Blank Promissory Note Form for Maryland

In the state of Maryland, the process of lending money is formalized with the use of a Promissory Note, a vital legal document that outlines the terms under which money is lent and the repayment is to occur. This legally binding form serves to protect both the lender and the borrower, ensuring clarity and agreement on the interest rate, payment schedule, and consequences of non-payment. The Maryland Promissory Note form is tailored to meet state-specific regulations and requirements, providing a clear framework for the transaction. It can involve various types of loans, ranging from personal loans between family members to more formal business loans. The inclusion of signatures from both parties on the document further solidifies the commitment to adhere to the agreed-upon terms. Understanding the major aspects of this form is crucial for anyone engaging in the lending process in Maryland, as it not only lays down the expectations and responsibilities for both parties but also helps in preventing misunderstandings and potential legal disputes down the line.

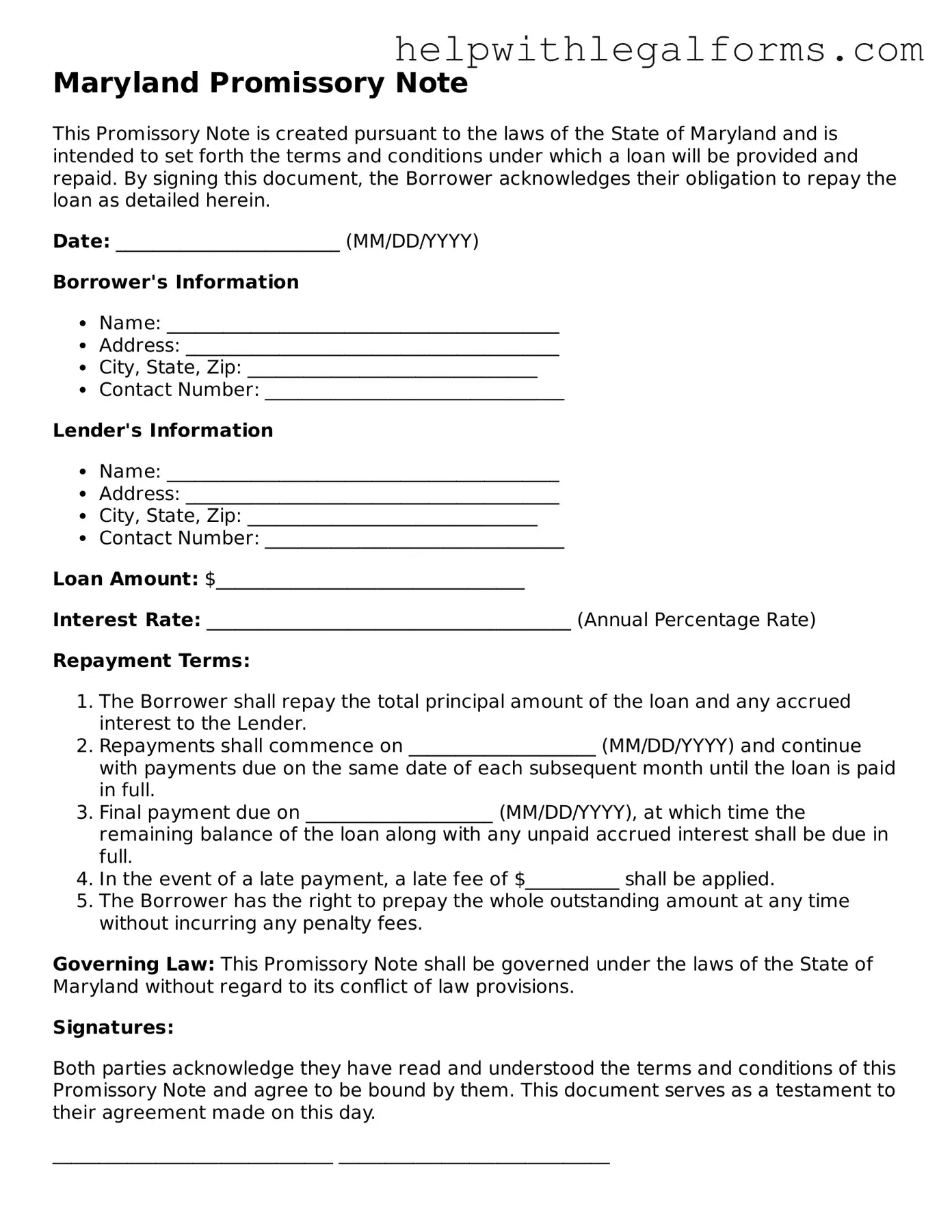

Example - Maryland Promissory Note Form

Maryland Promissory Note

This Promissory Note is created pursuant to the laws of the State of Maryland and is intended to set forth the terms and conditions under which a loan will be provided and repaid. By signing this document, the Borrower acknowledges their obligation to repay the loan as detailed herein.

Date: ________________________ (MM/DD/YYYY)

Borrower's Information

- Name: __________________________________________

- Address: ________________________________________

- City, State, Zip: _______________________________

- Contact Number: ________________________________

Lender's Information

- Name: __________________________________________

- Address: ________________________________________

- City, State, Zip: _______________________________

- Contact Number: ________________________________

Loan Amount: $_________________________________

Interest Rate: _______________________________________ (Annual Percentage Rate)

Repayment Terms:

- The Borrower shall repay the total principal amount of the loan and any accrued interest to the Lender.

- Repayments shall commence on ____________________ (MM/DD/YYYY) and continue with payments due on the same date of each subsequent month until the loan is paid in full.

- Final payment due on ____________________ (MM/DD/YYYY), at which time the remaining balance of the loan along with any unpaid accrued interest shall be due in full.

- In the event of a late payment, a late fee of $__________ shall be applied.

- The Borrower has the right to prepay the whole outstanding amount at any time without incurring any penalty fees.

Governing Law: This Promissory Note shall be governed under the laws of the State of Maryland without regard to its conflict of law provisions.

Signatures:

Both parties acknowledge they have read and understood the terms and conditions of this Promissory Note and agree to be bound by them. This document serves as a testament to their agreement made on this day.

______________________________ _____________________________

Borrower's Signature Date

______________________________ _____________________________

Lender's Signature Date

PDF Form Attributes

| Fact | Description |

|---|---|

| Purpose | A Maryland Promissory Note form is used as a written agreement to borrow or loan money, outlining the amount borrowed, interest rates, repayment schedule, and any other terms related to the loan. |

| Governing Law | The form is governed by the laws of the State of Maryland, including its statutes related to interest rates, lending practices, and usury limits. |

| Types | There are two main types: secured and unsecured. Secured notes are backed by collateral, while unsecured notes are not. |

| Interest Rates | Under Maryland law, the interest rate on a promissory note must not exceed the legal limit unless a specific exemption applies. |

| Repayment Schedule | The form should specify how the loan will be repaid, such as in installments, a lump sum at a certain date, or other agreed-upon terms. |

| Signature Requirements | For the note to be legally binding in Maryland, it must be signed by the borrower and, in some cases, co-signed by a guarantor. |

| Enforcement | If the borrower fails to meet the terms of the promissory note, the lender may pursue legal action to enforce the agreement and recover the owed amount. |

Instructions on How to Fill Out Maryland Promissory Note

When preparing to fill out the Maryland Promissory Note form, it's important to gather all necessary information beforehand to ensure a smooth process. This document is vital for both the lender and the borrower as it legally binds the borrower to repay the loaned amount under agreed-upon terms. The following steps are designed to guide you through completing the form accurately and efficiently.

- Begin by entering the date the promissory note is being created at the top of the form.

- Next, write the full legal name of the borrower, followed by their complete address, including city, state, and ZIP code.

- In the space provided, enter the lender's full legal name and full address, ensuring to include city, state, and ZIP code.

- Specify the principal amount of the loan in U.S. dollars.

- Detail the interest rate per annum that will be applied to the principal amount. This should comply with Maryland's legal limits on interest rates.

- Describe the repayment schedule. Indicate whether the loan will be repaid in a lump sum, in regular installments, or upon demand by the lender. If installments are chosen, specify the frequency (e.g., monthly) and the due date of the first payment.

- Include information on late fees. State the period of grace allowed after a missed payment before a late fee is charged, and specify the amount of the late fee.

- If applicable, mention any collateral that the borrower has agreed to secure the loan with. Describe the collateral in detail.

- Both the borrower and the lender must sign and date the form. If there are co-signers, they should do the same.

- Witness signatures may also be required, depending on the specific requirements in Maryland. If so, ensure the witness signs and dates the form as well.

Once the Maryland Promissory Note form is fully completed and signed, it will serve as a legal document that obligates the borrower to repay the loan as per the terms outlined. It's advisable for both parties to keep copies of the signed document for their records and reference throughout the duration of the loan period. Following these steps carefully will help in creating a clear and enforceable financial agreement.

Crucial Points on This Form

What is a Maryland Promissory Note Form?

In Maryland, a Promissory Note Form is a legal document that outlines the terms and conditions under which money is borrowed and must be repaid. This form serves as a written promise from the borrower to pay back the lender a certain amount of money, either in a lump sum or in scheduled payments. It contains details such as the principal amount, interest rate, repayment schedule, and the consequences of non-payment.

How does one create a legally binding Promissory Note in Maryland?

To create a legally binding Promissory Note in Maryland, the document must include the full names and addresses of both the borrower and the lender, the amount of money borrowed, the interest rate agreed upon, and the repayment plan. It must also be signed by both parties involved. To further ensure its enforceability, having the document witnessed or notarized can provide additional legal standing.

Are there different types of Promissory Notes?

Yes, there are primarily two types of Promissory Notes: secured and unsecured. A secured Promissory Note requires the borrower to pledge an asset as collateral, which the lender can claim if the borrower fails to repay the loan. An unsecured Promissory Note does not require collateral, making it riskier for the lender. The choice between secured and unsecured depends on the agreement between the borrower and lender and the level of risk they are willing to accept.

What happens if a borrower fails to repay the loan as stipulated in the Maryland Promissory Note?

If a borrower fails to repay the loan according to the terms outlined in the Maryland Promissory Note, the lender has the right to pursue legal action to recover the owed amount. For secured loans, this may involve seizing the collateral. For unsecured loans, the lender may seek repayment through court judgment. It's important for borrowers to understand the consequences of defaulting on a loan, as it can lead to significant legal and financial repercussions.

Common mistakes

When filling out the Maryland Promissory Note form, individuals often make a variety of errors that can affect the document's legality or enforceability. Paying attention to the common mistakes listed below can help ensure the promissory note serves its intended purpose without complications.

Not specifying the loan amount in words and figures - It's crucial to state the amount being lent both in numeric form and spelled out to prevent any ambiguity regarding the loan size.

Failing to clearly define the repayment terms - Detailed repayment conditions, including the schedule (monthly, quarterly), payment amounts, and any grace period, are essential for a clear understanding between parties.

Omitting the interest rate or not adhering to Maryland's legal maximum - The note must specify the interest rate being charged on the loan, and it's important to ensure this rate does not exceed the state's legal limit.

Lack of a late payment policy - It's advisable to outline the consequences of late payments, including any late fees, to incentivize timely repayments.

Ignoring the need for collateral details, if secured - For secured loans, clearly identifying the collateral that guarantees the loan is necessary. This omission can lead to disputes or uncertainty about the loan's secured status.

Forgetting to include the date and place of issue - The document should state where and when it was issued to establish its validity within a specific jurisdiction and timeframe.

Not obtaining the necessary signatures and notarization, if required - Both parties must sign the promissory note, and based on the amount or terms, notarization may also be necessary to authenticate the document.

Adhering to these guidelines when filling out a Maryland Promissory Note form can prevent common oversights that could weaken the document's effectiveness or enforceability.

Documents used along the form

When dealing with transactions that involve the creation of a Maryland Promissory Note, several other documents are often utilized to ensure completeness, legality, and clarity in the financial agreement. These documents not only provide additional layers of protection for both parties involved but also help in clarifying the terms and conditions, responsibilities, and expectations from each side. Let’s take a closer look at five crucial documents that are commonly used alongside a Maryland Promissory Note.

- Loan Agreement: This document complements the promissory note by detailing the terms and conditions of the loan. It includes information on the obligations of the borrower and the rights of the lender, and it often addresses matters not covered in the promissory note, such as dispute resolution methods and the governing law.

- Security Agreement: If the loan is secured with collateral, a security agreement is essential. It provides a legal framework that allows the lender to take possession of the collateral if the borrower fails to repay the loan as agreed. The document identifies the collateral and outlines the conditions under which it can be repossessed.

- Guaranty: This document is used when a third party agrees to guarantee the loan, promising to fulfill the debt obligations if the original borrower cannot. It serves as an added layer of security for the lender, ensuring that the loan will be repaid.

- Amortization Schedule: Often attached to the promissory note, an amortization schedule breaks down the loan repayment process into manageable installments. It shows the portion of each payment that goes towards the principal amount versus interest and highlights the balance still owed after each payment.

- Notice of Default: This document is a formal warning issued to the borrower in the event of a missed payment or other breach of the promissory note's terms. It outlines the default, potential consequences, and may offer a remedy period for the borrower to rectify the situation.

Each of these documents plays a vital role in the lending process, ensuring that both parties are well-informed and protected throughout the duration of the loan. It’s important to understand how they work in conjunction with the Maryland Promissory Note to ensure a smooth and legally binding financial transaction. Consulting with a professional to ensure proper use and execution of these documents can save a lot of time and prevent potential legal issues down the line.

Similar forms

Loan Agreement: Both a promissory note and a loan agreement are legally binding documents related to borrowing and lending money. While a promissory note is a straightforward agreement involving a pledge by one party to repay a specific sum of money to another, a loan agreement usually includes this promise along with detailed terms of the loan, such as the repayment schedule, interest rates, and what happens in case of default.

Mortgage Note: A mortgage note is a type of promissory note used specifically in real estate transactions. It signifies the borrower's promise to repay the loan used to purchase a property. The main similarity is the borrower's pledge to repay. However, a mortgage note is secured by the property itself, meaning the lender can foreclose on the property if the borrower fails to make payments.

IOU (I Owe You): Both an IOU and a promissory note acknowledge a debt. An IOU is an informal acknowledgment of a debt, while a promissory note is more formal and legally enforceable. An IOU typically covers who owes whom, but lacks detailed repayment terms that are found in a promissory note.

Personal Loan Agreement: Similar to a general loan agreement, a personal loan agreement is made between individuals (such as family members or friends) for personal loans. It is akin to a promissory note in documenting the obligation to repay an amount borrowed. However, personal loan agreements often contain more comprehensive terms of the loan, akin to those found in a formal loan agreement.

Bill of Exchange: A bill of exchange is an order made by one party to another to pay a third party a certain sum of money on a specific date or on demand. Like promissory notes, these are negotiable instruments that facilitate trade and finance. The key difference is in the parties involved: a promissory note involves two parties (debtor and creditor), while a bill of exchange involves three (the drawer, the drawee, and the payee).

Credit Agreement: A credit agreement outlines the details of extending credit from a lender to a borrower. Similar to a promissory note, it includes the promise to repay. The distinction comes from the credit agreement's broader scope, potentially including credit terms, interest rates, collateral requirements, and conditions for extending or revoking credit.

Debt Settlement Agreement: This agreement is made when a debtor and creditor agree on a reduced balance that will be regarded as payment in full. Similar to promissory notes in the sense that they document the terms of debt repayment, debt settlement agreements specifically focus on modifying those terms towards resolution of outstanding debts.

Rental Agreement: At first glance, a rental agreement might seem quite different from a promissory note. However, both document an agreement for one party to pay another. In a rental agreement, the payment is for the use of property. It's comparable in documenting a financial obligation, though a promissory note typically involves a repayment of borrowed funds rather than payment for services or use of assets.

Dos and Don'ts

When filling out the Maryland Promissory Note form, it's important to understand the procedure to ensure that the agreement is legally binding and clear to all parties involved. The following guidance outlines the dos and don'ts to assist you in completing the form accurately:

- Do include the full names and addresses of both the borrower and the lender to ensure there is no ambiguity about the parties involved.

- Do clearly state the loan amount in words and figures to prevent any discrepancies or confusion about the amount being borrowed.

- Do specify the interest rate, keeping in mind Maryland's usury laws, to avoid illegal terms that could render the note unenforceable.

- Do outline the repayment schedule in detail, including the due dates and any penalties for late payments, to ensure both parties are clear on the expectations.

- Don't leave any sections blank. If a section doesn't apply, mark it as "N/A" (not applicable) to indicate that it was not overlooked.

- Don't forget to include clauses regarding the consequences of default or late payments, as this establishes the legal remedies available to the lender.

- Don't sign the document without witnesses or notarization if required by Maryland law, as this step is crucial for adding legal validity to the document.

- Don't neglect to provide each party with a copy of the signed document for their records, as this ensures that all involved have access to the agreed terms for future reference.

By following these guidelines, individuals can create a promissory note in Maryland that is clear, comprehensive, and legally sound. Remember, it's not just about filling out a form; it's about creating a documented agreement that can protect both parties financially and legally.

Misconceptions

When it comes to understanding the Maryland Promissory Note form, numerous misconceptions can lead to confusion. By addressing these misconceptions, individuals can approach this financial document with a clearer understanding, ensuring they are fully informed about its implications and requirements. Below are seven common misconceptions about the Maryland Promissory Note form, explained to dispel any confusion.

- A single standard form fits all situations. Contrary to this belief, the Maryland Promissory Note form must be tailored to fit the specific agreement between the lender and borrower. Different situations may require different clauses, such as the inclusion of collateral in a secured loan.

- It's legally binding without being notarized. While a Maryland Promissory Note is a legally binding document once signed by both parties, notarization is not a requirement for it to be enforceable. However, having the note notarized can add an extra layer of authenticity and protection.

- Interest rates can be as high as agreed upon. The truth is, Maryland law places a cap on interest rates to protect borrowers from usury. The agreed-upon interest rate must comply with these legal limitations, or the note may be considered invalid or even illegal.

- Only the borrower needs to sign the note. While it is essential for the borrower to sign the note, it is also advisable for the lender to sign it. The lender's signature can provide evidence of the agreement's terms and the lender's commitment to those terms.

- Verbal agreements can supersede the written note. In reality, the written document usually takes precedence over any verbal agreements made prior to or after the note's execution. For changes to be legally binding, they should be made in writing and signed by both parties.

- Promissory notes and loans are the same. This is not entirely accurate. While a promissory note is a type of loan agreement, not all loan agreements are promissory notes. A promissory note is a specific form of agreement that outlines the repayment of a loan, whereas loan agreements might include additional terms and conditions beyond repayment.

- Any dispute regarding the note must be settled in court. Many believe court is the only option for dispute resolution, but parties can agree to alternative dispute resolution methods, such as mediation or arbitration, within the promissory note. This can often be a more efficient and less costly way to resolve disputes.

Understanding these misconceptions about the Maryland Promissory Note form is crucial for those entering into a borrowing or lending agreement in Maryland. By being informed, parties can ensure their financial transactions are fair, legal, and clear from the outset, thus avoiding potential complications down the line.

Key takeaways

Filling out and using the Maryland Promissory Note form requires attention to detail and an understanding of its importance. It's crucial to grasp the key elements to ensure that the agreement is legally binding and clearly understood by all parties involved. Here are six essential takeaways to consider:

- Complete All Sections Accurately: Every field in the Maryland Promissory Note form should be filled out with precise and accurate information to prevent misunderstandings or legal issues down the line. This includes the names of the borrower and lender, the amount of money being loaned, the interest rate, and the repayment schedule.

- Understand Interest Rate Regulations: Maryland law places restrictions on the maximum interest rate that can be charged. It is vital to ensure the interest rate specified in the promissory note is compliant with state law to avoid it being considered usurious.

- Specify Repayment Terms: Clearly outline how the loan will be repaid. This includes setting regular payment amounts and due dates. Whether the repayment is to be made in a lump sum or in installments should be unmistakably stated to avoid any confusion.

- Include a Co-signer if Necessary: If the borrower's creditworthiness is in question, including a co-signer can offer additional security to the lender. The co-signer becomes equally responsible for the repayment of the loan, which can mitigate the lender's risk.

- Ensure the Note is Legally Binding: For the promissory note to be considered a legally binding document, it must be signed by both the borrower and the lender. Witnesses or a notary public can further legitimize the document, although this may not be a legal requirement in Maryland.

- Keep Records Safe: Once the promissory note is fully executed, both parties should keep a copy in a safe place. This document serves as a legal record of the loan and may be necessary in the event of a dispute or if legal action becomes necessary to enforce repayment.

Adhering to these guidelines when filling out and using the Maryland Promissory Note form helps ensure that the loan process is fair and transparent for everyone involved. Should there be any confusion or legal uncertainties, it is advisable to seek the counsel of a legal professional.

Create Other Promissory Note Forms for US States

Georgia Promissory Note - It's crucial for both parties to review the promissory note thoroughly before signing to ensure mutual understanding of obligations.

California Promissory Note Requirements - Finally, understanding and properly utilizing a promissory note can significantly impact financial health and security for individuals and businesses alike.