Blank Promissory Note Form for New Jersey

In the bustling corridors of financial transactions within New Jersey, the Promissory Note stands as a pivotal document. It embodies an agreement that hinges on trust and legal commitment, involving a borrower's promise to repay a specified sum to a lender. At its core, this document does more than merely outline repayment details; it establishes a legally binding relationship between the parties involved. It is meticulously designed to encompass essential elements such as the amount borrowed, interest rates, repayment schedule, and the ramifications of non-compliance. Notably, in New Jersey, such forms are tailored to adhere to state-specific regulations and requirements, ensuring clarity, fairness, and enforceability. Understanding the makeup of the New Jersey Promissory Note form is crucial for both lenders and borrowers as they navigate the intricacies of financial agreements. It is a testament to the state's commitment to protect the interests of its citizens in financial dealings, making it an indispensable tool in the realm of personal and business finance.

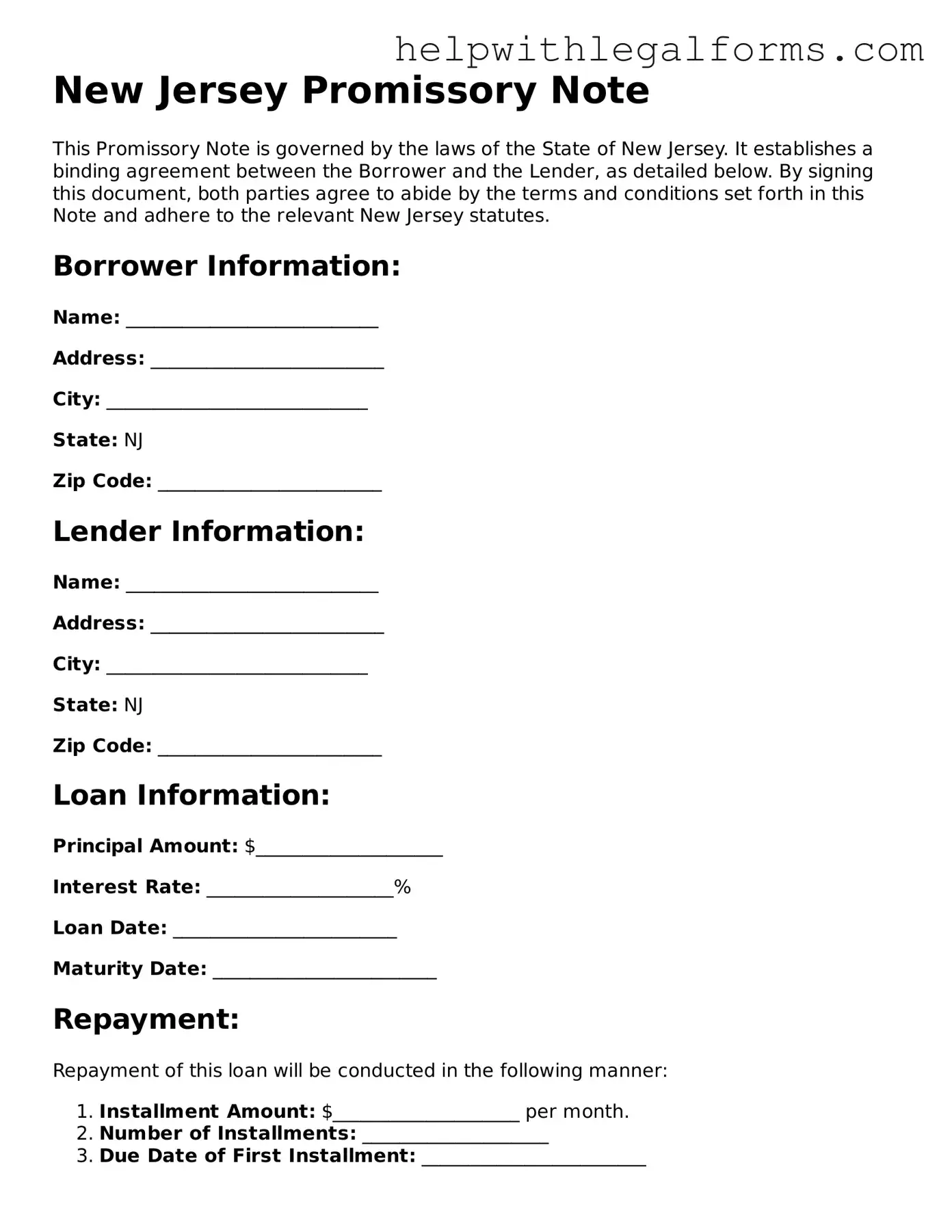

Example - New Jersey Promissory Note Form

New Jersey Promissory Note

This Promissory Note is governed by the laws of the State of New Jersey. It establishes a binding agreement between the Borrower and the Lender, as detailed below. By signing this document, both parties agree to abide by the terms and conditions set forth in this Note and adhere to the relevant New Jersey statutes.

Borrower Information:

Name: ___________________________

Address: _________________________

City: ____________________________

State: NJ

Zip Code: ________________________

Lender Information:

Name: ___________________________

Address: _________________________

City: ____________________________

State: NJ

Zip Code: ________________________

Loan Information:

Principal Amount: $____________________

Interest Rate: ____________________%

Loan Date: ________________________

Maturity Date: ________________________

Repayment:

Repayment of this loan will be conducted in the following manner:

- Installment Amount: $____________________ per month.

- Number of Installments: ____________________

- Due Date of First Installment: ________________________

- Due Date of Last Installment: ________________________

Interest:

In the event of a default, the interest rate applicable will be the highest rate allowed under New Jersey law.

Governing Law:

This Promissory Note shall be governed by and construed in accordance with the laws of the State of New Jersey.

Signatures:

This document is not considered valid until signed by both parties. The date next to each signature should accurately reflect when the signatory has signed this Promissory Note.

Borrower:

_______________________ Date: ______________

Lender:

_______________________ Date: ______________

PDF Form Attributes

| Fact | Detail |

|---|---|

| Definition | A New Jersey Promissory Note is a legal document that outlines the details of a loan made between two parties in New Jersey, specifying repayment terms. |

| Governing Law | The form and enforcement of promissory notes in New Jersey are governed by both New Jersey statutes and the Uniform Commercial Code (UCC) as adopted by New Jersey. |

| Usury Rate | In New Jersey, the maximum interest rate a lender can charge is governed by state usury laws, typically set at 6% per annum for written contracts but can vary under certain conditions. |

| Types of Promissory Notes | Two main types: secured and unsecured. A secured promissory note requires collateral to secure the loan, whereas an unsecured note does not. |

| Key Components | Essential elements include the amount borrowed, interest rate, repayment schedule, consequence of default, and signatures of the parties involved. |

| Co-signer Requirement | A co-signer may be required if the borrower has insufficient credit history or income, adding another layer of security for the lender. |

| Prepayment | Borrowers are often allowed to pay off the principal balance early without penalty, though this may vary based on the specific terms of the promissory note. |

| Default Consequences | In the event of a default, the lender may demand immediate payment of the entire outstanding balance, initiate legal proceedings, or take possession of any collateral. |

| Modification of Terms | Any changes to the promissory note's terms must be agreed upon in writing by both the borrower and lender to be enforceable. |

Instructions on How to Fill Out New Jersey Promissory Note

Filling out a promissory note in New Jersey is a straightforward process that creates a legal agreement for a loan. This document outlines the terms by which one party agrees to pay back money borrowed from another. Careful attention to detail ensures clarity and reduces the likelihood of misunderstandings in the future. Below are the steps needed to properly complete your New Jersey Promissory Note.

- Begin by clearly writing the date at the top of the form to establish when the agreement is being made.

- Enter the full name and address of the borrower in the designated space. This identifies who is taking responsibility for repaying the loan.

- Provide the full name and address of the lender. This acknowledges who is providing the funds.

- Specify the principal amount of money being loaned in U.S. dollars to clearly state the size of the obligation.

- Detail the interest rate per annum that will apply to the loan. This must be in compliance with New Jersey's legal maximum to avoid being considered usurious.

- Choose and clearly indicate the repayment structure. Options typically include a lump sum, installments, or regular periodic payments. Specify the due dates or intervals (e.g., monthly).

- If applicable, describe any collateral that the borrower is using to secure the loan. This could be property or another asset that is forfeited if the loan is not repaid.

- Include any co-signers by writing their full names. This step is necessary if the loan has a guarantor who will also take responsibility for its repayment.

- Detail any agreed-upon penalty fees for late payments or defaults to ensure both parties understand the consequences of not meeting the terms.

- Both the lender and the borrower (and any co-signers) must sign and date the form. This formalizes the agreement and indicates that all parties understand and consent to the terms.

- Notarization - if required or deemed necessary by the parties involved, having the signatures notarized may add an extra layer of legality and protection.

Once completed, the New Jersey Promissory Note becomes a binding legal agreement. Both the lender and the borrower should keep copies for their records. Should any questions or disputes arise, this document serves as a clear guide to the original intentions and agreements of both parties. Following the steps above helps ensure that all pertinent details are properly addressed.

Crucial Points on This Form

What is a New Jersey Promissory Note?

A New Jersey Promissory Note is a legal document that outlines the details of a loan between two parties in New Jersey. It includes information like the amount borrowed, the interest rate, and the repayment schedule. This form helps ensure that both the borrower and the lender understand their obligations.

Who needs to sign the New Jersey Promissory Note?

Typically, the borrower and the lender need to sign the New Jersey Promissory Note to make it enforceable. In some cases, a witness or a notary public may also be required to sign, depending on the specifics of the loan and the requirements of the parties involved.

Is a New Jersey Promissory Note legally binding?

Yes, a New Jersey Promissory Note is legally binding once it is signed by the involved parties. It is a serious financial document that obligates the borrower to repay the loan under the agreed-upon terms. Failure to follow these terms can result in legal repercussions for the borrower.

Can the terms of a New Jersey Promissory Note be changed after it is signed?

The terms of a New Jersey Promissory Note can be changed, but any modifications must be agreed upon by both the borrower and the lender. It is highly recommended that any changes to the agreement be documented in writing and signed by both parties, to avoid any confusion or disputes in the future.

Common mistakes

When filling out the New Jersey Promissory Note form, attention to detail is key. People often make mistakes that can affect the validity or enforceability of the document. Knowing these common pitfalls can help you complete the form correctly and ensure that it fully reflects your intentions.

Not Specifying the Loan Amount Clearly: It's crucial to state the exact loan amount in clear figures and words. Ambiguity in this section can lead to disputes.

Omitting the Interest Rate: Failing to explicitly mention the interest rate can render the note unenforceable or subject it to the state's default rate, which may not be favorable.

Leaving Out Repayment Terms: The note should include detailed repayment terms, such as the schedule, amounts, and due dates. Without this, the repayment expectations are unclear.

Forgetting to Define Default Conditions: It's important to specify what constitutes a default on the loan, including missed payments or other breaches of the agreement.

Ignoring Governing Law: Not stating that New Jersey law governs the note can lead to confusion, especially if parties are from different states.

Missing Signatures: The promissory note must be signed by both the borrower and the lender. Unsigned notes are generally not enforceable.

Not Including a Co-signer (if applicable): If the agreement involves a co-signer, their details and signature should be included to bind them legally to the agreement.

Skimping on Details about Both Parties: Full legal names, addresses, and contact information for both the lender and the borrower should be clearly mentioned to avoid any ambiguity.

Lack of Clarity on Prepayment: Failing to mention whether prepayment is allowed or if it incurs penalties can lead to confusion and potential disputes down the line.

Forgetting Collateral Description (if secured): If the note is secured with collateral, a detailed description of the collateral should be included within the document.

Making sure these key areas are addressed correctly in the New Jersey Promissory Note form is essential to creating a solid and enforceable agreement. Always review the form thoroughly before finalizing to avoid these common mistakes.

Documents used along the form

When handling financial agreements in New Jersey, particularly those involving loans or credit, the New Jersey Promissory Note form is a crucial document. However, to fully protect all parties involved and ensure compliance with state laws, several other documents are often used in conjunction with this promissory note. These additional forms and documents provide clarity, secure the loan, and detail the responsibilities of each party, making the process smoother and reducing potential disputes.

- Loan Agreement: This comprehensive document outlines the terms and conditions of the loan in detail, including interest rates, repayment schedule, and the consequences of non-payment. While the promissory note signifies the promise to pay, the loan agreement covers all nuances of the borrower-lender relationship.

- Security Agreement: If the loan is secured with collateral, this agreement details the asset(s) pledged as security. It clarifies what happens if the borrower defaults, ensuring the lender can legally claim the collateral.

- Guaranty: This form is used when a third party guarantees the loan, promising to repay the debt if the original borrower cannot. It provides an additional layer of security for the lender.

- Amortization Schedule: An amortization schedule is often attached to the promissory note or loan agreement to illustrate the payment plan. It breaks down payments into principal and interest, showing how the balance decreases over time.

- Notice of Default: Used by lenders to inform a borrower that they have not met their obligations under the promissory note, this document is important for initiating the process to remedy or resolve the default.

- Release of Promissory Note: This document is used once the loan is fully repaid. It serves as proof that the borrower has fulfilled their obligations, releasing them from the debt stated in the promissory note.

Each of these documents plays a vital role in ensuring a clear, legally-binding financial arrangement. When used together with the New Jersey Promissory Note, they create a robust framework that protects both the lender and the borrower, providing peace of mind throughout the duration of the loan.

Similar forms

Loan Agreement: Similar to a promissory note, a loan agreement is a written document between two parties -- the borrower and the lender -- that outlines the terms and conditions of a loan. The primary difference is that loan agreements are usually more detailed, including information regarding repayment schedules, interest rates, and what happens in case of default.

Mortgage: A mortgage document is used when purchasing real estate and includes a promise to repay the borrowed amount. Like a promissory note, it outlines payment obligations and interest. However, a mortgage specifically ties the loan to a piece of real estate as collateral, giving the lender the right to foreclose if the borrower fails to pay.

IOU (I Owe You): This is a less formal agreement than a promissory note and generally not legally binding. An IOU simply acknowledges that a debt exists but may lack details on repayment terms and interest rates. Despite these differences, both signify acknowledgment of a debt.

Bill of Sale: A bill of sale is similar to a promissory note in that it is a document demonstrating a transaction between two parties. However, a bill of sale transfers ownership of assets or goods from the seller to the buyer and typically does not include terms for repayment as a promissory note does for loans.

Credit Agreement: This is a formal agreement, often between a financial institution and a borrower, outlining the terms of credit being extended. It's similar to a promissory note because it involves a commitment to repay the borrowed amount under agreed terms. However, credit agreements often cover revolving types of credit, unlike the typically one-time loans of promissory notes.

Lease Agreement: Lease agreements, used for renting property, share similarities with promissory notes in the sense that both involve payments over a period. However, lease agreements cover the terms and conditions under which one party rents property owned by another, unlike the borrower-lender relationship in promissory notes.

Bond: A bond is an investment instrument through which an investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period at a fixed interest rate. Bonds and promissory notes are similar in their function as debt instruments that require repayment with interest. The primary distinction is that bonds are typically traded on markets and involve investors, whereas promissory notes are usually private agreements between individual entities or persons.

Personal Guaranty: A personal guaranty is a legal commitment by an individual to repay a loan issued to a business or another person if the original borrower fails to make payments. Similar to a promissory note, it underscores a promise to pay. The key difference lies in the guaranty’s association with another's debt obligation, rather than the creation of a direct obligation between borrower and lender as seen with promissory notes.

Dos and Don'ts

Filling out a New Jersey Promissory Note form requires attention to detail and understanding of what is legally binding. Below are essential dos and don'ts to consider while preparing the document:

- Do ensure all parties involved have their full legal names accurately entered. This clarity helps in the legality of the document.

- Do specify the exact loan amount in U.S. dollars to prevent any ambiguity regarding the financial obligations.

- Do provide a clear repayment schedule, including due dates, to make sure there is a mutual understanding of the payment expectations.

- Don't forget to include the interest rate, as failing to do so can lead to misunderstandings or legal issues related to usury laws.

- Don't leave signature lines blank. All parties involved must sign the document for it to be legally binding.

- Don't neglect to specify the jurisdiction (New Jersey) in the governing law section, ensuring that any legal disputes will be settled under New Jersey law.

Acknowledging these pointers can significantly enhance the clarity and enforceability of the promissory note. It's always recommended to review the document thoroughly before finalizing it.

Misconceptions

When discussing the New Jersey Promissory Note form, several misconceptions often arise, rooted in a lack of understanding of legal nuances and the complexities of financial documents. These misunderstandings can lead to misguided decisions and legal missteps. It's crucial to debunk these myths to ensure that individuals and entities are well-informed when engaging in financial agreements.

- Misconception 1: A promissory note is just a casual promise

Many believe that a promissory note in New Jersey is a mere informal agreement, akin to a handshake deal. However, it is a legally binding document. When properly executed, it compels the borrower to repay the debt under the agreed terms and conditions, giving the lender a clear legal pathway to seek repayment. - Misconception 2: All promissory notes are the same

Promissory notes can greatly vary. Some may contain collateral agreements, making them secured, while others do not, remaining unsecured. The terms, including interest rates and repayment schedules, can differ widely based on the agreement between the parties involved. - Misconception 3: A lawyer is not necessary for drafting a promissory note

Though it's possible to draft a promissory note without legal assistance, consulting with a lawyer ensures that all legal requirements are met. This can prevent disputes and issues that might arise from a poorly drafted document. A lawyer will ensure the promissory note complies with New Jersey’s legal standards. - Misconception 4: Promissory notes are only for business loans

While promissory notes are commonly used in business transactions, they are just as applicable to personal loans. Whether lending money to a friend or family member, a promissory note formalizes the agreement, offering legal protection and clarity for both parties. - Misconception 5: A promissory note guarantees repayment

While a promissory note legally obligates the borrower to repay the debt, it does not guarantee that the debtor will do so. Should the borrower default, the lender must still take legal action to pursue repayment or enforce the document’s terms. - Misconception 6: Verbal agreements can substitute for a promissory note

Verbal agreements, while legally binding in some contexts, lack the clarity and enforceability of a written promissory note. Without a written document, proving the terms of the agreement and ensuring repayment becomes significantly more challenging. - Misconception 7: Promissory notes are only enforceable if notarized

Though notarization can add a level of formality and help authenticate the document, a promissory note in New Jersey does not require notarization to be legally binding. As long as it meets the state’s legal requirements and contains the necessary signatures, it is enforceable in a court of law.

Understanding and dispelling these misconceptions is crucial for anyone involved in drafting, signing, or using a promissory note in New Jersey. Accurate knowledge ensures that these financial instruments are treated with the seriousness they deserve, protecting the interests of all parties involved.

Key takeaways

The New Jersey Promissory Note form is a legal document that outlines the details of a loan between two parties. Its careful completion and use can ensure clear communication, legal compliance, and can prevent misunderstandings. The following are key takeaways for accurately filling out and using this form:

- Accuracy is Key: All information provided in the Promissory Note must be accurate, involving the identities of the lender and borrower, loan amount, interest rate, and repayment schedule.

- Legal Compliance: It's critical to confirm that the interest rates and terms comply with New Jersey’s legal requirements to avoid any potential legal issues.

- Identification of Parties: Clearly identify both the borrower and the lender, including their legal names and addresses, to prevent any identity confusion.

- Loan Details: Clearly outline the loan amount and how it will be disbursed to the borrower. If there are any specific conditions for the disbursement, these should be detailed as well.

- Interest Rate: The interest rate should be explicitly mentioned. Ensure this rate is within New Jersey's legal limits to maintain the note's enforceability.

- Repayment Schedule: The repayment terms including the schedule, amount of each payment, and due dates should be explicitly outlined to avoid any ambiguity on repayment expectations.

- Security: If the note is secured, describe the collateral that will be used to secure the loan. This aspect reassures the lender and details what is at risk if the borrower defaults.

- Signatures: The promissory note must be signed by both the borrower and the lender. These signatures officially bind the parties to the agreement's terms.

- Witness or Notarization: Though not always required, having the document witnessed or notarized can add an additional layer of legality and security to the agreement.

- Record Keeping: Both parties should keep a copy of the promissory note. This ensures that there is a record of the agreement and terms accessible to both the lender and borrower.

- Legal Advice: Consider consulting a legal professional when drafting or signing a promissory note, especially for large sums, to ensure that all legal aspects are appropriately addressed and that the document is enforceable under New Jersey law.

Following these guidelines can help ensure that a promissory note serves its intended purpose – to clarify the terms of a loan and provide legal protection to both lender and borrower. It is an important step towards maintaining a clear and professional financial relationship between the parties.

Create Other Promissory Note Forms for US States

Florida Promissory Note - A documented promise from one individual or entity to pay another a specific amount of money.

Oklahoma Promissory Note - May include clauses on late payment penalties and options for loan prepayment.

California Promissory Note Requirements - Amortization schedules within the promissory note detail how the loan will be repaid over time, including interest.

Promissory Note Colorado - Interest rates can be fixed or variable, as detailed in the Promissory Note, affecting the repayment amount.