Blank Promissory Note Form for Oklahoma

Whether you're lending a friend money to help with car repairs or financing a family member's startup, the importance of documenting the transaction cannot be overstated. In Oklahoma, like in many states, a Promissory Note form serves as a legally binding agreement between a lender and a borrower. This document outlines how much money is being loaned, the interest rate (if any), repayment schedules, and what happens if the borrower fails to repay the loan. The beauty of the Oklahoma Promissory Note form lies in its simplicity and the legal protections it offers both parties. It bridges the gap between informal verbal agreements and more complex loan contracts, making it an essential tool for personal and small business transactions. By clearly setting out the terms of the loan, this form helps prevent misunderstandings and ensures that both the lender and borrower are on the same page, offering peace of mind and a clear path to financial resolution should issues arise.

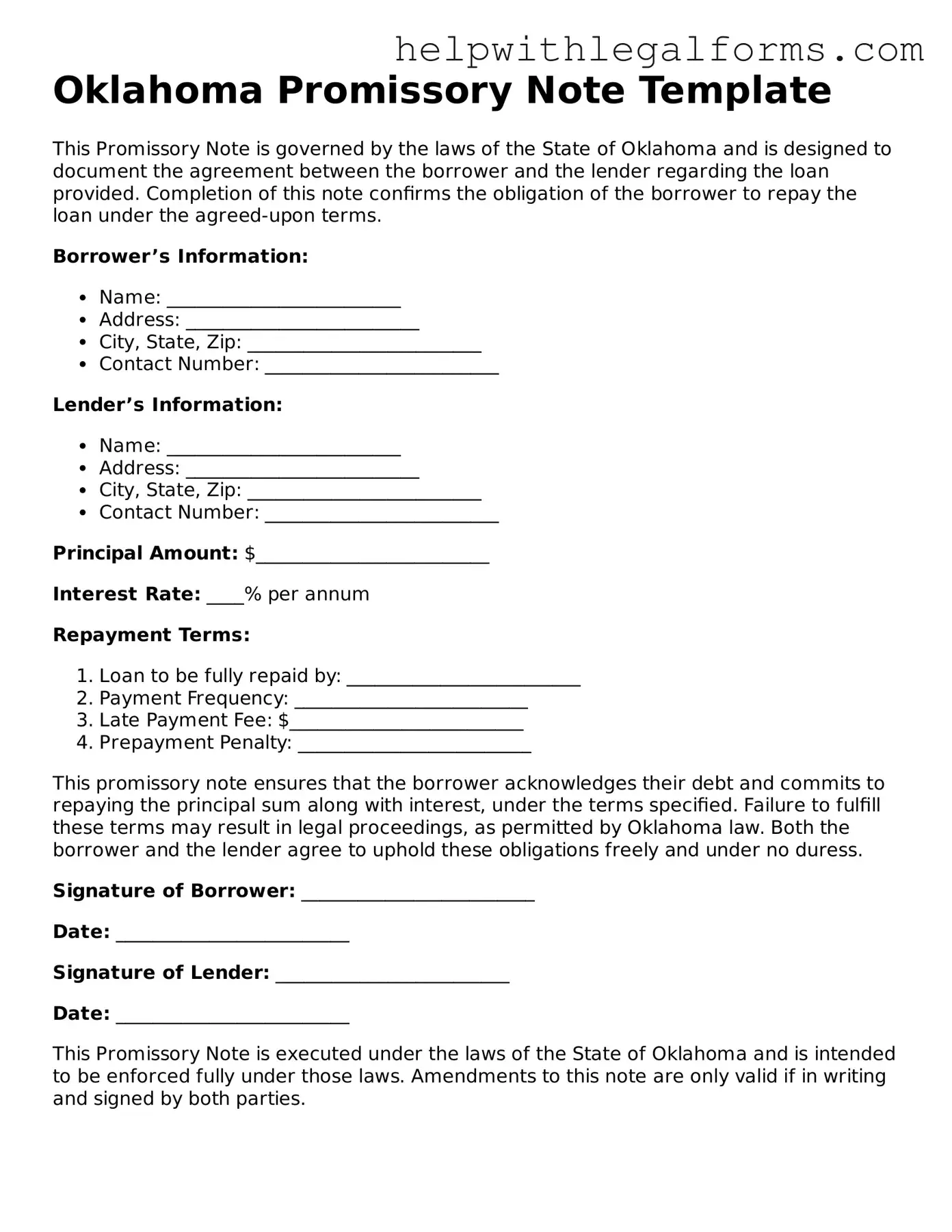

Example - Oklahoma Promissory Note Form

Oklahoma Promissory Note Template

This Promissory Note is governed by the laws of the State of Oklahoma and is designed to document the agreement between the borrower and the lender regarding the loan provided. Completion of this note confirms the obligation of the borrower to repay the loan under the agreed-upon terms.

Borrower’s Information:

- Name: _________________________

- Address: _________________________

- City, State, Zip: _________________________

- Contact Number: _________________________

Lender’s Information:

- Name: _________________________

- Address: _________________________

- City, State, Zip: _________________________

- Contact Number: _________________________

Principal Amount: $_________________________

Interest Rate: ____% per annum

Repayment Terms:

- Loan to be fully repaid by: _________________________

- Payment Frequency: _________________________

- Late Payment Fee: $_________________________

- Prepayment Penalty: _________________________

This promissory note ensures that the borrower acknowledges their debt and commits to repaying the principal sum along with interest, under the terms specified. Failure to fulfill these terms may result in legal proceedings, as permitted by Oklahoma law. Both the borrower and the lender agree to uphold these obligations freely and under no duress.

Signature of Borrower: _________________________

Date: _________________________

Signature of Lender: _________________________

Date: _________________________

This Promissory Note is executed under the laws of the State of Oklahoma and is intended to be enforced fully under those laws. Amendments to this note are only valid if in writing and signed by both parties.

PDF Form Attributes

| # | Fact | Description |

|---|---|---|

| 1 | Definition | An Oklahoma Promissory Note is a legal document where one party promises in writing to pay a certain amount of money to another party under specific terms. |

| 2 | Types | There are secured and unsecured promissory notes. Secured notes require collateral, while unsecured notes do not. |

| 3 | Governing Law | The Oklahoma Uniform Commercial Code (Title 12A) governs promissory notes in Oklahoma. |

| 4 | Interest Rate | Oklahoma law sets the maximum interest rate if it's not specified in the note. Without an agreement, the legal interest rate is 6% per annum. |

| 5 | Co-signer | Adding a co-signer, who also promises to repay the note, can provide additional security for the lender. |

| 6 | Repayment Schedule | The note must specify how the debt will be repaid, such as in installment payments, a lump sum, or other agreed-upon terms. |

| 7 | Late Fees | The note can include terms about late fees if payments are not made on time. |

| 8 | Prepayment | Borrowers are usually allowed to pay off the note early, but the note may specify if there are any penalties for doing so. |

| 9 | Default | The conditions under which the borrower is considered in default should be clearly defined, including any remedies or actions the lender can take. |

| 10 | Legal Enforcement | Should a dispute arise, Oklahoma courts can enforce the terms of the promissory note based on its provisions and applicable state laws. |

Instructions on How to Fill Out Oklahoma Promissory Note

Once you've decided to draft a promissory note in Oklahoma, it's important to follow a specific set of guidelines to ensure the document is completed accurately. This form serves as a binding agreement between a borrower and lender, detailing the terms under which money has been lent and how it will be paid back. Proper completion of this form is crucial for it to be considered valid and enforceable. Below, you'll find a step-by-step guide designed to help you fill out the Oklahoma Promissory Note form correctly.

- Gather all necessary information including the full names and addresses of both the borrower and the lender, the principal loan amount, the interest rate, and the repayment terms.

- Enter the date the promissory note is being executed at the top of the form.

- Write down the full legal names and addresses of both the borrower and the lender in the designated sections.

- Specify the principal amount of money being loaned in both words and numbers to prevent any confusion.

- Detail the interest rate being applied to the principal amount. This rate should comply with Oklahoma’s legal limits to avoid usury.

- Clearly outline the repayment schedule, including the start date, the number of payments, the frequency of payments (weekly, monthly, etc.), and the amount of each payment. If any balloon payments are agreed upon, describe the terms clearly.

- Include any applicable legal clauses, such as late payment fees, penalties for default, and prepayment terms. This information should be specific to Oklahoma law to ensure compliance.

- Both the borrower and the lender must sign the form, with printed names and dates next to the signatures. Witnesses or notarization may be required depending on the amount of the loan and the specific requirements in Oklahoma.

- Make copies of the signed document for both the borrower and the lender to retain for their records.

After completing these steps, the Oklahoma Promissory Note is ready to be used as a legal instrument governing the loan arrangement between the borrower and the lender. Remember, keeping the language clear, precise, and in compliance with local laws will help protect the interests of both parties throughout the term of the loan.

Crucial Points on This Form

What is an Oklahoma Promissory Note?

An Oklahoma Promissory Note is a legal document that outlines a loan agreement between two parties in the state of Oklahoma. It serves as a written promise from the borrower to pay back a specified sum of money to the lender within a set timeframe. This document includes important details such as the amount borrowed, interest rate, repayment schedule, and any other terms agreed upon by both parties.

Do Oklahoma Promissory Notes need to be notarized?

While notarization is not a legal requirement for Oklahoma Promissory Notes to be considered valid, it is highly recommended. Notarization can provide an additional layer of legal protection by verifying the authenticity of the signatures on the document. It ensures that the parties signing the note are doing so willingly and under their true identity.

Can I use an Oklahoma Promissory Note for both secured and unsecured loans?

Yes, Oklahoma Promissory Notes can be used for both secured and unsecured loans. A secured loan is one where the borrower pledges some form of collateral as security for the loan, which the lender can claim if the loan is not repaid. An unsecured loan does not involve collateral. The choice between a secured or unsecured promissory note depends on the agreement between the lender and the borrower, as well as the level of risk the lender is willing to take.

How is the interest rate determined for a promissory note in Oklahoma?

The interest rate for a promissory note in Oklahoma is agreed upon by the lender and the borrower at the time the note is created. However, it must comply with Oklahoma's usury laws, which cap the maximum interest rate that can be charged. It's important for both parties to be aware of the current legal limits to ensure the promissory note adheres to state regulations.

What happens if the borrower fails to repay the promissory note?

If a borrower fails to repay an Oklahoma Promissory Note according to the agreed terms, the lender has the right to pursue legal action to collect the debt. This may include suing for the balance owed along with any interest and legal fees. For secured loans, the lender might also have the right to seize the collateral that was pledged by the borrower.

Can the terms of an Oklahoma Promissory Note be modified?

Yes, the terms of an Oklahoma Promissory Note can be modified if both the lender and the borrower agree to the changes. Any modification should be documented in writing, and both parties should sign any amendment to the original document. This ensures that the modifications are legally binding and can prevent future disputes over verbal agreements.

Common mistakes

When filling out the Oklahoma Promissory Note form, attention to detail is crucial. This document is a binding agreement between a borrower and a lender, outlining the repayment of a loan. Mistakes can lead to misunderstandings or legal challenges down the line. Here are ten common errors to avoid for a smooth financial transaction.

-

Not Specifying the Full Names of the Parties Involved: It's essential to use the full legal names of both the borrower and the lender to avoid any confusion about the parties' identities.

-

Omitting the Loan Amount: Failing to clearly state the exact amount of money being borrowed can lead to disputes over the loan's terms.

-

Lack of Clarity on Interest Rates: The interest rate must be explicitly stated. An unclear interest rate can result in misunderstandings or unintended financial burdens.

-

Not Defining Payment Terms: Clearly define the payment schedule, including amounts and due dates, to ensure both parties understand the repayment expectations.

-

Forgetting to Specify Late Fees: Detail any late fees for missed payments to encourage timely repayment and cover additional administrative costs.

-

Ignoring the Governing Law: Indicating that Oklahoma law governs the note helps in resolving disputes under familiar local laws.

-

Missing Signatures: The document must be signed by both the borrower and the lender. Unsigned notes might not be enforceable.

-

Excluding the Date of the Agreement: Always date the agreement to establish when the obligations begin.

-

Not Specifying Security, if Applicable: If the loan is secured with collateral, failing to describe this explicitly could lead to legal complications if repayment issues arise.

-

Overlooking the Need for a Witness or Notarization: Depending on the arrangement or local regulations, having a witness or notarizing the document can add an extra layer of legal protection.

Taking the time to accurately complete the Oklahoma Promissory Note form helps in safeguarding the interests of both parties involved in the loan agreement. It's wise to review each section carefully, ensuring that all information is correct and clear. This diligence helps prevent potential issues and fosters a positive relationship between the borrower and lender.

Documents used along the form

When entering into a financial agreement in Oklahoma, utilizing a Promissory Note form is a critical first step. This document cements the borrower's promise to repay the lender under specific terms, acting as a legally binding guarantee. However, to ensure a comprehensive and protected transaction, several other forms and documents are often paired with the Promissory Note. These additional documents can strengthen the agreement, clarify terms, and offer further legal protection for all parties involved.

- Loan Agreement: This document provides a detailed outline of the terms and conditions of the loan, including the responsibilities of both the lender and the borrower. It often includes clauses about repayment schedules, interest rates, and what happens in the case of default.

- Security Agreement: If the loan is secured, a Security Agreement is necessary. This agreement identifies the collateral that the borrower offers against the loan, specifying rights in case the borrower fails to meet the terms of the Promissory Note.

- Guaranty: This is a separate agreement where a third party (the guarantor) agrees to fulfill the repayment obligations if the borrower defaults. It provides an additional layer of security for the lender.

- Amortization Schedule: An Amortization Schedule is often attached to clarify the repayment plan. It breaks down each payment over the course of the loan into principal and interest, showing how the loan balance decreases over time.

- Late Payment Notice: This form is used if the borrower fails to make a timely payment. It serves as a formal notification of the missed payment and any applicable late fees, and it may outline the steps the borrower can take to remedy the situation.

- Release of Promissory Note: Upon the loan's full repayment, a Release of Promissory Note is issued to formally acknowledge that the borrower has fulfilled their obligations under the agreement and that the Promissory Note is no longer in effect.

Complementing the Promissory Note with these additional documents not only provides clarity and legal fortification for the financial transaction but also helps in maintaining a positive relationship between the lender and the borrower. Understanding each of these documents and their purpose is crucial for anyone involved in lending or borrowing funds in Oklahoma, ensuring that all parties are well-informed and protected throughout the process.

Similar forms

A Mortgage Agreement shares similarities with a promissory note in that both are formal commitments regarding the repayment of a debt. While the promissory note is an agreement to pay back a loan, the mortgage agreement secures the loan with the borrower's property, serving as collateral in case of default. This linkage highlights the pair's shared focus on outlining loan repayment conditions, though the mortgage agreement delves into the specifics of property attachment and conditions for foreclosure.

A Loan Agreement is closely related to a promissory note, as both set out the terms under which money has been lent. The key difference is that loan agreements are typically more detailed, covering a broader spectrum of terms including repayment schedules, interest rates, and the responsibilities and obligations of both lender and borrower. Promissory notes, by contrast, are often more straightforward, summarizing the essential information about the loan's amount and its repayment.

The IOU (I Owe You) document is another relative of the promissory note, underlining an acknowledgment of debt. However, an IOU is a more informal manifestation, generally offering mere acknowledgment that a debt exists, without specifying repayment details like dates or interest rates. On the other hand, a promissory note provides a more formal and comprehensive outline, ensuring a legal binding commitment to repay the debt under clearly defined terms.

Similar in intent, a Bill of Exchange is used in international trade and involves three parties – the drawer, the drawee, and the payee – to make payment to a third party. It is similar to a promissory note, which typically involves two parties and a promise to pay. Both documents serve as written promises to pay a certain amount, albeit under different circumstances and with a bill of exchange usually involving cross-border transactions.

Corporate Bonds can be likened to promissory notes, as both signify a promise by the borrower to repay a principal amount plus interest. However, corporate bonds are issued by companies to raise funds for various purposes and are traded on the stock market, making them more complex financial instruments. They often include detailed terms regarding the bond's maturity, interest rate, and conditions of repayment. Promissory notes are generally simpler, more direct agreements between two parties.

Dos and Don'ts

Filling out the Oklahoma Promissory Note form is a crucial step in formalizing a loan agreement between a borrower and a lender. It's essential to approach this task with care and attention to detail. Here are some dos and don'ts to keep in mind to ensure the process is done correctly and effectively.

- Do review the form in its entirety before you begin. Understanding every section will help you provide accurate and comprehensive information.

- Do verify the legal names and addresses of both the lender and the borrower. This information is critical for the validity of the document.

- Do clearly outline the loan amount and repayment terms. This includes the interest rate, repayment schedule, and any provisions for late payments or defaults.

- Don't leave any fields blank. If a section does not apply, indicate with "N/A" (not applicable) rather than leaving it empty.

- Don't rush through the process. Take your time to fill out each section accurately to avoid any potential disputes or legal issues in the future.

- Don't forget to have all parties sign and date the form. A promissory note is a legally binding document, and it's important that it's executed properly.

Adhering to these guidelines when completing the Oklahoma Promissory Note form will help ensure that the agreement is legally sound and that both parties are protected. Always remember to keep a copy of the fully executed document for your records.

Misconceptions

When dealing with the Oklahoma Promissory Note form, several misconceptions frequently arise. It's crucial to debunk these misunderstandings to ensure that individuals are fully informed about their rights and obligations under this financial instrument.

All promissory notes in Oklahoma are the same: This is a common misconception. In reality, promissory notes can vary widely in terms of interest rates, repayment plans, and the consequences of default. It's important to read and understand your specific promissory note because the terms are not universal.

A verbal promissory note is legally binding in Oklahoma: While verbal contracts can be enforceable under certain conditions, a written promissory note is essential for clarity and enforceability. This written form ensures that all parties have a clear understanding of the terms and conditions, significantly reducing disputes.

Only the borrower needs to sign the promissory note: While the borrower's signature is crucial, the lender's signature is also important. Both parties’ signatures ensure mutual acknowledgment and consent to the terms, which can be crucial for enforcement.

Promissory notes are only for banks and financial institutions: This belief limits the understanding of promissory notes' utility. Individuals can also use promissory notes for personal loans between family members or friends, making it a versatile financial instrument beyond formal lending scenarios.

Interest rates on promissory notes are unregulated in Oklahoma: Oklahoma, like other states, has usury laws that set maximum interest rates for loans. It's a misconception that lenders can charge any interest rate. These laws help to protect borrowers from excessively high rates.

Signing a promissory note means you waive all rights: Borrowers maintain rights under state and federal law, even after signing a promissory note. For instance, borrowers have the right to be treated fairly under the Fair Debt Collection Practices Act and may have options for renegotiating the terms in case of financial hardship.

A promissory note is the only document needed for a loan: While a promissory note is crucial, other documents may be necessary, especially for significant loans. These can include security agreements that provide collateral to the lender, ensuring an additional layer of protection.

Defaulting on a promissory note has no significant consequences: On the contrary, defaulting on a promissory note can lead to serious repercussions, including legal action from the lender, damage to credit scores, and potential loss of collateral. Understanding the gravity of defaulting is important for all parties involved.

It's vital for parties engaged in creating or signing a promissory note in Oklahoma to recognize these misconceptions and understand the legal and practical realities of these financial instruments. This knowledge can pave the way for more informed decisions and clearer agreements.

Key takeaways

When dealing with the Oklahoma Promissory Note form, individuals are provided a legal avenue to formalize a loan agreement between a borrower and a lender. This document not only outlines the loan's terms and conditions but also ensures a structured and legally binding repayment plan. Below are five key takeaways to consider when filling out and using this form:

- Complete Accuracy is Crucial: Ensure all provided information is accurate and comprehensive. This includes the names of the parties involved, the loan amount, the interest rate, and the repayment schedule. Any errors or omissions can lead to misunderstandings or legal complications in the future.

- Specify Loan Details Clearly: The terms of the loan, including the interest rate, repayment schedule, and any collateral, should be specified clearly to avoid ambiguity. This clarity will help in enforcing the terms if any disputes arise.

- Understand the Legal Implications: Both lenders and borrowers should understand the legal obligations they are entering into. This includes the consequences of defaulting on the loan and the rights each party has under Oklahoma law.

- Signatures are Essential: The document must be signed by both parties to be legally binding. Consider having witnesses or a notary public present at the time of signing to further validate the document.

- Keep Records Updated: If any modifications to the original terms are agreed upon, such modifications should be documented and attached to the original promissory note. This ensures that the most current agreement is legally binding and reflects the intentions of both parties.

Utilizing the Oklahoma Promissory Note form with these key points in mind will facilitate a smoother, more transparent lending process. It offers a solid foundation for both parties to protect their interests and ensures accountability and fairness in the repayment of the loan.

Create Other Promissory Note Forms for US States

California Promissory Note Requirements - An unsecured promissory note does not involve collateral, relying solely on the borrower’s promise to pay.

Loan Promissory Note - In case of default, it facilitates the legal process of debt recovery for the lender.

Basic Promissory Note - By clearly stating the loan terms, it sets expectations and defines the relationship between lender and borrower.