the borrowed amount, plus any interest and legal fees, depending upon the terms of the note and Georgia law.

How does a secured Promissory Note differ from an unsecured Promissory Note?

In Georgia, a secured promissory note is backed by collateral, meaning the borrower pledges an asset (like real estate or a vehicle) as security for the loan. If the borrower defaults, the lender may take possession of the collateral. An unsecured promissory note does not involve collateral, relying solely on the borrower's promise to repay the loan amount.

What happens if a Promissory Note is lost in Georgia?

If a promissory note is lost in Georgia, the lender can still enforce it if they can prove the existence and terms of the original note. Legal actions may include a court petition to establish the note's contents and the obligation of the borrower to repay the debt under those terms.

Can the terms of a Georgia Promissory Note be modified?

Yes, the terms of a Georgia Promissory Note can be modified, but any modifications must be agreed upon by all parties involved. It's best to document any changes in writing and have all parties sign the updated document to avoid any future disputes.

What is the statute of limitations for a Promissory Note in Georgia?

In Georgia, the statute of limitations for enforcing the collection of debt under a promissory note is generally six years from the date of default. However, this period can vary depending on the specific terms of the note and any actions taken by the lender or borrower.

How can a Georgia Promissory Note be cancelled?

A Georgia Promissory Note can be cancelled when the loan is fully repaid. The lender should then mark the note as "paid in full" and return it to the borrower. If both parties agree to cancel the note before the loan is fully repaid, this agreement should be documented, and both parties should sign off on the cancellation.

Common mistakes

-

Not specifying the total amount loaned is a common error. This figure is crucial as it clarifies the obligation.

-

Omitting the interest rate can lead to misunderstandings. Always include the agreed-upon rate.

-

Failing to detail the repayment schedule leaves ambiguity about due dates and payments.

-

Not defining the consequences of late payments can encourage delinquency.

-

Skipping the inclusion of both lender's and borrower's full names and addresses compromises the form's clarity and enforceability.

-

Forgetting to stipulate what happens if the borrower fails to meet the terms of the note renders it less effective.

-

Leaving the signature lines blank is a critical oversight that can question the agreement's validity.

-

Ignoring state-specific legal requirements can result in the note not being legally enforceable.

Each of these mistakes can significantly impact the enforceability of the promissory note. It's essential to fill out the form completely and accurately to avoid potential legal complications.

Documents used along the form

When entering into a financial agreement in Georgia, the Promissory Note form often serves as the cornerstone document, evidencing the promise to repay a loan under specified conditions. However, to ensure the enforceability of the agreement and to address all legal nuances, several additional documents and forms are commonly used alongside the Promissory Note. These accompanying documents not only reinforce the terms of the loan agreement but also provide a comprehensive legal framework to protect the interests of both the lender and the borrower.

- Loan Agreement: A comprehensive document that outlines the full terms and conditions of the loan. It includes key details such as the loan amount, interest rate, repayment schedule, and any collateral securing the loan. This agreement provides a detailed framework for the loan, while the Promissory Note serves as a commitment to pay.

- Security Agreement: When a loan is secured with collateral, a Security Agreement is used to detail the specifics of the collateral that secures the loan. This document helps to enforce the lender's right to the collateral if the borrower defaults on the loan.

- Amortization Schedule: An Amortization Schedule breaks down the payments on the loan into principal and interest portions over the course of the loan term. This document helps both parties understand how each payment reduces the loan balance over time.

- Guaranty: A Guaranty is a separate agreement where a third party (the guarantor) agrees to assume responsibility for the loan if the primary borrower fails to repay. This provides an additional layer of security for the lender.

- Notice of Default: This document serves as a formal notice to a borrower that they have failed to meet their obligations under the terms of the Promissory Note, specifying the nature of the default and any corrective action required.

- Release of Promissory Note: Once the loan is fully repaid, a Release of Promissory Note is issued by the lender. This document officially releases the borrower from their obligations under the note.

- Lien Waiver: In transactions involving collateral, a Lien Waiver may be used post-repayment to relinquish any claims or liens the lender may have had on the property used as collateral.

- Mortgage Agreement: If real estate is used as collateral for the loan, a Mortgage Agreement may accompany the Promissory Note. This legally binding document secures the property as collateral for the loan.

- UCC-1 Financing Statement: For loans involving personal property as collateral, a UCC-1 Financing Statement may be filed. This document publicizes the lender's interest in the collateral to other potential creditors.

In conclusion, while the Promissory Note is a critical document for laying out the promise to repay a loan, it is the combination of the Promissory Note and these additional documents that together create a robust legal structure, ensuring clarity and security for both parties involved in a loan transaction in Georgia. Each document plays a vital role in outlining responsibilities, protecting rights, and clarifying the terms of financial engagements.

Similar forms

A Loan Agreement is quite similar to a Promissory Note in that both are legally binding agreements between a lender and a borrower about the terms of a loan. The key difference often lies in the complexity and detail of the document. A Loan Agreement typically covers more extensive terms, including the repayment schedule, interest rates, and what happens in case of a default, whereas a Promissory Note is usually more straightforward and focuses on the promise to pay a specific sum by the borrower.

An IOU (I Owe You) also shares similarities with a Promissory Note, as both document a debt owed by one party to another. However, an IOU is far less formal and typically does not include detailed terms of repayment such as interest rates or payment schedules. An IOU might merely state the amount owed and by whom, making it less enforceable than a Promissory Note.

A Mortgage Agreement is related to a Promissory Note in its function of documenting a loan that is used to purchase real estate, but it is more complex. In addition to including a promise to repay the loan, a Mortgage Agreement secures the loan with the property as collateral. This means that if the borrower fails to repay the loan, the lender has the right to take possession of the property. While a Promissory Note may accompany a Mortgage Agreement, detailing the borrower's promise to pay, it is the Mortgage Agreement that establishes the lien on the property.

A Bond is a form of a Promissory Note issued by corporations or governments as a way to raise funds. Both involve a promise to pay back a principal amount plus interest by a certain date. However, bonds are more complex financial instruments that can be bought and sold in financial markets, often involving many investors, and they typically include specific terms regarding the rate of return, maturity date, and conditions under which the issuer can default. Bonds also may be secured by specific assets or remain unsecured, depending on their type.

Dos and Don'ts

When filling out the Georgia Promissory Note form, it's crucial to approach the task with a clear understanding of what information is necessary and how it should be presented to legally bind the agreement and protect all parties involved. Below are key dos and don'ts to consider:

- Do ensure all party details are complete and accurate. This includes the full legal names of both the borrower and the lender, their addresses, and contact information.

- Do specify the loan amount in clear, unambiguous figures and words. Ensuring that there is no discrepancy between them is fundamental for legal clarity.

- Do clearly articulate the interest rate, adhering to Georgia's legal limits. This should be stated as an annual rate.

- Do outline a precise payment schedule. Include details such as the frequency of payments, the amount of each payment, and the due date for the final installment.

- Don't leave any ambiguity regarding the loan's terms and conditions. This includes failing to define the consequences of a default or late payments.

- Don't forget to specify any collateral securing the loan, if applicable. Detailing what the collateral is and the conditions under which it can be seized is key.

- Don't neglect to have all parties sign and date the document. In Georgia, acknowledging the agreement in writing and signatures are critical for enforceability.

- Don't omit the choice of law clause. Stating that the note will be governed by the laws of the State of Georgia cements the legal jurisdiction.

Misconceptions

When discussing the Georgia Promissory Note form, several misconceptions tend to surface. Understanding these misconceptions is crucial for individuals entering into a loan agreement, ensuring clarity and legal protection for all parties involved. Below is a list of common misunderstandings and explanations to shed light on the reality of promissory notes in Georgia.

- Misconception 1: Promissory notes in Georgia do not need to be in writing to be enforceable. Contrary to this belief, for a promissory note to be legally binding in Georgia, it must be documented in writing. Oral agreements are significantly more challenging to enforce and do not offer the same level of legal protection.

- Misconception 2: Witnesses or notarization are mandatory for all promissory notes. While having witnesses or a notarized document can add a layer of validation, Georgia law does not universally require these for promissory notes to be enforceable.

- Misconception 3: There is a one-size-fits-all format for promissory notes. Each promissory note can be tailored to the specific terms agreed upon by the lender and borrower. There is no strict universal format, but certain essential elements must be included for the note to be valid in Georgia.

- Misconception 4: Promissory notes and loan agreements are the same. A promissory note is a promise to pay back a debt under the agreed terms, whereas a loan agreement is a comprehensive contract detailing all terms of the loan, including but not limited to, repayment plans, interest rates, and collateral, if any.

- Misconception 5: Interest rates on promissory notes can be as high as the parties agree. Georgia law caps the interest rate that can be charged, and charging an interest rate higher than allowed can render the promissory note void or subject to penalties.

- Misconception 6: A promissory note guarantees repayment of the loan. While it legally binds the borrower to repay the debt, it doesn't absolutely guarantee that repayment will occur. Lenders may still need to take legal action to recover unpaid debts.

- Misconception 7: Only financial institutions can issue promissory notes. In reality, any individual or entity can issue a promissory note as a form of agreement for the repayment of a loan, provided all legal requirements are met.

- Misconception 8: Promissory notes are only for large loans. Promissory notes can be used for loans of any size and are particularly common in personal loans between individuals.

- Misconception 9: The borrower solely benefits from a promissory note. Both the borrower and lender benefit from the clarity and legal framework provided by a promissory note, ensuring the terms of the loan are understood and enforceable.

- Misconception 10: If a borrower defaults, the lender immediately takes possession of any collateral. The process for seizing collateral is governed by the specific terms of the promissory note and applicable Georgia laws. Lenders typically must follow a legal process, which can include notification of default and potentially court proceedings, before taking possession of collateral.

Understanding these misconceptions can help individuals better navigate the complexities of promissory notes in Georgia, enabling both lenders and borrowers to enter into agreements with confidence and clear expectations.

Key takeaways

When dealing with the Georgia Promissory Note form, it's important to approach the process with care and understanding. This document is a binding legal agreement between a borrower and a lender, specifying the loan's terms and conditions. Below are key takeaways to keep in mind:

- Understand the Types: Georgia promissory notes can be either secured or unsecured. A secured note requires collateral from the borrower, providing the lender with a safety net in case of default. An unsecured note, conversely, does not involve collateral.

- Accurately Fill Out the Form: It's crucial to provide precise and complete information on the form to avoid disputes or legal issues. This includes the full names and addresses of both the borrower and the lender, as well as the loan amount and interest rate.

- Interest Rate Compliance: Ensure that the interest rate agreed upon complies with Georgia's usury laws to prevent it from being void as illegal.

- Choose the Right Payment Schedule: The promissory note should clearly outline the payment schedule, whether in installments or a lump sum, at the end or over the course of the loan.

- Include a Co-signer if Necessary: If the borrower's creditworthiness is in doubt, including a co-signer on the note can provide additional security for the lender.

- Clearly State the Collateral for Secured Loans: If the note is secured, clearly describe the collateral that will secure the loan.

- Understand the Default Terms: The note should include specific terms that define what constitutes a default and the subsequent steps the lender can take, including any grace periods.

- Signatures Are Essential: The promissory note must be signed by both parties to be legally binding. Witness or notary signatures may also be required depending on the nature of the loan.

- Keep Records: Both the borrower and the lender should keep a copy of the signed promissory note for their records and any future reference.

Aligning with these key takeaways when filling out and using a Georgia Promissory Note form will help ensure that the agreement is fair, legal, and clear to all parties involved.

Create Other Promissory Note Forms for US States

Basic Promissory Note - It can be used for personal loans, business loans, or real estate transactions, offering flexible terms tailored to the agreement.

Promissory Note New York - This form is adaptable, capable of being modified to suit the specific needs and agreements of the involved parties.

Free Promissory Note Template Texas - The inclusion of a co-signer in a promissory note can offer additional security to the lender, as another party assumes responsibility if the primary borrower defaults.