Legal Promissory Note for a Car Form

When purchasing a vehicle, individuals often explore various financing options, one of which might include an agreement between private parties rather than through traditional financial institutions. In such instances, a Promissory Note for a Car becomes an essential document. This form outlines the agreement details where the buyer promises to pay back the seller the purchase price of the car over a specified period, under agreed-upon terms. The contents typically cover the loan amount, interest rate, repayment schedule, and the consequences of defaulting on the loan. It serves as a legally binding contract that offers security to the seller while providing the buyer with a clear path towards ownership of the vehicle. With this arrangement, trust is established through a formal commitment, making the private sale of a vehicle more secure for both parties involved.

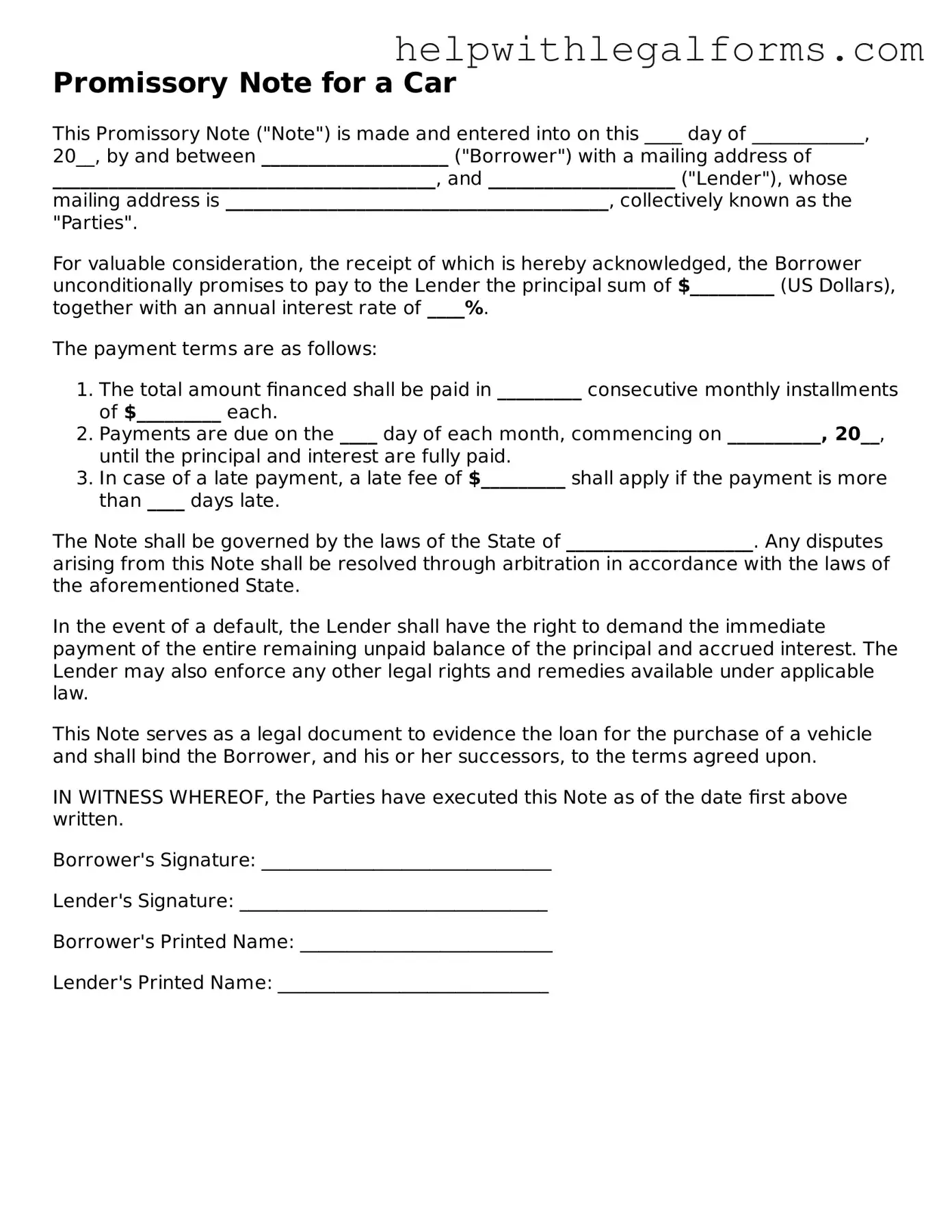

Example - Promissory Note for a Car Form

Promissory Note for a Car

This Promissory Note ("Note") is made and entered into on this ____ day of ____________, 20__, by and between ____________________ ("Borrower") with a mailing address of _________________________________________, and ____________________ ("Lender"), whose mailing address is _________________________________________, collectively known as the "Parties".

For valuable consideration, the receipt of which is hereby acknowledged, the Borrower unconditionally promises to pay to the Lender the principal sum of $_________ (US Dollars), together with an annual interest rate of ____%.

The payment terms are as follows:

- The total amount financed shall be paid in _________ consecutive monthly installments of $_________ each.

- Payments are due on the ____ day of each month, commencing on __________, 20__, until the principal and interest are fully paid.

- In case of a late payment, a late fee of $_________ shall apply if the payment is more than ____ days late.

The Note shall be governed by the laws of the State of ____________________. Any disputes arising from this Note shall be resolved through arbitration in accordance with the laws of the aforementioned State.

In the event of a default, the Lender shall have the right to demand the immediate payment of the entire remaining unpaid balance of the principal and accrued interest. The Lender may also enforce any other legal rights and remedies available under applicable law.

This Note serves as a legal document to evidence the loan for the purchase of a vehicle and shall bind the Borrower, and his or her successors, to the terms agreed upon.

IN WITNESS WHEREOF, the Parties have executed this Note as of the date first above written.

Borrower's Signature: _______________________________

Lender's Signature: _________________________________

Borrower's Printed Name: ___________________________

Lender's Printed Name: _____________________________

PDF Form Attributes

| Fact Name | Description |

|---|---|

| Definition | A Promissory Note for a Car is a written agreement where the borrower promises to repay the lender the money used to purchase a vehicle, plus any agreed-upon interest. |

| Key Components | It includes the amount borrowed, interest rate, repayment schedule, and signatures of both the borrower and lender. |

| Governing Laws | These notes are governed by the Uniform Commercial Code (UCC) in most states, along with any specific state laws related to promissory notes and vehicle sales. |

| State-Specific Forms | Some states may require additional disclosures or specific formats for Promissory Notes for a Car, making it critical to consult state laws before drafting or signing. |

Instructions on How to Fill Out Promissory Note for a Car

Filling out a Promissory Note for a car is a straightforward process, but getting it right is crucial for both the lender and the borrower. This document outlines the terms of the loan, including the repayment schedule, the interest rate, and any collateral involved—in this case, the car. It serves as a legal agreement that obligates the borrower to pay back the borrowed amount under specified conditions. After completing this form, both parties will have a clear understanding of their obligations, and the borrower can proceed with the purchase of the vehicle. Here are the steps needed to fill out the form accurately.

- Identify the Parties: Start by writing the full legal names of both the borrower and the lender, along with their addresses. This clarifies who is involved in the agreement.

- Describe the Loan Amount: Clearly state the total amount of money being loaned for the purchase of the car. This amount should be written in both words and figures for clarity.

- Define the Interest Rate: Enter the annual interest rate agreed upon for the loan. This will determine how much extra the borrower will pay in addition to the loan's principal amount.

- Set the Repayment Schedule: Specify the start date of the loan and detail how the borrower will repay the loan (e.g., monthly payments over a certain number of years). Include the due date for the final payment.

- Detail the Loan Security: Since the car itself is often used as collateral for the loan, provide a description of the vehicle (make, model, year, and VIN) to identify it as the secured asset.

- Signatures: Ensure that both the borrower and the lender sign and date the form. Witness signatures may also be required depending on local laws and regulations, so it's important to be aware of these requirements.

Once the form is fully completed and signed, both the borrower and the lender should keep copies for their records. This document is now binding, and the borrower can use the funds to purchase the car under the terms laid out in the Promissory Note. It’s essential for both parties to fully understand and agree to these terms before proceeding, as it outlines the legal obligations of the loan.

Crucial Points on This Form

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines the terms and conditions under which one party agrees to pay another party a specific amount of money for the purchase of a car. This document includes details such as the total amount to be repaid, the schedule of payments, interest rate (if any), and the consequences of failing to make payments as agreed.

Who should use a Promissory Note for a Car?

Anyone buying or selling a car through a private sale, where the buyer does not pay the full purchase price upfront, should use a Promissory Note for a Car. It provides a clear record of the agreement and helps protect the interests of both parties involved.

Is a Promissory Note for a Car legally binding?

Yes, a Promissory Note for a Car is a legally binding document. Once both parties have signed it, they are legally obligated to follow the terms agreed upon in the note. Failure to do so may result in legal consequences for the party at fault.

What information is needed to fill out a Promissory Note for a Car?

To fill out a Promissory Note for a Car, you will need the full names and addresses of both the buyer and the seller, the sale price of the car, payment amounts and schedule, interest rate (if applicable), and details about the car (make, model, year, and VIN).

Can the terms of a Promissory Note for a Car be negotiated?

Yes, the terms of a Promissory Note for a Car are fully negotiable between the buyer and the seller. Both parties should come to a mutual agreement on all terms, including the payment schedule, interest rate, and any other conditions before signing the note.

What happens if the buyer fails to make payments as agreed?

If the buyer fails to make payments as agreed in the Promissory Note for a Car, the seller has the right to take legal action to enforce the agreement. This may include repossessing the car or seeking a judgment for the outstanding balance owed. The specific consequences should be detailed in the promissory note itself.

Common mistakes

Filling out a Promissory Note for a car involves a detailed process that requires attention and understanding. People often make mistakes in this process due to oversight or misunderstanding. Below is a list of common errors made when completing a Promissory Note for a car:

Not specifying the loan amount clearly. It's crucial that the amount borrowed is written in numeric and word format to avoid any ambiguity.

Omitting the interest rate. Failing to clearly state the interest rate can lead to misunderstandings about the total amount to be repaid.

Forgetting to outline the repayment schedule. Details about when payments are due, including the frequency and number of payments, are essential.

Overlooking late fees and penalties for missed payments. These conditions must be clearly described to ensure the borrower understands the consequences of late or missed payments.

Failure to include prepayment terms. These terms would define if the borrower can pay off the loan early and if there are any penalties for doing so.

Misidentifying the parties involved. It's critical to correctly identify the borrower and lender with accurate and full legal names.

Not detailing the security agreement. If the loan is secured against the car, this should be thoroughly detailed, including conditions for repossession.

Skipping the requirement for witnesses or notarization. Depending on state law, having the document witnessed or notarized may be necessary to enforce the agreement.

Absence of signatures. The promissory note is not legally binding unless it is signed by both the borrower and the lender.

When individuals pay careful attention to these areas, they can avoid common pitfalls associated with filling out a Promissory Note for a car. Ensuring all details are correctly entered and understood by both parties can prevent misunderstandings and legal issues down the line.

Documents used along the form

When purchasing or selling a car, a Promissory Note is a critical document that outlines the loan's terms between the seller and the buyer, including the repayment schedule, interest rate, and the actions to be taken in case of default. However, this form does not stand alone. To ensure a thorough and legally binding transaction, several other documents are commonly used alongside it. Understanding these documents can help both parties feel confident and protected throughout the process.

- Bill of Sale: This document serves as proof of the transaction and transfer of ownership from the seller to the buyer. It typically includes details such as the vehicle's make, model, year, and VIN (vehicle identification number), along with the sale price and date.

- Loan Agreement: While similar to a Promissory Note, a Loan Agreement offers a more detailed breakdown of the loan terms, including any warranties and the obligations of each party. It serves as a comprehensive contractual agreement between the lender and borrower.

- As-Is Agreement: This form is important when the vehicle is sold without any warranties regarding its condition. It explicitly states that the buyer accepts the vehicle in its current state, protecting the seller from future claims about the vehicle's condition.

- Title Document: The title proves ownership of the vehicle. Once the transaction is complete and the promissory note fulfilled, the seller should transfer the title to the buyer, who then needs to register it with their local DMV (Department of Motor Vehicles).

- Odometer Disclosure Statement: This statement is a legal requirement by federal law for the sale of most used vehicles, indicating the car's actual mileage at the time of sale to prevent odometer fraud.

- Insurance Proof: Proof of insurance is necessary to legally drive the vehicle off the lot. Buyers are usually required to secure insurance before finalizing the purchase to protect both themselves and the seller from potential future liabilities.

- Release of Liability Form: The seller should file this form with the DMV to record the transaction and release them from liability for any future tickets, accidents, or violations that involve the vehicle after the sale.

Gathering and completing all relevant documents can seem daunting, but they are essential for protecting the interests of both the buyer and the seller during and after the transaction of a vehicle. Each form plays a unique role in ensuring clarity, legality, and peace of mind throughout the process. By understanding these documents and their purposes, individuals can navigate the sale or purchase of a vehicle with confidence and security.

Similar forms

A Mortgage Agreement closely resembles the Promissory Note for a Car form, as both outline the borrowing of a sum of money to purchase something of value (a home vs. a car), including the repayment terms, interest rates, and the consequence of failing to meet the agreement's terms.

A Personal Loan Agreement can also be compared to this type of promissory note. Both documents are structured agreements between two parties for a loan that specifies repayment schedules, interest, and the use of the loan, even though the purposes of the loans can vary widely.

Similarly, a Student Loan Promissory Note shares common grounds with a Promissory Note for a Car. This document is a pledge to repay borrowed money used for educational purposes, detailing the loan's terms, such as repayment schedule, interest rate, and the responsibilities of the borrower.

The Business Loan Agreement can also be considered akin to a Promissory Note for a Car, as it is a binding agreement between a lender and a borrower (in this case, a business) that outlines the loan’s purpose, repayment terms, and interest, aiming to facilitate the borrowing of money for business expansion or operations.

A Rent-to-Own Lease Agreement has similarities, particularly in the aspect of acquiring an asset (real estate vs. a car) through periodic payments, with the final aim of ownership transfer, albeit structured differently, focusing more on the rental aspect before the ownership is granted.

An IOU Document (I Owe You) also shares characteristics with a Promissory Note for a Car. It outlines a simpler form of agreement that acknowledges a debt owed by one party to another but is less formal and lacks the detailed repayment terms typically included in a promissory note.

The Secured Promissory Note is another document that closely aligns with a Promissory Note for a Car form. It entails an agreement to pay back a loan secured by collateral (in the case of a car, the vehicle itself often serves as collateral) and details the terms under which the loan must be repaid.

Lastly, a Lease Agreement, while primarily used for renting or leasing property, has its similarities in structure to a Promissory Note for a Car because it establishes a contractual relationship between two parties over the use of an asset. Although primarily for properties, the foundational legal principles of agreement, periodic payments, and specified terms are shared.

Dos and Don'ts

When filling out a Promissory Note for a Car, it's important to carefully navigate the process to ensure all legal and financial aspects are correctly handled. This document serves as a binding agreement between the lender and borrower, outlining the loan terms for the car purchase. Here are the dos and don'ts to consider:

Do:- Read the entire form before starting to fill it out. Understanding every section ensures that all the terms and conditions are clear and agreed upon.

- Use black or blue ink for clarity and formality. These colors are generally accepted and make the document easier to read and photocopy.

- Include all requested details such as the full names and addresses of both the lender and the borrower, the loan amount, interest rate, repayment schedule, and any other agreed terms.

- Check the legal requirements specific to your state or jurisdiction. Laws regarding promissory notes can vary, so it's important to ensure compliance.

- Sign and date the note in the presence of a witness or notary, if required. This step formalizes the agreement and can provide additional legal protection.

- Rush through the process. Taking the time to fill out the form accurately prevents misunderstandings and future disputes.

- Leave any sections blank. If a section doesn't apply, mark it as “N/A” (not applicable) instead of leaving it empty. This indicates that the section was reviewed but didn't apply to the agreement.

Adhering to these guidelines helps ensure that the promissory note stands as a clear, enforceable agreement between the lender and borrower. It also minimizes potential legal complications, making the car buying process smoother and more secure for both parties.

Misconceptions

While a Promissory Note for a Car may seem straightforward, numerous misconceptions surround its usage, implications, and requirements. Clarifying these misconceptions ensures that both the lender and borrower approach the agreement with a clear understanding, potentially avoiding complications down the line. Below are ten common misconceptions about the Promissory Note for a Car.

A Promissory Note is not legally binding. Contrary to this belief, a Promissory Note is a legally binding document once it is signed by both parties. It obligates the borrower to repay the loan under the specified conditions.

It only needs to be signed by the borrower. Both the lender and the borrower must sign the Promissory Note for it to be effective and enforceable. This ensures that both parties agree to the terms set forth in the document.

Interest rates can be set arbitrarily. Interest rates must comply with the usury laws of the state where the loan is made. These laws cap the maximum interest rate that can be charged to prevent exploitation.

Verbal agreements are as binding as a written Promissory Note. While verbal agreements may hold some weight, a written and signed Promissory Note provides a clear, enforceable record of the loan’s terms and conditions. Verbal agreements are much harder to prove in court.

A Promissory Note covers all aspects of the car sale. The Promissory Note documents the loan agreement but does not replace the need for a Bill of Sale, which records the vehicle's transfer of ownership.

It is unnecessary if the lender and borrower trust each other. Regardless of trust, a Promissory Note formalizes the loan's terms and protects both parties if disagreements or unforeseen circumstances arise.

Default consequences are arbitrary and can be decided after the fact. The consequences of default should be clearly outlined in the Promissory Note beforehand. They cannot be arbitrarily assigned after the default occurs.

Only the total loan amount needs to be stated. In addition to the total loan amount, the Promissory Note should include the interest rate, repayment schedule, late fees, and the consequences of default to prevent any misunderstandings.

Once signed, the terms of the Promissory Note cannot be changed. Alterations to the Promissory Note’s terms can be made if both the lender and borrower agree and document the changes in writing.

Any template will suffice. While templates can provide a starting point, the Promissory Note should be tailored to the specific terms of the loan and comply with state laws to ensure its enforceability.

By understanding these misconceptions and addressing them directly in the Promissory Note for a Car, lenders and borrowers can create a contractual environment that fosters clarity, fairness, and legal compliance, mitigating the risk of future disputes.

Key takeaways

When engaging in the process of filling out and using the Promissory Note for a car purchase, it's crucial to grasp the document's significance and the obligations it places on all parties involved. Here are six key takeaways for smoothly navigating this legal instrument:

- Ensure Accuracy: All information on the Promissory Note must be accurate. This includes the identities of the buyer and seller, the vehicle description (make, model, year, VIN), and the sales amount.

- Understand Payment Terms: The payment terms, including the loan amount, interest rate (if any), repayment schedule (number of payments, frequency, etc.), and the final payment due date, need to be clearly outlined and understood.

- Legal Binding: Remember, a Promissory Note is a legally binding agreement. By signing it, the borrower agrees to repay the loan under the terms specified.

- Consequences: The document should outline the consequences of failing to make payments as agreed. This might include late fees, repossession of the vehicle, or legal action.

- Collateral Security: In many cases, the car itself serves as collateral for the loan. This means that if the borrower defaults, the lender may take possession of the vehicle.

- State Specifics: Some states may have specific requirements or provisions that must be included in a Promissory Note. It's essential to ensure compliance with state laws and regulations.

Discover Other Types of Promissory Note for a Car Documents

Release of Promissory Note - The Release of Promissory Note form is legally binding and should be kept by both parties for their records and possible future reference.