Blank Promissory Note Form for New York

When embarking on financial agreements, clarity and security become paramount, a role dutifully served by the New York Promissory Note form. This crucial document outlines the terms under which money is borrowed and repaid, including the interest rate, repayment schedule, and what happens if the borrower fails to meet their obligations. Designed to protect both lender and borrower, the promissory note stands as a legally binding agreement that ensures all parties are on the same page and committed to the agreed-upon terms. While navigating the intricacies of loan agreements may seem daunting, understanding the protections and obligations laid out in the New York Promissory Note form can mitigate misunderstandings and foster a smoother financial transaction. This form, essentially, becomes the backbone of the lending agreement, providing a clear path forward for both individuals and businesses alike.

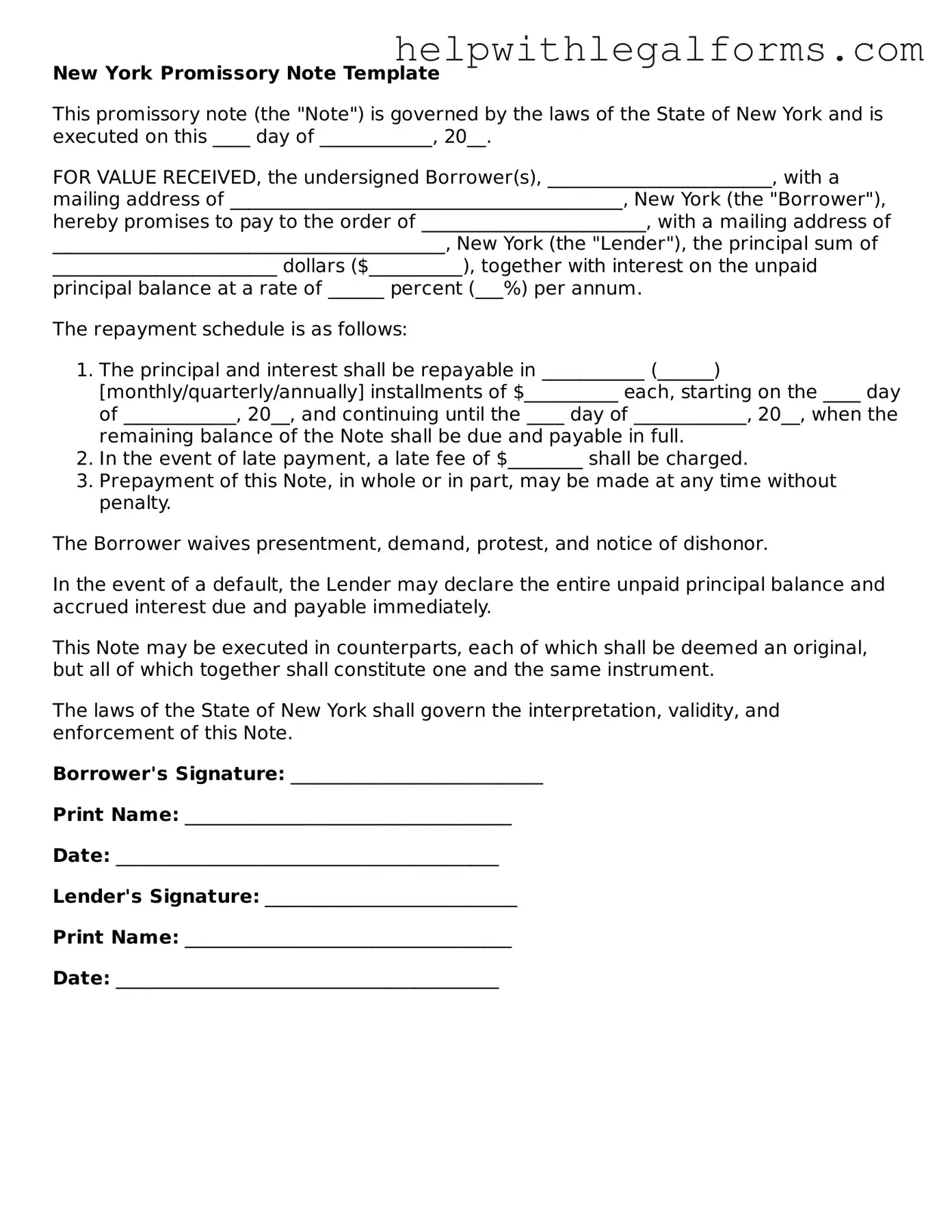

Example - New York Promissory Note Form

New York Promissory Note Template

This promissory note (the "Note") is governed by the laws of the State of New York and is executed on this ____ day of ____________, 20__.

FOR VALUE RECEIVED, the undersigned Borrower(s), ________________________, with a mailing address of __________________________________________, New York (the "Borrower"), hereby promises to pay to the order of ________________________, with a mailing address of __________________________________________, New York (the "Lender"), the principal sum of ________________________ dollars ($__________), together with interest on the unpaid principal balance at a rate of ______ percent (___%) per annum.

The repayment schedule is as follows:

- The principal and interest shall be repayable in ___________ (______) [monthly/quarterly/annually] installments of $__________ each, starting on the ____ day of ____________, 20__, and continuing until the ____ day of ____________, 20__, when the remaining balance of the Note shall be due and payable in full.

- In the event of late payment, a late fee of $________ shall be charged.

- Prepayment of this Note, in whole or in part, may be made at any time without penalty.

The Borrower waives presentment, demand, protest, and notice of dishonor.

In the event of a default, the Lender may declare the entire unpaid principal balance and accrued interest due and payable immediately.

This Note may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

The laws of the State of New York shall govern the interpretation, validity, and enforcement of this Note.

Borrower's Signature: ___________________________

Print Name: ___________________________________

Date: _________________________________________

Lender's Signature: ___________________________

Print Name: ___________________________________

Date: _________________________________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A New York Promissory Note is a legal document that outlines an agreement for the borrowing and repayment of money between a lender and a borrower in the state of New York. |

| Governing Law | The form and execution of promissory notes in New York are governed by the New York Consolidated Laws, specifically the Uniform Commercial Code (UCC) Article 3 – Negotiable Instruments. |

| Interest Rate Limitation | New York state law sets a maximum legal interest rate on personal loans at 16% per annum. Loans that exceed this rate may be considered usurious, unless exempted by law. |

| Enforceability | To be enforceable, a New York Promissory Note must contain a promise to pay a fixed amount of money, be signed by the maker/borrower, and include all essential terms such as the interest rate, repayment schedule, and maturity date. |

Instructions on How to Fill Out New York Promissory Note

Filling out a New York Promissory Note form is a straightforward process that requires attention to detail. This financial agreement is important for both parties involved, establishing a clear understanding of the borrowing terms. This step-by-step guide will help ensure that the form is completed accurately, making the lending process smoother and more transparent for everyone involved.

- Begin by adding the date the promissory note is being created at the top of the document.

- Enter the full legal name of the borrower, followed by their complete address, including city, state, and zip code.

- Provide the full legal name and complete address of the lender, mirroring the format used for the borrower.

- Specify the principal amount of money being borrowed. This should be written in both words and numbers to avoid confusion.

- Detail the interest rate per annum. This percentage should comply with New York's usury law to be legally enforceable.

- Outline the repayment schedule. Include the start date of payments, the frequency of payments (monthly, quarterly, etc.), and the due date for the final payment.

- If applicable, describe any collateral that the borrower is using to secure the loan. This should include a clear description of the property or asset, along with any identifying information (like vehicle identification numbers for cars).

- Insert any co-signer information, if relevant. This includes the co-signer’s full legal name and address, establishing their agreement to be responsible for the loan if the primary borrower fails to make payments.

- Both the lender and the borrower must sign the promissory note. If a co-signer is involved, ensure that they also sign the document.

- Lastly, it's highly recommended to have the signatures notarized. Although this step is not mandatory under New York law, it provides an additional layer of authenticity and may help in the enforcement of the note.

Upon completing these steps, the New York Promissory Note is fully executed, creating a legally binding agreement between borrower and lender. Both parties should keep a copy of the document for their records. Following the outlined steps helps in creating a clear financial agreement, reducing potential misunderstandings and fostering a positive lending relationship.

Crucial Points on This Form

What is a New York Promissory Note?

A New York Promissory Note is a legal agreement used in the state of New York where one party, known as the borrower, promises to repay a certain amount of money to another party, the lender. This document outlines how and when the payment will be made and can include details on interest rates, repayment schedule, and consequences of non-payment.

Is a New York Promissory Note legally binding?

Yes, a Promissory Note in New York is a legally binding document. Once it is signed by both parties, it becomes an official promise of payment from the borrower to the lender. This means the lender has the legal right to seek repayment according to the terms set out in the note, and legal actions can be taken if the borrower fails to comply.

Do I need a witness or notary for a Promissory Note in New York?

While New York law does not mandatorily require a witness or notary for a Promissory Note to be considered valid, it is highly recommended to have the note notarized or witnessed. This adds an extra layer of verification, can prevent disputes regarding the authenticity of the signatures, and could be helpful if enforcement of the note becomes necessary.

Can a Promissory Note include interest in New York?

Yes, a Promissory Note in New York can include interest on the loan amount. However, the interest rate must comply with New York’s usury laws, which set the maximum interest rate that can be charged. If the interest rate exceeds the legal limit, it could be considered usurious and may render the note unenforceable.

What happens if a borrower fails to pay according to the New York Promissory Note?

If a borrower fails to make payments according to the terms outlined in the New York Promissory Note, the lender has the right to initiate legal proceedings to recover the owed amount. This could include filing a lawsuit to enforce the note. The specific course of action may depend on the terms stated in the note and applicable state laws.

How can a New York Promissory Note be enforced if the borrower refuses to pay?

To enforce a New York Promissory Note, the lender may need to file a lawsuit against the borrower. Through the lawsuit, the lender can seek a judgment for the amount owed. Once a judgment is obtained, the lender may use various methods to collect the debt, including garnishing the borrower’s wages or placing a lien on their property.

Can changes be made to a Promissory Note after it has been signed in New York?

Changes can be made to a New York Promissory Note after it has been signed, but any modifications must be agreed upon by both the borrower and the lender. It is advisable to put any amendments in writing, and both parties should sign the updated document to ensure the changes are legally binding.

Are Promissory Notes the same as loans?

While Promissory Notes and loans are related, they are not exactly the same. A loan refers to the act of lending money, often represented by a larger agreement covering the loan's terms, conditions, and protections for both lender and borrower. A Promissory Note is a specific document that evidences the borrower's promise to repay the loan under agreed terms. It is a crucial component of the lending process but does not encompass the full scope of a loan agreement.

How long is a Promissory Note valid in New York?

The validity of a Promissory Note in New York, also known as its statute of limitations, is six years from the due date of the last payment outlined in the note or the date the borrower defaults, whichever occurs later. This means the lender has up to six years to take legal action to enforce the note from that time.

Common mistakes

When people fill out the New York Promissory Note form, several common errors can be made that may affect the validity or enforceability of the note. Recognizing and avoiding these mistakes is crucial for both the borrower and lender. Below is an expanded list of five frequent mistakes:

-

Not Specifying the Terms Clearly: One of the most significant errors is not being clear about the terms. This includes the interest rate, repayment schedule, and the maturity date. Ambiguities in these key areas can lead to disputes or legal challenges down the line.

-

Incorrect Details: Entering incorrect information, such as the names of the parties involved, or the principal amount, can render the document void or unenforceable. It's crucial for both parties to double-check the details before signing.

-

Forgetting to Include the Governing Law: The promissory note should specify that it is governed by the laws of New York. Omitting this information can create confusion about which state's laws apply, especially if the parties are from different states.

-

Failing to Sign the Document: It might seem obvious, but a promissory note is not legally binding unless it has been signed by both the borrower and the lender. A missing signature is a surprisingly common oversight.

-

Omitting Default Terms: Not defining what constitutes a default and the subsequent actions that can be taken can lead to unmanageable situations if the borrower fails to make payments. Clearly outlining these terms upfront can help prevent future legal battles.

To ensure the promissory note’s effectiveness and enforceability, parties should avoid these mistakes. A meticulously drafted promissory note, one that lays out all terms clearly and unambiguously, protects the interests of both the lender and the borrower, and adheres to New York State laws, is essential for a smooth and clear agreement.

Documents used along the form

In the realm of lending and borrowing in New York, the Promissory Note form plays a central role by detailing the terms under which money is loaned and must be repaid. However, to ensure a comprehensive understanding and enforcement of the agreement, various other documents are often used in tandem with a Promissory Note. These auxiliary documents not only enhance the enforceability of the agreement but also define additional terms, conditions, and understandings between the parties involved.

- Loan Agreement: This document outlines the comprehensive terms and conditions under which the loan is made. Unlike the Promissory Note, which might focus on the repayment aspects, the Loan Agreement can include clauses about dispute resolution, late payment penalties, and other detailed covenants between the lender and borrower.

- Security Agreement: When a loan is secured with collateral, a Security Agreement is used to detail the specifics about the collateral that is being used to secure the loan. This document ensures that the lender has a claim to the collateral if the borrower defaults on the loan.

- Guaranty: A Guaranty is often used in conjunction with a Promissory Note to provide an additional layer of security for the lender. In this arrangement, a third party agrees to repay the loan if the original borrower is unable to do so, thereby reducing the risk for the lender.

- Amortization Schedule: This document details the schedule of payments for the loan, including both principal and interest over a certain period. An Amortization Schedule is crucial for both parties to understand precisely how the loan will be repaid over time.

- Disclosure Statement: Required by federal and state laws, the Disclosure Statement offers the borrower detailed information about the loan, such as the annual percentage rate (APR), total cost of the loan over its lifetime, and any additional fees or charges. This ensures transparency and understanding of the financial commitment by the borrower.

Together with the Promissory Note, these documents create a clear and legally binding framework that governs the loan transaction. They provide certainty and clarity for both lender and borrower, ensuring that both parties understand their rights, obligations, and the consequences of failing to meet those obligations. In New York, as in many other jurisdictions, the use of these complementary documents helps protect the interests of all involved parties and supports the integrity of the financial agreement.

Similar forms

Loan Agreement: Similar to a Promissory Note, a Loan Agreement outlines the terms of a loan. However, it is more comprehensive, including details about the payment schedule, interest rates, and security (collateral) if applicable.

Mortgage: A Mortgage is secured by real property and includes specific terms under which the borrower must repay the loan used to purchase the property. Like Promissory Notes, it is a promise to pay but is secured by the property itself.

IOU: Short for "I Owe You," an IOU is a simple acknowledgment of debt. Though less formal than a Promissory Note, it similarly represents an agreement to pay a specified sum to another party.

Personal Guarantee: A Personal Guarantee requires an individual to pay back a loan personally if the original borrower defaults. It is akin to a Promissory Note in its promise to pay, but it applies to a third party guaranteeing the loan rather than the borrower directly.

Bill of Sale: A Bill of Sale is a document that transfers ownership of goods from one person to another. It resembles a Promissory Note in documenting an agreement between parties, though it's for the sale of goods rather than a promise to pay money.

Credit Agreement: This is a formal agreement detailing the terms under which credit is extended from a lender to a borrower. Like Promissory Notes, Credit Agreements set forth how and when the borrower will repay the lender, often including interest and financial covenants.

Lease Agreement: A Lease Agreement documents the terms under which one party agrees to rent property owned by another party. It ensures the lessee’s promise to pay rent to the lessor, similar to how a Promissory Note ensures a borrower’s promise to pay back a lender.

Dos and Don'ts

When filling out the New York Promissory Note form, it's crucial to ensure accuracy and completeness to avoid future disputes or legal issues. Here's a concise guide on what you should and shouldn't do:

What You Should Do:

- Verify the identities of all parties involved and accurately spell their names.

- Clearly detail the loan amount in words and numbers to prevent any misunderstandings.

- Specify the interest rate as per New York State law to ensure the agreement is legally enforceable.

- Outline a clear repayment schedule including dates and amounts, to maintain transparency.

- Include clauses that detail what happens in the event of a default, protecting both lender and borrower.

- Sign the document in the presence of a witness or notary to solidify its authenticity.

- Keep a copy of the note for both the borrower and the lender's records for future reference.

What You Shouldn't Do:

- Omit any personal or loan details, as every piece of information is crucial for legal standing.

- Ignore state laws regarding maximum interest rates to avoid rendering the note unenforceable.

- Forget to specify the repayment terms, which could lead to disagreements or legal issues down the line.

- Leave spaces blank, which could lead to unauthorized alterations after the agreement is signed.

- Sign the document without reading and understanding all its terms, as it is legally binding.

- Fail to consult a legal advisor if there are any uncertainties about the note's provisions.

- Neglect the importance of having the note notarized, especially for larger loan amounts, as this can add an extra layer of legal protection.

Misconceptions

In understanding the New York Promissory Note form, several misconceptions frequently arise, challenging the clarity and purpose of these legal documents. A promissory note, in essence, is a written promise to pay a specified sum of money to a specified person or the bearer of the note at a fixed or determinable future time. Below are eight common misconceptions about the New York Promissory Note form, providing insight to help demystify its usage and requirements.

- All promissory notes are essentially the same. Each state may have specific laws and requirements that affect the content and enforcement of promissory notes. New York is no exception, and its legal nuances demand that promissory notes adhere to New York’s particular legal standards and practices to be considered valid and enforceable.

- A verbal promise is as good as a written promissory note in New York. While verbal contracts can be enforceable, a written promissory note is far more reliable and easier to enforce in court. New York law, consistent with the Statute of Frauds, requires certain agreements to be in writing to be enforceable, including those pertaining to the borrowing of money.

- Filling out a standard form is all it takes. While templates can serve as a helpful starting point, a promissory note in New York must be customized to reflect the specific terms of the agreement, including interest rate, repayment schedule, and what happens in case of default. It should comply with New York laws to ensure its enforceability.

- Promissory notes do not need to be notarized in New York. While New York does not require a promissory note to be notarized for it to be valid, notarization can add a layer of verification and authenticity to the document, potentially making it easier to enforce.

- Interest rates can be as high as agreed upon by the parties. New York State law caps the amount of interest that can be charged on a loan. Charging interest above this cap can result in the note being considered usurious and void, and can even lead to criminal charges in extreme cases.

- No consequences exist for a late payment unless specified. Under New York law, if a promissory note does not specify a late fee or the consequences of a late payment, the lender is still entitled to seek legal remedies for the delay and can pursue the full amount due under the note.

- Only the borrower needs to sign the promissory note. While the borrower is indeed required to sign the promissory note, having a witness or notary sign can enhance the document's credibility. Moreover, if the note is secured by collateral, the lender may also need to sign, acknowledging their obligations under the agreement.

- Electronic signatures aren't valid on New York Promissory Notes. Under both federal law (the E-SIGN Act) and New York state law, electronic signatures are generally as valid and enforceable as traditional handwritten signatures, assuming all parties to the transaction choose to use them.

These misconceptions highlight the importance of understanding the legalities and nuances of promissory notes in New York. Properly drafting and executing a promissory note can protect the interests of all parties involved and ensure that the agreement is enforceable in court. It’s advisable for individuals to consult with legal counsel to ensure that their promissory notes comply with New York laws and accurately reflect the terms of their agreement.

Key takeaways

When dealing with the New York Promissory Note form, it's essential to navigate the process carefully to ensure that the document is legally binding and accurately reflects the agreement between the parties involved. The following key takeaways provide guidance for filling out and using this form:

- Details Matter: Ensure all information is accurate and complete. Names, addresses, loan amounts, and interest rates need to be clearly stated to prevent any misunderstandings.

- Understand the Types: New York offers both secured and unsecured promissory notes. Choosing the right type depends on whether the loan will be backed by collateral. This choice significantly impacts the lender's recourse in case of default, so consider it carefully.

- Clarity on Repayment: The repayment schedule should be laid out in clear terms within the document. Whether the loan will be repaid in a lump sum, in installments, or through another arrangement, it should be explicitly stated to avoid any confusion.

- Interest Rate Specifications: New York law dictates a maximum interest rate that can be charged. Ensure that the interest rate on your promissory note complies with these regulations to avoid rendering the note unenforceable or subject to penalties.

- Signatures are Key: The promissory note must be signed by all parties involved for it to be considered valid and legally binding. It's often recommended that the signatures be notarized, although not always required, to add an extra layer of authenticity.

- Keep Records: After the promissory note is completed and signed, all parties should keep a copy for their records. This ensures that everyone has access to the agreed terms, which can help in preventing disputes or in resolving them should they arise.

By following these guidelines, individuals in New York can navigate the process of creating and executing a promissory note with confidence, ensuring that both lenders and borrowers are protected under the law.

Create Other Promissory Note Forms for US States

Loan Promissory Note - Strengthening the lender’s confidence, it demonstrates the borrower’s commitment to repaying the debt.

California Promissory Note Requirements - In terms of security, a secured promissory note is backed by collateral, offering the lender added protection against default.